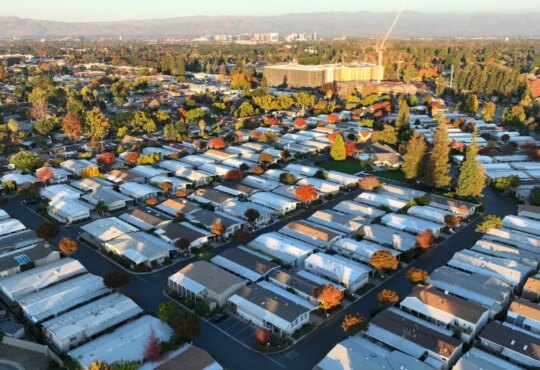

Retirement living doesn’t always mean traditional homes or condos. For many retirees, mobile homes offer an appealing alternative that combines affordability with community living.

Read Next: 6 Hidden Costs of Homeownership That Can Wreck Your Budget

Learn More: 6 Things You Must Do When Your Savings Reach $50,000

Affordable, with low utility bills, mobile homes provide a great lifestyle for a variety of retirement needs. Here are five key signs that retiring in a mobile home might be the right choice for you.

Reasons To Consider a Mobile Home

1. You’re Looking to Dramatically Cut Housing Costs

A typical mobile home costs around $88,200 compared to the median home value of about $356,000, with lot rents typically running $200-$300 per month, Yahoo Finance reports. The average sale price of a new, stationary manufactured home was approximately $124,000 as of 2023, while the average new house cost over $500,000, according to SeniorLiving.org.

Most lot rental fees include utilities like sewer, water and trash pickup, eliminating separate bills that can strain fixed incomes. Mobile home parks are an attractive option for those on Social Security or limited retirement savings.

Find Out: 5 Types of Homes Expected To Plummet in Value by the End of 2025

2. You Want Low-Maintenance Living

Mobile homes eliminate many traditional homeownership headaches. There’s no land maintenance or property taxes to worry about when you rent a lot. Yahoo Finance notes that maintenance costs are typically lower than standard houses, with painting, carpet cleaning and window repairs either handled by maintenance personnel or costing less if you pay directly.

3. You Crave Community and Social Connections

Most mobile home park residents are seniors, with many communities restricted to those 55 and older. The friendly atmosphere helps older adults develop social connections and avoid feelings of loneliness and isolation — a critical factor for healthy aging.

4. You’re a Snowbird or Love Flexibility

Mobile home parks make ideal destinations for retirees escaping harsh winters. They offer full hookups with electricity and potable water, and many allow extended stays of several months. For those who own their mobile home, the ability to relocate to different parks provides geographic flexibility traditional housing can’t match.

5. You Want To Simplify and Downsize

Mobile homes are easier to customize and build with unique features that would be difficult to achieve in traditional homes. For retirees ready to embrace minimalist living, they represent “the true OG tiny homes,” as real estate advisor Eddie Martini told Yahoo Finance.

Important Considerations To Buying a Mobile Home

While mobile homes offer significant advantages, there are drawbacks to consider. Mobile homes typically depreciate rather than appreciate in value. Lot rents can increase greatly. It can be tougher to get a sense of the neighborhood community before you commit, since it’s more susceptible to turnover (On the plus side, you can also pick up and leave if a lot isn’t your scene.)

Additionally, according to the Consumer Financial Protection Bureau, mobile homeowners face higher levels of housing insecurity and often struggle to afford basic living expenses, particularly in lower-end parks.

Mobile Home Life: Tips for Success

Before committing to mobile home living, drive through prospective parks at different times of day and night. Research whether homes are owner-occupied or rented, and check that properties are well-maintained. Look for parks with security protocols and background checks. Consider newer manufactured homes, which tend to be more energy-efficient than older models.

For retirees prioritizing affordability, community and simplified living over home equity and traditional homeownership, mobile homes can offer a comfortable and financially sustainable retirement lifestyle.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 5 Key Signs You Should Retire in a Mobile Home