miniseries/E+ via Getty Images

Stock markets raced higher in the third quarter, with the Russell 2000, S&P 500, MSCI EAFE (Local/USD), and MSCI World Indices gaining 12.39%, 8.12%, 5.38%/4.77%, and 7.27% respectively. The steep advance was fueled by a September rate cut by the Federal Reserve, unwavering enthusiasm around artificial intelligence (AI) and mega cap technology, and a frenzy of speculative buying activity. While it is impossible to know if we are officially in a stock market bubble, it certainly has many of the earmarks.

Fundamental Disconnect

While you would never know it when looking at how many global stock markets are trading at or near record highs, there are plenty of areas of weakness across the global economy. Global GDP growth is expected to fall to 2.9% in 2026 (from 3.2% in 2025), with the U.S., Europe, Japan, and China all slowing, according to the OECD. Labor markets are showing signs of easing, inflation remains elevated, and debt levels are substantial (with sizeable refinancing maturities on the horizon). Trade tensions remain high, with the full effect of tariff increases still yet to be felt.

In the U.S., the world’s largest economy, employment has slumped, the housing market is soft, construction spending is declining, ISM manufacturing activity has contracted in 32 out of the last 34 months, and transportation markets are in a “freight recession.” The low-income consumer has been under pressure and is cutting back, while the high-income consumer (a direct beneficiary of outsized stock market returns) is partying like it’s 1999.

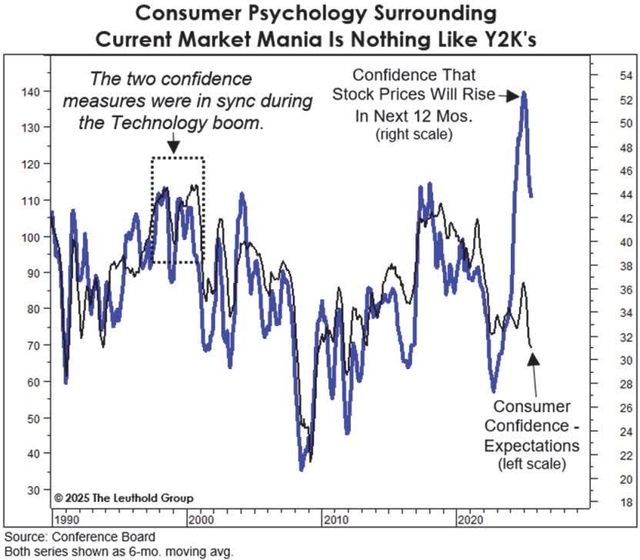

In the past, consumer confidence and stock market confidence have generally moved in harmony. Today, consumer confidence is low (and falling) at a time when stock market confidence is soaring (see graph on the top right). This dichotomy speaks to the growing disconnect between Wall Street and Main Street, which is unlikely to persist over the long run.

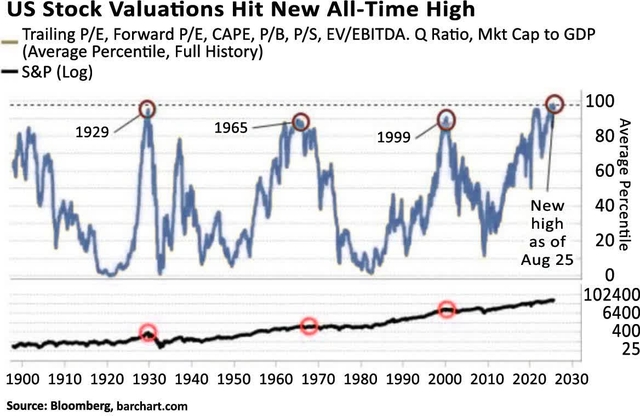

Record Valuations

We are currently in one of the most expensive stock markets in U.S. history. The bottom right chart tracks eight traditional valuation metrics over the last 125 years, with the latest reading hitting the highest level on record, and that was before the market advanced again in September.

Looking different than the market is currently a disadvantage, but we can take some comfort knowing that small cap, international, and value stocks all trade at a sizeable discount to U.S. large cap growth. That said, rising tides have lifted most boats, and absolute valuations have moved higher across asset classes. Fortunately, as owners of quality businesses with strong balance sheets, FMI’s portfolios trade at a discount to their primary benchmarks.

Speculative Excess

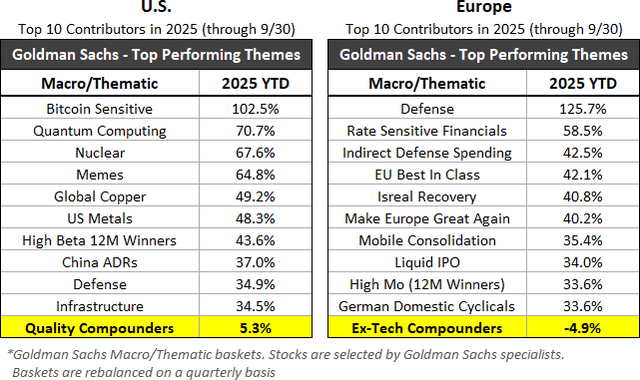

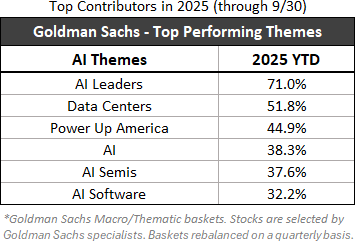

Exuberance is abundant and complacency is high, both of which may continue. Goldman Sachs tracks the top-performing themes in the U.S. and Europe (table on the right). Bitcoin sensitive equities and European defense stocks are up over 100% this year, while meme stocks and China ADRs climb the leaderboard. Pockets of lower-quality businesses (commodities, European rate sensitive financials) have also outperformed. Notably, quality compounders and ex-tech compounders have been left behind.

Goldman Sachs also tracks various AI-themed baskets within the U.S., as shown below. The worst performing AI basket has more than doubled the year to date return of the S&P 500, with the best performing basket outpacing the index by nearly 5-fold.

Unprecedented Concentration

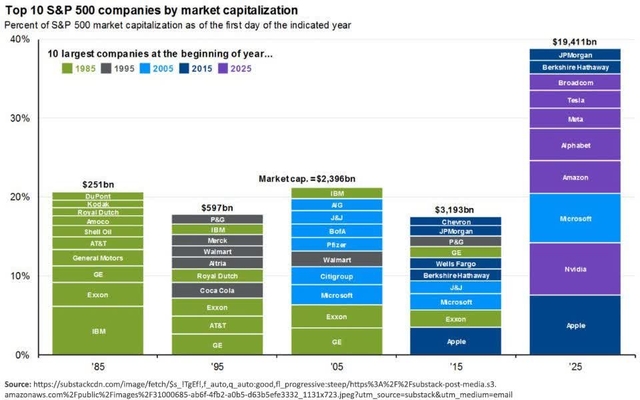

As displayed below, the market is narrow, with 10 holdings in the S&P 500 that are heavily influenced by AI reaching nearly 35% of the index. Prior stock market bubbles have been characterized by outsized sector performance, a lack of stock market breadth, and an unwavering adoration for a handful of market darlings, all of which are observed today.

As we wrote in our June 2023 letter, investors ought to consider an important question: are the winners of today going to be the winners of tomorrow? History would suggest no, as can be seen in the graphic below. Only one out of the top ten companies in the S&P 500 in 2005 is still in the top ten 20 years later. Historically, leaders change over time. Success invites competition and innovation can lead to disintermediation. Furthermore, despite what may appear to be strong competitive positioning and growth prospects, any company can be a bad investment if you overpay for it. In the 1970s, the “Nifty Fifty” were believed to be the best of the best; no price was too high for these businesses, and everyone piled in. In the 2000 tech bubble, many companies were also thought to be unassailable. Today, it appears these historical lessons have been forgotten.

A New Technology Paradigm (AI)

While AI has tremendous long-term potential and could certainly be a revolutionary technology, we marvel at the remarkable amount of capital expenditure (capex) being deployed. It reminds us of the fiber optic overbuild in the 2000 era, where massive amounts of capital were being spent on network infrastructure to take advantage of the growth of the internet. Simultaneous overbuilding by big competitors led to massive overcapacity that far outstripped demand. Many actors behaved irrationally, with debt exacerbating the problem. While it was true that the internet would ultimately change the world, vast amounts of capital were destroyed through malinvestment.

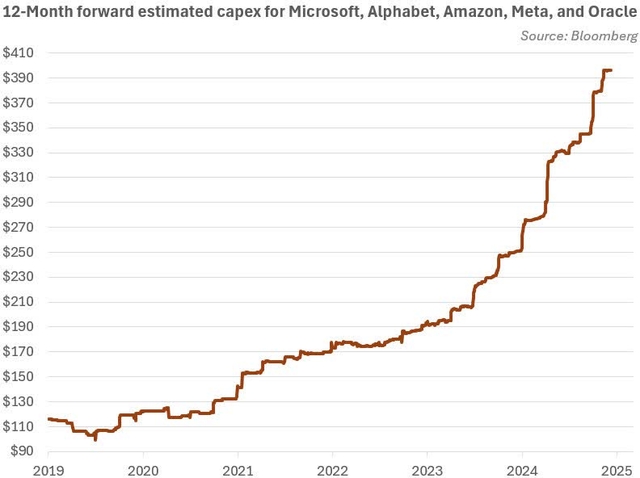

We are not naysayers on the prospects for generative AI. However, we are skeptical that the colossal amount of money being spent will generate attractive returns. As illustrated on the top right, a mega cap tech cohort of only five companies is on pace to spend nearly $400 billion in capex in the coming year. With each new AI capex announcement, investors get rewarded with an even bigger jump in market cap. McKinsey & Company does not see an end in sight, forecasting nearly $7 trillion more will be spent on datacenter capex by 2030. On the flip side, AI monetization remains an open question, with limited revenue generation thus far and an absence of “killer apps.” AI-native revenues (where AI is fundamental to a company’s product and operations) are believed to be less than $20 billion in total, paling in comparison to the amount of total investment. Ironically, increasing competition and capital intensity would tend to have an inverse relationship with stock market returns, yet investors are willing to look right through in the current environment. It remains to be seen if this dynamic is sustainable.

FOMO: Fear of Missing Out

The average investor underperforms the market by a wide margin over the long-term, as the DALBAR “Quantitative Analysis of Investor Behavior” studies have repeatedly shown. This can be attributed to predictable behavioral mistakes, namely piling into stocks after a period of strong performance (i.e. chasing returns), and aggressive selling when markets come under severe pressure; effectively doing the wrong things at the wrong times. Human emotion plays a crucial part in these behaviors, as the role of fear and greed cannot be underestimated.

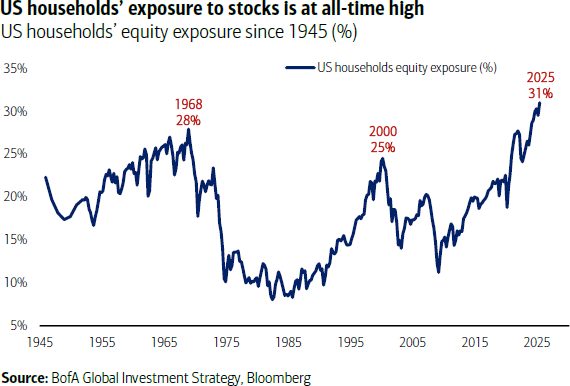

Given the precarious backdrop we have today, we find it interesting (and predictable) that global equity ETFs added a record $152 billion of inflows over the past 3 weeks, as reported by EPFR and Bank of America. The technology sector gathered over $9.3 billion last week alone, the biggest weekly inflow on record. As the bottom right chart depicts, classic herd behavior is alive and well. U.S. households’ exposure to public equities have climbed to a new all-time high, well above prior stock market peaks.

—–

Years from now there will be a more definitive view on 2025 relative to history. In the meantime, we stay the course and observe the following: economic growth is showing cracks, valuations are stretched, excess is abundant, the market is concentrated, AI exuberance is unrelenting, and investors are piling into equities at a record pace. Our portfolios look very different than our benchmarks, with a focus on idiosyncratic dislocations. With an eye toward business quality, balance sheet strength, and valuation, we will continue to proceed with caution. Downside protection has been a hallmark at FMI over our 45-year history. If volatility increases significantly and we find ourselves in a bear market, we will be poised to take advantage of more opportunistic valuations.

Listed below are a few portfolio holdings that we find compelling over the long term:

OneMain Holdings Inc. (OMF) – Small Cap/All Cap

OneMain is a scale leader in nonprime personal lending. Although they have a messy corporate history, our research suggests that in most key areas they are superior to their peers. We believe with a few years of clean results and an improved macro environment, this company could be reframed as a differentiated, high-quality financial. Given organic growth opportunities in personal lending, and newer areas such as credit card and direct auto, we believe they can grow organically in the mid-single digits with operating leverage, while at the same time returning significant capital through a large dividend and episodic buybacks. Although the current macro environment has stressed their core consumer and pressured net charge offs, we believe the income statement alone provides sufficient protection from an adverse outcome in nearly all reasonable scenarios, with further protection on the balance sheet in a tail risk scenario. The macro backdrop has given us the opportunity to own this industry leading business at an attractive valuation.

Becton Dickinson & Co. (BDX) – Large Cap/All Cap/Global

Becton Dickinson is a medical supply and device company, selling low-cost medical essentials. Products include vascular access devices, pre-fillable syringes, and catheters, to name a few. Becton is the leader in most of its product lines and often competes in oligopoly market structures. Their management team has been executing on a strategy to grow and simplify the business. This has been successful but is obscured by noise in the financials caused by the pandemic, portfolio actions, and other temporary factors, providing us with an opportunity to buy a quality business at an attractive price. We believe execution on the company’s growth strategy and pending business separation will unlock value, with management targeting over 5% annual organic revenue growth and continued margin expansion in the coming years. Manufacturing scale is a key competitive advantage, with the company manufacturing billions of devices annually. Driven by healthcare utilization, the business is durable. Post their separation of biosciences and diagnostics solutions business in 2026, ~90% of revenue is recurring in nature (consumables). The valuation is attractive given the company’s defensive attributes and growth potential.

Greggs PLC (OTCPK:GGGSF)[GRG LN] – International/Global

Greggs is a vertically integrated food-on-the-go operator with over 2,650 shops across the UK. Greggs sells products which are low ticket, consumed immediately, and often repurchased during the day. The company’s strong brand and differentiated business model have created loyal customers and long-term market share gains. Elevated cost inflation and growth investments have coincided with a demand slowdown, weighing on the near-term outlook and pressuring the stock. While sales growth and margins are likely to take a step back in the interim, given investments being made across the business (supply chain, innovation, employees, channels/ partnership), we think the company has a long runway for new store openings. The company is cresting the peak of their supply chain investment cycle this year, management remains disciplined, and they are in an excellent financial position with cash flow set to inflect thereafter. We view the valuation as too low relative to their long-term prospects.

Thank you for your continued support of Fiduciary Management, Inc.