Christine Dyken had just returned home after picking up her grandson from school, and she was stressed.

Dyken — who lives in a quiet corner of North Las Vegas with her daughter, Doreen, and 7-year-old Christopher — needed to move, and the process was overwhelming and expensive.

Doreen was getting divorced, and they’d been looking for a home they could move into quickly — but one that wouldn’t break the bank. The 74-year-old Dyken had moved in with her daughter to help care for Christopher but also because she couldn’t afford rising rents on her own.

Dyken’s income from disability payments, Social Security, her late husband’s pension and tax-preparation work doesn’t go far in a region where housing costs have soared in recent years, echoing conditions in California.

Newsletter

Get our L.A. Times Politics newsletter

The latest news, analysis and insights from our politics team.

You may occasionally receive promotional content from the Los Angeles Times.

“We’re really living paycheck to paycheck,” Dyken said last month, standing alongside Doreen, who works at a casino.

Home sale prices in Clark County have jumped by 50% since 2016, to about $414,000, according to an average of the middle-third of values collected by Zillow. The news for renters is no better. Zillow computed the expected price of a lease on a single-family residence, and it has jumped almost 70% over the same period, to about $1,750 a month.

As President Biden and Donald Trump prepare to face off once again in November, the hope of owning a home is all but dead — or at least on life support — for many middle-class voters in Nevada and Arizona, battleground states. The culprits are low supply, high interest rates and population growth — driven significantly by new arrivals from California.

Biden’s focus on the subject during a campaign swing last month is a reflection of how profound the crisis is for voters, political observers say.

“I think he realizes the magnitude of the situation,” Steve Sisolak, a Democrat who was Nevada’s governor from 2019 to 2023, said of Biden. “He’s not out there to chase polls, but when you do poll people, affordability of housing is a major issue. If you’re not in the housing market right now, it’s going to be difficult to ever get into the housing market.”

Former Nevada Gov. Steve Sisolak, center, at a newly opened Democratic campaign office in Las Vegas.

(David Becker / For The Times)

Dyken said she plans “to hold her nose and vote for Biden,” in part because Trump’s behavior during the Jan. 6, 2021, assault on the U.S. Capitol was so “insulting.” But Doreen, who asked that her last name not be used, said she likely won’t vote. There’s too much going on in her life, and voting never felt like much use, she said.

In the northern Nevada town of Fallon, loan officer Shannon Faught said she’s “leaning toward voting for Trump.” Low interest rates when he was president, at the outset of the pandemic, allowed her to buy several homes, which she uses as rental properties.

Politics don’t weigh on her heavily, she said, but she’d like to see the country run more like a business and thinks Republicans are better positioned to do that.

“I don’t think about the election a ton except for the fact that it’s maybe having an effect on interest rates,” she said, though she recognizes that those rates are set by the Federal Reserve, which is ostensibly insulated from politics. “I think about interest rates. Who knows if they’re being timed with the election?”

The fed funds rate — a benchmark set by the independent Federal Reserve — is about 5.3%, a 22-year high. Inflation has dropped to about 2.5% from 7%.

In Arizona, which Biden won by just 10,000 votes in 2020, home prices and rents have skyrocketed as well, as the unemployment rate remains lower than the national average, at 3.7%.

The jump in prices, driven partially by an influx of Californians, has boosted anxiety.

A study from the Common Sense Institute Arizona found a housing shortfall of approximately 67,000 units as of early 2024.

Daniel Scarpinato, who was chief of staff to former Republican Gov. Doug Ducey, said he thinks the border will be the dominant issue among Arizona voters, but issues of affordability and the direction of the economy won’t be far behind. Arizona’s 11 electoral votes and Nevada’s six will be pivotal in a contest where very few states are up for grabs.

Arizona Gov. Katie Hobbs, a Democrat, vetoed a bill that would have removed local control over some planning and zoning regulations.

(Ross D. Franklin / Associated Press)

A debate has roiled Arizona over proposed reforms to zoning laws. Democratic Gov. Katie Hobbs recently vetoed bipartisan legislation intended to boost housing that would have removed local control over some planning and zoning regulations.

A recent poll found that 53% of a representative sample of roughly 3,000 U.S. homeowners and renters said housing affordability would affect how they vote in the 2024 election. The same survey, funded by Redfin, found that about 65% of respondents said housing affordability made them feel negative about the economy overall.

“There’s a general sense that this was once an affordable place to live,” Scarpinato said, pointing to increases in rent and homelessness as byproducts of the malaise.

“The growth for the state from an economic standpoint has been off the charts and fabulous. If you owned a home, your value has probably tripled or quadrupled,” Scarpinato said. “But if you want to move and upsize because of a growing family or something, I think that there are some real stresses on people and just generally a sense that the quality of life is changing.”

In the run-up to his Arizona and Nevada visit last month, Biden called for a $10,000 tax credit for first-time home buyers and for funding to build or renovate more than 2 million homes. He called for the creation of a $20-billion competitive grant fund to accelerate housing creation. His administration is also looking for ways to incentivize local municipalities to do away with stringent zoning restrictions.

These proposals would require Congress to enact legislation, unlikely in an election year.

In 2021 and 2022, about 140,000 Californians moved to Arizona. In the same period, about 110,000 Californians moved to Nevada, according to figures released by the U.S. Census Bureau. This influx is part of the reason prices for housing went up in these states, said Daryl Fairweather, Redfin’s chief economist. There are large parts of the country, she said, where residents are doling out more than 30% of their income on rent. Fairweather and other economists say spending more than that on rent and utilities makes residents “cost burdened.” In 2022, 22 million Americans met this standard.

She said Biden’s ideas were encouraging, but building new homes is the only answer to the crisis.

Rep. Steven Horsford (D-Nev.) in a North Las Vegas neighborhood in his home district.

(David Becker / For The Times)

“That’s the only thing that’s really going to matter 10 years from now. I think everything else is too small to really make a difference in a product that’s so large,” Fairweather said. “Despite there being such a strong economy, when you look at [gross domestic product] or unemployment, people still feel like the economy isn’t good for them because of how high housing costs have gotten.”

Trump, whose campaign didn’t respond to requests for comment, offered few specifics about how he’d bring down home prices. He has mused about getting rid of the Fair Housing Act, which protects minorities from discrimination in the purchase or renting of housing. His campaign characterizes these regulations as waging a “full-scale war on the suburbs.”

Biden, meanwhile, has been “working to lower housing costs, help first-time home buyers achieve their dream of owning a home and lower rents, while Donald Trump spent his time in office gutting affordable housing programs and letting Wall Street firms jack up housing costs on hardworking families,” said the president’s senior campaign spokesperson, Sarafina Chitika.

Rep. Steven Horsford (D-Nev.), who chairs the Congressional Black Caucus, said it was a relief that Biden spoke so directly about the housing crisis when he visited Nevada. The anger over rising prices has made his own reelection contest more competitive, Horsford said, and has become the animating issue in conversations with constituents.

“The person who’s feeling the stress and the anxiety isn’t at fault. It is incumbent upon those of us who are in office to explain our position and what we’re doing to make it better,” he said in an interview at the Culinary Academy of Las Vegas, which he once ran. “I encouraged the White House to center the issue of housing and lowering the cost of housing — not to just talk about inflation as this broad general term. That’s not how average Americans talk about it.”

He described how in his Clark County district, large corporations have swept in, buying up hundreds of rental homes at a time. Many of the companies are based out of state, he said, and have turned around and quickly raised prices, done little to invest in upkeep and evicted residents at higher rates.

He has introduced legislation to empower the federal government to better track home purchases and look for market manipulation among institutional investors.

Christine Dyken, left, and daughter Doreen speak with Horsford.

(David Becker / For The Times)

In the Culinary Academy’s dining room, Horsford chatted with Ameeluz Cauton, who works at the Bellagio hotel, about the strain of finding stable housing. Caulton, 35, has worked at hotels and casinos for more than 15 years and at one point owned a home with a boyfriend. They broke up, and she struggled to find a roommate. Then the house next door became occupied with “sketchy people,” she said. For a while, she felt “trapped,” because selling the home wouldn’t give her enough to rent or buy something new, since prices had jumped so significantly.

Eventually, she resolved to just sell and move in with her sister, a temporary solution that’s working fine, she said. Her union, the politically powerful and Democratic-aligned UNITE HERE Culinary Workers Union Local 226, has a down-payment assistance program for first-time home buyers or those who haven’t owned in three years.

Many of her colleagues have felt a similar crunch, and it will certainly be on their mind this election season, Cauton said.

“They’re gonna vote for whoever is going to help them keep their jobs stable,” she said. “I don’t think they’re going to stick with a specific party. It’s just whoever is in line of what we need and what’s going to help us for our future. They could interpret both parties in a different way. But it’s whoever is for the workers.”

Get ready to rent forever. Photo illustration by Fortune; original photo by Getty Images

More bad news for anyone who wants to ever own a home: Home prices just went up again. The S&P CoreLogic Case-Shiller U.S. National Home Price index rose 6% in January, data released today shows; that’s up from a 5.6% increase in the previous month, setting the fastest annual gain since 2022. “On a seasonal adjusted basis, home prices have continued to break through previous all-time highs set last year,” Brian Luke, head of commodities for S&P Dow Jones Indices, said in an accompanying statement.

Renting isn’t necessarily affordable either, but it is cheaper than buying, and could be for years to come, according to Capital Economics. That should show just how unaffordable buying has become in a housing market beset by skyhigh home prices and mortgage rates that more than doubled in a short period of time. Still, “as mortgage rates fall, we think the difference between the cost of buying and renting will narrow from the current all-time highs,” Capital Economics’ property economist, Thomas Ryan, wrote in a new housing market update. “But even by 2026, renting will remain by far the more cost-effective option.”

Currently, the average sales price for homes sold in the country is $492,300; the average 30-year fixed mortgage rate is 6.91%; and the median rent for all bedrooms and property types is $2,055. Conversely, in the 2010s, the monthly cost of buying and renting were pretty close, but that changed a few years ago, when the cost of buying a home soared with the pandemic housing boom, Ryan wrote. The monthly payment for an average home with an 80% loan-to-value ratio mortgage is about $2,700, and that’s $970, or 56% higher, than the typical rent, according to Capital Economics. “That marks a historically large premium,” he wrote. “And in realty, the gap could be even larger.”

Capital Economics recently said the national average house price has risen almost 50% since the start of the pandemic. And in this note, Ryan wrote that rent as a share of disposable income among 25 to 34 year olds was 40.5% as of the fourth quarter of last year, dipping from a peak of 41.6%. So clearly, both rents and home prices are costly.

Still, despite the fact that the firm expects mortgage rates to fall from here, and borrowing costs to lessen, renting will still be cheaper. For one, Capital Economics doesn’t see mortgage rates falling below 6% by the end of 2026, and at the same time, it expects home prices to continue their upward trend, while rents stay muted. “Therefore, we’re forecasting that the additional monthly cost of buying a home rather than renting will still be $570 (or 47%) by end-2026,” Ryan wrote.

Unsurprisingly, it’s supply that is keeping rents subdued, and supply that is pushing home prices up. The only difference is the type of supply, multifamily versus single-family. And it’s apartments that are considered oversupplied (if there’s such a thing) and single-family homes that are undersupplied.

And of course, buying and renting aren’t synonymous; buying can help you build wealth, as Ryan pointed out. Capital Economics isn’t the only one to identify renting as cheaper than buying. Realtor.com’s newly released monthly rental report found renting a starter home is a more affordable option than buying one in all 50 of the largest metropolitan areas in the country. “The monthly cost of buying a starter home in February 2024 was $1,027 more or 60.1% higher than the cost of renting,” the report read. Separately, Capital Economics predicts home prices will rise 5% this year, and 3% next year.

Only time will tell where they all go from here, but we do know that going from renting to owning is becoming harder and harder.

The rising number of new apartments being built across the U.S. is causing rent prices to finally cool down, according to the latest data, in what’s the best news tenants have received in the past three years.

Rents, very much like home prices, skyrocketed during the pandemic years, soaring by the double digits. But as the number of new listings increases and landlords have to grapple with rising vacancies, rents are finally cooling down.

In August 2023, the median monthly rent prices reached a peak of $2,052. In January, the median U.S. asking rent rose by ‘only’ 1.1 percent year over year to $1,964, according to a February report by Redfin, remaining unchanged from a month before. Compared to the rollercoasters of the pandemic years, rent prices appear to be finally leveling off.

“Asking rents have flattened because the pandemic moving frenzy is over and landlords are grappling with vacancies due to a jump in apartment supply,” read the Redfin report.

Brandon Bell/Getty Images

The number of recently built apartments is near its highest level in more than 30 years, according to Redfin, and is expected to continue rising, as the number of apartments currently under construction is nearing a record high. Redfin Chief Economist Daryl Fairweather said that the number of completed apartments will peak this year.

According to another Redfin report, new listings in the U.S. jumped by 13 percent year over year in the four weeks ending on February 25, the latest data available. It was the biggest increase in nearly three years.

If rents are only now leveling off and are still far from dropping, as tenants might wish for, it’s because high mortgage rates continue to fuel demand for rented properties and because landlords are finding alternative ways of attracting tenants. According to the Redfin report, some landlords are offering one-time discounts rather than lowering rent.

The continued rise of home prices—which are back up after the brief correction of late summer 2022 and spring 2023—is also pushing more people to keep renting rather than buy a home they can hardly afford.

“Rent prices haven’t dropped, but rent growth has moderated significantly to the point where rent prices are now largely flat in an economy where inflation is running at about 3-4 percent,” Redfin’s head of economic research, Chen Zhao, told Newsweek. “The reason why rent growth hasn’t fallen more to the point where prices are declining is because demand is still strong. The affordability crisis—high rates and high prices—in the for-sale market means that there are more renters who want to buy but can’t right now.”

“There’s not a huge incentive for renters to buy right now,” Fairweather said in a press release. “Asking rents are stable, and while mortgage rates have dipped in recent months, they haven’t fallen enough to make the financial equation of homebuying feasible for many people.

“If you’re a renter who’s interested in buying but isn’t in a rush, there’s not much downside to waiting for mortgage rates to fall and your savings to grow.”

Zhao said she’s not sure that rent prices will go negative this year, “at least not very significantly at the national level.” It’s possible rent prices will go slightly negative nationally or in certain regions like the South, she said, “where there is still a lot of supply to come. However, overall, strong demand will likely keep rent prices flat.”

Update, 3/7/24, 8:50 a.m. ET: This article was updated to include a comment from Redfin’s Chen Zhao.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Listen to this article

Produced by ElevenLabs and NOA, News Over Audio, using AI narration.

When the Federal Reserve began jacking up interest rates in 2022, home sales cratered almost overnight; inventory dried up; the housing market “froze.” People who have mortgages with interest rates below 4 percent—which is more than 60 percent of homeowners—aren’t going anywhere. They’re not selling their houses. They’re staying put.

The current availability of homes for sale is about 36 percent lower than before the pandemic; this past October, home sales dropped to their lowest level in more than 13 years, and in November, the share of homebuyers looking to relocate to a different metro area was at its lowest level in 18 months. People who own homes have become so reluctant to move that they’re likely to pass up job offers in other cities, one study found.

If swapping a low mortgage for a much higher one is plainly undesirable, the way out of the problem—and into a new space—seems plainly obvious: renting. Now is a terrible time to buy a home, but renting would allow more Americans to relocate without becoming “house poor” at a 7 percent interest rate. A rental home could help a growing family break free of a too-small starter house. A national renting trend, in which owners put up their homes for rent and become renters themselves, could unfreeze the whole market.

“Why not just rent?” is a question I’ve asked myself (and my husband, and our real-estate agent) many times over the past couple of years, as we’ve tried and failed to sell our house and buy a new one. After a long day of touring gross, overpriced homes that would require thousands of dollars of renovation, all for double the interest rate we have now, I’d mutter, Why don’t we just rent a house instead of buying one of these dumps? Every time, they reacted like I’d suggested we live on an ice floe in the middle of the North Sea. Rent?

It turns out that deep cultural, regulatory, and financial incentives prod Americans toward the “homeownership ladder” and, once they’re on it, discourage them from hopping off. Although renting is often not any financially or psychologically worse than owning—in fact, it might be quite the opposite—renting after owning is just not something most Americans want to do.

It’s not that nobody wants to rent, of course. Demand for rental homes is healthy: In fact, rentals are becoming the new starter homes, as many would-be first-time buyers, who can’t afford to buy at today’s interest rates, rent houses instead. “Instead of moving from apartment to ownership, you move from apartment to renting a house and later on to ownership,” says Nicole Bachaud, a senior economist at Zillow.

But about 70 percent of people who sold a house recently also bought a home, according to a report by Zillow. (That doesn’t mean the other 30 percent all rented—they might have moved in with family, moved into a retirement home, or moved into another home they also own.) “Very, very few people make that transition back into renting,” Lu Liu, a finance professor at the University of Pennsylvania, told me.

Say someone does currently own a home at a low mortgage rate and wants to move. The first question would be what to do with that home. Financially, the ideal is to hold on to that house—and rate—for as long as possible. “Giving up a 3 percent mortgage in a 6.5 percent interest-rate environment is the equivalent of giving up 15 or 20 percent of home value,” Chris Mayer, a real-estate professor at Columbia University, told me. Nevertheless, renting your home out can be expensive and annoying. “You get a call at 7 a.m.—the hot-water heater is broken,” Mayer said. “Being a landlord is not that much fun or that easy.”

What’s more, the federal government, through regulations and incentives, practically begs Americans to buy homes, not rent them: Homeowners benefit from a slew of tax deductions that aren’t available to renters. Rents can increase, but fixed-rate mortgages never do. “During the pandemic, house prices went up by a lot, and that was very painful for renters and people who are trying to get onto the housing ladder,” Liu said. “But it wasn’t necessarily a problem for people who were already owning a house.” That means homeowners are shielded from inflation, their house payments a relic of the year in which they bought their home. Even if a current homeowner did opt to rent instead, they might find that typical rents are now even higher than their mortgage payment.

It’s not just fixed rates that make homeownership feel more stable than renting. In most cities and circumstances, a renter can get kicked out by a landlord who wants to move back into their house, or who simply wants to charge more rent. If you have kids, that raises the stakes of renting: What if they’re in a school they love, and the landlord decides you need to vacate?

Finally, homeownership has a firm hold on the American psyche—a preference that isn’t entirely rational. Though owning a home is often a good way to build wealth in the long run, in the short term, owners are on the hook for any repairs the home needs, which can be extremely costly.

Homeowners aren’t necessarily any happier than renters—one study of women in Ohio even found that homeowners are more miserable because they spend less time with their friends. But along with parenthood and marathons, it seems like one of those things that doesn’t make us happy but that we do anyway. “Homeownership in America is an ideal,” Daryl Fairweather, the chief economist of Redfin, told me. “And the ideal is that you don’t have a landlord, and you are the king of your own castle.” People want to paint the walls whatever color they wish—even if we all end up painting them Mindful Gray. We just want the option.

Perhaps more Americans would rent if renting weren’t so precarious. In countries where protections for renters are stronger, more middle-class people see renting as a long-term option for their family rather than as a temporary solution in their 20s. Take Germany, where only about 45 percent of households own, compared with two-thirds in the United States. There, landlords can’t terminate a rental contract for just any reason, and it’s extremely difficult for landlords to raise the rent. As a landlord you might “like to have a long-term renter leave, but you can’t,” Leo Kaas, an economist at Goethe University Frankfurt, told me. Rental contracts are open-ended, Kaas said, and that “makes it much more attractive for individuals in the first place to rent.” Some Germans move into low-income housing and stay there for years, even as their incomes rise and they technically no longer qualify.

For now, my husband and I have reached a détente in which I stare at Zillow rentals and he stares at Redfin’s for-sale listings. Neither of us much likes what’s on offer. So far, we’ve been doing what other homeowners have been doing: not moving.

By Ashley Nickel For Daily Mail Australia

05:00 23 Jan 2024, updated 06:04 23 Jan 2024

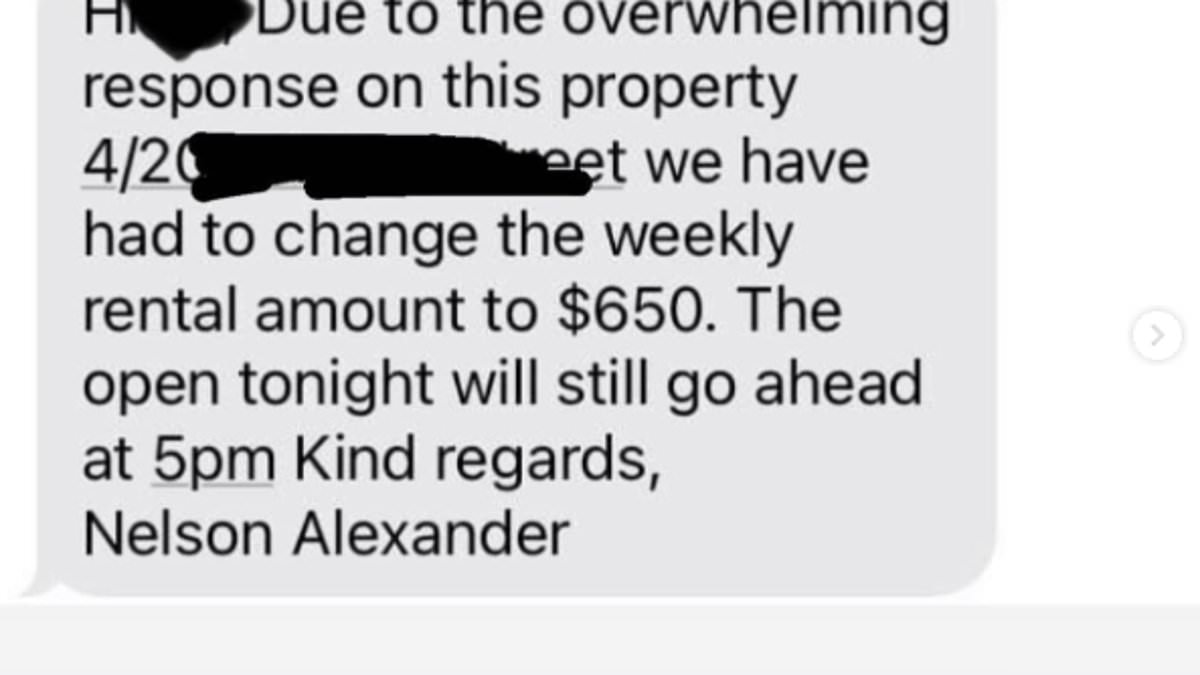

A real estate agent has sparked outrage after informing a would-be renter via text they were suddenly increasing the advertised price because of high demand.

The renter had been preparing to inspect the property in Melbourne when they received the text from the agency.

They said the property had been advertised at $600 a week but was bumped up to $650 a week due to high demand.

‘Due to the overwhelming response on this property, we have had to change the weekly rental amount to $650,’ the text read.

‘The open tonight will still go ahead at 5pm. Kind regards, Nelson Alexander.’

Nelson Alexander specialises in north Melbourne properties and was founded in 1971.

‘Nelson Alexander is unlike many real estate businesses in Australia and this gives us our competitive edge and ensures we can continue to deliver exceptional levels of service and results to our clients,’ its website states.

Nelson Alexander confirmed to Daily Mail Australia that the original listing was an error.

The company says it has put in processes and training to make sure such a mistake does not occur again.

‘For clarity, we do not solicit or encourage any form of rental bidding and we have taken the property offline and are currently reviewing our processes to ensure this doesn’t ever happen again,’ Nelson Alexander said.

‘We are deeply aware of the moral and social responsibility we have to the community during these challenging times and will continue to hold ourselves accountable.

‘We appreciate your patience and understanding as work though this.’

A shortage of housing in popular Melbourne suburbs has led to a drastic rise in rental prices with more people competing for limited accommodation.

A screenshot of the text was shared online where social media users said they were horrified of the real estate agency’s decision to increase the advertised price.

‘It’s hard enough for renters out there without this happening,’ one said.

‘What an absolute disgrace,’ another wrote.

Several others compared the price change to ‘rental bidding’ and called it ‘illegal’.

However, not everyone was offended by the realtor’s choice with one commenter writing: ‘Hotels increase their prices when there is high demand.’

Nelson Alexander also commented under the post and thanked Ms Felgate ‘for bringing this to our attention’.

‘We have immediately pulled the property to understand what has happened,’ it said.

‘Nelson Alexander takes great pride in the responsibility of managing as many properties as we do and this is not in line with our values.

‘We will be reviewing what additional training is required (on top of our current legislation training) to ensure this never happens again.’

The real estate agency followed the comment up with a longer statement on Friday.

‘We want to acknowledge and address the concerns raised about an advertised rental property under our management,’ it said.

‘This did not follow the standards we hold ourselves to and sincerely apologise for any frustration this may have caused.

‘We appreciate your patience and understanding as we work through this.’

Sydney, Canberra and Melbourne have long been touted as Australia’s most expensive cities when it comes to property, but after three years of a COVID-19-bolstered boom, Brisbane has climbed the ranks.

Since 2020, homes in Queensland’s capital have increased by 50 per cent, making it now the nation’s third most expensive city with median dwelling price of $787,217.

Corelogic data shows it’s the first time in 15 years that dwellings in the Greater Brisbane region are more expensive than Melbourne’s median price of $780,457.

Michael Deacon’s family had to get innovative to survive Brisbane’s booming property market, combining incomes with his mother-in-law to buy a home for three generations.

“It was pretty scary. We didn’t know what we were going to do,” he said.

“She was the one that actually suggested the idea to us.

“It’s a two-storey house but it’s complete dual living so an upstairs-downstairs, and it’s great for our daughter.”

While Mr Deacon’s mother-in-law Pat Smith had no mortgage on her home, rising interest rates coupled with the growing property market made her worry for her family’s future.

“We were thinking of leaving Brisbane altogether and going up to Yeppoon because prices were a bit cheaper, but we decided against that. It was too big a move,” Ms Smith said.

Brisbane remains seller’s market

While December’s median price for dwellings in Brisbane was more than Melbourne, the median house price was still cheaper in the Sunshine State at $875,991, compared to Victoria’s capital of $948,041.

According to Corelogic, units were also cheaper in Brisbane with a median price of $561,016, while the median price of units in Melbourne was $610,122.

Corelogic’s head of research Eliza Owen said the high amount of units in Melbourne, compared to Brisbane, brought down the dwelling cost overall.

“About a third of that market is units, which weighs down the median, as opposed to Brisbane, where only about 25 per cent of housing stock is estimated to be units,” Ms Owen said.

ABC News: Ian Cutmore

)

She said Brisbane would remain on top in the “tussle” against Melbourne in the short term, with prices in Queensland’s capital continuing to rise.

“Melbourne is actually still in decline, with values down about 0.3 per cent in the past four weeks,” she said.

While Brisbane remained “a seller’s market”, properties weren’t increasing in value at the same rate, with the monthly growth decreasing from 1.5 per cent in October to 1 per cent in December.

Ms Owen said flood-impacted homes could cause a further stabilisation of the market.

“Some people might find that they just want to get out of flood-prone areas altogether so that will impact demand and probably create some more variation in capital growth,” she said.

Brisbane’s continual rent increases ‘unheard of’

Renters in Brisbane are also under prolonged pressure, facing an “unheard of” streak of rental rises, with new figures showing rents increased steeply in the most recent quarter.

Released today, the Domain Rental Report shows Brisbanites are now paying an average of $600 per week for houses and $560 for units.

It marks the 10th consecutive quarter of growth for unit rents.

Domain’s chief of research and economics, Nicola Powell, said the state of the rental market was now at unprecedented levels.

“Ten consecutive quarters of unit rental growth is pretty much unheard of,” Dr Powell said.

“I think it really showcases the pressure that the rental market has experienced in Brisbane.”

She said record high rental prices showcase a serious lack of supply of rentals on the market, with rental vacancies at an all-time low back in February of last year.

Brisbane’s vacancy rate has increased slightly since then, to 0.9 per cent.

“It really showcases there hasn’t been enough investment activity across the city,” Dr Powell said.

She said demand was also outstripping supply as people moved in droves from interstate and overseas.

There is some hope for renters this year, with signs the rate of increase is slowing slightly — not just in Brisbane but across the country.

Domain’s report shows combined rents across Australia’s capital cities held steady for the first time in almost three years, ending its own stretch of 10 consecutive quarterly increases.

Across the nation, the average house and unit rent were each $600 per week.

At the end of 2023, Sydneysiders paid an average of $730 per week to rent a house, the most of any city across the nation.

Hobart saw the highest increase after the average rent rose by $20 per week during the last quarter, to $550 per week.

Loading…

If you’re unable to load the form, click here.

You’re one of the “lucky” ones that bought a new condo in 2019 or 2020 before the prices shot up because of the effects of the Covid-19 pandemic.

You may have bought it as an investment property, or maybe you even had the intention to stay, depending on how well the condo turned out.

But now that it’s completed, property sale prices are at all-time highs, and rental rates have never been better. Naturally, you are at a crossroads:

Should I rent out or sell my new condo in 2023?

While it seems like you can’t lose either way (which is true), there are some who also believe that property prices may be coming down soon, given the higher interest rates and seemingly unstable economy.

So, is it worth renting out for a few years, riding out the recession (maybe), and then selling at an even higher price at the next peak? Or is it more likely that you will rent high now, but when you need to sell, property prices would have (just your luck) fallen back down to earth?

You’ll likely hear conflicting opinions from different realtors and investors; some will tell you to cash in while prices are high, and others will say it’s the best time to be a landlord.

Here’s what you need to know about renting vs selling’s pros and cons:

Rent vs Sell: There’s no correct answer

At the most basic level, this is because not all properties provide the same rental yield, or the same gains when sold.

Why? All condos have different rental yields.

If you have a shoebox unit that you bought at a peak, but is now consistently providing yields of five to six per cent, holding on may be smarter than trying to cash out for slim gains. Conversely, if rental income seems to be stagnant despite the market, then your situation might favour selling.

The correct answer depends on the performance of the property in question, as well as your own financial targets.

Rent vs Sell Condo: 9 Things to consider

Now that you know there’s no perfect answer, here are some things you should think through before making your decision:

Important things to remember before deciding

Before we get into it, here are some important things that many property owners overlook or forget.

1. Interest paid to your home loan is tax deductible

Many readers have voiced concerns over rising interest rates. While rates are rising (the average home loan rate is now three per cent per annum), remember that landlords can claim the interest portion of the home loan as a tax deduction.

Do be aware of this, if you’re considering selling to escape interest rate hikes.

2. Rental property agent’s commission is tax deductible

From 2022, landlords can claim their agent’s commission as a tax deduction, for the first tenant. This is quite recent and applies as of Year of Assessment 2022.

“Agent’s commission, advertising, legal expenses, and stamp duties incurred to obtain, grant, renew or extend a lease for first and subsequent tenants are allowed.” – IRAS

It’s one other benefit to consider when deciding whether to rent out your unit.

3. ABSD is now 17% of property price or value

If you bought before ABSD, or when ABSD was lower, then bear in mind you won’t escape the tax a second time.

If you sell your second property now, any future attempts to buy a second home (barring exceptions like decoupling) will incur the ABSD.

For some buyers, this may mean there’s no “undo” function to selling. Once you decide you sell and give up on rental income, it may not be financially viable to try and own a second investment property again.

(Unless the ABSD vanishes or is reduced in the future, but remember this “temporary” measure has only gotten pricier over the past decade).

4. Freehold or leasehold status?

We are being quite general here, but freehold properties generally reward a longer holding period.

A freehold property is typically bought at a premium of 15 to 20 per cent, compared to a leasehold counterpart; and one of the main advantages is against lease decay if you are planning to hold on for a longer period.

Older condos attractive for en blocs

When it is an older development, it can also be seen as more attractive as an en bloc prospect (the developer does not need to pay to top up the lease).

However, these advantages are seldom evident during the earlier years of a condo’s existence – a leasehold condo will generally show better rental yields and gains if sold within the first one to two decades of age; this is simply due to its lower initial cost. It’s usually among older condos that freehold status starts to show its edge.

Freehold properties? Maybe hold longer

So if you’ve bought a freehold property, but have only held for a short period like five years or less, your gains may not be that impressive; you may want to consider holding on and renting for longer.

Conversely, if you bought a leasehold property with the specific aim of quicker returns, you may want to move fast to realise your gains at a market peak.

5. Would you need a replacement home after selling?

It’s not uncommon for some singles or young couples to live with their parents, while they rent out the property they bought.

We sometimes see this among younger homeowners in their 20s, who may need the first few years of rental income to afford their property (E.g., they rent out the property for three years and accumulate savings, before they move in and renovate).

If you’re in this situation, bear in mind that if you sell high, you’ll probably buy high as well. You may be better off holding on and continuing to rent out until you’re ready to move into the property yourself.

6. Attempt to sell at a higher-than-realistic price, and accept whatever happens

Using this approach, some property owners let luck/the free market decide for them. They will list their property for a price that they know is above market value, then sit back and see what happens.

If they can still get a high price for their property, they win on returns. If they can’t get a high price, they continue to rent out and generate income. Some may perceive this as a “no-lose” situation.

Case Study: Boulevard 88 at 86 Orchard Boulevard

This is likely what happened with the 4-bedroom sub-sale units so far at Boulevard 88. The first was sold at a profit of $3.12 million over a period of fewer than 3 years (even with the SSD, the seller has definitely made a very tidy sum).

This has set the precedent for the rest of the sub-sale units, which have all subsequently sold for higher prices.

While we don’t know the story behind these transactions, it’s likely that the current asking prices are just too good to turn down for these owners.

We also know of one case in 2022 where a seller listed her landed property at above market value and found a buyer on the same day. This was well worth paying off her tenant to break the lease and sell. Of course, you can also sell the property with a tenancy, it all depends on what the buyer wants to do with the property.

7. Check for surrounding future developments

Check the URA masterplan for surrounding developments, particularly changes in plot density. If you see newer condos appearing nearby, this could mean competition in terms of rental; and bear in mind that some tenants expect older condos to charge less.

A mega-development (1,000+ units) appearing nearby may just be bad news for landlords; especially since such developments tend to have more room for common facilities. It may be worth considering an exit earlier, depending on your future investment plans.

Besides providing competition for tenants, there’s another reason nearby new launches might prompt you to sell: new launch prices have a knock-on effect on existing properties. As the general price psf climbs for the area, you may find your condo increasing in value as well.

On the other hand, if there are no new launches nearby, you may have found a nice niche spot to continue renting out, minus competition.

8. Decide based on your long-term financial plan

This assumes you have an existing retirement plan, with quantified goals (e.g., $X in assorted assets by age Y). It’s quite important to do this before you make decisions like whether to sell; otherwise, you have no sound basis for any decision.

Prioritise your retirement goals over market movements

One possible approach is to stick strictly to the plan, and sell if you’d meet the target amounts; ignore any “gut feel” about holding on for rental gains. Conversely, those who plan on their second property to provide post-retirement income may decide not to sell, regardless of the market peak (remember that, if you do, buying another investment property in the future will come with the burden of ABSD).

Timing the property market is risky, and it’s not wrong to prioritise retirement or other financial goals over market fluctuations.

9. Do you plan to upgrade further?

Ultimately, the question of whether to hold to rent or sell right now is just dependent on your exit strategy.

For example, if you are a couple that bought a 2 bedroom new launch condo for own stay or maybe investment and have plans to upgrade to a bigger space in the next year or so, it could make more sense to just sell the property and keep your options open as you search for a more suitable home.

It may not be worth renting it out to earn the rental income in the interim as a tenanted house is typically more difficult to sell (arranging for viewings with potential buyers, and some people want to move in right away). This may cause you to lose out on a more suitable home because you got stuck trying to sell it in time.

Younger age, bigger home loan

Not forgetting, the younger you are, the easier it is typically to make the jump to a bigger property because of the longer loan tenure.

If your consideration of selling now is because of fear that prices may fall soon, then that is a valid concern. There are definitely risks on the horizon that may affect the property market – but realistically given the number of cooling measures imposed, how far can property prices really drop in Singapore?

Barring a catastrophic event, it is unlikely that property prices will be as volatile as they were before the ABSD and SSD were implemented.

As for renting out now to take advantage of the high rental prices, it certainly makes sense if that has always been your intention. Whether property prices drop in the next few years will be irrelevant, if you are planning for a longer hold anyway.

This article first appeared in StackedHomes.