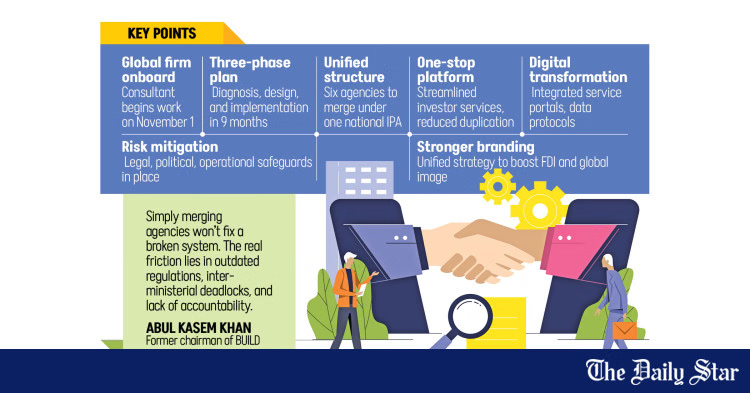

The interim government is planning to merge six investment promotion agencies within the next nine months in a major step toward overhauling Bangladesh’s fragmented investment facilitation system.

Officials at Bangladesh Investment Development Authority (Bida), tasked to lead the initiative, said the government has decided to hire a foreign consulting firm to design the unification, with an agreement with the firm expected to be signed next week.

Work on the project will begin by early November.

The initiative, backed by the Chief Adviser’s Office, will unify six parallel agencies: Bida, Bangladesh Economic Zones Authority (Beza), Bangladesh Export Processing Zones Authority (Bepza), Bangladesh Hi-Tech Park Authority (BHTPA), Bangladesh Small and Cottage Industries Corporation (BSCIC), and the Public-Private Partnership Authority (PPPA).

The goal is to create a single, investor-focused platform that simplifies approvals, removes overlaps, and improves coordination among government bodies that currently operate in silos. The move also aims at improving the ease of doing business and attracting more foreign direct investment (FDI).

THREE-PHASE PLAN

According to the project’s Terms of Reference, a formal document outlining the objectives and scope of the work, the foreign firm will conduct the work in three phases – diagnostic, design and implementation – over nine months, starting from November 1.

As per the document, seen by The Daily Star, in the diagnostic phase, the firm will assess the mandates, staffing, and structures of all six agencies.

In the design phase, the firm will create a unified institutional model, recommend legal harmonisation, and propose a new organisational structure. And lastly, the implementation phase will oversee restructuring operations and integrating digital systems to streamline investor services.

A national committee chaired by Industries Adviser Adilur Rahman Khan has met twice to guide the process. The final blueprint for the new body is expected by February 2026.

A LONG-AWAITED REFORM

“This reform is a direct response to investors telling us they don’t know where to turn when problems arise,” Nahian Rahman Rochi, head of business development at Bida, said about the planned merger.

The investment agencies currently perform overlapping roles, often requiring investors to submit the same documents multiple times for separate permits from different authorities.

For instance, industry insiders say that establishing a factory can involve at least 42 separate approvals, sometimes taking over 1-2 years to complete. Some even report paying up to six times the official rate to obtain permits.

Business leaders and economists have long argued that this bureaucratic complexity discourages both local and foreign investment. Bangladesh remains among the few lower-middle-income countries with standalone investment bodies. In contrast, countries like Vietnam, Malaysia, Rwanda, and Singapore have adopted unified models, allowing faster services and strategic alignment.

Bangladesh received $1.71 billion in FDI in fiscal year 2024-25, a modest rebound from the pandemic slump but still just less than 1 percent of the GDP, one of the lowest ratios in Asia, according to Bangladesh Bank data.

“Without proper coordination, investors get stuck in loops,” Rochi said. “One agency might issue two permits, another five, but there’s no system-level alignment.”

LESSONS FROM THE PAST

This is not Bangladesh’s first attempt at merging investment bodies. In 2016, the government combined the Board of Investment (BOI) and the Privatisation Commission to form Bida.

The move was seen as largely driven by external influence as it came after the Asian Development Bank (ADB), in a 2013 report, proposed the merger and backed it with a $500,000 grant. The World Bank followed with $1.5 million in parallel support. During the bill’s passage in the parliament, then finance minister AMA Muhith stated the reform was “suggested by the ADB and World Bank to enhance investment facilitation”.

Critics say the earlier merger improved branding more than performance. They also caution that merging agencies without tackling the underlying system may offer limited results.

“Simply merging agencies won’t fix a broken system,” said Abul Kasem Khan, former chairman of the Business Initiative Leading Development (BUILD). “The real friction lies in outdated regulations, inter-ministerial deadlocks, and lack of accountability.”

Bida officials say this new reform draws on those lessons and past failures.

“We’ve studied what went wrong with the previous merger,” said Rochi. “This time, we’re following a phased and consultative approach with international expertise and political buy-in.”

CONCERNS AND POTENTIALS

Policy experts say the new merger can succeed only if it goes beyond institutional restructuring.

“This reform has potential,” said M Masrur Reaz, chairman of Policy Exchange Bangladesh. “But execution, not intent, will determine its impact. Merging logos is easy. Building a better system is hard.”

He noted that agencies such as Beza and the hi-tech park authority manage land and infrastructure projects that require technical expertise beyond traditional investment promotion. Similarly, merging the PPP Authority could complicate project structuring, which involves financial and legal modelling skills.

Still, many in the private sector view the plan as a much-needed attempt to simplify the country’s business climate.

“Bringing all investment and regulatory agencies under one roof will enhance efficiency, reduce duplication, lower compliance costs, ensure accountability and improve transparency,” said Asif Ibrahim, former BUILD chairman.

“A cohesive branding strategy,” he added, “would strengthen Bangladesh’s global investment image, attract higher-quality FDI, and help build a more agile, transparent, and competitive investment ecosystem for sustainable growth.”

With the national elections approaching, many questions linger about the reform’s political continuity. Bida officials say the plan has been shared with all major parties and discussed on the sidelines of the UN General Assembly.

“We have soft alignment across the board,” said Rochi, adding that if executed well, the unified body might even facilitate investment in state-owned enterprises and underperforming sectors such as jute, sugar, tourism, and entertainment.

“We’re piloting models to bring in private and foreign investment into these areas,” he said. “Local reinvestment is also showing promising signs.”

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.