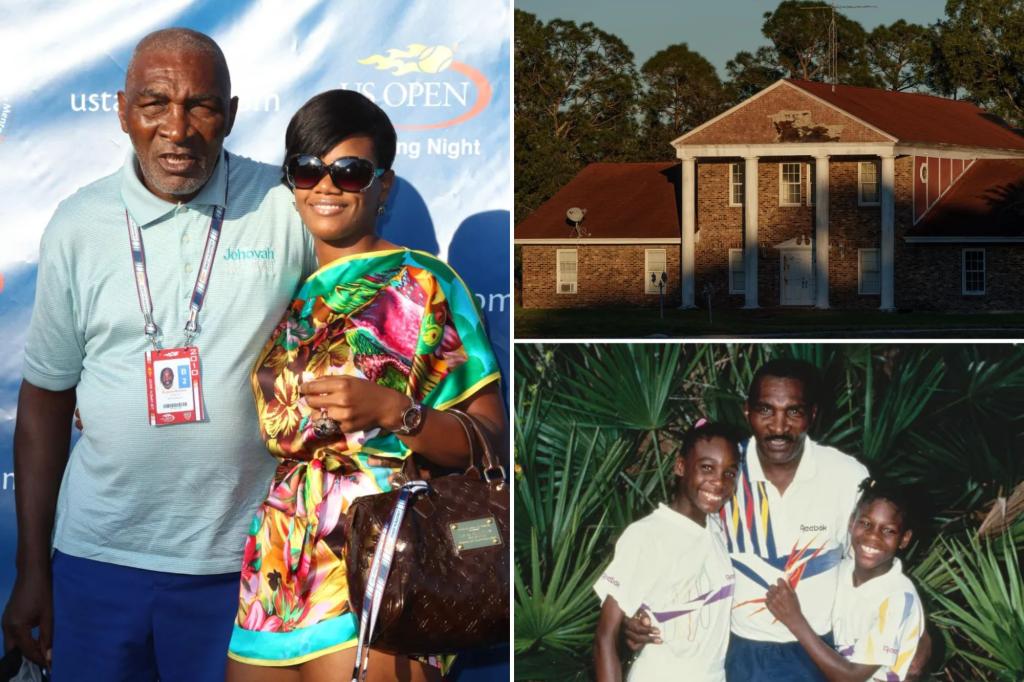

Richard Williams’ ex, Lakeisha Williams, is finally forced to sell the childhood home of Venus and Serena Williams after finding herself with a mountain of debt.

Getty Images

Serena Williams’ stepmother, Lakeisha Williams, has finally been dealt a blow in her bankruptcy attempt to dig out of a $600,000 financial quagmire.

The consequence? The childhood home of the Williams sisters is now poised to hit the market to offset the debts, according to The Sun.

Lakeisha, a former stripper, had managed to evade the sale of the $1.4 million Palm Beach Gardens, Florida, mansion for seven years to resolve her substantial debt.

The property, central to the legal saga, is alleged to have been illicitly acquired by Lakeisha from tennis legend Richard Williams, the father of Serena and Venus.

Williams bought the four bedroom, 10-acre spread back in 1995 for $355,000, records show.

She admitted to falsifying his signature on the title deeds to transfer ownership and subsequently secure a $279,000 loan, which she squandered on a failed trucking venture and fast food purchases.

Despite her efforts, including three attempts at Chapter 13 bankruptcy filings, Lakeisha consistently failed to meet the hefty $10,000-a-month repayment plan owed to creditor David Simon, a hard lender.

This failure has now culminated in Judge Mindy Mora granting the dismissal of her latest bankruptcy bid, leaving Lakeisha stripped of court protection and facing the imminent foreclosure of the property.

Simon is set to recoup most of the proceeds from the property sale, with the remainder distributed among over 20 other creditors.

Although Lakeisha could potentially file for Chapter 13 bankruptcy again, the prospect comes with added legal and court expenses. Any subsequent filing would necessitate proof of improved financial circumstances and a viable repayment plan, with a mere 30-day window of creditor protection granted upon refiling.

Meanwhile, Richard, who was also the tennis coach of Serena and Venus, remains embroiled in a protracted divorce saga initiated in 2017 upon discovering the alleged misappropriation of the family home.

The property became entangled in a complex web of deceit when Lakeisha purportedly manipulated documents to secure loans.

In a deposition to the courts, Simon disclosed that Lakeisha had initially sought a loan upon spotting a “for sale” sign on his $79,000 Volvo semi-truck tractor.

However, Simon insisted on property collateral, prompting Lakeisha to allegedly forge her now estranged husband’s signature to transfer ownership of the house.

The truck, central to this convoluted tale, was eventually repossessed by Simon in 2018 following an accident in Long Island City that rendered it unsalvageable.

In a saga spanning years and rife with shocking revelations, the ongoing legal battle between Lakeisha Williams and tennis coach Richard Williams has peeled back the layers of their tumultuous marriage.

Court documents dating back to April 2017 have laid bare astounding allegations against Lakeisha, including claims of forgery and financial strain within the relationship.

According to Lakeisha’s deposition, she admits to forging Williams’ signature on a previous occasion to facilitate the sale of his prized 1999 Bluebird Wanderlodge Motor Coach, valued at $45,000. The proceeds, she contends, were essential for providing sustenance for herself and their 8-year-old son, Dylan, during dire financial circumstances.

“I was broke, and my husband did not help me,” Lakeisha asserted. “It was my son and I not getting any money, so I had to sell it so I can eat and my son can eat… we didn’t have anything.” Despite these hardships, Lakeisha claims she remained unaware of Williams’ intentions for divorce until he served her with dissolution papers in May 2017, abruptly ending their cohabitation as a married couple.

Lakeisha recalled a tender moment shared with Williams on the very day he filed for divorce. “He just came and gave me a kiss actually that morning, the morning of [the divorce filing], and he … would share with me to pray, you know, to always pray for our family and then he left with Chavoita,” she disclosed during her deposition.

However, tensions within the Williams family extend beyond the marital discord between Lakeisha and Richard. Chavoita Lesane, Richard’s son, has levied accusations against Lakeisha, alleging theft of vehicles, social security checks and document forgery.

Despite threats of legal action, including the possibility of an elder abuse suit, Lesane’s claims have yet to materialize into formal proceedings.

Reflecting on the family’s turmoil, Lesane expressed frustration, tell The Sun, “We’re just putting all of it together, it’s a lot. This whole situation has been frustrating.”

Load more…

{{/isDisplay}}{{#isAniviewVideo}}

{{/isAniviewVideo}}{{#isSRVideo}}

{{/isSRVideo}}

Dear Nancy,

I had planned to sell our family cottage and an investment property next year. With the recent budget change and the expected capital gain from the sale of these two properties being more than $250,000 I’m not sure I should wait. What do you think?

Dear Steve,

Certainly, the change of tax rules on capital gains should be considered but I don’t like a tax decision to rule an investment decision. You must have had some reason that you were going to wait until next year.

Deciding to sell a real estate property is not something that can be done as quickly as when selling a stock or bond. There is something to think about that could come into play if you try to sell before the June 25th deadline. There are many other real estate investors that will be trying to do the same thing. That can cause an increase of listings for sale. When there is more supply than demand, prices go down. You could end up selling for less than you expect. You could end up losing more money than the higher tax rate if you don’t wait.

Consult your real estate agent to get advice on pricing, expected time to complete the sale and cost to get your properties ready for sale. In the end it may turn out it is better to wait after the rush for the exit is finished.

Nancy Woods is portfolio manager and senior investment adviser with RBC Dominion Securities Inc. Send your questions to asknancy@rbc.com

See related stories:

Cottage owners rush to sell ahead of capital gains tax changes, realtors say

Seven ways the 2024 federal budget affects your finances, from selling your cottage to RESPs

Rob Carrick: Own a cottage or investment property? Here’s how to navigate the new capital gains tax changes

Tim Cestnick: Capital gains tax changes impact Canadians in many — and needlessly complicated — ways

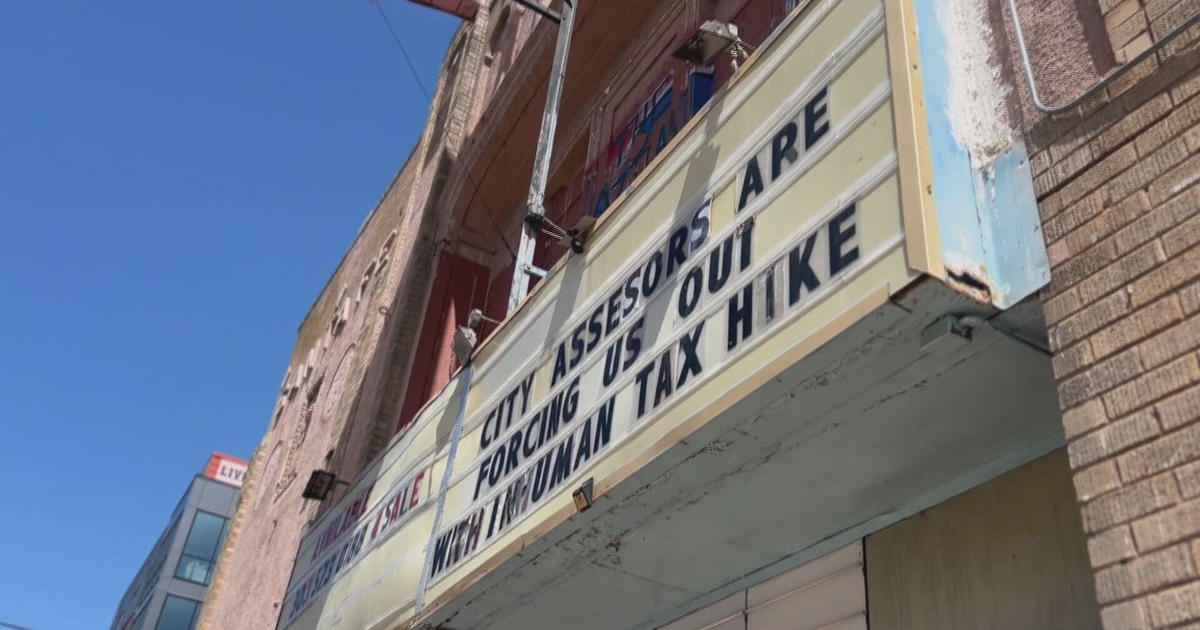

The future of the Aztlan Theatre in the Santa Fe Arts District stands uncertain after the owner claims property taxes are forcing him to sell. Tim “Timeo” Correa, a longtime activist and a business owner, took over the theatre in 1972 and used it as a community space for decades.

CBS

In the 70s, it was a place where Chicanos would gather and catch Spanish-American films, then in the late 80s the theatre became a space for live shows and concerts.

In the last year business at the theatre has slowed down. Correa and his wife Aurora are still open every First Friday and every other weekend, keeping the theatre’s spirit alive. However, that’s a huge change in comparison to previous years. The Aztlan was once a space that was open six days a week, according to Correa.

During the COVID-19 pandemic, the theatre suffered in a major way, losing out on at least $60,000, according to Correa. He says business has not been the same since. Now property taxes are causing huge concern for the couple.

In the past year, the estimated value of Correa’s property went from $882,000 to $1,654,800, according to the city’s Denver Property Taxation and Assessment System. As the property value increases, so do the property taxes. Correa’s bill this year came in at $37,000 which is a $15,000 increase from the previous year.

“It’s draining my retirement, it is draining my whole retirement savings,” said Correa.

The couple says property taxes are now costing them more than half of their current income.

“Thirty-seven thousand dollars property tax for a year… that’s outlandish, it’s inhumane,” said Correa.

CBS

Customers of the establishment signed a petition asking the city to support Correa in decreasing their property taxes, many expressing how special this theatre is to the community.

“This a community service theater and they don’t want to see it gone,” said Correa.

Correa also used the space to serve troubled youth. He once hosted an event where he invited Mexican-American actor Edward James Olmos to speak with youth from local high schools about gang violence.

“I have done a lot for the community and in the past have done a lot for city problems or issues, now I need help!”

Despite a storied past, the future of the building is in jeopardy. Correa blames skyrocketing property taxes for the most part.

“It’s a slap in the face, of course, because I have to pay the other half and I am a small business,” said Correa.

Correa paid the first half of the bill earlier this year but is due to pay another $17,562 in June for a total of $37,448 in property taxes.

“We recognize the importance of that particular property historically in that community so we are aware of that,” said Denver County Assessor, Keith Erffmeyer, “But, the state statutes and other things direct us to do what we are doing and that’s to value the property of what we think it would sell for.”

Over the years, Correa says the business has encountered many changes including weather damage and recent break-ins. This has led to a plethora of repairs now needed.

However, the city assessor’s office says the theatre’s property taxes are based on the land value. The reason for the high property taxes has a lot to do with the area the building sits on.

“It just so happens that particular property in Santa Fe is in an area that is undergoing a lot of transformation and transition and growth, which is good for property values, but does result in higher taxes,” said Erffmeyer.

The city assessor’s office has confirmed that the Aztlan filed two protests on their assessed value that were denied as part of the appeals process. According to the city, the total number of Denver assessment appeals was 24,769. Denver adjusted 11,044 of them which is 45%.

“The value on this property was supported by information gathered from the surrounding market, the value was for the land whereas other property values include the condition of structures,” said Erffmeyer.

Still with a fixed income and high taxes, the couple remains weighing their options.

“We could have used a lot of that money to put into the theatre and help fix it up,” said Correa, “This is a community service theatre and they (customers) don’t want to see it gone or demolished.”

Correa is thinking about a historic designation to try to keep the theatre’s history alive and lower property taxes. He is also looking to sell the Aztlan Theatre for an estimated $4 million.

Correa hopes to sell the theatre to someone with a similar passion for activism, making a difference and keeping the culture in the community alive.

Millbrook told its investors the loan-to-value ratio in the deal was 55 per cent as it was based on a $23.1 million valuation of the property the firm had acquired from Egan National Valuers. This valuation was on an “as if complete” basis, or what the property would be worth if proposed improvements and development were to be carried out.

Millbrook said in the document the loan was on a six-month basis, with a 10 per cent interest rate. If interest was not paid on time, Millbrook told investors it would charge Mr Adgemis a 15 per cent rate and keep the difference. It said it was expecting to refinance the loan after six months.

But now, Millbrook has listed Manor House with Savills. The site does not appear to have been drastically improved since Mr Adgemis’ purchase and photos show it would need renovation to attract guests.

The move has upset one other major investor in Mr Adgemis’ debts. Gemi’s Justin Epstein, one of Mr Adgemis’ largest lenders which also has a mortgage over the same property, said: “[Millbrook] have agreed to take [the property advertisement] down”.

However, Nick Lower, Savills’ director of hotels, who is selling the property said as far as he was aware, the sale is going ahead. Mr Adgemis declined to comment. “Millbrook’s priority is the protection of our investor’s capital, and has enforced its security in order to do so,” a spokeswoman for the firm said.

Mr Adgemis is scrambling to put together another refinancing deal after a previous attempt led by Bain Capital fell over in early April.

Millbrook also put the Empire Hotel in Sydney’s Annandale up for sale, which Mr Epstein said came as a surprise to him. The pub is being touted to the market as having a $39 million valuation with $33 million in debt, although it was bought for far less than that in 2021. Other lenders have lost patience. Angas Securities took control of one of Mr Adgemis’ properties in Bondi last week, an apartment block next to the vacant Noah’s Backpackers hostel site.

However, she doesn’t have absolute rights to sell or transfer the property when there are competing claims by other legal heirs, including children, clarified the court in a recent order.

The court was hearing a matter where the husband (who died before the wife) made a detailed Will giving right to his wife to enjoy the property till her death and further laid down how the asset will devolve.

“In the case of Hindu women, who may not have their own income, receiving a life estate given to them by their husbands – who may predecease them – is an essential safeguard for their financial security during their lifetime. Such security is essential to ensure that the woman is not dependent on her children, after the demise of the husband. Under such circumstances, the wife has complete rights to enjoy the property during her lifetime. She can also enjoy the income from the said property throughout her life. However, it cannot be held that the entire property should be construed as maintenance giving the wife absolute rights over the property, after the death of her husband,” noted Justice Prathiba M Singh.

The court was hearing a case stemming from a property dispute where the civil court concluded that since there was a Will by the husband before his death, the wife became absolute owner of his property since she lived there for 23 years.

But the verdict was challenged with multiple claims over the property by the dead man’s six children and a granddaughter. One party sought rights over the property as envisaged in the Will by the dead man while the other side argued that since mother had absolute ownership, fresh partition of property must devolve from that.

“The Will categorically states that the wife has no right to sell, alienate, or transfer the subject property. Given this position, to assert that upon the death of her husband she became the absolute owner of the subject property and could have sold or alienated the property would contradict the clear intent expressed in the Will as also the intention of the deceased mother clearly expressed through her conduct that she did not execute a Will or sell the property during her lifetime,” the court observed.

Expand

- By Helen Burchell

- BBC News, Bedfordshire

Image source, Getty Images

The family home where Captain Sir Tom Moore raised millions for NHS charities during the pandemic has been put up for sale for £2.25m.

The house and grounds in Marston Moretaine, in Bedfordshire, became well-known after the Army veteran walked laps around the garden, raising £38m for NHS Charities Together.

He lived there with his daughter Hannah Ingram-Moore and her family.

The Grade II listed property has seven bedrooms and four bathrooms.

In a marketing video posted online, estate agent Hadyn van Weenen said the Old Rectory featured an “iconic and very famous driveway”.

The estate had seven bedrooms, four reception rooms, four bathrooms and a separate coach house, that was being used as a gym but had planning permission to be converted into an annex, the agency said.

The “enclosed and secluded grounds” were set in 3.5 acres, with a pond and “part moat”.

Interested parties would be required to sign a confidentiality agreement prior to viewing, the property agent said.

Image source, Getty Images

Capt Sir Tom was born in Keighley, West Yorkshire, in 1920.

He served in India and Myanmar during World War Two, when it was known as Burma, but at the age of 99 he became an international star by walking laps around his garden.

His 100th birthday on 30 April 2020 was marked with an Royal Air Force flypast, personal birthday greetings from Elizabeth II and the prime minister, and he was made an honorary colonel of the British Army.

Central Bedfordshire Council initially approved plans but later the authority refused revised proposals, which included a spa, after it had already been partly built.

It said the inquiry was amid concerns his family may have profited from using his name.

The foundation said it would “work closely” with the inquiry.

Last year, the family’s lawyer Scott Stemp said the foundation was “unlikely to exist” in the future.

The Kislak Co. Inc. recently sold a 6,400-square-foot retail building at 1683-1687 St. Georges Ave. in Rahway for $765,000.

Kislak marketed the property on an exclusive basis, with Senior Vice President Daniel Lanni handling the assignment on behalf of the seller, LMN Financial Group LLC, and he also procured the purchaser, a private investor that was not disclosed.

“The long-term owner contacted us since he was ready to retire and wanted a professional marketing and sale process with fast results. We immediately generated multiple offers and closed in 30 days with an all-cash investor,” Lanni said.

The property consists of a one-story retail building constructed in 1950 on a 14,800-square-foot lot. The building has a newer roof and HVAC system, on-site parking and is fully occupied by three tenants.

Rahway recently reinvented itself increasingly as a diverse regional center for the arts and biological sciences, with official certification as a Film Ready Community through the New Jersey Motion Picture and Television Commission; and with Merck’s new global headquarters and Robert Wood Johnson University Hospital situated there. Centrally located, Rahway is 15 miles southwest of Manhattan and 5 miles west of Staten Island.

Captain Tom’s daughter has used his name in a brochure to help sell the family home in Bedfordshire, which is currently listed for £2.25m.

Hannah Ingram-Moore and her husband Colin have recently listed the Grade II seven-bedroom property in Rightmove, just months after they were forced to tear down an unauthorised spa building.

Among the many pictures of the property is one of the hallway, which features a large bust of the war veteran, which commemorates the 100 laps he walked around his garden to raise money for the NHS.

In a statement from the owner that is included in the brochure, Ms Ingram-Moore says: “A particularly special memory of our time here is of my father walking 100 laps of the garden to raise a record-breaking sum of almost £40million for NHS charities during the pandemic!”.

Within the brochure, it adds: “The property is owned by the family of Captain Sir Tom Moore who spent his final years there raising money for the NHS during the Covid pandemic.”

The property in Marston Moretaine boasts four bathrooms, four reception rooms and comes with a stand alone coach house.

While Captain Tom received a knighthood for his charitable efforts for the NHS, his family have since become embroiled in controversy after an investigation was launched into the charity established in his memory.

In February 2022, the Charity Commission announced it would be reviewing the accounts, after it emerged that the foundation had given grants of £160,000 to four charities but paid more than £162,000 in management costs.

During an interview with TalkTV’s Piers Morgan Uncensored in October 2023, his daughter tearfully admitted that the family kept the profits from three books that Captain Tom had written, which amounted to an estimated £800,000.

This was despite a prologue in his autobiography ‘Tomorrow will be a Good Day’ stating that the opportunity to write the memoir gave him “the chance to raise even more money” for his foundation.

She also revealed that she was paid £18,000 to attend the Captain Tom awards but only donated £2,000 of that sum to charity.

Since July last year, the foundation is not actively seeking donations or making payments and is co-operating with the inquiry.

The controversy escalated further after Ms Ingram-Moore and her husband were ordered to knock down an unauthorised building that was being used as a home spa.

The U-shaped building received planning permission from the Captain Tom Foundation in August 2021, with revised plans submitted in February 2022, which included the construction of a spa pool, toilets and a kitchen.

These were rejected by Central Bedfordshire Council, with an appeal dismissed and the building was demolished earlier this year.

- The 52-year-old is selling the seven-bedroom property with her husband Collin

Captain Tom’s scandal-hit daughter Hannah Ingram-Moore is selling her family’s £2.25million mansion by showcasing her late father’s pandemic heroics.

Mrs Ingram Moore, 52, and her husband Colin, 66, have put the seven-bedroom property in Bedfordshire up for sale months after they were forced to demolish an unauthorised spa block.

The listing features a photo of the mansion’s hallway, where a statute of Captain Tom doing one of his daily garden laps which raised £38million for NHS charities is pride of place.

The home’s history is also promoted in the brochure, stating that the ‘property is owned by the family of Captain Sir Tom Moore who spent his final years there raising money for the NHS during the Covid pandemic.’

It continues: ‘A particularly special memory of our time here is of my father walking 100 laps of the garden to raise a record-breaking sum of almost £40million for NHS charities during the pandemic.’

The sale comes after a series of scandals surrounding Captain Tom’s daughter, that ended with the £200,000 spa complex being torn down in February this year.

In August 2021, the Ingram-Moores were granted permission for a Captain Tom Foundation Building in the grounds of their home to support its charitable objectives.

The extension was called the Captain Tom Building in the plans, but it soon became apparent that the structure taking shape bore little resemblance to the one that had been sanctioned.

Following complaints from locals, a site visit was undertaken in March 2022, but the planning officer reported that the ‘windows were covered and access to the inside of the building was not possible’.

Central Bedfordshire Council refused a subsequent retrospective application in 2022 for a larger C-shaped building containing a spa pool.

The council insisted that the C-shaped building, that was built on a tennis court, was 49 per cent larger than what had been approved and must be demolished.

The demolition work was carried out on February 7, after the family lost an appeal to keep the complex after a planning inspector ruled it was ‘at odds’ with their Grade ll-listed home.

Before it was taken down, the Ingram-Moore’s were seen packing away Sir Tom’s legacy into boxes with photos of the war hero at Windsor Castle and his Sports Personality of the Year and Guinness World Record awards removed from the complex.

Mrs Ingram Moore also faced a probe into payments made through her family company for appearances linked to her late father’s charity in August 2023.

She reportedly attended and judged awards ceremonies in 2021 and 2022 as interim chief executive of the Captain Tom Foundation, but had payments for the appearances made to her company, Maytrix Group.

The BBC claim she received thousands of pounds into Maytrix for attending the Virgin Media O2 Captain Tom Foundation Connector Awards – despite promotional videos suggesting she was representing the charity.

The Charity Commission began investigating possible conflicts of interest between the Ingram-Moore’s private companies and the charity in November 2022. At the time, the family did not respond to the claims.

In an interview with Piers Morgan on TalkTV in October 2023, Ms Ingram Moore admitted to keeping £800,000 from books that the late army veteran had written.

She said the family kept the sum from three books because Captain Tom had wanted them to retain the profits.

World War Two veteran Captain Tom was knighted by the late Queen for walking 100 laps around the garden of the house during the Covid pandemic in 2020, raising £38million for NHS charities.

He died on February 2, 2021, aged 100, with Buckingham Palace announcing the Queen had sent the family a ‘private message of condolence’.

The family’s home up for sale boasts four bathrooms, four reception rooms and is set in 3.5 acres with a stand alone Coach House.

Potential buyers will have to provide ID, proof of wealth and sign NDAs before visiting the property.

The owner description continues: ‘It was the opportunity for multigenerational living that first drew us to this property.

‘We were living in Surrey, my elderly father was in Kent, and we were setting up our own business needing access to London, so we drew a circle on the map to determine how far we were willing to move.

‘Initially, we were looking for a house for us and our young family, and another nearby for my father, but when we found The Rectory with its own Coach House in the grounds, we increasingly liked the idea of all living together.

‘As the Coach House was in use as a B&B, my father ended up living with us in the main house, which with its 7 bedrooms including two master suites is more than big enough!

‘In the years since, it has been wonderful to see young and old thrive in a family home where everyone has their own space.’

Stay informed with free updates

Simply sign up to the Property sector myFT Digest — delivered directly to your inbox.

European commercial real estate deal making fell to a 13-year low at the start of 2024, as fading hopes of imminent interest rate cuts prolonged the slump in property markets.

Transaction volumes of €34.5bn in the first quarter were 26 per cent lower than the already depressed levels in the same period last year, the seventh successive quarter of declines, according to data from MSCI released on Thursday. Fewer offices buildings changed hands than in any quarter on record.

The commercial property market has suffered a brutal adjustment to much higher interest rates, which have slammed property values and increased financing costs in a market that relies heavily on debt to fund deals.

“After a very slow 2023, there were hopes that European property investment would start to pick up in the first quarter of 2024,” said Tom Leahy, head of Emea real assets research at MSCI.

“But the continued and sometimes painful readjustment to the end of historically low interest rates means the market remains a difficult place in which to transact.”

The report followed last week’s US data showing a 16 per cent decline in deal volumes in the first quarter from a year earlier.

European office values have sunk about 37 per cent on average from their peak in 2022, according to Green Street research. Residential and industrial property prices are down by about a fifth.

Although some owners have been forced to sell by debt pressures, many property owners are reluctant to crystallise losses at what they believe could be the bottom of the market.

High net worth investors who can buy without debt have powered the bulk of recent transactions — although they are generally limited to smaller deals.

London was “by far” the number one city for investment, MSCI said, despite transaction volumes falling. A faster correction in prices in the UK, relative to elsewhere in Europe, has encouraged investors to return to the market in search of bargains.

Two high-profile office deals — the £240mn sale of 20 Old Bailey and a £110mn deal brokered by receivers to sell 5 Churchill Place in Canary Wharf — collapsed during the quarter. However, this has been read by some in the market as a signal that sellers are hopeful that they can wait for better prices after the Bank of England lowers borrowing costs.

“Statistically the first quarter was pretty woeful,” said Nick Braybrook, head of London capital markets at Knight Frank. “But actually it is not reflective of what is going on out there. It feels pretty different.” He said private equity groups are starting to follow family offices into the market, which will result in more deals over the next six months.

MSCI estimated the prices sellers are willing to pay are still often lower than those buyers would accept. “Many segments of the market have not repriced sufficiently to bring greater interest from buyers,” MSCI said.

Hotels were the only part of the market to see a rise in transactions. The sector has enjoyed a post-Covid resurgence in travel that has boosted dealmaking.