Will Strong Q3 Results and New Acquisition Change COPT Defense Properties’ (CDP) Narrative?

-

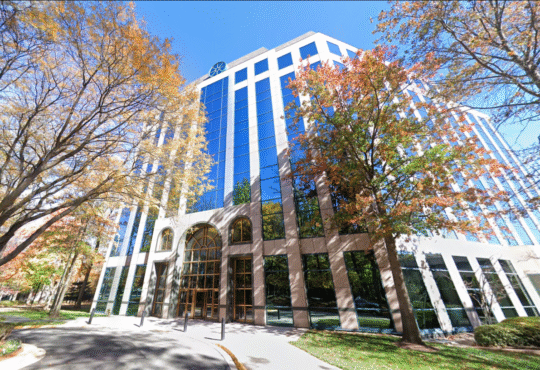

COPT Defense Properties recently reported its third quarter 2025 results, delivering US$0.37 in diluted EPS and US$188.8 million in revenue, both above prior consensus estimates, while also raising its full-year earnings guidance and acquiring the fully leased Stonegate I office building for US$40.2 million in Chantilly, VA.

-

A unique aspect of the results was the company’s record-high occupancy rate of 95.4%, underscoring robust demand from defense and technology clients and signaling confidence in the portfolio’s long-term growth prospects.

-

With these developments, including raised guidance and new accretive acquisitions, we’ll explore how COPT’s latest quarterly performance may influence its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

To be a COPT Defense Properties shareholder, one needs to believe that rising government defense and technology spending will drive sustained demand for specialized, high-security office space, supporting reliable occupancy and income. The recent quarterly outperformance and guidance raise reinforce expectations for strong growth catalysts in the near term, but do not fully resolve the longer-term risk of tenant concentration and exposure to federal spending priorities, which remains material for investors focused on revenue predictability.

Among the latest announcements, the acquisition of Stonegate I, a fully leased Class A office asset with a long-term defense contractor tenant, directly supports short-term leasing stability and income visibility. With ten years of committed tenancy, this move aligns with current catalysts by enhancing portfolio occupancy and potentially strengthening earnings, reflecting immediate benefits amid a backdrop of broader office market challenges.

However, investors should keep in mind that if government contract awards are delayed or funding priorities shift…

Read the full narrative on COPT Defense Properties (it’s free!)

COPT Defense Properties is projected to reach $821.6 million in revenue and $152.6 million in earnings by 2028. This outlook relies on 3.0% annual revenue growth, with earnings rising by $8.9 million from the current $143.7 million.

Uncover how COPT Defense Properties’ forecasts yield a $32.57 fair value, a 16% upside to its current price.

The Simply Wall St Community currently shows just one fair value estimate for COPT at US$39.39, significantly above recent prices. With a record-high occupancy rate now driving optimism, you can explore how shifting government budgets and demand dynamics might shape alternative views on future performance.