Hong Kong’s residential rental market has improved for eight consecutive months, with rents reaching a record high amid sustained local and overseas demand as analysts predict the gains will continue into 2026.

Home rents in the city have increased 2.95 per cent this year, according to Benny Sham, an analyst at Midland Realty.

“The rental index stands at a historical high since tracking began, and we expect the figure to increase further, as the drivers for leasing momentum will remain robust,” he said.

At the end of September, residential rents had grown 14.9 per cent from 2023, Sham said, citing Midland’s data. Meanwhile, property prices fell 12.7 per cent over the past two years before recovering 2.2 per cent this year as of October 12, he added.

Analysts attributed the rental boom to sustained demand arising from the government’s talent-import scheme and its efforts to boost the non-local student population at universities.

Nearly three years after the launch of the Top Talent Pass Scheme, more than 220,000 successful applicants had arrived with their families, according to government figures.

“Most of these people will rent a unit first instead of buying, which significantly drives up the demand,” Sham said. “And with more overseas students incoming, we have seen strong rental performance during peak seasons.”

As institutional student dormitories cannot keep pace with the surge, students arriving in Hong Kong must seek rental housing near their campuses. The volume of such demand will continue to rise, market experts said.

Half of the 10 major housing estates in the city achieved rental yields of more than 4 per cent in September, compared with three in December, according to Midland.

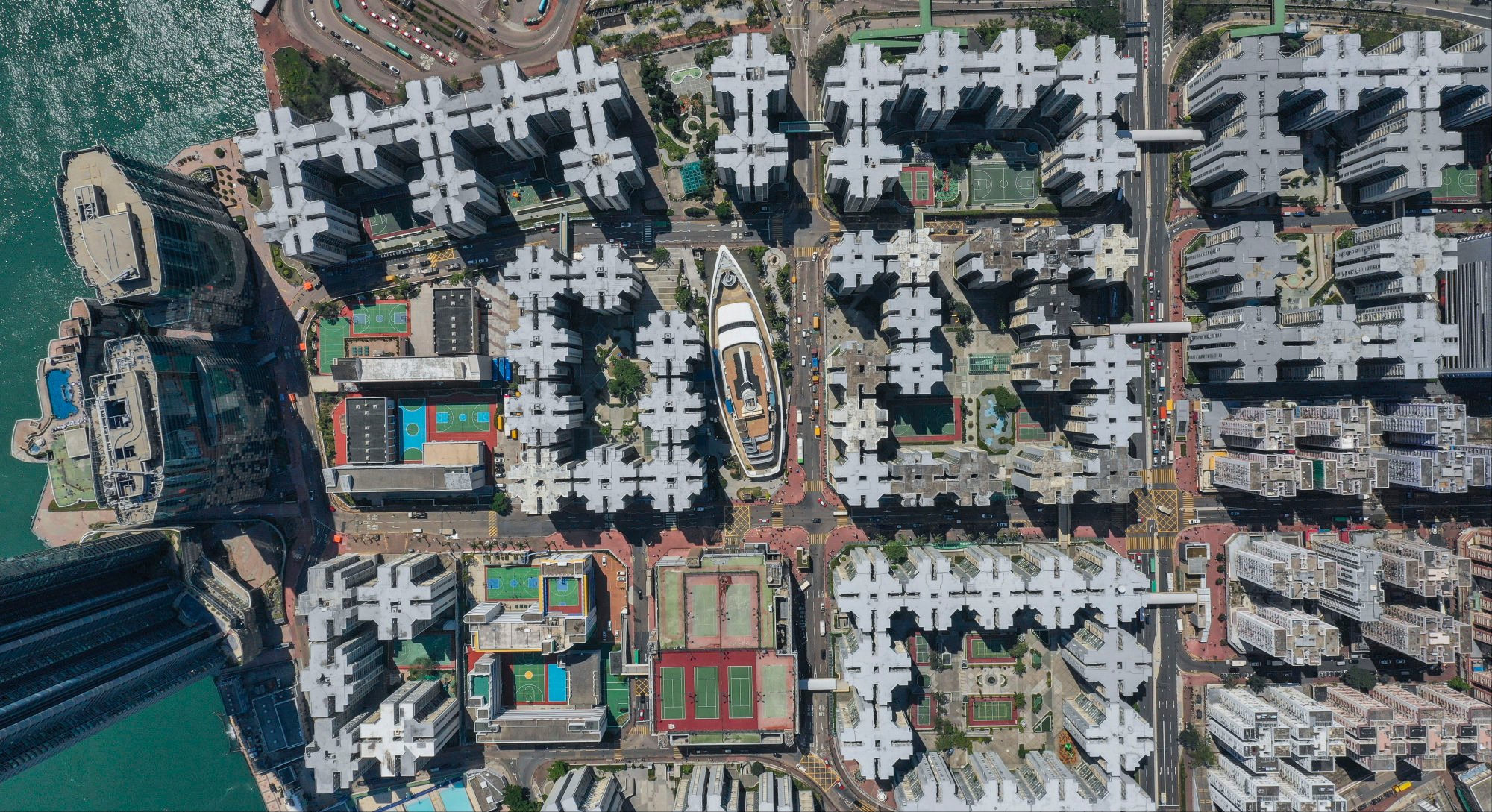

Mei Foo Sun Chuen recorded the highest rental yield at 4.23 per cent. Laguna City in Lam Tim ranked second at 4.22 per cent. Whampoa Garden, City One Shatin and Metro City in Po Lam recorded yields from 4 per cent to 4.11 per cent.

Rents would rise about 5 per cent this year and continue to increase next year amid strong local and overseas demand, said Martin Wong, senior director and head of research and consultancy for Greater China at Knight Frank.

Raymond Cheng, an independent property analyst, said rents would rise another 6 per cent next year.

The recent escalation of the China-US trade war had introduced uncertainty into the market, with future trends remaining contingent upon the trajectory of the dispute, analysts said.

However, Midland’s Sham said the outlook was positive as the US Federal Reserve resumed interest-rate cuts, fixed deposit rates declined and the low-interest environment attracted sustained capital inflows.

“Simultaneously, rising rents maintain high returns, suggesting long-term investors’ demand for rental properties will further increase,” he said.

For the past two years, the city experienced falling home prices amid rising rents, but this year both are trending up.

An official index measuring lived-in home prices rose for a fifth month in August, with the 0.14 per cent gain narrowing this year’s decline to 0.24 per cent. Since April, overall home prices have risen 1.26 per cent.

The latest figures point to a stabilising trend after home prices fell 28.4 per cent up to March this year from a peak in September 2021.

Meanwhile, transaction volumes remained above the 5,000 level for the sixth consecutive month in August. A total of 5,291 homes were sold, according to the Land Registry. While that represented a drop of 8.2 per cent from 5,766 in July, it was nearly 45 per cent higher than a year earlier.

Hong Kong’s residential rents also climbed in August, nearing a record high, official data showed. The rental index jumped by 1.12 per cent – the largest increment in 14 months – to 198.7, just 1.4 points shy of the peak of 200.1 recorded in August 2019.

Official statistics on September rents and home prices are expected later this month.

With robust rental demand, many owners have been capitalising on the booming market.

For example, award-winning actor Tony Leung Ka-fai recently rented out his 498 sq ft two-bedroom unit at The Sail at Victoria in Kennedy Town for HK$27,500 per month, or HK$55 per square foot, amounting to a rental yield of about 2.6 per cent, agents said.