Developers have had myriad reasons to stay away from starting construction on a new apartment complex in Houston recently.

It is difficult to raise equity and secure financing, especially given surging construction costs, flat rent growth and high interest rates. The region also had a huge supply wave that demand is still catching up to.

But now interest rates are dropping, the supply wave is crashing and costs are leveling off. Yet developers aren’t jumping back in, and they may not for years to come.

Most builders will wait for even cheaper debt, stronger rent growth, improved property values and more eagerness from equity partners, hoping market fundamentals will strengthen in the meantime.

The ongoing development slump may benefit those who can go against the grain.

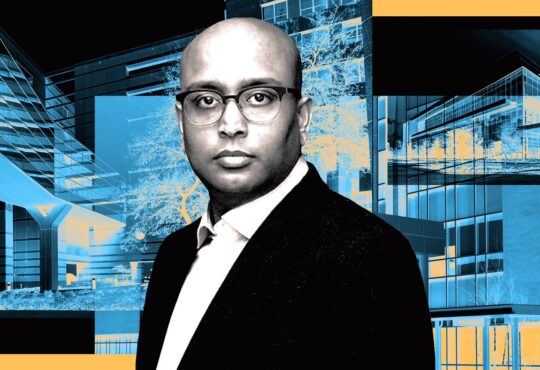

“Nobody is doing the start volume that they would like to be doing, and that applies for us as well,” said Philip Morgan, CEO of Morgan Group, a Houston-based firm with $4.5B worth of multifamily assets.

About 9,000 units were under construction in the third quarter, Houston’s fewest since 2011, according to Matthews. Construction started on only 840 units during the quarter, a stark contrast to 9,288 starts during the first quarter of 2022.

“What’s going to be delivered next year and the next three years is not a lot comparable to our population and what our normal trajectory is,” Lincoln Property Co. Executive Vice President Gabe Lerner said.

Groundbreaking activity in the first half of the year suggests a potential 15-year low for annual starts. This could help ease pressure on the 11.6% vacancy rate, which is at a 20-year high, according to Matthews.

Absorption outpaced new deliveries in the first half of 2025, but rent softness and elevated vacancies are expected to continue until supply moderates and demand fully catches up. Rents should stabilize next year, Matthews reported.

Even if builders start to lean in now, it takes about a year to design and permit a development, plus another two years or so to build it, Lerner said.

“If you’re not buying land right now … you’re a year and a half away from even getting a shovel in the dirt, and you’re three years away from real supply,” he said.

Developers have delivered about 11,000 units in Houston this year and have fewer than 1,000 units slated for delivery in Q4, according to MMG. This will bring deliveries well below the region’s historical annual average of about 20,000 units.

“The reality is we could have another year, two, three or four of this type of volume, which will be good for fundamentals,” Morgan said at the Houston Bisnow Multifamily Annual Conference this month at the Hyatt Regency Houston West.

Morgan Group has 10 active developments across Texas and Florida, down from its historical average of 20 to 25.

It has another 10 developments in the planning phase and is recycling existing deals to rebuild its pipeline and have more starts in 2026, 2027 and 2028, anticipating the market will reward developments that get started in those years.

But it isn’t easy being a first mover.

“The deals that are getting capitalized have to tick a lot of boxes,” Morgan said.

New developments need to be in a great location with barriers to entry and low supply, plus have a great basis. Morgan Group has gotten creative by working with landowners or developers who control sites but have struggled to get a deal capitalized.

The firm also has an in-house general contractor, and it is partnering with subcontractors to work out deals to satisfy return requirements for itself and equity partners.

“The bar is higher, and it’s harder to make deals work,” Morgan said.

Capital providers have become more interested in development this year than they were last year, but their interest is still well below historical levels, he said.

Rockefeller Group, which is partnering with Pelican Builders on a 298-unit multifamily project in Katy, is also trying to build, which is a bit of a bet, Senior Managing Director Philip Croker said at the Bisnow event.

Construction pricing — which increased 0.2% in August compared to the previous month — has offered some relief, Croker said. While prices are nowhere near 2020 levels, they have leveled off, which gives Rockefeller confidence to forecast.

“We weren’t able to predict things in 2024,” Croker said. “Nobody could see where pricing was going to stop. So we’re in a predictable phase, which feels good.”

Rent growth will likely be the last piece needed to give developers more confidence, and it will happen as fewer units are delivered, he said. Rents fell 0.6% last quarter, with oversupply keeping concessions widespread, according to the Matthews report.

“We need rents to rise,” Morgan said. “We need interest rates to continue to go down. Both of those things would lead to more equity coming into the market. We need some combination of those things to happen.”

While Houston had a significant development surge, developers didn’t overbuild as much as they did in markets like Austin, where rents dropped 4.3% year-over-year last quarter. Austin’s construction pipeline now has about 16,100 units, which is just over 4% of its existing inventory.

While development likely won’t shoot back up, Houston’s fundamentals are in better shape than other Texas markets, Morgan said, adding that Morgan Group is seeing that in its own data.

“The Houston recovery will be quicker because there wasn’t as much oversupply,” he said.