Located 60 miles east of Los Angeles is the historic city of Riverside. Home to 24 nationally registered historic sites and 100 city landmarks, Riverside was built around the citrus industry and is known for its sweet and zesty navel oranges. Riverside’s affordability, growing economy, temperate weather, scenic hills and valleys, and enviable location between the beach and the mountains make it a great place to live.

That said, buying a home or renting an apartment in Riverside isn’t for everyone. Luckily, there are numerous cities near Riverside that may better fit your budget and needs. Keep reading to see if one of these cities is right for you.

#1: Rialto, CA

Miles from Riverside: 10

Population: 104,000

Median home sale price: $565,000

Average 1-bed rent: $1,700

Walk Score: 41

Bike Score: 27

Transit Score: 43

Rialto is a small city located in the heart of Southern California’s Inland Empire. The town is nestled at the base of the San Bernardino Mountains and is west of the city of San Bernardino. Rialto offers the charm and community of a small town along with the convenience of suburban life.

There are a ton of activities and amenities in Rialto to keep residents busy. Downtown Rialto is located on Riverside Avenue and is home to a variety of eateries, shops, and businesses. The Heritage Trail is perfect for a walk or bike ride and if you’re interested in the area’s history, be sure to check out the Rialto Historical Society Museum.

Homes for sale in Rialto, CA

Apartments for rent in Rialto, CA

#2: Colton, CA

Miles from Riverside: 10

Population: 54,500

Median home sale price: $447,500

Average 1-bed rent: $1,863

Walk Score: 43

Bike Score: 26

Transit Score: 45

Nestled against the scenic San Gorgonio Mountains is the city of Colton, which encompasses approximately 18 square miles. Colton is known as the “Hub City” because it is a popular center for new business and employment opportunities in the Inland Empire area.

There is a lot to do for residents living in Colton. Here are just a few ideas: spend the day at the Colton Community Center, where you can swim, play tennis, and work out in the gym; play a round of golf at the Colton Golf Club. Shop at the Colton Plaza Shopping Center.; take a walk or bike ride through Heritage Park; go fishing at Cajon Lake. Visit the Perris Hill Park Observatory; attend a performance at the Fox Performing Arts Center; or have a picnic at Sycamore Canyon Park. The city also hosts many festivals and events throughout the year, including the Inland Empire Greek Fest on the Hill.

Homes for sale in Colton, CA

Apartments for rent in Colton, CA

#3: Moreno Valley, CA

Miles from Riverside: 11

Population: 209,000

Median home sale price: $540,000

Average 1-bed rent: $2,102

Walk Score: 33

Bike Score: 26

Transit Score: 37

Moreno Valley is a relatively young city, only beginning to develop in the 1980s. It is now the second largest city in Riverside County. Moreno Valley is full of gorgeous outdoor attractions in this part of California, such as stunning lakes and mountains. In fact, one of the highlights of the city is the towering Box Springs Mountain, which can be seen virtually anywhere within the city.

There are plenty of activities to do while living in Moreno Valley. You can visit the March Air Reserve Base, go shopping at the Moreno Valley Mall, go hiking or camping at Box Springs Mountain Reserve, play golf at Sycamore Canyon Golf Course, see a movie at Moreno Valley Stadium 14, visit the Riverside County Fairgrounds, or go fishing at Lake Perris.

Homes for sale in Moreno Valley, CA

Apartments for rent in Moreno Valley, CA

#4: San Bernadino, CA

Miles from Riverside: 12

Population: 217,000

Median home sale price: $480,000

Average 1-bed rent: $1,625

Walk Score: 45

Bike Score: 31

Transit Score: 44

San Bernardino is the second largest city in the Inland Empire region. San Bernardino is most famous for its connection to Route 66, one of the most iconic roads in the world. The city is so indebted to the road that there is an annual festival held in its honor. However, Route 66 is not the only thing happening in San Bernardino. The city is also blessed with an abundance of natural beauty. It sits at the base of the Southern California mountain ranges and is also close to the Mojave Desert.

There are many activities to do in San Bernardino, CA. For example, residents can visit the San Bernardino Zoo, go on a tour of California State University, or explore the city’s many museums. There are also several parks and recreation areas in the city, such as the San Bernardino National Forest, which offer a variety of outdoor activities.

Homes for sale in San Bernadino, CA

Apartments for rent in San Bernadino, CA

#5: Fontana, CA

Miles from Riverside: 12

Population: 213,000

Median home sale price: $600,000

Average 1-bed rent: $1,537

Walk Score: 37

Bike Score: 27

Transit Score: 41

Fontana is a great city to call home. It is conveniently located near mountain resorts like Big Bear, Lake Arrowhead, and Mountain High. Plus, the California Speedway – which hosts several small races in addition to two NASCAR races every year – is located in Fontana. Fontana also has a strong industrial presence, with companies such as Coca-Cola, Pepsi, and Nestle having bottling plants in the city.

If you decide to move to Fontana, there are plenty of activities and amenities to keep you entertained. You can go hiking in the San Bernardino Mountains, fishing in the Fontana Reservoir, and horseback riding in one of the many parks. You can also visit the Heritage House Museum or the Auto Club Speedway.

Homes for sale in Fontana, CA

Apartments for rent in Fontana, CA

#6: Redlands, CA

Miles from Riverside: 15

Population: 72,000

Median home sale price: $603,500

Average 1-bed rent: $2,025

Walk Score: 40

Transit Score: 53

Redlands is a city in Southern California near San Bernardino. The city is known for its beautifully preserved historic buildings from the 1800s. Redlands, CA, is a great place to live if you’re looking for quick and easy access to San Bernardino International Airport and Norton Air Force Base. The schools in the area are also top-notch, with the University of Redlands and the University of California San Bernardino being close by.

There are plenty of activities to do in Redlands. Top attractions in the city include the Kimberly Crest House & Gardens, the Redlands Bowl amphitheater from the 1920s, and the San Bernardino County Museum. No matter your interests, you’re sure to find something to do while living in Redlands.

Homes for sale in Redlands, CA

Apartments for rent in Redlands, CA

#7: Corona, CA

Miles from Riverside: 15

Population: 168,000

Median home sale price: $756,000

Average 1-bed rent: $2,422

Walk Score: 39

Bike Score: 19

Transit Score: 35

The city of Corona offers residents a diverse landscape, from bustling retail centers to unspoiled natural beauty. Its convenient location provides easy access to both the Inland Empire and Orange County. Add to that the abundance of Spanish-style homes and excellent public schools, and it’s no wonder Corona is a popular choice for Californians.

There are a lot of activities for residents living in Corona. The Santa Ana Zoo, Corona Heritage Park, the Corona Public Library, Corona Lake, the Fender Museum, and the Corona Farmers Market are all great places to explore.

Homes for sale in Corona, CA

Apartments for rent in Corona, CA

#8: Highland, CA

Miles from Riverside: 19

Population: 55,500

Median home sale price: $572,500

Average 1-bed rent: $1,662

Walk Score: 35

Bike Score: 26

Transit Score: 36

The city of Highland is located in the Inland Empire of Southern California, nestled against the beautiful San Bernardino Mountains at 1,300 feet. Highland is primarily a residential community and offers a full range of affordable housing options.

With easy access to many parks, hiking trails, restaurants, and shopping areas, Highland is a great place to call home. The Highland Citrus Harvest Festival and the San Bernardino County Fair are just two of the many festivals and events that take place in Highland throughout the year.

Homes for sale in Highland, CA

Apartments for rent in Highland, CA

#9: Perris, CA

Miles from Riverside: 19

Population: 78,000

Median home sale price: $509,000

Average 1-bed rent: $725

Walk Score: 24

Transit Score: 33

With a population of just 78,000, Perris is a small city located in the Perris Valley area of Riverside County. Although it is technically a suburb of the larger city of Riverside, Perris has a much more relaxed and spacious feel to it, making it perfect for outdoor activities and a laid-back lifestyle. The city is also home to beautiful Lake Perris and enjoys a pleasant climate with hot summers and short, mild winters.

Perris is full of interesting attractions and amenities for residents to enjoy. If you love trains and all things related to them, you’ll be impressed by the Orange Empire Railway Museum. It has the West’s largest collection of railway artifacts, some dating back to the 1870s. For outdoor enthusiasts, quick access to recreational destinations like Lake Perris State Recreation Area, Lakeview Hot Springs, Mount San Jacinto State Park, and San Bernardino National Forest is a real treat.

Homes for sale in Perris, CA

Apartments for rent in Perris, CA

#10: Rancho Cucamonga, CA

Miles from Riverside: 20

Population: 178,000

Median home sale price: $721,250

Average 1-bed rent: $2,312

Walk Score: 41

Bike Score: 22

Transit Score: 45

Known for being a city on historic Route 66, Rancho Cucamonga is located in Southern California, just south of the foothills of the San Gabriel Mountains. The area was originally inhabited by the Kukamongan Native Americans, who established a village settlement near present-day Red Hill. The name “Cucamonga” comes from a Native American word meaning “sandy place.”

There are plenty of activities to do while living in Rancho Cucamonga. For outdoor enthusiasts, there are hiking and biking trails galore. For the more laid-back visitors, take a stroll through the many shopping centers and enjoy a meal at one of the delicious restaurants. If you’re looking for some fun for the whole family, check out the Rancho Cucamonga Epicenter, which has an outdoor amphitheater, a movie theater, and plenty of shops and restaurants.

Homes for sale in Rancho Cucamonga, CA

Apartments for rent in Rancho Cucamonga, CA

#11: Ontario, CA

Miles from Riverside: 21

Population: 178,000

Median home sale price: $630,000

Average 1-bed rent: $2,200

Walk Score: 48

Bike Score: 23

Transit Score: 46

Ontario, California, is a suburban city with a laid-back atmosphere and lifestyle. There are plenty of things to do in Ontario. For starters, you can visit the Ontario Mills Mall, one of the largest shopping malls in the Inland Empire. There’s also the Citizens Business Bank Arena, where you can catch a hockey game or concert. And if you’re looking for something more outdoorsy, you can head to Cucamonga-Guasti Regional Park or the Chaffey Trail.

Homes for sale in Ontario, CA

Apartments for rent in Ontario, CA

#12: Upland, CA

Miles from Riverside: 23

Population: 77,500

Median home sale price: $749,000

Average 1-bed rent: $2,092

Walk Score: 48

Bike Score: 21

Transit Score: 47

Upland is a wonderful place to live in Southern California because of its stunning scenery and rich history. The city was established in 1906 by George and William Chaffey, and it has become a thriving community in the Inland Empire region. Upland is home to the world’s oldest and largest aircraft salvage facility, Aircraft Accessories & Instruments, and the annual Upland Lemon Festival. The city is also known for its gorgeous parks and trails, making it a great place to enjoy the outdoors.

The city is home to the University of La Verne and the Chaffey College Upland Campus. There are also several parks and recreation areas, including the Upland Sports Arena, the Upland Memorial Park, and the Mt. Baldy Ski Area. There’s something for everyone living in Upland.

Homes for sale in Upland, CA

Apartments for rent in Upland, CA

Methodology: All cities must have a population of more than 50,000 and be less than 50 miles away from Riverside. Median home sale price data from the Redfin Data Center during August 2022. Average rental data from Rent.com during August 2022. Walk Score, Bike Score, and Transit Score from Walkscore.com during August 2022. Population data sourced from the United States Census Bureau.

Anaheim, California, which is located in Orange County, is best known for its family-friendly attractions like Disneyland Resort, as well as its sports teams, the Angels and the Ducks. Anaheim offers its residents a good mixture of urban and suburban living and a wide range of neighborhoods. The city is located near many attractions, green spaces, and cultural activities that make the city such a fast-growing area.

However, renting an apartment or buying a home in Anaheim isn’t going to be for everyone. Fortunately, there are lots of awesome places to live near Anaheim that don’t have the same traffic, tourists, and city noise. To help you find the right place to buy or rent in, Redfin has gathered a list of 10 great cities near Anaheim to consider instead. Let’s get started.

#1: Placentia, CA

Miles from Anaheim: 5

Population: 52,000

Median home sale price: $830,000

Average 1-bed rent: $2,130

Walk Score: 50

Bike Score: 29

Transit Score: 46

One of the smallest cities in Orange County, Placentia is most well known as the location of the original planting of the county’s cash crop, Valencia oranges. Derived from a Latin word meaning “pleasant place to live,” the city of Placentia lives up to its name.

There are plenty of things to do in Placentia, CA. Visitors can explore George Key Ranch Historic Park, stroll down Main Street, visit the Muckenthaler Cultural Center, play a round of golf at Alta Vista Country Club, take a hike or bike ride through Craig Regional Park, enjoy a meal at one of Placentia’s delicious restaurants, and or catch a movie at Krikorian Premiere Theatres.

Homes for sale in Placentia, CA

Apartments for rent in Placentia, CA

#2: Garden Grove, CA

Miles from Anaheim: 6

Population: 173,000

Median home sale price: $855,000

Average 1-bed rent: $2,201

Walk Score: 62

Bike Score: 36

Transit Score: 58

Garden Grove is a vibrant Southern California city situated just on the other side of Anaheim’s Harbor Boulevard. With nearly 173,000 residents, it is today the fifth largest city in Orange County. One of the City’s biggest claims to fame is the annual Strawberry Festival, which debuted in 1958. The Strawberry Festival is the second largest community-sponsored event in the western U.S., second only to the Rose Parade. The festival features a star-studded parade and the world’s largest strawberry shortcake.

There are many things to do for those living in Garden Grove. You can visit the Garden Grove Historical Museum, attend a concert at the Garden Grove Amphitheater, shop at the Garden Grove Farmers Market, play at the Garden Grove Sports Complex, visit the Garden Grove Regional Library, hike or bike the Garden Grove trails, spend a day at the Garden Grove Community Center, or enjoy a meal at one of Garden Grove’s many restaurants.

Homes for sale in Garden Grove, CA

Apartments for rent in Garden Grove, CA

#3: Orange, CA

Miles from Anaheim: 7

Population: 139,500

Median home sale price: $950,000

Average 1-bed rent: $1,940

Walk Score: 51

Bike Score: 32

Transit Score: 53

Orange is a small city located in Southern California, about 30 miles from Los Angeles and just 7 miles from Anaheim. The city is home to about 140, 000 people and is known for its historic Old Towne district, which is filled with quaint shops and restaurants. Orange is also home to Chapman University, a private university with about 8,000 students.

Orange, CA, is a great place to live with a wide variety of activities to enjoy. From dining at delicious restaurants to visiting one of the many parks, you’ll never be bored. Hilbert Museum of California Art, Victorian Bridal Museum, and Mission Arts Center are just a few of the city’s five museums. Performing arts venues like Waltmar Theatre and Pot O’ Gold Studios are top spots amongst locals. There are many parks and green spaces within the city, including Irvine Regional Park, Santiago Oaks Regional Park, and Peters Canyon Regional Park. There’s something for everyone living in Orange.

Homes for sale in Orange, CA

Apartments for rent in Orange, CA

#4: Buena Park, CA

Miles from Anaheim: 7

Population: 82,500

Median home sale price: $845,000

Average 1-bed rent: $1,675

Walk Score: 57

Bike Score: 36

Transit Score: 54

Buena Park is located in northwest Orange County and is referred to locally as the “Center of the Southland” due to its easy access to both the 91 and 5 freeways. Buena Park was once an agricultural area overflowing with dairy farms, orange groves, and berry fields. Today it is home to some of Southern California’s most popular attractions. It is minutes from Disneyland, award-winning beaches, and Los Angeles landmarks.

There are plenty of things to do in Buena Park, CA. You can visit Knott’s Berry Farm, go to Medieval Times, take a ride on the Buena Park Historic Train, check out Ripley’s Believe It or Not! Museum, and so much more.

Homes for sale in Buena Park, CA

Apartments for rent in Buena Park, CA

#5: Yorba Linda, CA

Miles from Anaheim: 10

Population: 68,000

Median home sale price: $1,275,000

Average 1-bed rent: $1,550

Walk Score: 28

Transit Score: 34

Yorba Linda, CA, is located in north Orange County and is most famously known for being the birthplace of Richard Nixon. With 68, 000 residents, those living in Yorba experience the accessibility of urban amenities while also enjoying a strong sense of community and small-town charm. The city features 100 miles of multi-purpose trails, and beautiful beaches are only a short drive away.

Living in Yorba Linda means you’ll be surrounded by delicious restaurants, many parks, countless museums, performing arts centers, and local galleries. Some of the museums you can visit include The Richard Nixon Library and Museum, Yorba Linda Heritage Museum & Historical Society, and Susanna Bixby Bryant Museum & Botanic Garden. With Box Canyon Park, Veterans Park, and Jessamyn Park, there are lots of parks where you can spend a relaxing evening. There are a variety of unique eateries and restaurants that appeal to every palette in Yorba Linda,.

Homes for sale in Yorba Linda, CA

Apartments for rent in Yorba Linda, CA

#6: Tustin, CA

Miles from Anaheim: 10

Population: 81,000

Median home sale price: $830,000

Average 1-bed rent: $2,947

Walk Score: 51

Bike Score: 32

Transit Score: 59

Tustin is a small city located in Orange County, California. The city has a population of about 81,000 people and is known for its tree-lined streets and family-friendly atmosphere. The city is also home to many schools, including Tustin High School, which is one of the top-rated public schools in the state of California.

There are many things to do for those living in Tustin. You can visit Tustin Ranch Golf Club, play at Tustin Legacy Park, shop at The District at Tustin Legacy, or dine at one of Tustin’s many restaurants. You can also visit the Tustin Museum, attend a community event, or go for a hike or bike ride on one of Tustin’s many trails.

Homes for sale in Tustin, CA

Apartments for rent in Tustin, CA

#7: Cypress, CA

Miles from Anaheim: 12

Population: 50,000

Median home sale price: $825,000

Average 1-bed rent: $1,905

Walk Score: 53

Bike Score: 30

Transit Score: 61

Cypress, California, is an ideal location for those who want to be close to the beach and the region’s best amusement parks. The city is situated just eight miles west of Anaheim, 25 miles southeast of Los Angeles, and about 15 miles northeast of Long Beach and other nearby sandy shorelines.

If you’re considering moving to Cypress, know that this city has plenty to offer. From nature parks to stellar restaurants and a thriving arts and culture scene, there’s something for everyone in Cypress. The city is also home to the Los Alamitos Race Course, and Adventure City and the famous Knott’s Berry Farm are just a few miles outside of town.

Homes for sale in Cypress, CA

Apartments for rent in Cypress, CA

#8: Westminster, CA

Miles from Anaheim: 13

Population: 91,000

Median home sale price: $900,500

Average 1-bed rent: $1,774

Walk Score: 65

Transit Score: 58

Westminster, CA, is a vibrant and culturally diverse city located a few miles from the shore of the Pacific Ocean. It has access to interstate highways, so residents can easily travel to and from neighboring cities.

If you’re living in Westminster, you may be curious about what to do in your free time. Westminster offers a lot, from nature parks to stellar restaurants and an up-and-coming arts and culture scene. Popular museums in the city include the Donut Life Museum and Westminster Museum, both of which are frequented by tourists and locals alike. Rose Center Theater is among the many performing arts venues you can also check out. If you are looking to spend a day in a city park, pay a visit to Bolsa Chica Park, Elden F. Gillespie Park, or Russell C. Paris Park, where you can spend a day relaxing in the sun.

Homes for sale in Westminster, CA

Apartments for rent in Westminster, CA

#9: Newport Beach, CA

Miles from Anaheim: 20

Population: 87,000

Median home sale price: $3,800,000 </span

Average 1-bed rent: $3,427

Walk Score: 49

Bike Score: 27

Transit Score: 53

The City of Newport Beach is located in the coastal center of Orange County and surrounds Newport Bay, which is home to approximately 4,300 boats of all types. The bay area and the city’s eight miles of ocean beach offer outstanding fishing, swimming, surfing, and other aquatic sports activities. The city is also known for its many high-end shopping and dining options.

There are many things to do while living in Newport Beach. You can visit the Balboa Island Ferry, walk along the boardwalk, visit the Newport Beach Pier, shop at Fashion Island, visit the ExplorOcean Aquarium, take a ride on the Balboa Pavilion Wheel, play mini golf at Boomers, or go on a whale watching tour. The options are endless – there’s truly something for everyone living in Newport Beach.

Homes for sale in Newport Beach, CA

Apartments for rent in Newport Beach, CA

#10: Glendale, CA

Miles from Anaheim: 34

Population: 199,500

Median home sale price: $1,132,500

Average 1-bed rent: $3,001

Walk Score: 71

Bike Score: 45

Transit Score: 52

Glendale is a suburb of Los Angeles that is located where the eastern end of the San Fernando Valley and the western end of the San Gabriel Valley meet.

There are plenty of things to do in Glendale, CA. For starters, you can check out the Americana at Brand, which is a large outdoor shopping mall. You can also explore the Glendale Galleria, another popular shopping destination. If you’re looking for something a little more low-key, you can stroll through one of the city’s many parks, such as Verdugo Park or Glendale Central Park. You’ll find plenty of restaurants and up-and-coming eateries throughout Glendale as well.

Homes for sale in Glendale, CA

Apartments for rent in Glendale, CA

Methodology: All cities must have a population of more than 50,000 and be less than 50 miles away from Anaheim. Median home sale price data from the Redfin Data Center during August 2022. Average rental data from Rent.com during August 2022. Walk Score, Bike Score, and Transit Score from Walkscore.com during August 2022. Population data sourced from the United States Census Bureau.

Fort Worth, TX, is one of the country’s largest and fastest-growing metropolitan areas. It’s the fifth largest city in Texas and the 12th largest city in the US. The city is known for its Texas hospitality and is filled with culture and fun. Fort Worth is a great place to live, work, and play, no matter your interests or hobbies.

Even though there are countless things to do in Fort Worth, you may not want to commit to buying or renting in the city. Luckily, there are many cities near Fort Worth that may better fit your budget and needs. And, not to mention, keep you within commuting distance of Fort Worth.

We’ve made a list of 9 cities near Fort Worth to consider buying a house or renting an apartment in this year.

#1: Arlington, TX

Miles from Fort Worth: 15

Population: 397,500

Median home sale price: $353,000

Average 1-bed rent: $1,072

Walk Score: 38

Bike Score: 0

Transit Score: 40

Arlington is one of the great cities near Fort Worth that you may want to consider moving to. Home to Globe Life Field and AT&T Stadium, you can watch the Texas Rangers and the Dallas Cowboys game, respectively. The University of Texas at Arlington, a major research university, and the Arlington Museum of Art are other hallmarks of the city.

If you’re living in Arlington, there is plenty to keep you busy. From fun attractions, such as Six Flags Over Texas and Hurricane Harbor, to visiting the Arlington Museum of Art, you’ll always find an exciting adventure. Arlington has many parks and recreation facilities, including River Legacy Parks, Virginia Hills Park, and Arlington Sports Park.

Homes for sale in Arlington, TX

Apartments for rent in Arlington, TX

#2: Grand Prairie, TX

Miles from Fort Worth: 21

Population: 194,000

Median home sale price: $385,000

Average 1-bed rent: $1,543

Walk Score: 32

Transit Score: 34

Grand Prairie is just east of Arlington, a Dallas and Fort Worth suburb. The city is home to the Grand Prairie Premium Outlets, the Uptown Theater, and the Traders Village.

Grand Prairie has a lot to do, from exploring Epic Waters Indoor Waterpark, Ripley’s Believe It or Not!, or spending the day at Joe Pool Lake. For those who enjoy the outdoors, there are several parks and lakes to explore, and golfers will find many challenging courses to play. Whatever your interests, you are sure to find something to do in Grand Prairie.

Homes for sale in Grand Prairie, TX

Apartments for rent in Grand Prairie, TX

#3: Grapevine, TX

Miles from Fort Worth: 23

Population: 54,000

Median home sale price: $552,250

Average 1-bed rent: $1,716

Walk Score: 30

Transit Score: 38

Grapevine is known for its historic Main Street District, containing 19th-century Victorian-style storefronts and brick streets. The Main Street District also has a variety of restaurants, antique stores, art galleries, and hotels. The city is also home to the Grapevine Vintage Railroad, which operates vintage diesel trains on the Cotton Belt Route through the city. Grapevine also hosts over 1,400 Christmas events in just 40 days, including the largest Christmas parade in North Texas.

There are many things to do in Grapevine, like checking out one of the many wineries in the area, taking a walk or bike ride through one of the city’s many parks, or visiting the Grapevine Vintage Railroad. You can also explore the Grapevine Historic Main Street District, visit the Sea Life Grapevine Aquarium, and or take a ride on the Grapevine Lake Balloon Adventure.

Homes for sale in Grapevine, TX

Apartments for rent in Grapevine, TX

#4: Irving, TX

Miles from Fort Worth: 26

Population: 240,500

Median home sale price: $357,500

Average 1-bed rent: $1,520

Walk Score: 45

Bike Score: 29

Transit Score: 42

Irving is another one of the fantastic cities near Fort Worth that you may want to add to your list. There are many things to do in Irving, and some famous attractions include the Irving Arts Center, the Mustangs of Las Colinas Sculpture, and the Toyota Music Factory. Other Irving highlights include the Heritage House Museum, the Mandalay Canal Walk at Las Colinas, and the Irving Heritage District.

Homes for sale in Irving, TX

Apartments for rent in Irving, TX

#5: Dallas, TX

Miles from Fort Worth: 33

Population: 1 million

Median home sale price: $420,450

Average 1-bed rent: $1,591

Walk Score: 46

Bike Score: 39

Transit Score: 49

No doubt you know of Dallas, the other half of the Dallas-Fort Worth metroplex. Home to the Dallas Zoo, the Dallas Arts District, and the Dallas Arboretum and Botanical Garden, there’s plenty that makes this city stand out.

If you decide to move to Dallas, some of the city’s most popular attractions include the Dallas World Aquarium, the Perot Museum of Nature and Science, the Sixth Floor Museum at Dealey Plaza, and the George W. Bush Presidential Library and Museum.

Homes for sale in Dallas, TX

Apartments for rent in Dallas, TX

#6: Lewisville, TX

Miles from Fort Worth: 33

Population: 108,000

Median home sale price: $410,000

Average 1-bed rent: $1,565

Walk Score: 39

Transit Score: 39

Lewisville is located along Lewisville Lake and offers the best of small-town charm and big-city living. Old Town Lewisville is home to many historic homes and landmarks, like the Old Well House and Main Street Cafe. The city also offers recreation facilities, including parks, about 14 miles of trails, and two recreation centers.

There are many things to do for those living in Lewisville. You can visit the Lewisville Lake Environmental Learning Area, go fishing or swimming at Lewisville Lake, or explore one of the many hiking and biking trails. You can check out the shops and restaurants in Historic Downtown Lewisville.

Homes for sale in Lewisville, TX

Apartments for rent in Lewisville, TX

#7: Denton, TX

Miles from Fort Worth: 37

Population: 140,000

Median home sale price: $405,000

Average 1-bed rent: $1,355

Walk Score: 34

Transit Score: 46

Denton is located northeast of Fort Worth and is home to two state universities, the University of North Texas and Texas Woman’s University. Denton has 30 parks featuring 300 acres of open space, three recreation centers, a water park, community swimming pools, and trails for hiking and biking.

If you’re living in Denton, you might be contemplating what to do in your free time. Denton has many great options for entertainment and dining. For museums, check out the Bayless-Selby House Museum, the Chairy Orchard, and Denton Firefighters Museum. If you’re interested in the performing arts, UNT Murchison Performing Arts Center and Buffalo Valley Event Center offer great productions. And finally, no experience in Denton would be complete without stopping by El Matador Restaurant, Mazatlan Restaurant, and La Milpa Mexican Restaurant for some of the best food in town.

Homes for sale in Denton, TX

Apartments for rent in Denton, TX

#8: Plano, TX

Miles from Fort Worth: 50

Population: 289,000

Median home sale price: $527,500

Average 1-bed rent: $1,751

Walk Score: 41

Bike Score: 15

Transit Score: 52

Plano is often considered one of the Dallas suburbs, but it’s one of the cities near Fort Worth you should consider moving to. The city is home to several large corporations and many small businesses.

There is plenty to do in Plano, such as visiting the Historic Downtown Plano Arts District, which is home to various shops, restaurants, and businesses. There are also several parks and recreation areas in Plano, including Arbor Hills Nature Preserve, Oak Point Park and Nature Preserve, and Bob Woodruff Park. Make sure to check out the Plano Children’s Museum or the Crayola Experience. And, of course, there are plenty of great restaurants to choose from in Plano.

Homes for sale in Plano, TX

Apartments for rent in Plano, TX

#9: Garland, TX

Miles from Fort Worth: 50

Population: 239,000

Median home sale price: $3,330,000

Average 1-bed rent: $1,379

Walk Score: 40

Bike Score: 29

Transit Score: 41

Garland is one of the largest manufacturing cities in Texas and is home to 239,000 residents. The firewheel, a wildflower that flourishes during the spring and summer, is Garland’s signature flower, and the nearby Spring Creek Forest Preserve has over 600 plant species and trees, some of which are over 300 years old.

There are a number of things to do in Garland, Texas. You can visit the Garland Landmark Museum and Dallas Heritage Village for those interested in history. Nature lovers can explore the 750-acre Garland Nature Preserve, and shoppers can enjoy the many retail options available at the Firewheel Town Center.

Homes for sale in Garland, TX

Apartments for rent in Garland, TX

Methodology:

All cities must have a population of more than 50,000 and be less than 50 miles away from Fort Worth. Median home sale price data from the Redfin Data Center during August 2022. Average rental data from Rent.com during August 2022. Walk Score, Bike Score, and Transit Score from Walkscore.com during August 2022. Population data sourced from United States Census Bureau.

Baltimore is the largest city in Maryland and the center of a metropolitan area of 1.5 million people. It is located on the Chesapeake Bay and is known for its Inner Harbor. The city offers cultural opportunities, professional sports, outdoor activities, and much more. If you enjoy the surf and sand, Baltimore is within driving distance of beaches and ocean resorts. Washington, D.C., Philadelphia and New York are also an easy drive or train ride away.

However, renting an apartment or buying a home in Baltimore isn’t going to be for everyone. Fortunately, there are countless cities near Baltimore that may meet your budget and needs while keeping you within commuting distance. Redfin has gathered 11 cities near Baltimore to consider buying a house or renting an apartment this year. Check them out – you may end up deciding to call one of them home.

#1: Dundalk, MD

Miles from Baltimore: 10

Population: 64,000

Median home sale price: $199,000

Average 1-bed rent: $1,187

Walk Score: 49

Bike Score: 31

Transit Score: 43

Dundalk, MD, comprises more than 20 small town-like neighborhoods, all with easy access to Baltimore. Its 43 miles of waterfront, great restaurants, and expansive parks make it a desirable place to live. A fun fact about the city is that it was named after Dundalk, Ireland.

There are a variety of things to do in Dundalk. There are several parks and recreation areas, including the Patapsco Valley State Park, which offers hiking, biking, and camping. There are also some historical sites, such as the Thomas Viaduct and the Baltimore and Ohio Railroad Museum. There’s something for everyone living in Dundalk.

Homes for sale in Dundalk, MD

Apartments for rent in Dundalk, MD

#2: Towson, MD

Miles from Baltimore: 10

Population: 58,000

Median home sale price: $408,345

Average 1-bed rent: $1,807

Walk Score: 50

Bike Score: 37

Transit Score: 36

Towson is located just north of Baltimore’s city center. It is best known as the home of Towson University, Maryland’s second-largest university. Towson might be a college town, but has all the benefits of living in a major metropolitan area, including shopping, entertainment, and family activities.

There are plenty of things to do for those living in Towson. Residents can visit the Towson Town Center mall, dine at one of the many restaurants, or catch a movie at the AMC Towson Town Center 16 movie theater. For those looking for something more active, residents can check out the Towson Sports Complex, which offers a variety of sports facilities and programs. There are also several parks in the area, and perfect for a picnic or a game of fetch with a furry friend.

Homes for sale in Towson, MD

Apartments for rent in Towson, MD

#3: Ellicott City, MD

Miles from Baltimore: 13

Population: 73,500

Median home sale price: $690,000

Average 1-bed rent: $1,760

Walk Score: 23

Bike Score: 11

Transit Score: 23

Ellicott City, MD, is recognized for Centennial Park, which has won awards for its natural design and sensitivity to nature. The city is home to 73,000 residents and provides a welcoming and small-town feel. An interesting fact about the city is that its home to the oldest surviving railroad station in the U.S.

If you’re moving to Ellicott City, you won’t be disappointed by the wealth of things to do in the area. The area is known for its museums, like the Ellicott City B&O Railroad Station Museum and the Ellicott City Firehouse Museum, as well as the Howard County Historical Society. You can also catch a show at the Blackbox Theatre or browse the local galleries, like the Howard County Arts Council. And when you need to get some fresh air, you can explore one of the many parks, such as Centennial Park, Patapsco Valley State Park, and or Patapsco State Park.

Homes for sale in Ellicott City, MD

Apartments for rent in Ellicott City, MD

#4: Glen Burnie, MD

Miles from Baltimore: 13

Population: 70,000

Median home sale price: $360,000

Average 1-bed rent: $1,457

Walk Score: 36

Bike Score: 22

Transit Score: 41

Glen Burnie, Maryland, is located in Anne Arundel County. The city has more than a dozen neighborhoods, each with its own local flavor.

There are plenty of things to do in Glen Burnie, Maryland. For outdoor enthusiasts, there are hiking and biking trails at the nearby Patuxent River Park. History buffs can explore the Glen Burnie House, a historic home dating back to the 18th century. The Maryland Maritime Museum is also worth a visit, as is the Anne Arundel County Fairgrounds. For shoppers, the Arundel Mills Mall is a popular destination. And for those looking for a bite to eat, there are plenty of restaurants, cafes, and bars to choose from.

Homes for sale in Glen Burnie, MD

Apartments for rent in Glen Burnie, MD

#5: Severn, MD

Miles from Baltimore: 16

Population: 53,500

Median home sale price: $470,000

Average 1-bed rent: $2

Walk Score: 17

Bike Score: 16

Transit Score: 30

Severn, MD, is known for its industrial past, rich natural resources, and suburban feel. With a population of just 51, 000, it offers the benefit of small-city living with the perks of being located near many large cities, including Washington, D.C., and Baltimore.

Severn is a great place to move to, with plenty of places to visit. The downtown area has a vibrant art and culture scene, and you’ll never get tired of it. The city is also home to Jessup-Provinces Park, Lake Village Park, and Quail Run Dog Park – perfect for a relaxing day out. For a taste of what Severn has to offer, make sure to grab a bite to eat at China Sea Restaurant.

Homes for sale in Severn, MD

Apartments for rent in Severn, MD

#6: Columbia, MD

Miles from Baltimore: 20

Population: 105,500

Median home sale price: $425,000

Average 1-bed rent: $1,751

Walk Score: 33

Bike Score: 28

Transit Score: 32

Columbia is known for being comprised of 10 self-contained villages. The village concept gives Columbia a small-town feel even though its population is 105, 500.

Living in Columbia means you’ll have access to a vibrant town center featuring Lake Kittamaqundi, a promenade, restaurants, a mall with a variety of shops, department stores, and a multiplex movie theater. Other popular attractions include the Columbia Museum of Art, the National Aquarium, and the Maryland Zoo.

Homes for sale in Columbia, MD

Apartments for rent in Columbia, MD

#7: Annapolis, MD

Miles from Baltimore: 30

Population: 39,500

Median home sale price: $550,000

Average 1-bed rent: $2,360

Walk Score: 48

Bike Score: 35

Transit Score: 58

Annapolis, MD, is a beautiful city located on the water. It’s known as the Sailing Capital of the U.S. and home to the U.S. Naval Academy. Annapolis is also home to Romanesque-style buildings, such as St. Anne’s Episcopal Church, which features Tiffany glass windows.

There are a variety of things to do while living in Annapolis. Some popular attractions include visiting the United States Naval Academy, strolling through the historic district, and enjoying the waterfront. Restaurants and top-rated eateries are found in Annapolis, so you don’t want to skip over these local favorites. For a quick taste of the town, stop by Cooper’s Hawk Winery & Restaurants, Gordon Biersch Brewery Restaurant, and Chevy’s Fresh Mex Restaurants.

Homes for sale in Annapolis, MD

Apartments for rent in Annapolis, MD

#8: Bowie, MD

Miles from Baltimore: 30

Population: 58,000

Median home sale price: $490,000

Average 1-bed rent: $2,052

Walk Score: 25

Bike Score: 24

Transit Score: 38

The city of Bowie, Maryland, has a rich and diverse historic and cultural heritage. The city was incorporated in 1874 as Huntington but changed its name in honor of local resident Governor Oden Bowie. Bowie has since become a dynamic community and rivaling the most prosperous cities in the region.

If you’re looking for things to do in Bowie, Maryland, there are plenty of options available. You could visit the Bowie Train Museum, take a walk or hike through one of Bowie’s many parks, or check out the historic Bowie Town Center. Or, if you’re looking for something more active, you could play a round of golf at one of Bowie’s several golf courses or attend a concert or event at the Bowie Center for the Performing Arts. And, of course, you could always shop at one of Bowie’s many retail stores and outlets. Whatever you choose to do, you’re sure to have a great time living in Bowie.

Homes for sale in Bowie, MD

Apartments for rent in Bowie, MD

#9: Silver Spring, MD

Miles from Baltimore: 35

Population: 81,000

Median home sale price: $540,000

Average 1-bed rent: $1,852

Walk Score: 63

Bike Score: 63

Transit Score: 58

Silver Spring, Maryland, is a city located on the northern border of Washington, D.C. This city is a great place to live if you’re looking for all the entertainment and arts of a major city without the congestion and other issues that usually come with city living. Silver Spring is made up of many different neighborhoods, each of which feels more like the suburbs, and with quiet streets and plenty of space.

There is a lot to do in Silver Spring. There are plenty of great restaurants, bars, shops, and parks to explore. The American Film Institute Silver Theatre and the National Museum of African Art are both located in Silver Spring. Several great events take place in Silver Spring throughout the year, such as the Silver Spring Jazz Festival and the Silver Spring Blues Festival.

Homes for sale in Silver Spring, MD

Apartments for rent in Silver Spring, MD

#10: Germantown, MD

Miles from Baltimore: 48

Population: 90,000

Median home sale price: $391,000

Average 1-bed rent: $1,743

Walk Score: 36

Bike Score: 37

Transit Score: 45

Germantown, MD, is a city with a lot to offer. Not only is it home to beautiful national parks, but it also has a rich history dating back to the Civil War. The city gets its name from the German settlers who opened shops along the main road during the 1800s. Today, Germantown is a welcoming and small-town feel city with various outdoor venues to visit, including peach orchards and farmers’ markets.

There are plenty of things to do for those living in Germantown. There are plenty of shops and restaurants to explore in the historic downtown area, and the community is home to several parks, including the Seneca Creek State Park. There are also several events and festivals held throughout the year, such as the Germantown Oktoberfest and the Germantown Day Celebration.

Homes for sale in Germantown, MD

Apartments for rent in Germantown, MD

#11: Frederick, MD

Miles from Baltimore: 50

Population: 72,000

Median home sale price: $392,600

Average 1-bed rent: $1,767

Walk Score: 47

Transit Score: 47

Frederick, MD, which is home to 72, 000 people, has a 50-block historic district with a lot of Civil War history. It’s a small city, so you’ll get that small-town feel. An interesting detail is that Frederick served as a major hospital center during the Civil War for wounded soldiers. Another fun piece of information is that Frederick was home to Francis Scott Key and the author of the Star-Spangled Banner.

There are many things to do in Frederick, Maryland. The National Museum of Civil War Medicine, downtown Frederick with its shops and restaurants, the historic buildings, Gambrill State Park, the Monocacy National Battlefield, and the Weinberg Center for the Arts are just some of the attractions.

Homes for sale in Frederick, MD

Apartments for rent in Frederick, MD

Methodology: All cities must have a population of more than 50,000 and be less than 50 miles away from Baltimore. Median home sale price data from the Redfin Data Center during August 2022. Average rental data from Rent.com during August 2022. Walk Score, Bike Score, and Transit Score from Walkscore.com during August 2022. Population data sourced from the United States Census Bureau.

Detroit, MI, is the most populous city in the state of Michigan and the largest city on the United States-Canada border. It’s well-known for being the birthplace of Motown Records, home of Detroit-style pizza, and is nicknamed “Motor City” for its rich history involving the auto industry.

While Detroit has lots to offer its residents, it’s not the city for everyone. And even if you work in Detroit, that doesn’t mean you have to live there. There are many cities near Detroit within 50 miles of the city where you may want to move to instead.

So before you commit to buying a house or renting an apartment, find out 9 cities near Detroit that may just meet your needs.

#1: Dearborn, MI

Miles from Detroit: 9

Population: 94,500

Median home sale price: $235,000

Average 1-bed rent: $1,360

Walk Score: 58

Transit Score: 47

Dearborn is one of the great cities near Detroit, located just west of the city. You may know Dearborn as Henry Ford’s birthplace and home to the largest Ford Motor Company factory, the Rouge River complex.

If you decide to move to Dearborn, there is plenty to keep you busy. Visit the Henry Ford Museum, Greenfield Village, and the Ford Rouge Factory Tour. Enjoy a meal at the Dearborn Inn or one of the many excellent restaurants in town. Take a walk or bike through the scenic Ford Woods Park, shop at Fairlane Town Center, or one of the many unique shops in Dearborn.

Homes for sale in Dearborn, MI

Apartments for rent in Dearborn, MI

#2: Southfield, MI

Miles from Detroit: 15

Population: 73,000

Median home sale price: $216,000

Average 1-bed rent: $1,118

Walk Score: 34

Transit Score: 39

Southfield is a city located in the northern suburbs of Detroit in Oakland County. The city is home to a number of major corporations, parks, and historical museums.

Southfield is a great place to live for people of all ages and interests. With more than 800 acres of parkland, a public golf course, miles of nature and fitness trails, and numerous other recreational activities, Southfield has something for everyone.

Homes for sale in Southfield, MI

Apartments for rent in Southfield, MI

#3: Warren, MI

Miles from Detroit: 19

Population: 134,000

Median home sale price: $205,000

Walk Score: 44

Transit Score: 44

Warren is located near Lake St Clair and is home to about 134,000 people. You’ll find there’s a great balance of small-town charm and big-city living.

There are plenty of things to do in Warren, like exploring local parks, checking out some of the best restaurants, and enjoying local art. The Detroit Arsenal of Democracy Museum is a popular attraction for Warren locals and tourists. If you’re looking for somewhere to spend time outdoors, there are plenty of parks in Warren, such as Veterans Park, Halmich Park, and Wiegand Park.

Homes for sale in Warren, MI

Apartments for rent in Warren, MI

#4: Livonia, MI

Miles from Detroit: 20

Population: 94,000

Median home sale price: $267,000

Walk Score: 36

Transit Score: 45

Livonia is one of the well-known cities near Detroit and overall a great community with a variety of parks and recreation facilities and lots of shopping and dining options.

Some of the top things to do in Livonia are checking out a book at the Livonia Civic Center Library, visiting Newberg Lake, and shopping at Laurel Park Place. You can also play a round of golf at one of the city’s many courses or explore Greenmead Historical Village.

Homes for sale in Livonia, MI

Apartments for rent in Livonia, MI

#5: Sterling Heights, MI

Miles from Detroit: 23

Population: 132,500

Median home sale price: $277,100

Average 1-bed rent: $1,355

Walk Score: 33

Transit Score: 37

Sterling Heights is just north of Warren and home to just over 132,000 people. The city is home to some large businesses and industries and is a major shopping destination for the region.

There is a lot to do in Sterling Heights. There are several parks in the city, including Freedom Hill County Park, which hosts many concerts throughout the year. There is also Dodge Park, which has a playground, a splash pad, and a golf course. For shopping, there are the Lakeside Mall and the Partridge Creek Mall. There are several great options for dining, including the Sterling Heights Grill, the Fort Street Brewery, and the White Star Bar & Grill.

Homes for sale in Sterling Heights, MI

Apartments for rent in Sterling Heights, MI

#6: Farmington Hills, MI

Miles from Detroit: 23

Population: 81,000

Median home sale price: $337,000

Average 1-bed rent: $1,269

Walk Score: 25

Transit Score: 36

Farmington Hills is a great place to live for those who enjoy outdoor recreational activities and want to be close to Detroit. With a population of only 81,000, Farmington Hills provides a welcoming small-town feel. Some of the local attractions in Farmington Hills include the Park West Gallery and Marvin’s Marvelous Mechanical Museum. In addition, the city has over 600 acres of public parks and an 18-hole golf course that covers 175 acres.

There are plenty of things to do in Farmington, like visiting the Farmington Farmers Market, which runs from May through October. If you’re looking for something a little more low-key, there are plenty of parks and trails to explore in the area.

Homes for sale in Farmington Hills, MI

Apartments for rent in Farmington Hills, MI

#7: Troy, MI

Miles from Detroit: 24

Population: 84,000

Median home sale price: $425,000

Average 1-bed rent: $1,921

Walk Score: 29

Transit Score: 41

Troy is located north of Detroit and is home to many businesses and shopping destinations. Troy is home to some great historical museums like Troy Historic Village and parks like Stage Nature Center.

There are many great things to do in Troy. You can enjoy the sunset at one of the parks, visit a museum, or see a play. There are also many great places to eat, including El Patio Mexican Restaurant and Maple Leaf Family Restaurant.

Homes for sale in Troy, MI

Apartments for rent in Troy, MI

#8: Westland, MI

Miles from Detroit: 26

Population: 82,000

Median home sale price: $200,000

Average 1-bed rent: $985

Walk Score: 40

Transit Score: 45

Westland is located in Detroit’s western suburbs, bordered by Livonia to the east, Canton to the south, Wayne to the west, and Garden City to the north.

There are plenty of things to do in Westland. For starters, you can check out one of the area’s many museums or art galleries. If you’re looking for something more active, you can go hiking or biking in one of the many parks, such as Nankin Mills Park, William P. Holliday Park, Central City Park, and Westland Shopping Center Park. And, of course, you can always just grab a bite at one of the many restaurants and bars in the area. Consider checking out Andiamo, Bacco Ristorante, Big Boy Restaurant, and Coney Island Lunch.

Homes for sale in Westland, MI

Apartments for rent in Westland, MI

#9: Ann Arbor, MI

Miles from Detroit: 44

Population: 121,000

Median home sale price: $440,000

Average 1-bed rent: $1,719

Walk Score: 52

Bike Score: 49

Transit Score: 71

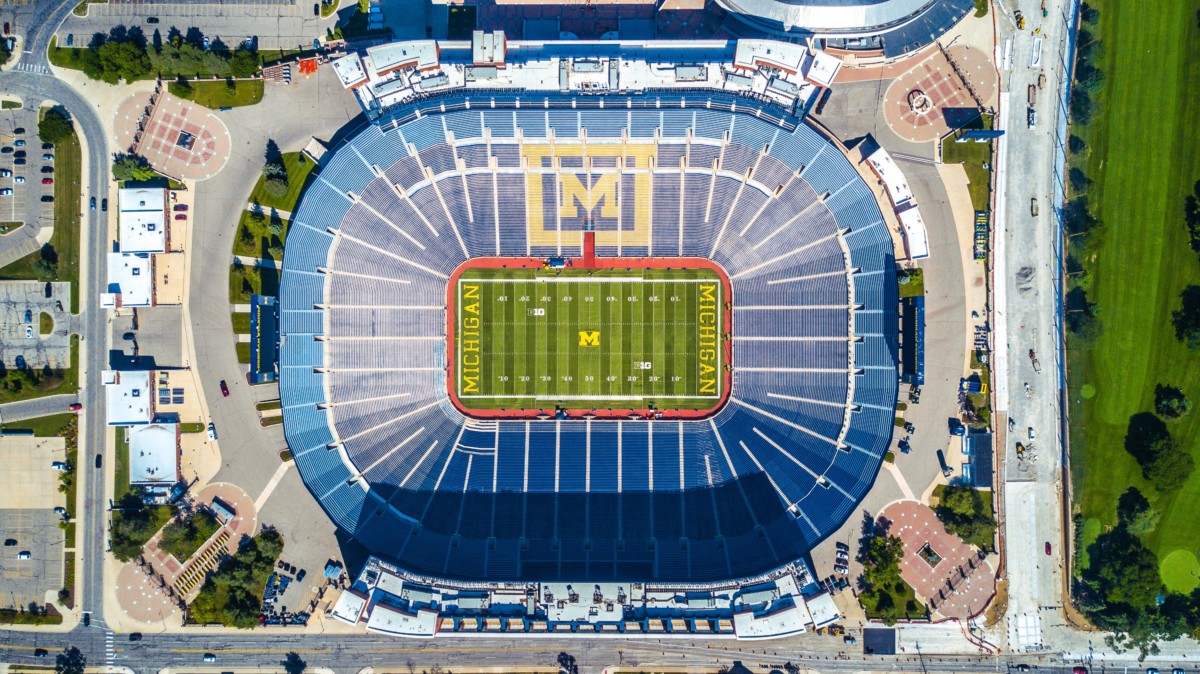

Ann Arbor is a college town with one of the largest stadiums in the country at the University of Michigan. The university significantly shapes Ann Arbor’s economy, employing about 30,000 workers. Known as “Tree Town,” Ann Arbor has about 1.5 million trees throughout the city.

Some of the top things to do in Ann Arbor are shopping and dining on Main Street, visiting the University of Michigan campus, taking a walk or bike ride through the Huron River Valley, checking out the Ann Arbor Art Fair, and seeing a show at the Ann Arbor Summer Festival.

Homes for sale in Ann Arbor, MI

Apartments for rent in Ann Arbor, MI

Methodology:

All cities must have a population of more than 50,000 and be less than 50 miles away from Detroit. Median home sale price data from the Redfin Data Center during August 2022. Average rental data from Rent.com during August 2022. Walk Score, Bike Score, and Transit Score from Walkscore.com during August 2022. Population data sourced from United States Census Bureau.

Explore more Detroit articles

The 10 Fastest-Growing Cities in Michigan

The city of Long Beach is spread over 50 square miles and is known for its beautiful beaches, vibrant downtown area, and diverse attractions. Long Beach is also home to a large port, which is one of the busiest in the world.

While Long Beach is home to so much, even the most loved cities have their drawbacks. And for you, Long Beach’s best qualities may not outweigh the cost of living, large population, or traffic. Fortunately, you have options if you want to live near Long Beach without being in the city center. Redfin has gathered a list of 10 cities near Long Beach, all within 50 miles of the city, that you may want to consider buying or renting in this year. Let’s take a look.

#1: Carson, CA

Miles from Long Beach: 10

Population: 91,500

Median home sale price: $799,000

Average 1-bed rent: $2,735

Walk Score: 55

Transit Score: 51

Carson, CA, is a manufacturing hub that hosted the first air show in the U.S. in 1910. Located in Los Angeles County, Carson is home to around 91, 500 people. The city has 120 acres of recreational use, including 12 parks, three swimming pools, and a sports complex.

If you’re living in Carson, you may be curious about what to do on weekends. The city offers a range of activities, from nature parks to stellar restaurants and arts and culture scenes. Home to 4 museums, Carson is also a great destination for art and history lovers. The International Printing Museum and University Art Gallery are both must-sees. Performing arts venues like The SOL Venue and DH Sports Lounge are top spots amongst locals. There are plenty of green spaces to be found throughout Carson. For example, you can enjoy a picnic or jog through many parks, like Carson Park, Stevenson Park, or Calas Park. There are a variety of delicious eateries and restaurants that appeal to every palette in Carson. Don’t miss out on popular spots like El Pescador Family Restaurant, Spire’s Restaurants, and Sriracha Thai Restaurant.

Homes for sale in Carson, CA

Apartments for rent in Carson, CA

#2: Paramount, CA

Miles from Long Beach: 11

Population: 54,000

Median home sale price: $565,000

Average 1-bed rent: $1,745

Walk Score: 64

Transit Score: 56

Although it’s considered a suburb of Los Angeles, Paramount has a small-town feel with all the amenities of a large city center. Paramount is known for its fabulous year-round weather and central location that allows easy access to the coast. The city is known for its many parks and recreation facilities and proximity to Hollywood. Paramount Studios, one of the major film studios in the world, is located within the city limits.

There is a lot to do while living in Paramount. There are several parks in the area, including Lake Perris State Recreation Area, which offers swimming, fishing, hiking, and camping. Other attractions include the Museum of Tolerance, the California State Railroad Museum, and the Los Angeles Zoo.

Homes for sale in Paramount, CA

Apartments for rent in Paramount, CA

#3: Compton, CA

Miles from Long Beach: 12

Population: 96,000

Median home sale price: $565,250

Average 2-bed rent: $2,095

Walk Score: 65

Transit Score: 60

Compton, CA, is a small city that is famous for being the home of professional tennis athletes Serena and Venus Williams. A fun fact about Compton is that it was given the nickname “Hub City” because it’s located at the geographical center of Los Angeles. Compton, CA, is one of the oldest cities in the United States. It was actually the eighth city in the county to incorporate, and it quickly became a popular place for settlers, especially due to its proximity to LA.

If you’re moving to Compton, CA, you’ll be pleased to know that there are plenty of places to visit in the city. Dominguez Rancho Adobe Museum, Tomorrow’s Aeronautical Museum, and Museum of Creative Arts, Compton are all great museums that are worth exploring. If you’re a fan of parks and green spaces, you’ll be happy to know that Compton has plenty of those, too, such as Campanella Park, Kelly Park, and Gonzales Park. And when it comes to restaurants, Compton definitely has some great ones, such as Piggie’s Charbroiled Restaurant, Restaurant Onofre, and Los Sombreros Restaurant.

Homes for sale in Compton, CA

Apartments for rent in Compton, CA

#4: Bellflower, CA

Miles from Long Beach: 13

Population: 76,500

Median home sale price: $679,500

Average 1-bed rent: $2,005

Walk Score: 66

Transit Score: 60

Bellflower, California, is colloquially known as “The Friendly City.” While the origin of the city’s name is unknown certain, it is believed to be derived from the French term “belle fleur,” meaning “beautiful flower.” The city was first settled by a few families in the late 18th century and has since grown into a densely populated area.

If you’re moving to Bellflower, you won’t be disappointed by the array of places to visit. Some popular attractions include the Bellflower Bike Path, the Bellflower Boulevard, Cerritos Regional Park, and the Los Angeles County Arboretum. You can also find plenty of parks, like Ruth R. Caruthers Park and Simms Park, and top-rated restaurants like NORMS Restaurant and New Wave Restaurant & Bar.

Homes for sale in Bellflower, CA

Apartments for rent in Bellflower, CA

#5: Torrance, CA

Miles from Long Beach: 15

Population: 144,500

Median home sale price: $1,025,000

Average 1-bed rent: $2,250

Walk Score: 67

Bike Score: 37

Transit Score: 54

An hour south of downtown LA and just 15 miles from Long Beach, Torrance is a relaxed coastal community with a classic small-town feel and urban sophistication. Torrance Beach is a local favorite for its quieter and less crowded environment.

There are many things to do while living in Torrance, including visiting Torrance Beach, the Del Amo Fashion Center, and the Toyota USA Automobile Museum. Torrance is a beautiful city with many nature preserves and parks. You can explore green spaces like Charles H. Wilson Park, Columbia Park, and Paradise Park. King’s Hawaiian Bakery & Restaurant, La Esperanza Restaurant, and Lazy Dog Restaurant & Bar are some of the many popular restaurants in the area.

Homes for sale in Torrance, CA

Apartments for rent in Torrance, CA

#6: Downey, CA

Miles from Long Beach: 15

Population: 111,500

Median home sale price: $815,000

Average 1-bed rent: $1,695

Walk Score: 61

Transit Score: 53

Downey is a vibrant city located in southeast California and part of the Gateway Cities of Los Angeles County. Although it is much quieter and more peaceful than other large cities in the nearby Los Angeles metro area, Downey is still a city with many great features. From its exciting history to its culture and diversity, many things make Downey a great city. You might be surprised to know that Downey is the Apollo space program’s birthplace and the home of the oldest operating McDonald’s restaurant.

There are many things to do while living in Downey, including visiting local parks, checking out restaurants, and enjoying local art. Downey Civic Theatre and Downey Stages are just a few of the performing arts venues that contribute to the city’s unique arts and culture scene. There are also many parks and green spaces within the city, including Wilderness Park, Furman Park, and Apollo Park. Restaurants and highly-rated eateries abound in the city, so you won’t be disappointed with the food options. For a quick taste of the town, stop by Pieloon Restaurant or Lazy Dog Restaurant & Bar.

Homes for sale in Downey, CA

Apartments for rent in Downey, CA

#7: Cypress, CA

Miles from Long Beach: 17

Population: 50,000

Median home sale price: $825,000

Average 1-bed rent: $1,905

Walk Score: 53

Bike Score: 30

Transit Score: 61

Cypress, California, is a highly sought-after location in the glamorous Orange County. Just a short distance from the beach and surrounded by some of the best amusement parks in the region, it’s a great place to call home.

If you’re living in Cypress, CA, and are looking for something to do, this city has plenty to offer, from nature parks to stellar restaurants and a thriving arts and culture scene. There are many unique landmarks in Cypress, including Cypress College Pond. The arts and culture scene is thriving, with many performing arts centers like Cypress College Theater and Cypress Civic Theatre Guild. Parks are plentiful in Cypress, where you can find green spaces like Veterans Park, Arnold Cypress Park, and Manzanita Park. For a taste of Cypress’s cuisine, there are a couple of local eateries you don’t want to skip. The Loft Hawaiian Restaurant, Echizen Japanese Restaurant, and Francos Italian Restaurant & Bakery are just three of the numerous restaurants worth stopping by for a meal.

Homes for sale in Cypress, CA

Apartments for rent in Cypress, CA

#8: Cerritos, CA

Miles from Long Beach: 17

Population: 50,000

Median home sale price: $925,000

Average 1-bed rent: $3,285

Walk Score: 54

Transit Score: 57

Cerritos is a scenic suburb located in the heart of the Los Angeles Basin. It has long enjoyed sustained growth due to its central location and innovative atmosphere. Cerritos boasts the country’s first solar-heated City Hall. Families are particularly drawn to Cerritos for its excellent school district, numerous parks, and its landmark library.

There are several things to do for residents living in Cerritos. The city is home to many attractions, including the Cerritos Center for the Performing Arts, the Cerritos Sculpture Garden, and the Cerritos Heritage Park. There are also several shopping and dining options available in the city. If you; ‘re looking for a bite to eat, check out Sushi-Ai, The Hanging Garden, La Strada, and Primo Italia.

Homes for sale in Cerritos, CA

Apartments for rent in Cerritos, CA

#9: Norwalk, CA

Miles from Long Beach: 17

Population: 105,000

Median home sale price: $700,000

Average 1-bed rent: $1,795

Walk Score: 61

Bike Score: 42

Transit Score: 52

Norwalk is a lovely residential city with plenty of rentals available in its charming neighborhoods. Commuting from Norwalk is simple, with direct access to I-5, I-105, I-605, and the 91 Freeway, as well as the Metro Green Line and the Metrolink system.

Norwalk, CA, is a great place to live for various reasons. Two of the most popular museums in Norwalk are the Sproul Museum and Hargitt House, which are frequented by both tourists and locals. If you’re looking to spend a relaxing afternoon at one of Norwalk’s parks, some of the most popular ones include Holifield Park, Glazier Park, and Hermosillo Park. Lastly, be sure to try some of the local cuisines at one of Norwalk’s many great restaurants, such as Los Compadres Mexican Restaurant, Ho Ho China Restaurant, and Marquez Restaurant.

Homes for sale in Norwalk, CA

Apartments for rent in Norwalk, CA

#10: Santa Ana, CA

Miles from Long Beach: 25

Population: 333,000

Median home sale price: $694,500

Average 1-bed rent: $2,487

Walk Score: 67

Bike Score: 43

Transit Score: 62

Home to 330,000 residents, Santa Ana, CA, is one of the most populous and largest cities in Orange County. Just a few miles away from the beach, the city is known for its warm Mediterranean climate and its strong arts and culture scene. Santa Ana is also a major transportation hub, with several freeways and airports serving the area.

There are many things to do in Santa Ana. A few popular attractions include visiting the Santa Ana Zoo, Discovery Cube Orange County, and the Bowers Museum. If you’re looking to spend a day outdoors, there are plenty of options in Santa Ana. Morrison Park, Santiago Park Nature Reserve, and Edna Park are all great choices. And when you get hungry, you’ll find plenty of excellent restaurants to choose from, no matter what kind of food you’re in the mood for. Kaisen Sushi Restaurant, Bella Cuba Restaurant, and NORMS are all worth checking out.

Homes for sale in Santa Ana, CA

Apartments for rent in Santa Ana, CA

Methodology: All cities must have a population of more than 50,000 and be less than 50 miles away from Long Beach. Median home sale price data from the Redfin Data Center during August 2022. Average rental data from Rent.com during August 2022. Walk Score, Bike Score, and Transit Score from Walkscore.com during August 2022. Population data sourced from the United States Census Bureau.

If Brooklyn were its own city, it would be the third-largest city in the U.S. with over 2.5 million residents, second to Los Angeles and Chicago. For centuries, immigrants have been coming to Brooklyn and leaving their unique (and delicious) marks on the borough, making it one of the most ethnically diverse areas in the nation. Even today, Brooklyn attracts newcomers and families from all over with its excellent schools, booming job market, and a strong sense of community.

However, renting an apartment or buying a home in Brooklyn isn’t going to be for everyone. Fortunately, Redfin knows about countless cities near Brooklyn that may meet your budget and needs. Whether you’re seeking a quieter suburban lifestyle, a waterfront haven, or a culturally rich community, these cities provide a diverse range of options to suit every preference and budget.

#1: Jersey City, NJ

Miles from Brooklyn: 8

Population: 263,000

Median home sale price: $605,000

Average 1-bed rent: $4,085

Walk Score: 87

Bike Score: 70

Transit Score: 64

Jersey City is situated between the Hudson and Hackensack Rivers, with a rich history dating back to its days as a hub for shipping and manufacturing. Now a modern urban community, old factories have been repurposed into office buildings and housing units, and abandoned rail yards are now landscaped parks. While living in Jersey City, you can explore popular attractions like Liberty State Park, Ellis Island, and the Statue of Liberty, or visit one of the many museums or historical sites located in the city.

Homes for sale in Jersey City, NJ

Apartments for rent in Jersey City, NJ

#2: Hoboken, NJ

Miles from Brooklyn: 10

Population: 53,500

Median home sale price: $855,000

Average 1-bed rent: $3,599

Walk Score: 97

Bike Score: 74

Transit Score: 78

Hoboken is a small New Jersey city west of the Hudson River that is only 1.28 square miles. It is referred to as “the mile square city.” Hoboken is well known for its being a historic city with a strong sense of community. It is also known for its diverse population, vibrant nightlife, and proximity to New York City.

There’s something for everyone living in Hoboken. Some of the many museums you can visit in Hoboken are the Hoboken Historical Museum, which is popular with locals and tourists, and the Hoboken Fire Department Museum. There is also a unique arts and culture scene, with performing arts venues such as the Hudson Theatre Ensemble and Mile Square Theatre. Make sure you grab a bite to eat at La Isla Restaurant and Zack’s Oak Bar & Restaurant for a small taste of what this city offers.

Homes for sale in Hoboken, NJ

Apartments for rent in Hoboken, NJ

#3: Union City, NJ

Miles from Brooklyn: 12

Population: 75,000

Median home sale price: $490,000

Average 1-bed rent: $1,950

Walk Score: 94

Bike Score: 80

Transit Score: 54

Union City is a historic city located just off the Hudson River. It has a rich cultural heritage and a tight-knit community. Union City is easy to access from New York City via the Lincoln Tunnel, making it a popular home base for New York commuters seeking more affordable places to live.

There are plenty of things to do in Union City. For starters, you can check out the Liberty Science Center, which is a great place for kids and adults alike. If you’re looking for something a little more outdoorsy, you can explore the Hudson County Park system, which offers plenty of trails and activities. There’s something for everyone living Union City.

Homes for sale in Union City, NJ

Apartments for rent in Union City, NJ

#4: Newark, NJ

Miles from Brooklyn: 15

Population: 282,000

Median home sale price: $410,000

Average 1-bed rent: $2,742

Walk Score: 76

Bike Score: 65

Transit Score: 51

Newark, located just a 20-minute train ride to New York City, is in the middle of all the action. With ample access to transit lines, a plethora of restaurants, and plenty of other amenities, Newark is a city of character and culture.

There is a lot to do for those living in Newark. You can visit the Prudential Center, the Newark Museum, the New Jersey Performing Arts Center, or the Cathedral Basilica of the Sacred Heart. You can also go shopping at the Newark Penn Station or dine in one of the many great restaurants in the city. If you’re looking for a night out, you can check out the Newark Symphony Hall or the Newark Bears Stadium.

Homes for sale in Newark, NJ

Apartments for rent in Newark, NJ

#5: Elizabeth, NJ

Miles from Brooklyn: 21

Population: 128,500

Median home sale price: $470,000

Average 1-bed rent: $1,879

Walk Score: 80

Bike Score: 47

Transit Score: 54

Elizabeth, NJ is known for its large port and associated shipping industry, plus its role in the American Revolutionary War. The city has a rich history that can be seen through the city’s grand architecture, such as the Elizabeth Public Library and the Union County Courthouse. Warinanco Park and Elizabeth River Park are just two of the many parks in the city. There are also several museums and historic sites, including the Liberty Hall Museum, the Museum of Russian Icons, and the site of the Battle of Springfield.

Homes for sale in Elizabeth, NJ

Apartments for rent in Elizabeth, NJ

#6: Yonkers, NY

Miles from Brooklyn: 25

Population: 200,000

Median home sale price: $512,500

Average 1-bed rent: $2,279

Walk Score: 69

Bike Score: 53

Transit Score: 37

Yonkers is the fourth largest city in New York, located along the Hudson River. It is the largest city in Westchester County and is home to many businesses and industries, as well as several colleges and universities. Yonkers is a diverse city with plenty of things to do. For starters, you can check out the Yonkers Raceway, which is a harness racing track that also features electronic gambling. If you’re feeling adventurous, you can also go whitewater rafting on the Hudson River. And, of course, no trip to Yonkers would be complete without visiting the Saw Mill River, which is a popular spot for fishing. Yonkers is also a cultural hub, with the Hudson River Museum, Sarah Lawrence College, shopping centers, and arts and entertainment venues.

Homes for sale in Yonkers, NY

Apartments for rent in Yonkers, NY

#7: Edison, NJ

Miles from Brooklyn: 36

Population: 101,000

Median home sale price: $540,500

Average 1-bed rent: $1,940

The city of Edison, New Jersey, was named after the famous inventor Thomas Edison. The town is very proud of its most famous citizen and has many tributes to Edison, including a museum, park, and memorial tower. If you decide to move to Edison, you can check out the Thomas Edison National Historical Park, which is dedicated to preserving the site of the famous inventor’s laboratory. You can also head to Menlo Park Mall or one of the many other shopping centers in the area.

Homes for sale in Edison, NJ

Apartments for rent in Edison, NJ

#8: New Brunswick, NJ

Miles from Brooklyn: 39

Population: 777,000

Median home sale price: $312,500

Average 1-bed rent: $2,385

Walk Score: 73

Bike Score: 35

Transit Score: 60

New Brunswick is a regional hub for central New Jersey and a commuter town for New York City. The city is the home of Rutgers University and is a commercial hub for businesses and pharmaceutical companies, such as Bristol Myers Squibb and Johnson and Johnson.

There is plenty to do in New Brunswick. For starters, you can visit the Rutgers Gardens, which are free and open to the public. The gardens feature over 10,000 plant species, making them a great place to learn about horticulture. You can also explore the city’s rich history by visiting the New Brunswick Museum or taking a walking tour of the city. If you’re looking for a more active adventure, you can hike or bike through the Delaware and Raritan Canal State Park.

Homes for sale in New Brunswick, NJ

Apartments for rent in New Brunswick, NJ

#9: Long Island, NY

Miles from Brooklyn: 49

Population: 7.7 million

Median home sale price: $634,000

Average 1-bed rent: $4,220

Walk Score: 95

Bike Score: 94

Transit Score: 82

Long Island is a large island located in southeastern New York State, east of Manhattan. It is divided into four counties: Kings, Queens, Nassau, and Suffolk. Long Island is home to over 7 million people, making it the most populous island in the United States. The island is also home to two major airports, John F. Kennedy International Airport and LaGuardia Airport. In addition, Long Island is home to many colleges and universities, including Stony Brook University, Hofstra University, and Nassau Community College. There are several things to do in Long Island, NY. One can visit the various beaches, go fishing, hiking, or biking. There are also some historical sites to visit, such as the Montauk Lighthouse or the Old Bethpage Village Restoration. In addition, there are many museums, such as the Long Island Museum or the Nassau County Museum.

Homes for sale in Long Island, NY

Apartments for rent in Long Island, NY

Methodology: All cities must have a population of more than 50,000 and be less than 50 miles away from Brooklyn. Median home sale price data from the Redfin Data Center during August 2022. Average rental data from Rent.com during August 2022. Walk Score, Bike Score, and Transit Score from Walkscore.com during August 2022. Population data sourced from the United States Census Bureau.

Newark, located just a 20-minute train ride to New York City, is in the middle of all the action. With ample access to transit lines, a plethora of restaurants, and plenty of other amenities, Newark is a city of character and culture.

While Newark has so much to offer, buying a home or renting an apartment here won’t be for everyone. Thankfully, there are plenty of amazing places to live near Newark that don’t have the same heavy traffic, high cost of living, and hustle and bustle. To help you find the right place to buy or rent in, Redfin has gathered a list of 8 great cities near Newark to consider instead.

#1: Elizabeth, NJ

Miles from Newark: 6

Population: 128,500

Median home sale price: $470,000

Average 1-bed rent: $1,879

Walk Score: 80

Bike Score: 47

Transit Score: 54