OVERLAND PARK, Kan. (KCTV) – A new stadium under construction in Overland Park promises to host some of the finest athletes and trainers in the region as Kansas City Surf finds a new home.

AdventHealth Sports Park at Bluhawk announced at the beginning of April that Kansas City Surf, a leading local soccer club, would soon call the stadium home. The partnership begins as the complex nears the end of its first phase of construction and is set to open later in 2024.

Sports park officials indicated that the club is a community dedicated to nurturing a love for soccer as well as talent at all levels. Founded in 2010 as Puma FC, the club has a history built on family, friends, competition and community.

Park leaders noted that Kansas City Surf boasts a brand of youth and semi-professional soccer. Audiences become captivated by the skilled athletes and fast-paced action. The club also cultivates the future of soccer with strong programs under elite coaches and staff. More than 2,500 players call the club home.

According to officials, the club also offers multiple platforms like Surf Select, Surf Champions League, ECNL Regional League, nPL Heartland League local Tournaments and showcase events nationwide.

“We are thrilled to welcome Kansas City Surf to AdventHealth Sports Park at Bluhawk,” said Greg Jackson, General Manager of the facility. “Their commitment to excellence aligns perfectly with our mission to provide a world-class facility for young athletes in our community. Surf’s energy and passion for the sport will undoubtedly create a thrilling atmosphere at our facility.”

Sports park officials said the stadium was built to host championships with an elite 40,000 square foot indoor turf field, six locker rooms and a private performance training area.

“Kansas City Surf is excited to be a valued partner to AdventHealth Sports Park at Bluhawk. Kansas City Surf’s mission is to create the ‘Best of the Best’ experiences and opportunities for youth soccer players through our clubs, events, and facilities. This partnership with a facility of this magnitude fulfills that mission,” said Rob Million, President of Kansas City Surf.

Park leaders said the new partnership is a symbol of dedication to providing world-class training grounds for athletes. The collaboration promises to elevate the soccer experience in the Kansas City metro and foster a hob for athletic excellence as well as community engagement.

Copyright 2024 KCTV. All rights reserved.

Nashville restaurant group Strategic Hospitality recently announced that after over a decade at the 1711 Division Street location, both the Catbird Seat and the Patterson House will relocate to the Gulch. This coming summer, the award-winning Nashville restaurant and bar will take residence on the rooftop of the recently revitalized historic Bill Voorhees building in Paseo South Gulch.

Along with the move, the Catbird Seat will install two new executive chefs in its fifth iteration of the restaurant: Andy Doubrava and Tiffani Ortiz. The two are best known for their nomadic restaurant series Slow Burn, which is dedicated to the preservation of wild and sustainable ingredients.

Chef Brian Baxter, who has served as Catbird’s executive chef for the past four years, will remain with the restaurant until the summer move. However, both Doubrava and Ortiz will host a series of pop-ups offering a preview of what’s to come, including collaborative dinners with Chef Brian Baxter at The Catbird Seat. Reservations for the Catbird Seat are available here with walk-in availability at the Patterson House.

Union Teller Diner and Bar re-opens at the Fairlane Hotel

Union Teller, the Fairlane Hotel’s former lobby-level delicatessen, is back as both a diner and a bar serving all-day breakfast and lunch along with a new evening menu. Led by Executive Chef Angeline Chiang, Union Teller’s new menu highlights include a Big Boy Sando stuffed with four different deli meats, a salmon classic sandwich on a biscuit, stuffed French toast, sausage hash, and a bagel of the day with pimento cheese fondue. Union Teller Diner and Bar is open daily starting at 7 a.m.

A Lainey Wilson pop-up bar at Good Times

Country singer Lainey Wilson is behind a new three-day pop-up bar in downtown with Barmen 1873. Taking over Good Times (1529 4th Ave S.), the space will be decked out in Western flair and playing Wilson’s music. The bourbon-forward drinks include the Wildflowers Old Fashioned, the Wild Horses Manhattan, and the Buckle. The pop-up will be open April 5 to 6 from 6:30 to 11:00 p.m. and April 7, 2024, from 4:30 to 9:00 p.m. Tickets are $10 and available here — 100% of proceeds from the pop-up experience will go to Lainey Wilson’s charitable fund, Heart Like A Truck.

Blue Sushi Sake Grill opens a new location in Franklin

After two years at Fifth and Broadway, Blue Sushi Sake Grill has opened another location at the McEwen Northside complex in Franklin. The restaurant, which was designed in collaboration with Design Collective Nashville, features splashy elements like a backlit collage of a massive Godzilla in the lounge area and large geisha murals on the building’s exterior created by local muralist Eric “Mobe” Bass. As with its other locations, the menu features an assortment of rolls, sashimi, and Japenese-inspired dishes like the Cherry Bomb featuring bigeye tuna on top of rice tempura, topped with serrano, sriracha, togarashi, and ponzu sauce; a beef tenderloin served on sizzling rocks with jalapeno ponzu and yuzu kosho; and crispy Brussels sprouts tossed in a creamy lemon miso sauce and toasted cashews. Blue Sushi Sake Grill is open Monday through Thursday from 11 a.m. to 10 p.m., Friday and Saturday from 11 a.m. to 11 p.m., and Sunday from noon to 9 p.m.

Quick hitters:

- All-you-can-eat crawfish boil at Bringle’s Smoking Oasis: On Sunday, April 7 at 11 a.m., Bringle’s is partnering with Billy Link from Louisiana for a classic crawfish boil with drink specials throughout the day. Tickets are $45 and can be purchased here.

- Dine to Shine: Lighting the Night for Nashville Children’s Alliance: Nashville Children’s Alliance will host a fundraiser on Friday, April 5 at 6 p.m. featuring a multi-course dinner from local favorites like Noko, Sean Brock, Black Box Ice Cream, East Side Banh Mi, Butcher & Bee, and the Indigo Road Hospitality Group (Oak Steakhouse, O-Ku). Tickets are still available for $150 per person and can be purchased here.

- Juan Soto, Oswaldo Cabrera and Anthony Volpe hit homers for the Yankees

- It is the first time since 2003 that the Yankees have won the first three games

- DailyMail.com provides all the latest international sports news

Oswaldo Cabrera hit a tying two-run homer in the seventh, Juan Soto had a go-ahead drive for his first Yankees homer and New York rallied for the third straight game in a 5-3 win over the Houston Astros on Saturday night.

Anthony Volpe gave the Yankees some insurance with a home run with two outs in the eighth as they improved to 3-0 for the first time since opening the 2003 season with four wins.

Houston, which reached its seventh straight AL Championship Series last season, dropped to 0-3 for the first time since losing five straight to start the 2011 season.

Marcus Stroman (1-0) allowed four hits and three unearned runs in six innings to get the win in his Yankees´ debut. Stroman, who was born and raised on Long Island, signed a $37 million, two-year contract to join the Yankees this offseason after spending the previous two seasons with the Cubs.

Clay Holmes pitched a scoreless ninth for his second save. New York’s bullpen has allowed no runs while Houston’s has given up 13.

The Astros led 3-1 when Bryan Abreu made his season debut in the seventh inning after serving a two-game suspension for intentionally throwing at Texas star Adolis García in last year´s AL Championship Series.

He walked Austin Wells and Cabrera sent a fastball into the second row of the seats in right field for his second homer this season.

Trent Grisham walked but was picked off. Soto drove a slider on the outside corner to left field for a 4-3 lead.

Abreu (0-1) blew four saves last season and had 24 holds

Soto, the Yankees’ big offseason acquisition, is off to a great start and has six hits and three RBIs in three games and has also dazzled defensively. But overshadowing him at the plate so far early is Cabrera, who´s opened the season with seven hits and six RBIs.

Houston went ahead in the second inning when Yainer Diaz reached on a throwing error by Cabrera at third, Stroman plunked José Abreu on a hand and Mauricio Dubón lined a two-run double just over Soto in right field.

Soto and Aaron Judge hit back-to-back singles with one out in the third. Soto scored on an error by first baseman José Abreu that allowed Anthony Rizzo to reach and cut the lead to 2-1.

The Astros boosted their lead to 3-1 in the fifth when the Yankees committed two errors on one play to make it 3-1.

Houston starter Hunter Brown allowed four hits and a run with five strikeouts in four innings.

There is something about Opening Day in baseball that looks back even as it looks forward, a Mobius strip twist in time during which the past and future co-exist. The T-Mobile magenta carpet is rolled out, then rolled back for another year. One elevator attendant wore a button proclaiming this to be their fourth opening day; another, their 23rd. The pageantry at the ballpark is familiar, if staffed by new faces: different kids running around the bases and announcing “play ball”; a national anthem from a member of a band many of us have been listening to since the days of burning CD mixes. A different Mariners legend throwing out the first pitch: this year, Nelson Cruz, taking his place in the firmament of Mariners stars by signing a one-day contract to retire as a Mariner. He threw to Félix Hernández, himself already ensconced in eternal Mariners glory, in a perfectly chaotic first pitch that involved Nelson—who said he blew out his biceps tendon in one last farewell tour of LIDOM—spiking the ball into the ground, then recovering to lob in a pitch that Félix summarily dropped. Chaos ball, is that you?

Cruz was teammates with Mitch Haniger; when asked pregame to reflect on what Haniger was like in his “younger” playing years, Cruz smiled and said Mitch had always been very mature as a player. Haniger, making his return to T-Mobile Park, enjoyed a loud ovation when he ran down the magenta carpet, a Mariner once again: when he came up to bat for the first time, the fans gave him a standing ovation, something Mitch recounted warmly postgame, calling T-Mobile a “special” place to play.

But that ovation was nothing compared to the noise they made when Haniger homered to give the Mariners their first runs of the season:

While Haniger has historically gotten a lot of his power from the pull side, this ball—102.2 mph off the bat, 372 feet to the opposite field—showed some of the improvements he’s made during his time away from the team, something he credits to a deeper swing path and different rear-arm and top-hand mechanics.

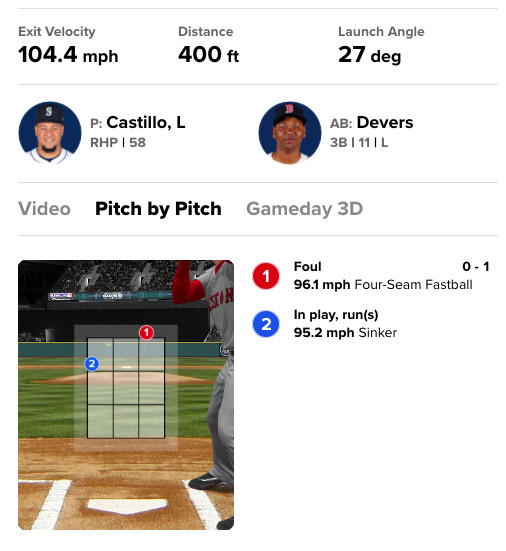

Also so back: Dylan Moore’s power. After an injury-hampered 2022, DMo—pinch-hitting in the seventh for Mitch Garver—absolutely demolished this sinker from lefty Joely Rodriguez, crushing this pitch at 104 mph 409 feet. (Scoring on the play: Mitch Haniger, who had singled, natch.) DMo’s one job is beach, and by “beach” we mean “crush lefties”; if he can be back to his power-hitting form of the past, that’s an incredible boon for this ballclub.

Per Mariners PR, that makes DMo only the second player to hit a pinch-hit home run on Opening Day, joining Roberto Petagine on April 3, 2006. Unfortunately, that game was also a loss. The Mariners have generally had a good record on Opening Day, even in the fallowest years: per stats guru Alex Mayer, the Mariners have a .655 winning percentage on home openers, third-best among all active franchises. But tonight’s game will not join that rare air.

Luis Castillo had a lot of life on his pitches but poor command, and a patient Red Sox lineup was able to sit on his pitches and exhaust his pitch count early. The Sox drew first blood in the third inning, when Rafael Devers did what Devers does best and reached across the plate to pop this sinker that didn’t quite sink over the left-field fence for a two-run homer.

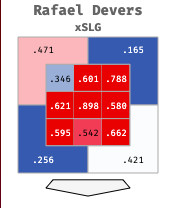

I was sitting next to Alex Mayer for this game and he immediately recalled (because he has an enormous baseball computer for a brain) Devers hitting a home run off a similar pitch from Sewald in 2022, so I looked up Devers’s zone splits and dang. Sometimes you just have to tip your cap.

The Sox would get another run off Castillo in the fourth: Triston Casas singled, and Masataka Yoshida doubled, bringing Tyler O’Neill (who is with the Red Sox now!), who had hit into a force out, to third. O’Neill would then score when Josh Rojas almost made a great play, snagging a sharply hit grounder from Ceddanne Rafaela and touching third for the force, but then his throw home hit O’Neill in the helmet. D’oh. Another run crossed home in the fifth, again with Devers providing a big hit with a double, pushing speedy Jarren Duran to third; he’d then score on a force out.

Speaking of Tyler O’Neill, he made some history of his own tonight, becoming the first player to homer in five straight Opening Day games, torching Cody Bolton for a solo shot. For O’Neill, the achievement was probably even sweeter coming against the team that traded him away. Everything that’s old is new again (derogatory).

That gave the Red Sox six runs, and the Mariners two two-run home runs. The Mariners lineup threatened at times tonight: they had a good chance in the first, when Julio worked an 0-2 count to a 2-2 count and doubled, followed by a single from Jorge Polanco, but Mitch Garver hit into an inning-ending double play. Later, Garver would double, but be stranded by a Cal Raleigh inning-ending groundout. J.P. Crawford hit two balls with exit velocities over 107 mph, right at defenders. That’s how things would go for the Mariners tonight: the sequencing luck just wasn’t there, even as the process was. Postgame, Haniger said the results weren’t there for the team tonight, but he likes the process, and he feels like this is the most complete Mariners team he’s been a part of—significant words coming from the man who was once Nelson Cruz’s teammate.

Layered on every Opening Day is the ghost of other, previous Opening Days: time spent with friends who have moved away, family members no longer with us, and to take stock of the changes for those that remain, steps a little slower, hair a little grayer. For me, this was my first Opening Day without my dad, who passed away this February. It’s hard knowing that he won’t be there to dissect the big plays of the night with me, that he won’t get to see what this team will become. He would have really loved to see Mitch Haniger’s second act as a Mariner. But mostly, it’s hard to know that he will now only exist in memories, the layers that make up every Opening Day experience. Maybe by this time next year it will be a fond memory, easier to see him woven into the fabric of the history of my personal Mariners fandom and the Opening Day experience writ large: another star in the firmament, and a reminder of how inextricably linked what was, is, and will be all are; maybe by then it will be easier to find the beauty in that. Maybe next year.

By Kylie Stevens For Daily Mail Australia

23:39 24 Mar 2024, updated 01:25 25 Mar 2024

Australia needs 90,000 more tradies in the next 90 days in order to meet the Albanese government’s ‘impossible’ new goal to build 1.2million new homes in five years, the building industry has warned.

Major building industry groups have called out the Federal government’s plan – which would see the country construct 60,000 new homes each quarter from July 1 – as unrealistic.

One solution would be for Australia to boost immigration and fast-track skilled tradespeople, Master Builders Australia chief executive Denita Wawn suggested.

Ms Wawn said she was concerned ‘there is no way … we can get 90,000 (workers) in three months, unless we had a radical change in the way which we are looking at our migration system’.

Recognising tradies’ qualifications from other countries should be easier and cheaper, Ms Wawn said.

‘We know that there are a large number of tradies in this country that can’t get their licences recognised as it’s too expensive and too cumbersome for them,’ she said in an interview with Sunrise.

‘We have to focus on those who are currently in the country by their skills aren’t recognised.’

Ms Wawn also said there needs to be a massive push to skill up Australians and encourage them to work in the trades industry.

‘We really are focusing on school levers particularly but also those who want a career change to look at trade,’ Ms Wawn said.

‘Thirdly, as an industry, we need to retain the current tradies and call back the ones that have decided enough is enough.’

But she acknowledged finding 90,000 tradies in the next 90 days is unrealistic.

‘I think this figure reflects the difficulty that we’re going to have if we don’t resolve the tradie shortage in meeting the agreed target of 1.2 million homes over five years,’ she said.

‘The clock starts ticking on July 1 and we’ve got a huge, huge issue to resolve.’

Ms Wawn remained hopeful the government’s target of 1.2m new homes by 2029 can be achieved, despite only 170,215 new homes being built in the 12 months to September last year for 548,800 newly-arrived migrants.

‘We need to focus on how we can actually get there,’ she said. ‘The issue really is: how do we actually encourage more people into our sector?’

BuildSkills Australia executive director of research and planning Robert Sobyra said finding skilled labour will be the biggest supply-side barrier to addressing the housing supply crisis.

‘Returning the housing market to a healthy state will require a significant uplift in the national dwelling completion rate,’ he said.

‘While there are plenty of hurdles to overcome in achieving this goal, labour will be the single biggest supply-side barrier.’

Housing Minister Julie Collins said that while the government’s housing target was ambitious, it was getting on with the job.

‘We know we’ve got a lot of work to do,’ she told Sky News.

‘We’re working right across government – I know the skills ministers had a meeting just over two weeks ago, where they talked about the skills required to meet the housing demand in Australia and the challenges we currently have.’

A rise in modular housing or pre-fabricated homes common in Japan and Germany could see the housing supply fast-tracked.

Australian housing giant Mirvac is among the developers trialling modular housing construction in response to the crisis.

‘We’ve been able to reduce the construction of those homes to be watertight within 12 weeks,’ Mirvac chief executive of development Stuart Penklis told Nine News.

He added that modular housing doesn’t come with some of the challenges of a traditional build, such as supply chain shortages and severe weather disruptions.

Industry and Science Minister Ed Husic added that governments were working together ‘to take a serious look’ at modular housing.

‘Other countries have got their act together on modular housing and are seeing great jobs and great new homes – we want to be able to do that right here on shore,’ Mr Husic said.

- It made its way to its spiritual home in Perthshire for the first time in 700 years

- It will be the centrepiece of the new £27 million museum which opens this month

It left the capital city to much pomp and pageantry befitting a sacred ancient relic.

However, the Stone of Destiny has now been driven to its new home at the Perth Museum in the most unceremonious of fashions.

The fanfare and high security operation put in place to transport the stone from Edinburgh Castle to Westminster Abbey for the King’s Coronation last May was certainly not adopted last week.

Instead, the relic was bundled into the back of a Transit van.

The historic sandstone slab has played a role in Royal coronations on both sides of the Border for hundreds of years, and will be the centrepiece of the new £27 million museum when it opens on March 30.

A small-scale farewell ceremony was held at Edinburgh Castle on Thursday to mark the departure of the stone as it made its way to its spiritual home in Perthshire for the first time in 700 years.

First Minister Humza Yousaf attended the ceremony in his capacity as a Commissioner for the Safeguarding of the Regalia.

But its arrival was somewhat anticlimactic, as the artefact was delivered to the museum in the back of a white van.

One onlooker called it ’embarrassing’, while another said they expected ‘such an iconic piece of history’ to have been delivered with some solemnity and with its return home being heralded by museum chiefs.

Perth businessman Iain Fenwick said: ‘You would have thought having spent £26.73 million there would have been more pomp and ceremony.

;However, I have been assured this is a deliberate tactic, and those with experience at Culture Perth and Kinross and Perth and Kinross Council know what they are doing.

‘Leaving everything to the last second, apparently, gathers the biggest crowds for free-to-attend events.

‘I’m looking forward to finding out what all of these events are.

‘All top secret right now, with two weeks to go.’

A council spokesperson said: ‘Arrangements remain on track for display of the Stone of Destiny in the new Perth Museum which opens to the public on March 30.’

The building now housing the Stone of Destiny has so far attracted just 500 followers on social media platform X, formerly Twitter, even though its grand opening will take place in less than two weeks’ time.

Despite the massive investment in the new home for the Stone of Destiny, it has so far failed to spark the imagination of the public.

The attraction, which is managed by quango Culture Perth and Kinross, will be hoping online follower numbers will spike once the venue officially opens. Free tickets for the opening weekend will be available to book from Friday at 10am.

The museum describes itself as a ‘world-class cultural and heritage attraction’ which will boast ‘objects and stories to put Perth and Kinross at the centre of Scotland’s story’.

The museum website says: ‘At its heart will sit the Stone of Destiny, also known as the Stone of Scone, one of Scotland and the UK’s most significant historical objects.

‘Returning to Perthshire for the first time in over 700 years, the Stone will be the centrepiece of the new museum.

‘Alongside the Stone, the Museum will display Perth & Kinross’s Recognised Collections of National Significance as well as iconic loans and exhibitions from the UK and abroad.’

Legislation Creates Homeownership Opportunities for New Jersey Residents

TRENTON – Governor Phil Murphy today signed A5664/S4240, establishing a Community Wealth Preservation Program to promote equity and fairness in foreclosure sales by providing opportunities for foreclosed-upon residents and their next of kin, tenants, and other prospective owner-occupants – along with nonprofit community development corporations – to purchase and finance a foreclosed-upon home.

The current foreclosure market favors investment companies that can afford to purchase foreclosed-upon properties and sell them at a profit. The legislation helps to level the playing field, support affordable homeownership, and empower those with a vested interest in the community to purchase property.

“For too many, the dream of homeownership feels far out of reach,” said Governor Murphy. “With today’s bill signing, we are creating a new avenue to homeownership for individuals and families throughout New Jersey, giving many the opportunity to remain in the homes and communities they cherish while also protecting our neighborhoods from rapid investor-driven homebuying.”

“This new law shows that New Jersey is continuing to find creative ways to create affordable homeownership opportunities for families and, in the process, ensure more homes stay owned by local residents,” said New Jersey Department of Community Affairs Acting Commissioner Jacquelyn A. Suárez. “With the Community Wealth Preservation Program, it is now much easier for all residents to buy a home to live in at a sheriff’s sale because of the lower deposit required and the extra time to come up with money for the remaining balance. Rather than corporations and investors buying the homes to rent or flip for profit, everyday families now have a better opportunity of purchasing a house they can call home for generations to come.”

Then-Assemblywoman, now-Senator Britnee Timberlake championed this legislation in the Legislature. Additional primary sponsors include Senators Andrew Zwicker and Shirley Turner and Assemblymembers Shanique Speight, Shavonda Sumter, and Benjie Wimberly.

“New Jersey is consistently in the top three in the nation with the highest foreclosures. Our state also has the widest racial wealth gap in the country. Black and brown wealth is hemorrhaging through the loss of foreclosed property, and the people who live in the community often do not have deep enough pockets to even participate in the foreclosure process. This bill is a creative opportunity for families to save their wealth at the time of a foreclosure sale by using financing,” said Senator Britnee Timberlake. “This legislation also levels the playing field for renters, affordable housing non-profit developers and people who want to purchase an abandoned home to restore and live in or to create affordability. This is what equity in systems look like.”

“Community wealth preservation represents an important way of ensuring affordable housing opportunities remain with the local community, stabilizing neighborhoods, and improving lives, all the while making a variety of other positive impacts that will boost our towns economically and socially and keep them viable for future generations to come,” said Senator Andrew Zwicker.

“Too often foreclosed properties are bought up by real estate investors and developers only looking to make a profit,” said Senator Shirley Turner. “This legislation will help to keep property ownership within the community. By creating pathways for owners, tenants and local organizations to make purchases at sheriff’s sales we can help to keep money in the community and keep people in their homes.”

“The current process for buying foreclosed houses favors companies that have the money to purchase property at sheriff sales and resell it for a profit,” said Assemblywoman Shanique Speight. “By enacting the changes detailed in this bill, we can give people vested in their community a better chance of securing a home at these sales.”

“Home ownership is an important way to build generational wealth, and this bill combats housing insecurity,” said Assemblywoman Shavonda Sumter. “The trauma of losing the family home due to foreclosure leaves a lasting emotional scar. This bill makes it easier for families to support one another, buy that home at a sheriff’s sale and keep it in the family.”

“We need to make housing affordable and accessible, especially in Black and brown neighborhoods and the ‘Community Wealth Preservation Program’ does that. This legislation provides an opportunity for many New Jerseyans who want to own a home and join a community,” said Assemblyman Benjie Wimberly. “We’re removing barriers that stand in the way of a potential homeowner’s success at sheriff sales.”

“Today we are taking a major step to address NJ’s enormous racial wealth gap, the largest in the nation,” said Staci Berger, president and chief executive officer of the Housing and Community Development Network of NJ. “The Community Wealth Preservation Program will help to HouseNJ by preventing the loss of a family’s greatest asset — their home. This landmark legislation, which has been persistently championed by Senator Britnee N. Timberlake during her time in the Assembly, allows relatives to keep their home within their family when possible, and allows nonprofit developers to help keep the property affordable when not. NJ needs to do everything we can to prevent foreclosures, which contribute to the racial wealth disparity, and provide people with safe and stable housing. We thank all the sponsors including Senators Timberlake and Andrew Zwicker, our legislative leaders, and Governor Phil Murphy for their leadership and commitment to bring this generational wealth building tool to New Jerseyans.”

“The bill puts the interests and wellbeing of people before corporate real estate interests and protects families and communities from the disruption and devastation caused by foreclosure,” said New Jersey Citizen Action’s Financial Justice Program Director, Beverly Brown Ruggia. “The legislation is an important step toward reversing the devastating impact of the great recession and foreclosure crisis on black and brown families in New Jersey. It will help ensure that the chain of generational wealth building through home ownership isn’t broken when a family falls on hard times. We want to especially thank Senator Britnee Timberlake for championing this bill, and Governor Murphy for signing it into law.”

“We are pleased to see Governor Murphy sign this critical piece of legislation into law. Providing expanded opportunities for Black and Brown communities to retain wealth through homeownership is vital. Closing the racial wealth gap in New Jersey will require more work, but the Community Wealth Preservation Act will create a desperately needed pathway and is a great step in the right direction. We commend Senator Timberlake for her leadership and advocacy in championing this bill,” said James Williams, Director of Racial Justice Policy at the Fair Share Housing Center.

“This legislation is an important step in addressing New Jersey’s racial wealth gap by preserving housing wealth in families and communities rather than turning it over to outside investors,” said Laura Sullivan, Director of the Economic Justice Program at the New Jersey Institute for Social Justice. “This new policy is especially important in New Jersey where people of color face some of the worst racial wealth disparities and are most vulnerable to foreclosure.”

- EXCLUSIVE: Locals are furious with the plans to create a new national park

Residents living in and around a proposed new national park in the heart of Wales have blasted the eco-scheme as a ‘crazy idea’ that will cause planning chaos and drive up house prices.

Welsh Labour in their ‘Programme for Government’ have pledged to create a new national park in north east Wales, based around the current Clwydian Range and Dee Valley area of outstanding natural beauty.

The park would cut through sections of Powys, Flintshire, Wrexham and Denbighshire where residents say there is already a large discrepancy between the value of similar sized housing, with research showing it can be up to £100k.

Last year it was revealed that Powys recorded the biggest spike in house prices in the UK with the average property going up 17.4 per cent in value.

While locals say that creating a new park would see them paralysed by bureaucracy when it came to home improvements and extensions,

On resident told MailOnline: ‘If they turn it into a national park you won’t be able to do anything. It’s a crazy idea – why does it need to be a national park?’

At picturesque Llangollen, next to the river Dee – a town with a popular canal and a gateway to Wales which attracts thousands of tourists properties inside the area of outstanding natural beauty are already £100,000 more expensive than those outside.

Research by property firm Purplebricks revealed that a four-bedroom home within the proposed park site at Froncysyllte in Llangollen costs £500k while a four-bed detached property in nearby Wrexham, but outside of the zone, costs just £399k.

Two three-bedroom homes inside the proposed site. in Ruthin and Corwen, are worth £375k and £339k respectively compared to a bigger four-bed home worth just £275k outside of it.

Resident Pat Convery, 64, told MailOnline the prospect of the park being pushed through fills him with dread.

He explained: ‘You won’t be able to do anything. There’s enough bureaucracy around planning and you have an area of outstanding natural beauty already.

‘If they turn it into a national park you won’t be able to do anything. It’s a crazy idea – why does it need to be a national park?’

Mr Convery said it would become another ‘costly bureaucracy’ established by the Welsh Government which had spent millions of pounds already on the controversial 20mph default speed limit.

He added: ‘They need to run things more like a private business. There are enough people employed by the state already.’

Kevin Burns, 68, an engineer, said the plans were ‘not a good idea’ and would be ‘too restrictive’ in industrial areas of nearby Flintshire. ‘There’s too much bureaucracy already in Wales,’ he added.

John Simon, 70, a property owner and local, said :’I would get rid of the National Assembly. I have got to the age now where all politicians and all parties I have no regard for any of them because they don’t take account of people’s real requirements.

‘I am so fed up of the whole lot of them. It’s just another gravy train for politicians.’

The Welsh government have argued that the new park would be ‘important for the environment’ and help Wales ‘achieve more sustainable tourism’ – but previously warned of painful budget choices for Wales in the devolution era.

In north west Wales, in the Snowdonia national park, there have been some complaints of ‘over-tourism.’

Mountain paths have been eroded by walkers, there have been issues with rubbish and complaints about selfish parking blocking country roads.

House prices have soared in villages popular with families wanting a beauty-spot holiday home. There are fears it could happen in a new national park, within just an hour of Manchester and Liverpool.

But at his town centre food shop Ross Anderson, 52, said a new national park would be ‘a good thing.’

He said :’We are largely a tourist town. It can only be a good thing for the area. There have been a lot of positive things with the area of outstanding natural beauty, it’s pulled a lot of people in.

‘The last twelve months have been the busiest we have ever had.’

Customer Sharon Gunning, 56, visiting family from Spain, said :’It would be a shame if it became too expensive for local people. It’s a beautiful area.’

It is expected that the proposals and boundary of the park will be confirmed this year ahead of possible implementation by 2026, the Powys County Times reported.

Local Plaid Cymru Councillor Elwyn Vaughan has opposed the plan at every turn and warned that should it go through it could cost local people £4m a year and raise house prices by 25 per cent making things ‘even worse’ for young people.

Cllr Vaughan told a Powys County Council meeting last month: ‘The existence of a national park status makes no difference to biodiversity.

‘What it will do is cost about £4 million a year at a time when Powys needs to save £40 million over the next three year.’

He added: ‘Setting up a new authority is not sustainable when we are likely to see other authorities go into the wall.’

Commenting on the Welsh government’s plans, Purplebricks chief sales officer Jonny Magill told MailOnline that any new national park could see some teething problems.

He explained: ‘I can see how the introduction of the proposed Clwydian Range and Dee Valley National Park will lead to an increase in house prices in this area.

‘It could ensure more control to limit new housing developments, due to restrictions in areas of natural beauty- therefore, reducing the amount of homes available in these sought-after postcodes.

‘The associated lifestyle and beauty are certainly at a premium.

‘National parks have notably contributed to a positive effect on house prices, creating an increased demand for properties. This trend is evident even in locations like Nottingham, where I am from.

‘Sherwood Forest, a renowned national park, has become a focal point enhancing the desirability of the surrounding properties. Interestingly, this surge in demand not only impacts traditional home sales but also translates into a higher demand for rental properties, Airbnb’s etc.

‘As Wales continues to enhance its appeal for both residents and visitors, the establishment of this national park seems poised to exert a positive influence on property prices. This optimism persists even in the face of potential increases in council tax for investors.’