After a slight drop in the third quarter of last year, the price of housing has risen once again in Malaga province, according to the latest data.

In the first three months of this year, the average price per square metre of a property for sale in the province has climbed to 2,412 euros, according to estate appraisal firm Gesvalt. It is 1.2% more than the figure recorded at the end of 2023 and about the same figure as a year ago, when the valuer’s studies showed an average price of 2,419 euros per square metre. The data shows the 4% drop in the prices of property for sale in Malaga in the third quarter of last year was a one-off event.

Additionally, rental prices continue to soar in both Malaga city and throughout the province. According to Gesvalt data, the average rental price at provincial level is 14.32 euros per square metre, which is 13.5% more than a year ago and 3.2% more than three months ago.

However, the increase in rent is most noticeable in Malaga city, where the average cost has risen to 14.41 euros per square metre, 16% more than a year ago, according to the data.

In Malaga city, the average price of housing for sale stands at 2,374 euros per square metre, which is 8% more than in the first quarter of 2023 and 2.5% more than in last year’s year-end report.

According to Gregorio Abril, Gesvalt’s regional director for Andalucía and Extremadura, house prices in Malaga are set to continue “the upward trend of recent months, but at a more moderate pace than in recent years, tending towards stabilisation, after the slight slowdown in demand caused by successive interest rate increases and a general economic slowdown”. “Once this phase has been overcome, and with the prospect of the next interest rate cuts, demand has once again been reactivated in a market that remains under pressure, pushing prices up again,” Abril said.

One of most active real estate markets in Spain

Malaga is one of the most active real estate markets in Spain, “with demand, both national and international, very active, compared to a supply that, despite the efforts of the city council and the great developer activity, is still insufficient to satisfy it”, the real estate expert added. “All these factors lead us to believe that there will not be a change in trend in the coming months and it is not possible to foresee when price rises will be limited.”

As for the unstoppable rise in rent, Abril pointed out that this is a “more paradigmatic issue than that of buying and selling”. “While supply is more limited than for sales, there is a transfer of demand from the buying and selling to the rental market, due to the number of buyers who are unable to afford the purchase of a home at current prices and decide to opt for renting as a way of life. Our forecast is that the current trend will continue over the next few years,” he added.

Throughout the province, Marbella continues to lead in rental prices with an average of 18.8 euros per square metre, 12% more than a year ago. Also noteworthy is the rise in rent in towns such as Torremolinos and Benalmádena, possibly due to the increase of prices in Malaga city leading to an increase in demand for rentals in these municipalities. In the case of Torremolinos, rent has risen to 14.6 euros per square metre and is now at the same level as Estepona, with a year-on-year increase of 12%, the data shows. At the other extreme, Velez-Malaga offers rents at half of those registered on the Costa del Sol, with prices around 7.5 euros per square metre.

In terms of homes for sale in Malaga municipalities with more than 50,000 inhabitants, Marbella continues to lead the way with an average cost of 3,202 euros per square metre, followed by Benalmádena, with 2,423 euros per square metre. In contrast, in the eastern part of Malaga province, the price drops to 1,391 euros, according to the data.

Southern California home prices hit a record in March amid sky-high mortgage interest rates, a combination that’s creating the most unaffordable housing market in a generation.

The average for the six-county region reached $869,082 in March, according to Zillow. That’s up 9% from a year earlier and 1% higher than the previous all-time high in June 2022.

With rates hovering in the upper 6% range, the mortgage payment on the average home now tops $5,500 — if you can put 20% down.

“It’s bananas,” Tommy Kotero, a 43-year-old refinery worker, said last weekend after touring a dated, $899,000 house in north Torrance with visible cracks in the ceiling and walls. “The asking prices for what we are getting is crazy.”

How home prices hit a record despite the high cost of borrowing is a tale of too few homes for sale, combined with a wealth gap that has equipped some buyers with reams of cash that negate the effect of high rates.

When interest rates first soared in 2022, buyers backed away en masse, inventory swelled and home prices dropped.

Then potential sellers all but went on strike, with many deciding they didn’t want to move and trade their sub-3% mortgages for a loan at more than double that rate.

Inventory plunged and enough buyers returned to send home prices back up. Many of these buyers are well-heeled first-timers who aren’t ditching a low-cost mortgage.

Others are holding on to their old home and buying another. Still more are selling their old home and turning their considerable equity into hefty down payments well over 20%.

“People who have cash are not paying too much attention to interest rates,” said Alin Glogovicean, a real estate agent with Redfin who specializes in northeast L.A.

He estimates that in about one-third of his deals a buyer is paying all cash. Another third put down at least 50%, with a mortgage on the rest.

At least two-thirds of the buyers with down payments of at least 30% aren’t investors but people who want to live in the home, he said. They are professionals such as architects and Hollywood types who have saved, liquidated stock portfolios, built up equity or received help from family.

Some are willing to dip into retirement savings — a strategy many financial experts advise against.

Nationally, similar trends are afoot, according to a Zillow survey, with the share of home buyers putting at least 20% rising, as well as those who received help from family and friends.

In all, 23% of L.A. County homes sold in February were bought with all cash, up from 16% in 2021, according to Redfin.

For those without access to a spare half-a-mill, times are tougher.

According to the California Assn. of Realtors, only 11% of households in Los Angeles and Orange counties could reasonably afford the median-priced house during the fourth quarter, the smallest number since the housing bubble of the mid-aughts.

At that time, risky lending practices allowed people to buy homes they couldn’t really pay for. Today, lending standards are far tighter, which economists say should prevent a similar collapse in prices if there’s another recession.

Across the region, home prices have now set records in Orange, San Bernardino, San Diego and Ventura counties. In Los Angeles and Riverside counties, prices are less than 1% from their all-time highs.

Agent Alicia Fombona of United Real Estate Pacific States works across the Southland — from the coast to the Inland Empire. Amid high rates and high prices, she said, one strategy that’s growing more popular is co-borrowing: family and friends coming together to buy a house or duplex to keep payments somewhat affordable.

“Everybody needs a place to live and there is not enough housing for everybody,” Fombona said.

More homes are starting to come onto the market, but inventory is still tight and expected to remain so, according to forecasters. Rates may drop somewhat but are expected to remain elevated.

That combination could create a scenario in which prices don’t soar but also don’t drop much — if at all, especially because incomes for many households are growing.

“We are going to continue to see robust price growth, but nothing near where we were in the pandemic,” said Orphe Divounguy, a senior economist with Zillow.

If rates fell considerably, it would immediately make homes more affordable, but a new crop of buyers probably would flood the market and could put even more upward pressure on prices.

To help housing truly become more affordable, Divounguy said, there must be continued income growth and more housing construction.

“The way out of this is not going to come from mortgage rates,” he said.

In California, construction headed in the wrong direction in 2023, with building permits falling from the previous year, though lately there are signs of a rebound in single-family construction, which is mostly for-sale homes.

Some Californians, however, are on a timeline.

Kotero, the buyer looking in Torrance, currently rents a house in the city with his wife, Rikah, and their four children. But he said they need to find a new place by summer because the landlord is moving back in.

They’d like to buy and stay in Torrance for the schools but so far have struck out — even though Kotero makes $160,000 as a manager at a local oil refinery.

He said he and his wife were recently outbid, despite stretching their budget to offer $1 million for a house listed for $900,000.

Unlike others, the Koteros don’t have hundreds of thousands in cash to meaningfully offset high rates. Instead, Rikah, who currently stays home with the children, is thinking of looking for a job.

“If we are realistically looking to buy a home in Torrance, there’s no way around it,” Kotero said.

Christine Dyken had just returned home after picking up her grandson from school, and she was stressed.

Dyken — who lives in a quiet corner of North Las Vegas with her daughter, Doreen, and 7-year-old Christopher — needed to move, and the process was overwhelming and expensive.

Doreen was getting divorced, and they’d been looking for a home they could move into quickly — but one that wouldn’t break the bank. The 74-year-old Dyken had moved in with her daughter to help care for Christopher but also because she couldn’t afford rising rents on her own.

Dyken’s income from disability payments, Social Security, her late husband’s pension and tax-preparation work doesn’t go far in a region where housing costs have soared in recent years, echoing conditions in California.

Newsletter

Get our L.A. Times Politics newsletter

The latest news, analysis and insights from our politics team.

You may occasionally receive promotional content from the Los Angeles Times.

“We’re really living paycheck to paycheck,” Dyken said last month, standing alongside Doreen, who works at a casino.

Home sale prices in Clark County have jumped by 50% since 2016, to about $414,000, according to an average of the middle-third of values collected by Zillow. The news for renters is no better. Zillow computed the expected price of a lease on a single-family residence, and it has jumped almost 70% over the same period, to about $1,750 a month.

As President Biden and Donald Trump prepare to face off once again in November, the hope of owning a home is all but dead — or at least on life support — for many middle-class voters in Nevada and Arizona, battleground states. The culprits are low supply, high interest rates and population growth — driven significantly by new arrivals from California.

Biden’s focus on the subject during a campaign swing last month is a reflection of how profound the crisis is for voters, political observers say.

“I think he realizes the magnitude of the situation,” Steve Sisolak, a Democrat who was Nevada’s governor from 2019 to 2023, said of Biden. “He’s not out there to chase polls, but when you do poll people, affordability of housing is a major issue. If you’re not in the housing market right now, it’s going to be difficult to ever get into the housing market.”

Former Nevada Gov. Steve Sisolak, center, at a newly opened Democratic campaign office in Las Vegas.

(David Becker / For The Times)

Dyken said she plans “to hold her nose and vote for Biden,” in part because Trump’s behavior during the Jan. 6, 2021, assault on the U.S. Capitol was so “insulting.” But Doreen, who asked that her last name not be used, said she likely won’t vote. There’s too much going on in her life, and voting never felt like much use, she said.

In the northern Nevada town of Fallon, loan officer Shannon Faught said she’s “leaning toward voting for Trump.” Low interest rates when he was president, at the outset of the pandemic, allowed her to buy several homes, which she uses as rental properties.

Politics don’t weigh on her heavily, she said, but she’d like to see the country run more like a business and thinks Republicans are better positioned to do that.

“I don’t think about the election a ton except for the fact that it’s maybe having an effect on interest rates,” she said, though she recognizes that those rates are set by the Federal Reserve, which is ostensibly insulated from politics. “I think about interest rates. Who knows if they’re being timed with the election?”

The fed funds rate — a benchmark set by the independent Federal Reserve — is about 5.3%, a 22-year high. Inflation has dropped to about 2.5% from 7%.

In Arizona, which Biden won by just 10,000 votes in 2020, home prices and rents have skyrocketed as well, as the unemployment rate remains lower than the national average, at 3.7%.

The jump in prices, driven partially by an influx of Californians, has boosted anxiety.

A study from the Common Sense Institute Arizona found a housing shortfall of approximately 67,000 units as of early 2024.

Daniel Scarpinato, who was chief of staff to former Republican Gov. Doug Ducey, said he thinks the border will be the dominant issue among Arizona voters, but issues of affordability and the direction of the economy won’t be far behind. Arizona’s 11 electoral votes and Nevada’s six will be pivotal in a contest where very few states are up for grabs.

Arizona Gov. Katie Hobbs, a Democrat, vetoed a bill that would have removed local control over some planning and zoning regulations.

(Ross D. Franklin / Associated Press)

A debate has roiled Arizona over proposed reforms to zoning laws. Democratic Gov. Katie Hobbs recently vetoed bipartisan legislation intended to boost housing that would have removed local control over some planning and zoning regulations.

A recent poll found that 53% of a representative sample of roughly 3,000 U.S. homeowners and renters said housing affordability would affect how they vote in the 2024 election. The same survey, funded by Redfin, found that about 65% of respondents said housing affordability made them feel negative about the economy overall.

“There’s a general sense that this was once an affordable place to live,” Scarpinato said, pointing to increases in rent and homelessness as byproducts of the malaise.

“The growth for the state from an economic standpoint has been off the charts and fabulous. If you owned a home, your value has probably tripled or quadrupled,” Scarpinato said. “But if you want to move and upsize because of a growing family or something, I think that there are some real stresses on people and just generally a sense that the quality of life is changing.”

In the run-up to his Arizona and Nevada visit last month, Biden called for a $10,000 tax credit for first-time home buyers and for funding to build or renovate more than 2 million homes. He called for the creation of a $20-billion competitive grant fund to accelerate housing creation. His administration is also looking for ways to incentivize local municipalities to do away with stringent zoning restrictions.

These proposals would require Congress to enact legislation, unlikely in an election year.

In 2021 and 2022, about 140,000 Californians moved to Arizona. In the same period, about 110,000 Californians moved to Nevada, according to figures released by the U.S. Census Bureau. This influx is part of the reason prices for housing went up in these states, said Daryl Fairweather, Redfin’s chief economist. There are large parts of the country, she said, where residents are doling out more than 30% of their income on rent. Fairweather and other economists say spending more than that on rent and utilities makes residents “cost burdened.” In 2022, 22 million Americans met this standard.

She said Biden’s ideas were encouraging, but building new homes is the only answer to the crisis.

Rep. Steven Horsford (D-Nev.) in a North Las Vegas neighborhood in his home district.

(David Becker / For The Times)

“That’s the only thing that’s really going to matter 10 years from now. I think everything else is too small to really make a difference in a product that’s so large,” Fairweather said. “Despite there being such a strong economy, when you look at [gross domestic product] or unemployment, people still feel like the economy isn’t good for them because of how high housing costs have gotten.”

Trump, whose campaign didn’t respond to requests for comment, offered few specifics about how he’d bring down home prices. He has mused about getting rid of the Fair Housing Act, which protects minorities from discrimination in the purchase or renting of housing. His campaign characterizes these regulations as waging a “full-scale war on the suburbs.”

Biden, meanwhile, has been “working to lower housing costs, help first-time home buyers achieve their dream of owning a home and lower rents, while Donald Trump spent his time in office gutting affordable housing programs and letting Wall Street firms jack up housing costs on hardworking families,” said the president’s senior campaign spokesperson, Sarafina Chitika.

Rep. Steven Horsford (D-Nev.), who chairs the Congressional Black Caucus, said it was a relief that Biden spoke so directly about the housing crisis when he visited Nevada. The anger over rising prices has made his own reelection contest more competitive, Horsford said, and has become the animating issue in conversations with constituents.

“The person who’s feeling the stress and the anxiety isn’t at fault. It is incumbent upon those of us who are in office to explain our position and what we’re doing to make it better,” he said in an interview at the Culinary Academy of Las Vegas, which he once ran. “I encouraged the White House to center the issue of housing and lowering the cost of housing — not to just talk about inflation as this broad general term. That’s not how average Americans talk about it.”

He described how in his Clark County district, large corporations have swept in, buying up hundreds of rental homes at a time. Many of the companies are based out of state, he said, and have turned around and quickly raised prices, done little to invest in upkeep and evicted residents at higher rates.

He has introduced legislation to empower the federal government to better track home purchases and look for market manipulation among institutional investors.

Christine Dyken, left, and daughter Doreen speak with Horsford.

(David Becker / For The Times)

In the Culinary Academy’s dining room, Horsford chatted with Ameeluz Cauton, who works at the Bellagio hotel, about the strain of finding stable housing. Caulton, 35, has worked at hotels and casinos for more than 15 years and at one point owned a home with a boyfriend. They broke up, and she struggled to find a roommate. Then the house next door became occupied with “sketchy people,” she said. For a while, she felt “trapped,” because selling the home wouldn’t give her enough to rent or buy something new, since prices had jumped so significantly.

Eventually, she resolved to just sell and move in with her sister, a temporary solution that’s working fine, she said. Her union, the politically powerful and Democratic-aligned UNITE HERE Culinary Workers Union Local 226, has a down-payment assistance program for first-time home buyers or those who haven’t owned in three years.

Many of her colleagues have felt a similar crunch, and it will certainly be on their mind this election season, Cauton said.

“They’re gonna vote for whoever is going to help them keep their jobs stable,” she said. “I don’t think they’re going to stick with a specific party. It’s just whoever is in line of what we need and what’s going to help us for our future. They could interpret both parties in a different way. But it’s whoever is for the workers.”

HOUSE PRICES in Finland fell by more than five per cent year-on-year in February.

Statistics Finland on Thursday reported that the prices of old dwellings in housing companies fell especially in large cities – by 10.4 per cent in Vantaa, 7.1 per cent in Helsinki and 6.8 per cent in Oulu.

While the six largest cities in the country recorded a drop of 6.1 per cent and the capital region a drop of 6.7 per cent from the previous year, areas outside the largest cities registered one of 4.4 per cent.

Also the volume of sales decreased, with real estate agents brokering 15 per cent fewer sales in February 2024 than in February 2023.

The preliminary data offer some grounds for optimism, too. The prices of old dwellings in housing companies crept up by 1.4 per cent from the previous month, with increases recorded also in all large cities.

“In February, the development of home prices was better than expected both in and outside the capital region. The development witnessed at the start of the year is a reflection of the tax code change that took effect at the turn of the year, which encouraged first-time home buyers to take action late last year and decreased sales early this year,” Joona Widgrén, a senior economist at OP Financial Group, analysed according to Helsingin Sanomat.

“[The change] explains the lacklustre sales in January—February.”

Although house prices developed slightly better than the financial services provider expected, a more meaningful recovery will hinge on market activity, according to Widgrén.

“People will still have to wait for a recovery in the house market because sales volumes recover will have to recover before prices start increasing on a more permanent basis,” he stated.

Also Juhana Brotherus, the chief economist at the Federation of Finnish Enterprises, estimated that the market will continue to decline for some time. An upswing, he predicted, will not occur until later this year once falling interest rates and strengthening purchasing power make the financial equation more favourable for potential buyers.

“The house market is being depressed by hard and soft headwinds,” he wrote. “Buyers are losing interest because interest costs and maintenance fees can exceptionally be even higher than rents. Also loan repayments add to the monthly costs. At the same time, households are extremely cautious and sensitive to crises because their general sense of security has been shaken by the coronavirus, energy, war and, most recently, strike crises.”

“The uncertainties are reducing especially large acquisitions, of which home is the most important.”

Veera Holappa, a senior economist at Pellervo Economic Research (PTT), is slightly more optimistic, estimating that the return of first-time buyers could provide a boon to the housing market as soon as this spring.

“As household sentiment improves and first-time house buyers are starting to return to the market, chains of sales will start going through. It could rejuvenate the market as soon as at the dawn of summer,” she said.

Aleksi Teivainen – HT

February auto sales hit an all-time high for the month after jumping 24.4 per cent from last year, DesRosiers Automotive Consultants Inc. said Monday.

Sales totalled an “astounding” 129,000 units for the month, the consultancy said, up from around 104,000 for the same month last year.

The sales total also eclipsed the 125,000 units sold in February 2020, the last time the month had an extra day and just before the pandemic threw the industry into turmoil.

The seasonally adjusted annual rate of 2.1 million units for the unseasonably warm month was the highest since January 2018, said DesRosiers.

The latest sales figures, marking the 16th consecutive month of year-over-year growth, shows many of the challenges faced by the industry are now under control, said Andrew King, managing partner at DesRosiers, in a release.

“February 2024 sales tell us that some of the hurdles of recent years – and specifically the supply constraints of new vehicles – are now well and truly in the rear-view mirror.”

The pandemic had created supply issues both through plant shutdowns and a surge in demand for electronics that led the auto industry to have a shortfall of semiconductors. The disruptions led to a shortage of supply and a surge in pricing as automakers focused on their priciest and most profitable models.

Production is expected to finally return to pre-pandemic levels this year.

A Scotiabank report last month estimated that North American production should hit 16 million units this year, roughly in line with the 10-year pre-pandemic average.

Last year’s production was estimated at 15.6 million units, while the 2021 low was 12.9 million.

But while production is recovering, prices are still elevated.

The average price of a new vehicle hit $67,259 in December, up 14.2 per cent from a year earlier, said AutoTrader in its latest monthly report. The average for used vehicles reached $36,863, a 1.7 per cent increase.

More supply does look to be at least taking pressure off price growth. The average new vehicle price in December was down 0.3 per cent from November, while the used vehicle price was down 2.4 per cent from the previous month.

But even with prices high, King said there is enough pent-up demand to keep helping drive sales.

- The house boasts nine bedrooms, five bathrooms and an indoor swimming pool

The stunning 14th century love nest where Lord Nelson romanced Lady Hamilton over 200 years has dropped in price by £500,000 after it has failed to sell.

It was originally listed at a guide price of £3.25million by Lindsay Cuthill’s Blue Book Agency in July last year, MailOnline previously reported.

Grade I-listed Rudhall Manor, in Phocle Green, Herefordshire dates back to the 1300s and could be yours after it has plummeted by half a million to a bargain price of £2,750,000.

A beautiful sprawling mansion, the house boasts nine bedrooms, five bathrooms, an indoor swimming pool and is set in ten acres of picturesque landscaped gardens.

An enchanting manor – it has been owned by a number of important figures over the years – most notably Admiral Lord Nelson.

The British hero saved the nation at the Battle of Trafalgar but had an illicit affair which lasted 12 years with Lady Emma Hamilton after being introduced to her in the 1790s.

They used the picturesque abode as their own love nest to evade prying eyes in what was the biggest scandal of the age.

Lord Nelson and Lady Hamilton met in Naples, Italy, while they were still both married to other people.

A romance blossomed and the couple resided at Rudhall Manor, the home of a friend, Thomas Westfaling, when they returned to Britain.

The affair later became public knowledge and there is a room in the house named after the great Royal Navy hero.

The letters to Lady Hamilton were written by Nelson with his left-hand after he lost his right arm in battle.

They had a daughter together, Horatia, who was born in 1801.

Estate agents Blue Book has described the period property as ‘one of the most special of houses in the whole of England.’

A spokesperson added: ‘A magical Grade I listed house whose rich history has spanned the centuries to provide a warm and comfortable family home.

‘Rudhall Manor sits in an enchanted private setting surrounded by beautiful gardens and grounds.

‘As a Grade l listed building it is only one of very few private residences in the county and as such is one of the most special of houses in the whole of England.’

Rudhall Manor was also used by the Royal Hospital to house retired British soldiers who fought in the Boer war and the First World War during the Second World War.

Other notable owners include Alexander Baring, later the first Lord Ashburton, ornithologist Sir Peter Scott and Sir John Harvey Jones, the high-profile British businessman and entrepreneur.

It dates back to the 14th Century, but features Tudor, Georgian and Jacobean architecture.

This historical manor is equipped for the 21st century too and has been re-purposed for modern living – including a heated indoor swimming pool and gym, a self-contained studio apartment above a garage along with a greenhouse and working space.

The listing adds: ‘To the first time visitor Rudhall Manor immediately welcomes you with its warm tones, mixture of the grand and the cosy but most of all the enchantment of a long cherished home to a host of families over the centuries.

‘The history lover will particularly appreciate the extensive Tudor oak paneling, immaculate cornice work, historic fireplaces and exposed beams.’

Sprawling gardens and grounds terraces, including a woodland and a rockery garden, are spread out across the land.

The house overlooks an extensive lawn which leads down to Rudhall Brook and enters the grounds via a waterfall and is crossed by a series of small fairy tale-like bridges.

Two lakes, fed by a brooke, are said to provide a haven for birds and wildlife.

The property listing continues: ‘The gardens and grounds make the whole setting complete and essentially a private paradise.’

- Property prices are impacted by postcode, schools and transport links

- We look at what the average house price gets you in markets around the country

Although the twin horrors of soaring inflation and volatile interest rates seem to be slowly in retreat, buying a property in 2024 could still prove to be challenging for the pocket.

So not unreasonably, pound for pound, we want to know whether we’re getting anything like value for money before we decide to make a move.

According to Daniel Copley, consumer expert at Zoopla, it varies widely when the nation’s 30 million homes are spread across thousands of housing markets.

Daniel says: ‘Property prices will also be impacted by proximity to local schools, train stations and transport links.’

So with this in mind, how far can you make your money go? To find out, we took a whistle-stop tour of markets around the country to see what you can get for the average UK house price of £264,400.

Nefyn, North Wales

The average price for a property in North Wales is £232,692, according to Rightmove.

Nefyn is a tranquil village on an elegant crescent-shaped sandy beach.

‘The Llyn peninsula is an area of outstanding beauty,’ says Carol Peett, the owner of West Wales Property Finders.

For sale: £255,000 buys you a two-bedroom bungalow which is just a short walk to the beach.

Poole

With its busy quayside, clean beaches and historic town centre, house prices average at £434,403.

‘Poole is only two hours from London and has award-winning Blue Flag beaches from Sandbanks to Bournemouth,’ says Neil Roff, of Winkworth.

For sale: A £255,000 two-bedroom flat is a few minutes’ walk from the harbour.

Kings Heath, Birmingham

Research by comparison site GetAgent.co.uk reveals the West Midlands has been the best-performing housing market since interest rates started to rise.

Kings Heath, in the south of the city, has independent shops, bars and a farmers’ market.

For sale: £260,000 is the price of this three-bedroom semi.

Forres, Inverness

With its castle, parks and gardens, Forres on the Moray coast is one of Scotland’s oldest towns. It is 27 miles north-east of Inverness, and has won Scotland in Bloom.

Forres had an average price of £212,763 for property in the past year.

For sale: £255,000 will get you a three-bedroom link-detached family home.

Northumberland

This beautiful county offers all the tranquil benefits of a rural location yet it’s not far to Newcastle.

Affordable housing and a rural setting means there’s a low crime rate and a strong sense of community. Average house prices are about £206,233.

For sale: A £260,000 four-bedroom house is set within the port of Amble.

South-West London

There may be some green spaces and plenty of shops, but average house prices are a whopping £1 million.

Yolanda Jacob, sales and marketing director at Barratt, says: ‘Millennials are drawn to this pocket of London, thanks to its rich culture and vibrant art scene without compromising on connectivity.’

For sale: £255,000. This one-bedroom period flat in Lavender Hill requires ‘refurbishment and upgrading’.

The Wirral

Wedged between the River Dee to the west and the River Mersey to the east, the Wirral peninsula overlooks both the Welsh hills and the Liverpool skyline.

You’ll find genteel seaside locations, including the market town of Neston. Average house prices are about £212,000.

Nature lovers can enjoy bird watching across the salt marshes. A half-hour train offers access to Liverpool.

For sale: At £269,950, a four-bedroom semi-detached house has lovely views over to Wales.

West Sussex

As well as holding a 29-year record with the Met Office for being the sunniest county in the country, West Sussex also offers plenty of countryside, coastline and national parks.

Demand is outweighing supply across the county.

For sale: £260,000. This two-bedroom, two-bathroom flat in the seaside town of Bognor Regis is set on the ground floor.

Michael Peart Photography/Michael Peart Photography

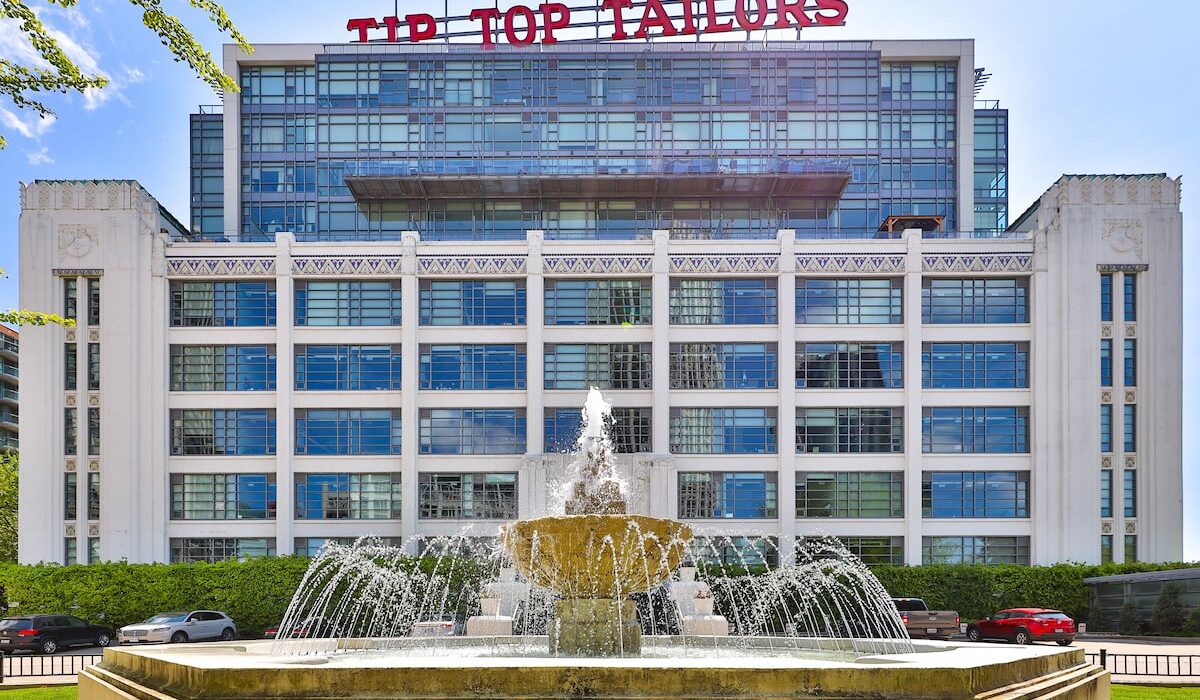

637 Lake Shore Blvd. W., No. 407, Toronto

Asking price: $1,198,000 (January, 2024)

Previous asking price: $1,225,000 (November, 2023)

Selling price: $1.15-million (January, 2024)

Previous selling prices: $524,000 (July, 2013); $520,000 (February, 2012); $465,000 (May, 2007)

Taxes: $4,077 (2023)

Property days on market: 71

Listing agent: Christopher Bibby, Re/Max Hallmark Bibby Group Realty

The loft in the retrofitted 94-year-old former menswear warehouse has 14-foot concrete ceilings and multiple windows in the den and living room.Michael Peart Photography/Michael Peart Photography

The action

The sellers of this one-bedroom plus den unit at Tip Top Lofts found buyers paralyzed by high mortgage rates going into the winter holidays. It didn’t help that a near-identical loft was also for sale and at an asking price $106,000 below theirs. In January, they trimmed their price by $27,000, a move that jumpstarted negotiations with one interested buyer. Finally, with another $48,000 climb down, a deal was struck.

“People who visited it in the past saw the price drop and came back to bid on it,” said agent Christopher Bibby.

“The unit next door was available at the exact same time,” said Mr. Bibby. “The last time I checked, it was still available.”

This loft’s advantage was the owner’s redesign of its bathroom and the addition of a second one. “The unit next door had one washroom and we had two,” Mr. Bibby said. “That gave us the upper hand.

“Typically, the washroom is a walk-through that could be accessed from the living room, but they closed it to make a proper ensuite. But they also added a powder room, which isn’t something you see too often.”

The remodeled kitchen has quartz countertops and upscale appliances.Michael Peart Photography/Michael Peart Photography

What they got

This loft is in a retrofitted 94-year-old former menswear warehouse and has 14-foot concrete ceilings and multiple windows across the den and living room.

The remodeled kitchen has quartz countertops and upscale appliances.

The parking spot is underground. Monthly fees of $794 cover water, heating, concierge and use of a rooftop terrace.

The seller had redesigned the bathroom and added of a second one.Michael Peart Photography/Michael Peart Photography

The agent’s take

“Tip Top Lofts has always been a very sought-after and iconic property,” Mr. Bibby said.

“If you want to be in a loft conversion on the waterfront, that’s really the only option.”

This unit also faces west. “It is the most sought-after exposure with the view overlooking [Coronation Park] and the water,” said Mr. Bibby.

The average price of a house in Rotorua has risen to $746,000 after the city’s average residential property values increased by 0.4 per cent in three months.

According to the latest data from the OneRoof Valocity House Value Index, taken at the end of January, property values across the country are up by 0.9 per cent compared to three months ago.

OneRoof’s latest House Price Report showed property values were up quarter-on-quarter in 90 per cent of suburbs nationwide, with the biggest quarterly lifts in Arrowtown, Mataura and Whitford.

Of the 793 suburbs with 20-plus settled sales in the last 12 months, more than 40 per cent saw year-on-year value lifts, reflecting the turnaround in the market.

Rotorua suburbs with more than 20 settled sales in the year ending January 31 included Hamurana, where property values increased by 2.1 per cent in the last three months to $1.23 million.

Western Heights saw the second-highest three-month increase in suburb property value, a difference of 2 per cent.

Rotorua Professionals McDowell Real Estate principal and auctioneer Steve Lovegrove said the post-summer, early autumn season was normally a busy one for real estate.

“The good news for everybody is that prices seem to be mostly stable, certainly not going backwards and probably increasing,” Lovegrove told the Rotorua Daily Post.

“We are starting to see the green shoots of property price increases.”

Lovegrove said there was also a lift in the stock available.

“So buyers do have a little more choice and less need to act urgently. We’re seeing a little bit of lag in decision-making and a significant lift in buyers actively entering the marketplace.”

Lovegrove said there was more competition for properties in the $500,000 to $700,000 value range.

“Anything just below that average price is getting hit quite hard with active buyers, mostly first-home buyers.”

Lovegrove said there was also a trend of people looking to downsize which also saw more buyers looking in the lower price ranges.

“There’s a lot of confidence, a positive vibe and a positive outlook looking forward. We’re not expecting a rapid price increase. We are expecting simply more confidence.”

Tremains central region general manager Stuart Christensen said there was more property coming onto the market.

“More people have decided to make a move. Westpac dropped their interest rates on Friday. All those are encouraging signs,” Christensen said.

“We are seeing an increasing number of people at our open homes. So there’s appetite to come out and a good number of first-home buyers are out there.”

Christensen said first-home buyers did have a window to make their decisions, however, as investors were coming gradually back into the market as well.

“Overall there’s a lot more positivity. It’s a new year. People are out looking for a move whether they are upsizing, downsizing or entering the market for the first time.”

The news comes after New Zealand’s average property value grew just 0.9 per cent in the three months to the end of November to $973,000, as buyers retreated from the market after a busy November and October.

Valocity global chief executive of real estate Helen O’Sullivan said sales volumes in December were lower than had been anticipated, given the lift in October and November, although they were up year-on-year.

Valocity data showed mortgages registered to first-home buyers in the last quarter of the year dipped to 44 per cent from the five-year high of 45 per cent the previous quarter. Mortgages registered to investors increased slightly from 22.4 per cent to 23.6 per cent over the same period.

O’Sullivan said the Reserve Bank’s announcement around debt-to-income ratios was unlikely to have an impact on the current market.

“The proposed settings are not expected to make a significant difference to prices or activity levels in the current high-interest rate environment,” she said.

“When interest rates are lower, [debt-to-income ratios] will limit the level of debt borrowers can assume despite being able to service the debt.”

Maryana Garcia is a regional reporter writing for the Rotorua Daily Post and the Bay of Plenty Times. She covers local issues, health and crime.

Almost as soon as home prices began their unprecedented climb in 2020, doomsayers began warning of a looming crisis. The housing market, they claimed, was a bubble destined to burst.

A litany of supposed catalysts was going to send prices into a tailspin: the “Airbnbust,” the sudden surge in mortgage rates, a flood of grifters and hucksters looking to make a quick buck in real estate. Bubble watchers forecast chaos, then sat back and waited. And waited. And waited.

I’ve spent the past few years asking experts a simple question: Has the housing market reached bubble territory? The answer remains a resounding no. More than three years after prices started to soar, the only thing that’s gone bust is the gloomy predictions. Despite some cooling in a handful of overheated markets such as Charlotte, North Carolina, and Austin, the median home-sale price increased by a respectable 4% nationwide in 2023, Redfin reported. The price for a typical home has risen by more than 47% since late 2019, according to the S&P CoreLogic Case-Shiller National Home Price Index, a closely watched measure of housing costs.

But maybe I’ve been posing the wrong question all along. The B-word implies an impending pop, a point when the combination of greedy speculation, unscrupulous behavior, and soaring prices brings everything crashing down. Barring a large-scale economic disaster, there’s no pop in sight.

The staggering jump in home prices is concerning, to be sure. But it’s a function of a severe lack of supply, not a byproduct of investors swarming the market or shady lenders artificially juicing demand. Those looking for parallels to 2008 are grasping at straws — homeowners are in far better financial shape than they were the last time prices cratered, and homebuilders, rather than flooding the market with new properties, aren’t keeping pace with the sheer volume of millennials suddenly consumed by dreams of backyards and picket fences.

So if you’ve been waiting — maybe even cheering — for prices to plummet: Don’t hold your breath.

Warning signs

A funny thing about bubbles is they don’t fall neatly into a single definition. Ask a dozen economists to sketch out their criteria, and you’ll probably get 12 different answers. But Mike Simonsen, the president of the housing research firm Altos Research, offered a useful way to think of a bubble’s life cycle in a post on X, formerly Twitter, late last year (which I’ve slightly paraphrased):

1. You got rich! Good for you! You did the hard work and got in early.

2. Hm. It seems like everyone is getting rich?

3. Wait. That asshole?! That guy is not smart, maybe even criminal.

4. Pop.

For a time, it seemed like the housing market was doing a speedrun through Simonsen’s checklist. There were the runaway prices: Before the pandemic, you could buy a median-price home in Las Vegas for about $281,300, according to Redfin. Good luck finding that kind of deal now — even with a dip from pandemic highs, the cost of a typical house there has swelled to $422,000, an eye-watering 50% increase. Similar stories have played out in Miami (70%), Boise, Idaho (40%), and Dallas (36%). The typical household would have to spend nearly 34% of its income to afford major homeownership expenses such as mortgage payments and property taxes, according to the data firm Attom, the highest percentage since 2007 and well beyond the 28% debt-to-income ratio that’s typically preferred by lenders.

Then there were the people getting rich. Speculators were using supercheap loans to buy homes, expecting to profit by selling to an even bigger fool; home flippers, aspiring megalandlords, and Airbnb owners flaunted their debt-funded miniempires on TikTok; and seemingly everyone was signing up to be a real-estate agent. Even usually buttoned-up real-estate professionals were giving off bubble vibes: High-flying mortgage companies threw lavish parties featuring bands such as Imagine Dragons, while Zillow, the ubiquitous home-search site, morphed into one of the country’s biggest homebuyers — even though its acquisition math didn’t add up.

All the signs seemed to point to a bubble, and there were plenty of people predicting the “pop” was coming: In late 2022, the prominent Wall Street economist Ian Shepherdson forecast home prices to fall by as much as 20% the following year. Goldman Sachs expected a more modest, but still significant, decline of up to 10% from the peak. Countless headlines wondered whether home values were set to crash. Even Federal Reserve Chair Jerome Powell, whose every word threatens to move markets, said at a Brookings Institution event in 2022 that housing was in a “bubble” during the pandemic, with “prices going up at very unsustainable levels.”

But there was no pop, no sudden collapse in home prices. Even with mortgage rates tripling and buyers retreating, values held up.

The gloomy oracles could even point to an instigator of the coming collapse. The Fed, led by Powell, began raising interest rates in spring 2022 to fight inflation, sending mortgage rates shooting upward. Mortgage rates kept rising through most of 2023, eventually reaching a 20-year high in October of nearly 8%, up from less than 3% during the depths of the pandemic in 2020 and 2021. Suddenly it wasn’t so cheap to borrow money, making it tougher for reckless investors to enter the market. Speculation is the oxygen for a market-frenzy fire, Rick Palacios Jr., the director of research and managing principal at John Burns Research and Consulting, told me. By hiking rates, the Fed cut off the air supply.

But there was no pop, no sudden collapse in home prices. Even with mortgage rates tripling and buyers retreating, values held up. To understand why, you have to look at the fundamentals — the deep-seated reasons all the “Bubble Boys,” doomsayers, and fear-mongering headlines are dead wrong.

Debunking the bubble

Rising prices, no matter how steep, aren’t enough to constitute a bubble. Prices also need to diverge from the fundamentals, or the basic components of supply and demand, that determine how much things cost. If the run-up in prices defies logical explanation or obscures sketchy business practices, watch out. In the years leading up to the global financial crisis, for instance, lenders came up with creative ways to boost demand: They devised predatory mortgages that left borrowers on the hook for impossibly high payments once their teaser rates expired and handed out so-called NINJA loans (no income, no job, and no assets). If you owned a home at that time, you might’ve felt like the only direction its value could go was up.

The recent housing-bubble theory was always going to age poorly because of one fact: The pandemic soaring prices were justified. Prices didn’t spiral out of control because we built too many homes or made it too easy to borrow money, like in 2008; they took off because there simply weren’t enough homes for all the creditworthy people who wanted to buy them.

It’s a savagely unhealthy housing market. But it’s also a market that just had too many people chasing too few homes.

For home prices to suddenly crash, there would have to be a pool of desperate sellers looking to offload their homes on the cheap — or, worse, losing them to the foreclosure process. Sure, speculators were loud and proud about their get-rich-quick schemes, but they were a vocal minority. And regular homeowners have “never looked this good” when it comes to their financial and credit health, Logan Mohtashami, the lead analyst at HousingWire and an outspoken critic of bubble alarmists, told me. Less than 4% of outstanding mortgages were delinquent at the end of the third quarter last year, according to the Mortgage Bankers Association, a near-record low. In the fourth quarter of 2023, the median credit score for people getting a new mortgage was a stellar 770, according to the Federal Reserve Bank of New York. (Lenders typically consider a score above 700 to be a marker of future success for a borrower.) Almost 79% of homeowners with a mortgage have locked in a rate below 5%, a Redfin analysis of data from the Federal Housing Finance Agency found. In the history of rates, that’s a pretty incredible deal. And nearly 40% of homeowners don’t even have to stress about mortgage payments at all, according to census data — they own their homes free and clear.

Rather than facing a housing bubble, we’re staring down an entirely different crisis: a supply shortage that has regular buyers fighting just to break into the market. US homebuilders spent the decade after the global financial crisis building at about half the rate of the three decades prior, contributing to the housing crunch. Various estimates have pegged the national housing shortage anywhere between 2 million and 6 million homes. The supply constraint hit right as millennials, the largest living generation in the US, reached their prime homebuying years. Add in people’s sudden desire for a bigger house or a place of their own in the heat of the pandemic, and the recent surge in home prices seems less bubbly and more logical. The lack of inventory is the reason prices didn’t suddenly drop, even when mortgage rates shot up. Sure, buyers pulled back. But sellers pulled back even more, leaving the supply-demand imbalance in place.

“It’s a savagely unhealthy housing market,” Mohtashami told me. “But it’s also a market that just had too many people chasing too few homes.”

Staying high

It’s tempting to look for echoes of 2008 in today’s housing market. You might even be inclined to cheer on a crash in prices — all the better for everyone who feels locked out of homeownership. But cycles rarely repeat in the same way, Selma Hepp, the chief economist at CoreLogic, told me. Anything that could incite a housing crash probably wouldn’t leave average consumers in a position to suddenly pounce on all that excess inventory.

Fannie Mae now projects a modest 3.2% increase in home prices this year and a jump in home sales, along with a decline in mortgage rates. Goldman Sachs predicts a 5% rise in home prices. John Burns Research and Consulting doesn’t publish an exact forecast of home prices, but Palacios told me the firm expected to see a similar increase in the “low single digits.”

Perhaps the biggest threat to the housing market at large is a severe economic slowdown, one in which many people lose their jobs and can’t pay their mortgages. It’s notoriously difficult to estimate where the economy is headed, but right now, it’s roaring along, especially compared with other rich countries. Things aren’t perfect, but the vibes are definitely up. And even if the economy does take a turn, a run-of-the-mill recession probably wouldn’t be enough to topple the housing market. Things would have to get so bad that banks would be forced to walk away from the mortgage-lending space almost entirely, as they did during the foreclosure crisis. If the market is cratering and nobody can get a mortgage to put a floor on prices, “that’s where you get pretty meaningful declines in asset prices,” Palacios said.

There’s a silver lining baked into all this: Prices aren’t poised to drop, but the days of skyrocketing valuations appear to be behind us, Mohtashami told me. The housing market is far from balanced, but we’re at least heading in that direction.

After the past few years, the lingering fears of a sudden fallout are just a distraction from the bigger issues at hand. The bubble debate was fun; now it’s time to put it to bed.

James Rodriguez is a senior reporter on Business Insider’s Discourse team.