Some investors are feeling anxious about the move, but there’s good reason to stay optimistic.

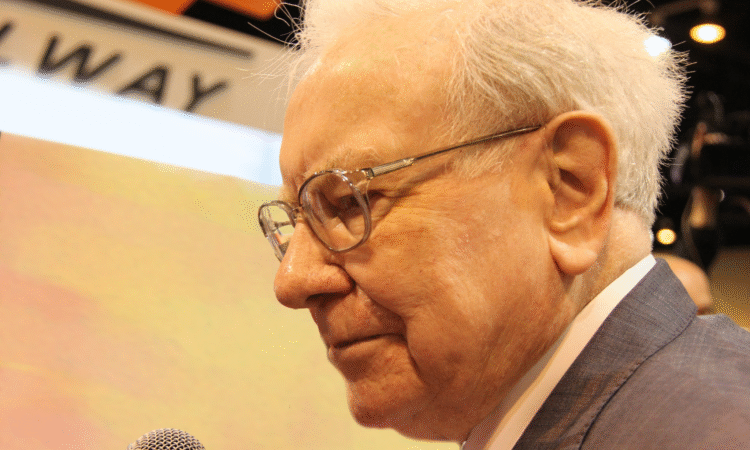

There are few names in the investing world as revered and recognized as Warren Buffett, so when he speaks, it pays to listen.

Through his holding company, Berkshire Hathaway, Buffett regularly buys and sells a variety of stocks. But one of his recent sell-offs has some investors feeling anxious about what it might signal for the future of the market. Here’s what you need to know.

Image source: The Motley Fool.

Buffett no longer owns his most recommended investment

Warren Buffett has long recommended the S&P 500 index fund, going so far as to call it “the best thing” for most investors during Berkshire’s 2020 annual meeting. Back in 2008, he even bet $1 million that this investment could outperform a group of actively managed hedge funds. He not only won that bet, but his S&P 500 index fund trounced the competition by a long shot.

Within the past year, however, Buffett sold all of his shares of both the Vanguard S&P 500 ETF (VOO +1.55%) and the SPDR S&P 500 ETF Trust (SPY +1.54%).

The sale caused ripples of anxiety among investors, as Buffett’s investing moves are often considered predictive of where the market is headed. Some people worry this means a market crash could be looming, or at the very least, that the S&P 500 is overvalued.

While Buffett selling off his S&P 500 shares may be alarming to some, there’s a good chance that the man himself would advise against everyday investors selling their investments.

Why it pays to stay invested in the market

Perhaps the most important takeaway from this sell-off is that career investors like Warren Buffett often have different approaches than those who don’t have as much time to dedicate to their portfolios.

In fact, Buffett himself acknowledges this: “If you like spending six to eight hours per week working on investments, do it. If you don’t, then dollar-cost average into index funds.”

Dollar-cost averaging involves buying investments at regular intervals throughout the year, no matter what the market is doing at the time. This strategy can help limit the impact of price volatility, as the highs and lows should average each other out over time. It’s also a particularly smart move when investing in index funds, as these investments typically perform best when given decades of uninterrupted time to grow.

To be clear, there’s nothing wrong with pouring loads of time and energy into investing in individual stocks. In fact, this approach can often lead to above-average returns over time. But it is a commitment, and not everyone has the time or eagerness to manage a portfolio of individual stocks.

Warren Buffett almost certainly has valid reasoning for his stock market moves, but that doesn’t mean everyday investors should follow his lead in every situation. If you’re going to sell your investments, ensure it’s because you believe it’s the right move, not because you’re simply following someone else’s strategy that may or may not align with your goals.

Buffett’s timely advice about investing amid volatility

The future of the market is always uncertain to some degree, but it remains promising. In fact, one of Buffett’s best pieces of advice involves staying invested even when the headlines make you anxious.

During the Great Recession, Buffett wrote an opinion piece for The New York Times to reassure demoralized investors. In it, he explained that despite the market’s seemingly endless challenges, it’s still managed to perform incredibly well over time.

“Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.

“You might think it would have been impossible for an investor to lose money during a century marked by such an extraordinary gain,” he continued. “But some investors did. The hapless ones bought stocks only when they felt comfort in doing so and then proceeded to sell when the headlines made them queasy.”

If the headlines are making you queasy right now, you’re not alone. However, the best way to build significant wealth in the stock market is to maintain a long-term outlook. While there are valid reasons to sell investments, panic over the market shouldn’t be one of them.