Lloyds Banking Group has offered a boost to homeowners and those trying to get on the property ladder as it predicted interest rates cuts on property prices.

They have predicted that the Bank of England will cut the base rate three times by the end of the year, starting in the summer; which is consistent with their earlier forecasts.

The Banking Group expects UK property prices to rise by 1.5 per cent this year.

However, their previous prediction was that house prices would fall 2.2 per cent.

William Chalmers, the banking group’s chief financial officer, said there’s a “more benign economic outlook” with the housing market proving more resilient than expected.

It also says unemployment will stay low, which is good news since Lloyds is seen as a proxy for the performance of the wider UK economy.

The Banking Group expects UK property prices to rise by 1.5 per cent this year

GETTY

They posted a 28 per cent drop in pre-tax profits to £1.6billion in the three months of the year, compared with £2.2billion a year ago.

There was an impairment charge of £57 million compared to loans of £448 billion.

Lloyds said its margins had been hit “mainly within UK mortgages” amid heightened competition between lenders to offer squeezed buyers better deals.

There were less mortgage lenders due to customers being squeezed amid the ongoing cost of living crisis.

Lloyds reassured the City by saying results this year would be in line with expectations, though profit margins will fall to 2.9 per cent from 3.22 per cent.

The fall was expected as more people moved their cash into savings accounts with higher returns and mortgage rates eased because of the competition stepping up among lenders.

Charlie Nunn, the group’s chief executive, said: “The Group is continuing to deliver in line with expectations in the first quarter of 2024, with solid net income, cost discipline and strong asset quality.

“Our performance provides us with further confidence around our strategic ambitions and 2024 and 2026 guidance.

“Guided by our purpose, we are continuing to support customers and successfully execute against our strategic outcomes, as highlighted in the third of our strategic seminars last month.

“This underpins our ambition of higher, more sustainable returns that will deliver for all of our stakeholders as we continue to Help Britain Prosper.”

Last month, Lloyds Banking Group said it planned to close 53 further branches in its network.

LATEST DEVELOPMENTS:

The group said it was closing 21 Lloyds branches, 22 Halifax branches and 10 Bank of Scotland sites.

In total, the banking group is closing 166 branches this year and 10 next year.

Jeremy Leaf, north London estate agent and a former chairman of the Royal Institution of Chartered Surveyors, said the housing market is still “playing catch-up” as the increase in new enquiries emboldens sellers to not only make their properties available, but chance their arm at higher asking figures.

He added: “The prospect of more stable or even falling mortgage rates is certainly helping to improve confidence generally.

“However, the uplift in supply has meant more choice, so the market remains price sensitive and buyers are negotiating hard – particularly those who require little or no finance.”

Rates peaked in July 2023, reaching 6.86pc, but have since fallen. The average two-year fix sits at around 5.83pc, while the average five-year fix is more like 5.40pc according to data firm Moneyfacts.

But in more recent times, mortgages have begun to edge up again as higher-than-expected inflation figures cast doubt over the likelihood the Bank of England will cut interest rates before the summer.

Tom Bill, head of UK residential research at Knight Frank, said changing economic predictions mean buyers and sellers “have faced mixed messages” this year, which may mean asking prices aren’t achieved.

He said: “While rising asking prices show seller expectations have improved, there is broader downwards pressure on prices as mortgage rates edge higher, supply increases and a wave of people roll off sub-2pc fixed-rate mortgages agreed in early 2022.

“The result is more friction around prices, particularly when a rate cut seems to move further into the distance with every release of economic data. That said, higher supply means there should be a recognisable spring bounce in the housing market.”

Nick Mendes, of mortgage brokerage John Charcol, said he had noticed a “slow down” of activity in recent weeks as mortgage rates stagnate and some buyers wait eagerly for a Bank Rate reduction.

He added: “We did see a lot of people entering the market earlier on in the year to beat the summer rush. Some house prices were reflecting the highs we saw just a few years ago.

“Some people will have stretched themselves, now unable to renew their rate in the current market and trying to downsize without losing on their property value.

“Always take asking prices with a pinch of salt; look at Land Registry prices for what [properties] were actually sold for.”

Inflation is not only cramping Americans’ food and energy budgets, but it’s taking a bite out of the housing market. The combination of high interest rates and high prices continues to stifle the residential real estate market. The latest data shows mortgage applications have dropped for three straight weeks, while the average rate on a 30-year fixed mortgage has risen to 6.82%, up more than a half-percent from a year ago. At the same time, the average home price in the U.S. is at a record high. “Taking into account mortgage rates, incomes, and house prices, affordability right now is strained at the worst levels in about four decades,” says Lance Lambert, CEO of the real estate analytics firm ResiClub, in a recent interview with Fox Business.

With limited supply keeping prices elevated and the Federal Reserve keeping interest rates high to counter inflation, the market is caught in the perfect storm for buyers and sellers. “A lot of home buyers can’t get in, and a lot of home sellers can’t sell and buy something else because they can’t afford those new monthly payments,” says Lambert.

Faced with this latest economic challenge in an election year, the Biden administration is doing what it does best: blaming someone else. The same administration that tried to blame high gas prices on greedy gas station owners, and high food prices on ‘price-gouging’ corporations, is now blaming high home prices on…you guessed it…greedy real estate agents. “They’re scapegoating,” says Lambert. “They act like lowering commissions would improve housing affordability…you know, going after soccer moms making $60,000 a year, because that’s the only job that works around their kids’ schedule.”

Rather than attacking realtors, the administration should be implementing policies to increase housing supply and reduce inflation, according to Lambert. “Putting in tax policy that works for new construction and not against new construction, lower fees on homebuilding, all the boring stuff that would increase supply in the long-term…that is what would improve housing affordability,” he says.

The overseers of South Dakota’s investments have put some money into companies that aim to cash in on artificial intelligence, but the explosion in public interest hasn’t changed the state’s money management strategy.

Leadership with the South Dakota Investment Council offered insights on the AI boom after prompting from its advisory board, which met in Sioux Falls on Thursday.

Matt Clark, the state’s chief investment officer, compared the current plenitude of cash-burning AI operations to companies wrapped up in the dot-com bust of 2000. That year’s crash of tech stocks left scores of companies that had hoped to find a toehold in the then-nascent world of online commerce in history’s dustbin.

As with the internet of 2000, Clark said, there’s little doubt that investments in AI will pay off for some companies. The question – one being asked and reevaluated constantly by the investment council during booms in one sector or the other, Clark said – is which ones.

“A lot of those companies that were around in 1999 did prosper, but over half of them disappeared, went bankrupt,” Clark told the council’s advisory board this week. “You can’t have 10 companies all get 30% market share. There’s going to be some disappointment.”

About the council

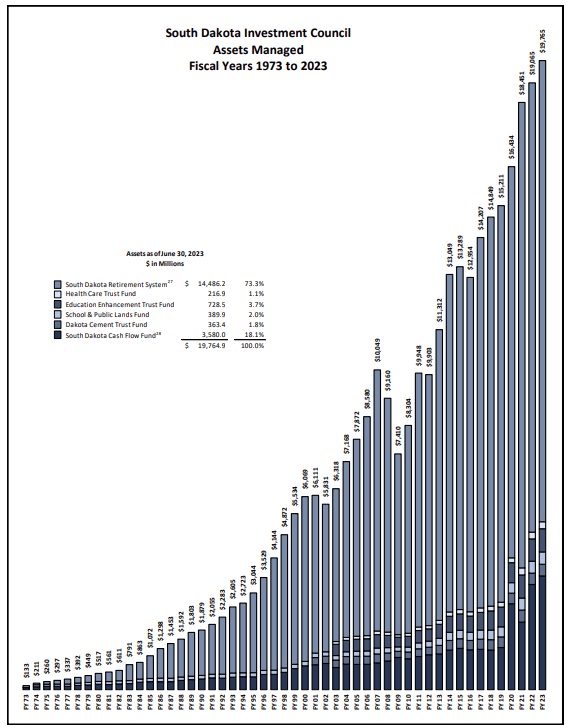

The council manages the assets of the South Dakota Retirement System, the Education Enhancement Trust, and the School and Public Lands Trust, among others.

The returns from investments and interest in the funds are used for a variety of purposes, such as boosting the state’s general fund and paying for scholarships. Unlike most states, the retirement system in South Dakota is fully funded for its participants, which include public employees ranging from teachers to correctional officers, state troopers and employees of the Department of Transportation.

On Thursday, council staff told board members that $13 million from the School and Public Lands Trust was transferred to schools in the month of February.

The South Dakota Retirement System returned 5.8% for the fourth quarter, underperforming compared to its benchmark. Staff told the board that quarterly underperformance was tied to a more conservative investment mix than its benchmark funds, which are more heavily influenced by the stock market.

Over the long-term, the state’s investments have grown considerably.

Today, at the 50-year mark in its history, the retirement fund is worth $14.5 billion and covers more than 33,000 recipients. When it began, there were 2,900 recipients and $50 million in the fund.

“The return over the full period has exceeded other state retirement systems across the nation,” according to the council’s 2023 annual report.

There’s a similar long-term growth trajectory for the managed assets as a whole. Day to day, week to week, and month to month, however, the funds may lose money or underperform.

Managing investments amid AI scramble

Board member questions on which sectors might be the best bets in the stock market followed a rundown of the state’s equity portfolio performance for the months of February and March. The council’s Jan Zeeck told the board that the equity portfolio moved into negative territory in February briefly before bouncing back to neutral last month, in line with a global rebound in durable goods orders.

Market volatility was an issue in the early months of 2024, Zeeck said, and the state has moved to a “defensive position” in response. The health care and pharmaceutical sectors have “taken a hit,” Zeeck said, as did consumer staples.

That comment prompted a board question on where the value might be in the market right now. Zeeck framed her response in part around the interest in AI. Pharmaceuticals and other staples, she said, are “just not exciting compared to all the talk of technology and AI.”

There are some significant differences between the 1999-2000 bubble and today, Zeeck said. The “Magnificent Seven” of the tech world – Microsoft, Alphabet (Google), Meta (Facebook), Apple, Tesla, Amazon and NVIDIA – are “bringing in a lot of cash flow, and it’s real.”

But that doesn’t mean investments in AI at companies like those will pay off in the long term, Zeeck said. NVIDIA stock has been on a roller coaster this year as the chip maker manages AI-related demand for its products.

“We don’t know what the returns will be on a lot of that,” she said. “Nobody really knows that yet.”

The state does have investments in tech firms, and Zeeck said they are “constantly evaluating” its position in those areas. In the full scope of the state’s managed assets, though, the technology sector and AI are minor factors.

“We really don’t have a big bet on tech stocks,” Clark told South Dakota Searchlight after the meeting.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX