Denver-based Apartment Investment and Management Co., better known as Aimco, plans to ask shareholders to approve its proposal to go out of business.

The multifamily owner and operator announced its plan to sell off all of its assets along with third-quarter results Monday after markets closed. The decision ends a strategic review of options that began in January and would wind down Aimco’s operations.

Aimco is under contract to sell an office building and multifamily assemblage at 1001 Brickell Bay Drive in Miami for $520M.

Aimco has already been shedding assets as part of the strategic review, and its portfolio has shrunk to 15 properties in New York, Georgia, Illinois, California, Tennessee and Florida.

Two of its properties were recently delivered and aren’t yet stabilized. It is also building a luxury apartment complex on the Miami waterfront that is set to deliver in 2027 and owns a development site in Fort Lauderdale.

“Having thoroughly explored various strategic alternatives with these counterparties, the Board unanimously concluded that the voluntary and orderly liquidation of the Company’s remaining assets is most likely to result in the greatest value for shareholders as compared to other alternatives,” Pat Gibson, the chair of Aimco’s investment committee, said in a statement.

The strategic review included conversations with more than 100 firms, including financial sponsors, investment managers, public REITs and private real estate firms, Gibson said.

Aimco reported a 1.9% decline in property net operating income in 2025 compared to the prior year. Its average property occupancy slipped 30 basis points from the prior quarter to 94.8%, while property expenses ticked up 1.1% over the same period.

The public real estate firm plans to put its liquidation up for a shareholder vote early next year. If approved, Aimco would accelerate its efforts to sell assets and return the proceeds to shareholders after paying for any of Aimco’s liabilities and obligations.

Its stock was up more than 6 percentage points in early trading Tuesday, but the company has lost more than 30% of its value this year, including a steep sell-off last month.

Aimco had $404M in cash on hand at the end of September and $748M in debt, including mortgages backing properties. The investment firm used proceeds from recent sales to pay off its revolving credit facility in September.

The sale of its remaining assets will generate distributions ranging from $5.75 to $7.10 per share after accounting for transaction and wind-down costs, Aimco estimates.

Aimco’s recent sales include a $740M deal in August to sell five New England communities to Harbor Group International. A month later, it sold four suburban Boston properties for a combined $490M.

Aimco is also under contract to sell a waterfront Miami multifamily and office assemblage for $520M, which would be a record sale for the city.

The deal in Miami’s financial district of Brickell is set to close next month, according to Aimco, which has also already begun marketing several other properties in its portfolio.

“Aimco has remained laser focused on our mission, which aims to create value for our shareholders, our teammates, and the communities in which we operate,” CEO Wes Powell said in a statement.

Aimco operated as a REIT for decades until it spun off a majority of its stabilized properties into Apartment Income REIT, better known as AIR Communities, in 2020. Aimco kept the firm’s opportunistic assets and development pipeline in the deal and shifted from a REIT to a traditional publicly traded company.

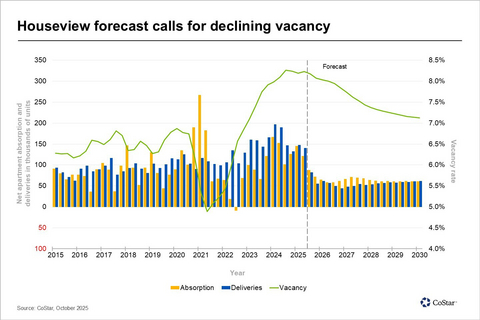

Blackstone took AIR Communities private in a $10B acquisition last April that commercial real estate analysts and brokers hoped would spur more transaction volume after investors fled from apartment deals over fears of oversupply.

Multifamily sales volume is down modestly compared to last year, according to JLL, but a Berkadia survey at the end of the first quarter found that more than 8 in 10 multifamily investors were looking to buy in 2025.