When it comes to potential tax liabilities, it’s also important to understand whether you’ll be subject to an inheritance tax.

“There’s no federal inheritance tax, but some states have an inheritance tax,” Greene-Lewis says.

Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania levy inheritance taxes, which are paid by heirs.

How a financial advisor can help you sell inherited property

Having a professional in your corner can help you understand the financial implications of selling an inherited home and ensure you’re making decisions that consider your full financial picture.

Weeks says he’s seen people move too fast after receiving an inheritance and regret it later, so he helps clients take a pause and figure out what they really want.

“I think sometimes what gets lost is the emotional component and reflecting on the property,” he says. “A lot of times, we’re talking about legacy properties that have been in families for a long time, and what I think can be really tricky for people is to navigate the emotional experience of this with the business experience.”

A financial advisor who specializes in estate planning can guide you through this process, help you understand your options and advise you on how to limit your tax burden.

How to prepare the inherited property for sale

A real estate agent can help you with listing the property and tell you if there are improvements or repairs you can make to improve the likelihood of a successful sale. Making improvements can also reduce your tax burden.

“[If you make any] enhancements to the property, you want to add those costs to your cost basis,” Greene-Lewis says. “So any permanent enhancements like remodels, roofing, anything that is permanent on the property, can be added to the cost and that will lower your taxes.”

However, Weeks warns that it’s important to work with a real estate professional to understand which improvements will add value to the home. It’s typically not worth it to spend a lot of money making a renovation that doesn’t end up increasing your sales price.

Some of the other expenses you incur when selling the home, such as closing costs, can also be included in your cost basis, Weeks says. Make sure to keep a thorough record of all your costs so you can properly account for them when you do your taxes.

“Sometimes those things can swing the house into a loss,” Weeks says. “It’s totally possible to have a capital loss on a property, which isn’t really a horrible thing because then you can use those losses in the future” to offset your income or future capital gains.

How to divide and distribute proceeds among heirs

If there are multiple heirs to a single property, proceeds from the sale are split among the heirs, Greene-Lewis says. The tax implications are generally the same, with all heirs responsible for capital gains on their portion of the proceeds. However, if they’re taking advantage of the home sale exclusion, co-owners who aren’t married will only be able to exclude $250,000.

What emotional and legal pitfalls should heirs watch out for?

“What happens time and time again is you have friction,” Weeks says. It’s common, he notes, for one heir to want to keep the family home because they have an emotional attachment to it, while another heir feels it’s impractical to keep it.

If the heirs can’t agree on what to do with the property, an heir who wants to sell might need to go to court to try to force the sale. Alternatively, an heir who wants to keep the property can buy out the other co-owners.

Weeks says talking to your loved ones before they die about their wishes for the property can help avoid some of that friction.

“Your biggest pitfall is hoping people get along and hoping they can make good coordinated decisions together,” Weeks says. “Sometimes it just doesn’t work that way. Sometimes clients have different goals and motivations.”

You’ll also want to be aware of any debts or liens attached to the property you’re inheriting. If the home has a mortgage on it, keep in mind that you’ll need to pay that off if you sell the home, lowering your net proceeds. The same is true for other loans secured by the property or tax liens.

Timing the sale for tax and financial goals

To get the most out of the step-up in basis, timing is crucial and you’ll need to act quickly. Weeks says one of the first steps you should take when you inherit property is to complete a date of death appraisal so you know what your cost basis is. Then, if your goal is to limit your tax burden, you should sell as soon as possible, before the home appreciates in value.

“If you sell it quickly and you divest in the property immediately, it’s typically true that there’s not going to be a meaningful tax impact to that client,” Weeks says. “It will essentially be what we call a net-neutral transaction.”

A quick sale has other advantages when it comes to financial goals. For one, it provides faster access to a lump sum of cash that can be used to pay off debt, invest, make a large purchase or buy a different home. Additionally, selling the property soon after inheriting it can help you avoid the ongoing costs of ownership—including utilities, maintenance and property taxes—if they aren’t in your budget.

Can I defer capital gains when selling inherited property?

If you use the inherited property for business or investment before selling it, you might be able to defer paying capital gains through a 1031 exchange. This requires you to reinvest the proceeds from the sale into a like-kind property of equal or greater value—meaning it is similar in nature or character, like selling an apartment building and investing in a different rental property. There are strict rules regarding what properties qualify and time limits on when you must identify and close on the new property, so it’s important to work with an independent and qualified intermediary like a title insurance company, bank or escrow company.

FAQ

Do I have to pay capital gains tax when I sell inherited property?

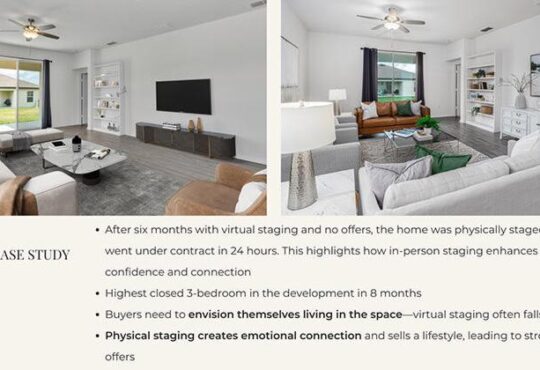

If you sell the property for more than what it was worth on the decedent’s date of death, you’ll pay long-term capital gains taxes on the difference. However, you may be able to lower your tax liability by deducting expenses you incurred from selling the home, including agent commissions, marketing costs, home staging and attorney fees.

What documents are needed before selling?

Documents you might need before selling an inherited home include the deed, receipts for recent property renovations or paperwork verifying that you’re the legal heir to the house. The laws governing real estate sales vary by state, so you should consider working with a local real estate agent who can help you gather the documents you need.

How long does probate take?

Probate rules vary by state, but generally, the time it takes to complete the process can range from a few months to over a year. The timeline depends on the size and complexity of the estate.

What if multiple heirs disagree on selling the property?

If a house has multiple heirs who can’t agree on selling the property, the heir or heirs who want to keep the property might consider buying out their co-owners. Heirs can also sue to force the sale of the property.

Should I make repairs or sell as-is?

Work with a local real estate professional to determine whether you should make repairs on a property you inherit. Making repairs can ultimately increase the sales price, but it can also be costly and time-consuming.