Homeowners looking to sell could be better off doing so before the next general election, according to new research published by the estate agent Winkworth.

While we don’t know when that will be yet, those planning to move may be concerned that any changes in policy or general uncertainty could affect their plans.

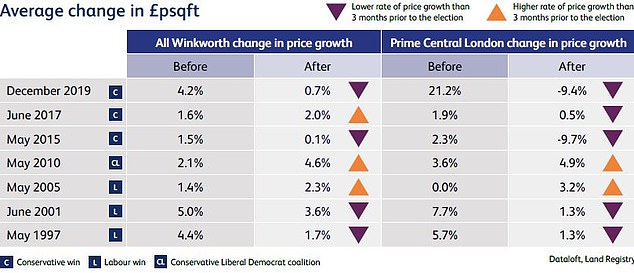

The research, conducted by analysts Dataloft, looked at house price changes before and after the seven previous general elections, in the regions where Winkworth has offices.

That includes Greater London, the South East, South West, East Anglia and Northamptonshire.

In those areas, it found that property price growth was more likely to go down in the three months after the country went to the polls than it was to go up.

All photos from Getty Images: Credit top left to right – Photo by Colin Davey. Anthony Harvey, Scott Barbour, Matt Cardy. From bottom left to right – photo by Sean Gallup, Mustafa Yalcin/Anadolu Agency, Nicolas Economou/NurPhoto and Stefan Rousseau

Looking at the most recent election in 2019, it found that the so-called ‘Boris bounce’ in the property market after the last General Election failed to deliver.

In the three months prior to the December 2019 election, where Johnson’s opponent was Labour’s Jeremy Corbyn, average UK prices rose by 4.2 per cent.

However, in the three months following the election, average prices rose by just 0.7 per cent. In prime central London, prices fell 9.4 per cent in the three months following Boris’ election.

Dominic Agace, chief executive at Winkworth said: ‘The effect of a general election is to distract people in the three months leading up to polling day.

‘Politicians are pushing policies to win votes, and the politics can be more extreme than the reality of what happens once a party is in power.’

Prices rose by almost the same percentage in advance of Tony Blair’s win in 1997, at 4.4 per cent – only to fall to 1.7 per cent in the three months after.

The research looked at house price changes for three months before and after the last seven elections across London, the South East, South West, East Anglia and Northamptonshire

House price growth also tailed off following elections in 2001, when Blair won again, and in 2015 when David Cameron’s Conservatives were handed sole control following five years of coalition.

However, in the 2005, 2010 and 2017 elections, prices rose faster in the following three months.

In the three months prior to each of the last seven elections, the average price per square foot has risen by 20.2 per cent in total, Winkworth said.

Meanwhile in the three months post election the price per square foot has risen by 15 per cent when totted up together.

Winkworth’s experts say this mixed picture suggests that elections might not be the primary driver of price trends – and that ‘waiting to put a property on the market after an election, with the hope of achieving a much higher price, could be a risky strategy’.

The Boris dip? The study found the so-called Boris bounce in the property market after the last general election failed to deliver

The data, which is based on Land Registry figures, has some limitations. Land Registry data is based on sold prices, and therefore may relate to sales that were agreed months before they appeared on the record.

This means the homes sold in the three months following an election might have been agreed before the election, and the homes sold before the election might have been agreed up to six or more months before the election.

What does UK-wide house price data say?

We decided to take a look at the Land Registry figures for all of the UK and look at what prices did in the years before and after the previous seven general elections.

These figures include homes sold across the whole of the UK, and not just in the South of England.

This analysis suggests that house prices may be more likely to do better following an election than prior to one.

Taking into account each year leading up to the last seven elections, house prices rose by a collective 44 per cent, equating to a yearly average of just over 6 per cent for each year before a general election.

However, in each year following the last seven general elections, house prices rose by a collective 53 per cent – equating to a yearly average of just over 7.5 per cent.

Ultimately, house prices are more likely to be impacted by other factors, rather than general elections.

For example, in the year following Boris Johnson’s election in December 2019, house prices across the whole of the UK rose by 6.99 per cent.

Rather than being owed to a Boris bounce, this is more likely down to the stamp duty holiday that began in July 2020 – alongside the race for space and home moving boom that began during the pandemic.

Do elections slow housing market activity?

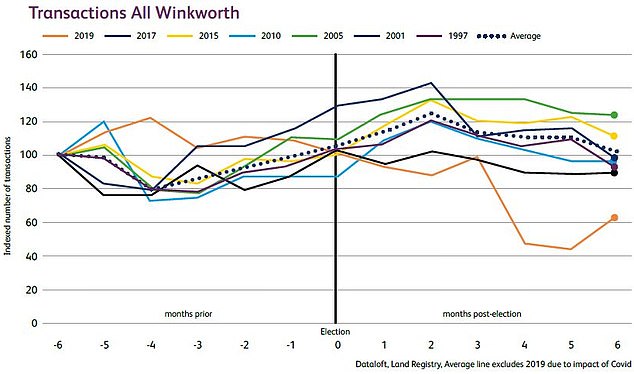

Aside from house price changes, Winkworth’s analysis also picked up that pre-election uncertainty has a short-term effect of slowing the number of sales in the three to four months before voting day.

It found this pattern held true for six out of the last seven elections.

Once the election result is known, the increased certainty over the political landscape and policies will normally allow the markets to pick up momentum again.

However Dataloft’s report also suggests that the time of year rather may have more of an impact than the fact there is a general election.

Transaction hit? Pre-election uncertainty has a short-term impact slowing the number of sales in the three to four months before voting day

Postponing selling or buying a home until after the election could mean missing out on the best time of year in the property calendar, with spring typically being the best period for home sales.

The report found that over the last five years (excluding 2020 due to Covid), 27 per cent of sales took place in spring, the highest of any of the seasons, according to HMRC figures.

Over the same period, properties took an average of just 51 days to sell, compared with 61 days in winter.

Is the upcoming election affecting the market yet?

Jeremy Leaf, north London estate agent and a former Rics residential chairman thinks the uncertainty that comes with elections always causes some people to hold off buying or moving.

However, with the coming election, he hasn’t noticed people changing tack yet – probably because the date is yet to be announced.

‘Elections have been a factor when it comes to decisions to buy and sell homes because they tend to create uncertainty, particularly when we are nearing the expected date,’ says Leaf.

Ed Davey(left), Rishi Sunak (middle) and Sir Keir Starmer (right) will want their party to be seen as the best choice for homeowners, first-time buyers and renters

‘If the bookies are to be believed and there is a change of Government, the pronouncements to date from Labour have indicated a pro-business and particularly pro-building strategy, which if implemented is likely to only benefit the housing market in terms of improving the number of transactions, if not prices.

‘If anything, it is likely to be higher-value transactions and high-net-worth individuals who are most likely to be clobbered for tax rather than the more run-of-the-mill transactions, which form the overwhelming majority of those taking place.

‘However, we haven’t noticed a drop-off in UK or foreign-based investors’ enquiries or interest in buying UK property over the past few months, and don’t expect that to change even though they are proceeding cautiously without building in too much potential gain.

‘Most people are not holding off or changing their minds and waiting until the outcome of the election, although that may change as the date looms.’

Sam Mitchell, chief executive of online estate agent brands Strike and Purplebricks says that there is a danger that as the election looms near, people may start to put plans on hold until after the result.

This could be exacerbated if each party begins making housing commitments such as promising to cut stamp duty or capital gains tax.

‘We anticipate a window of positivity between now and the general election where the market remains strong, with house prices continuing to rise month-on-month and an uptick in buyer demand,’ says Mitchell.

‘In light of the faster-than-anticipated fall in inflation, and the expectation of rate cuts beginning to be priced in from June, we can be optimistic about housing market activity in the coming months.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

Whether you’re buying or selling, the process is always riddled with stress, anxieties and unanswered questions – especially in today’s housing market.

But help is at hand from Roger Punch of Marchand Petit in Devon who, with more than 50 years’ experience, is one of the South West’s most well-known agents. Here are his top tips for securing a sale – or buying at a bargain price.

Selling

- Interview several estate agencies before choosing the best. Ask if they have sold many other properties in the neighbourhood; how long did they take to sell? Be sure they’ll put an experienced negotiator in charge of your sale – not the new boy.

- Keep a parking space free for viewers. You don’t want a viewing to start on the wrong foot with your buyer having to thread his way into a parking space two streets away.

- First impressions count so make the outside look cherished with clean windows, walls, paths and driveways. A power wash can work wonders. Hide the wheelie bins.

- Get a friend to cast an objective eye and nose over your home. Are there any smells of damp dogs, nappies or worse that you’ll be immune to but which will have the buyer gasping for fresh air?

- Make sure every room has an obvious function, be it a kitchen, study, play room or home cinema.

With more than 50 years’ experience, Roger Punch of Marchand Petit in Devon is one of the South West’s most well-known estate agents

- If your house has an obvious flaw, such as a kitchen that is too small, call in a builder to give you an estimate for knocking through a wall or adding an extension. Show the written estimate to the buyer.

- Price the house accurately by checking the competition on the property portals. If you are asking more than the house down the road, have good reasons ready for prospective buyers, such as you have a larger garden, new kitchen, two bathrooms, a new en-suite. Be prepared to give a little. The average seller only gets about 92 per cent of the asking price.

- Reclaim your garage. If your garage is full of junk then it not only fails to fulfil its purpose, it’s a sign that the storage in your house is inadequate. Sort it out.

- Keep your neighbours informed about your sale. Then, if they see you conducting a viewing you can make the necessary introductions and the buyers will feel welcome. That sure beats them being glared at over next door’s fence.

- Not everybody likes animals so if you have a viewing, remove any cats, dogs, snakes, rats. Make sure your children are presentable. You may love him but the sight of a teenager grunting from his bed while listening to deafening music may put off a potential buyer.

When selling, do the basics well – fill vases, light fires and pay attention to lighting

- Tidy up your garden. Keep lawns trimmed, flower beds neat and patio furniture clean. But don’t over-complicate your planting and create such a gardener’s paradise that your buyer feels intimidated. Not everyone has green fingers.

- Some conservatories – notably the small lean-to variety – are a turn off to most buyers. If you have one of these then give it a proper function, perhaps as a ‘book nook’ or a mini-orangery. Do not let it be a shelter for your unused rowing machine or exercise bike.

- If you haven’t got a very good ‘eye’ for interiors, call in an expert home-stager. A one-day make-over may seem expensive but these people make their fees back by helping sell your home in double quick time.

- Do the basics well. Fill vases, light fires and pay attention to lighting. A few well-placed table lamps are visually soothing and they also get rid of dark corners.

- Selling a house is about selling a lifestyle. Give your buyers leaflets from the local council or tourist board showing colour pictures of the local parks, country walks and river views.

- Be friendly and welcoming to your viewers. Offer them coffee. Tell them about the local schools, nurseries, child-minders, sports and arts amenities and any coffee house and gastro pub nearby. But don’t give too much away. There’s no need to tell would be buyers how long the house has been for sale. Don’t let on if you are desperate to sell quickly to secure your own new home. Play your cards close to your chest. During a viewing, one former client painted a lovely word picture of her village as a country idyll with church bells on Sundays and the hunt passing by outside. When I phoned to ask the viewer what she made of her visit she said: ‘Lovely cottage but the village is not for us, I’m a hunt saboteur!’

Buying

- Don’t judge a building from the outside and don’t rely on Google earth or Street View, which are invariably historic.

- Visit the property several times before you make an offer. Ideally go there in the week and the weekend at different times. Look out for signs that you or your family may not feel safe there. Defaced signage, skid marks on the road, graffiti, litter and uncared for neighbouring properties should all flash up warning signs.

- Having roughly decided on the area you want to live in, focus on your favourite road. You can improve a property but you can’t change a neighbourhood – so don’t compromise. The best long-term buy is usually the worst property in the best street.

- Don’t put in a ‘silly’ offer to start negotiations. It will probably result in you annoying the seller and losing the deal.

- Make notes. You may later have trouble remembering everything about the house, especially if you have to see more properties on the same day. So jot down details such as the state of the window frames, the proximity of the main road, the distance from the shops.

Visit the property several times before you make an offer. Ideally go there in the week and the weekend at different times

- Make a wish list of what you need from the house. How many bedrooms and bathrooms do you want? Is a good size garden or home office important to you?

- Study plans for the local infrastructure. You may love the fact that your chosen house has country views across fields and valleys. Check there are no plans for suburban sprawl to wreck it all.

- Make sure the vendor is aware you know your stuff. I once had a buyer in Cornwall who asked ‘what time does the tide go out on a Saturday?’ Credibility blown!

- Don’t overestimate your own DIY skills. Installing a kitchen or a bathroom may look simple on television but it’s not that easy. If you are buying a house with a renovation project in mind get a tried and trusted builder to talk you through what is involved. Perhaps it would be best to leave it to him or her.

- Keep in mind the other members of your family. The stream at the bottom of the garden my look tranquil but could it be a danger to your toddlers? The steep staircase may be cute but could granny manage it if she came to stay?

- If the property has under gone building work recently then make sure the seller has a Building Control Certificate.

- Take care if you are moving to the countryside. You may be attracted to the bucolic Archers-style way of life but are you really happy to be woken up by chickens every day? Will smells from the pig farm add to the charm of your garden? If you share a country lane are you ready to be held up by cows coming back from milking? The country folk were there first and they’ll be there long after you leave.

- Be friendly but don’t give the seller too much information. If you say, ‘I’m desperate to move this month because my wife is evicting me,’ then the seller is likely to stick to his asking price.

- Never make an offer immediately. Remain flexible and negotiate on other terms such as closing dates or fixtures and fittings to reach a mutually acceptable agreement.

- Apax Partners made a £203m takeover approach last October for Kin & Carta

- Digital services provider Valtech came out in December with a £239m deal

Apax Partners is out of the race to buy Kin & Carta after a rival put forward a higher bid for the digital technology consultancy.

The private equity group made a £203million takeover approach last October for Kin & Carta, which advises firms on technology strategies, claiming it was ‘better placed’ to help further the company’s growth.

It subsequently increased the offer to £220.3million in December, meaning investors would receive 120p per share compared to the previous proposal of 110p.

Acquisition bid: Private equity group Apax Partners made a £203million takeover approach last October for Kin & Carta, which advises firms on technology strategies

Later that month, Valtech, a digital services provider whose largest shareholder is investment firm BC Partners, came out with a 130p-per-share deal valuing the business at £239million.

Apax had until the end of trading on 8 March to lodge a higher bid, but the company refused to budge, meaning its offer has now lapsed.

Founded in 1964 by future Labour peer Robert Gavron, Kin & Carta was initially a printing business called St Ives, named after the town where it was located.

Over the following decades, it expanded to become Britain’s biggest printing firm, producing annual company reports and popular magazines like The Economist, Vogue, and Time Out.

By the time Gavron stepped away from day-to-day management, St Ives had a market value exceeding £400million.

But during the 2000s, the group began struggling as the publishing world shifted online and print journalism suffered a significant slump in revenues.

After recording its first-ever annual loss in 2009, the firm began transitioning to a more digital-focused operation when it acquired marketing and data business Occam.

St Ives exited the printing sector following the sale of its print management division to Paragon Group in 2018, the same year it was renamed Kin & Carta.

In its most recent annual results, the company blamed ‘macroeconomic challenges’ leading to longer sales cycles and more cautious spending among clients for its revenue flatlining at £195.9million.

The firm’s adjusted operating profits also declined by approximately 18 per cent to £18.5million amid more difficult trading conditions across the Americas.

Kin & Carta shares were 0.3 per cent lower at 128.2p just after midday on Monday, although they have surged by around a quarter over the past 12 months.

- The estate agency revealed that profit before tax fell by 34% to £7.9m

- It also added that lettings revenue jumped 16% to £101.2m

Foxtons revenues generated by house sales slumped last year, but the estate agent’s performance was buffered by a jump in rental income.

The London-listed group’s sales revenue fell 14 per cent to £37.2million in 2023 while the number of houses sold sank by 11 per cent year-on-year, reflecting higher mortgage rates and weaker mortgage availability.

But Foxton’s annual revenue rose 5 per cent to £147.1million, as lettings revenue – which accounted for about 70 per cent of turnover – jumped 16 per cent to £101.2million despite a 6 per cent fall in the number of properties letted.

The London-listed estate agency reported saw a 34 per cent drop in profits before tax to £7.9million

It reported a 34 per cent drop in profits before tax to £7.9million, largely as a result of one-off costs including closing some of its branches.

Commenting on the fall in house sales, Foxtons said transaction volumes ‘were at some of the lowest levels since 2008 and 2020, years impacted by the global financial crisis and the Covid-19 market shutdown respectively.’

However, Foxtons noted that mortgage rates had begun to dip below 4 per cent towards the end of the year, from levels of around 6 per cent 12 months earlier, helping to lift demand.

Guy Gittins, chief executive officer, of Foxtons said: ”Our strategy to deliver growth through sales market cycles by delivering lettings growth is working, delivering resilient earnings for the year despite a weak sales market and the investment we made in fee earners.

‘We are on track against our medium-term target of delivering £25million to £30million of adjusted operating profit, through organic and acquisitive growth and supported by improving market conditions.’

In recent times, Foxtons has largely benefitted from its letting business. The UK capital is home to the country’s highest rental prices, which have seen enormous increases since 2021.

This is in part because landlords who have seen their mortgage payments spike have passed on the extra cost to their tenants.

Higher rents equal more commission for lettings agents – and the firm also earns interest on tenant deposits which it holds.

Office for National Statistics data shows that average rental prices in London were up by 6.9 per cent in the 12 months ending November 2023.

In addition to a healthy 28 per cent year-on-year jump in its sales business, Foxton’s scored a 36 per cent increase in lettings sector market share last year

Foxtons shares were down 3.02 per cent to 57.90p in early afternoon trading on Tuesday.

Sophie Lund-Yates, lead equity analyst, Hargreaves Lansdown said: ‘Estate agents will always feel the pain at times of economic stress, but Foxton’s market share means it’s in a better position than some in the short-term.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

eToro

eToro

Share investing: 30+ million community

Bestinvest

Bestinvest

Free financial coaching

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Jacob Rothschild’s death yesterday at 87 could result in a Succession-style battle between his heirs for his sprawling property and investment empire.

A colossal figure in the City, he bestrode the Square Mile for several decades.

Starting at the family banking group NM Rothschild in 1963, he left 17 years later after falling out with his cousin Sir Evelyn de Rothschild over a merger with rival SG Warburg.

At the time, it was the talk of the town. One financial journalist described it as the ‘the most notorious bank-family split in City of London history’.

Striking out on his own, he took charge of RIT Capital Partners, which is worth £2.6billion and a stalwart of the FTSE 250.

Legacy: Jacob Rothschild (pictured), who died yesterday at the age of 87, was a colossal figure in the City who bestrode the Square Mile for several decades

His deal-making skills and easy charm saw the business grow fast, while his market commentaries were highly anticipated, such as when in 2019 he described the post-Brexit deadlock as the UK’s biggest political challenge since the 1956 Suez crisis.

While doing all this, he also co-founded wealth manager St James’s Place in 1991, money manager GAM in 1983 and made an unsuccessful bid for British American Tobacco in 1989, which, had it come off, would have been one of the biggest take-overs of all time.

A source close to the family said: ‘He was viewed as an establishment figure. Business-wise he was far from it. He took plenty of risks.’

To this day, RIT Capital remains one of the most popular trusts in London with offices based in Spencer House overlooking Green Park.

Its investments are varied and include WeBull, the New York investment platform, and Motive, the logistics group.

In the UK, the firm backs technology investor Firstminute Capital. The annual return of 10.7 per cent remains impressive to this day and RIT has turned a £10,000 investment in 1988 to £345,000 in 2024.

But the big question is who will step into Rothchild’s shoes and what happens to his 13pc stake in the business.

To the Rothschilds, leadership succession is treated like that of an accession to the throne in a monarchy – not unlike the fictional Roy family in the popular TV series Succession.

It is an obsession that has enabled them to keep their name alive while other traditional City families – such as Kleinworts and Warburgs – have disappeared.

For many years, Nat, 52, appeared to be the natural successor, ‘a chip off the old block’ who moved effortlessly in the world of high finance. But his father disliked his playboy lifestyle and rebellious streak.

Born in 1971, he is the youngest child and as the only son is heir apparent. But he does not have a direct stake in RIT Capital, but instead holds an indirect holding through the family’s private equity firm Five Arrows.

He upset his parents in 1995 when he eloped with socialite Annabelle Neilson, but the marriage lasted just three years.

Relations with his family became strained and, in 2016, Nat refused to invite his father to his second wedding to former glamour model Loretta Basey.

He has since rebuilt his name with Volex, a cable manufacturer to Tesla.

But it is his sister Hannah, 61, an author, and Jacob’s eldest daughter, who has emerged as the frontrunner.

Known for her savvy and calm head, she has a 10 per cent stake in RIT and sits on the board as a non-executive director.

A divorced mother of three, she is also chairman of Yad Hanadiv, the Rothschild charitable foundation in Israel.

Whether Hannah or Nat win out, both will have big shoes to fill.

RIT Capital Management said in a statement: ‘RIT is proud that its association with Lord Rothschild’s family interests continues via his daughter, Hannah Rothschild, who has served as a Director of RIT for over a decade.

‘The majority of the beneficial and non-beneficial interests relating to the Rothschild family are in respect of shares held via trusts, companies or charitable foundations where Hannah is a beneficiary, trustee, or is able to exert significant influence.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

Crime fiction writer Sharon Birch, 58, and her partner Stephen are desperate to downsize from their five-bedroom townhouse in Seaton Carew, Hartlepool.

They are among the almost 90 per cent of people aged over 65 who are rattling around homes that are now too big for them, according to figures from research institute the International Longevity Centre.

But like millions of homeowners who would like to downsize, Sharon and Stephen’s plans are being thwarted by stamp duty, which they say is putting off potential buyers and leaving them stuck in a home that no longer suits them.

In fact, Sharon is so worried about it that she is willing to pay a potential buyer’s stamp duty out of her own pocket — just so that they are not deterred from purchasing it.

The couple’s children have long since flown the nest — they now have five grandchildren. The granny annexe and large garden that were once a huge asset to the couple are now a burden requiring upkeep and maintenance.

Desperate measures: Sharon and Stephen Birch don’t want buyers to be put off

‘We really need to downsize as it’s too big for us now that the family have moved out,’ says Sharon.

Sharon and Stephen long instead for a more manageable bungalow — and have set their sights on one — if they can only find a buyer for their own home.

Their property will go on the market this week for £280,000 with Manners & Harrison in Hartlepool. At this price, potential buyers will be forced to pay £1,500 in stamp duty. Anyone considering buying it as a second home or to rent out would pay nearly £10,000 in tax.

Only first-time buyers, who have an exemption for paying stamp duty on properties worth up to £425,000, would avoid stamp duty all together.

Sharon and Stephen’s five-bedroom townhouse in Seaton Carew, Hartlepool, will go on the market this week for £280,000 with Manners & Harrison. At this price, potential buyers will be forced to pay £1,500 in stamp duty

Sharon worries that for home movers or landlords with a budget of £280,000 a significant tax bill such as this would be a huge deterrent.

Stamp duty most commonly puts off downsizers because it eats into the amount of money they could free up by moving to a smaller home.

Moving home and transforming it into somewhere you are happy to live throughout your retirement years costs enough as it is — adding a tax bill worth thousands of pounds on top can make it feel like it’s not worth bothering.

Sharon and Stephen’s living room in their five-bedroom townhouse in Seaton Carew, Hartlepool

Anyone considering buying the property as a second home or to rent out would pay nearly £10,000 in tax

Only first-time buyers, who have an exemption for paying stamp duty on properties worth up to £425,000, would avoid stamp duty all together

Stamp duty is a barrier to selling across the housing market. Jennie Hancock, of Property Acquisitions, says: ‘I have sellers moving from a £2 million house who only downsize by £500,000,’ she says. ‘For some, paying £90,000 in stamp duty is a deterrent.’

However, even downsizers — such as Sharon — who do not face a large bill themselves may still be hit by the impact of stamp duty, as it can put off potential buyers of the home they are looking to sell.

Sharon feels that the level of stamp duty is a deterrent to young couples looking for a family home and especially unfair given the tax was cut to nothing for properties valued at under £500,000 during the pandemic.

‘It’s ridiculous. The Government should have increased the stamp duty thresholds so that they rose with house price inflation — the current system makes no sense whatsoever. Stamp duty is such a disincentive for buyers — we feel we have no option but to offer to pay the stamp duty.’

According to experts, the thorny issue of stamp duty is stagnating property sales at the top and bottom ends of the market.

Buyers on the first and second rung of the property ladder cannot afford to climb up one rung at a time as the cost of moving is too expensive.

Rather they are having to wait until they have saved enough money to jump a few rungs at a time — which in a cost of living crisis could take years.

The result is a sluggish property scene with frustrated property owners feeling trapped in a property that no longer suits their lifestyle or their needs.

Anyone looking to purchase a property in the Home Counties for more than £575,000 will pay 10 pc stamp duty.

Given the average house price in Berkshire is £522,959, Kent, £456,352, Surrey, £636,42 and Middlesex is £800,566, then most buyers looking to purchase a family home with three bedrooms will need to set aside stamp duty prices of around £60,000-£100,000.

As the average salary in the UK is £34,963, this is almost impossible for the average family even with two adults working full-time. Stamp duty needs to be paid within 14 days of buying a property or piece of land.

And although it may seem like a short-term solution to add the cost of stamp duty to your mortgage, it will incur interest over the duration of the mortgage term and will also affect your loan to value ratio (LTV).

If there’s one thing Jeremy Hunt can do to turbocharge the economy and transform Tory fortunes, it’s tackling a hated tax that’s wrecking the housing market. So today we call on the Chancellor to… CUT STAMP DUTY NOW!

If there is one tax cut that Chancellor of the Exchequer Jeremy Hunt should make in next month’s Budget it is to stamp duty on house purchases.

An already beaten Chancellor would leave it alone, while a cautious one would reduce it. But a bold Chancellor would axe it — or pledge to get rid of this much despised tax.

Which Mr Hunt will turn up at the despatch box in the House of Commons in four weeks’ time is anyone’s guess, but if the Tories want a fighting chance of winning the next General Election, boldness must surely be the order of the day.

It is time for Conservatism with a big C, rather than a small one. Conservatism based on empowering people who work and save hard to better themselves.

Not only would the scrapping of stamp duty reinvigorate a faltering housing market, encouraging more people to move — either to larger homes or to downsize. But it would also give a huge fillip to the UK economy as movers spend money on their new properties, renovating and extending them.

If there is one tax cut that Chancellor of the Exchequer Jeremy Hunt should make in next month’s Budget it is to stamp duty on house purchases

In addition, it would increase job mobility as onerous stamp duty costs would not stand in the way of people moving from one end of the country to the other in the pursuit of a new job.

Maybe, it would also wipe the smile off the face of Sir Keir Starmer, who is acting as if he has already won the oncoming General Election.

While Treasury officials may baulk at the loss of tax revenue arising from such a move — between £4.5 billion and £9 billion a year depending upon whether abolition is extended to non-primary residence homes — they would be wrong to do so.

The revenue lost would be offset in part by a boost in VAT receipts that the resulting spend on home improvements would trigger — running into many millions of pounds a year.

Like no other country in the western world, the Brits love owning their home, so any steps by the Tories to ease the financial burden of moving up or down the housing ladder would be a sure-fire vote-winner — across all ages and all socio-economic groups.

Abolishing stamp duty, which kicks in for movers on house sales above £250,000 (£125,000 from April 2025), would be as brash a policy decision as the one Margaret Thatcher announced in the run up to the 1979 General Election on right to buy.

This key manifesto commitment, paving the way for council and new town tenants to buy their homes, was instrumental in Thatcher’s landslide victory at the polls — and she delivered on it in style, turning millions of renters into joyous homeowners.

Doing away with stamp duty would also provide a boost to the rental market. Under the Conservatives, landlords have been subject to a crippling tax assault — and now pay a 3 pc stamp duty premium on property purchases.

Abolishing stamp duty, which kicks in for movers on house sales above £250,000 (£125,000 from April 2025), would be as brash a policy decision as the one Margaret Thatcher announced in the run up to the 1979 General Election on right to buy

Getting rid of stamp duty would breathe new life into the private rental market, boosting property supply and (hopefully) moderating rents for new tenants (many of whom are wannabe first-time home buyers).

Although the axing of stamp duty may appear radical, it wouldn’t be. Far from it. Outside of the Labour Party, stamp duty is reviled by nearly everyone — not just homeowners, but leading academics, economists and financial institutions, too. Last month, Paul Johnson, director of the influential Institute for Fiscal Studies, described stamp duty on house purchases as ‘among our worst and most damaging taxes’.

He added: ‘It gums up the housing market, keeps people who don’t need them in houses that are too big for them, thus reducing the supply available to growing families; and it serves to reduce labour mobility.’

Other economic think-tanks are of the same opinion. Both the Adam Smith Institute and the Centre For Policy Studies have long argued that stamp duty should either be abolished or cut. The Adam Smith Institute’s view is that a ‘change to the tax system to one without stamp duty would be beneficial’.

The Centre For Policy Studies believes that any cut in stamp duty costs would help stimulate housing transactions — by around 20 pc for every 1 pc cut in stamp duty.

Stimulation is certainly the order of the day. Recent data from Her Majesty’s Revenue & Customs confirmed that the housing market almost ground to a halt last year — with transactions falling by 18 pc in the 12 months to December.

Although a combination of higher mortgage rates and the cost-of-living crisis were the main drivers behind this reduction, high stamp duty costs also threw a spanner in the works.

Yesterday, Kevin Purvey, director of mortgages at building society Coventry, told Money Mail: ‘If ever there was a tax which is ripe for change, it’s stamp duty. The right changes would not only oil the wheels of the property market, they would also put money back in homebuyers’ pockets and help them cover the costs of buying and furnishing a home.

‘Home buyers are now spending an average of £9,937 on their stamp duty bill, which is almost double what it was ten years ago. This spend isn’t going to reduce until real change happens.’

It is a view shared by property specialist Landmark and building society Nationwide.

Former housing secretary Robert Jenrick recently described stamp duty as a ‘terrible’ tax because it leaves people in the ‘wrong houses’

Simon, Brown, chief executive of Landmark, said: ‘Stamp duty is an anchor which slows the economy. A fifth of the economy is built around the housing market. Get rid of stamp duty — or cut it — and the economic benefits will be massive.’

Robert Gardner, chief economist at Nationwide, said: ‘Stamp duty is a barrier to house moving and a negative for the economy. It puts sand in the gears of the housing market. It’s a rubbish tax.’

Stamp duty is currently levied on a sliding scale with the first £250,000 of a property’s sale price tax-free. Thereafter, the rate jumps alarmingly, from 5 pc on the value from £250,001 to £925,000; 10 pc from £925,001 to £1.5million; and 12 pc on any surplus.

For example, someone buying a house for £400,000 currently pays stamp duty of £7,500, although from April 2025 this would rise to £13,750 if the nil-rate band fell back to £125,000 as the Government has said it will (I can’t see Labour changing this if it wins the election). For a buyer of an £800,000 home, the respective stamp duty costs are £27,500 and £33,750.

Currently, around a quarter of home movers pay no stamp duty, but this will fall to just 3 pc when the nil-rate threshold drops to £125,000.

These stamp duty costs ratchet up if the property being bought is a second home. Three per cent tax is levied on the first £250,000 of a sale value. The rates then jump to 8, 13 and 15 per cent — they are even higher in Scotland.

For first-time buyers, the stamp duty regime is currently kinder. Anyone buying a property up to £425,000 in value pays no stamp duty. Above this value, the rate is 5 pc up to £625,000 — properties worth more do not qualify.

Nationwide’s Gardner says 85 pc of first-time buyers do not pay stamp duty, although this figure falls to 45 pc in London because of higher house prices. In April 2025, the nil-rate threshold will reduce from £425,000 to £300,000, resulting in the percentage of buyers not paying tax falling to 63 pc.

What is obvious in speaking to professionals over the past 24 hours is that stamp duty is ripe for reform — if not abolished, then it should be overhauled.

It is ludicrous, given the country’s love affair with home ownership, that property taxes in the UK (of which stamp duty is one component) are higher than most of the 38 other countries that are members of the Organisation for Economic Co-operation and Development. It is also obvious that tinkering is not the answer.

Short-term increases in the zero-rate band for stamp duty are not the answer — they simply distort the market.

‘A well-thought-out permanent solution to stamp duty is what is going to bring lasting stability and confidence to the housing market,’ said Coventry’s Mr Purvey yesterday.

‘Short-term thinking risks spikes in demand for properties and causes longer term distortion in the market, potentially pushing up prices and making it harder for people to get on to the housing ladder.’

It’s a view shared by David Hollingworth, a director of broker L&C Mortgages. ‘Any rethinking of stamp duty should avoid the limited window approach that causes a mad rush to beat a deadline. Removing or limiting the weight of stamp duty is the only answer.’

The last word goes to Robert Jenrick, former Housing Secretary. Although not particularly flavour of the month in Government circles, he knows the housing market inside out.

He recently described stamp duty as a ‘terrible’ tax because it leaves people in the ‘wrong houses’: the young find it difficult to move to take advantage of employment opportunities elsewhere while the elderly are deterred from downsizing.

Spot on. Chancellor, it’s time to be brave.

Abolish stamp duty.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.