Shutterstock Images.

Shutterstock Images.Like most Boomers, I’ve both bought and sold a house. But still couldn’t pretend to comprehend all the economic forces at work that make the housing market function. So when I downsized last year:

If the conversations between myself, my devoted Irish Rose and either the realtor or the mortgage broker got too complicated for this state college grad, I would politely ask them to dumb it down and don’t be afraid to talk to me like I’m four years old. Then remind them that everything I understand about real estate I learned from Margot Robbie in a bathtub:

Fortunately, we do have people who understand the complexities of all the forces exerting pressure on the market. The myriad of factors affecting this most essential part of The American Dream.

And this one particular expert, who has displayed a genius for predicting disasters in the past has declared another one is coming. And it doesn’t take Robbie covered in bubble bath to know the root cause is dudes not getting laid enough:

Source – A financial analyst nicknamed the ‘Oracle of Wall Street’ has said a ‘growing crisis of the young American male’ will cause house prices to fall as much as 30 percent.

Meredith Whitney, who earned the title after predicting the financial crisis of 2007 – 2008, suggested young men increasingly living with their parents and disinterested in starting families will drastically reduce housing demand.

The trend of men refusing to settle in turn means more women are remaining single into later life, leaving them without the income or need for big family homes.

But it comes as baby boomers start to downsize, meaning there will be a surplus of available properties. Much of the last decade’s gains in home values have been driven by high demand and low supply – a phenomenon, Whitney says, is reversing.

To explain the rise in men living at home, she pointed to the increasing prevalence of video games, starting in the mid-2000s. …

Whitney cited US Census Bureau data showing that before the financial crisis around 13 percent of men aged between 25 and 34 lived at home. …

The data also shows that young women have consistently been around twice as likely to leave their parents’ homes. Last year, just 12.3 percent were still at home. …

‘The biggest driver of home prices has historically been household formation,’ Whitney told DailyMail.com. ‘Household formation today is the lowest it’s been in 160 years.’

And household formation, she said, is driven by the ‘five Ds’ – ‘diamonds, diapers, divorce, debt, and death.’

‘Without at least the first two Ds, there’s no reason to buy a home,’ she said.

Before we get into this, a definition is in order:

Oracle or-e-kel – A person (such as a priestess of ancient Greece) through whom a deity is believed to speak. A person giving wise or authoritative decisions or opinions

In the world of Ancient Greece, no great decisions could be made without first consulting the Oracle of Delphi. And it’s clear that Meredith Whitney earned the nickname by predicting the housing crash that everyone but her and the Christian Bale character completely whiffed on.

So what the actual? She’s seeing another one coming because Gen Z has decided to … what, exactly? Stop trying to meet women? Reverse the entire process that has driven all living things since we were just single-celled microorganisms floating around in the primordial soup? The drive to have sex and pass on your genes? They’ve traded in the most powerful instinct in nature – the desire to procreate the species – for 8 hours a day of chasing zombies through a wasteland in Fallout?

Listen, I’m the last guy to use the played out Boomer trope of the guy “living in his mom’s basement.” That’s a tired, lazy stereotype best left for sports radio hosts who have contempt for their audience. But here it is coming directly from one of our most brilliant economists. Her depiction, not mine. And apparently it’s statically proven to be about to tank our entire way of life.

Look, I’m a Live and Let Live kinda guy. If you’d rather slap hookers or whatever you do in GTA than leave the house and try to find actual flesh and blood women who are sexually attracted to you, that’s not my concern. Go live your life. I might not think it’s a life worth living and will judge you quietly to myself, but you do you. (And if that’s you, you’re literally doing yourself.) You have the right to squander your existence and never take a desirable female to the summit of Bone Mountain all you want.

That is, until it starts to affect me. And I say this for all Boomers. I didn’t come this far and invest my entire net worth into my home just to lose it all to a bunch of people I’ve never met who’d rather sit at home on their Playstations, getting fed by their moms and the Doordash guy, instead of going out, being fruitful and multiplying.

Yours has got to be the first generation in human history to get criticized for NOT being obsessed with sex enough. And it’s time you get off the bench and into the game. The great coach called America is sending you in. You owe it us to put down the controllers, climb out the gaming chairs, get out to the bars and clubs and start doing what comes naturally. The financial health of your country – and me in particular – depends upon you to quit being such pusses and start making the babies, already.

It’s not a big ask, afterall. It’s not like your great grandfathers being handed rifles and told to storm Omaha Beach or Iwo Jima. Now get out there and do your patriotic duty. We’re counting on you.

By Kylie Stevens For Daily Mail Australia

23:39 24 Mar 2024, updated 01:25 25 Mar 2024

Australia needs 90,000 more tradies in the next 90 days in order to meet the Albanese government’s ‘impossible’ new goal to build 1.2million new homes in five years, the building industry has warned.

Major building industry groups have called out the Federal government’s plan – which would see the country construct 60,000 new homes each quarter from July 1 – as unrealistic.

One solution would be for Australia to boost immigration and fast-track skilled tradespeople, Master Builders Australia chief executive Denita Wawn suggested.

Ms Wawn said she was concerned ‘there is no way … we can get 90,000 (workers) in three months, unless we had a radical change in the way which we are looking at our migration system’.

Recognising tradies’ qualifications from other countries should be easier and cheaper, Ms Wawn said.

‘We know that there are a large number of tradies in this country that can’t get their licences recognised as it’s too expensive and too cumbersome for them,’ she said in an interview with Sunrise.

‘We have to focus on those who are currently in the country by their skills aren’t recognised.’

Ms Wawn also said there needs to be a massive push to skill up Australians and encourage them to work in the trades industry.

‘We really are focusing on school levers particularly but also those who want a career change to look at trade,’ Ms Wawn said.

‘Thirdly, as an industry, we need to retain the current tradies and call back the ones that have decided enough is enough.’

But she acknowledged finding 90,000 tradies in the next 90 days is unrealistic.

‘I think this figure reflects the difficulty that we’re going to have if we don’t resolve the tradie shortage in meeting the agreed target of 1.2 million homes over five years,’ she said.

‘The clock starts ticking on July 1 and we’ve got a huge, huge issue to resolve.’

Ms Wawn remained hopeful the government’s target of 1.2m new homes by 2029 can be achieved, despite only 170,215 new homes being built in the 12 months to September last year for 548,800 newly-arrived migrants.

‘We need to focus on how we can actually get there,’ she said. ‘The issue really is: how do we actually encourage more people into our sector?’

BuildSkills Australia executive director of research and planning Robert Sobyra said finding skilled labour will be the biggest supply-side barrier to addressing the housing supply crisis.

‘Returning the housing market to a healthy state will require a significant uplift in the national dwelling completion rate,’ he said.

‘While there are plenty of hurdles to overcome in achieving this goal, labour will be the single biggest supply-side barrier.’

Housing Minister Julie Collins said that while the government’s housing target was ambitious, it was getting on with the job.

‘We know we’ve got a lot of work to do,’ she told Sky News.

‘We’re working right across government – I know the skills ministers had a meeting just over two weeks ago, where they talked about the skills required to meet the housing demand in Australia and the challenges we currently have.’

A rise in modular housing or pre-fabricated homes common in Japan and Germany could see the housing supply fast-tracked.

Australian housing giant Mirvac is among the developers trialling modular housing construction in response to the crisis.

‘We’ve been able to reduce the construction of those homes to be watertight within 12 weeks,’ Mirvac chief executive of development Stuart Penklis told Nine News.

He added that modular housing doesn’t come with some of the challenges of a traditional build, such as supply chain shortages and severe weather disruptions.

Industry and Science Minister Ed Husic added that governments were working together ‘to take a serious look’ at modular housing.

‘Other countries have got their act together on modular housing and are seeing great jobs and great new homes – we want to be able to do that right here on shore,’ Mr Husic said.

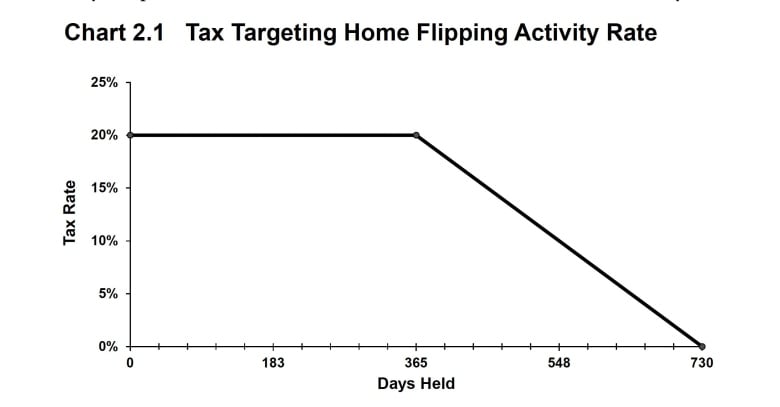

The B.C. government has announced plans to introduce a tax of up to 20 per cent on profits made when properties are sold within two years of their purchase.

The 20 per cent rate will be in place for a year after purchase and will slide to zero between 366 and 730 days after the acquisition.

B.C. Finance Minister Katrine Conroy announced the tax as one of the province’s latest tools to try to curb speculation over housing in a province where many struggle to afford appropriate shelter.

“Prices went up as governments stepped back and speculators moved in,” said Conroy during her speech presenting her latest budget in the legislature.

“That’s why we’re bringing in a home-flipping tax as our latest measure to crack down on bad actors.”

The tax is one of 20 pieces of legislation the government plans to introduce this session, meaning it will need to be passed at some point over the next three months before becoming law.

The plan is to implement it for properties sold on or after Jan. 1, 2025. It will also apply to properties purchased before then.

Conroy’s 2024-25 budget forecasts that the tax, once in place, would result in an additional $44 million in revenue in the 2025-26 fiscal year.

That revenue will go directly to building affordable housing throughout the province, she said.

Sellers would be taxed around 10 per cent after owning a home for a year and a half, with the tax lifted after ownership for two years.

The tax will apply to income from the sale of properties with a housing unit and properties zoned for residential use. It also applies to income made from condo assignments.

It does not apply to land or portions of land used for non-residential purposes, according to the government’s budget documents.

Other exemptions under the tax include life circumstances such as separation, divorce, death, disability or illness, relocation for work, involuntary job loss, change in household membership, personal safety or insolvency.

“The purpose of this tax is to support housing supply, not impede it,” reads the government’s budget documents.

“Exemptions will be provided for those who add to the housing supply or engage in construction and real estate development.”

The tax is to be paid in addition to any federal or other provincial income taxes incurred from the sale of property.

Alex Hemingway, a senior economist with the Canadian Centre for Policy Alternatives, said although the tax is another tool to try and address speculation, he’s not sure how successful it will be.

“I think a flipping tax can take a little bit of air out of the tires in terms of speculation, but it’s not really getting at the root of the housing crisis, which is a shortage of housing overall and a shortage of non-market housing in particular.”

He also said the tax could inadvertently drive down home sales and transactions, siphoning tax revenue away from property transfers.

First-time homebuyer credit

The budget also introduced expanded property transfer tax exemptions, increasing the First Time Homebuyers Program threshold up to $500,000 on the purchase of a home worth up to $835,000.

The province said the move would result in savings of up to $8,000 per purchase and would double the number of buyers that will benefit to approximately 14,500.

The province will also waive the property transfer tax for eligible purpose-built rental buildings that have four or more units until 2030.

Tax breaks for property investors have created a quarter of a trillion dollar budget black hole that could instead fund 500,000 new social homes, a new report has found.

Everybody’s Home, a national campaign to “fix the housing crisis”, is calling on the government to scrap negative gearing and capital gains tax concessions in favour of building more social housing.

It has warned the housing affordability crisis will only worsen if the government doesn’t switch tack from supporting the private market to investing in homes for people being increasingly priced out of the sector.

The latest report proposes a regime of tax reform, finding concessions are on track to cost the budget about $228bn from 2010 to 3203, and that tax breaks for investors have outstripped federal funding on social housing by at least five times.

The report found investment in social housing under Commonwealth-State housing agreements is less today than it was 40 years ago, and that housing policy has been “geared towards subsidising the private market” rather than directly supplying social housing.

The campaign says the cost of those investor tax breaks could build 549,310 social homes over the next decade.

“Taxpayers are being ripped off by property investor write offs. The federal government is spending record amounts on housing to line the pockets of investors. That has made renting and buying homes more expensive than ever,” Everybody’s Home spokesperson Maiy Azize said.

“Tax handouts for investors will be a quarter of a trillion dollar mistake if the government doesn’t change tack. Giving money to investors is a choice. If the government wants to make housing more affordable and fairer for all Australians, it can choose to put money into homes instead of investor profits.

“The government must scrap negative gearing and capital gains tax concessions, and use the revenue savings to build hundreds of thousands of social homes. This would help end Australia’s massive social housing shortfall, and help reach the goal of another one million social homes within the next 20 years.

“Governments must take back responsibility to make housing affordable. It’s time to abolish unfair tax handouts and build the homes we need.”

Negative gearing allows investors to deduct losses incurred on investment properties, such as from interest rates and maintenance, therefore, reducing their overall tax bill.

Under the capital gains tax concessions, tax is levied on only 50 per cent of the capital gain of an asset held for more than one year.

The Greens last year published Parliamentary Budget Office costings that estimated property tax concessions would cost $37.5bn in lost revenue in 2023-24, while capital gains tax discounts were estimated to cost $1.5bn.

The Albanese government’s centrepiece housing policy, the Housing Australia Future Fund, passed in September after months of negotiations with the minor party, with a guaranteed $500m to be spent each year on building new and affordable social homes.

The government last year also announced a separate $2bn Social Housing Accelerator, and increased the Commonwealth Rent Assistance payment in the May budget.

But the Greens want the government to invest even more in social housing, with acting Greens leader Mehreen Faruqi vowing the minor party would keep pushing the government to overhaul the tax concessions.

“These tax breaks are turbo charging the housing crisis, making it easier for wealthy property moguls to buy a property than a first homebuyer, driving up property prices and depriving the government of revenue that could be put to work building housing for those who need it,” she said.

“It is an indictment on Labor’s priorities that they think that $39bn on tax breaks for wealthy property moguls is a reasonable investment, but won’t spend more than $3bn on public housing, as the crisis continues to worsen.”

Prime Minister Anthony Albanese – who famously grew up in social housing – came under fire last year after internal pressure within the Labor Party called for reform on investment property tax concessions.

He dismissed calls to reform the tax concessions, and said he would not revisit the party’s negative gearing policy before the next election, due next year.

“The government’s position is very clear, and it’s a position for which we received a mandate at the 2022 election – and I’m someone who keeps the commitments that we made,” Mr Albanese said last May.

Mr Albanese instead has regularly pointed to the government’s other housing commitments, including building social housing.

Treasurer Jim Chalmers was contacted for comment but did not respond before deadline.