Property investors to get slightly less tax relief than promised in National-Act coalition agreement

The Government has decided not to give residential property investors as much tax relief as National promised Act in the parties’ coalition agreement.

Rather than start phasing out the interest limitation rule in the current tax year, as stated in the agreement, it will start being phased out in the year to March 31, 2025.

The interest limitation rule prevents residential property investors from writing off mortgage interest as an expense when paying tax. Exclusions apply, including for new builds.

Under the existing law, introduced by the former Labour Government when the property market was overheating, no interest can be deducted for property bought from March 27, 2021.

For property bought before then, 50 per cent interest can be deducted in the current tax year, which winds up at the end of this month.

National and Act had agreed to allow investors to deduct 60 per cent of their interest in the current tax year.

Making this change would have been unorthodox, as it would have had a retrospective effect (applied to the past). Some investors would have received tax refunds.

It also would have meant the Government would not have received as much revenue as it was banking on getting.

This might have been particularly problematic in the current environment, with the sluggish economy seeing the Government collect less tax than forecast by Treasury. Indeed, Finance Minister Nicola Willis is already walking back from National’s pre-election commitment to return the books to surplus by 2026-27.

So the Government has decided to keep the rules as they are for the current tax year, then allow investors to write off 80 per cent of their mortgage interest in the year to March 2025, and all their interest in the year to March 2026.

Act leader and Associate Finance Minister David Seymour didn’t dwell on the fact he lost his battle with National on the matter, noting it was easier to avoid making a retrospective change. He didn’t mention what National might have given him to agree to deviate from the coalition agreement.

Rather, he focused on the positives for both investors and renters.

“Landlords have been hit with a double whammy of rising mortgage interest rates and increasing interest deductibility limitations during a cost-of-living crisis. These costs are inevitably passed on to tenants, one of the reasons New Zealand has all-time high rental costs,” Seymour said.

“Removing the ability for landlords to claim interest expenses made residential properties less attractive and reduced the pool of properties for tenants to choose from.”

An argument Labour made when it introduced the interest limitation rule was that it put investors on the same footing as owner-occupiers, who can’t deduct their mortgage interest as expenses to reduce their tax bills.

Investors hit back, saying that interest can normally be expensed in business, so preventing this in regard to a certain type of investment created inconsistency in the tax system.

Nonetheless, Labour’s finance spokesperson Barbara Edmonds accused the Government of abandoning first-home buyers, struggling to get ahead.

“The ripples of this decision will be felt for generations,” she said.

“Landlords will become tax cut millionaires, once again showing the Coalition Government’s priorities are a disgrace.”

Edmonds said the decision showed the priorities were “not lunches in schools, the smokefree generation or continuing the Cook Strait ferries” but “it’s mega landlords”.

“The assertion that this will bring the cost of rent down is a wolf in sheep’s clothing, there is nothing in today’s announcement that guarantees tenants will have savings passed on to them as a result,” Edmonds said.

“This tax advantage for the wealthy is not only set to be unfair for tenants, it shuts first home buyers out from getting a foot on the property ladder. Parents and grandparents who hope for their children to own their own home will realise it is a more difficult path to homeownership than ever before.”

The interest limitation rule change will be added to the Taxation (Annual Rates for 2023–24, Multinational Tax and Remedial Matters) Bill, which is currently before a select committee and is due to be passed before the end of the month.

Act had campaigned before the election on removing the interest limitation rule in one go, rather than phasing it out.

If it had its way, it would also have scrapped the bright-line test (a de facto capital gains tax on investment property), which will be reduced from 10 to two years from July 1.

“To overcome New Zealand’s many challenges there needs to be an environment where investment and development is encouraged. This [interest limitation rule] change is a step in the right direction,” Seymour said.

Jenée Tibshraeny is the Herald’s Wellington Business Editor, based in the Parliamentary press gallery. She specialises in government and Reserve Bank policymaking, economics and banking.

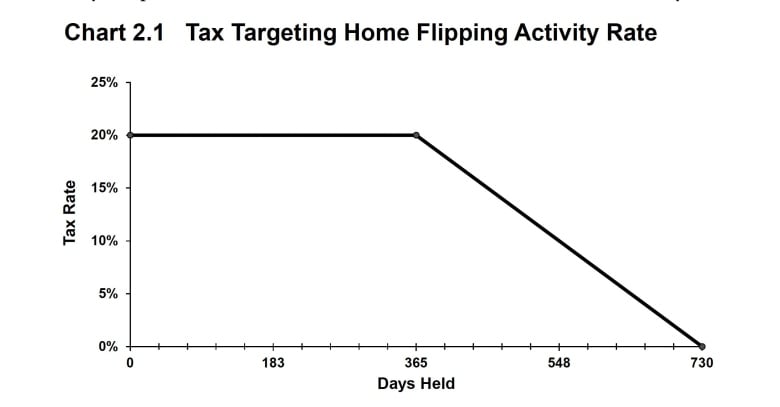

The B.C. government has announced plans to introduce a tax of up to 20 per cent on profits made when properties are sold within two years of their purchase.

The 20 per cent rate will be in place for a year after purchase and will slide to zero between 366 and 730 days after the acquisition.

B.C. Finance Minister Katrine Conroy announced the tax as one of the province’s latest tools to try to curb speculation over housing in a province where many struggle to afford appropriate shelter.

“Prices went up as governments stepped back and speculators moved in,” said Conroy during her speech presenting her latest budget in the legislature.

“That’s why we’re bringing in a home-flipping tax as our latest measure to crack down on bad actors.”

The tax is one of 20 pieces of legislation the government plans to introduce this session, meaning it will need to be passed at some point over the next three months before becoming law.

The plan is to implement it for properties sold on or after Jan. 1, 2025. It will also apply to properties purchased before then.

Conroy’s 2024-25 budget forecasts that the tax, once in place, would result in an additional $44 million in revenue in the 2025-26 fiscal year.

That revenue will go directly to building affordable housing throughout the province, she said.

Sellers would be taxed around 10 per cent after owning a home for a year and a half, with the tax lifted after ownership for two years.

The tax will apply to income from the sale of properties with a housing unit and properties zoned for residential use. It also applies to income made from condo assignments.

It does not apply to land or portions of land used for non-residential purposes, according to the government’s budget documents.

Other exemptions under the tax include life circumstances such as separation, divorce, death, disability or illness, relocation for work, involuntary job loss, change in household membership, personal safety or insolvency.

“The purpose of this tax is to support housing supply, not impede it,” reads the government’s budget documents.

“Exemptions will be provided for those who add to the housing supply or engage in construction and real estate development.”

The tax is to be paid in addition to any federal or other provincial income taxes incurred from the sale of property.

Alex Hemingway, a senior economist with the Canadian Centre for Policy Alternatives, said although the tax is another tool to try and address speculation, he’s not sure how successful it will be.

“I think a flipping tax can take a little bit of air out of the tires in terms of speculation, but it’s not really getting at the root of the housing crisis, which is a shortage of housing overall and a shortage of non-market housing in particular.”

He also said the tax could inadvertently drive down home sales and transactions, siphoning tax revenue away from property transfers.

First-time homebuyer credit

The budget also introduced expanded property transfer tax exemptions, increasing the First Time Homebuyers Program threshold up to $500,000 on the purchase of a home worth up to $835,000.

The province said the move would result in savings of up to $8,000 per purchase and would double the number of buyers that will benefit to approximately 14,500.

The province will also waive the property transfer tax for eligible purpose-built rental buildings that have four or more units until 2030.

The average price of a house in Rotorua has risen to $746,000 after the city’s average residential property values increased by 0.4 per cent in three months.

According to the latest data from the OneRoof Valocity House Value Index, taken at the end of January, property values across the country are up by 0.9 per cent compared to three months ago.

OneRoof’s latest House Price Report showed property values were up quarter-on-quarter in 90 per cent of suburbs nationwide, with the biggest quarterly lifts in Arrowtown, Mataura and Whitford.

Of the 793 suburbs with 20-plus settled sales in the last 12 months, more than 40 per cent saw year-on-year value lifts, reflecting the turnaround in the market.

Rotorua suburbs with more than 20 settled sales in the year ending January 31 included Hamurana, where property values increased by 2.1 per cent in the last three months to $1.23 million.

Western Heights saw the second-highest three-month increase in suburb property value, a difference of 2 per cent.

Rotorua Professionals McDowell Real Estate principal and auctioneer Steve Lovegrove said the post-summer, early autumn season was normally a busy one for real estate.

“The good news for everybody is that prices seem to be mostly stable, certainly not going backwards and probably increasing,” Lovegrove told the Rotorua Daily Post.

“We are starting to see the green shoots of property price increases.”

Lovegrove said there was also a lift in the stock available.

“So buyers do have a little more choice and less need to act urgently. We’re seeing a little bit of lag in decision-making and a significant lift in buyers actively entering the marketplace.”

Lovegrove said there was more competition for properties in the $500,000 to $700,000 value range.

“Anything just below that average price is getting hit quite hard with active buyers, mostly first-home buyers.”

Lovegrove said there was also a trend of people looking to downsize which also saw more buyers looking in the lower price ranges.

“There’s a lot of confidence, a positive vibe and a positive outlook looking forward. We’re not expecting a rapid price increase. We are expecting simply more confidence.”

Tremains central region general manager Stuart Christensen said there was more property coming onto the market.

“More people have decided to make a move. Westpac dropped their interest rates on Friday. All those are encouraging signs,” Christensen said.

“We are seeing an increasing number of people at our open homes. So there’s appetite to come out and a good number of first-home buyers are out there.”

Christensen said first-home buyers did have a window to make their decisions, however, as investors were coming gradually back into the market as well.

“Overall there’s a lot more positivity. It’s a new year. People are out looking for a move whether they are upsizing, downsizing or entering the market for the first time.”

The news comes after New Zealand’s average property value grew just 0.9 per cent in the three months to the end of November to $973,000, as buyers retreated from the market after a busy November and October.

Valocity global chief executive of real estate Helen O’Sullivan said sales volumes in December were lower than had been anticipated, given the lift in October and November, although they were up year-on-year.

Valocity data showed mortgages registered to first-home buyers in the last quarter of the year dipped to 44 per cent from the five-year high of 45 per cent the previous quarter. Mortgages registered to investors increased slightly from 22.4 per cent to 23.6 per cent over the same period.

O’Sullivan said the Reserve Bank’s announcement around debt-to-income ratios was unlikely to have an impact on the current market.

“The proposed settings are not expected to make a significant difference to prices or activity levels in the current high-interest rate environment,” she said.

“When interest rates are lower, [debt-to-income ratios] will limit the level of debt borrowers can assume despite being able to service the debt.”

Maryana Garcia is a regional reporter writing for the Rotorua Daily Post and the Bay of Plenty Times. She covers local issues, health and crime.

- Landlord Mosser Companies defaulted on a 2018 loan for $88 million that was underwritten by its 459 rental units across 12 buildings in San Francisco

- Its creditors are now selling off the multifamily home properties as vacancies fall to 82 percent

- San Francisco is experiencing a post-Covid ‘doom loop’ as occupancies have risen as families move out to escape rising crime and open air drug markets

San Francisco’s residential property market has hit troubled waters as a major investor landlord announced the sell-off of a large section of its rental empire this week.

Landlord Mosser Companies defaulted on a 2018 loan for $88 million that was underwritten by its 459 rental units across 12 buildings in San Francisco.

The company’s creditor has now hired real estate firm Cushman & Wakefield to sell the multifamily home properties, The San Francisco Chronicle reported.

Mosser Companies took on the debt pre-pandemic with low occupancy rates, but as the city by the bay grapples with a post-Covid doom loop occupancies have risen as families move out to escape rising crime.

This, coupled with historically high interest rates as the loan came due, means Mosser and other real estate investors are looking to sell off their assets.

‘San Francisco has gone through a wave of distress in real estate because of the economic upheaval resulting from the COVID years‘ a spokesperson for Mosser explained.

‘And while the market reset is in play, an enormous amount of real estate debt is coming due, creating a push to refinance loans that were originated pre-pandemic.

Adding: ‘This also comes at a time when both general vacancies and interest rates are historically high.’

The Mortgage Bankers Association estimates that $2.6 trillion of real estate loans are coming due nationally through 2028, 38 percent of which are in the multifamily sector.

San Francisco also saw the sale of more than a third of its 2,4000 rental units by the multifamily landlord Veritas Investments after it defaulted on a $1 billion of loans.

‘It’s more about the outmigration of people, increasing operating expenses, all the eviction moratoriums and rent increase moratoriums — it’s just wreaking havoc on certain multifamily projects, especially when people took on short-term or floating-rate debt,’ John Drachman, co-founder Waterford Property Company, explained.

By January occupancy for Mosser’s properties had dropped to 82 percent.

‘This is the reason why multifamily in San Francisco is suffering so badly and you have these portfolios that have gone up for sale: multifamily was hit with a triple killer, which is increased interest rates, lower occupancy rates and declining rents,’ Nathaniel Touboul, a real estate partner at law firm Allen Matkins, said.

‘In San Francisco, in 2018 and 2019, business was booming, people were paying top dollar for apartments, and vacancy rates were extremely low. No one at that time was underwriting vacancy rates and declining rents such as the ones we have experienced post-pandemic, Touboul said.

Adding: ‘What is happening right now is really an illustration of and a reminder that, ultimately, San Francisco is a boom and bust city, and real estate is cyclical in nature.’

San Francisco has become an international by-word for urban squalor with the proliferation of open-air drug markets and an exodus of businesses, retailers and now residents.

Data from the Office of the Chief Medical Examiner showed that San Francisco has entered its deadliest year on record for drug overdoses with 752 accidental overdose deaths as of December 6.

It tops the highest year on record – 2020 – when 726 people died.

And the city stands to lose $200 million a year in lost tax revenue through its business exodus.

San Francisco’s also has a dismally high office vacancy rate, which was 35.9 percent in December.

That situation is compounded by the departure of several large companies, including accounting giant KPMG, which announced earlier this month that it will quit its $400 million namesake building in the downtown area.

Residential property investors took out $894 million of new bank loans in December – the lowest amount for a December month since at least 2014. Photo / Mark Meredith

The change of government wasn’t enough to get investors rushing back into the residential property market – in December at least.

Residential property investors took out $894 million of new bank loans during the month.

Lunenburg’s town council will gather more details on what a major new development could mean for local taxes before starting the process to sell public land for the new neighbourhood.

People packed the gallery of the Town of Lunenburg’s council meeting Tuesday evening where Blockhouse Hill was on the agenda.

Consultants MacKay-Lyons Sweetapple Architects presented three options of what a new neighbourhood could look like on the back slope of Blockhouse hill, and a fourth option to leave it as a park.

Resident Heather Langille was among the six residents who raised concerns about the plan and called for councillors to consider more information before moving ahead.

“It should stay in public hands and it should not be sold for private interests,” Langille said after the meeting.

The development options have a mix of semi-detached duplexes, townhomes and secondary suites in a stepped design down the slope to the Back Harbour. New roads and pedestrian-only green streets are also included, and all options would not touch the existing RV campground and Sylvia Park.

The number of possible housing units range from none, if the land remains as is, to the highest-density option of 368 units.

Municipal staff said during the meeting that selling the land, and adding new taxpayers to the town, will help with Lunenburg’s aging infrastructure and housing crunch. A recent town report said it will cost about $46 million to fix 10 buildings in need of maintenance.

A housing assessment for Lunenburg states the town of 2,300 people needs 120 new housing units by 2027, and 170 by 2032 to accommodate its growing population.

But Langille said there are other areas of town “much more suitable” for housing. A petition from more than 700 local residents has asked to pause the project.

Council, based on a suggestion from Mayor Jamie Myra, voted to delay voting on declaring the land surplus — which would allow it to eventually sell the land for development — until March to hear back from staff on the taxes implications.

“We need to have some idea of those costs going forward to make educated decisions … that are better for the residents of our community and I think that’s really important,” Myra said after the meeting.

There will be another public hearing before any final decision is made.

Councillors also directed the consultants to draft development rules for the highest-density option — 368 units with about 36 per cent of the site as park space — which would set out detailed requirements attached to land even after it changes hands.

Consultants have estimated that option would cost about $182 million in construction, labour and water and wastewater upgrades for whoever develops the land.

Coun. Peter Mosher said he’d like to have rules for the “full plan” that could always be scaled down, or built in phases over the coming decades.

Staff had suggested drafting rules for the second-densest option (256 units) which was also the top choice for most people surveyed during the consultant’s workshops.

The Friends of Blockhouse Hill advocacy group raised concerns during the meeting, and in a letter to council, about development’s impact on the town’s UNESCO World Heritage designation. They have also taken issue with how only 10 per cent of the homes would be designated as affordable.

Julian Smith is an expert heritage planner on the consultant’s team who co-authored UNESCO’s recommendation on the historic urban landscape. He told the meeting all the development options in the buffer zone around Old Town Lunenburg are not highrise or industrial, so they would not hurt its designation.

In fact, Smith said a past chair of UNESCO’s World Heritage Committee told him buffer development that helps the Old Town survive as a “healthy community” where locals can afford to live would benefit both Lunenburg and be an inspiration to sites around the world.

Concerns about tourism pressure

Smith said Venice’s UNESCO designation, for instance, was put in danger this summer because tourism pressures have pushed affordable housing, and the ability for people to live normal lives, out of the historic city.

“Lunenburg is already feeling the effects of global tourism but those will only increase with time, and that’s a very serious threat to the integrity of world heritage sites,” Smith said.

But resident and Friends of Blockhouse Hill member, Alison Strachan, said Lunenburg’s tourism is seasonal and housing shortages could be reduced by cracking down short-term rentals.

She said town council could possibly look at Halifax’s rules requiring that rentals are owner-occupied in most residential zones.

Strachan also said consultation with the Mi’kmaw community is needed, as well as more research into the Indigenous history around the hill which has been largely unexplored.

“We should be the leaders in reconciliation. We are a colonized town — at their detriment,” Strachan said.

Myra said he would like the issue to go to a plebiscite in the upcoming October municipal elections.