Minneapolis, MN, “The City of Lakes,” is quickly becoming home for many Minnesotans and out-of-staters alike. With its picturesque views of the Mississippi River, outstanding restaurants, and iconic Spoonbridge and Cherry sculpture, it shouldn’t come as a surprise that close to 445,000 people live in Minneapolis.

And if you’re thinking about moving to the city, you’ll find that the average rent price for a 2-bedroom apartment in Minneapolis is $1,625, the median home sale price is $340,000, and the housing market is somewhat competitive.

If those prices are out of your budget, don’t worry. We’ve got options to help you find a home. We’ve rounded up a list of the 10 best affordable Minneapolis suburbs to consider living in – and they’re all under a 35-minute drive from the city. From a reasonable commute time to an easy weekend getaway, you’ll still be close enough to Minneapolis to explore all the city has to offer – without the price of living there.

#1: Hopkins

Median home price: $272,500

Driving distance from Minneapolis: 15 minutes

Hopkins, MN homes for sale

Hopkins, MN apartments for rent

With a median home sale price of $272,500, Hopkins lands the number one spot on our list as the most affordable Minneapolis suburb. Just about a 15-minute drive away from Minneapolis, you won’t miss out on finding all the city’s hidden gems. Living in Hopkins, you can spend time exploring Burnes Park, learning about the area’s history at the Hopkins Historical Society, or checking out the exhibits at Hopkins Center for the Arts.

#2: Hastings

Median home price: $285,000

Driving distance from Minneapolis: 35 minutes

Hastings, MN homes for sale

Hastings, MN apartments for rent

Minneapolis’s second most affordable suburb, Hastings has a median home sale price of $285,000. Only 35 minutes from the city center, you’ll be visiting Minnehaha Regional Park in just a quick drive. While living in Hastings, make sure to explore Hastings Water Park or grab a bite to eat at one of the many riverfront restaurants.

#3: Circle Pines

Median home price: $291,000

Driving distance from Minneapolis: 20 minutes

Circle Pines, MN homes for sale

Circle Pines, MN apartments for rent

20 minutes away from downtown Minneapolis, you’ll find yourself in the suburb of Circle Pines. Even with a population of about 5,000, there are plenty of cool areas to explore in Circle Pines. If you find yourself moving here, make sure to visit Golden Lake Park to spend a sunny afternoon fishing, boating, or playing tennis.

#4: Lexington (tie)

Median home price: $300,000

Driving distance from Minneapolis: 20 minutes

Lexington, MN homes for sale

Lexington, MN apartments for rent

Located just west of Circle Pines is Lexington, the next suburb on our list. About 4,500 people live in this Minneapolis suburb, where you’ll find Lexington Memorial Park. And weekend trips into downtown Minneapolis won’t take you too long, only about 20 minutes if you’re lucky to catch a traffic-free drive.

#4: Coon Rapids (tie)

Median home price: $300,000

Driving distance from Minneapolis: 30 minutes

Coon Rapids, MN homes for sale

Coon Rapids, MN apartments for rent

Tying Lexington for the fourth spot on our list is Coon Rapids. Just 30 minutes outside of Minneapolis, Coon Rapids is another great area to add to your list of places to consider moving to. Home to 65,000 residents, this affordable town can be a great choice for people looking to remain close to Minneapolis without paying the price for a home in the city. Living in Coon Rapids, you’ll find Coon Rapids Dam Regional Park, the Mississippi River Regional Trail, and the Lilli Putt, a mini-golf course. Don’t forget to stop by Coon Rapids Ice Center as you’re checking out the town.

#6: Columbia Heights

Median home price: $312,500

Driving distance from Minneapolis: 15 minutes

Columbia Heights, MN homes for sale

Columbia Heights, MN apartments for rent

Sixth on the list is another well-known Minneapolis suburb, Columbia Heights, where the home prices are about $30K less than in Minneapolis. With roughly 20,300 people calling Columbia Heights home, it’s a great area to consider buying a house or renting an apartment in. There are lots of activities to do in this suburb like checking out Kordiak Park, among many other local favorites.

Take a 15 minute drive from Columbia Heights to visit, “The Walker Art Center and Sculpture Garden. The Sculpture Garden is outdoors and you can see the infamous Cherry Spoon plus other works of art. It’s a great photo opportunity so be sure to bring your camera,” recommends Sarah Pierce, Owner of Minneapolis Headshots.

#7: Fridley

Median home price: $314,000

Driving distance from Minneapolis: 15 minutes

Fridley, MN homes for sale

Fridley, MN apartments for rent

Seventh on our list of affordable Minneapolis suburbs is Fridley, which is almost 15 minutes away from the heart of the city. With a population of about 28,000, living in Fridley is a great alternative to city life. Don’t miss out on visiting Moore Lake Park or Manomin Park once living in Fridley.

Just a 20 minute drive from Fridley, Erin Johnson Photography suggest, “I enjoy walking the Stone Arch Bridge and the areas around the bridge on both sides of the Mississippi River. Minneapolis is filled with great food, breweries and coffee shops. I would suggest the Spyhouse for a gourmet coffee, Brasa for an amazing meal, and Surly Brewing for a great indoor/outdoor experience with a beer in hand.”

#8: Robbinsdale

Median home price: $321,500

Driving distance from Minneapolis: 15 minutes

Robbinsdale, MN homes for sale

Robbinsdale, MN apartments for rent

If you’ve lived in Minneapolis for a while, chances are you know of Robbinsdale. About 14,000 people live in Robbinsdale, so you’ll have a fraction of Minneapolis’s population while remaining close to the city and its attractions. Make sure to visit Lakeview Terrace Park, Manor Park, or the art exhibits at Robbin Gallery once you move to Robbinsdale.

“We absolutely love going to the Minneapolis Institute of Arts,” mentions Nicole Spangler Photography. “We are so lucky to have works by Monet, Renoir, Van Gogh, and more in Minnesota.”

#9: Brooklyn Park

Median home price: $323,000

Driving distance from Minneapolis: 15 minutes

Brooklyn Park, MN homes for sale

Brooklyn Park, MN apartments for rent

Without traffic, you’ll be in downtown Minneapolis in about 15 minutes, making Brooklyn Park a great place to consider moving to. Close to 80,000 people live in this suburb, but you’ll find lots to do in Brooklyn Park. Fun activities to check out in Brooklyn Park include exploring Mississippi Gateway Regional Park and the Brooklyn Park Activity Center.

Just a 15 minute drive from Brooklyn Park is, “a cluster of beautiful lakes and trails, known as the Chain of Lakes, that offer all sorts of opportunities for free outdoor recreation,” recommends Lulle Photo & Film. “The five interconnected lakes span over 6 miles, so there’s plenty of space to explore. Take a walk or bike ride around the lakes. There’s activities for everyone: enjoy fishing, canoeing, kayaking, paddle-boarding, and relaxing by the water. Also, there are a lot free concerts and movie nights at the Bandshell at one of the five lakes, Lake Harriet.”

#10: Farmington

Median home price: $335,212

Driving distance from Minneapolis: 35 minutes

Farmington, MN homes for sale

Farmington, MN apartments for rent

Rounding out our list of affordable Minneapolis suburbs is Farmington. If you’re lucky to avoid traffic, it’ll only take about 35 minutes to drive into Minneapolis. This suburb has a population of 23,000 and is home to Fountain Valley Golf Club and Rambling River Park. There’s always something to check out while living in this awesome suburb.

Other affordable things to do in Minneapolis

1. Minneapolis Institute of Art

“If you’re into the arts, I highly recommend checking out The Minneapolis Institute of Art [MIA]. Admissions are free at the MIA. This place is perfect for a free date night in the city. You can explore the museum’s vast collection, featuring art over 6,000 years ago. You can also enjoy special events such as artist talks and live music,” recommends Lulle Photo & Film.

2. Minnehaha Falls

“My favorite park in Minneapolis is Minnehaha Falls. The trails, the iconic waterfall, and the amazing restaurant Sea Salt is a Minneapolis Classic. I love bringing my dog for a walk around the trails near the falls; and then to Minnehaha Dog Park just a short distance away. It’s a great off-leash area, and a spot for pups to play together,” provides Lulle Photo & Film.

3. Minnesota Landscape Arboretum

“The Minnesota Landscape Arboretum has indoor and outdoor gardens that change throughout the seasons. Be sure to visit their Apple House in the fall for the best fresh picked apples, the home of the original honey crisp apple,” recommends Sarah Pierce from Minneapolis Headshots.

4. Central Park Maple Grove

“The City of Maple Grove features award winning parks and recreational opportunities,” suggests Economic Development Director of Maple Grove, Brett Angell. “During the winter months, the ice skating loop at Central Park of Maple Grove offers a great opportunity for leisure skating for all ages.”

Methodology: Affordability is based on whether a suburb is less than the median sale price of Minneapolis and under a 35-minute drive from downtown Minneapolis. Median home sale price data from the Redfin Data Center during April 2022. Average rental data from Rent.com May 2022. Population data sourced from United States Census Bureau.

This is a home for sale in Mount Lebanon, Pa., on Tuesday, Sept. 21, 2021. Homebuilders and other real estate companies are increasingly betting that would-be homebuyers frustrated with a shortage of homes for sale and runaway prices will settle for renting their slice of the American Dream. While individual homeowners and mom-and-pop investors still account for the vast majority of single-family rental homes, homebuilders have stepped up construction this year of new houses being built for rent.(AP Photo/Gene J. Puskar)

SPRINGFIELD, Mo. – The Greater Springfield Board of Realtors (GSBOR) has provided year-over-year statistics on the residential market comparing May 2021 to May 2022. The numbers show home prices have gone up by about $50,000 and homes don’t stay on the market as long. A local realtor gave us some perspective on the current market in Greene, Christian and Webster counties.

Realtor Dusty Loveland says these numbers are fairly typical going up and down the way they are.

He says the larger issue is the price of new construction where the builders can’t build under $200,000.

“They can’t make any money on a home. You know, we’ve… always been able to have a lot of new construction around and that really did spoil a lot of the first home buyers. And we builders can’t afford to make a house for under $200 a square foot right now,” says Loveland. “Because the land is so expensive, the materials are so expensive and we’re running out of the surplus of all the new homes that were in the progress of being built in the last few years.”

He says builders aren’t able to replenish homes as fast as people are buying them and that affects the whole market.

“You also have to take into consideration lumber has gone up so much a sheet of OSB plywood was $9 two-three years ago. Now it’s $35 for the same. I mean, and that’s when you consider the price of building a house… we’ve always had new houses in the area, and now there’s no new houses.” said Loveland.

These problems with supply and demand drive the prices of older homes and rent up, according to Loveland.

“If the builders can’t build a house as affordable as they used to be, then, unfortunately, the price of everything is going to go up in the market,” Loveland said. He said gas prices have made it difficult for builders trying to build outside of the city as well.

“It’s what we would call a seller’s market for the most part. The interest rates are on the way up,” says Realtor Dusty Loveland. “There’s no new homes to compete with… There’s just so few houses that people have to buy what’s for sale.”

According to GSBOR, slightly fewer homes were sold in May of 2022 versus May of 2021. In May 2022, 710 homes were sold, but 722 were sold in May 2021.

The median sales price has gone up from $207,000 in May 2021 to $260,000 this year. The average number of days on market also decreased from 15 to 12.

Looking at the statistics by county, Greene County sold 523 homes in May 2021 but has only sold 475 this year. The median sales price has gone up from $200,000 to $251,000 and the average number of days on market was 16 in 2021 and was 12 days this year.

Christian County sold 144 homes last May and actually sold 179 homes this year. The median sales price did go up from $260,000 to $300,000, while the average number of days on market was 11 in 2021 to 12 this year.

Webster County sold 55 homes in May of 2021 and sold 56 this year. The median sales price was at $185,000, but now it has risen to $217,500. The average days on market was 19 but is now at 13 days.

In terms of a year to date, all three counties totaled 3,113 Homes sold in 2021 and 2,824 this year. As for median sales prices, 2021 cost $207,000 and 2022 cost $247,000 with the average days on market going from 24 to 15.

In reality, there’s never a perfect time to buy a house anywhere. The property market and global economy change rapidly, but whether you should buy a property or not also highly depends on your personal financial situation more than anything. Nevertheless, there are certain elements in the Italian real estate market that are important to take into account. Are property prices falling in Italy? Is 2022 a good time to buy property in Italy? We explain everything.

Current real estate market in Italy

While your personal financial situation is key in deciding whether it’s the right time to buy in Italy, there are several other factors in the Italian market that could also affect your decision whether to buy or rent. With pressures on demand in certain parts of the country, you have to act quickly to get the house of your dreams in Italy, as well as taking the following points into consideration.

Rising interest rates

One of the challenges faced by potential home buyers in Italy in 2022 is taking out a mortgage. Euribor interest rates, on which Italian mortgages are based, are rising thanks to inflation and the war in Ukraine, meaning higher mortgage instalments and more pressure on household budgets. For more information about mortgages in Italy and how much you could pay, check out the idealista/mutui mortgage simulator and find your mortgage.

Italian house prices on the up

House prices in Italy are on the rise and this upward trend is set to continue throughout the year. In spite of this, according to real estate experts, prices are expected at a steady rate and not as rapidly as in other EU countries. In spite of rising prices, the residential real estate market is showing its resilience and people are committed to buying property, considering it a safe investment in 2022.

Mortgages for young buyers

For those who are under 36 and wish to buy their first home in Italy, banks have special rates as part of Italy’s “bonus prima casa” (first home bonus) which is part of the government’s Sostegni-Bis Decree. If you’re buying property in Italy in 2022 and fit the criteria, make sure to check all the options with banks, as you could save a lot, especially when it comes to taxes.

Therefore, for young people planning to buy property in Italy, now could be the perfect time. Originally set to expire in June 2022, the measure has been extended to December this year, giving buyers a further opportunity to get financial help with purchasing their first property. Note that this applies to everyone who is an official resident in Italy and for properties up to a maximum value of 250,000 euros.

Buy or rent in Italy in 2022?

For those undecided as to whether buying property in Italy is the right choice, renting is also an option. This depends on your financial situation, whether you can afford to pay a deposit for buying a house up front or not, and whether you intend on staying in Italy for a long period of time. For more details, check out our guide on whether it’s better to buy or rent property in Italy in 2022.

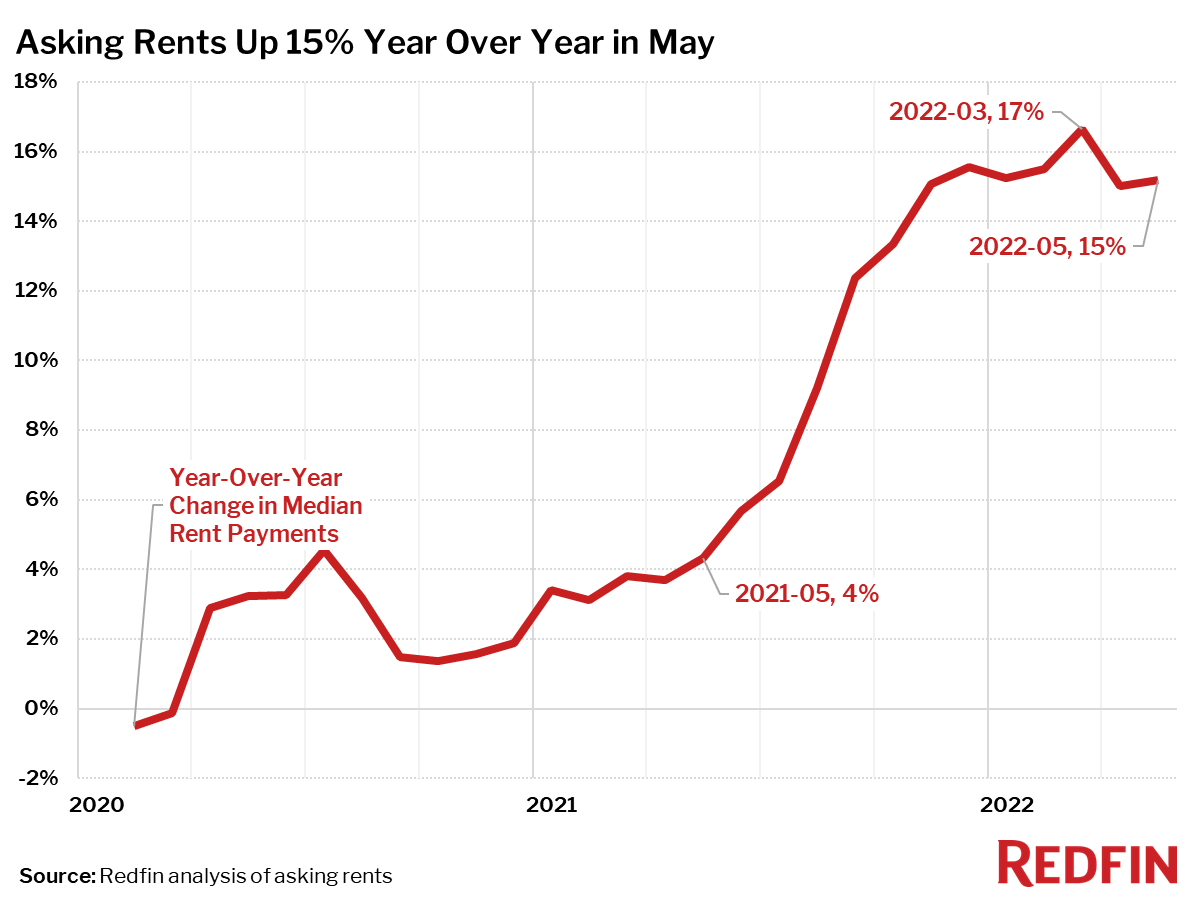

Asking rents were up over 30% in Cincinnati, Seattle, and Nashville and nearly 50% in Austin.

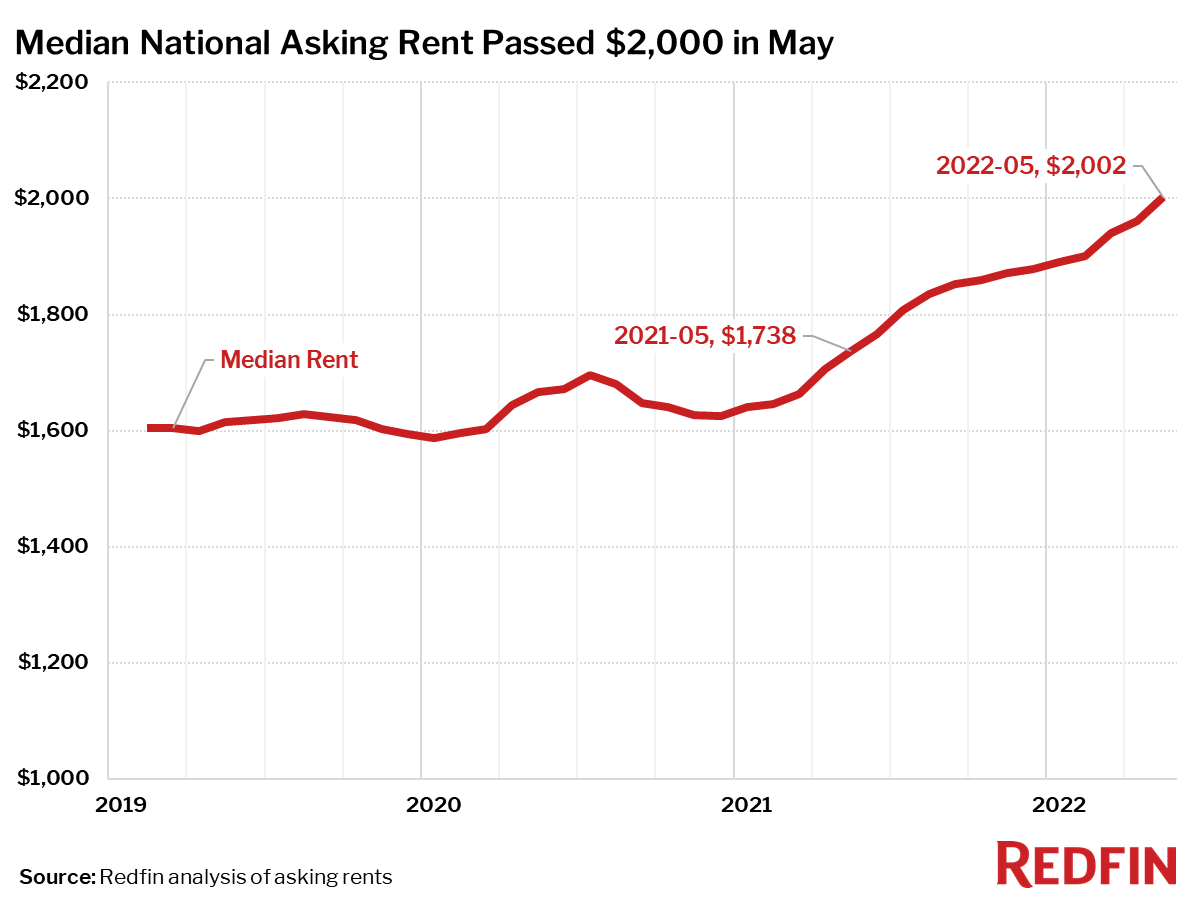

The median monthly asking rent in the U.S. surpassed $2,000 for the first time in May, rising 15% year over year to a record high of $2,002. That’s on par with April’s annual increase of 15%, but a slowdown from March’s 17% gain.

“More people are opting to live alone, and rising mortgage-interest rates are forcing would-be homebuyers to keep renting,” said Redfin deputy chief economist Taylor Marr. “These are among the demand-side pressures keeping rents sky-high. While renting has become more expensive, it is now more attractive than buying for many Americans this year as mortgage payments have surpassed rents on many homes. Although we expect rent-price growth to continue to slow in the coming months, it will likely remain high, causing ongoing affordability issues for renters.”

| Rental Market Summary | May 2022 | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Average Monthly Rent | $2,002 | 2% | 15.2% |

Rents Up Over 30% in Austin, Nashville, Seattle and Cincinnati

Asking rents surged 48% year over year in Austin, TX—the largest increase on record in any metro area since at least the beginning of Redfin’s rental data in 2019. Nashville, TN, Seattle, and Cincinnati also saw asking rents increase over 30% from a year earlier. Rent growth in Portland, OR (24%) fell below 30% for the first time since the start of the year, causing it to drop out of the top 10.

Top 10 Metro Areas With Fastest-Rising Rents Year Over Year

- Austin, TX (48%)

- Nashville, TN (32%)

- Seattle, WA (32%)

- Cincinnati, OH (32%)

- Miami, FL (29%)

- Fort Lauderdale, FL (29%)

- West Palm Beach, FL (29%)

- New York, NY (24%)

- Nassau County, NY (24%)

- New Brunswick, NJ (24%)

Just three of the 50 most populous metro areas saw rents fall in May from a year earlier. Rents declined 10% in Milwaukee and 3% in Kansas City, MO and Minneapolis. The same three metro areas saw rents decline in April as well.

Metro Areas Where Rents Declined Year Over Year

- Milwaukee, WI (-10%)

- Kansas City, MO (-3%)

- Minneapolis, MN (-3%)

Median Asking Rents, May 2022

| U.S. Metro Area | Median Asking Rent | Year-Over-Year Change in Median Asking Rent |

|---|---|---|

| Anaheim, CA | $3,400 | 9.6% |

| Atlanta, GA | $2,143 | 18.3% |

| Austin, TX | $2,707 | 48.4% |

| Baltimore, MD | $2,101 | 7.9% |

| Boston, MA | $3,970 | 17.7% |

| Charlotte, NC | $1,822 | 8.7% |

| Chicago, IL | $2,454 | 6.6% |

| Cincinnati, OH | $1,713 | 31.7% |

| Cleveland, OH | $1,477 | 9.6% |

| Columbus, OH | $1,627 | 9.0% |

| Dallas, TX | $2,200 | 21.6% |

| Denver, CO | $2,681 | 16.1% |

| Detroit, MI | $1,674 | 13.6% |

| Fort Lauderdale, FL | $3,157 | 29.0% |

| Fort Worth, TX | $2,200 | 21.6% |

| Houston, TX | $1,822 | 16.1% |

| Indianapolis, IN | $1,471 | 20.4% |

| Jacksonville, FL | $1,681 | 17.1% |

| Kansas City, MO | $1,428 | -2.9% |

| Las Vegas, NV | $1,837 | 17.4% |

| Los Angeles, CA | $3,400 | 9.6% |

| Miami, FL | $3,157 | 29.0% |

| Milwaukee, WI | $1,616 | -10.0% |

| Minneapolis, MN | $1,776 | -2.8% |

| Montgomery County, PA | $2,385 | 13.2% |

| Nashville, TN | $2,141 | 32.5% |

| Nassau County, NY | $4,008 | 24.4% |

| New Brunswick, NJ | $4,008 | 24.4% |

| New York, NY | $4,008 | 24.4% |

| Newark, NJ | $4,008 | 24.4% |

| Oakland, CA | $3,752 | 16.6% |

| Orlando, FL | $2,193 | 22.9% |

| Philadelphia, PA | $2,385 | 13.2% |

| Phoenix, AZ | $2,261 | 23.8% |

| Pittsburgh, PA | $1,937 | 15.5% |

| Portland, OR | $2,536 | 23.6% |

| Providence, RI | $2,283 | 3.4% |

| Riverside, CA | $2,681 | 10.0% |

| Sacramento, CA | $2,764 | 17.8% |

| San Antonio, TX | $1,453 | 17.7% |

| San Diego, CA | $3,432 | 21.5% |

| San Francisco, CA | $3,752 | 16.6% |

| San Jose, CA | $3,621 | 16.7% |

| Seattle, WA | $3,097 | 31.9% |

| St. Louis, MO | $1,561 | 4.3% |

| Tampa, FL | $2,188 | 22.4% |

| Virginia Beach, VA | $1,670 | 13.5% |

| Warren, MI | $1,674 | 13.6% |

| Washington, D.C. | $2,681 | 12.5% |

| West Palm Beach, FL | $3,157 | 29.0% |

| National | $2,002 | 15.2% |

Methodology

Redfin analyzed rent prices from RentPath across the 50 largest metro areas in the U.S. This analysis uses data from more than 20,000 apartment buildings across the country.

It is important to note that the prices in this report reflect the current costs of new leases and new mortgages during each time period. In other words, the amount shown as the median rent is not the median of what all renters are paying, but the median cost of apartments that were available for new renters during the report month. Currently, Redfin’s data from RentPath includes only median rent at the metro level. Future reports will compare median rent prices at a more granular geographic level.

San Diego, California, a beachside haven, is one of the top locations for those looking to rent or buy a home in the state. With calming views of the Pacific Ocean and San Diego Bay, stellar fish tacos, California burritos, and endless ways to spend your days, it shouldn’t come as a shock that nearly 1 million people are living in San Diego. If you’re considering buying a home or renting an apartment in San Diego, keep in mind that the median home sale price is $900,000 and the average rent for a 1-bedroom apartment is $2,890.

If that number is out of your budget, don’t worry. We’ve got options to help you find a home. We’ve collected the 8 best affordable San Diego suburbs to consider living in. And the best part is that they’re all less than 30 minutes away from the city center. If you decide to live in any of these suburbs, you’ll still be close enough to San Diego to explore the city’s great neighborhoods without the price of living there.

#1: Winter Gardens

Median home price: $605,000

Driving distance from San Diego: 25 minutes

Winter Gardens, CA homes for sale

Winter Gardens, CA apartments for rent

With a median home sale price of $605,000, Winter Gardens lands the number one spot on our list as the most affordable San Diego suburb. Only a 25-minute drive away from San Diego, you can comfortably live in the suburb and still experience what the city offers.

#2: El Cajon

Median home price: $712,500

Driving distance from San Diego: 20 minutes

El Cajon, CA homes for sale

El Cajon, CA apartments for rent

20 minutes away from downtown, you’ll find yourself in El Cajon. The city’s name means “the box” in Spanish, which describes the valley in which El Cajon is located. From parks and outdoor recreation to supporting local businesses, many things make El Cajon a great place to live. If you find yourself moving to the third most affordable suburb, make sure to visit the Olaf Wieghorst Museum.

“El Cajon, CA is a great place for people who enjoy the festivities that come with the city. From the Mother Goose Parade to HauntFest, classic car nights to outdoor concerts, movies in the park to America on Main Street multi-cultural celebration, there is something for everyone in El Cajon. To find more information about what’s going on in the area, check out East County Magazine for articles and calendar listings of local events.”

#3: National City

Median home price: $715,000

Driving distance from San Diego: 10 minutes

National City, CA homes for sale

National City, CA apartments for rent

A little more expensive than El Cajon is none other than National City. Home to 62,000 residents, this suburb is the second oldest community in San Diego and is full of rich history. Whether you decide to move to or visit National City, be sure to check out the four buildings in the city that are listed on the National Register of Historic Places: Granger Music Hall, Brick Row on Heritage Square, St. Matthews Episcopal Church, and the Santa Fe Rail Depot.

#4: Chula Vista

Median home price: $731,000

Driving distance from San Diego: 15 minutes

Chula Vista, CA homes for sale

Chula Vista, CA apartments for rent

Only a 15-minute drive into the city, consider adding Chula Vista to your list of San Diego suburbs to see. With 285,500 residents, moving to this affordable suburb can keep you close enough to San Diego without paying the premium for a home there. Chula Vista features more than 52 square miles of coastal landscape, canyons, rolling hills, mountains, quality parks, and miles of trails. The area is also known for its great attractions, including the Living Coast Discovery Center and Aquatica San Diego.

“Head to Chula Vista Bayside Park for an inexpensive and pleasant experience,” shares California Beautiful. “San Diego has the perfect spots for you to appreciate nature without hurting your wallet.”

“At Bayside Park in Chula Vista, I love taking advantage of the beautiful scenery and pleasant weather,” recommends SDtoday. “From the Coronado Bridge to the city skyline, the views of San Diego Bay are amazing. Plus, there’s plenty of space for a picnic, activities, and even fishing – all without costing a cent.”

“My family loves to take advantage of the gorgeous weather in Chula Vista by visiting the Third Avenue Village Market for some fresh food and then having a picnic at Chula Vista Bayside Park,” suggests San Diego Moms. “The park has stunning views that make it the perfect spot for a family outing. There are also several other farmers markets throughout the week, so there are plenty of opportunities to get out and enjoy the area.”

#5: Lemon Grove (tie)

Median home price: $740,000

Driving distance from San Diego: 15 minutes

Lemon Grove, CA homes for sale

Lemon Grove, CA apartments for rent

Located to the east of San Diego is the suburb of Lemon Grove, where the home prices are about $150K less than in San Diego. Home to 26,500 residents, Lemon Grove is known for its 3000-pound lemon monument that sits near the Orange Line trolley tracks. The area also features a variety of local shops and mom-and-pop restaurants for residents to enjoy.

#6: Santee (tie)

Median home price: $740,000

Driving distance from San Diego: 25 minutes

Santee, CA homes for sale

Santee, CA apartments for rent

The next post on our list of affordable San Diego suburbs is Santee, which is roughly 25 minutes away from downtown. With a population of about 58,500, you’ll live in a smaller area, but there’s no shortage of things to experience in Santee. Don’t miss out on visiting Big Rock Park and checking out the Creation & Earth History Museum once moving here.

#7: Mira Mesa

Median home price: $800,000

Driving distance from San Diego: 25 minutes

Mira Mesa, CA homes for sale

Mira Mesa, CA apartments for rent

Mira Mesa is a great place to consider moving to that will get you access to downtown San Diego in just about 25 minutes. Close to 44,000 people live in this neighborhood. Attractions in Mira Mesa include exploring Hourglass Community Park and San Diego Ice Arena.

“The Miramar Air Show, located in Mira Mesa, San Diego, is my favorite affordable family activity,” shares Fab Everyday. “The show is the largest military air show in the US and is sure to impress with its incredible sights. There are different ticketing options available at various prices, but general admission is free of cost. No matter if you’re a Top Gun fan, an aviation enthusiast, or just someone looking for an exciting experience, you won’t want to miss out on this amazing show.”

#8: Escondido

Median home price: $805,000

Driving distance from San Diego: 30 minutes

Escondido, CA homes for sale

Escondido, CA apartments for rent

Escondido takes the last spot on our list of affordable San Diego suburbs. Without traffic, you’ll find yourself in San Diego in roughly 30 minutes. This suburb has a population of 151,000 and is home to San Diego Zoo Safari Park, Dixon Lake, and Daley Ranch. You’ll have plenty of activities to explore during your free time living in this great suburb.

“Exploring Queen Califia’s Magical Circle in Escondido is an amazing and affordable experience,” says Milana’s Travels. “Stroll around and marvel at the captivating sculptures – all for free. It’s truly a hidden gem.”

Additionally, San Diego Mamas insists, “Dixon Lake located in Escondido is an amazing secret. It is an incredible park and lake with a campground, and our family has had many unforgettable camping trips there. Despite being in the heart of the city, when you’re at Dixon Lake you feel like you’re in an entirely different world.”

Located in Escondido, “the San Diego Children’s Discovery Museum is an excellent spot to spend the day with little ones. It features various interactive and educational activities tailored to children of all ages, plus special discounts.”

6 Affordable things to do in San Diego

1. Balboa Park

“Balboa Park, a stunning urban park close to the heart of San Diego, is a joy for visitors to explore. It houses an array of museums, performing art venues, and botanic gardens, and offers free admission to several of its museums on certain Tuesdays of each month.” Giving Back Magazine

“Exploring the museums in Balboa Park, San Diego, with my children is my favorite budget-friendly activity,” states Absolute Winery. “This park offers a great combination of stunning gardens, interesting museums, and other cultural attractions.”

The team at San Diego DISCOVER has some great budget-friendly ideas for your next trip. “Start by playing disc golf at the Morley Field Golf Course in Balboa Park for only $5.00, then take a kayak out on the bay for one hour for $25 (single) or $30 (tandem). After that, head to Pure Brewing in North Park for $3.00 craft beer tasters. Finally, don’t miss out on the Farmers Market in Little Italy and a stroll down the Mission Beach Boardwalk.”

2. The San Diego Botanical Garden

“San Diego is a very spiritually rich area with charming natural sceneries. We love spending time outdoors without breaking the bank.” Cardiff Vacations says, “a great way to do this is to have a peaceful day at the beach or explore the San Diego Botanical Garden.”

3. Lake Poway

“Lake Poway is a great spot for a budget-friendly day out – you can go hiking up to the renowned Potato Chip Rock, enjoy picnics in the shade of its huge trees, or rent a paddle boat and go trout fishing” shares So Diego Tours. “But that’s not all – the Poway Midland Railroad is located in a large park and gives visitors the chance to ride vintage trains, including a steam locomotive. My personal favorite hiking trail begins at Lake Poway, where it climbs up 2,900 feet to the peak of Mount Woodson. It’s definitely a must-do if you’re in Poway.”

4. The San Diego coastline

“Experience San Diego’s breathtaking coastline on your bike,” recommends Top Rope Media. “Pedal north from Torrey Pines State Beach or Solana Beach through Encinitas, Leucadia, and Carlsbad, finishing up at Oceanside Harbor Village. The entire journey is 27 miles one way, but you can turn around whenever you’re ready. Pack all the beach essentials like sunblock, hat, water, bathing suit, and a towel so you can take a dip at Fletcher’s Cove, Moonlight Beach, or Swamis. Enjoy the amazing views and fresh ocean air on this unforgettable ride.”

5. San Diego museums

“This February, visit San Diego and take advantage of the amazing San Diego Museum Month. With half-off admission to more than 60 museums, you can explore the USS Midway Museum, the Fleet Science Center, and many more. Even better – there are over 20 museums that are free all year round, with rotating Tuesdays each month offering free admission to 10 Balboa Park museums for San Diego residents. Get your pass from any San Diego public library or online at San Diego Museum Council and enjoy the fun.”

6. Go San Diego Pass

“With the Go San Diego Pass, you can save a substantial amount of money on admission to many of San Diego’s attractions,” shares Food Family and Chaos. “This pass offers multiple packages to suit your individual needs and allows you to enjoy the city’s sights without breaking the bank. If you are planning a trip to San Diego and visiting multiple attractions, this pass is an ideal choice.”

Methodology: Affordability is based on whether a suburb is less than the median sale price of San Diego and under a 30-minute drive from downtown San Diego. Median home sale price data from the Redfin Data Center during April 2022. Average rental data from Rent.com May 2022. Population data sourced from the United States Census Bureau.

Learn more about San Diego:

15 Hot Spots and Can’t-Miss Hidden Gems in San Diego

12 Beautiful Places in San Diego Locals Rave About

10 Fun Facts About San Diego: How Well Do You Know Your City?

-

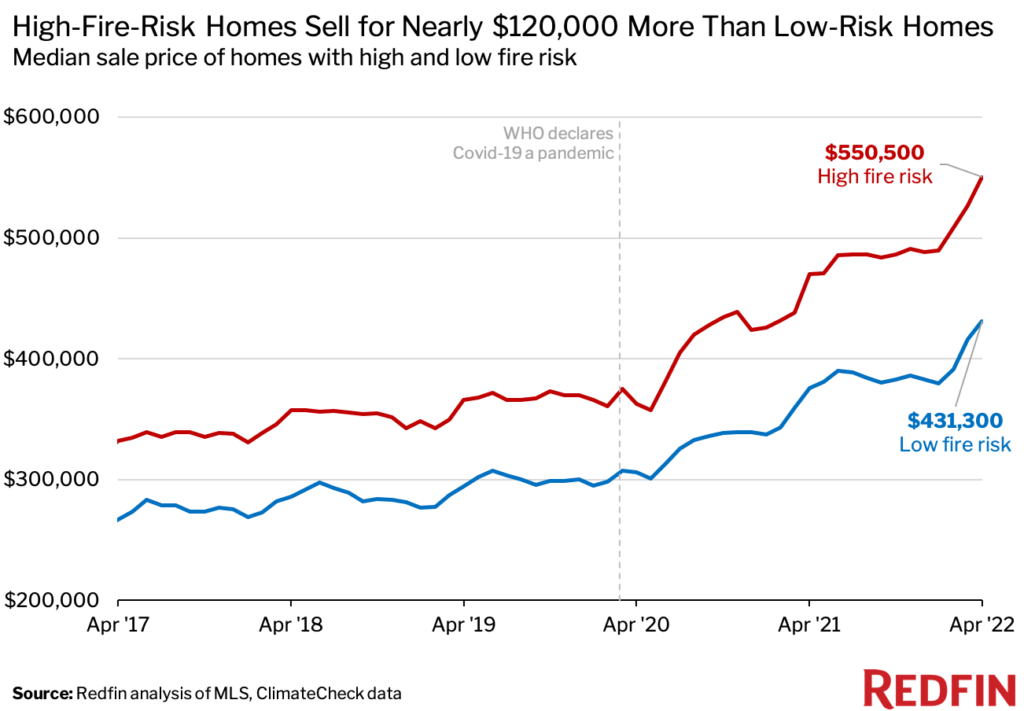

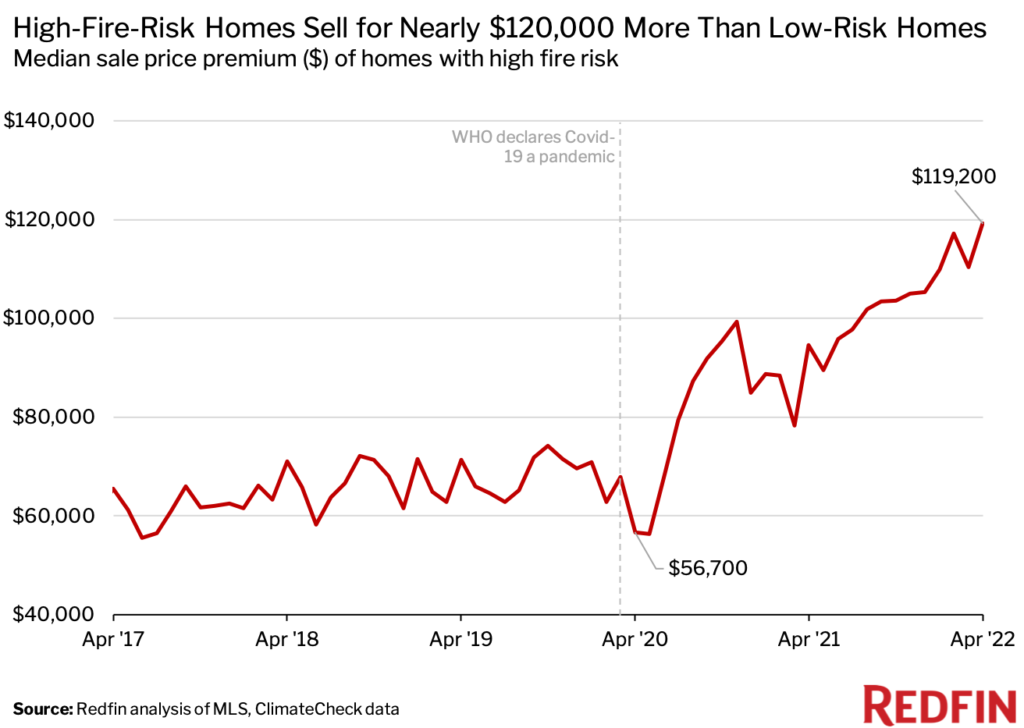

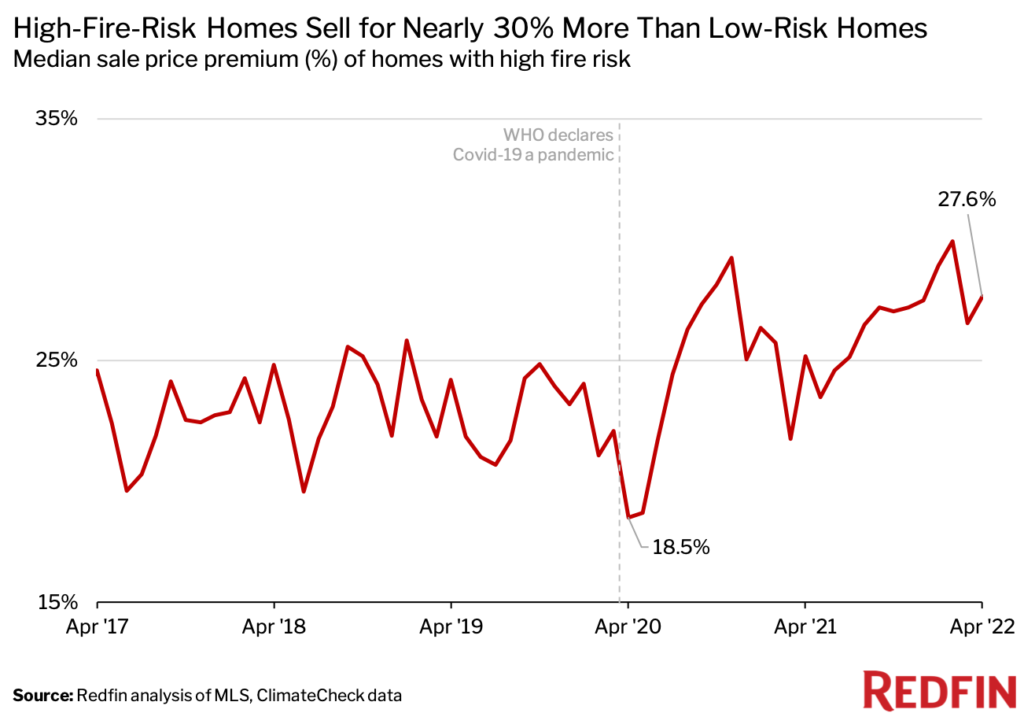

The typical high-fire-risk home sold for $550,500 in April, while the typical low-risk home sold for $431,300. That’s the biggest premium since at least 2017.

-

The median sale price of high-risk homes jumped 52% during the pandemic, while the median sale price of low-risk homes rose 41%.

-

High-risk homes sell for more in part because remote work has allowed many Americans to move to suburbs and rural areas, which are often more vulnerable.

-

Homes with high fire risk are also selling faster than low-risk homes, but are more likely to experience price cuts once they’re on the market.

The median sale price of U.S. homes with high fire risk was $550,500 in April, compared with $431,300 for homes with low fire risk. In other words, the typical home with high fire risk sold for $119,200 (27.6%) more than the typical home with low fire risk—the largest premium in dollar terms since at least 2017. By comparison, homes with high fire risk sold for just $56,700 more (18.5%) two years earlier.

Fire-prone homes have historically fetched higher prices, likely because they tend to be larger and/or located in pricey West Coast metros. The typical high-fire-risk home purchased in April was 2,000 square feet, while the typical low-risk home was just 1,706 square feet. But the price premium for high-risk homes has surged during the pandemic. That’s in part because scores of Americans moved out of cities and into suburbs and rural areas, where homes are more likely to face fire risk due to the proximity to flammable vegetation. The median sale price of high-risk homes was up 51.7% in April from two years earlier, while the median sale price of low-risk homes was up 40.9%.

“Suburban homes tend to be more expensive because they’re large, and demand for large homes skyrocketed during the pandemic as Americans sought respite from crowded city life,” said Redfin Senior Economist Sheharyar Bokhari. “Pandemic buyers also hunted for deals due to surging home prices, and while fire-prone homes aren’t cheaper on average, buyers may feel they’re getting more bang for their buck because they’re getting more space. And for some pandemic buyers, the fire-prone home they bought in suburbia was actually cheaper than their last home because they were relocating from somewhere like San Francisco or Seattle.”

Wildfires in the U.S. have become increasingly catastrophic in recent years. The three most destructive wildfire years, in terms of acreage burned, have all occurred in the last decade, according to the National Interagency Fire Center.

While research has shown that many house hunters are concerned about climate risk when deciding where to live, oftentimes, it’s not a dealbreaker. For some, that’s because factors like relative affordability, home size and proximity to family take precedence. For others, it’s because they’re not aware of the climate risks in the area they’re moving to. Redfin.com now publishes climate-risk data for nearly every U.S. home, with the exception of rentals, to help house hunters make more informed decisions.

“For a lot of pandemic-era homebuyers, what has felt much more urgent than avoiding fire danger is finding a home they can afford at a time when inventory is so low and prices are so high,” said Corey Keach, a Redfin real estate agent in the Boulder, CO area, where the Marshall Fire—the most destructive in the state’s history—destroyed more than 1,000 homes at the end of 2021. “I worked with a young family whose Louisville home burned down in the Marshall Fire. Afterwards, they moved to nearby Superior, where a lot of homes also burned down. They just wanted to get into their next home fast because they had already gone through the painstaking buying process in 2020 and were worried prices were going to skyrocket another 20%.”

Keach continued: “As the market cools and shifts more in buyers’ favor, buyers may start thinking more about climate risk. My advice for house hunters in fire-prone areas is to look at newly built homes, which are more likely to have sprinkler systems and concrete-board siding instead of wood siding.”

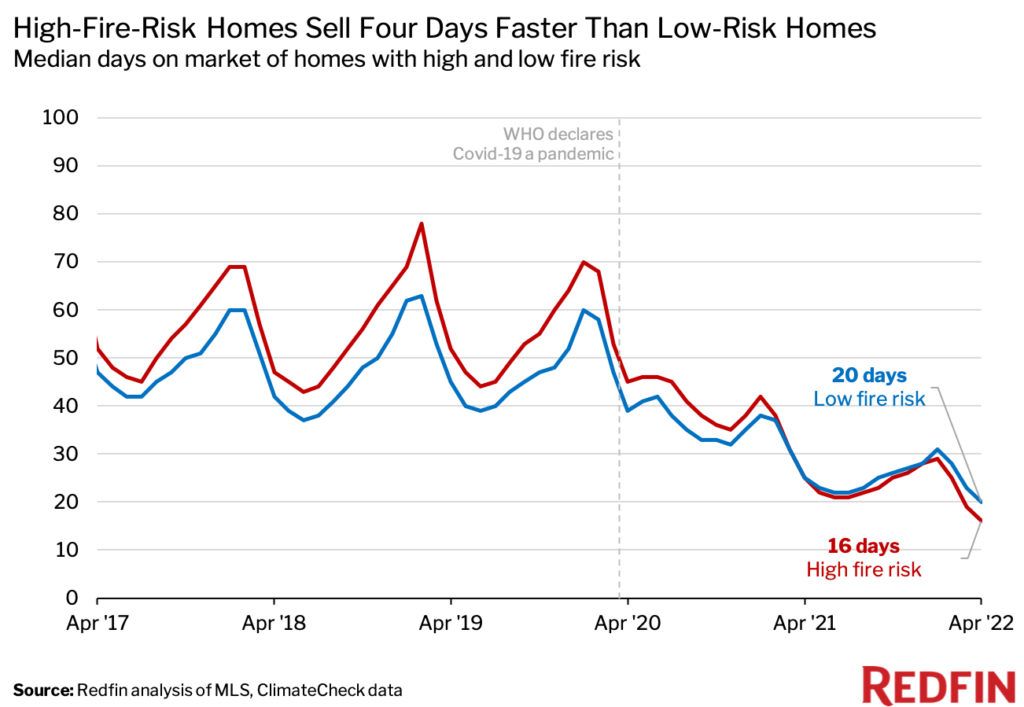

Homes With High Fire Risk Also Sell Faster Than Low-Risk Homes

Fire-prone homes not only sell for more; they also get snatched up faster—another indication that evolving homebuyer preferences during the pandemic made high-risk areas seem more attractive to many house hunters. The typical high-risk home sold in 16 days in April, compared with 20 days for the typical low-risk home. That marks a shift from before the pandemic, when low-risk homes typically sold faster.

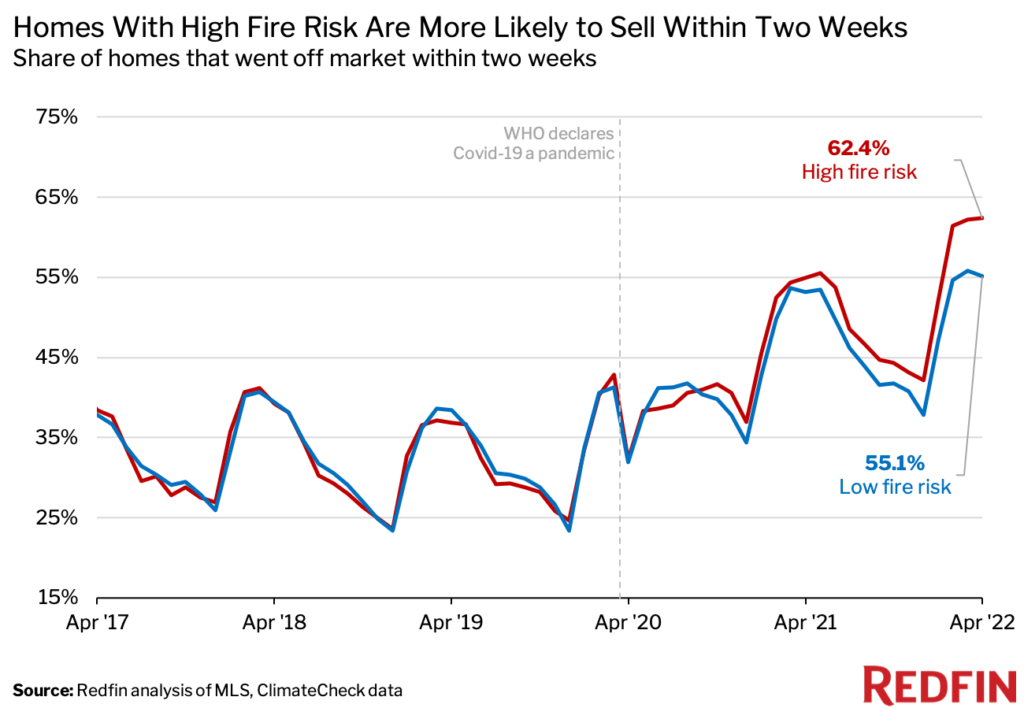

Another gauge of housing-market speed shows a similar trend: Nearly two-thirds (62.4%) of high-fire-risk homes sold within two weeks in April, compared with just 55.1% of low-risk homes. Prior to the pandemic, high- and low-risk homes had about the same likelihood of selling within two weeks.

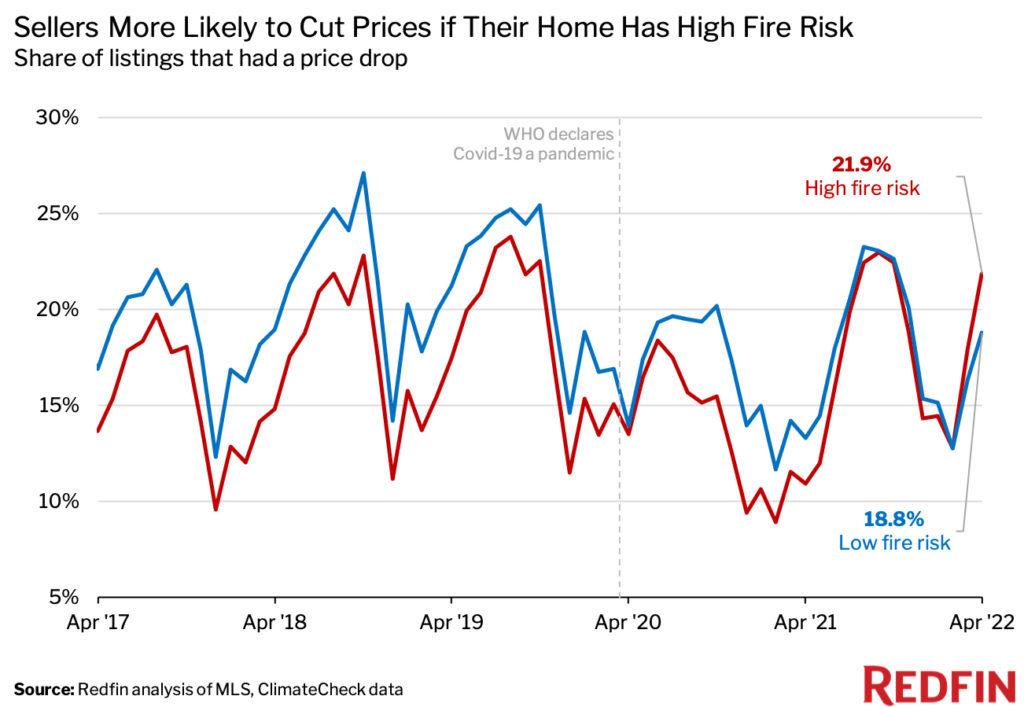

Price Cuts Are More Common For Homes With High Fire Risk

Another interesting shift we’ve observed in recent weeks is that sellers of high-fire-risk homes have become more likely than sellers of low-risk homes to slash their listing prices after putting their homes on the market. In April, 21.9% of high-risk listings had price drops, compared with 18.8% of low-risk listings. That’s only the second month on record (the first was March) during which fire-prone homes were more likely to have price drops.

“As the housing market cools, sellers are more likely to lower their pricing expectations in places where surging homebuyer demand has caused prices to significantly overinflate—places like the fire-prone suburbs Americans flocked to during the pandemic,” Bokhari said.

Price drops have been on the rise in the country as a whole lately as surging mortgage rates have triggered a slowdown in homebuyer demand. Boise, ID and Sacramento, CA, two hotspots for homebuyers relocating from pricey major cities, were among the top five metros where sellers cut their asking prices in April. Both face substantial risk from wildfires.

Methodology

Fire-risk data came from ClimateCheck, which assigns six different fire-risk categories to properties across the U.S.: very low risk, low risk, moderate risk, high risk, very high risk and extreme risk. For the purposes of this report, a high-risk property is one that falls into the high, very high or extreme category, while a low-risk property is one that falls into the very low, low or moderate category. We matched fire-risk data with MLS data in roughly 700 U.S. metro areas, allowing us to report on metrics including home sales and prices by fire risk. The climate-risk data in this report is from March 31, 2021.

Boston, Massachusetts, otherwise known as the “Athens of America,” is swiftly becoming home for many Bay Staters and out-of-staters alike. With its iconic history and delicious foods, it shouldn’t come as a surprise that nearly 700,000 people live in Boston. However, with that higher demand comes higher home prices. The median home sale price is $772,500, and the average rent for a 1-bedroom apartment in Boston is $3,988.

If that price is out of your budget, don’t worry. We’ve got options to help you find a home. Redfin has rounded up a list of the best affordable Boston suburbs to consider living in – and they’re all under a 45-minute drive from the city. That way, you can live close to Boston and all its unique activities without paying a premium price.

#1: Bolton

Median home price: $319,000

Driving distance from Boston: 45 minutes

Bolton, MA homes for sale

Bolton, MA apartments for rent

With a median home sale price of $319,000, Bolton lands the number one spot on our list as the most affordable Boston suburb. About 45 minutes away from downtown Boston, Bolton is home to roughly 5,500 people. Living in Bolton, you can spend time exploring Animal Adventures Family Zoo & Rescue Center.

Drive to Boston to “Enjoy the beach, walk around Castle Island, play in the then Lago Playground, and then pop in Local 149 for a great inexpensive meal,” recommends Steven Herrman. “Here on the southern side, we have a fair and reasonably priced food and beverage menu, especially when you compare it to our neighbors. We make house-made products that are featured on our food and beverage menus.”

#2: Topsfield

Median home price: $365,000

Driving distance from Boston: 30 minutes

Topsfield, MA homes for sale

Topsfield, MA apartments for rent

Home to 3,000 people, Topsfield is Boston’s second most affordable suburb. Just about 30 minutes from Boston, you can go to and from the city in just a quick drive. Some popular things to do in Topsfield are visiting Bradley Palmer State Park and exploring the charming downtown.

“A wonderful way to spend an afternoon in Boston’s Back Bay neighborhood is to visit art galleries, all of which are free and open to the public,” recommends Zola Solamente, Owner of Arden Gallery. Take about a 30 minute drive from Topsfield, and you can find yourself at the wonderful, “Arden Gallery, a gallery featuring contemporary works of art in a variety of styles. It’s open six days a week, and the art is free to view, enjoy, and repost.”

#3: Ayer

Median home price: $432,000

Driving distance from Boston: 45 minutes

Ayer, MA homes for sale

Ayer, MA apartments for rent

Taking the third spot on our list of affordable suburbs is Ayer. Just 45 minutes outside of Boston, you’ll find the home prices are much less expensive in this quiet suburb. Home to about 3,000 people, there are plenty of cool things to check out in Ayer. If you find yourself moving here, be sure to visit Sandy Pond Beach.

#4: Lynn

Median home price: $507,500

Driving distance from Boston: 20 minutes

Lynn, MA homes for sale

Lynn, MA apartments for rent

Only slightly more expensive than Ayer is Lynn, the next suburb on our list. With a population of about 94,000 residents, Lynn is the largest city in Essex county. This is a perfect place to call home if you’re looking for a less expensive Boston suburb with proximity to both the city and the beach.

Cafe Iterum’s East Boston Team shares, “The city of Boston has been committed to opening water access to the public. Today, miles of path span across the waterfront for all the public to use from the tip of Boston Logan International Airport [at least 22 minute drive from Lynn], to the award winning Piers Park, and through Maverick Square. All Boston parks are free and feature some of the first landscape architectures by Frederick Law Olmsted.”

#5: Beverly

Median home price: $520,000

Driving distance from Boston: 30 minutes

Beverly, MA homes for sale

Beverly, MA apartments for rent

About a 30-minute drive into the city, consider adding Beverly to your list of Boston suburbs to check out. With 42,000 people living in this affordable town, Beverly is a great option to consider when looking to stay close to Boston without paying the premium for a home in the city. Living in Beverly, you’ll find stunning New England landscapes and plenty of outdoor activities. Don’t forget to stop by Lynch Park on your way through town.

#6: Salem

Median home price: $525,000

Driving distance from Boston: 30 minutes

Salem, MA homes for sale

Salem, MA apartments for rent

Another well-known Boston suburb is Salem, where you’ll find the home prices are about $200K less than in Boston. Salem has about 43,000 residents and is a great suburb to consider buying a home in. With the Salem Witch Museum and many local shops, you’ll have easy access to what makes this suburb unique.

“Our team loves Salem during the off-season in the spring or summer to walk along the waterfront and relax at the Salem Common,” suggests BOStoday’s City Editors Jessica Burton and Sara Frazier. “There are also several historical and cultural sites with free admission, like the Salem Maritime National Historic Site and Punto Urban Art Museum. Of course, you can’t go wrong with a self-led tour around the many Hocus Pocus filming locations.”

#7: Wakefield

Median home price: $540,000

Driving distance from Boston: 20 minutes

Wakefield, MA homes for sale

Wakefield, MA apartments for rent

Coming in seventh place on our list of affordable Boston suburbs is Wakefield, which is about 20 minutes away from downtown. With a population of close to 27,000, living in Wakefield is an excellent alternative to Boston’s hustle and bustle. If you’re going to call this suburb home, plan time to explore Lake Quannapowitt.

#8: Danvers

Median home price: $545,000

Driving distance from Boston: 30 minutes

Danvers, MA homes for sale

Danvers, MA apartments for rent

If you’ve lived in Boston for a while, chances are you know of Danvers. This affordable area is home to approximately 27,500 residents, so you’ll have a fraction of Boston’s population while remaining close to the city and its attractions. Add the Sunnyside Bowladrome, CoCo Key Water Park, and Endicott Park to your list of must-sees once living in Danvers.

#9: Peabody

Median home price: $575,000

Driving distance from Boston: 25 minutes

Peabody, MA homes for sale

Peabody, MA apartments for rent

Moving to Peabody will give you access to downtown Boston in close to 25 minutes – as long as you don’t find yourself in traffic. This vibrant community is home to 53,000 residents and is a quintessential New England city. Fun activities to do near Peabody include exploring Peabody Essex Museum and George Peabody House Museums.

#10: Woburn

Median home price: $621,000

Driving distance from Boston: 15 minutes

Woburn, MA homes for sale

Woburn, MA apartments for rent

Woburn takes the last spot on our list of affordable Boston suburbs you’ll want to consider moving to. Without traffic, you’ll find yourself in Boston in roughly 15 minutes. This suburb has a population of 40,000 and is home to Woburn Bowladrome and Horn Pond Recreation Area. There’s plenty to do on an afternoon or weekend while living in this great suburb.

Methodology: Affordability is based on whether a suburb is less than the median sale price of Boston and under a 45-minute drive from downtown Boston. Median home sale price data from the Redfin Data Center during April 2022. Average rental data from Rent.com May 2022. Population data sourced from the United States Census Bureau.

Explore more Boston articles:

Top 8 Reasons to Move to Boston and Why You’ll Love Living Here