Florida and Texas remain the top two destinations for international investors buying real estate in the U.S. in the third quarter of the year, according to the latest data by digital real estate company Waltz.

But Texas is gaining pace over Florida, especially among buyers from Mexico, who have shown three times more interest in buying property in the Lone State than the Sunshine State.

This choice “highlights a clear preference for a border state with deep cultural ties and a large Mexican-American community,” Waltz’s Founder and CEO, Yuval Golan, said in a statement shared with Newsweek.

Where Are International Investors Buying Homes?

According to Waltz data, a weak U.S. dollar is driving an uptick in investment property transactions in the country, as buyers take advantage of this favorable moment while believing that the currency would bounce back down the line.

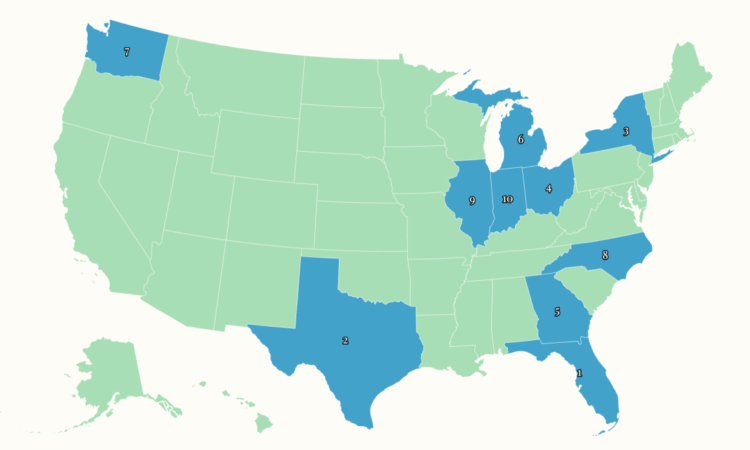

The top ten states where international buyers were looking to buy property between July and September, based on international visitors who expressed interest in U.S. real estate investments on Waltz’s platform, were:

- Florida

- Texas

- New York

- Ohio

- Georgia

- Michigan

- Washington

- North Carolina

- Illinois

- Indiana

Where Do Buyers Come From?

Different states attract investors from different countries.

Florida, for example, was the most popular state among Canadians and Argentinians.

Investors from Canada are still looking to buy homes in the U.S. despite recent clashes between the Trump administration and the Canadian leadership over tariffs, as housing costs in their home country remains high, governments introduce tenant-friendly policies, and the U.S. is geographically convenient.

Argentinians are still looking to shore up their assets out of the country as their nation’s economy navigates troubled waters.

Indiana and Ohio (respectively the fourth and tenth most popular states among all international investors) were most popular for Israelis, “which is consistent with this nationality’s preference for Midwest states that offer strong rent-to-price ratios and therefore stronger cash flow potential,” Golan said.

Texas, on the other hand, was the most popular state for Mexican investors looking to buy residential real estate in the U.S, who Golan said are looking to make a stable investment that would make up for the “inconsistencies of local politics” and the volatility of the Mexican economy.

Why Are They Buying In These States?

One in five (20 percent) enquiries from international investors were about refinancing a home in the U.S.—trading a home’s mortgage for a new, possibly lower one—while 80 percent were about new purchases.

Florida was the most popular state for refinancing, attracting 37 percent of investors looking for that on Waltz. Ohio was the second-most popular state (11 percent) and Texas followed third after dipping in popularity from 12 percent in the first quarter of the year to 6 percent.

When it comes to new purchases, Florida and Texas still dominate the list of destinations sought after by international investors because both states “don’t tax income at the state level, which offers an inherent advantage to investors,” Golan said.

“These states also have many affordable housing options where cash flow potential exists.”

Both Florida and Texas have experienced a steeper correction than the rest of the country in recent months after booming during the pandemic homebuying frenzy.

While home prices are still rising at the national level and mortgage rates continue hovering around 6.5 percent, home prices are now falling in Florida and Texas after inventory skyrocketed in these markets and demand dwindled due to ongoing affordability issues.

The median sale price of a typical Texas home was $339,300 in September, down 1.4 percent from a year earlier, according to Redfin. That of a typical Florida home in the same month was $404,200, up by a modest 0.1 percent from September 2024. It was the first year-over-year increase in 6 months, likely due to the fact that sellers and builders are starting to withdraw from the market, which has clearly turned in favor of buyers—including foreign ones.