exclusive

The family of five relocated from Knoxville to New York three months ago — itself a move that’s typically made in reverse — settling into a four-bedroom Park Slope apartment.

OLGA GINZBURG FOR THE NEW YORK POST

In a pre-war Brooklyn building, Lisa Miller cheerfully opens the door in khakis and a white-laced top with socks on — no shoes from the outside allowed in, especially on the day of a torrential April downpour.

From the entry, Miller — a photographer and content creator — waves to her neighbor. She and her family already seemed acclimated to Park Slope and the people in it, despite the short time they’ve lived there.

The Millers have called a roughly 1,100-square-foot unit their home for just three months after giving up their spacious life in Knoxville, Tennessee. It’s a move not typically heard of, and particularly in the wake of 2020 uprooting the lives of many New Yorkers who headed in directions south seeking fewer restrictions, safety and cheaper prices. In 2024, the move in the opposite direction certainly goes to show that, for those seeking opportunities in a bustling atmosphere — such as this brood — New York’s still got it.

But despite the change in location, the family brought a sense of home and charm with them. Upon entering the four-bedroom, two-bathroom apartment, a whiff of a fresh ocean breeze scent fills the air — with Miller noting it’s one of Anthropologie’s popular Capri Blue candles.

Furniture and other items of decor are intricately placed throughout the railroad residence, as if this space has already been inhabited for years, not months.

“It’s my OCD,” Lisa told The Post of their new home already being perfectly furnished.

It’s a move that also shows will — an attribute that ties her family of five together.

During the pandemic and its aftermath, New York City witnessed a significant departure of residents. Between April 2020 and July 2022, the population of the Big Apple plummeted by nearly half a million individuals, constituting a 5.3% decline and erasing nearly three-quarters of the growth achieved in the preceding decade.

Factors attributed to the mass exodus the Concrete Jungle saw included high crime rates, affordability and space.

By contrast, the South grew during COVID, and accounted for a whopping 87% of the nation’s growth in 2023, though it holds just 39% of the population. Tennessee, North Carolina and Florida in particular have all received a number of new residents since the coronavirus years, and continue to do so.

Recent data also shows the family’s home of Knoxville, known as an up-and-coming city, is one of the fastest-growing mid-size cities in America.

More Americans are moving from large metropolitan areas to mid-size cities; Knoxville was among the top destinations, with 70% of moves inbound in 2023, according to a recent study released by Mayflower Transit.

And as opposed to Brooklyn, Knoxville offers the prime perk of space.

“In Knoxville, we had a full office, a studio, a dining room and an eat-in kitchen,” said Miller. “So by not having those things, that was probably a good 1,200 square feet there that we weren’t going to use anymore.”

Miller, along with her husband, Dusty, and their three children — 15-year-old daughter, London, and sons Cooper, 12, and Luke, 11 — signed the lease in November, though they didn’t actually move in until a month later.

The benefits of the move immediately became apparent.

“Our family has grown closer together since being here because we’re not going 100 different ways,” Miller said. “We’re all here together and there’s not as many people that we know here.”

Miller’s upbringing was somewhat different to the other kids she grew up up with, having moved from foster home to foster home.

“I grew up in a lot of really traumatic situations,” Miller said. “And so I always romanticized the city as this dream place. I was a creative as a kid. I drew, I sang, I didn’t start doing photography and decorating and stuff until I was older, but I’ve always been super creative and kind of saw New York as the stage for whatever that looks like for me . . . my whole life was like, ‘I’m going to live there.’”

Entering the cozy living room, neutral and color tones mix with an oversize couch to fit the whole family and a touch of vintage charm. Dusty, who works as a Department of Defense contractor, along with their daughter, London, join in on the conversation.

“I’m eating my way across the city and when we first moved here, adapting wasn’t as difficult as I thought it was going to be, because I told Lisa it was kind of like when I was in college,” Dusty said. “I lived in downtown Knoxville. You would park a car and leave it there for a month. You walk to class, you’d walk to get food . . . So when we first got here, I said, ‘It’s just like being in college all over again.’”

What initially motivated them to make this big move: London and her aspirations as a dancer.

“I love it here,” London said, adding that she took delight in dancing at Manhattan’s famed Alvin Ailey.

“We had never even talked about the possibility of moving here, until she spent last summer here, at the Joffrey Ballet,” Lisa Miller added. “She did summer intensive, and they offered her a permanent spot. The option was for her to come here on her own. We are very tight-knit family. That was not ever really an option.”

The move was also beneficial for Lisa and Dusty’s youngest son, who has autism.

“For a child like Luke, who is high-functioning on the autism spectrum, with some learning difficulties and social difficulties, we just could not find a fit for him in Knoxville,” Miller said. “The way people receive and accept him here is different than in Tennessee. We already feel like he is surrounded by support and people who see him as being different as something special and good.”

Despite each person admitting that leaving family and friends behind was the most difficult part of the transition, they have found New York to be its own support system in many other ways. What’s more, they can thrive in a beautifully decorated space.

For her part, Miller adds that her inspiration of creating the interior was to do the opposite of what was trendy.

“Years ago, I did home decor influencing on Instagram,” she said. “And, embarrassingly, it was like the farmhouse era. Everything was so trendy and so when we kind of started over, I was like, ‘I don’t want to follow a trend. I really want to just put things on the wall that are purposeful and meaningful.’”

One wall in her living room is adorned with vintage frames of black and white photography, and the images are pictures of her family she took herself. The wall also included a map of Knoxville, paying homage to the only other place they’ve all really ever known.

Each bedroom is decked with its own flare and style. Luke’s room displays his favorite collectible trinkets. Cooper opted for a basketball hoop as the centerpiece. London’s room has bohemian energy, with blue and green tones.

Still, there are some quotidian nuisances. The family sees grocery shopping in the Concrete Jungle taking some time to get used to. Unlike in Knoxville, they cannot just load up a shopping cart full of groceries into the trunk of their car.

There is also using the subway as their main mode of transportation, instead of the convenient car, and having to find more affordable options for meals.

Meanwhile, they are no longer homeowners. Instead of a reasonable mortgage, they are now spending more than $5,000 per month on rent.

“I think the trade off for what we were looking for, which were creative opportunities, was knowing that we wouldn’t be owning a home,” Miller said. “That’s not going to make sense to everyone. And that’s fine, because the beauty of life is that we all get to do what we want.”

And so, a fresh start for 2024 is already off to a roaring start.

“We have been in Tennessee for almost 40 years. My whole life. So it’s been neat to kind of go and experience, you know, the exact opposite,” Dusty added.

Load more…

{{/isDisplay}}{{#isAniviewVideo}}

{{/isAniviewVideo}}{{#isSRVideo}}

{{/isSRVideo}}

Everyone seems to be having a tough time in today’s housing market. Even billionaire media mogul and proprietor Rupert Murdoch is struggling—but just in a very different way from young, aspiring homebuyers who can’t afford to break into a housing market riddled with high mortgage rates and home prices.

Indeed, Murdoch’s Manhattan penthouse was listed at such a high price, that he and his agent have had to cut the price by nearly 40% from $62 million to $38.5 million.

“The revised price reflects current realities and is closer to where the market values the residence,” Kyle Blackmon, head of luxury sales at Compass, tells Fortune. Murdoch did not respond to requests for comment. The triplex was first listed by the News Corp. chairman emeritus for $62 million in 2022, and has since endured multiple price cuts.

At the current list price, Murdoch will take a loss on the property, since he purchased it for $57.9 million in 2014, according to a Wall Street Journal report. For comparison, the average home price in Manhattan is about $1 million, according to Redfin’s most recent data. Murdoch (and his family) have an estimated net worth of nearly $21 billion, according to Forbes, having built a media empire that includes Fox News, the Times of London, and the Wall Street Journal. Murdoch stepped down as chairman in September 2023.

About Murdoch’s sky-high Manhattan mansion

The luxury triplex is roughly 7,000 square feet—more than twice the size of the average American home. It boasts 20-foot ceilings, “massive art walls,” and a 586-square-foot terrace, which are features that “create true scarcity value,” Blackmon says.

While the penthouse, which sits at the pinnacle of One Madison in Manhattan, is undoubtedly one of a kind, the price of the property attracts a very niche set of interested buyers.

“Ultra-luxury property sales are challenging due to the limited buyer pool at these price points,” Noah Rosenblatt, cofounder of New York City–based real estate analytics company UrbanDigs, tells Fortune. “These unique trophy homes are more akin to the art market than the real estate market, with value determined mainly by a potential buyer’s perception.”

Even Blackmon agrees that the property is so unique that it’ll likely sell to a very specific buyer.

“We will sell this residence, and the buyer, who will likely be an art collector, will secure an exceptional value for this important and rare offering,” Blackmon says. “This is the equivalent of a [Jean-Michel] Basquiat oil painting, an asset that can’t be replicated in this location. Residences of this size and importance are selling for twice as much in several buildings in the city.”

While price cuts can sometimes signal that a property was overpriced to begin with, Rosenblatt says these changes are relatively normal in the luxury real estate market.

“Contrary to popular thinking, ultra-luxury listings are rarely overpriced,” Rosenblatt says. “Astronomical listing prices serve to affirm the property’s luxury status and signal its availability, making the initial price a strategic tool rather than a straightforward market assessment—an invitation more than a statement.”

In other words, original list prices serve to mark properties as being ultra-luxury, and price cuts bring more buyers to the conversation of actually buying the property, Rosenblatt says.

“From the outside, it looks like the seller is chasing the market down, [but] these price reductions are more aptly described as trying to achieve market fit,” Rosenblatt says. “The challenges [with selling the property] highlight the ultra-luxury market’s volatility, driven by unique buyer preferences rather than traditional market forces, and underscore the ever-evolving definition of ‘trophy’ properties in NYC’s resilient ultra-luxury segment.”

An old house, different from the one on the market in Oak Island, on the water of the Long Island Sound. Jodi Jacobson — Getty Images

An Oak Island home, situated on Long Island’s southern shore near Fire Island, won’t come with electricity, trash collection, or emergency services. And it’s only accessible by boat.

It’s on sale for $500,000.

Yes, the area offers beautiful ocean views and the chance to rough it on a quiet island oasis just 50 miles from Times Square. Oak Island life is for those with “a very hearty soul,” a resident told The New York Times in 2021, and rewards people who don’t mind doing almost everything on their own.

But there’s not a single store, restaurant, or postal services, the New York Times reported. Residents rely on solar panels, battery-powered pumps, and propane-fed gas lamps—and notably, it’s illegal to live there the whole year. Its residents return to their waterfront properties seasonally during the summer months.

The listed house—a four bedroom, two bathroom with 1,950 square feet—was built in 1904 and comes with a small cottage towards the back of the property, a fireplace, and a private waterfront dock. It offers about an acre of land and has “no damages from Hurricane Sandy,” according to the property listing, which was one of the costliest storms in U.S. history.

According to Redfin, the average house in Long Island sells for about $645,000, up more than 12% since last year—and it’s much in line with rising home prices that people are facing all over the country.

The growing unaffordable housing crisis has been pushing some people to try alternatives, like moving off the grid, which is now a $2.27 billion market poised to reach $4.5 billion by 2030, according to a SkyQuest report. More expensive housing means demand for tiny or off-the-grid housing is “likely to rise significantly over the next five years,” according to SkyQuest, and that younger people who can’t afford home prices and retired people who struggle to maximize their savings will be the main drivers of its growth.

Here are the latest trends in the NYC real estate market as well as the statewide market. In the current state of the NYC housing market, the balance between buyers and sellers is a crucial consideration. With the persistent decline in housing inventory and an increase in median prices, the market tends to favor sellers.

The limited supply of homes puts sellers in a favorable position, allowing them to potentially secure better deals. However, this doesn’t necessarily mean it’s a bleak scenario for buyers. The increased demand and fluctuating market conditions provide opportunities for those seeking to make strategic investments in real estate.

The surge in New York home prices reflects the impact of low housing inventory and heightened demand. As a result, the current trend suggests that home prices are not dropping but rather experiencing growth, indicating a robust market with potential for profitable returns for sellers.

The Current State of the New York Real Estate Market

Interest Rates and Market Trends:

The year 2024 commenced much like its predecessor, with low housing inventory and fluctuating interest rates around 6.5 percent, according to the New York State Association of REALTORS®. The average on a 30-year fixed-rate mortgage experienced a marginal decrease from 6.82 percent in December 2023 to 6.64 percent in January 2024. However, when compared to the same period last year, the interest rate has shown an increase from 6.27 percent, highlighting the dynamic nature of the real estate market.

Housing Inventory and Market Dynamics:

One of the notable shifts in the market is the continuous decline in housing inventory, which has persisted for 11 consecutive months in year-over-year comparisons. The inventory of homes for sale across New York decreased by 10.2 percent, dropping from 39,544 homes in 2023 to 35,492 units in 2024. This limited supply poses challenges for buyers but also creates an environment where sellers may find opportunities to leverage the scarcity of available homes.

Median Price and Market Performance:

The median price of homes in January 2024 witnessed a substantial increase, rising by 9.6 percent to reach $400,000. This marks a noteworthy surge from the median price of $365,000 in January 2023. The surge in prices is indicative of the demand for housing and the impact of reduced inventory on the overall market dynamics.

New Listings, Closed Sales, and Pending Sales:

New listings experienced a modest decline of 1.5 percent, totaling 9,279 in January 2024 compared to 9,423 in the same month of the previous year. Closed sales saw a more substantial decrease, dropping by 3.8 percent from 7,486 to 7,203 homes in January 2024. In contrast, pending sales increased by 8.9 percent, signaling a potential rebound and heightened activity in the coming months.

Market Indicators and Future Prospects:

Days on Market decreased by 6.8 percent, reaching a duration of 55 days. The Months Supply of Inventory remained flat at 3.9, indicating a delicate balance between supply and demand. As we navigate the intricacies of the New York housing market, it is crucial for both buyers and sellers to stay informed about these market indicators to make informed decisions in this dynamic real estate environment.

The Current State of the New York City Housing Market

How is the NYC Housing Market Doing Currently?

The recent data from StreetEasy reveals interesting trends and shifts. January saw a 6.7% increase in the number of homes entering contract, marking a positive turn as buyers returned amidst declining mortgage rates. This surge, slightly higher than the average over the past five years, is attributed to the drop in mortgage rates during November and December, enticing buyers back into the market post-year-end holidays.

However, despite this uptick, challenges persist. Highly-priced homes are lingering longer on the market, keeping the city’s median asking price elevated. Elevated asking prices, coupled with rising mortgage rates, are prompting sellers to make concessions to attract buyers, showcasing a nuanced market scenario.

How Competitive is the NYC Housing Market?

As of January, the median asking price in NYC stood at $1.095 million, reflecting an 11.7% increase from a year ago. This uptick is largely due to a slowdown in the luxury market, where homes priced at $4.975 million and above are taking longer to sell. The median asking price in Manhattan rose by 8.4% year-over-year to $1.68 million, indicating a market that’s still resilient but experiencing notable shifts.

While luxury listings in Manhattan witnessed a rise in median asking price, the typical luxury listing received only 93.2% of its initial asking price, signaling a shift in power from sellers to buyers at the highest end of the market. In Brooklyn, where inventory is limited, the median asking price surged by 16.8% to $1.05 million. Meanwhile, Queens offers a more affordable option, with a 4.2% year-over-year increase, resulting in a median asking price of $624,900.

Are There Enough Homes for Sale in NYC to Meet Buyer Demand?

The NYC housing market is grappling with the aftermath of elevated mortgage rates and median asking prices, constraining the pool of potential buyers. While the monthly mortgage payment on a median-priced home rose by 16.1% year-over-year to $5,619 in January, the median asking rent increased by just 0.1% to $3,500. With a considerable number of potential buyers still on the sidelines, those who can afford to stay in the market now have more room for negotiation.

The median asking price for homes entering contract in January was $925,000, 15.5% lower than the overall median asking price of homes on the market. This divergence indicates a market where more affordable homes are gaining traction among buyers, while the luxury segment experiences a slowdown.

What is the Future Market Outlook for NYC?

Despite the recent decline in mortgage rates, the outlook for the New York City housing market remains complex. Seller concessions, aimed at attracting buyers, have become more prevalent. In September 2023, when mortgage rates were above 7%, 2.7% of for-sale listings mentioned seller concessions. Despite a subsequent decline in average mortgage rates to 6.7%, concessions in January held steady at 2.3%, showcasing a significant increase from the 1.4% average in 2021.

In terms of negotiations, buyers are finding more areas to maneuver. NYC sellers are increasingly willing to offer concessions explicitly in their listings, helping to reduce closing costs for buyers without reducing the asking price. One notable concession gaining popularity is the rate buydown, with 1.7% of sponsor condos offering this option in January, a significant increase from the 0.1% average in 2021.

Is NYC a Buyer’s or Seller’s Housing Market?

As the market dynamics shift, buyers in NYC are gradually regaining negotiating power. In January, while the typical NYC home received 96.3% of its asking price, up from 95.4% a year ago, sellers are increasingly open to negotiations. The share of for-sale listings mentioning seller concessions, a tool to attract buyers, has increased despite a decline in average mortgage rates.

For sellers, a smart pricing strategy is crucial to increase the likelihood of receiving strong offers. While declining mortgage rates offer additional financial flexibility to homeowners looking to move, the market remains highly competitive. Nearly one in five homes (17.4%) sold for more than their initial asking price in January, emphasizing the importance of a compelling offer in the current market scenario.

New York Real Estate Market Forecast for 2024 and 2025

The New York Metropolitan Statistical Area (MSA) encompasses a vast geographical region, including multiple counties. The housing market within this MSA is substantial, catering to the diverse needs of its population. The counties within the MSA contribute to the overall housing market, with each area influencing the regional real estate landscape.

1. Average Home Value

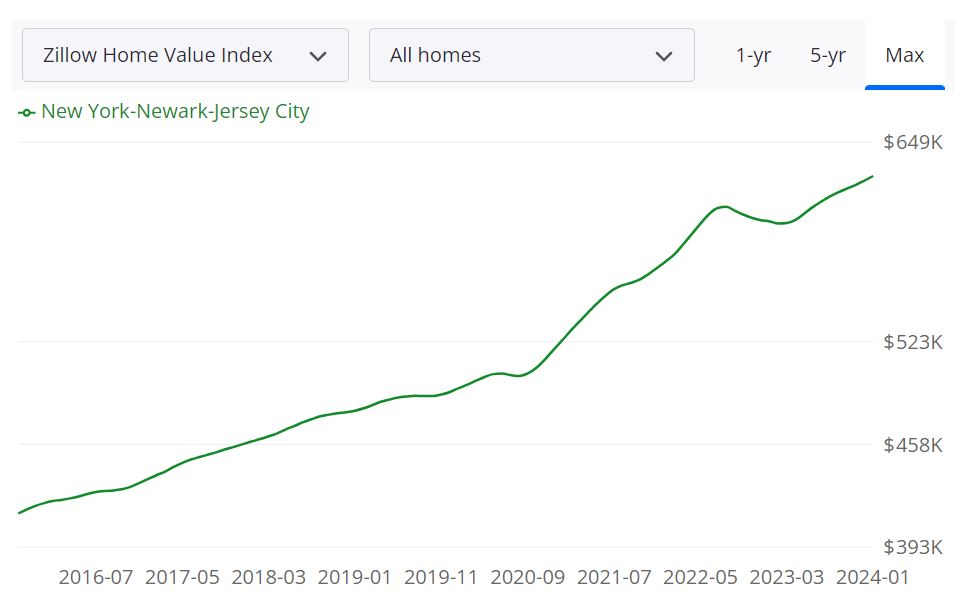

According to Zillow, the average home value in the New York-Newark-Jersey City area stands at $627,944, reflecting a 4.8% increase over the past year. This surge indicates a robust and thriving real estate market in the region. Homes in this area tend to go pending in approximately 37 days, showcasing the demand for properties.

Market Forecast

The 1-year market forecast as of January 31, 2024, is optimistic, projecting a 2.2% increase. This forecast is a positive sign for prospective buyers and sellers, hinting at sustained growth in property values.

2. For Sale Inventory

As of January 31, 2024, the New York-Newark-Jersey City area boasts a total of 36,432 homes available for sale. This inventory level plays a significant role in shaping the overall market dynamics, providing options for potential buyers.

3. New Listings

In the same period, the region witnessed 7,611 new listings, indicating a dynamic real estate market with continuous property turnover. This influx of new listings contributes to the variety of options available to potential buyers.

4. Median Sale to List Ratio

As of December 31, 2023, the median sale to list ratio stands at 1.000, emphasizing the equilibrium between listed and sold prices. This ratio is a crucial indicator of market stability and fair pricing.

5. Median Sale Price

December 31, 2023, recorded a median sale price of $565,000 for homes in the area. This metric provides a snapshot of the prevailing property values, guiding both buyers and sellers in their transactions.

6. Median List Price

As of January 31, 2024, the median list price is $689,967, indicating the average asking price for properties in the New York-Newark-Jersey City housing market. This figure guides sellers in setting competitive prices for their homes.

7. Percent of Sales Over and Under List Price

Examining sales dynamics, 49.6% of transactions as of December 31, 2023, were concluded over the list price, while 39.5% were under the list price. These percentages highlight the negotiation landscape and buyer-seller interactions in the market.

Places in New York Poised for Significant Home Price Increases

Delving into specific regions within the New York housing market, several areas stand out with the potential for notable increases in home prices. These projections, based on data from Zillow, provide valuable insights for both investors and homebuyers looking to make informed decisions.

1. Kingston, NY

In Kingston, New York, the housing market is anticipated to experience a substantial uplift in home prices. The forecast indicates a gradual progression, with a projected increase of 0.4% by February 29, 2024, followed by a more significant surge to 2% by April 30, 2024. Looking ahead to January 31, 2025, the expected increase is an impressive 7.4%. This upward trend suggests a thriving real estate environment in Kingston, making it an attractive prospect for potential property investors.

2. Rochester, NY

Rochester, New York, emerges as another hotspot for prospective homebuyers and investors. The forecast projects a steady climb in home prices, starting with a 0.4% increase by February 29, 2024, followed by a more substantial rise to 2.5% by April 30, 2024. The upward trajectory continues into January 31, 2025, with an anticipated 7% increase. This positive outlook positions Rochester as a region with growing real estate value and potential returns for those entering the market.

3. Syracuse, NY

Syracuse, New York, is poised for a noteworthy appreciation in home prices. The forecast outlines a progression from a 0.5% increase by February 29, 2024, to a more substantial 2.2% rise by April 30, 2024. Looking ahead to January 31, 2025, the projected increase is 6.4%. These projections underscore the attractiveness of Syracuse as a real estate investment destination, with potential gains for those entering the market.

4. Hudson, NY

Despite a slight dip in the short term with a projected decrease of -0.1% by February 29, 2024, Hudson, New York, is expected to rebound. The forecast indicates a subsequent rise to 1.3% by April 30, 2024, and a notable 6.4% increase by January 31, 2025. This indicates a potential buying opportunity for those willing to navigate through the temporary dip, as Hudson shows signs of resilience and growth in the real estate market.

5. Olean, NY

Olean, New York, demonstrates a positive trajectory in home price appreciation. The forecast outlines a steady increase, starting with 0.2% by February 29, 2024, rising to 1.6% by April 30, 2024. Looking further into the future, an anticipated 6.2% increase is projected by January 31, 2025. These projections position Olean as a region with potential investment opportunities and growing real estate value.

6. Jamestown, NY

In Jamestown, New York, the housing market is expected to experience a gradual rise in home prices. The forecast projects an increase of 0.1% by February 29, 2024, followed by a 1.2% surge by April 30, 2024. Looking ahead to January 31, 2025, a 6% increase is anticipated. These projections indicate stability and growth in Jamestown’s real estate market, making it a region worth considering for potential investors.

7. Binghamton, NY

Binghamton, New York, emerges as a promising market with projections indicating a steady rise in home prices. By February 29, 2024, a 0.7% increase is anticipated, followed by a more substantial 2.3% surge by April 30, 2024. Looking ahead to January 31, 2025, the forecast suggests a 5.4% increase. These positive trends position Binghamton as an area with growing real estate value, making it an attractive prospect for potential investors and homebuyers.

8. Buffalo, NY

Buffalo, New York, is poised for a noteworthy appreciation in home prices according to the forecast. The projections indicate a 0.3% increase by February 29, 2024, followed by a 1.5% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 5.2%. These positive indicators make Buffalo an interesting market for individuals seeking potential returns on their real estate investments.

9. Amsterdam, NY

Amsterdam, New York, is another region showing positive signs in its housing market. The forecast outlines a 0.3% increase by February 29, 2024, followed by a 1.4% rise by April 30, 2024. Looking ahead to January 31, 2025, the projected increase is 5.2%. These trends position Amsterdam as an area with potential for real estate appreciation, offering opportunities for investors and homebuyers alike.

10. Utica, NY

Utica, New York, stands out with projections indicating a positive trajectory in home prices. The forecast suggests a 0.3% increase by February 29, 2024, followed by a 1.6% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 5.1%. These projections make Utica an area worth considering for those seeking potential returns in the real estate market.

11. Batavia, NY

Batavia, New York, shows stability and potential growth in its housing market. Projections indicate a 0% increase by February 29, 2024, followed by a 1.2% rise by April 30, 2024. Looking ahead to January 31, 2025, the forecast suggests a 4.8% increase. These indicators make Batavia an area with steady real estate value, offering a reliable investment option for those looking for stability in the market.

12. Gloversville, NY

Gloversville, New York, demonstrates positive trends in its housing market. The forecast outlines a 0.2% increase by February 29, 2024, followed by a 1.3% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 4.3%. These projections position Gloversville as a region with potential for real estate appreciation, making it a compelling choice for investors and homebuyers seeking growth in their property investments.

13. Auburn, NY

Auburn, New York, presents a stable real estate market with projections indicating consistent growth in home prices. The forecast suggests a 0% increase by February 29, 2024, followed by a 0.9% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 4.2%. These projections position Auburn as an area with reliable real estate value, offering a steady and potentially lucrative investment option for those seeking stability in the market.

14. Seneca Falls, NY

Seneca Falls, New York, demonstrates resilience in its housing market, even with a slight dip in the short term. Projections indicate a -0.1% decrease by February 29, 2024, followed by a 0.7% rise by April 30, 2024. Looking ahead to January 31, 2025, the forecast suggests a 4.2% increase. This indicates potential opportunities for investors willing to navigate through the temporary dip in Seneca Falls, as the region shows signs of stability and growth in real estate values.

15. Glens Falls, NY

Glens Falls, New York, presents a positive outlook for potential investors and homebuyers. The forecast outlines a 0% increase by February 29, 2024, followed by a 0.9% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 3.9%. These projections make Glens Falls an area with potential for real estate appreciation, offering opportunities for those looking for growth in their property investments.

16. Albany, NY

Albany, New York, emerges as a robust market with positive projections for home price increases. The forecast suggests a 0.4% increase by February 29, 2024, followed by a 1.1% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 3.5%. These positive indicators position Albany as an attractive region for potential returns on real estate investments, reflecting a thriving market.

17. Plattsburgh, NY

Plattsburgh, New York, showcases stability and gradual growth in its housing market. Projections indicate a 0% increase by February 29, 2024, followed by a 0.8% rise by April 30, 2024. Looking ahead to January 31, 2025, the forecast suggests a 3.5% increase. These projections make Plattsburgh an area with steady real estate value, offering a reliable investment option for those looking for stability and potential growth in the market.

18. Ogdensburg, NY

Ogdensburg, New York, presents a market with stability and moderate growth in home prices. Projections indicate a -0.3% decrease by February 29, 2024, followed by a 0.4% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 3.2%. These projections make Ogdensburg an area with potential for real estate appreciation, providing opportunities for investors and homebuyers seeking growth in their property investments.

Will the New York Housing Market Crash?

As of the latest available data and forecasts, there is no definitive indication that the New York housing market is on the verge of a crash. However, it’s essential to approach this analysis with a nuanced understanding of the various factors influencing real estate dynamics.

The New York housing market currently exhibits positive trends, with an average home value of $627,944, reflecting a 4.8% increase over the past year. Additionally, the 1-year market forecast as of January 31, 2024, projects a 2.2% increase, indicating sustained growth. Metrics such as for sale inventory, new listings, and median sale prices contribute to the overall stability of the market.

While the overall market shows resilience, it’s important to acknowledge regional variations. Specific areas within the New York housing market are projected to experience varying degrees of home price increases. Some regions, such as Kingston, Rochester, and Syracuse, anticipate substantial growth, while others, like Hudson and Ogdensburg, may face temporary declines or slower growth.

Several factors contribute to the stability of the New York housing market. The diverse economic activities, employment opportunities, and cultural attractions in the state contribute to sustained demand for housing. Additionally, historically low mortgage rates and a competitive real estate landscape further support market stability.

While the current outlook is positive, it’s essential to consider potential risks. Economic fluctuations, interest rate changes, and unforeseen external factors can influence market dynamics. Additionally, the real estate market’s sensitivity to broader economic conditions and global events should be taken into account when assessing the potential for a market shift.

As of now, the New York housing market does not show definitive signs of an impending crash. The overall positive trends, coupled with regional variations, suggest a nuanced and evolving landscape. However, individuals should remain vigilant, closely monitoring market indicators, economic conditions, and any regulatory changes that may impact the real estate sector. Making informed decisions based on a thorough understanding of market dynamics remains crucial in navigating the complexities of the New York housing market.

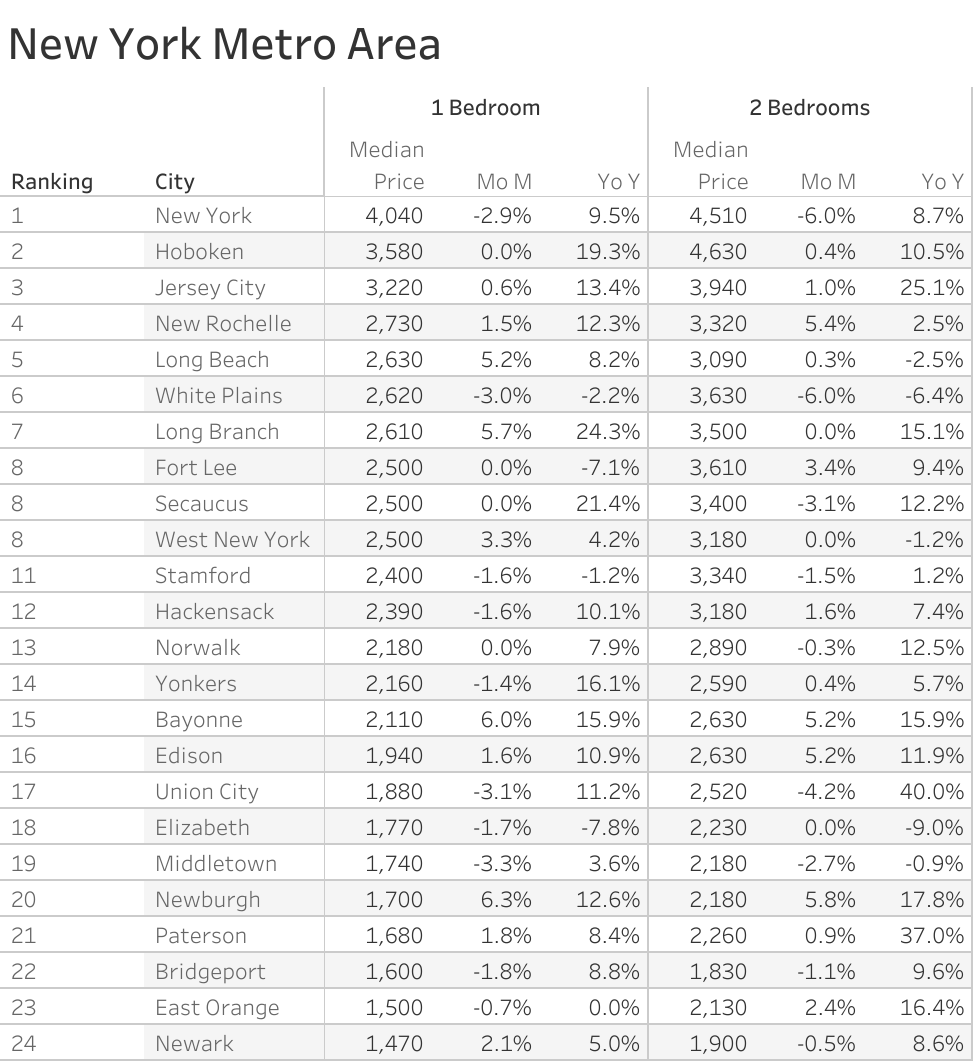

New York Rental Market Report

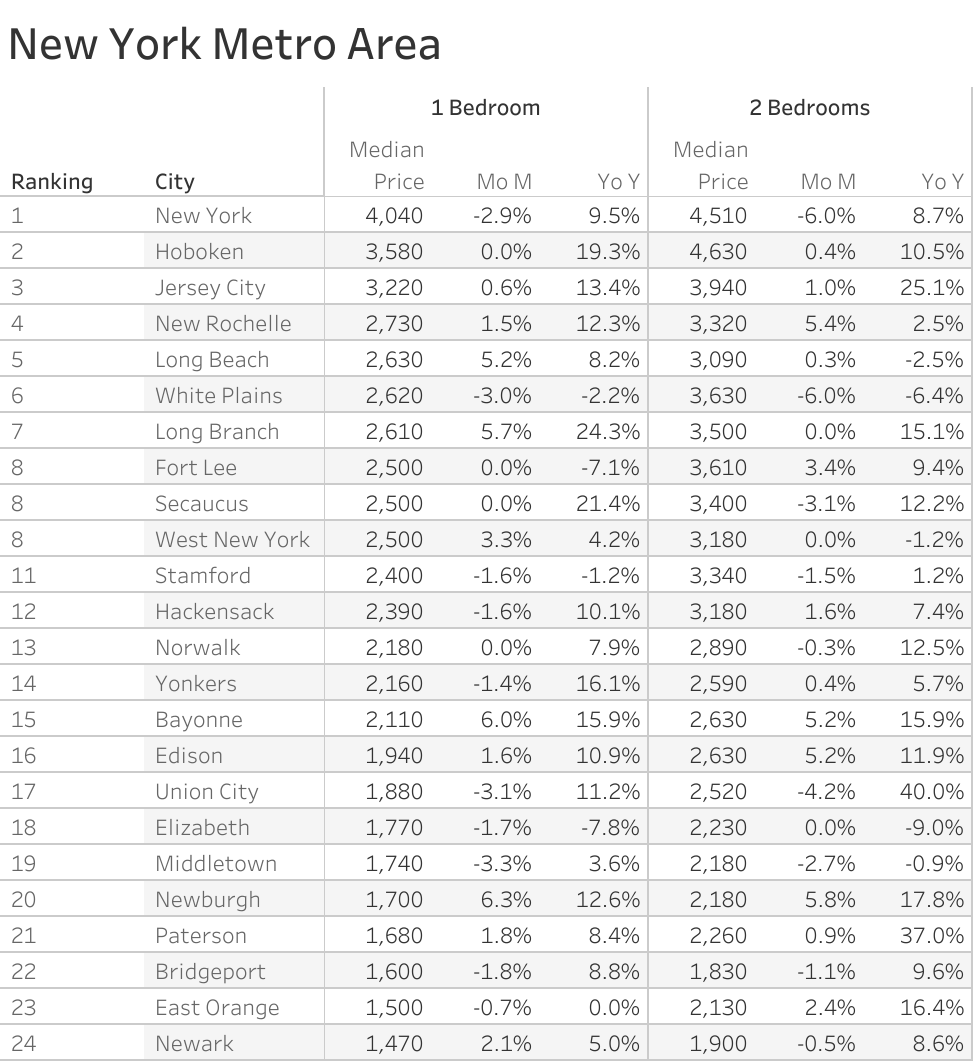

The Zumper New York City Metro Area Report analyzed active listings across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The New York one-bedroom median rent was $2,390 last month. New York City was the most expensive market with one-bedrooms priced at $4,040 whereas Newark was the most affordable city with rent priced at $1,470.

Here are the places where it makes sense to invest in rental properties in the New York City Metro Area. These are the places where the demand for rentals is growing strong in 2024.

The Fastest Growing Cities For Rents in New York City Metro Area (Y/Y%)

- Long Branch had the fastest growing rent, up 24.3% since this time last year.

- Secaucus saw rent climb 21.4%, making it second.

- Hoboken rent was the third fastest growing, jumping 19.3%.

The Fastest Growing Cities For Rents in New York City Metro Area (M/M%)

- Newburgh had the largest monthly rental growth rate, up 6.3%.

- Bayonne rent was the second fastest growing, climbing 6%.

- Long Branch was third with rent growing 5.7%.

Top Real Estate Estate Markets in New York

Buffalo real estate market

The Buffalo real estate investment offers a surprisingly good deal with low prices and relatively high rental rates. The Buffalo real estate market is dominated by older homes. A majority of homes in the Buffalo housing market were built before World War 2. Interestingly, this also means that many small apartment buildings are designed to serve a population that rented small units close to their jobs.

For example, roughly a third of homes are single-family detached homes, while almost half take the form of small apartment buildings. This creates an excellent opportunity for those in the market for Buffalo rental properties. You could buy a small apartment building with multiple tenants for the cost of a single rental property in a more expensive New York real estate market.

Syracuse real estate market

Syracuse’s real estate market offers cheaper property with a higher return on investment and a less hostile legal climate. It is one of the better choices if you want to invest in New York state. Another issue that factors into the equation is the job market. Lots of cities have a great quality of life but almost no one can afford to live there.

The Syracuse housing market ranked 6.3 out of 10 for its job market. That’s better than rural and much of upstate New York. And it is why there is a slow trickle of people moving in to replace those who leave. That’s why the Syracuse real estate market has a net migration of 5 or a stable population. This is in sharp contrast to the depopulation seen in most Rust Belt cities. It also means Syracuse’s real estate investment properties will hold their value for the foreseeable future if they don’t appreciate it.

Albany real estate market

Albany is a steadily appreciating real estate market. While it isn’t as famous or hot as NYC, it offers an affordable entry point and a massive pool of perpetual renters. Though it may not be somewhere you want to live, many locals are choosing to stay and make their homes here. And that will continue to drive demand for Albany real estate investment properties as long as they are priced right.

Rochester real estate market

You can also consider Rochester. The Rochester real estate market is stable, offering slow appreciation, affordable properties to outsiders, and good returns. It has strong, long-term potential that is only buoyed if NYC collapses. And this is one of the reasons why being everything the Big Apple isn’t is in your favor.

The Rochester real estate market enjoys a healthy population profile. Roughly a quarter of the population consists of children, and many are likely to remain due to the healthy job market. It also means that the Rochester housing market won’t crash if the job market weakens the way San Francisco collapses whenever the tech bubble bursts. Others choose to remain here because of the low cost of living.

References

- https://www.nysar.com/news/market-data/reports

- https://www.redfin.com/blog/data-center

- https://www.zillow.com/new-york-ny/home-values

- https://www.realtor.com/realestateandhomes-search/New-York_NY/overview

- https://streeteasy.com/blog/nyc-housing-market-data/

- https://www.redfin.com/city/30749/NY/New-York/housing-market

- https://www.elliman.com/corporate-resources/market-reports

New Yorkers hoping for good real estate news are in luck, that is if you’re a buyer.

Data out from the popular real estate listing site StreetEasy is highlighting a healthy list of neighborhoods favorable to home buyers right now.

What makes a good neighborhood? StreetEasy said their top neighborhoods have the most frequent price cuts for buyers, largest gaps between asking price and sale price, and greatest increase in days on market compared to a year ago.

“StreetEasy data shows there are neighborhoods across the city and at every price point where buyers are likely to have the upper hand right now,” the real estate company said last week.

Big Apple buyers, StreetEasy says, can expect more wiggle room to negotiate. They also said buyers should feel less pressure to fork over more money than they are comfortable paying.

Top 5 Buyer Neighborhoods With Median Asking Price > $1 Million

- Greenwich Village

- East Village

- Upper East Side

- DUMBO

- Bushwick

As of January, three neighborhoods (Upper East Side, East Village, and Greenwich Village) have median asking prices from $1.4 to $2 million. The current citywide average is just under $1.1 million.

Greenwich Village homes may generally come with higher prices tags — the average asking price is just shy of $2 million — the neighborhood boasts a surprising statistic. The Manhattan hotspot sees more than 12% of listings drops their price in an effort to entice buyers.

Meanwhile, in a village not so far away, average prices may look more appealing to certain buys. With an average asking price around $1.4 million, the East Village has home generally lingering on the market a little while longer — reflecting a 1-in-10 chance buyers may find a reduced price.

Top 5 Buyer Neighborhoods With Median Asking Price < $1 Million

- Brighton Beach

- Bay Ridge

- Sheepshead Bay

- Midtown East

- Flushing

Neighborhoods like Sheepshead Bay, StreetEasy points out, have a lower average asking price than others. The medium for the southern Brooklyn neighborhood sits around $565,000 and a “typical home” sells for under the initial asking price.

In Flushing, the only Queens neighborhood to make the list, the real market is slightly more competitive. StreetEasy says an influx of new homes has helped tick the average price up. Still, the borough generally has more affordable options than Manhattan and Brooklyn.

One takeaway for buyers the site wants to point out — mortgage rates should stay below last year’s record highs.

Google welcomed thousands of “Googlers” this week to its newest New York City facility at St. John’s Terminal, a 1.3 million-square-foot former rail terminal that has been transformed into an urban campus featuring shared neighborhood seating, a range of communal workspaces, lounges on every floor, cafes, terraces, micro-kitchens, gardens and views of the Hudson River.

Over 14,000 Google employees now work in New York today, up from 7,000 in 2018. “It’s a testament to New York’s vibrancy, diverse talent pool and world-class institutions that keep us rooted here,” Sean Downey, President, Americas & Global Business, wrote in a blog post announcing the new office.

Google purchased St. John’s Terminal at 550 Washington Street in Manhattan’s Hudson Square neighborhood in 2022 for $1.97 billion, bringing the tech giant’s footprint to nearly 6 million square feet across seven Manhattan sites.

Companies Take Advantage of Weaker CRE Market

Major firms are following Google’s lead and taking advantage of New York City’s weaker investment sales market to pick up prime office, retail and industrial assets to enhance their own brands.

New York City saw investment property sales fall 40 percent to $22.1 billion in 2023 the lowest in the past decade, excluding 2020 during the Covid-19 pandemic, according to Ariel Property Advisors’ New York City Year-End Sales Report.

The office market was particularly hard hit last year with sales falling 59% citywide to $3.2 billion in 2023 compared to the previous year.

Demand for office assets cooled as the pandemic fundamentally changed the way we do business and companies shifted from five-day work weeks to a hybrid model, bringing average office occupancy rates to 65% of pre-pandemic levels in 2023. As a result, the value of Manhattan office buildings dropped year-over-year by 22% to $848/SF, with Class A offices trading at a premium and Class B and C buildings trading below the average, Ariel’s Manhattan 2023 Year-End report shows.

Major Companies Make Offices Their Home

The anemic office market presented an opportunity for companies seeking to enhance collaboration and retain talent by controlling their office environment and acquiring space at one of the lowest value points in years.

Wells Fargo was among them, purchasing over 400,000 square feet of space at 20 Hudson Yards from developer The Related Companies for $408 million. The financial institution announced the transaction as a significant investment in the New York City and “an opportunity to bring most NYC-based Wells Fargo employees together in one location for improved collaboration and access to new, more modern workspaces, technology, and amenities.” The Hudson Yards space had been vacant since 2020 after its previous tenant, Neiman Marcus, declared bankruptcy.

Consumer products leader Enchanté Accessories purchased a 12-story, 121,000-square-foot building at 147-149 Madison Avenue for $77 million, 12% below the $87.7 million price Columbia Property Trust paid in 2017. WeWork had signed a lease for the entire building in 2018 but abandoned the project in 2020 after Columbia had reportedly made $16 million in renovations.

Additionally, Seoul-based automaker Hyundai acquired 15 Laight Street in Tribeca for $275 million. Hyundai will use the newly redeveloped, eight-story building to house its offices and showroom. Another Korean firm, media company MediaWill, purchased a 113,000 square foot office building at 110 West 32nd Street from a long-term owner for $37 million.

Educational institutions also saw value in buying their own buildings as demonstrated by New York University, which acquired 400 Lafayette Street in Manhattan for $97.5 million in 2023 and 3 Metrotech Center in Brooklyn for $122 million the year before.

Prada: The Retail Story of 2023

Luxury retailers noticed that Manhattan was on sale and acted on it. Last December, Prada closed on its $822 million purchase of 720-724 5th Avenue from Wharton Properties. Prada has been selling its luxury fashions in a 15,500-square-foot space at 724 Fifth Avenue for 25 years, renewing its lease in 2013 starting at $19 million, according to an article published in The Real Deal.

Gucci’s parent company, Kering SA acquired Wharton’s 115,000-square-foot, three-level retail space at 715-717 Fifth Avenue this January for nearly $1 billion. And, the Wall Street Journal reported that LVMH Moët Hennessy Louis Vuitton “is in discussions to purchase the 5th Avenue retail space occupied by Bergdorf Goodman’s men’s store.”

With increased foot traffic and tourism as a backdrop, leasing activity on 5th Avenue improved last year. Abercrombie and Aritzia relocated to new spaces on the prime retail corridor, Swarovski opened a two-story flagship at 680 5th Avenue, Italian sneaker brand P448 moved to 663 5th Avenue and footwear designer Armando Cabral is planning to take space at 620 5th Avenue, according to the Real Estate Board of New York’s latest Manhattan Retail Report. Vacancies are rare and average asking rents on prime 5th Avenue are exceeding $2,000 per square foot, but still below the peak of $3,900 in late 2017, the report showed.

When it comes to retail, the value is in prime locations as illustrated by these transactions. Like the companies buying office buildings, Prada and Gucci are enhancing their brands and cementing their commitment to New York City through real estate.

Delivering Opportunity: FedEx

In Brooklyn, another company decided to control its future by buying industrial space last year. This time it was FedEx that purchased 50 21st Street in Sunset Park for $248 million, a deal that accounted for 38% of the borough’s total $652.4 million in industrial sales in 2023, according to Ariel Property Advisors’ Brooklyn 2023 Year-End Commercial Real Estate Trends report.

Fed Ex’s purchase follows the acquisition of two warehouses leased to Amazon at 640 Columbia Street and 578 Cozine Avenue, which traded last year for a combined $560.6 million.

These transactions are examples that reaffirm Brooklyn’s position as a premier distribution hub with easy access to all five boroughs, Long Island, New Jersey and beyond. Looking ahead, we expect Brooklyn’s industrial market to continue to reap the benefits of the e-commerce boom.

Will the Owner/User Trend Continue?

In addition to South Korea and Italy, other international investors from Germany, Qatar, Japan, France and Spain are being drawn to New York City because of its lower prices and other factors. Japanese investors alone put $3.7 billion into commercial real estate in the United States, the largest level since 2016, due in part to Japan’s lower borrowing rates.

Mortgage maturities are expected to double in 2024, according to a forecast by Moody’s. The anticipated result is that there will be more forced decisions to sell, which could present major brands seeking to attract top talent and control their destiny with more opportunities in the New York City commercial real estate market this year.

Canadian pension funds have been among the world’s most prolific buyers of real estate, starting a revolution that inspired retirement plans around the globe to emulate them. Now the largest of them is taking steps to limit its exposure to the most-beleaguered property type — office buildings.

Canada Pension Plan Investment Board has done three deals at discounted prices, selling its interests in a pair of Vancouver towers, a business park in Southern California and a redevelopment project in Manhattan, with the New York stake offloaded for the eyebrow-raising price of just $1. The worry is those deals may set an example for other major investors seeking a way out of the turmoil too.

“It’s the opposite of a vote of confidence for office,” said John Kim, an analyst tracking real estate companies for BMO Capital Markets. “My question is, who could be next?”

Anxiety over office buildings has swept the financial world as the persistence of both remote work and higher borrowing costs undercuts the economic fundamentals that made the properties good investments in the first place. A wave of banks from New York to Tokyo recently conceded that loans they made against offices may never be fully repaid, sending their share prices plunging and prompting fears of a broader credit crunch.

But the real test will be what price office buildings actually trade for, and there have been precious few examples since interest rates started rising. That’s why industry-watchers see discounted deals like CPPIB’s as an ominous sign for the market.

Redeploying Cash

The pension fund isn’t actively backing away from offices, but it’s not looking to increase its office holdings either, according to a person with knowledge of its strategy. And where a property requires additional investment, CPPIB might simply look to sell so it can put that cash somewhere it can get higher returns instead, said the person, who asked not to be identified discussing a private matter.

Peter Ballon, CPPIB’s global head of real estate, declined to comment on the recent deals, but said the fund has continued to invest in office buildings, including a recently completed, 37-story tower in Vancouver.

“Selling is an integral part of our investment process,” Ballon said in an emailed statement. “We exit when the asset has maximized its value and we are able to redeploy proceeds into higher and better returns in other assets, sectors and markets, including office buildings.”

CPPIB’s C$590.8 billion ($436.9 billion) fund is one of the world’s largest pools of capital, and its C$41.4 billion portfolio of real estate — stretching from Stockholm to Bengaluru — includes almost every property type, from warehouses, to life sciences complexes, to apartment blocks. While that scale would mitigate any potential losses from individual transactions, it also means even a small shift in CPPIB’s office appetite has the power to cause ripple effects in the market.

Manhattan Tower

At the end of last year, the fund sold its 29% stake in Manhattan’s 360 Park Avenue South for $1 to one of its partners, Boston Properties Inc., which also agreed to assume CPPIB’s share of the project’s debt. The investors, along with Singapore sovereign wealth fund GIC Pte., bought the 20-story building in 2021 with plans to redevelop it into a modern workspace.

Boston Properties said last month that the selling partner — which the company didn’t name — had already spent $71 million on the project, but severing its ties released it from an obligation to commit an additional $46 million to the effort.

Around the same time, CPPIB sold its 45% stake in Santa Monica Business Park, which the fund also owned with Boston Properties, for $38 million. That’s a discount of almost 75% to what CPPIB paid for its share of the property in 2018. The deal came just after the landlords signed a lease with social media company Snap Inc. that required they spend additional capital to improve the campus, Boston Properties Chief Executive Officer Owen Thomas said on a conference call.

The two Vancouver towers, co-owned with another Canadian pension fund, were different in that they didn’t need substantial new investment and had Amazon.com Inc. already in place as the major tenant. But last month’s sale price of about C$300 million was down more than 20% from where the property’s value was assessed at in 2023, data from Altus Group shows.

That sale coincided with the completion last year of a new office tower in Vancouver that CPPIB developed with the same pension fund, and the partners wanted to keep their overall exposure to the city’s office market from increasing, a person familiar with their thinking said.

With hybrid work schedules set to depress demand for office space in the long term, and higher interest rates increasing the cost of the constant upgrades needed to attract and keep tenants, even the best office buildings may not be able to compete with investment opportunities elsewhere.

“To get even better returns in your office investment you’re going to have to modernize, you’re going to have to put a lot more money into that office,” said Matt Hershey, a partner at real estate capital advisory firm Hodes Weill & Associates. “Sometimes it’s better to just take your losses and reinvest in something that’s going to perform much better.”

New York is a large and diverse state. The home-sale process looks very different in New York City than it does in the rest of the state, so if you’re gearing up to sell your house in New York, be aware that there can be drastic differences between individual New York housing markets. For example, the median asking price in Manhattan is $1.7 million, according to December data from StreetEasy, while the median sale price in the upstate college town of Syracuse, according to Redfin, is just $155,000.

No matter where in the Empire State your property is located, selling a home here requires careful consideration of when to list, how to price and how to prepare for showings — especially if you’re hoping to sell in a hurry. Read on to understand how to sell a house fast in New York.

How fast can you sell your home in New York?

Selling a New York home may take some time, depending on your local market conditions. The New York State Association of Realtors reported an average of 50 days on the market across the state in December 2023 — that’s the length of time it takes for the home to go into contract, after which you must typically wait for your buyer’s financing to be approved before you can close. The days-on-market number fluctuates seasonally and is typically shorter in spring and summer, which is prime home-selling season.

Need to sell faster?

What if you’re pressed for time and can’t wait two months or longer? Say you need to relocate ASAP for work, for example, or you just need the money fast — there are things you can do to help speed the process along.

- Sell to an iBuyer: The “i” in iBuying stands for “instant,” and these companies do in fact operate with great speed. Most make cash offers within 24 hours, though the offer probably won’t be as high as you could get in a traditional sale, and they can close the entire deal in just a few weeks. Opendoor, one of the biggest players in the industry, currently buys homes in two New York regions: Long Island and the Lower Hudson Valley.

- Sell to a cash-homebuying company: Local homebuying companies are a closely related option that operate with equal speed and also pay in cash. These often specialize in purchasing homes in poor condition, which is appealing if you’re overwhelmed by an older home’s need for updates or repairs. But, like iBuyers, they are not likely to offer as high a price as you might get otherwise.

- Sell as-is: Telling prospective buyers upfront that you are selling the home in as-is condition means you won’t waste precious time negotiating back-and-forth over who will pay for repairs.

-

Be flexible: You can still expedite a sale if you choose to work with a real estate agent. Be candid about your need for speed right from the beginning, and be open to arrangements that may help move things along faster, including pricing your property to move and offering seller concessions.

Selling your home fast for fair market value

Working with a local real estate agent will take a bit longer, but it’s the best way to fetch a competitive market price for your home. Here are some things to consider before you list:

Is it worth upgrading your home before you sell?

Some issues should be fixed before listing, even when you’re moving quickly. You don’t want obvious imperfections, like a broken garage door or cracked window panes, to turn off potential buyers. But some issues are not worth addressing — and bigger home-improvement projects, like a full kitchen or bath remodel, are not likely to recoup their cost when you sell. There are plenty of smaller, less expensive and faster things you can do to increase your home’s allure, such as upping its curb appeal to make a good first impression. Your agent can provide guidance on what’s worth doing and what’s not.

Bankrate Insight

Should you pay to stage your home?

Professionally staging your home may help to make it a star on the local market. How much you’ll pay for home staging depends on just how much help you need: Simple rearranging and decluttering will be fairly affordable, while renting furniture to fill an empty home you’ve already moved out of might be quite expensive. Again, your agent can help you decide whether staging will help you make more money on the sale.

How should you price your listing?

Price your home competitively might be the most important consideration of all, especially if you’re trying to sell quickly. Online resources might give you a basic idea of what your house is worth, but your agent will take a close look at the comps in your specific area to figure out the best pricing strategy. More than 40 percent of New York homes sold for above their listing price in December 2023, per Redfin data, and your agent can help you figure out how to put your house into that same category.

What do you need to disclose to the buyer?

Most home sellers in New York will need to fill out the state’s property condition disclosure statement, which includes various details about the home as well as potential issues that may affect its safety or value. In addition, if your property is part of a homeowners association, you’ll have to compile HOA paperwork for the buyer to look over, including financial documents and bylaws.

Closing day

Even though the closing is when your money is handed over, it won’t be free. As a seller, the biggest line item in your budget will likely be the commissions for the real estate agents involved in the transaction. The payouts for each agent come out of your pocket, and they usually total somewhere between 5 and 6 percent of the home’s sale price. There’s often room for negotiation here though, particularly with a higher-priced property.

Here are some of the other typical closing costs in New York for sellers:

- Title insurance: Protection against title issues is a common cost for sellers, but unlike in many states, the buyer usually covers the cost of title insurance in New York. So, that’s one area where you can expect to pay nothing.

- Transfer taxes: The seller does typically cover the cost of New York’s real estate transfer tax, though. The rate is $2 for every $500 of value, so the more a property is worth, the more you pay. New York also has a “mansion tax” that includes an additional 1 percent on any home that sells for $1 million or more.

- Flip tax: If you are selling a co-op in New York City, be sure to check whether the board charges a flip tax — essentially a fee to transfer the ownership of your apartment. The cost varies from building to building.

- Attorney fees: It’s customary in New York for each party in a real estate transaction to be represented by an attorney. Legal fees will be due at closing.

- Seller concessions: Sellers often agree to pay for a portion of the buyer’s closing costs, or to pay for the cost of a necessary repair. If you have agreed to concessions, those funds will also be due at closing.

- Escrow fees: You may also be charged modest fees related to the escrow account that held the buyer’s earnest money deposit.

Find a trusted real estate agent

Ready to sell your New York home fast? Interview several real estate agents to find one you feel comfortable working with. Look for someone who knows your local market well and who has an actionable plan to make your sale happen quickly. Bankrate’s Agent Match can help you get started.

FAQs

-

Selling your house to an iBuyer or cash-homebuying firm is the fastest method. Going this route will allow you to close the entire deal within a few weeks, rather than waiting nearly two months to sell and then potentially another month or so before you can close. (The median length of time a home here spends on the market is 50 days, according to the New York Association of Realtors.) However, selling to one of these companies will not get you a top-dollar price for your home.

-

Yes, skilled real estate agents can market your home with speed in mind and will be able to implement various strategies for selling quickly. The process still won’t move as fast as an iBuyer or cash-homebuyer transaction, though, because once you’ve signed the contract you’ll likely need to wait at least a couple weeks for your buyer’s financing to be approved.

Despite several price cuts and years on the market, Las Vegas casino mogul Steve Wynn is having trouble selling his Beverly Hills and New York City properties.

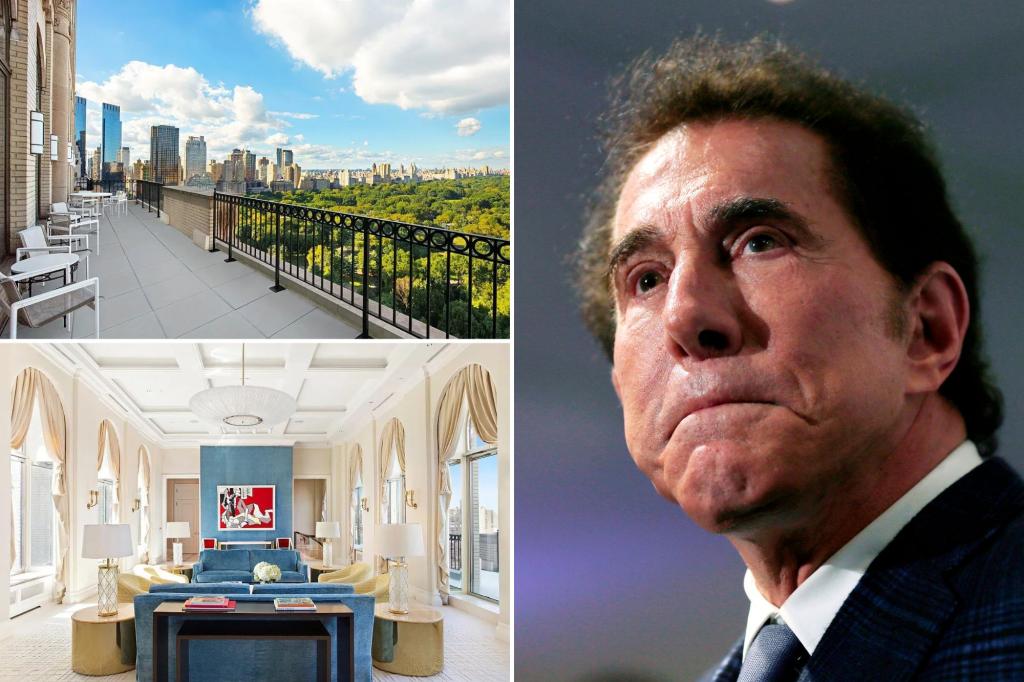

Sotheby’s International Realty / REUTERS

Las Vegas casino mogul Steve Wynn is having a tough time selling his multimillion-dollar homes across the United States.

Wynn’s New York City pied-à-terre, a lavish Central Park South penthouse spanning nearly 11,000 square feet, for instance, has hit a stumbling block.

Despite a price slash from an initial $90 million to $65 million last year, the casino czar has withdrawn the property from the market.

Notably, this final price was $5 million less than what Wynn paid for the opulent duplex in 2012.

The residence, located on the 30th and 31st floors of the Ritz-Carlton New York, Central Park, boasts three bedrooms, and stunning views of the park and the Manhattan skyline.

Originally aimed to fetch $90 million in 2022, the sale at that price would have set a record as the most expensive ever seen in the building.

The duplex includes a dining room opening to a 28-foot-long terrace, a media room, a library and a wet bar.

Past residents of the building include billionaires Larry Ellison and Sidney Kimmel.

Wynn’s struggles most recently extend to the West Coast, where his expansive Beverly Hills estate faces challenges in the luxury property market.

The 11-bedroom, 16-bathroom mansion at 1210 Benedict Canyon Drive has been on and off the market for a few years.

As of Jan. 17, its price dropped by about 12%, currently listed for $75 million.

Last year, it asked $85 million, significantly down from its initial off-market asking price of $135 million in 2020.

This follows a tough year for LA’s luxury home market, where sellers have been advised to reduce prices.

Wynn’s Beverly Hills estate, situated on 2.7 acres, offers amenities such as a championship tennis court and a resort-style gym.

Despite the hurdles in offloading his New York City and Beverly Hills residences, Wynn successfully sold his Las Vegas mansion for $17.5 million in 2022.

Load more…

{{/isDisplay}}{{#isAniviewVideo}}

{{/isAniviewVideo}}{{#isSRVideo}}

{{/isSRVideo}}