Houston-based Winthrop Realty Group bought two Class-B office buildings and another flex property in the city over the past 90 days.

Courtesy of Winthrop Realty Group

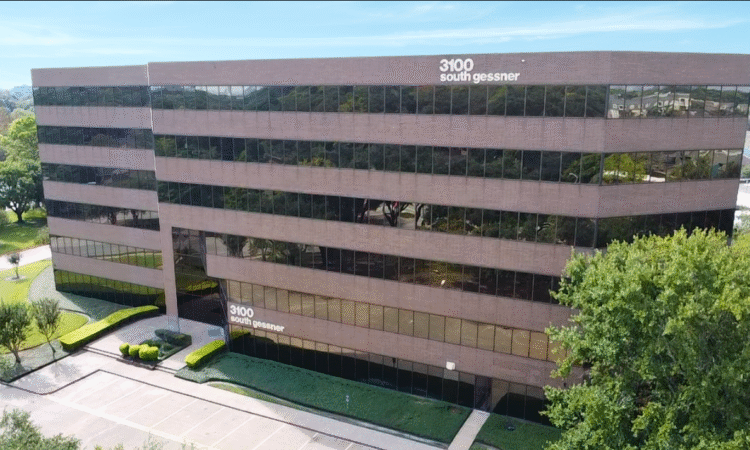

3100 S. Gessner Road in Houston

“These acquisitions underscore our confidence in Houston’s growth story and the resilience of the market that supports small businesses,” Andrew Armour, principal at Winthrop, said in a statement.

Winthrop acquired a six-story, 137K SF office building at 3100 S. Gessner Road and a six-story, 93K SF office building at 1800 St. James Place. Winthrop also acquired Corporate Park Northwest, a 13-building flex property totaling 175K SF near U.S. 290 and West Tidwell Road.

Winthrop’s plans for the three properties include lobby and common-area upgrades, modernization of building systems and the creation of turnkey spec suites. Leasing and management efforts will be led internally by the Winthrop Realty Group team.

SALES

ExchangeRight, a California DST operator, bought a newly built Sprouts Farmers Market in Richmond. The 23K SF grocery store is the seventh Sprouts in the Houston area.

JLL Capital Markets’ Net Lease team represented the seller, GBT Realty. JRW Realty represented the buyer.

The grocery will be an anchor for Waterview Town Center, a 134-acre retail development with 1M SF of retail at full build-out. It is at the intersection of the Grand Parkway and Harlem Road.

***

Marcus & Millichap’s Alex Wolansky and Gus Lagos arranged the sale of Resource Place Shopping Center, a 31K SF retail property in Conroe. The property at 3500 W. Davis St. has 13 suites and 3 acres of undeveloped land behind it. The seller was a family estate and the buyer is a Texas-based investor. Neither the buyer’s nor the seller’s names were divulged.

***

Walk to Emmaus purchased the 25K SF building at 12194 Sleepy Hollow Road in Conroe. Oxford Partners’ Matt Rogers and Nathan Buckhoff represented the buyer while Evan Ballew of Evan Ballew Group represented the seller.

***

Timber Hill Group bought a 44-acre industrial outdoor storage property with a 51K SF building at 29315 Highway Blvd. in Katy. Partners Real Estate’s Hunter Stockard and Wyatt Huff represented the seller, BioUrja.

***

CenterSquare Investment Management acquired a four-building, 225K SF portfolio of industrial properties in The Woodlands and Spring. The portfolio is 88% occupied with 55 suites averaging 4,454 SF. CenterSquare plans to make minor roof and concrete repairs and add HVAC where needed.

LEASES

KBC Advisors announced the following leases at 6401 N. Eldridge Parkway in Northwest Houston:

- Trendsetter Engineering leased 65K SF in Building B. KBC Advisors’s Jim Autenreith and Sam Rayburn represented the tenant.

- ProEnergy leased 456K SF of Building G. Drew Coupe and Josh Morrow of Avison Young represented the tenant.

CONSTRUCTION AND DEVELOPMENT

Courtesy of Harris County Housing Finance Authority

Hartwood at Spring Shadows

Hartwood at Spring Shadows, a $33M affordable housing community in Houston’s Spring Branch, officially opened this week.

The community was developed by Blazer Real Estate Services in collaboration with Blazer Building, CVS Health, Harris County Housing and Community Development Department, Harris County Housing Finance Corp., Amegy Bank, Memorial Hermann Foundation and Boston Financial Investment Management.

The 125-unit property at 4014 Clarblak Lane includes 112 affordable rental units for households earning from 30% to 60% of the area median income, as well as 13 market-rate units. The property offers one-, two- and three-bedroom units. Amenities include a pool, dog park, playground and package lockers.

***

Pearlmark, in partnership with Vigavi Realty and Ley Wilson Development, formed a joint venture to develop Wallisville Logistics Center near Beltway 8 in East Houston. The industrial park will have two buildings, one 135K SF and one 128K SF, to total 273K SF.

Amegy Bank provided construction financing, led by Hannah Murphy. JLL’s Trent Agnew arranged the equity capital and JLL’s Richard Quarles will lease the project.