Do I pay capital gains tax on property?

If you sell a property in the UK, you might need to pay capital gains tax (CGT) on the profits you make.

You generally won’t need to pay the tax when selling your main home.

However, you will usually face a CGT bill when selling a buy-to-let property or second home. You may also need to pay CGT if your home is partly used as a business premises, or if you lease out part of your property.

Video: capital gains tax on property

The video shows how capital gains tax works when you sell a property that’s not your main home.

CGT rates on property

In the UK, you pay higher rates of CGT on property than other assets.

Basic-rate taxpayers pay 18% on gains they make when selling property, while higher and additional-rate taxpayers pay 28%.

With other assets, such as shares, the basic-rate of CGT is 10%, and the higher-rate is 20%.

Bear in mind that any capital gains will be added to your other income sources when working out which income tax bracket you’ll fall into for the year, and therefore might push you into a higher bracket.

All taxpayers have an annual CGT allowance, meaning they can earn a certain amount tax-free.

In 2023-24 you can make tax-free capital gains of up to £6,000 – down from £12,300 in 2022-23. The allowance is due to be cut further in 2024-25, so you can earn just £3,000 tax-free.

Couples who jointly own assets can combine this allowance, potentially allowing a gain of £12,000 without paying any tax.

You’re not allowed to carry over any unused CGT allowance into the next tax year – so if you don’t use it, you’ll lose it.

You can find out more in our guide to capital gains tax rates and allowances.

How much CGT will I pay?

As the name suggests, CGT is only charged on the gains you make (the profit), rather than the full amount you sell the property for.

To work out your gain, you can deduct the amount you originally paid for the property from the sales price.

You can also deduct any legitimate costs involved with buying and selling the property. This includes things like broker fees, stamp duty, and some improvements to the property that were made while you owned it.

You can also offset losses you’ve made when selling other assets. For instance, if you own several properties and make, say, a £50,000 loss when selling one of them, you can use that against the gains you make from another property and therefore reduce your overall CGT bill.

You should claim any losses on your self-assessment tax return, or by calling HMRC. You can claim losses up to four years after they were incurred.

For any taxable gains above the tax-free allowance of £6,000 in 2023-24 (£12,300 in 2022-23), you’ll pay the CGT property rates.

- Do your 2022-23 tax return with the Which? tax calculator. Tot up your tax bill, get tips on where to save and submit your return direct to HMRC with Which?.

When is capital gains tax on property due?

For UK properties sold on or after 27 October 2021, you must pay the tax owed within 60 days of the completion of the sale or disposal.

You’ll do this by submitting a ‘residential property return’ and making a payment on account.

For property sales made between 6 April 2020 and 26 October 2021, the window to pay your CGT bill was 30 days.

What can I deduct from my taxable gain?

You’re allowed to deduct certain costs from your gain, if they’re involved with buying and selling the property. These include:

- solicitor and estate agent fees

- stamp duty when buying the property.

Costs involved with improving the property, such as paying for an extension, can also be taken into account when working out your taxable gain.

However, you’re not allowed to deduct costs involved with the upkeep of a property. You’re not allowed to deduct mortgage interest either (though that can reduce the tax you pay on rental income).

Example of selling a second home

Someone is selling a second home in England in 2023-24 for £220,000 after buying it 10 years ago for £120,000.

Their capital gain is the increase in the property value, which is £100,000.

However, they spent £5,000 on solicitor fees and estate agent fees when selling the property, which reduces their gain to £95,000.

They have no other gains or losses, so they can simply use their £6,000 CGT allowance – reducing the taxable part of their gain to £89,000.

The rate of CGT they’ll pay depends on their other income. In this case, let’s say it’s £25,000.

This means they’d pay 18% basic-rate CGT on £25,270 of their gain (taking them up to the threshold of £50,270) – coming in at £4,548.60.

They’d have to pay the higher rate of 28% on the remaining £63,730, which is £17,844.40.

Altogether, the CGT bill would be £22,393.

Capital gains tax on your main home

In most cases, you won’t need to pay CGT when selling the property you live in, because you will be entitled to ‘private residence relief’.

You won’t need to pay CGT for the time a property was your main residence, plus the past nine months of ownership (even if you weren’t living in the property during those nine months).

People with a disability, or those who move into a care home, can claim for up to the past 36 months of ownership.

That said, you may have a capital gains tax bill to pay if you:

- develop your home, for example, by converting part of it into flats

- sell part of your garden, and your total plot – including the area you’re selling – is more than half a hectare (1.2 acres)

- use part of your home exclusively for business

- let out all or part of your home – this doesn’t include having a single lodger if you are living in the property, too

- moved out of your property nine months or more ago – to move into a partner’s home, for example

- bought a home for the purpose of renovating it and selling it on.

Which property is my main home?

If you use more than one home, you can nominate which will be tax-free for CGT purposes. It doesn’t have to be the one where you live most of the time.

Generally, it makes sense to nominate the property that’s you expect to make the largest gain when you come to sell it. You have two years from when you get a new home to make the nomination.

Married couples and civil partners can have only one main home between them, but unmarried couples can each nominate a different home.

Remember, you don’t get tax relief if you bought your home just to sell it on and make a gain.

How does letting relief work with CGT?

If you have let out either all or part of a property, a proportion of any gain when you sell it could be taxable. But if you used to live in the property (or still did at the time of selling), you might be able to claim letting relief, which will reduce your capital gains tax bill.

Letting relief doesn’t apply to buy-to-let investors who let out their properties and never live in them, and it’s now only available for people who have been in shared occupancy with their tenant/tenants. You can also only claim letting relief on the proportion of the property being let, for the period of time it was let out for.

The amount of letting relief you can claim will be the lowest of either:

- the gain you receive from the letting proportion of the home, or

- the amount of private residence relief you can claim, or

- £40,000.

Note that you can’t claim private residence relief and letting relief for the same period. So, if you are letting the property out when you sell it, the past nine months of ownership will qualify for private residence relief rather than letting relief.

The exact amount of private residence relief and letting relief you can get depends on the amount you sell the home for.

How letting relief works in 2023-24

Letting relief can feel confusing. This example illustrates how to work out capital gains tax when you sell a home you have been letting out.

John has owned a property for 20 years and has decided to sell up. He has no spouse or civil partner.

He bought the property for £200,000, but sold it for £300,000, giving him a £100,000 profit, or gain. We’ve assumed this gain has no allowable costs to be deducted.

During the 20 years (or 240 months) John:

- Lived in the property for 12 years (144 months)

- He then used it as a second home for four years (48 months)

- He then let it out to a tenant for four years, while living at the property (48 months) up to the point of selling the property. The tenant occupied an area equivalent to 25% of the home.

Here’s how John works out his CGT bill for a sale in 2023-24.

The example amount that John has to pay as a basic-rate taxpayer is made on the assumption that John’s gain does not push his overall income into the higher-rate tax band.

CGT on gifted and inherited homes

Your parents or relatives may want to leave you their home in their will. When they pass away, you’ll inherit the property at its market value at the time of death.

There is no CGT payable on death, but the value of the home will be included in the person’s estate. An estate is defined as being the total of someone’s assets and property, minus any debts and funeral expenses.

Depending on the value of the person’s estate, inheritance tax may be payable on the property.

If you then sell the property without having made it your own home, there could be CGT to pay.

The tax you pay will be based on the property’s value when you sell it, compared with its value on the date of death. If the value has increased, you’ll have made a taxable gain. As with any other property gains, you’re able to deduct any associated selling costs.

If you’re given the home while the owner is still alive and living in it, this is called a ‘gift with reservation’.

Essentially, this means the value of the property will still be included in inheritance tax calculations when the gift giver passes away.

However, it may change things in terms of CGT. If you sell the property, the CGT you owe will be based on the increase in value between the date you were given the property – not the date of their death – and the date you sell it.

This is the case even though there may also be inheritance tax to pay on the home at the time of death.

Example of CGT on inherited homes

These tables explain what would happen if John inherited his father’s home.

The first table explains what would happen if it was gifted on death.

The second table explains what would happen if John was given the home 10 years before his father’s death, and his father continued to live there until he died.

With a taxable gain of £56,000, the rate of CGT depends on the rest of John’s income. He’d have to pay 18% if it made up some of his basic-rate threshold up to £50,270. Anything above that would be charged at the higher rate of 28%.

If John already received other income of more than £50,270, the most CGT he could expect to pay is £15,680, which is 28% of the full £56,000.

Which other taxes may be due on UK property?

CGT is just one of the taxes that is levied on properties in the UK, charged when you come to sell it.

When you buy a home, you will likely need to pay stamp duty on the purchase price. The amount depends on whether the property is your main home or a second home or buy to let investment.

Residents also need to pay council tax, with the amount depending on the property size, location, and a few other factors.

If you’re letting out a property, you’ll probably need to pay income tax on the rent you receive.

And, if you leave a property to someone after you pass away, inheritance tax may be charged on some of its value.

For the above example, if the share price had declined to $70, it would reflect a -30% rate of return. A good return on investment is generally considered to be about 7% per year, which is also the average annual return of the S&P 500, adjusting for inflation. The rate of return can be calculated for any investment, dealing with any kind of asset. Let’s take the example of purchasing a home as a basic example for understanding how to calculate the RoR.

Formula for Annualized ROR

Investors use rate of return to measure the performance of their investments. The realized rate of return can be assessed against their own return expectations, or compared to the performance of other investments, indices, or portfolios. Rate of return can be used to measure the monetary appreciation of any asset, including stocks, bonds, mutual funds, real estate, collectibles, and more. Arithmetic mean return calculates the average return of an investment over a specified time by taking the simple average of the returns for each period. The shares had earned dividends of $500 over the one-year holding period. The investor also spent a total of $125 on trading commissions when buying and selling the shares.

Free Financial Modeling Lessons

The nominal rate of return is the rate of return (RoR) before adjusting for inflation, while the real rate of return is the RoR after adjusting for inflation. The real rate of return is a more accurate measure of the investment’s profitability as it takes into account the effects of inflation. Total Rate of Return (TRR) is a financial measurement that shows the overall return over a period of time.

How to Calculate Rate of Return in Excel

The simple rate of return is a basic return measure that requires only two inputs. It takes the increase in accounting net income from an investment and divides it by the cost of the investment. This method measures the additional profit each year from a capital investment. The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula. A non-discounted cash flow formula does not take into consideration the present value of future cash flows that will be generated by an asset or project.

Does Rate of Return apply to other assets?

- Again, depending on the company, the guidelines for using the rate could be very different.

- It overcomes a critical drawback of the arithmetic average—the assumption that the amount invested at the beginning of each period is the same.

- For example, if a piece of land increases in value by 3% per year, but inflation is running at 4% per year, the value of the land isn’t keeping up with inflation, so is delivering a real return of -1% per year.

- The nominal rate of return is the rate of return (RoR) before adjusting for inflation, while the real rate of return is the RoR after adjusting for inflation.

In this regard, ARR does not include the time value of money whereby the value of a dollar is worth more today than tomorrow because it can be invested. This method is called the time-weighted method, or geometric https://www.business-accounting.net/ linking, or compounding together the holding period returns in the two successive subperiods. The Accounting Rate of Return formula is straight-forward, making it easily accessible for all finance professionals.

What are real and nominal rates of return?

The method uses net income in the numerator of the calculation, rather than cash flows. Examples of non-cash items that impact net income are depreciation and amortization, which are not included in a cash flow analysis. The method does not use discounting to reduce the incremental amount of net income to its present value. Instead, it assumes that any net income earned during the measurement period is the same as its present value.

How Is Return on Investment (ROI) Used?

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The average book value is the sum of the beginning and ending fixed asset book value (i.e. the salvage value) divided by two. What rate of return are Seeking Alpha contributors expecting from the S&P 500 in 2023? Sign up for the 365 Financial Analyst platform and advance your finance career.

The incremental net income generated by the fixed asset – assuming the profits are adjusted for the coinciding depreciation – is as follows. Therefore, Adam realized a 35% return on his shares over the two-year period. For additional practice look at this exercise on the simple rate of return method. Older Excel versions require pressing the Control, Shift and Enter keys after you key in the formula. This command makes the spreadsheet software convert the expression to an array formula—i.e., performing multiple calculations on one or more items in an array. If you’ve done that correctly, you’ll see brackets within the cell automatically.

By the same token, leverage can amplify losses if the investment proves to be a losing investment. This calculation can also be used for holding periods of less than a year by converting the holding period to a fraction of a year. A loss instead of a profit is described as a negative return, assuming the amount invested is greater than zero. Austin invested $1000 in shares of Apple Company in 2021 and sold his stock in 2022 at $1200. He then invested $2000 in the stocks of Google in 2021 and sold his stock in 2022 at $2800.

The nominal rate of return does not account for inflation, while the real rate of return does. The real rate of return gives a more accurate depiction of the changes in purchasing power. When we would like to account for the time length and effect of reinvested return, in particular the compounding frequency, things become tricky. Let’s say an investor is considering a five-year investment with an initial cash outlay of $50,000, but the investment doesn’t yield any revenue until the fourth and fifth years.

While the simple rate of return isn’t perfect and won’t take everything to account, it can be a method to measure whether a given project has high potential profitability and is worth further examination. But it is more complicated in other cases, such as calculating the ROI of a business project that is under consideration. Finally, to calculate ROI with the highest degree of accuracy, total returns and total costs should be considered. For an apples-to-apples comparison between competing investments, annualized ROI should be considered.

To calculate the capital gain for US income tax purposes, include the reinvested dividends in the cost basis. The investor received a total of $4.06 in dividends over the year, all of which were reinvested, so the cost basis increased by $4.06. The overall period may, however, instead be divided into contiguous subperiods. This means that there is more than one time period, each sub-period beginning at the point in time where the previous one ended. In such a case, where there are multiple contiguous subperiods, the return or the holding period return over the overall period can be calculated by combining the returns within each of the subperiods.

It may be measured either in absolute terms (e.g., dollars) or as a percentage of the amount invested. RoR is a measure of the gain or loss on an investment over a given period of time, expressed as a percentage. RoR takes into account the initial investment amount and the final value, including any capital gains or losses, dividends, or interest earned.

A negative initial value usually occurs for a liability or short position. If the initial value is negative, and the final value is more negative, then the return will be positive. inventory management in 2021 In such a case, the positive return represents a loss rather than a profit. A simple rate of return is just a number unless a company has some idea how to use it.

A Rate of Return (ROR) is the gain or loss of an investment over a certain period of time. In other words, the rate of return is the gain (or loss) compared to the cost of an initial investment, typically expressed in the form of a percentage. When the ROR is positive, it is considered a gain, and when the ROR is negative, it reflects a loss on the investment. The simple rate of return is calculated by taking the annual incremental net operating income and dividing by the initial investment. When calculating the annual incremental net operating income, we need to remember to reduce by the depreciation expense incurred by the investment. A rate of return (ROR) measures the performance of an investment over time.

Commentary

Property agents are usually hungry for work, so it’s a surprise when they put you on the back-burner. This has been increasingly common in 2022, as the market is hot and agents are spoiled for choice of clients – and it’s led to some people wondering: why aren’t agents interested in helping with their listing? Here are some of the unspoken truths about how realtors may play favourites:

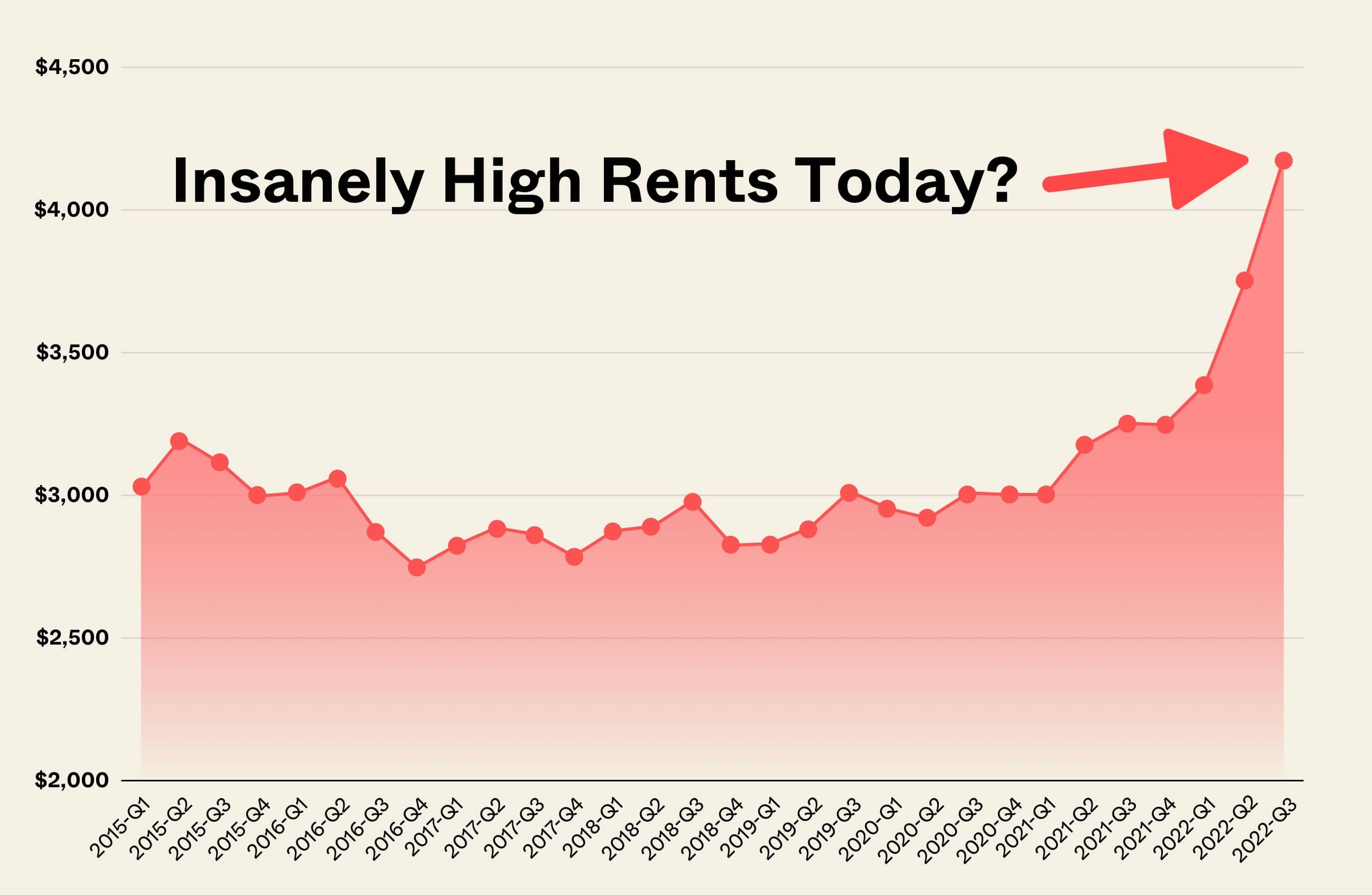

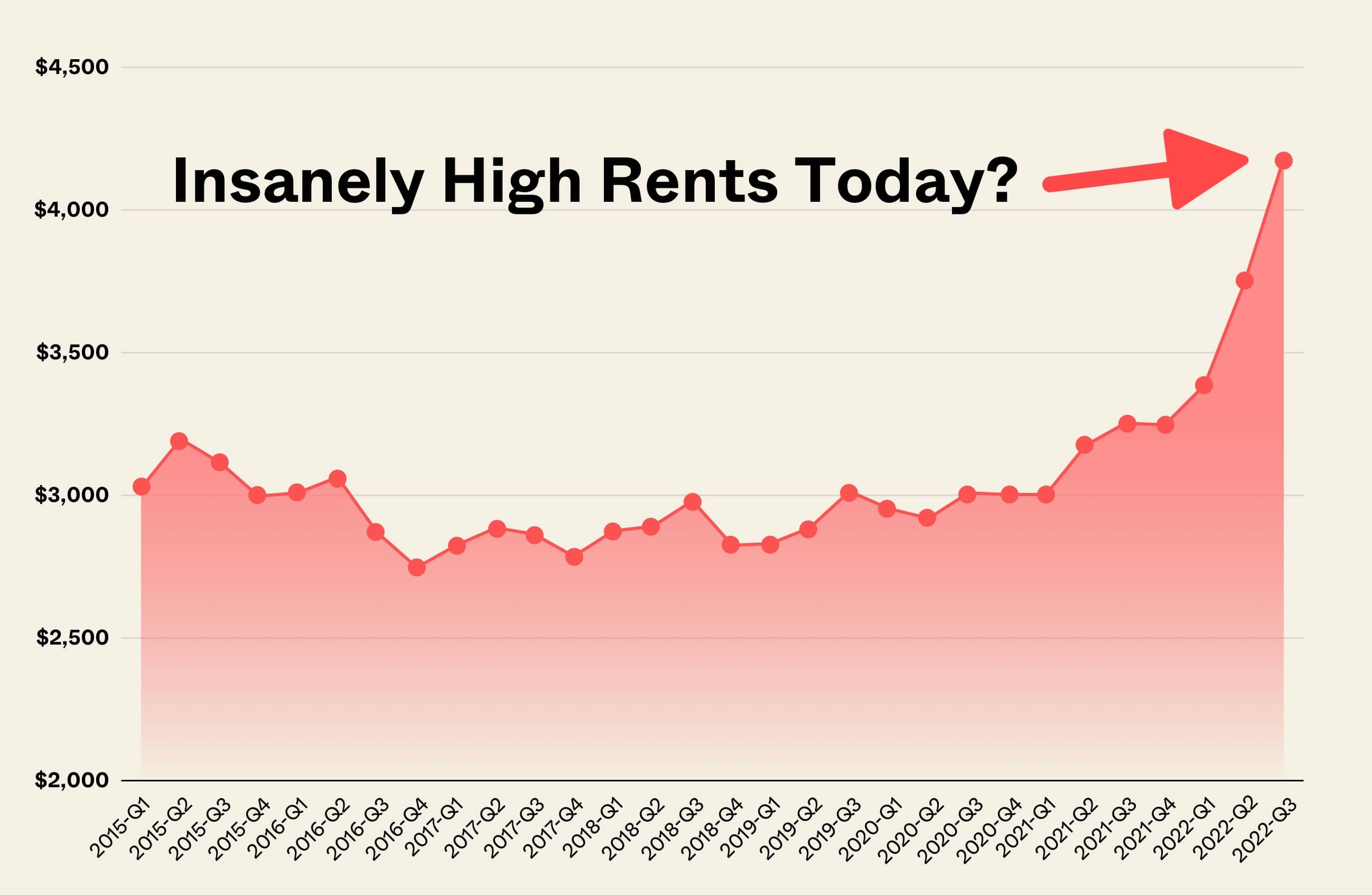

1. Fewer realtors want to help with rental listings

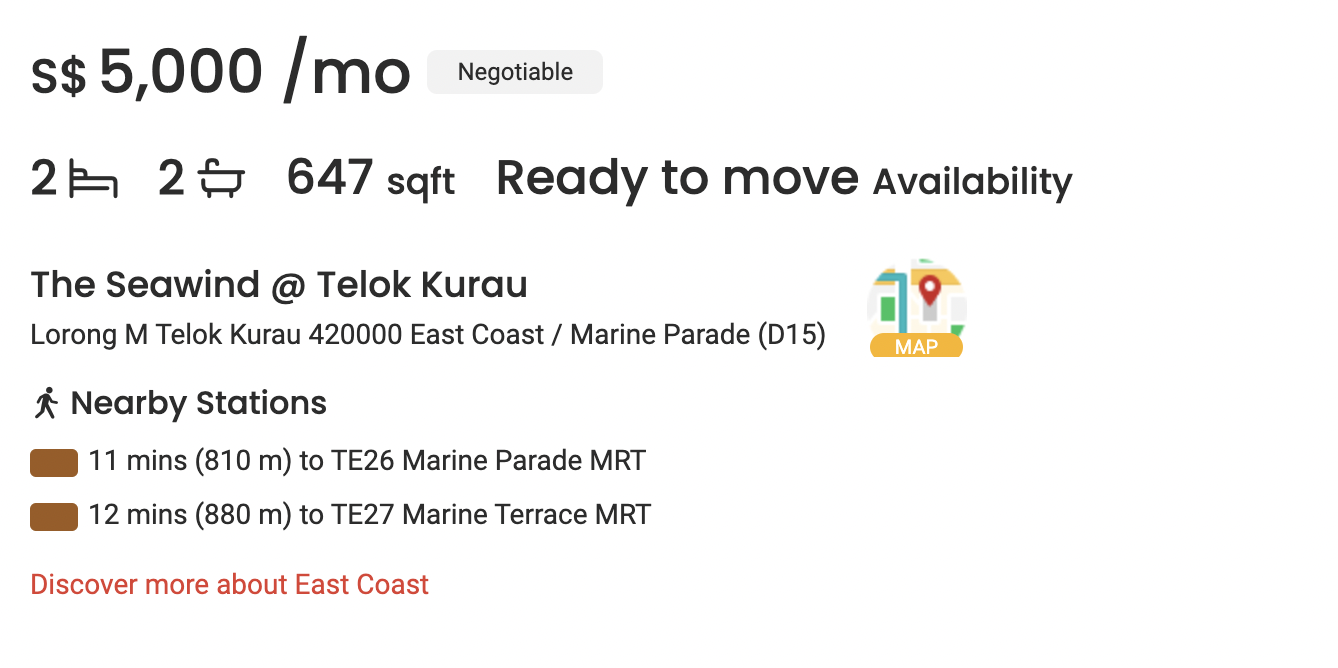

This is an industry problem that’s been hard to rectify: the commissions for handling rental are so low, and the effort so high, that many agents give it a wide berth. The typical rate right now is one month’s rent for a two-year lease, or half that for a one-year lease. Also, the typical market practice is that below $3,500, the tenant is the one that has to pay the commission.

At present (2022), the typical 4-room flat rents for $2,500 to $2,800, while a similar sized (non-central) condo rents for about $4,200 to $4,500.

For this amount, the agent must:

- Pay to put up the listing on a property portal

- Pay to refresh the listing

- Conduct viewings, which incur transport costs

- Help to vet the tenants, and ensure all their paperwork is in order (some foreign tenants may have communication difficulties, making this an especially time-consuming process)

- Handle other essential paperwork, such as the Tenancy Agreement

And given the hot rental market now, a popular listing can garner hundreds of messages, that the agent will have to go through.

Several realtors complained that, in practice, this is not even where the job will end.

Most landlords in Singapore also expect realtors to deal with subsequent issues, ranging from disputes between tenants, to leases being broken under unusual circumstances (e.g., a student tenant fails their exam, and wants to break the lease to go home a year earlier).

The landlord may not understand realise that the agent’s job officially ends once the TA is signed. If the agent hopes to get future business, such as during lease renewal, they have to go above and beyond.

And if you think about it, this is the same amount of work that will have to be done with a listing for sale.

Given the more lucrative selling/buying market, don’t be surprised if realtors show less enthusiasm about taking on rental units.

2. Your listing is an urgent sale

The most typical example of this is being close to your Additional Buyers Stamp Duty (ABSD) deadline: if you bought a second property before selling your previous home, you have only six months to sell your old property if you want to claim ABSD remission.

If you’re down to the last one or two months, realtors may not want get involved – not without a higher commission. The reason is simply that, for such urgent sales, the realtor is required to drop other business to prioritise you. This can result in opportunity costs, such as a slower response to leads for other listings.

The other concern is how you’ll react, if the realtor’s efforts fail. One property agent told us that, when she failed to close an urgent sale back in 2018, the seller even threatened to take legal action against her for the loss of their ABSD money. This was despite the fact she had only two months to find a buyer, and that the buyer had forfeited the Option and backed out of the deal at the last minute. She has since sworn off similar situations.

One agent said that raising the commission for urgent sales – a common tactic among desperate buyers – doesn’t always entice realtors. Urgent sales are so stressful and demanding, some realtors will avoid these for the sake of their own mental health.

In any case, an urgent sale is tough to pull off, and many agents simply don’t have leads on buyers ready to transact so soon – so don’t be surprised if you never hear back from them.

3. You don’t have an exclusive agreement with an agent or agency

Taking a non-exclusive agreement represents an extra risk for realtors. The main worry is that the agent may spend time and money to market your listing, but you end up transacting through another agent instead.

Regarding property portals, for instance, there have been cases where agents spend more on refreshing a listing, but by sheer luck the buyer contacts an agent who barely spent anything. This shouldn’t happen in theory, as the agents who spend more should go to the top of the page – but it has happened.

| Monthly Marketing Expenses | |

| PropertyGuru Subscription + extra credits every quarter | $580.9 |

| 99.co Subscription + 2,500 credits | $558.3 |

| Traditional Flyers | $400 |

| Newspaper Ads (3 days/month) | $153 |

| Social Media Marketing | $1,500 |

| Home Tour Video (1/month) | $500 |

Some agents also don’t like how this appears on property portals: the listing for the same property could be linked to multiple agents at the same time, and this gives the impression that something shady is going on. One agent said she once had to explain she wasn’t “stealing” a listing, when the prospective buyer noticed the same unit (albeit with different pictures) was linked to two other realtors.

When agents do take a non-exclusive deal, it becomes secondary to their exclusive clients, so you may notice fewer viewings or offers.

4. There are financing issues regarding your property

In some cases, property agents will back out after buyers mention financing issues. These can occur based on the following:

- Legal proceedings that make it difficult for buyers to obtain loans for your property (e.g., the MCST is currently involved in a lawsuit, or you are currently facing issues related to bankruptcy or divorce settlements). Agents are usually fine to take on your listing after the case is resolved.

- Cash-only purchases are required, such as for properties with 30 or fewer years on the lease, or are within the Geylang red light district*

- Banks offer a lower loan quantum due to the nature or age of the property (e.g., buyers may require a down payment of 45 per cent for some very old or decrepit properties)

There are some realtors able to help even in these cases – some realtors are especially experienced in marketing older properties, and may have ready contacts who look out for these units; but these are not most of the property agents you’ll encounter.

*For properties that must be fully transacted in cash, buyers and sellers sometimes make the transaction via private contracts. For these cases, you need to contact a conveyancing firm, rather than a property agent. There may be no realtor involved in a private contract.

5. Your asking price is too far off the mark

One of the most common reasons we see realtors back off is price: when you set your rental or sale price way too high, many realtors may give up rather than even attempt it.

A common question here is “Why don’t they just try anyway? They will get higher commissions.” The reason is that realtors need to pay for the marketing of your property first, and commit time and money to it – failure to close the deal means they won’t be compensated for any of those efforts.

And the more unrealistic the price, the more expensive the marketing attempts need to be; realtors will need to stretch the perceived value with pricey home staging, video tours, etc.

So if a realtor has no confidence in your price, they would rather avoid the expense and turn down your listing altogether.

Do note that even if you are asking for an impossibly high price and the agent takes it without question, that might be a sign your listing is used for price anchoring.

It may seem unethical, that the agent is using your listing for a bait-and-switch. They may show your property first, but imply it’s expensive for what it offers; next they’ll show the property they actually aim to push on the buyer.

This will make the second property more attractive than yours, due to price anchoring.

On the buyers’ side of the equation, some realtors will actively avoid those with unrealistic budgets (e.g., earning less than $3,000 a month, but trying to buy a four-bedder condo), or some buyer’s that are extremely out of touch with the market, and are hoping that sellers will sell at 2017 prices. Realtors still need to spend for transport, and conduct viewings, even if the property being viewed is way beyond the buyer’s reach.

Have you had property agents who seemed reluctant to work with you? Let us know in the comments. In the meantime, you can follow us on Stacked to check on news and trends in the Singapore property market.

Advice

Dear Ryan,

I’ve been reading your articles and find them very informative. I would like to seek your advice on what I can do with regard to my property.

I am 45 years old and single and looking for passive income or capital gains for my retirement. I currently own a 2+1 bedder condominium (99 years leasehold) which is about 13 years old which I bought for about $700k with a remaining loan amount of about $330k. The condominium is in district 16. The place is currently unoccupied as I am staying with a friend.

I have currently about $240k in cpf and if I were to sell my current place, about $280k would be returned to my cpf. I earn about $10k per month.

I am thinking of the following options:

1. Sell the current place to earn capital gain and use the profits with a new bank loan to buy a new condominium and sell the new condominium upon TOP.

2. Rent out the current place for rental income.

3. Sell the current place to earn capital gain, keep the profits as retirement fund and buy a resale hdb flat as retirement home using cpf only.

4. Sell the current place to earn capital gain and buy a smaller unit at a new condominium for rental and keep as future retirement home.

Thank you.

Hi there,

As always, happy to hear that our content has benefitted you in some way.

It’s always good to start your retirement planning early. You’re in a good position where you’re still working and able to take advantage of your age to secure a decent amount of loan. We will run through your affordability as well as the options you’ve listed, but the first step is to determine how your current property is performing.

How is your current property performing?

From the information that you’ve provided, it’s likely that the property you’re currently holding onto is a unit at Optima @ Tanah Merah. It’s the closest in age in District 16 with a lease starting from 2008 which would make it 14 years old this year.

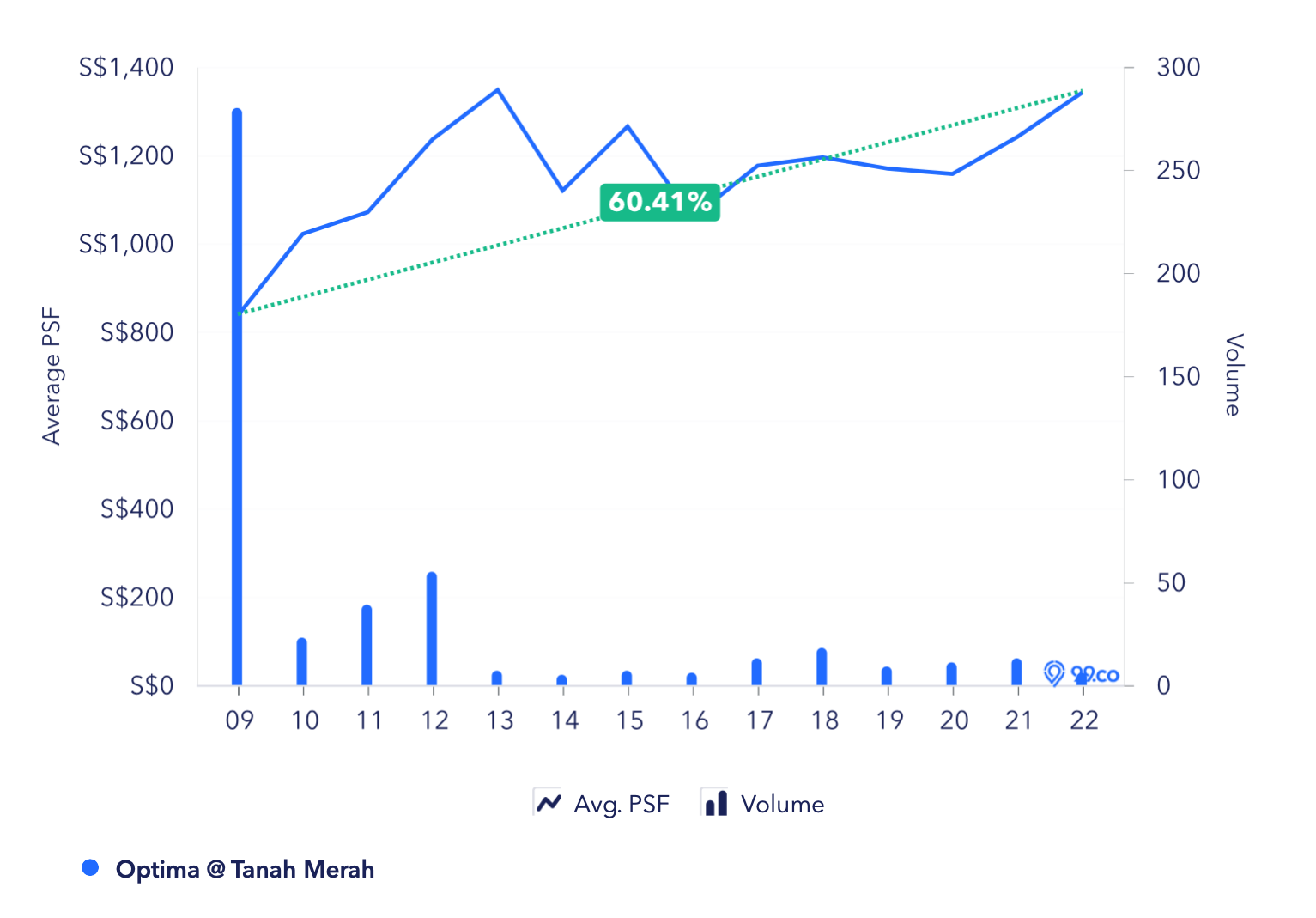

With that out of the way, let’s take a look at how Optima @ Tanah Merah is performing:

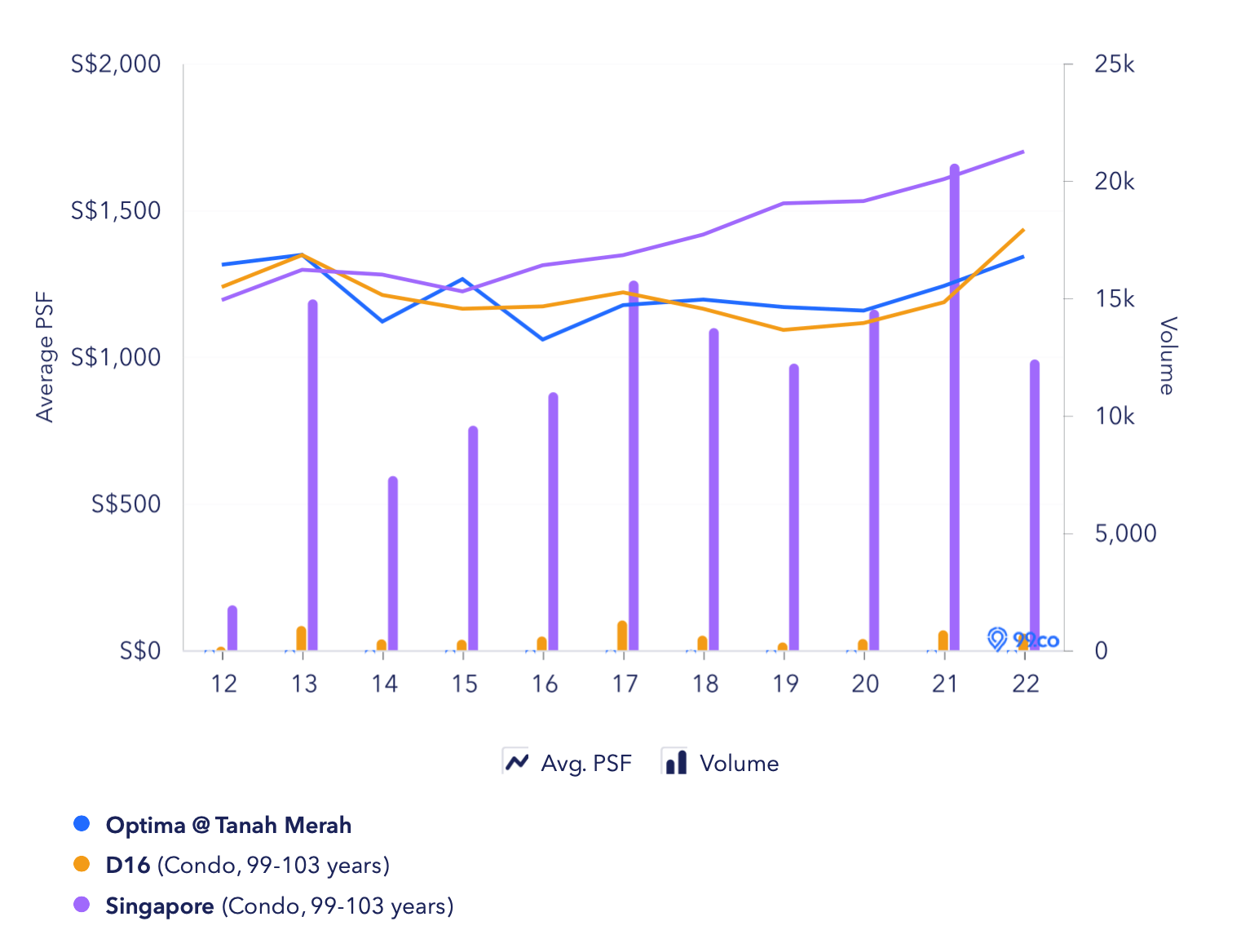

Since its launch, prices have gone up by 60% which is excellent. From the graph it may seem like prices are going up and down between the years 2013 – 2017 but this is because there were very few transactions each year (less than 10 from 2013 – 2016 and only 13 in 2017) which affects the average PSF.

For instance, in 2013 there were just 7 transactions, out of which 5 are 1 and 2 bedders. Also, smaller unit types tend to have a higher PSF so naturally, the average PSF went up. Then in 2014, there were 5 transactions, out of which 3 are 3 bedders so the average PSF went down.

To date in 2022, there have only been 6 transactions out of 297 units. This translates to a 2% turnover rate which is rather low. A low turnover rate would mean prices are not able to grow as quickly because banks value a property based on recent transactions.

For example, let’s say that out of these 6 transactions in 2022, 1 or 2 owners are desperate and sold at a low price. This will likely affect the valuation of the other units as well, as there aren’t enough transactions to support a higher price.

Also, due to the low number of transactions, it may not always accurately reflect the performance of the project.

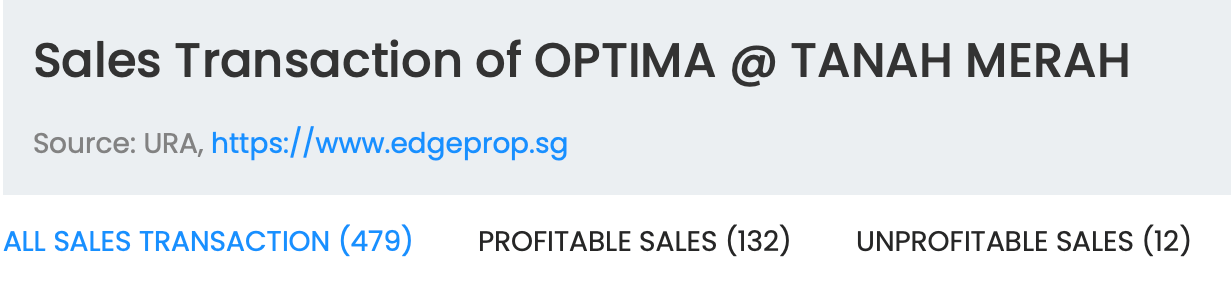

Based on the data from Edgeprop, there were 132 profitable sales and 12 unprofitable sales in the development.

The price trend of Optima @ Tanah Merah is pretty comparable to the average prices of 99-year leasehold developments in District 16. Its low number of transactions causes more peaks and troughs and is probably the reason they are not exactly parallel. However, we can see from the graph that there is a growing gap between the prices of Optima @ Tanah Merah and the overall prices of 99-year leasehold developments in Singapore.

These are some of the recent 2-bedroom transactions in Optima @ Tanah Merah:

| Date | Size (sqft) | Unit type | PSF | Price | Level |

| Nov 2022 | 840 | 2 | $1,257 | $1,055,000 | #06 |

| Apr 2022 | 850 | 2 | $1,388 | $1,180,000 | #07 |

| Apr 2022 | 840 | 2 | $1,310 | $1,100,000 | #13 |

| Dec 2021 | 969 | 2 + S | $1,239 | $1,200,000 | #12 |

In the past year, only one 2 + S was sold. The average PSF for these transactions is at $1,299 and the average price is at $1,133,750.

So assuming you purchased the 915 sq ft 2 + S during the launch at $700,000 and using the average PSF of $1,299, the selling price is approximately $1,188,585. As such, we will use $1,180,000 to determine your affordability for the next place.

Affordability

For selling

| Description | Amount |

| Selling price | $1,180,000 |

| Outstanding loan | $330,000 |

| CPF refund | $280,000 |

| Estimated cash proceeds | $570,000 |

For buying

| Description | Amount |

| Maximum loan based on a fixed monthly income of $10K and age 45 | $907,620 (20 years tenure) |

| CPF funds ($240K in OA + $280K refund after the sale) | $520,000 |

| Cash | $570,000 |

| Total loan + CPF + cash | $1,997,620 |

| BSD based on $1,997,620 | $64,505 |

| Estimated affordability | $1,933,115 |

Now that we know your affordability, let’s run through the options you’ve listed!

Option 1: Cash out on the current property to purchase a new condominium and sell it upon TOP

For this, let’s be conservative and look at a purchase price of $1.5M instead of maxing out your budget at $1.9M, as it is only prudent to save some funds for emergency purposes considering the loan depends solely on your income.

These are some of the new launches that are currently available on the market below $1.5M:

| Project | District | Tenure | Unit type | Level | Size (sqft) | PSF | Price |

| Lentor Modern | 26 | 99 years | 1b1b | #25 | 527 | $2,550 | $1,344,000 |

| Leedon Green | 10 | Freehold | 1b1b | #11 | 474 | $2,941 | $1,394,000 |

| Kopar @ Newton | 09 | 99 years | 1b1b | #20 | 517 | $2,756 | $1,425,000 |

| Bartley Vue | 19 | 99 years | 2b1b | #15 | 657 | $2,204 | $1,448,000 |

| Pasir Ris 8 | 18 | 99 years | 2b1b | #04 | 710 | $2,076 | $1,474,000 |

Do note that these developments were picked purely on the basis that they are within your affordability so it’s advisable to consult an agent for further analysis.

Many buyers have the impression that buying a new launch and selling it upon TOP will most definitely be profitable but this is a misconception. There are new launches that are unprofitable, people just don’t talk about them as much. We have previously done an article on this and you can read more on that here.

For a more balanced view, here’s a simplified look at some of the pros and cons of buying a new launch:

| Pros | Cons |

| You are buying in at a similar price range with your neighbours (who will be your competitors when you decide to sell the place) | Locations are limited to wherever the launches are (not an issue if you’re buying for investment) |

| The financial burden will not be as heavy for an initial couple of years with the progressive payment scheme | Longer waiting time (unable to rent out while the building is under construction) |

| Development is brand new so you have a fresh lease and can save on renovations | Unable to see the unit physically and don’t know who your neighbours are |

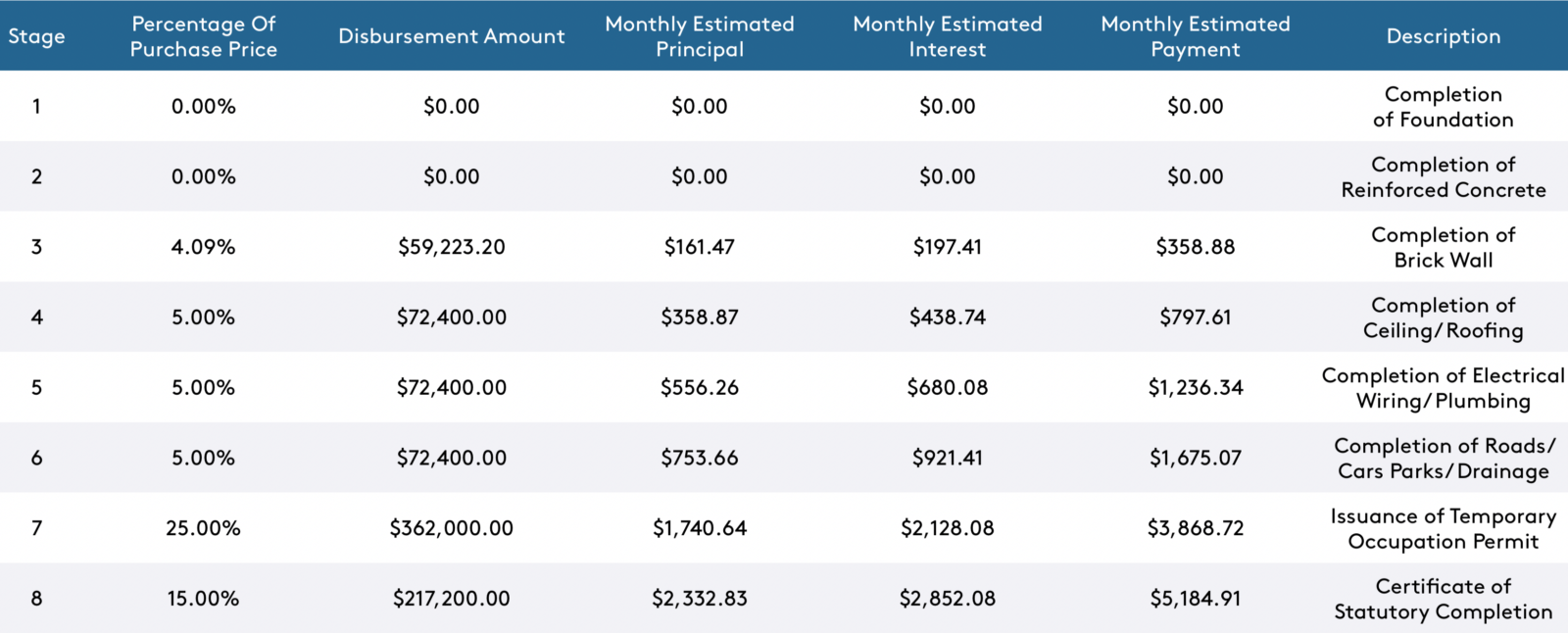

Since your intention is to sell upon TOP, let’s do a 5-year projection assuming you were to sell your existing property and purchase a unit at Bartley Vue for $1,448,000.

For our growth rate, we’ll look at how the private property index has fared in the past 10 years but we’ll halve this since we are looking at a 5-year horizon:

| Year | Property Price Index |

| 2012 | 151.5 |

| 2013 | 153.2 |

| 2014 | 147 |

| 2015 | 141.6 |

| 2016 | 137.2 |

| 2017 | 138.7 |

| 2018 | 149.6 |

| 2019 | 153.6 |

| 2020 | 157 |

| 2021 | 173.6 |

| 2022Q3 | 187.1 |

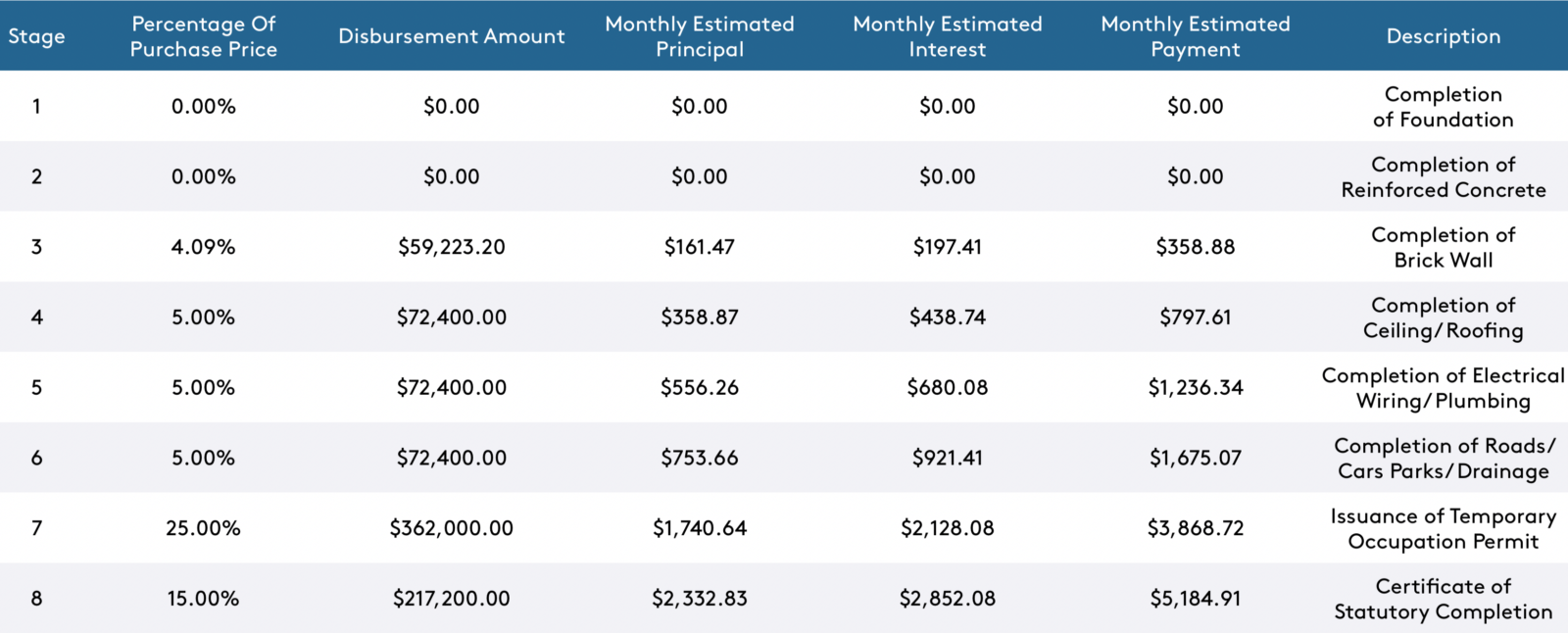

| Construction progress | Time period |

| Completion of foundation | 6 – 9 months |

| Completion of reinforced concrete | 6 – 9 months |

| Completion of brick wall | 3 – 6 months |

| Completion of ceiling/ roofing | 3 – 6 months |

| Completion of electrical wiring/ plumbing | 3 – 6 months |

| Completion of roads/ car parks/ drainage | 3 – 6 months |

| Issuance of Temporary Occupation Permit (TOP) | 3 – 6 months |

| Certificate of Statutory Completion | 6 – 12 months |

| Description | Amount |

| Assuming 11.7% growth over 5 years | $1,617,416 |

| Current valuation | $1,448,000 |

| Interest costs (Assuming loan of $855,600 at 4% interest with 20 year tenure) | $60,419 |

| MCST (Assuming $300/month – only pay for a year as estimated TOP is in 2026) | $3,600 |

| Estimated gains | $105,397 |

Do note that these projections are just meant to be a guide and will change depending on market conditions.

The actual gains may be more because you still have some cash proceeds leftover from the sale of your current property which we set aside for emergency funds.

Option 2: Rent out the current place

In the last 6 months, there were 23 2-bedder rental transactions in Optima @ Tanah Merah:

| Date | Size (sqft) | Price ($) |

| Sep 2022 | 800 to 900 | 3,700 |

| Sep 2022 | 1,300 to 1,400 | 4,600 |

| Sep 2022 | 800 to 900 | 4,000 |

| Sep 2022 | 1,000 to 1,100 | 3,600 |

| Sep 2022 | 800 to 900 | 3,700 |

| Sep 2022 | 800 to 900 | 3,100 |

| Sep 2022 | 600 to 700 | 3,700 |

| Aug 2022 | 900 to 1,000 | 3,600 |

| Aug 2022 | 900 to 1,000 | 3,900 |

| Aug 2022 | 1,000 to 1,100 | 3,300 |

| Jul 2022 | 1,000 to 1,100 | 4,000 |

| Jul 2022 | 900 to 1,000 | 3,050 |

| Jul 2022 | 600 to 700 | 3,000 |

| Jul 2022 | 1,000 to 1,100 | 3,500 |

| Jul 2022 | 1,000 to 1,100 | 4,500 |

| Jul 2022 | 600 to 700 | 4,000 |

| Jul 2022 | 800 to 900 | 3,700 |

| Jul 2022 | 900 to 1,000 | 3,650 |

| Jul 2022 | 1,000 to 1,100 | 3,300 |

| Jul 2022 | 900 to 1,000 | 3,800 |

| Jun 2022 | 900 to 1,000 | 3,500 |

| May 2022 | 900 to 1,000 | 3,600 |

| May 2022 | 800 to 900 | 3,400 |

The average rental for a 2 bedder is at $3,661 per month. If we were to only look at the 2 + S which are between 900 – 1,000 sq ft, the average rental is $3,586 per month. Based on the estimated selling price of $1,180,000, the rental yield will be 3.65%.

Let’s take a look at how that compares with other 2-bedroom rentals in the immediate vicinity:

| Project | Completion date | Size range (sqft) | Average rent (last 6 months) | Average price (last 10 months) | Rental yield |

| Grandeur Park Residences | 2020 | 500 – 900 | $3,344 | $965,000 (only 1 transaction) | 4.16% |

| eCO @ Bedok South | 2017 | 800 – 1100 | $3,502 | $1,332,000 | 3.15% |

| Urban Vista | 2016 | 500 – 1300 | $2,722 | $874,631 | 3.73% |

| The Glades | 2016 | 500 – 900 | $3,188 | $983,429 | 3.89% |

Given that Optima @ Tanah Merah is older compared to these developments (TOP in 2012), the rental yield is pretty decent.

We will also do a 5-year projection to compare with Option 1.

| Description | Amount |

| Assuming 11.7% growth over 5 years | $1,318,060 |

| Current valuation | $1,180,000 |

| Interest costs (Outstanding loan of $330,000 at 4% interest with 17-year tenure) | $58,869 |

| MCST (Assuming $300/month) | $18,000 |

| Rental income ($3,586/month for 11 months a year) | $197,230 |

| Agency fees ($1,793/year) | $8,965 |

| Estimated gains | $249,456 |

To rent out the current unit instead of selling and buying a new launch will make you $144,059 more ($249,456 – $105,397). These additional gains are mostly from the rental income and also assuming the growth rates are the same for both developments.

Option 3: Cash out on the current place, keep the profits as retirement funds and buy a resale HDB as a retirement home using only CPF funds

Unfortunately at this point in time, this option is not as feasible due to the September 2022 cooling measures. This is because there is now a 15-month wait-out period if you sell your private property to downgrade to a resale HDB flat. (Although they have stated that this is a temporary measure rather than a permanent one).

And since you are below the age of 55, that concession doesn’t apply to you as well. If anything, the wait-out period may be beneficial for you, as more supply will be coming onto the market in the next few years.

Nevertheless, let’s just see the options available to you at this point in time.

After selling your condo, your CPF funds will add up to $520,000. Setting aside $20,000 for BSD, legal and agency fees will mean you’ll have a budget of $500,000.

These are the median resale prices by town and flat type for resale cases registered in the third quarter of 2022:

| TOWNS | 1-ROOM | 2-ROOM | 3-ROOM | 4-ROOM | 5-ROOM | EXECUTIVE |

| ANG MO KIO | – | * | $365,500 | $516,500 | $800,000 | * |

| BEDOK | – | * | $355,000 | $475,000 | $680,000 | $820,000 |

| BISHAN | – | – | * | $640,000 | $855,000 | $1,045,000 |

| BUKIT BATOK | – | * | $353,000 | $500,000 | $720,000 | $790,900 |

| BUKIT MERAH | * | * | $368,000 | $765,000 | $875,000 | – |

| BUKIT PANJANG | – | * | $386,500 | $471,900 | $610,000 | $750,000 |

| BUKIT TIMAH | – | – | * | * | * | * |

| CENTRAL | – | * | $460,000 | $680,000 | * | – |

| CHOA CHU KANG | – | * | $380,000 | $493,900 | $588,000 | $742,000 |

| CLEMENTI | – | * | $385,000 | $555,000 | * | * |

| GEYLANG | – | * | $320,000 | $560,000 | $738,900 | * |

| HOUGANG | – | * | $370,000 | $506,000 | $648,400 | $822,000 |

| JURONG EAST | – | * | $355,000 | $460,000 | $619,000 | * |

| JURONG WEST | – | * | $339,000 | $475,000 | $565,000 | $665,000 |

| KALLANG/WHAMPOA | – | * | $390,000 | $778,400 | $840,000 | * |

| MARINE PARADE | – | – | $412,500 | * | * | – |

| PASIR RIS | – | * | * | $519,000 | $619,000 | $780,000 |

| PUNGGOL | – | * | $436,900 | $555,000 | $612,000 | * |

| QUEENSTOWN | – | * | $395,000 | $860,000 | $894,000 | * |

| SEMBAWANG | – | * | * | $515,000 | $566,000 | $636,500 |

| SENGKANG | – | $317,500 | $438,000 | $536,000 | $595,400 | $723,600 |

| SERANGOON | – | – | $380,000 | $520,900 | * | * |

| TAMPINES | – | * | $395,000 | $530,000 | $650,000 | $844,000 |

| TOA PAYOH | – | * | $341,400 | $740,000 | $870,000 | * |

| WOODLANDS | – | * | $345,000 | $468,000 | $560,000 | $778,000 |

| YISHUN | – | * | $362,000 | $473,000 | $608,000 | $748,000 |

Unless you’re aiming for flats in Central Area, Queenstown or Toa Payoh (particularly newer flats), $500,000 in CPF funds will not be an issue if you are considering just 3 or 4-room flats.

HDB has a ruling that owners are not allowed to rent out their whole unit before the flat obtains its MOP, but you are allowed to rent out the bedrooms. You’ll also need to stay in the flat. So perhaps you can rent out one or two of the bedrooms depending on whether you purchase a 3 or 4-room flat and earn some passive income.

The assumption here is that you’ll invest the remaining cash proceeds for at least the next 5 years:

| Description | Amount |

| Assuming 7% returns annually | $799,454 |

| Initial investment | $570,000 |

| Estimated gains | $229,454 |

This option is definitely the least stressful financially as you would have fully paid off the property, plus you will be earning a passive income if you rent out the rooms and also gains from investing the cash proceeds.

Option 4: Cash out on the current property to buy a smaller unit at a new condominium for rental and keep it as a future retirement home

If you were to buy a brand new condominium, that would mean you have to wait 3 – 4 years for it to be completed before you can rent it out, so unless you can stay in the alternative accommodation during that period, this may not be a viable option.

Currently, the lowest-priced new launch condo is at $1.23M for a 398 sq ft studio unit at Irwell Hill Residences. If you were to utilise all your CPF funds plus pay the 5% downpayment in cash, you’d still need to take a loan of $648,500.

At 4% interest with a 20-year tenure, this would mean a monthly repayment of $3,929.52 after the project obtains its CSC. Renting it in the future could partially help to cover the monthly mortgage.

However, in 10 years time you will be 55 years old and if you do plan to move in by then, paying $3,900 monthly may be a rather heavy financial burden. Plus, you will still have another 10 years of payment to go. Although you likely won’t be retired at 55, it’s worth taking into consideration that you might prefer to be more financially free at that stage of your life.

Let’s say you were to purchase this new launch at $1.23M and rent it out for 5 years upon TOP:

| Description | Amount |

| Rental income (Assuming $3,100/month for 11 months a year) | $170,500 |

| MCST (Assuming $250/month) | $15,000 |

| Agency fees ($1,551/year) | $7,755 |

| Interest costs (Assuming loan of $648,000 at 4% with a 20 year tenure) | $118,471 |

| Estimated gains | $29,274 |

As you can see, the interest costs will significantly reduce your gains.

If your plan is to keep the property as a retirement home, you won’t be able to cash out from it so the most important thing is whether or not the property you purchase can also meet your lifestyle needs. If you do prefer having facilities at your doorstep, you could also consider purchasing a resale project which you can immediately rent out for rental income while you’re staying at the alternative accommodation.

One good thing about a new launch is that it’s nice and new. But if your plan is to buy and rent it out, it becomes irrelevant as, by the time you move in further down the road, you would not have been able to enjoy the development while it was brand new. Also, given the higher price you’re paying for a new launch (per square foot, at least), the rental yield may not necessarily be better than a resale unit.

These are some of the most affordable 1 bedder units currently on the market:

| Project | District | Tenure | Unit type | Size (sqft) | Asking price |

| Cavan Suites | 08 | Freehold | 1b1b | 365 | $620,000 |

| Suites @ Shrewsbury | 11 | Freehold | 1b1b | 370 | $620,000 |

| Thomson V One | 20 | 99 years | 1b1b | 420 | $620,000 |

| Riverbay | 12 | 999 years | 1b1b | 387 | $625,000 |

| Mountbatten Lodge | 15 | Freehold | 1b1b | 334 | $648,880 |

We will assume you use your CPF funds and cash to fully pay off this property. Let’s say you were to purchase the unit at Riverbay at $625,000 and rent it out for 5 years:

| Description | Amount |

| Rental income (Assuming $2,075/month for 11 months a year) | $114,125 |

| MCST (Assuming $250/month) | $15,000 |

| Agency fees ($1,037/year) | $5,185 |

| Estimated gains | $93,940 |

Just like with Option 3, as you’re planning to keep this property as your retirement home, you won’t be able to cash out from it but we will still do a 20-year projection until your presumed retirement at 65 years old:

We will use the Property Price Index (20-year horizon) for the projection. As of 2022Q3, the PPI stands at 187.8. Compared to 2002Q4 (82.3), this is a 128% increase in 20 years.

| Description | Amount |

| Assuming 128% growth over 20 years | $1,425,000 |

| Current valuation | $625,000 |

| Interest costs (House is fully paid) | $0 |

| MCST fees (Assuming $250/month) | $60,000 |

| Estimated gains | $740,000 |

For this option, it gives you an alternative route should you decide later down the road that you’d like to cash out and downgrade to an HDB instead.

Having said that, how you choose the property matters a lot if you’re looking out for capital gains – and it’s not always the ‘obvious’ things that determine this such as the freehold status.

For example, we knew someone with a $1.3 million budget looking to invest in a small unit, ultimately shortlisting two properties – The Sound (freehold) and Stirling Residences (99-year leasehold).

Between the two, The Sound seemed like a better choice given its freehold status, lower $PSF and upcoming MRT station along the Thomson-East Coast line.

It was also smaller so the overall cost was lesser than the new Stirling Residences.

Fast forward 4 years later, and you can see that the unlikely winner Stirling Residences had a much larger profit:

If you account for cost such as agent fees, taxes and maintenance fees, you’ll also see that the $30,000 profit from The Sound would more or less disappear.

Purchased in the same year for around the same $PSF and size – yet about a $200,000 profit difference!

From here, it’s easy to see how doing a projection table can only serve as a guide. Ultimately, it’s down to whether or not you’re able to pick out a fundamentally sound property that suits your objectives.

Conclusion

Seeing that your current property has appreciated pretty well, it may be a good time to cash out while the development is still relatively young.

Option 1 would definitely be ideal provided the new launch you purchase becomes profitable upon TOP or soon after. With this option your monthly repayment is lower, reducing your financial stress but the potential gains are not guaranteed.

For Option 2, a rental yield of 3.65% is decent and still comparable with newer projects in the vicinity. In the current climate, it is a lot easier to start collecting rental income and ride on the potential capital gains of the development in the next 5 years as compared to banking on a new launch to become profitable upon TOP. Selling and buying would also incur more fees than if you were to just hold on to the property to rent it out.

Option 3 will be the least financially taxing given that the property will be fully paid with your CPF and you will have cash on hand which you can put into other investments or just keep it if you so wish. Although again do note, you will have a 15-month wait-out period so you will need a place to stay in the meantime or at least account for the cost of rent.

As for Option 4, buying a new launch to rent out and eventually move into could be quite a heavy financial burden especially when age catches up. This, of course, will depend on the individual, but most people would prefer to have more financial freedom by then. Perhaps buying a more affordable resale unit which you can rent out immediately would be a better choice. This option will also allow you one more opportunity to cash out and downgrade if the right property is chosen.

Another option you can also consider is to purchase a dual key unit as a retirement home so even when you are staying in the unit, you will still be able to earn passive income that can partially cover the mortgage and eventually support your retirement.

Perhaps instead of choosing just one option, you can do a combination of 2 of these options. Since you’re only 45 years old now and you have an alternative accommodation, you could go with Option 2 to take advantage of the hot rental market and look toward Option 3 or 4 depending on the retirement home you eventually want to live in.

Have a question to ask? Shoot us an email at hello@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

The buyout option at the end of a car lease can be an attractive opportunity or a tool for damage control.

What is a lease buyout? Essentially, you are buying a used car you know and like, at a price set by the leasing company at the beginning of your contract. If you’re anticipating extra fees and penalties, buying the car can cut your losses. Or, if market conditions have changed since you signed the lease and you’ve lightly driven the car, you could turn the hidden lease equity in your vehicle into real savings.

Now that you know the numbers, here are the times when you might want to stay with old faithful.

Compare lease buyout options

1. You’re way over — or under — the allowed mileage

Most lease contracts are for three years and 36,000 miles. If you’re over, you’ll owe money; if you’re under, you could leave money on the table.

“Why pay two or three grand in mileage penalties and have nothing to show for it?” says Matt Jones, a senior consumer advice editor at Edmunds.com. “Not only that, but buying the car will save you the disposition fee,” the charge to prepare the car for resale, which is usually $350-$500.

But also check your contract for purchase option fees (typically about $350), charged by some leasing companies, and factor that into your decision.

Conversely, returning a car you drove only 10,000 miles, when you paid for 36,000 miles is like handing the dealer a big check. Instead, buy the car and use the value you’ve paid for, Jones says. Or you can get a no-haggle appraisal at online car buyer such as Carvana (or at a dealer, although this could involve some haggling). If the numbers break in your favor and the under-mileage car is worth more than the buyout price, you could buy your car to sell for a profit.

2. Your car has excess wear and tear

If your car has a collection of indiscretions — scrapes, dings or tears in the upholstery — you could be looking at penalties for excess wear and tear. But if you buy the car, you won’t be charged for the damage or the disposition fee, and you can fix the bumps and bruises when, and if, you want, says Paul Maloney, owner of Car Leasing Concierge.

3. Your car is worth more than its buyout price

In some cases, your car may increase in value for reasons not anticipated when the buyout price was set in the lease agreement. If the car is worth more than the buyout price, it can provide an opportunity to buy the car, sell it and pocket the difference.

If your car’s market value is less than the buyout price, it typically isn’t a good idea to buy it. However, you might consider buying it if the leasing company offers to lower the buyout price and you want to keep the car. A lender may do this to eliminate its own shipping and auction fees.

Auto loans from our partners

4.0

NerdWallet’s ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

4.0

NerdWallet’s ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

4.5

NerdWallet’s ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

4.5

NerdWallet’s ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

4.5

NerdWallet’s ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

4.5

NerdWallet’s ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

4. Your friend wants to buy your leased car

If you buy the car then sell it to a friend, you’ll have to pay sales tax. Instead, see if the finance manager at a local dealership will do a “lease pass-through,” says Scot Hall, executive vice president of operations for Swapalease, which matches leaseholders with car shoppers looking to take over a lease.

Basically, the dealer buys the car from you and immediately sells it to your friend. You aren’t charged sales tax and the dealer makes a few hundred dollars for moving paper. But be aware: Your warm body without a car in a car dealership means that you’re probably in for a sales pitch.

5. You like the car and don’t want the hassle of car shopping

Maybe, you think, it’s time to stop being a serial leaser, jumping from one leased car to another, always having a monthly car payment. If you like your car, compare the buyout price to the retail price on Edmunds.com and Kelley Blue Book. If it’s a fair deal, skip the dealership and send the lease company a check.

Keep in mind, however, that you won’t be protected by the bumper-to-bumper warranty which is typically for three years and 36,000 miles. But the powertrain warranty, covering major parts like the engine, transmission and suspension, might still be in effect.

I advise traders to select parameters similar to planned live portfolios for a more realistic demo trading experience. Alpari added functions to its demo account to simulate live conditions, alpari review including virtual deposits, leverage changes, and deletion of old accounts. It confirms that Alpari understands the requirement of demo traders for beginners and seasoned traders.

- A trader will be trading more quickly and with more confidence in no time.

- I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability.

- Before investing in foreign exchange, carefully consider your level of experience and risk appetite.

- Negative balance protection provides prevention against going into negative numbers on your trading account in case of overleveraged trading.

Best Brokers

It’s suggested to focus on trading psychology and risk management while avoiding paid courses and mentors. Alpari chose not to use a web-based platform, preferring its mobile app for Android and iOS. They also offer Alpari Invest, a mobile app for one-click investments. Alpari gives you many ways to deposit and withdraw from your trading account.

How to start trading with Alpari

Their guide to trading is designed to break down the terminologies and answer the most frequently asked questions by traders. A trader will be trading more quickly and with more confidence in no time. You’ll get the full technical analysis toolkit on both systems, the difference being your trading style and preferred markets. All the services on the TopForx.com website are free for you to use.

What is the minimum deposit for Alpari (Comoros) Ltd?

Also, Alpari is part of the International Financial Commission. This group handles problems between traders and brokers worldwide. Alpari (Comoros) Ltd offers demo accounts for MetaTrader 4 and MetaTrader 5. Demo accounts are especially important for beginners as they allow them to practice their strategies and get comfortable with the trading platform without risking real money. Alpari (Comoros) Ltd provides a broad range of deposit and withdrawal methods. These include bank wire, credit card, digital wallet, cryptocurrency, and various other electronic payment methods.

What are examples of trading instruments?

All with the confidence you’re joining a trusted global leader, with over 25 years’ experience – and more than 1 million clients worldwide. Effective March 28, 2016, the broker will no longer support demo.nano.mt4 accounts. Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. They always try to work hard to make sure traders make the best trading and investment decisions. Autochartist handles the bulk of market research and actionable trading signals. Still, Alpari complements it with high-quality in-house research, which includes trading ideas.

Our Alpari Mobile app is available for iOS and Android, giving you powerful trading in the palm of your hand. Find the perfect trading platform for your needs from our range of options available. Remember, when you’re trading with leverage, it’s important to manage your risks carefully to avoid big losses.

What platforms does Alpari (Comoros) Ltd offer?

Choose from three accounts, each one made to help you find your opportunity. Pro ECN runs on MetaTrader 4, offering tight spread and market execution to immediately take advantage of market movements. Due to a migration of services, access to your personal https://forexbroker-listing.com/ client area is temporarily disabled. An alternative Alpari website offers services that are better suited to your location. Hereby, Alpari offers you MetaTrader 4 (Limited with 10 days of inactivity) and MetaTrader 5 (Limited with 10 days of inactivity).

Alpari will send a PIN to verify the mobile phone, which grants access to the back office. I appreciate that Alpari does not engage in unnecessary data mining as part of its registration process. Therefore, beginners should consider the Alpari introduction before consulting online educational resources available for free.

Support via chat was very responsive with wait times of less than a minute. Via phone, we also had a good experience, with short wait times and helpful guidance. Response via email was not as good, we sent multiple messages, but several of them were unanswered.

Its ownership by Exinity Group and Andrey Dashin adds to its credibility. Like every broker, Alpari provides products and services to traders and derives its revenues from spreads and commissions. Swap-free Islamic accounts are available, and all account types except for Nano MT4 are eligible for PAMM accounts. Alpari (Comoros) Ltd performed well in research, offering regularly updated commentary written by in-house analysts. In addition, clients can utilize various tools such as an economic calendar and research from third-party provider AutoChartist.

This may impact how, where and which companies / services we review and write about. Our team of experts work to continually re-evaluate the reviews and information we provide on all the top Forex / CFD brokerages featured here. Our research focuses heavily on the broker’s custody of client deposits and the breadth of its client offering. Safety is evaluated by quality and length of the broker’s track record, plus the scope of regulatory standing. The Alpari Nano account is the most basic account type and is suitable for beginners or traders who prefer to trade with smaller amounts. This means that you can open an Alpari Nano account with just $1 and start trading Forex.

Besides lots of currency pairs, Alpari also offers some instruments you would like to trade on, such as Forex, CFD and Crypto for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose. Besides lots of currency pairs, Alpari also offers some instruments you would like to trade on, such as Forex, Gold & silver, CFD and Crypto for your best choice. Besides lots of currency pairs, Alpari also offers some instruments you would like to trade on, such as Forex, Gold & silver and Crypto for your best choice.

You may feel they will make a scene in front of others, embarrass you, move out, or either use more or more secretly. These are all things that have happened to others, but they don’t have to happen to you. Remember that, unless violence is a concern, the risks of having this conversation are generally far outweighed by the potential benefits. If you are genuinely concerned about a violent reaction, however, it is best to not have the conversation alone. Be open with your husband and communicate that while you’re supportive of his decision to try and re-establish a relationship with his mother, you’re not there yet. I’d hope that he’d be understanding and wouldn’t put pressure on you.

Signs Of An Alcoholic Parent

Luckily there are many ways that you can help get them on the road to recovery, even if they have to take it themselves. The Coping Kit and Calm Zone may bipolar disorder and alcohol also have some activities or exercises that can help if you’re feeling overwhelmed. Newsweek’s “What Should I Do?” offers expert advice to readers.

How Do I Approach My Alcoholic Parent About Their Problem?

Substance abuse can certainly alter a person’s behavior and actions. My guess is that your mother really does love you but has a limited capacity to show it because of her own set of serious problems. And, experiencing aggression and cruelty from the mother who is supposed dealing with stomach pain after quitting alcohol lantana recovery to be your biggest supporter could and in your case did lead to depression. If these feelings of depression return you must see a therapist. Your mother does not need to know about this particularly given her reaction to your speaking to “outsiders” in the past.

Does My Mom Drink Too Much?

- What might seem like a reasonable expectation in some circumstances might be totally unreasonable when it comes to someone with an addiction.

- The action you just performed triggered the security solution.

- You may tell yourself that surely there is something you can do.

- Try as hard as you can to disengage from your mother when she is drinking, smoking and being cruel.

- Others may not notice it until many years later, perhaps when their parent developed the condition.

- If you’re uncertain about whether your parent is addicted to alcohol, we can help you to identify the signs and symptoms of a drinking problem.

She’s already made her priorities clear and they are to maintain a level of intoxication that makes life glide by in a blur. It’s hard for a tenacious survivor like you to accept, but she’s probably willing her health to deteriorate because that way she’s even less to blame for her misery. In addition to the higher rate of selecting an alcoholic partner, ACOAs are also more likely to experience the symptoms of trauma. Dr. Tian Dayton, a clinical psychologist, reports the impact of this trauma on a child and how the environment in which these children grow up directly reflects the major factors contributing to PTSD. These factors include the feeling of being unable to escape from the pain, being at risk in the family, and being frightened in a place that should be safe. If your parent is struggling with alcoholism or other substance abuse issues, help is out there.

Alcoholism has a lasting impact on children.

Addiction can cause some really serious problems, and when it’s a part of your family, it also affects your everyday life and how you deal with your feelings. It’s really important to look for an adult you can talk with about your parent’s addiction and how you’re handling it. Talking with someone else who acknowledges that your parent has a problem can really lift a weight off your chest. Some children have dealt with their parent’s alcoholism since the time they were born. Others may not notice it until many years later, perhaps when their parent developed the condition.

I developed this list from years of clinical practice with ACOAs. You might like tocreate your own personal list, as well. Healing can start by simply knowing that you arent alone. Groups like Al-Anon and ACA (Adult Children of Alcoholics) provide free support and recovery.

There are many resources and support groups out there that specialize in helping the children and other family members of alcoholics. It may be beneficial for you to seek help from a mental health professional such as a psychiatrist, psychologist, or social worker. They may be able to help you understand, cope with your feelings about, and improve your mental state over your parent’s situation and the impacts that it has had on you. Alcohol use disorders, more commonly known as alcoholism, affect approximately 17.6 million Americans.

If you can’t find the phone number, a trusted adult can help you get in touch with the right people. This again stems from experiencing rejection, blame, neglect, or abuse, and a core feeling of being unlovable and flawed. It’s natural to close off your heart as a form of self-protection. You hold back emotionally and will only reveal so much of your true self.

If you’ve been covering up for your loved one and not talking about their addiction openly for a long time, it may seem daunting to reach out for help. However, it’s important to make sure you’re getting the support you need as well. Lean on the people marijuana detox: what you should know around you, and, if you need to, reach out to a mental health professional to speak about your stress and what you’re going through. There are several different signs and symptoms of PTSD and trauma exhibited by adult children of alcoholics.

You’re incredibly hard on yourself and struggle to forgive or love yourself. During childhood, you came to believe that you’re fundamentally flawed, and the cause of the family dysfunction. If youre an adult child of an alcoholic, you feel different and disconnected. You sense thatsomething is wrong, but you don’t know what. It can be a relief torealize that some of yourstruggles are common to ACOAs.

Children with alcoholic parents often have to take care of their parents and siblings. As an adult, you still spend a lot of time and energy taking care of other people and their problems (sometimes trying to rescue or “fix” them). As a result, you neglect your own needs,get into dysfunctional relationships, and allow others to take advantage of your kindness. Having an alcoholic parent can be difficult, so it’s important to get the help you need to take care of yourself. If possible, try to find a safe place to go when your parent is drinking, like a library, friend’s house, or a local park.

I got an education and a healthy perspective on life. I’m now 27 and over the years I learned to make peace with my parents’ decisions and lifestyle. Having a parent who drinks can be very painful and confusing. Your parent may have promised to stop drinking time and time again, but they never do.

Whether you’re renting an apartment in Baltimore or saving for your first house in Tacoma, WA, sharing a house or apartment with roommates is a great way to mitigate living costs. However, choosing the wrong roommates can make you question if the savings are worth the headache. To prevent a dreadful situation, keep these tips in mind when choosing a roommate.

1. Find someone similar to yourself

Keep in mind that you’re going to spend a lot of time with your new roommate, so make sure you choose a roommate who you’ll get along with.

“The best tip for selecting a roommate to share a place with is to find the closest version of you,” says Michael Jefferson of Allsource Property Management. “Yes, opposites attract in intimate relationships, but usually break down when it comes to living together. You know yourself very well. If you’re not tidy, it probably won’t work living with a tidy person. If you’re the tidy one, a messy person won’t do either.”

2. Consider whether you could be friends with a potential roommate

While you don’t necessarily have to be best friends with your roommate to make the arrangement work, it certainly helps if you get along well with them. Meeting someone and learning more about them can provide important insight when choosing a roommate.

“Over the years, we have found that it is important to do something with your potential roommate, like grab a coffee or go for a run together,” says Benjamin Porter of Roomie, an app that helps people find roommates. “This will allow you time to get to know them on a more personal level, as well as allow you to look out for red flags that they might be hiding from their digital profile.”

3. Find someone you’re excited to come home to

Lifestyle medicine expert Rebecca Deutsch of the American Board of Lifestyle Medicine emphasizes the importance of a positive social connection when choosing a roommate.

“When selecting a roommate, find someone you are excited to come home to, as positive social connection is a key pillar of lifestyle medicine,” she says. “Don’t forget to discuss schedules, as nobody wants a roommate who disrupts a good night’s sleep. Find somebody who is supportive of healthy lifestyle habits, and in turn, be willing to support theirs.”

4. Make sure your potential roommate is clean and organized

Another essential factor to consider when choosing a roommate is neatness. A messy roommate can undermine any effort you make to keep your living space clean.

“A quick tip from our team about selecting roommates is to look beyond your relationship with this person and to look deeper and finer into the details of this person,” says Sherry Williams of MIKOL. “One area that you can observe is the cleanliness of this potential roommate. if you can, do a pop-in visit to their current living quarters. Usually, pop-in visits are difficult, so the next best thing is to see if their car is well maintained. Since we tend to spend a good amount of time in our cars, a messy car can reflect on someone’s living habits.”

5. Choose roommates that you can trust

If you’re going to share a space with a roommate, make sure you choose someone that you trust, as an unreliable roommate can impact your finances, your mental health, and your safety.

“Trust should be the number one factor when selecting a roommate,” according to The PO Box Blog. “I can’t count the times my friends and I have been put in the most unfortunate situations because we found a roommate online or ended up playing roommate roulette by getting matched with a stranger through a dorm or apartment complex program. You need to have some level of trust with your roommate because this is the person who will have access to your home and belongings, who has the power to potentially affect your credit score with their own poor financial decisions and wreak havoc on your mental health.”

6. Choose a roommate with similar values and priorities as you

No one wants to be stuck in a one-sided relationship, and this is especially true when it comes to choosing roommates. Make sure you pick someone with similar priorities to you. If you don’t, you’ll likely end up in a situation you want to escape from.

“If you would like to share an apartment with a roommate, you should select someone who shares the same values as you,” says Jessica Reid of Lifestyle DiJess. “For example, if doing chores every week to maintain a clean apartment is very high on the list of things you value, then you should find a roommate that values doing chores on a weekly basis just as much. If you value quiet time at home free from visitors, then you should make sure the person you select to be your roommate isn’t interested in hosting sleepovers and having friends come over every day. They should value quiet time almost as much as you. Finding someone who shares your home values will help you both thrive as roommates and get the most out of your apartment living experiences.”