Are you considering a move to El Paso but unsure if it’s the right place for you? With its unique blend of cultures, affordable cost of living, and proximity to nature, El Paso can be an attractive option for many people. However, like any city, it also has its share of potential drawbacks.

In this Redfin article, we’ll explore 10 pros and cons of living in El Paso to help you make an informed decision about whether this city is the right fit for you. So, is El Paso a good place to live? Let’s find out.

Pros of living in El Paso

If you’re considering buying a house or renting an apartment in El Paso, you’ll be happy to know that there are many advantages to living here.

1. Affordable living

The cost of living in El Paso is 11% lower than the national average, residents can enjoy a comfortable lifestyle while managing their expenses more efficiently. A notable factor contributing to this affordability is the housing market, where the cost of housing in El Paso is 30% less than the national average. When comparing the cost of living in El Paso, TX to other prominent Texas cities, it becomes evident that El Paso offers a more affordable lifestyle. It is 12% lower than Austin, 13% lower than Dallas, and 3% lower than San Antonio.

2. Strong economy

Another pro of living in El Paso is the city’s strong economy. El Paso is home to several major employers, including Fort Bliss, Texas Tech University Health Sciences Center, and the University of Texas at El Paso. In addition, the city has a thriving healthcare industry, with several hospitals and medical centers throughout the area.

The proximity to Mexico also makes El Paso a hub for international trade, with numerous businesses and industries taking advantage of the city’s location to conduct cross-border commerce. With a low unemployment rate and a variety of job opportunities, El Paso is a great place to build your career and achieve your professional goals.

3. Proximity to nature

El Paso is also a great city for outdoor enthusiasts. With its location near the Franklin Mountains, there are a variety of opportunities for hiking, biking, and other outdoor activities. Whether you’re looking for a challenging trail or a leisurely stroll, you’ll find plenty of options in and around El Paso.

4. Arts and culture

If you’re a fan of the arts, you’ll love El Paso. The city is home to a thriving arts and culture scene, with numerous museums, galleries, and theaters throughout the area. Some local favorites include the El Paso Museum of Art, the Flor de Barro Gallery, and the Plaza Theatre.

Whether you’re interested in contemporary art, classic literature, or live theater, you’ll find plenty of opportunities to explore your passions.

5. Friendly community

Finally, one of the best things about living in El Paso is the sense of community. You’ll find that the people here are friendly, welcoming, and supportive. From local events and festivals to neighborhood gatherings, there are plenty of opportunities to connect with your fellow El Pasoans and build lasting relationships.

Cons of living in El Paso

While there are many reasons to love living in El Paso, there are also some potential drawbacks to consider before making the move.

1. Sweltering summers

The extreme desert climate can be a challenge for some people. Summers in El Paso can be scorching hot, with temperatures frequently soaring above 100 degrees Fahrenheit. While the city does have a relatively mild winter season, the summer heat can be difficult to handle, especially for those who aren’t used to it.

2. Lack of public transportation

With a transit score of only 28, another potential downside of living in El Paso is the lack of public transportation options. While the city does have a bus system, it can be difficult to navigate and often runs on limited schedules. This means that owning a car is almost a necessity, which can be expensive and inconvenient for those who prefer to rely on public transportation.

3. Somewhat isolated

El Paso is also a relatively isolated city, with few major cities or attractions nearby. While this can be a pro for those who prefer a quieter, more relaxed lifestyle, it can be a con for those who crave the excitement and variety of a larger urban center.

4. Extreme weather

El Paso can be subject to extreme weather events, such as dust storms, flash floods, and occasional winter storms. While these events are relatively rare, they can be dangerous and disruptive when they do occur. Residents should be prepared to take appropriate safety measures and have contingency plans in place in case of an emergency.

5. Water shortages

Finally, El Paso can be subject to occasional water shortages and drought conditions. The city is located in a desert region, and water resources can be limited, particularly during times of low rainfall. While the city has taken steps to conserve water and manage resources, it’s still important for residents to be mindful of their water usage and take steps to conserve this precious resource.

Final thoughts: Is El Paso a good place to live?

El Paso offers a unique blend of cultures, an affordable cost of living, and outdoor opportunities that make it an attractive place to live. However, there are also potential downsides to consider, such as the extreme desert climate and limited access to certain amenities.

Ultimately, whether or not El Paso is a good place to live will depend on your individual needs and preferences. We hope that this article has helped you weigh the pros and cons of living in El Paso and make an informed decision about whether it’s the right place for you.

Bothell, Washington is a small city located in King and Snohomish counties, in the greater Seattle area. It is a quiet suburban area with a population of approximately 47,000 people. Bothell is known for its high-quality schools, diverse community, and outdoor recreational opportunities. However, like any city, Bothell also has its share of drawbacks that come along with the perks.

In this article, we will take a closer look at the pros and cons of living in Bothell, Washington. So whether you’re buying a home in Bothell, renting an apartment in the city, or still considering making a move to the area, keep reading to help you make an informed decision about whether this city the right place for you.

Pros of living in Bothell:

1. Quality of life

Bothell offers a high quality of life, with excellent public services and amenities, including parks, libraries, and community centers. Additionally, the city has a diverse population, which creates a rich cultural tapestry that residents can enjoy.

2. Outdoor activities

Bothell offers an array of outdoor activities for residents. With its proximity to the Cascade Mountains and the Puget Sound, outdoor enthusiasts can hike or bike through nearby nature trails, go boating or fishing, and enjoy various water sports. Additionally, Bothell has several parks and recreational areas, including the Sammamish River Trail, which offers miles of trails for walking, running, and biking, and the Blyth Park, which features a playground, picnic areas, and a scenic view of the Sammamish River. Bothell is also home to the Burke-Gilman Trail, a popular 27-mile recreational trail that runs through multiple cities and offers scenic views of Lake Washington and Lake Union, making it a favorite spot for runners, cyclists, and walkers.

3. Access to Seattle

Bothell’s location just 20 miles northeast of Seattle provides residents with a multitude of benefits. The short distance between the two cities makes it easy for Bothell residents to access Seattle’s diverse cultural events, world-renowned museums, and excellent restaurants. Seattle’s prestigious universities and thriving economy, including companies in the technology, healthcare, and aerospace sectors, offer Bothell residents ample educational and professional opportunities..

4. Education

Bothell’s commitment to education is a major strength, primarily due to the presence of the highly respected University of Washington Bothell. The university offers a diverse range of undergraduate and graduate programs that prepare students for success in a rapidly evolving job market. Its innovative approach to education emphasizes interdisciplinary studies and experiential learning, creating opportunities for cutting-edge research in areas such as cybersecurity, sustainable energy, and health informatics.

Bothell’s focus on education extends beyond the university, with exceptional public and private schools in the area, including the Northshore School District, which consistently ranks among the best in the state. Overall, Bothell’s emphasis on education provides residents with access to top-notch educational opportunities at all levels and makes it an attractive place to live for families and individuals seeking a stimulating and well-rounded community.

5. Employment opportunities

The greater Seattle area is home to many major corporations, including Amazon, Microsoft, and Boeing, which creates a wealth of job opportunities for Bothell residents. Additionally, Bothell is home to several smaller companies and startups, providing further opportunities for employment.

6. Proximity to nature

Bothell’s abundant natural beauty is one of the city’s most attractive features. Surrounded by lush trees and greenery, Bothell boasts numerous parks and green spaces that provide residents with ample opportunities to explore and connect with the outdoors. The North Creek Forest is a 64-acre urban forest that serves as a vital habitat for wildlife and offers visitors hiking, birdwatching, and nature photography opportunities. Another natural gem in Bothell is the Wayne Golf Course, which has been transformed into a beautiful park and nature reserve with miles of trails, picnic areas, and a creek. Bothell’s commitment to preserving natural resources and creating beautiful and functional public spaces ensures that residents can enjoy the city’s natural beauty for generations to come.

7. Small-Town Feel

Despite being located near a major city, Bothell has a small-town feel with a strong sense of community. The city’s walkable downtown area, locally owned shops, and restaurants create a charming atmosphere that allows residents to connect with their community. Residents can also enjoy local events throughout the year such as the Bothell Farmers Market and the annual Fourth of July parade.

Cons of living in Bothell:

1. High housing costs

Housing costs in Bothell can be expensive. Currently, the median home sale price in Bothell is $875,000, while the national average is only $387,000. That said, rental prices in Bothell are closer to the national average. The average rent for apartments in Bothell is between $1,939 and $2,499, while the national median rent is now $1,937. So if you’re looking to save money on housing, renting an apartment in Bothell might be the way to go.

2. Traffic congestion

Bothell is located near major highways, which can lead to heavy traffic during peak commute times. Additionally, the city’s growing population has led to increased traffic congestion. That said, Bothell has taken steps to address this issue by implementing traffic management strategies, such as improved signal timing and intersection design, as well as developing alternative modes of transportation, such as bike lanes and pedestrian walkways.

3. Rainy weather

One of the potential downsides of living in Bothell is its rainy weather, which can persist throughout much of the year. While some residents appreciate the mild and moderate temperatures that come with the rainy climate, others may find the constant drizzle and gray skies to be a challenge. The rainy weather can limit outdoor activities and make it difficult to enjoy the area’s natural beauty, such as hiking trails and parks. Additionally, the dampness can cause issues with mold and mildew, and the constant need for rain gear and wet-weather driving can be a hassle. However, the rainy weather is also part of the region’s unique character and contributes to its lush greenery and stunning natural landscapes.

4. Lack of nightlife

One potential drawback of living in Bothell is its limited nightlife compared to larger cities like Seattle. While Bothell has a variety of restaurants and bars that offer casual and family-friendly dining options, it may not provide the same level of entertainment or social scene as larger metropolitan areas. Residents seeking more vibrant nightlife or cultural experiences may need to travel to nearby cities, such as Seattle or Bellevue. That being said, Bothell has made strides to provide entertainment options for its residents by hosting community events, such as the summer concert series and the Bothell Beer Festival, and offering recreational activities like bowling and movie theaters.

5. Limited shopping options and cultural attractions

Bothell’s commercial areas are largely centered around the downtown district and are home to a variety of independent shops, boutiques, and restaurants, rather than large shopping centers or malls. While these independent stores offer unique and charming shopping experiences, residents may need to travel outside of Bothell for more extensive shopping needs.

While Bothell offers a variety of community events and recreational activities, it may not provide the same level of museums, art galleries, or theaters as larger metropolitan areas. However, Bothell is located just a short drive away from Seattle, which offers a vibrant cultural scene with numerous museums, galleries, and performance venues.

Nestled in the heart of Maryland lies the historic and picturesque city of Frederick, a community that has been steadily growing in popularity. As with any location, there are both advantages and drawbacks to consider when contemplating a move to this charming city.

In this Redfin article, we’ll explore the benefits and drawbacks of residing in Frederick, so you can make an informed decision about whether this city is the right fit for you. So whether you’re looking at Frederick homes for sale, or just wondering what living in Frederick, MD is like, keep reading to learn more.

Pros of living in Frederick, MD

1. Affordable housing

Frederick has a relatively affordable cost of living compared to other metropolitan areas on the East Coast. The median sale price in Frederick is $403K and the average rent for apartments in Frederick, is between $1,692 and $1,950. While housing prices have risen over the past few years, they remain more reasonable than those found in nearby cities such as Washington, DC, and Baltimore.

2. Community events

Frederick is a vibrant community that offers a wide variety of events and activities throughout the year. One of the most popular annual events is the In The Street festival, which takes place in September and features live music, food vendors, and activities for all ages. The city also hosts the Frederick Festival of the Arts, which showcases the work of local artists and artisans.

Other community events include the Great Frederick Fair, the Frederick Wine Festival, and the Frederick Running Festival, which attracts runners from around the world. With such a diverse range of community events, there is always something to do and see in Frederick.

3. Outdoor recreation

Frederick is home to a variety of outdoor recreation opportunities. The city is surrounded by several state parks and forests, including Cunningham Falls State Park and the Catoctin Mountain Park, which offer hiking, camping, and fishing. The Monocacy National Battlefield, which played a significant role in the Civil War, is also a popular destination for history buffs and nature enthusiasts. Additionally, the city has numerous parks and trails for hiking, biking, and picnicking, including the Baker Park and Carroll Creek Linear Park. The Potomac River is also nearby, offering opportunities for water activities such as kayaking, fishing, and swimming.

4. Education

Frederick has a highly-rated public school system, with several schools ranking among the top in the state. Additionally, there are many private schools, including religious-based schools and alternative education programs, providing families with a variety of choices. The city is also home to various colleges and universities, including Frederick Community College and Hood College. These institutions offer undergraduate and graduate degree programs in a range of disciplines, including business, education, and healthcare. Frederick is also known for its robust adult education and continuing education programs, providing lifelong learning opportunities for community members. With its focus on providing quality education at all levels, Frederick is a great place for families and individuals seeking to enhance their knowledge and skills.

5. Location

Frederick is located in the western part of Maryland, approximately 50 miles northwest of Baltimore and 40 miles west of Washington, DC. The city is situated in the foothills of the Appalachian Mountains, offering scenic views and access to outdoor recreational activities. Frederick is easily accessible by car via several major highways, including Interstate 70 and Interstate 270, and by train through the MARC commuter rail system. Additionally, the city has a regional airport, Frederick Municipal Airport, which offers limited commercial flights and private aviation services. The city’s location provides a perfect balance of small-town charm and access to urban amenities, making it an attractive place to live for individuals and families seeking a high quality of life with easy access to major metropolitan areas.

Cons of living in Frederick, MD

1. Traffic

Traffic in Frederick can be congested during peak travel times, particularly on major roads such as Route 15 and Interstate 70. The city has seen significant population growth in recent years, resulting in increased traffic volume and longer commute times for some residents. The downtown area can also experience heavy traffic, especially during festivals and events. However, the city has implemented several initiatives to improve traffic flow, including expanding public transportation options and implementing smart traffic management systems.

2. Job opportunities

The lack of job opportunities in Frederick can be a significant con for those considering making the city their home. While the city itself boasts a charming atmosphere and a rich historical backdrop, the limited job market can make it challenging for individuals to find stable, well-paying employment that aligns with their skills and career aspirations. This constraint may force residents to seek work in neighboring cities or the Washington, DC, metropolitan area, resulting in longer commutes and potentially higher transportation costs. Moreover, a restricted job market can also impact the local economy, as the reduced spending power of residents can hinder the growth and development of small businesses and community services.

3. Public transportation

Frederick’s public transportation options are limited, leading to a higher reliance on personal vehicles and potentially disadvantaging residents without access to a car, such as seniors, people with disabilities, and low-income individuals. The primary public transportation option in Frederick is the TransIT system, which offers local bus routes within the city and connections to nearby regions. While the TransIT system provides some coverage, it may not be as extensive, frequent, or convenient as the public transportation networks found in larger metropolitan areas.

4. Weather

Weather can be unpredictable and often includes hot summers and cold winters. The city experiences an average of 42 inches of rain and 20 inches of snow per year. Due to its location in the Appalachian Mountains, the city can experience occasional severe weather events, such as tornadoes and severe thunderstorms.

If you’re struggling to afford a home, you’re not alone. In the past five years, home prices have risen by over 60% due to increased demand and a shortage of homes. Rent prices have also increased dramatically year over year — an average of over 8% since 1980 — and recently increased by 20% in 2021. Rising costs of housing combined with high inflation rates have placed a large financial burden for many people. In 2020, 46% of all households had unaffordable rent or mortgage payments, meaning they spent more than 30% of their income on housing.

If you’re looking for an affordable home or just want to learn more, this article is for you. We’ll dive into affordable housing so you can stay informed and find resources you need. Read on to learn about affordable housing, including definitions, history, and how the government manages dozens of policies and programs.

What is affordable housing?

Affordable housing is housing that people can afford for 30% of their income or less, although this definition may be outdated as most people actually spend about 32% of their income on housing. Affordable housing is also colloquially used to refer to specific housing assistance programs.

In the US, there are two primary affordable housing programs: public housing and subsidized housing. Low-income housing is another common term that generally falls under the public housing umbrella, although some governments differentiate them.

Unfortunately, the need for affordable housing is far greater than the number of available homes. For example, the waitlist for a subsidized one-bedroom apartment in King County, WA, is over five years long, meaning many people end up with housing insecurity.

Why affordable housing matters

The majority of people who live in affordable housing are from underrepresented communities, including women with children, immigrants, people of color, the elderly, and people with disabilities. People from all walks of life utilize affordable housing. And, as housing prices continue to outpace wages, leading to a higher cost of living, many middle-income individuals and families also need assistance in expensive coastal metros.

How does affordable housing help?

Affordable housing plays a crucial role by providing a stable and secure home for individuals and families, which can reduce financial stress and create a solid foundation for life.

Affordable housing programs help people transition from housing instability into affordable houses and homes. Homes must be considered safe, decent, and sanitary to qualify as housing. Individual programs and municipalities handle their housing needs differently.

The housing process generally starts with emergency homeless shelters, then moves to transitional housing, public and subsidized housing, and can end with homeownership, although this isn’t right for everyone.

Overview of affordable housing programs

The Department of Housing and Urban Development (HUD) addresses affordable housing under two large umbrellas: public housing and subsidized housing.

Public housing is usually owned by the government, while subsidized housing relies on the private market. HUD provides funds, and individual Public Housing Authorities (PHAs) in every county (and a few territories) manage the programs and cater them to their needs. Some states use different programs as well. For example, Washington State utilizes government-sponsored, volunteer-run Public Development Authorities (PDAs) to work alongside PHAs.

Affordable housing is a complicated mishmash of dozens of definitions, laws, grants, and funds that change from city to city. Many states, cities, and counties also have unique housing laws, and some nonprofit organizations offer solutions and work with individual governments. This fragmented method makes finding affordable homes incredibly difficult, especially for unhoused people.

Who funds affordable housing programs?

HUD funds most programs through The National Housing Trust Fund and the Low-Income Housing Tax Credit (LIHTC). These are the primary resources for building, rehabilitating, and operating affordable housing. The IRS and individual state agencies actually manage and distribute LIHTC funds, but HUD is in charge of related policies.

The HOME program also offers a large amount of funding for building new rental units and permanently affordable houses. There are many federal, state, and local down payment assistance programs for homebuyers, a few of which are included in Redfin home listings.

What about homeownership?

Homeownership can create financial stability and reduce housing inequity. However, it’s not right for everyone. Publicly funded affordable homeownership opportunities are also much harder to find, which is why many nonprofits help fill in the gap.

Some programs use ‘affordable housing’ to refer to both renting and owning, which can be confusing.

To make homeownership affordable, governments and nonprofits help through down payment assistance, low-interest rate loans, first-time homebuyer programs, and property tax relief, among other ways. The HCV Homeownership Program is the primary government housing assistance fund, but it is underfunded.

Take your situation into consideration and do research before searching for affordable homeownership.

Do you qualify for affordable housing?

If you make less than 80% of your municipality’s median income, you can apply for most affordable housing programs. You may also have to complete a background check. Someone who makes less than 30% of the median income is considered extremely low-income and may receive priority. Some forms of affordable housing have different income limits.

Cities and counties determine median incomes, and they vary widely throughout the country. They also change depending on how many people live in a home. For example, if you live in a home with four people, your income limit will be higher compared to a home with two people.

Danny Michael, Founder and CEO of Satori Wealth Management, notes that “Eligibility for housing programs depends on your income, where you live, and any adjustments in income limits as required by HUD.”

How do you apply for affordable housing?

If you’re looking for affordable housing, visit your local Public Housing Authority (PHA) or nonprofit and determine if you qualify. Depending on your income, area, and living situation, you’re usually put on a waiting list. Wait times vary throughout the country, but the average is about 28 months. If you have a family, are unhoused, or currently pay more than 50% of your income toward rent, you can receive priority.

Issues facing affordable housing

Affordable housing programs are strained and often can’t serve everyone who needs help. This can make it extremely hard to find a home.

There are three main issues that affect affordable housing: funding, zoning, and availability. Let’s break these down.

Is there enough funding for affordable housing?

Federal government funding for affordable housing programs has been inconsistent for decades, generally trending downward since the 1990s. Before 2022, the only increases went to Section 8 housing programs, while the largest cuts came from public housing and related funds. However, since 2022, funding has risen across the board. Individual cities and states can set their own budgets alongside the money they receive from HUD, but that usually falls short of what’s needed.

There also aren’t enough homes to go around, as Jacob Millican from 9M Investments points out: “There has been nearly 15 years of underbuilding in single-family and multifamily homes,” he says. “With a surge in new homebuyers coming into home-buying age, this has been a perfect storm causing rising home and rental prices.”

Brian Reilly from BankBound notes that there are many down payment assistance programs that can help make homeownership more affordable. “Local financial institutions are also a great resource for buyers that need help finding the right program for their individual needs,” he says.

How does zoning impact affordable housing?

Restrictive zoning laws are a method many municipalities use to exclude low-income renters and owners from certain areas. They also play a large role in where governments choose to build affordable housing.

Historically, public housing communities were commonly built on top of older metropolitan neighborhoods. These communities were intentionally segregated, with white affordable housing communities receiving more care and maintenance than other communities. Intentional housing segregation continued until the passage of the Fair Housing Act of 1968 (as part of the Civil Rights Act). However, while overt segregation became illegal, other methods popped up, including exclusionary zoning laws.

Are there enough homes for low-income renters?

There is a massive backlog of affordable housing across the country, topping 7 million in 2021. This shortage is systemic and affects every state and metropolitan area. In fact, no single county in the US meets its low-income housing needs, affecting every facet of the system, including public, subsidized, and Section 8 housing.

Another example is Section 8 vouchers. Even though Section 8 receives the most funding, vouchers routinely fall short of demand, typically by hundreds of thousands. In fact, when demand reaches a certain threshold, a PHA may permanently close its waitlist because it can’t assist people within a certain number of years.

Expert advice: property managers can be a good resource

Kathleen Richards from PM Made Easy suggests talking with a property manager. “Many property managers are at the forefront of the affordable housing crisis. They are often knowledgeable on Fair Housing laws, voucher programs, rent control, and local ordinances. It may be a good idea to rent from or talk with a verified professional property manager or management company.”

Affordable housing solutions

Affordable housing in the US is hard to find, hard to understand, and dwindling in most areas of the country. So, what are solutions to help people in need?

A well-funded, accessible, inclusive public housing program is often considered the most comprehensive long-term solution. However, in the short term, “we need more drastic measures that will incentivize developers to build more affordable housing,” says Jane Mepham, CFP® and founder of Elgon Financial Advisors.

Here are a few more steps we can take:

- Make housing a human right.

- Protect the National Housing Trust Fund: Investing in government funding helps fix uninhabitable public housing and build new developments.

- Expand financial incentives for the private market: In the short term, the private market is essential to address critical home shortages for the most vulnerable. This is not a long-term solution, as private market options can’t serve everyone.

- Fund down payment assistance programs: This can help move people from renting to owning if they desire it, closing the homeownership gap. It’s especially important for women with children, homeowners of color, immigrants, and people with disabilities.

- Pair housing support with education and other stability resources: Bad housing conditions and poor health are tied together. Education, health care, and food are key to helping people long-term.

- Evaluate and zoning laws: Zoning policies are a big reason affordable housing is inequitable and in short supply. Inclusive zoning laws are necessary to reverse systemic inequities.

- Ensure disaster recovery efforts are equitable and fair: Many public homes are at an increased risk of natural disasters and are not equipped with adequate protection from the weather. For example, “if you’re a Florida homeowner with limited financial resources, a hurricane or tropical storm can be impossible to recover from,” says Steven Venook from Advocate Claims Public Adjusters. “A disaster claim may determine if you can afford to stay in your home.” Climate upgrades are a part of HUD’s 2022 budget, but additional investments are necessary.

Final thoughts on affordable housing

Affordable housing is housing that people can afford without spending more than 30% of their income. The term also refers to government housing assistance programs, the two largest of which are public housing and subsidized housing. Section 8 (The Housing Choice Voucher Program) is the most popular subsidized program that receives the most public funding.

If you make less than 80% of their municipality’s median income, you can apply for most housing assistance. However, because of chronic underfunding and a lack of policy changes, there aren’t nearly enough affordable homes for those who need them. Those that are available are often overcrowded, uninhabitable, or rundown.

Without intervention, affordable housing in the U.S. will likely continue focusing on temporary private market rental solutions, leaving many underserved. More funding and a societal shift away from systemic housing equality is necessary to provide housing to everyone who needs it.

Affordable housing resources

Finding affordable housing can be extremely difficult. Here are resources to help:

- To learn how to apply for affordable housing, click here

- To learn how to apply for affordable homeownership, click here

- To learn about nonprofit programs, click here or here

- To learn about resources in your area, click here

Housing affordability in Australia has been at near-crisis levels for years now, and this continues to be the case in some locations, despite modest falls in booming markets such as Sydney and Melbourne over the past six months. Younger people and higher-income earners may find it especially frustrating that they can’t gain a foothold in the property market, despite employment stability and good credit history, simply because they can’t save up a deposit.

Common issues like these are inspiring some to turn to other solutions, such as rent-to-own home schemes.

How to spot rent-to-own scams

Rent-to-own home schemes, also called rent-to-buy schemes, may seem like a great idea, especially if you’ve been unsuccessful in obtaining a home loan through more conventional channels and you’re sick of renting, which can seem like throwing money down the drain. A rent-to-own contract can also help you pin down a price in a period of rapidly rising real estate.

So, what could possibly go wrong? You probably don’t need to apply Murphy’s Law to most real estate transactions but rent-to-own schemes may just be the exception.

Familiarise yourself with common rent-to-own red flags

First and foremost, there is a minefield of scams out there designed to separate you from your hard-earned cash. Differentiating legitimate solutions from fake ones may be difficult if you’re unprepared.

There are several types of rent-to-own scams, like the one where scammers try to sell you a property they don’t actually own. This usually involves the scammers finding a vacant house then listing it for rent with the promise of a sale and taking upfront fees or some type of non-refundable deposit from the unsuspecting renter/buyer.

Watch out for predatory pricing models

But, even if the seller does own the home, the deal can be a very poor one because of the condition of the property, the house could be in the midst of foreclosure, or the seller may simply be asking for way above the market value.

Additionally, legitimate operators are also known to follow predatory pricing models similar to those found in the US. Some providers will shamelessly charge up to twice the average rate for rent for the rental period of the contract. [1]

» MORE: Should you buy or rent?

Steps you can take to minimise risk

Rent-to-own schemes are relatively new in the Australian marketplace and are touted as a realistic alternative to getting into the property market without the need for a deposit. If you’re considering a rent-to-own scheme, make sure you take steps to minimise the risk.

Make sure the price is fair

With rent-to-own schemes, there are two main elements the buyer needs to be aware of — the rent being charged over the rental period and the cost of the property (the agreed-on sale price).

With regards to rent, it’s easy to see what the average price is in your area and to find similar properties online for comparison. Likewise, with the asking price, it’s easy to tell if you’re being ripped off right at the outset of the process.

Establish the legitimacy of the seller

Once you’ve been given a price and had a building inspection to ensure there are no nasty, hidden surprises, you’ll need to establish the legitimacy of the seller beyond a reasonable doubt. This should be a fairly straightforward process because legitimate financial companies have websites and a plethora of other information about them available.

For peace of mind, using one of the larger providers might be better. Your solicitor should also obtain a title report that ensures that the seller is the owner and can legally sell the property to you well before you sign any contract.

Crunch the numbers

Before you even get to the contract stage, however, you’ll need to do some serious number crunching to see how much that $500,000 property you’re buying in three years is really going to cost you. After factoring in a potentially oversized rental commitment and a raft of other fees and charges, that $500k property ends up costing you more than $650,000, for example.

Thoroughly review the contract with a solicitor

Unfortunately, because the market here is so new, what is contained in contracts is still somewhat of a legal grey area.

A 2016 study by the Victorian Consumer Action Law Centre[2] couldn’t identify a single successful case of a rent-to-buy scheme.

The report stated that the contracts often made it nearly impossible for the buyer to make the repayments and that the risks associated with these schemes far outweighed any rewards.

In 2019, the Victorian government enacted laws prohibiting some of the more predatory behaviour associated with these contracts to protect buyers from price gouging and scams. The rule changes prohibit certain rent-to-buy arrangements, with significant penalties for vendors and third-party intermediaries to act as a deterrent, according to Consumer Affairs Victoria[3].

Rent-to-own contracts can still contain nasty surprises though, such as the harsh penalties for late payments, and in some cases even the voiding of the contract, meaning you lose everything you’ve invested up to that point if you miss a single payment for whatever reason.

Make sure you go over the contract thoroughly with a solicitor who understands the nature of these contracts and preferably some type of property expert who would be able to spot any hidden surprises.

Know your rights and what to do if you get scammed

You should also familiarise yourself with your rent-to-own legal protections and what rights you have if you have been scammed.

Information about your legal rights and options is available on the Australian Competition and Consumer Commission’s Scamwatch website, including how to report an incident and get help.

Additionally, if you think you may be a victim of a rental scam, you should talk to your bank and the police as quickly as possible and contact your state’s Consumer Protection office, like Fair Trading in NSW.

DIVE EVEN DEEPER

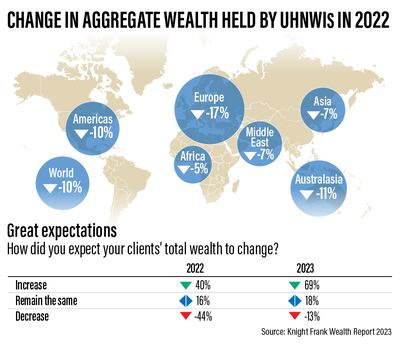

The world’s ultra-wealthy people shed a combined $10 trillion, or 10 per cent, from their net worth in 2022, driven by the triple “shock” of global economic uncertainty, the energy crisis and the war in Ukraine, a report by property consultancy Knight Frank has said.

The super-rich in Europe were at the centre of the crisis, with ultra-high-net-worth individuals (UHNWIs) losing an average of 17 per cent from their fortunes, Knight Frank said in The Wealth Report 2023 on Wednesday.

Knight Frank defines UHNWIs as people who possess a net worth of $30 million or more, including primary residences and second homes not held as investments.

“Last year, the Ukraine crisis fuelled the European energy crunch and supercharged already surging inflation,” Liam Bailey, Knight Frank’s global head of research, said in the report.

“As a result, 2022 saw one of the sharpest upwards movements in global interest rates in history, leading to economic conditions which Collins English Dictionary neatly dubbed the ‘permacrisis’.”

Global economic uncertainty — compounded by the Russia-Ukraine war, high inflation and rising interest rates — has stoked volatility in global financial markets, which fell into bear territory in 2022 after a 13-year bull run.

Central banks around the world have been increasing interest rates to rein in inflation.

The US Federal Reserve has increased its benchmark rates eight times since March 2022 to bring inflation down from 40-year highs to a target range of 2 per cent.

In January, the International Monetary Fund raised its estimate for global economic growth in 2023 by 0.2 percentage points from its October forecast.

Growth is now estimated at 2.9 per cent for the year, following a 3.4 per cent expansion in 2022.

Although 40 per cent of UHNWIs saw their wealth increase in 2022, the overwhelming trend was negative for the world’s super-rich, driven by a change in residential and commercial property values, fixed income, investments of passion and other assets, Knight Frank said.

“The fall in wealth is unsurprising, given the dramatic pivot in monetary policy that culminated in the worst performance for the traditional blended portfolio since the 1930s,” it said.

While Europe had the largest decline in wealth in 2022, the Australasia region recorded an 11 per cent drop and the Americas 10 per cent. In comparison, Africa experienced the smallest decline with 5 per cent, followed by Asia and the Middle East at 7 per cent.

However, 69 per cent of wealthy investors surveyed by Knight Frank expect to grow their portfolios this year, with confidence driven by asset repricing, perceived value opportunities and an expected economic rebound.

About 33 per cent of respondents said their main goal in 2023 was capital appreciation and 25 per cent are focused on wealth preservation.

High-net-worth individuals (HNWIs) — defined as someone with a net worth of $1 million or more, including their primary residence — in the Asia-Pacific region are more optimistic about growth, while wealth preservation is the top goal in Europe and the US as interest rates take their toll on the economy.

“Expect increases in investment allocations, with almost a third of investors looking at property investments to provide an inflation hedge and diversification,” Knight Frank said.

“A cautious approach will see 29 per cent of investors reduce debt volumes.”

Meanwhile, an “ironic legacy” of the pandemic has been a surge in the desire for mobility, with 13 per cent of UHNWIs saying they plan to acquire a second passport or citizenship.

The boom in so-called digital nomads is only just starting — promising disruption to outbound countries, destination markets, tax systems, residential rental demand and office requirements

Knight Frank

Singapore and Dubai are also expected to grow rapidly as wealth centres, the report found.

In a separate survey by Henley & Partners last September, Dubai was ranked the 23rd-most popular city in the world for ultra-wealthy residents.

The city’s population of HNWIs rose to 67,900, up from 54,000 in June last year, while the number of billionaires increased from one to 13 in 2022 and that of multimillionaires jumped to 3,170 from 2,480, Henley & Partners, which tracks private wealth and investment migration trends worldwide, said.

In recent years, the UAE, the Arab world’s second-largest economy, has undertaken several economic, legal and social reforms to strengthen its business environment, increase foreign direct investment, attract skilled workers with new visas and provide incentives to companies to set up or expand their operations.

In 2019, amendments were introduced to the 10-year golden residency initiative to simplify the eligibility criteria and expand the categories of beneficiaries.

The UAE also introduced a one-year digital nomad visa in March 2021 that allows people to live in the Emirates while continuing to work for employers in their home countries.

“The boom in so-called digital nomads is only just starting — promising disruption to outbound countries, destination markets, tax systems, residential rental demand and office requirements,” Knight Frank said.

Updated: March 01, 2023, 8:42 AM