There’s a widely held belief that real estate prices will, inevitably, only rise higher and higher. There are, however, long periods when that maxim is decidedly not the case.

Toronto is a prime example. After a surge in the 1980s, the Toronto market peaked in 1989 and didn’t regain that high until 2002 – more than a decade later. A 1995 peak in Vancouver was the high-water mark until eight years later. In the United States, it took a decade after the 2006 peak before that level was seen again.

Each example is different yet each shares central elements, from burst bubbles after manias to the gyration of interest rates and economic woes. What’s clear is real estate can go sideways for a long time, even if everyone believes the natural direction is up.

As Canada works to build a path to housing affordability, the most important thing is new supply – a lot of new homes. But just as important is changing the culture, the mindset that prices are destined to escalate.

Housing has long been expensive but the situation is now extreme. Five years ago, about 60 per cent of households could afford a condo. Last year, it was less than half. And that’s for a condo.

After many years of dizzying gains in the price to buy or rent a home, it’s become widely clear that higher and higher isn’t ideal and comes with many costs.

How to restore some semblance of affordability has shot to the centre of the political debate. This week, Canada Mortgage and Housing Corp., which has called for millions of new homes, held a conference on the question in Ottawa. The Globe on Wednesday illuminated how we got here in a series of charts, from record-low rental vacancies to the way-too-long time it takes to get new housing approved and built.

Many new homes are needed, yes. As this space showed last week, a burst of construction in booming Austin, Tex., has helped reduce the price to rent.

The shift in entrenched philosophy is also necessary. We need to rein in the housing market mindset that up is good, so pervasive in North America.

The mentality leads to speculation, starting with many families betting on the ever-rising value of their home as a pot of retirement savings. Generation Squeeze, an advocacy group for younger Canadians, puts it this way: “break the addiction to high home values.”

The celebration of higher home prices is deeply ingrained. Ownership in Canada peaked in 2011 at almost seven out of 10 households. Almost all political leaders own their homes and many are landlords. That’s the reason that as things started spinning out of control in the 2010s, blame was first cast on factors such as foreigners or investor speculation without grappling with the real problem: not enough housing.

In each example of real estate markets going sideways for a long time, Toronto, Vancouver, the U.S., it was always considered bad news. The Wall Street Journal lamented Austin’s shift from “America’s hottest housing market” to “running in reverse.”

The bigger goal is to rein in prices, bring them closer to people’s incomes.

The Teranet-National Bank house price index shows the price of housing rose 4.2 per cent annually from 2000 to this year, excluding inflation. Household incomes, according to Statistics Canada, rose by far less, about 1.2 per cent a year from 2000 through 2021.

The goal of a steady surge of new supply would be to establish a lasting buyer’s market. Critics of new supply will often say it won’t ease prices but big housing investors specifically warn shareholders that “competition for residents” and an “oversupply” of homes will affect the prices they charge.

Instead of hoping and cheering prices will someday soon recoup and exceed previous highs, the target has to shift to an extended, and welcome, period of nominal gains. If home prices this century had risen at only the rate of inflation, they would be less than half of what they are – and at levels last seen in 2006. Beyond a return to affordability, a market that offered such nominal returns is what would undercut and eventually end housing speculation.

Decades of culture and policy got us here. It will take time to restore affordability. It will take time to change the culture. But as Canada sets the initial foundations to allow for many more new homes, it is starting on the path to affordability.

LONDON, March 05, 2024 (GLOBE NEWSWIRE) — Resonance is a leading adviser in tourism, real estate and economic development, and its annual Europe’s Best Cities rankings quantify and benchmark the relative quality of place, reputation and competitive identity for the continent’s urban centres.

The Best Cities data is lauded as the world’s most thorough annual city rankings, based on original methodology that analyses key statistics, user-generated reviews, social media and online activity.

The second annual Europe’s Best Cities ranking is an important, timely analysis of the urban centres that are leading the region (and planet) in post-pandemic economic recovery and a resilient future in the face of geo-political and environmental polycrisis.

Download the 2024 Europe’s Best Cities Report and all 100 city profiles at WorldsBestCities.com.

Learn more about how Resonance Consultancy can help your city and community at ResonanceCo.com.

”The 2024 Europe’s Best Cities rankings benchmark the overall performance of more than 180 principal cities in metropolitan areas with populations of more than 500,000, based on a wide variety of measures, in order to identify the Top 100 places to live, visit and invest in Europe,” says Resonance President & CEO Chris Fair.

The overall Best Cities rankings are determined by analysing the performance of each city for a wide range of factors that have historically shown positive correlations with attracting employment, investment and/or visitors to cities. Resonance groups these 27 metrics into a ranking of each city’s Livability, Lovability and Prosperity.

Based on each city’s performance across our methodology, these are Europe’s Top 10 Best Cities for 2024:

1. London, United Kingdom

2. Paris, France

3. Berlin, Germany

4. Rome, Italy

5. Madrid, Spain

6. Prague, Czechia

7. Barcelona, Spain

8. Amsterdam, Netherlands

9. Istanbul, Türkiye

10. Milan, Italy

The full ranking and extensive profiles of all 100 Europe’s Best Cities are available at WorldsBestCities.com.

About Resonance Consultancy

Resonance creates transformative strategies, brands and campaigns that empower destinations, cities and communities to realise their full potential. As leading advisors in real estate, tourism and economic development, Resonance combines expertise in research, strategy, branding and communications to make destinations, cities and developments more valuable and more vibrant. ResonanceCo.com

About World’s Best Cities

Best Cities is the home of Resonance’s exclusive ranking of the world’s top urban regions. The data is used by leading news outlets, trusted by city leaders, and is widely considered to be the world’s most comprehensive annual city ranking. Bloomberg calls it, ”The most comprehensive study of its kind; it identifies cities that are most desirable for locals, visitors, and businesspeople alike, rather than simply looking at livability or tourism appeal.” WorldsBestCities.com | #BestCities

In a recent analysis conducted by the Njuškalo online advertisement website, it has been revealed that house prices across Croatia experienced a continuous upward trajectory throughout 2023. The study showcased a significant surge, with the average asking price for flats soaring by 21%, reaching €3,223 per square metre. House prices experienced an even more substantial increase, rising by 40% to €2,606.

Dubrovnik and Istria Counties: Pinnacles of Property Rates

The coastal regions of Istria, Dubrovnik-Neretva, and Split-Dalmatia emerged as the epicentres of the escalating property market, with these areas commanding the highest prices. In Istria County, the average asking price for a flat reached €3,836 per square metre, and for a house, it was €3,183 per square metre. The Dubrovnik-Neretva County followed closely, with figures at €3,602 and €2,699, respectively. In Split-Dalmatia County, the corresponding prices stood at €3,590 and €2,960.

City-Specific Trends

In the capital city, Zagreb, the average asking price for a flat reached €2,987 per square metre, while for a house, it was €1,795. Rijeka experienced a 26% increase in flat prices, reaching an average of €2,661 per square metre. Split witnessed a 20% surge, with flats commanding an average of €4,061 per square metre. Meanwhile, Osijek saw a 17% rise, with an average asking price of €1,733 per square metre.

Osijek Leads House Price Surge

Osijek, located in the eastern part of the country, recorded the most substantial increase in house prices, jumping by 15% to an average of €963 per square metre.

The findings point towards a dynamic real estate market in Croatia, with certain regions, particularly Dubrovnik-Neretva and Istria, standing out as hotspots for property investments.

With philanthropist and homeless advocate Pope Francis in charge, things are really changing inside the walls of the venerable institution, and the Vatican will never be the same again.

Over the last year the Vatican has been involved with countless fund-raising opportunities that have brought in private corporate dollars as well as income from high-profile celebrities and billionaires.

Last year Pope Francis for the very first time allowed the Sistine Chapel to be rented out for a private corporate event, with the proceeds going to his homeless charities. The Vatican would not reveal how much it was paid for the event, but the ultimate visit arranged by Porsche cost over $10,000 per person. The 40 wealthy guests enjoyed a spectacular dinner and concert in the Sistine Chapel, beneath its famed Michelangelo ceiling. The concert was performed by a choir from the historic Accademia di Santa Cecilia in Rome.

It is believed this is the first time that the chapel, which was built by Pope Sixtus IV starting in 1473, has been leased out to a company for a private event. The Pope now wants to use the Vatican’s treasures to good use for the benefit of the poor. Porsche was required to make a sizeable donation for the use of the Sistine Chapel, with the money then passed onto charity.

But as the fundraising event was revealed, the Vatican announced it would limit the number of visitors allowed inside the chapel to just six million per year, fearing that the frescoes were being damaged by the huge swarms of tourists.

While Pope Francis urges the world to care for the poor, he presides over the world’s most valuable collection of treasures. According to Catholic Church historian Michael Walsh, “If sold, the money could lift millions out of destitution. Pope Paul VI, whom Francis has just beatified, was so conscious of this paradox that he sold the papal tiara – the triple-tiered crown used in his coronation – to raise alms for the poor. It was bought by an American cardinal, and there has never been a papal ‘coronation’ since. But not everything is saleable. Certainly not the Sistine Chapel. The next best thing is to allow its use as a money-making enterprise with the profits going to the poor.”

Celebrities and billionaires have always had the opportunity to score private visits to the Vatican museums. Justin Bieber was reported to have offered over $50,000 on an exclusive private tour. Angelina Jolie met Pope Francis during a private audience at the Vatican this year as the Goodwill Ambassador for the United Nations High Commissioner for Refugees.

Recently Pope Francis startled the old guard by closing portions of the Vatican and welcoming a group of 150 homeless for a VIP private tour including the Pope’s residence in the St. Martha guesthouse. After visiting the Carriage Pavilion, the large group ventured into the Upper Galleries with the Gallery of the Candelabra and the Gallery of Maps – before making a unique visit to the apartment of Pius V and finally the Sistine Chapel itself. They were then treated to a private sit down dinner.

The brainchild of Archbishop Konrad Krajewski, the visit was designed to show the city’s homeless population not just the beauty from outside St. Peter’s Basilica, but also the beauty within, which belongs to everyone, including those who have met misfortune and are living in poverty.

Now word has come that even the most revered Vatican Secret Archives are for sale to very wealthy buyers. Billionaires now have the opportunity to not only visit the Archives but also purchase a one-of-a-kind high quality copy of a transcript on parchment with a very high price tag (over $100,000 per page). But only an elite group of investors know how to get involved in this opportunity.

As an attempt to showcase the Archives, the Vatican invited a journalist for the very first time to visit the inner sanctum. Belgian publisher Paul Van den Heuvel was handpicked to create a $5,000 photo coffee table book on the Secret Archives, which has now become a catalog of sorts for buyers worldwide. The one caveat is that no documents after 1939 were available to view, which for obvious reasons includes the most scandalous periods of time for the Vatican.

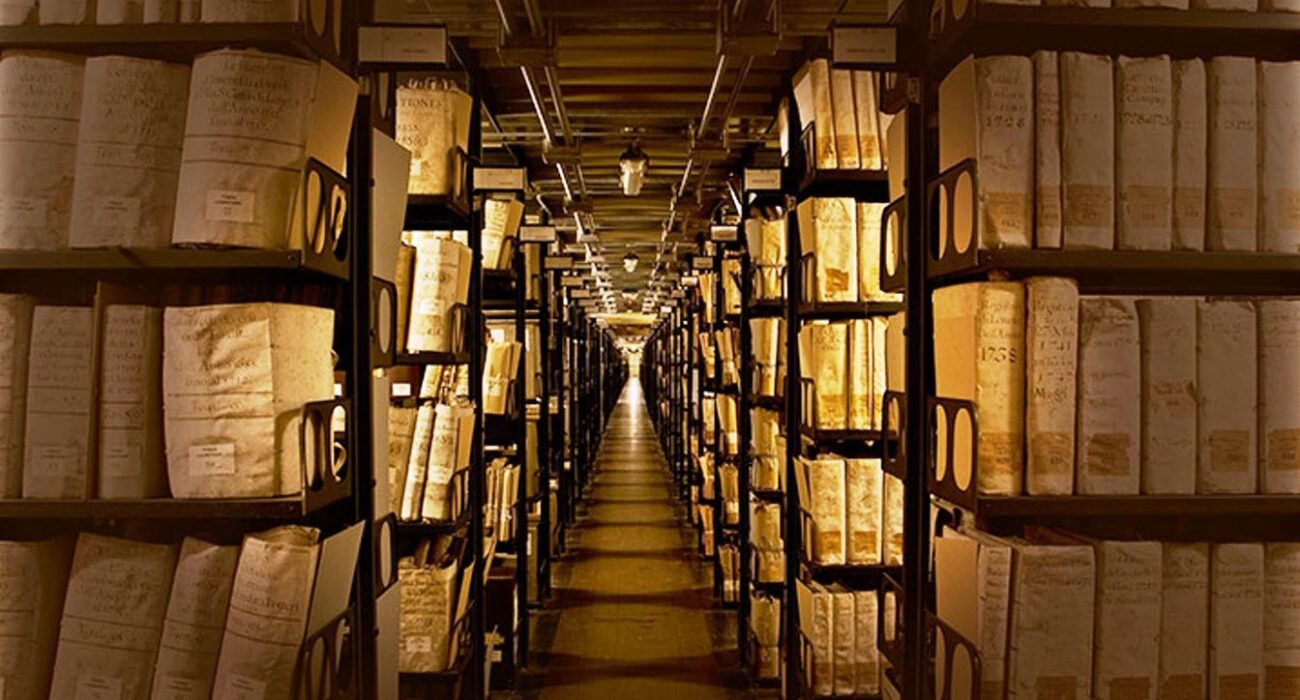

Scholars have been allowed in the archive since 2003, as long as they knew exactly which documents they will research. But now, elite visitors may have the opportunity to have the ultimate in bragging rights. They will be able to walk through an enormous pair of brass doors, through multiple security checkpoints, up a narrow winding staircase to the 73m Tower of the Winds, which was built by Ottavinao Mascherino in 1578. This is a sacred place where the public is never admitted.

Beyond the Tower of Winds are rooms lined with 50 miles (roughly the length of the Panama Canal), filled with dark wooden shelves. Inside are hundreds of thousands of volumes (some almost two feet thick) filled with antiquated parchment. This is the Vatican secret archive, the most mysterious collection of documents in the world.

Among the historic documents are: Handwritten records of Galileo’s trial before the Inquisition; the 1530 petition from England’s House of Lords asking the Pope to annul Henry VIII’s marriage to Catherine of Aragon; letters from Abraham Lincoln and Jefferson Davis during the U.S. Civil War; the papal bull excommunicating Martin Luther, and letters from Michelangelo including one where he complained about not receiving payment for his work on the Sistine Chapel.

Some of the more controversial, and much argued theories about hidden documents include; documentation of the Jesus bloodline; secular historical proof of Jesus’s existence, with correspondence between Saint Paul and Emperor Nero; secular historical proof via the same correspondence that Jesus did not exist; and contemporary depictions of Jesus (formal portraits of Jesus made by people who actually saw and depicted him in real life).

Many historians and scholars have also hinted the Church has hidden the existence of various Biblical relics, either the relics themselves, or reliable documentation as to their whereabouts, including the Ark of the Covenant, the Holy Grail, the True Cross, the truth about the Shroud of Turin, and many others.

Once, Napoleon had the whole of the secret archive transported to Paris. In 1817 it was eventually returned with countless documents missing. Private investors have speculated about what truly is available in the public sector, hidden for decades.

For now, the future of the Vatican is certainly changing forever. Many more opportunities will be unveiled in the coming year with fund raising efforts giving help to a lot of people less fortunate…. thanks to Pope Francis.