Ahmedabad Cover Story

‘Can’t use EoI to sell properties’

RERA to take suo motu action against builders selling properties based on Expression of Interest (EoI) before mandatory registration under GUJRERA

representational picture

Gujarat Real Estate Regulatory Authority (GUJRERA) has plans to take suo motu action against developers who are selling their projects to end users and investors via Expression of Interest (EoI). The move is being planned in light of instances where developers are selling residential and commercial projects even before getting the mandatory GUJRERA registration. Most of such projects are in the western part of the city and are being sold on the EoI model through different marketing channels.

Sources said recently the area between SG Highway and SP Ring Road has seen several such realty deals.

“Areas like Sindhu Bhavan Road (SBR) and Iscon-Ambli Road among others are also selling retail cum office space on paper to their investors.” The sources said these projects however do not have the GUJRERA nod as developers are either yet to apply for registration or have not got the clearance for the same after applying.

Talking to Mirror a developer said many investors prefer to invest at this stage (before GUJRERA registration) as they get special rates (higher discounts) on upcoming properties. “However, if the builder is not trustworthy then it can create issues for investors,” said the source.

A senior advocate told Mirror that most developers sell space immediately after buying land and the space thus sold makes up almost 70% of the total project cost. “They do it to quickly recover their money,” said the advocate.

“Most developers buy land on term payment which has to be paid over a short period. So developers immediately start selling their project via realtors (brokers) and to their regular investors, even before getting clearances from respective authorities like AUDA, AMC or GUJRERA,” the advocate said. He said this is done to recover the initial investment so that payments can be made for the land that they bought. “However, it’s still not legal, unless it is GUJRERA registered. Since most of the time the partial payment is in case of commercial or retail properties, there is an issue of lack of accountability too.”

A senior GUJRERA official said no project can be sold to investors or end users unless it’s registered with GUJRERA and has the mandatory clearance. “Even the marketing of such projects under EOI is illegal if it is yet to get the RERA number. However, if such a thing is happening we will take action against them.”

Game of Trust

Realty experts said investing in a project before it gets a nod from respective authorities is an old practice but it needs to be done with caution. Managing Partner of Space Management, Hitesh Shah said there are established developers who have a strong investor base and they prefer to invest in the upcoming schemes of such developers in advance due to the value, commitment and past accountability that they bring to the project. “However, when a developer is a new entrant there is a question of trust and accountability. But most importantly, the role of the broker is crucial; if s/he isn’t trustworthy, you may face opportunity loss and sometimes delay in getting your money back.”

Most developers buy land on term payment which has to be paid over a short period. So they start selling their project via brokers via EoI even before RERA nod

–A senior advocate

Mark Frie stood Friday inside a nondescript white building in east Tulsa full of thousands of costumes and accessories, and he smiled.

And shook his head. And laughed.

“When we got all this in here, I was just like, ‘I’ll see you all later.’ It is really overwhelming,” said the CEO of the Tulsa Performing Arts Center.

It still is. The old exercise center at Boeing Park is full of rack after rack after rack of costumes. If you’ve got a sartorial need, it can be fulfilled here: tuxedos, Medieval and Victorian dresses, faux straw hats, rubber horse head masks.

And so many boxes and containers yet to unpack.

Don’t be fooled — it’s a boon for the local theatrical community, unfolding one cataloged piece of clothing at a time.

People are also reading…

It all began several years ago with a city councilor who was losing her day job. Crista Patrick worked 15 years at the University of Tulsa, where she ran the Theatre Department’s costume shop and taught classes.

When TU decided to close its theater program, Patrick was out of a job, and 40 years or so of costumes and accessories were suddenly homeless.

Patrick estimates that during her time at TU she would lend her expertise and TU’s treasure trove of costumes to about 50 local productions a year. So she set out to find a new home for what had been the tools of her trade for a decade and a half.

“We don’t have a lot of costumes around this community,” Patrick said. “And so I didn’t want, especially the smaller theaters, to lose that resource.”

After kicking around some ideas, she set her sights on the PAC.

“I wanted a public entity to be in charge. That way it could be equitable for all,” Patrick said. “And so I immediately started calling Mark.”

Patrick jokingly recalled that when she gave Frie and other PAC officials a tour of the costume department in the basement of TU’s Kendall Hall, “they walked around with their mouths hanging open a little bit, and they said, ‘We’ll do it.’”

But how? The PAC didn’t have room for the roughly 12,000 costumes — and countless accessories — that TU would eventually donate.

So Patrick went to work on the city, pleading with them to consider providing storage space. She even shed a few tears — and it worked.

For nearly two years, volunteers have spent several days a month cataloging what is estimated to be a total of 20,000 pieces. They’re not yet half way done.

In addition to the TU contributions, the two local costumers assisting in the project — Alice Wegley and Bruce Lewis — donated the items they have collected during their decades in the business.

Wegley said costumes and accessories have already been loaned to Theatre North, Theatre Tulsa, World Stage Theatre Co. and other local performing arts groups.

“If they say, ‘Hey, I’m looking for this,’ we can look on the computer. Oh, yeah, we have three of those,” Wegley said. “We can send them the pictures of the item, and they can say, ‘Oh, yeah, I want those,’ and then we know. It tells on the computer where it’s at. Each rack has a number, so it tells us exactly where it is.”

Frie said he is grateful to all the parties involved in what he described as a total team effort. The donated costumes from TU and the donated storage facility from the city will allow the PAC to further assist the nonprofit community partners that put on dozens of productions a year at the PAC.

“We felt this was just too important to just let this go into the wind, so to speak,” Frie said. “Part of our philosophy and vision with a PAC Trust is we offset the costs, the expense to be in the Performing Arts Center. We get facility grants to these (local) companies to make it affordable for them to be in our spaces.

“And it just made perfect sense that we could carry on this vision of making sure that not only are we helping you get in the space, but now we can help you costume your show. And it’s just kind of an added layer of how we can serve our groups.”

The new Tulsa World app offers personalized features. Download it today.

Users can customize the app so you see the stories most important to you. You can also sign up for personalized notifications so you don’t miss any important news.

If you’re on your phone, download it here now: Apple Store or Google Play

Others Specials

NanoTech Consultancy Drives Make in India Tech Revolution: Surat’s Infotech Leader, in Line with PM Modi’s Vision, Collaborates with Intel for Revolutionary Semiconductor Manufacturing

Civil Work to Commence Soon at post Vareli Ta-Kamrej Facility, Marking the First Semiconductor Project in Southern Gujarat After Vibrant Gujarat Initiatives

Surat (Gujarat) [India], March 23: In a groundbreaking collaboration that echoes the spirit of the “Make in India” initiative and aligns with Prime Minister Narendra Modi’s visionary tech goals, NanoTech Consultancy, a leader in Surat’s infotech sector, is set to revolutionize semiconductor manufacturing in partnership with Intel, the world’s largest manufacturer of central processing units and semiconductors.

As part of this milestone initiative, NanoTech Consultancy is gearing up to commence civil work at its Kamrej facility, signifying a crucial step towards establishing the first semiconductor project in Southern Gujarat. This development comes in the wake of extensive initiatives during Vibrant Gujarat, where most INFOTECH companies have opted for locations in Sanand or GIFT City. NanoTech Consultancy’s decision to establish a semiconductor project in Kamrej not only adds a new dimension to the regional tech landscape but also marks a significant stride towards realizing the objectives set during Vibrant Gujarat.

“Our strategic partnership with Intel reflects our unwavering commitment to innovation and excellence in the semiconductor industry. By merging our cutting-edge technologies with Intel’s manufacturing capabilities, we are poised to deliver unparalleled semiconductor manufacturing capabilities to our clients,” affirmed a spokesperson for NanoTech Consultancy.

NanoTech Consultancy’s comprehensive solutions in nanotechnology, software development, and semiconductor manufacturing, coupled with a client-centric approach, position it as a leader in addressing complex challenges. The company empowers businesses with state-of-the-art problem-solving tools, utilizing information technology to drive efficiency and achieve tangible results.

Recognizing NanoTech Consultancy’s pivotal role in this achievement, a representative stated, “The capacity of the plant and the collaborative vision with Intel by this Surat-based premium consultancy, providing 360-degree solutions in the infotech segment, is commendable. It’s a proud moment for Surat and, especially, for Gujarat, aligning with the vision of Prime Minister Shri Narendra Modi.”

NanoTech Consultancy’s success is intrinsically linked to the success of its clients. With a commitment to innovation, strategic collaborations, and a client-centric approach, the company continues to lead the way in the technology industry.Based in Kamrej, NanoTech Consultancy is at the forefront of cutting-edge technology, specializing in providing tailored solutions in the realms of nanotechnology, software development, and semiconductor manufacturing. The company has a successful track record of 11 years and offers its unmatched technology solutions to clients across diverse sectors and geographies.

A dog with a rough start in life has been in a local shelter for almost 600 days, hoping someone would give him a forever home.

Now, Chester finally gets adopted to a family he can call his own and he did it in style.

After 587 days living in a kennel, Chester the pit bull left the Euclid Animal Shelter Monday morning to cheers and tears.

It has been a long and tough road for Chester throughout his life, but he now has a new “leash” on life.

“Chester was completely skin and bones, the dog couldn’t even lay down. He had his paw stuck in a prong collar and he was a mess. He had to be carried out after a little bit because he could not stand,” said Kyrie Brickman, kennel manager for the shelter.

Back in August of 2022, Chester, who was chained to a window, and three other dogs were found in an empty house, where they had been for over a week.

“He absolutely was so relieved to see people and to be honest, I don’t know how much longer he would have lasted,” Brickman said.

For about 10 months, shelter workers worked around the clock to bring him to good health.

But after a year and a half, no one was interested in adopting him until a special woman came along. Now, Chester was on the way to a forever home and in a limousine, donated by Lake Erie Limo.

Within minutes, Chester, about 4 or 5 years old, pulled up to his new home and family in North Royalton like a rockstar.

“Oh my goodness, did you ride in a limo to get here? Did you ride all the way in a limo,” said Chester’s new owner.

Lauren Reitsman instantly fell in love with him when a friend sent her an online post of Chester.

“He has all these people around him and he’s just bopping around just to see who he can get love from, so I think I won the lottery,” Reitsman said.

Chester is living the life of a happy dog who plays with toys, gets belly rubs and lots of doggie kisses.

Shelter workers recommended for Chester a home without other dogs or small children and someone who understands his past.

“I think adoption is so important, especially when an animal, now I’m getting emotional, an animal has had a rough start in life because they deserve it even more,” said Reitsman.

Chester’s name will remain the same, sort of.

“His government name, if you will, is going to be Chester William Reitsman the First, of Royalton,” she said as people in the home laughed.

Reitsman plans to make Chester meatballs, his favorite meal.

The other dogs discovered in the vacant house with Chester have been adopted as well.

Source: FOX 8

NEW YORK (AP) — The lyrics to “Hotel California” and other classic Eagles songs should never have ended up at auction, Don Henley told a court Wednesday.

“I always knew those lyrics were my property. I never gifted them or gave them to anybody to keep or sell,” the Eagles co-founder said on the last of three days of testimony at the trial of three collectibles experts charged with a scheme to peddle roughly 100 handwritten pages of the lyrics.

On trial are rare-book dealer Glenn Horowitz and rock memorabilia connoisseurs Craig Inciardi and Edward Kosinski. Prosecutors say the three circulated bogus stories about the documents’ ownership history in order to try to sell them and parry Henley’s demands for them.

Kosinski, Inciardi and Horowitz have pleaded not guilty to charges that include conspiracy to criminally possess stolen property.

Defense lawyers say the men rightfully owned and were free to sell the documents, which they acquired through a writer who worked on a never-published Eagles biography decades ago.

The lyrics sheets document the shaping of a roster of 1970s rock hits, many of them from one of the best-selling albums of all time: the Eagles’ “Hotel California.”

The case centers on how the legal-pad pages made their way from Henley’s Southern California barn to the biographer’s home in New York’s Hudson Valley, and then to the defendants in New York City.

The defense argues that Henley gave the lyrics drafts to the writer, Ed Sanders. Henley says that he invited Sanders to review the pages for research but that the writer was obligated to relinquish them.

In a series of rapid-fire questions, prosecutor Aaron Ginandes asked Henley who owned the papers at every stage from when he bought the pads at a Los Angeles stationery store to when they cropped up at auctions.

“I did,” Henley answered each time.

Sanders isn’t charged with any crime and hasn’t responded to messages seeking comment on the case. He sold the pages to Horowitz. Inciardi and Kosinski bought them from the book dealer, then started putting some sheets up for auction in 2012.

While the trial is about the lyrics sheets, the fate of another set of pages — Sanders’ decades-old biography manuscript — has come up repeatedly as prosecutors and defense lawyers examined his interactions with Henley, Eagles co-founder Glenn Frey and Eagles representatives.

Work on the authorized book began in 1979 and spanned the band’s breakup the next year. (The Eagles regrouped in 1994.)

Henley testified earlier this week that he was disappointed in an initial draft of 100 pages of the manuscript in 1980. Revisions apparently softened his view somewhat.

By 1983, he wrote to Sanders that the latest draft “flows well and is very humorous up until the end,” according to a letter shown in court Wednesday.

Musician Don Henley, center, arrives to court in New York, Wednesday, Feb. 28, 2024. Three collectibles-world professionals are on trial in the criminal case involving roughly 100 legal-pad sheets from the development of the Eagles’ 1976 “Hotel California” album. They are charged with scheming to conceal the pages’ disputed ownership and sell them despite knowing that Henley claimed they had no right to do so.. (AP Photo/Seth Wenig)

But the letter went on to muse about whether it might be better for Henley and Frey just to “send each other these bitter pages and let the book end on a slightly gentler note?”

“I wonder how these comments will age,” Henley wrote. “Still, I think the book has merit and should be published.”

It never was. Eagles manager Irving Azoff testified last week that publishers made no offers, that the book never got the band’s OK and that he believed Frey ultimately nixed the project. Frey died in 2016.

The trial is expected to continue for weeks with other witnesses.

Henley, meanwhile, is returning to the road. The Eagles’ next show is Friday in Hollywood, Florida.

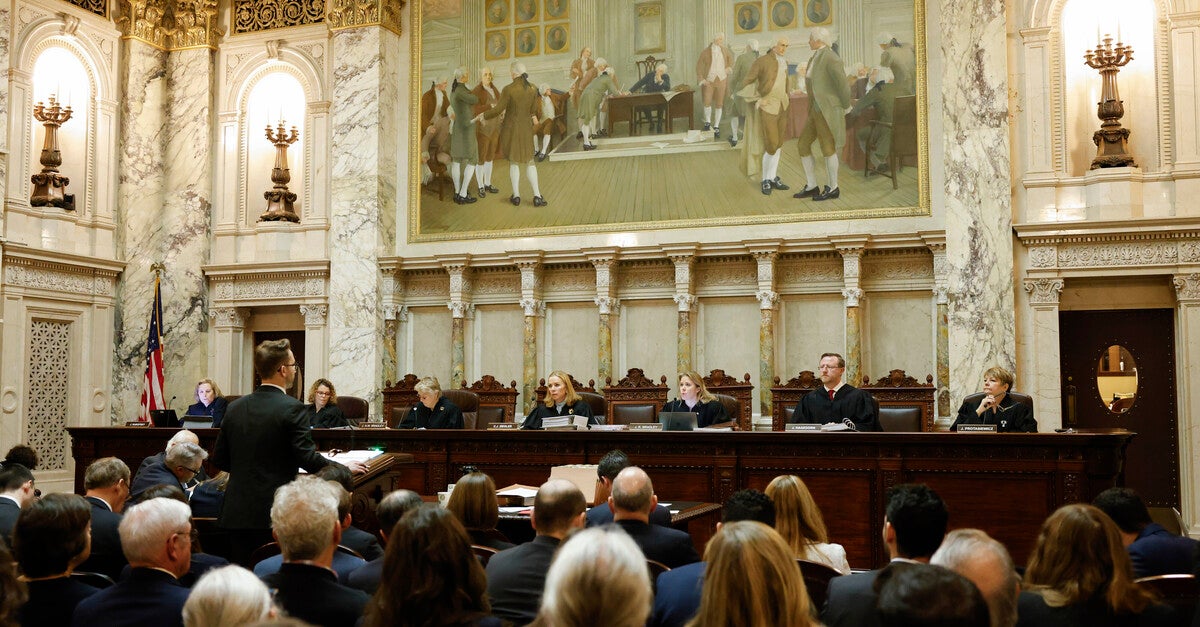

Two redistricting consultants hired by the Wisconsin Supreme Court’s liberal majority will be paid up to $100,000 each to evaluate new legislative maps ahead of the November elections.

Contracts for University of California, Irvine Political Scientist Bernard Grofman and Carnegie Mellon University Political Scientist Jonathan Cervas were posted by the court Thursday. The consultants will each be paid rates of $450 per hour. The $100,000 cap on expenses can be exceeded with approval from the director of state courts.

Those costs will be paid by parties to Wisconsin’s redistricting lawsuit “as determined by the court in a future order.” With state lawmakers and Gov. Tony Evers involved in the case, the fees could fall to state taxpayers.

Taxpayers are already funding attorneys representing both Republican and Democratic state senators named in the redistricting lawsuit, where fees could total around $2 million.

Both Grofman and Cervas have served as consultants in redistricting cases before.

Grofman worked for Wisconsin Republicans during two previous rounds of redistricting, in 2011 and 2001. More recently, he was hired by the Supreme Court of Virginia in 2021 to help with redrawing legislative districts after a bipartisan commission failed to agree on how lines should be drawn.

Cervas was hired by a New York State judge as a special master last year to draw new legislative districts following a lawsuit by Republican state lawmakers there.

As consultants for Wisconsin’s highest court, the two will submit a report by Feb. 1 evaluating legislative maps submitted by parties in the state’s ongoing redistricting lawsuit per a court order. If Grofman and Cervas find those maps don’t meet requirements set out in the Wisconsin Constitution, federal law and partisan impact guidelines issued by the court’s liberal majority, the consultants will be tasked with drawing their own remedial map.

On Dec. 22, the state Supreme Court’s four liberal justices ruled Republican-drawn legislative maps violate the Constitution’s contiguity requirement, because multiple voting districts contain separate, detached pieces located within other nearby districts. The court’s three conservatives dissented, accusing their colleagues of pre-judging the case with political ends in mind.

The current legislative maps, which were originally drawn by Republican lawmakers in 2011 and signed by former Gov. Scott Walker, bolstered GOP majorities in the state Assembly and state Senate. They were tweaked slightly under a “least changes” approach adopted by the Supreme Court’s former conservative majority during redistricting litigation in 2021, giving Republicans an even bigger advantage.

Currently, Republicans have a 64-35 majority in the Assembly and a 22-11 supermajority in the Senate.

Republican lawmakers have asked the court to stay its order and reconsider their ruling, which is unlikely.

Assembly Speaker Robin Vos, R-Rochester, hinted at a federal appeal, stating that the U.S. Supreme Court will “have the last word.”

The Wisconsin Supreme Court’s conservatives have also criticized the hiring of Grofman and Cervas to critique proposed remedial maps or draw them themselves. They claim the liberal justices’ decision to contract with the consultants raises legal questions.