Marny owns over 60% of Anaergia’s outstanding shares, and appoints chairman of the board

BURLINGTON, Ontario, July 10, 2024–(BUSINESS WIRE)–Anaergia Inc. (“Anaergia” or the “Company“) (TSX: ANRG), a global renewable fuels leader, is pleased to announce that the third tranche of the previously announced equity investment of C$40.8 million (the “Strategic Investment“) from Marny Investissement SA (“Marny“), through a wholly owned subsidiary, Marny Holdco Inc. (“Marny Holdco“), has closed today, with the issuance of 36,750,000 units of the Company (“Units“) for gross proceeds of C$14.7 million. Each Unit consists of one subordinate voting share of the Company (each a “Subordinate Voting Share“) and 1/5 of one Subordinate Voting Share purchase warrant of the Company (each a “Warrant“). Each Warrant entitles the holder to purchase one additional Subordinate Voting Share at an exercise price of C$0.80 until February 2, 2027. In aggregate, 102,000,000 Units were issued to Marny Holdco pursuant to the Strategic Investment.

This closing of the third tranche of the Strategic Investment follows the resumption of trading yesterday, on the Toronto Stock Exchange (“TSX“), of the Subordinate Voting Shares.

Dr. Andrew Benedek agreed to convert the final-third of all multiple voting shares of the Company held by him into Subordinate Voting Shares on a one-for-one basis in accordance with Anaergia’s constating documents with the closing of the third tranche of the Strategic Investment. With the closing of the third tranche of the Strategic Investment, Dr. Andrew Benedek now holds approximately 19.5% of the voting rights attached to the Subordinate Voting Shares (on a non-diluted basis) and approximately 17.4% of the voting rights attached to the Subordinate Voting Shares (on a partially diluted basis), assuming the exercise in full of the Warrants. Marny Holdco, owns and controls approximately 60.9% of the voting rights attached to the Subordinate Voting Shares (on a non-diluted basis) and approximately 65.2% of the voting rights attached to the Subordinate Voting Shares (on a partially diluted basis), assuming the exercise in full of the Warrants.

In connection with the Strategic Investment, Anaergia has provided an undertaking to the TSX to reclassify the Subordinate Voting Shares as “common shares” and to eliminate the multiple voting shares from Anaergia’s authorized capital within 60 days from the closing of the third tranche of the Strategic Investment. Pursuant to a voting and support agreement, Dr. Andrew Benedek has agreed to vote in favour of the reclassification.

In connection with the closing of the third tranche of the Strategic Investment, Ohad Epschtein, the beneficial owner and a nominee of Marny Holdco, has been appointed to the Company’s board of directors. Owing to Marny’s control position in Anaergia, Mr. Epschtein will assume the role of chairman of the board of directors, previously held by Dr. Andrew Benedek, who continues to serve as a director of the Company.

“I am very pleased that Ohad and his team share my enthusiasm for Anaergia, and that they are dedicated to growing the Company and to optimizing its potential,” said Andrew Benedek. “I have no doubt that Ohad is the right person to lead the board going forward,” added Dr. Benedek.

“Andrew Benedek’s founding of Anaergia, and its growth under his direction has made it among one of the technology leaders in the global renewable biogas sector,” said Ohad Epschtein. “Because of this, we are enthralled by the prospects for this Company, and we are genuinely excited to be part of Anaergia’s journey forward,” added Mr. Epschtein.

About Marny

Marny is a holding company in Luxembourg that invests in investment properties globally. Marny uses modern technology and materials in its build-own and operate projects and works with its global market leader as partners to its investments to increase their value.

About Anaergia

Anaergia was created to eliminate a major source of greenhouse gases (“GHGs“) by cost effectively turning organic waste into renewable natural gas (“RNG“), fertilizer and water through the use of proprietary technologies. With a track record of delivering innovative projects, Anaergia is uniquely positioned to provide solutions to today’s most pressing resource recovery challenges using a broad portfolio of proven technologies and multiple project delivery methods. Anaergia is one of the world’s only companies with a proprietary portfolio of end-to-end solutions that integrate solid waste processing as well as wastewater treatment with organics recovery, high efficiency anaerobic digestion, RNG production and recovery of fertilizer and water from organic residuals. The combination of these technologies enhances carbon-negative biogas, clean water and natural fertilizer production, utilizes a minimized footprint and lowers waste and wastewater treatment costs and GHG emissions.

For further information please see: www.anaergia.com

Forward-Looking Statements

This news release contains forward-looking information within the meaning of applicable securities legislation, which reflects Anaergia’s current expectations regarding future events, including but not limited to, the growth of the Company and optimizing its potential. Forward-looking information is based on a number of assumptions, including, but not limited to the Company’s ability to grow and optimize its potential. The Company is subject to a number of risks and uncertainties, many of which are beyond the Company’s control. Such risks and uncertainties include, but are not limited to, the factors discussed under “Risk Factors” in the Company’s annual information form for the fiscal year ended December 31, 2023 and under “Risks and Uncertainties” in the Company’s most recent management’s discussion and analysis. Actual results could differ materially from those projected herein. Anaergia does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required under applicable securities laws. Additional information on these and other factors that could affect Anaergia’s operations or financial results are included in Anaergia’s reports on file with Canadian regulatory authorities.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States or other jurisdiction in which such offer, solicitation or sale would be unlawful.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240710056325/en/

Contacts

For media and/or investor relations please contact: IR@Anaergia.com

Key Insights

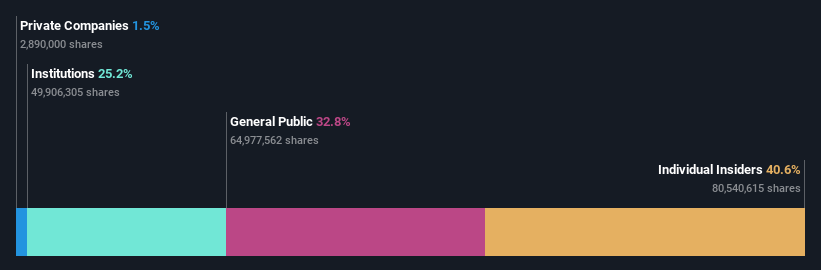

Every investor in Pinnacle Investment Management Group Limited (ASX:PNI) should be aware of the most powerful shareholder groups. With 41% stake, individual insiders possess the maximum shares in the company. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

So, insiders of Pinnacle Investment Management Group have a lot at stake and every decision they make on the company’s future is important to them from a financial point of view.

In the chart below, we zoom in on the different ownership groups of Pinnacle Investment Management Group.

Check out our latest analysis for Pinnacle Investment Management Group

What Does The Institutional Ownership Tell Us About Pinnacle Investment Management Group?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

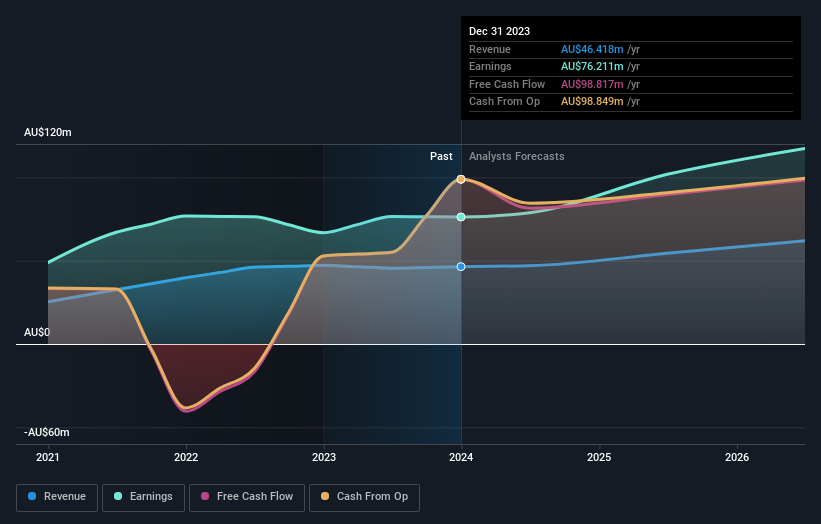

As you can see, institutional investors have a fair amount of stake in Pinnacle Investment Management Group. This suggests some credibility amongst professional investors. But we can’t rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Pinnacle Investment Management Group, (below). Of course, keep in mind that there are other factors to consider, too.

We note that hedge funds don’t have a meaningful investment in Pinnacle Investment Management Group. Looking at our data, we can see that the largest shareholder is the CEO Ian Macoun with 18% of shares outstanding. In comparison, the second and third largest shareholders hold about 9.3% and 5.3% of the stock.

On further inspection, we found that more than half the company’s shares are owned by the top 8 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock’s expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Pinnacle Investment Management Group

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Pinnacle Investment Management Group Limited. Insiders own AU$1.0b worth of shares in the AU$2.6b company. That’s quite meaningful. Most would say this shows a good degree of alignment with shareholders, especially in a company of this size. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, hold a 33% stake in Pinnacle Investment Management Group. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Take risks for example – Pinnacle Investment Management Group has 1 warning sign we think you should be aware of.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Story continues below Advertisement

A Tata Consultancy Services (TCS) employee said that he had been suspended after reporting a security incident to the company. The employee took to Reddit to narrate the incident where he said that his manager had asked staffers to use their personal laptops and share login credentials.

“I reported a security incident in TCS where my manager was making employees use their personal laptops and sharing login credentials,” the staffer wrote on the platform.

Story continues below Advertisement

The employee said that his suspension was against the company policy, which said that no action can be taken against a whistleblower and added that he would not receive any help from either his manager or human resources as he wasn’t in good terms with them.

“According to the TCS whistleblower policy no action can be taken against whistleblower but today I received a suspension notice. Some background: my HR and managers will not help me because of poor relations,” the employee wrote.

Story continues below Advertisement

The post saw a lot of replies from users, who offered suggestions of the next steps that can be taken.

“Raise it on LinkedIn. Tagging higher officials of Tata group. (Not only TCS). All this act is against, Tata code of conduct. Spread this like a wild fire on x, LinkedIn and other social media platforms,” one user wrote.

“Raise this issue with TCS ethics committee. They will definitely look into this. When I was in TCS ILP I remember there was an altercation between the faculty and one of the associate from our batch. The faculty told the associate that they will fail him in the finals and they did. He reported them to ethics committee and a team came to ILP center to investigate. The associate was later passed,” another user wrote.

Story continues below Advertisement

Also read: TCS won’t give variable pay to employees with less than 60% attendance in office

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Key Insights

To get a sense of who is truly in control of Cromwell European Real Estate Investment Trust (SGX:CWBU), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are retail investors with 45% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

Institutions, on the other hand, account for 42% of the company’s stockholders. Institutions often own shares in more established companies, while it’s not unusual to see insiders own a fair bit of smaller companies.

In the chart below, we zoom in on the different ownership groups of Cromwell European Real Estate Investment Trust.

View our latest analysis for Cromwell European Real Estate Investment Trust

What Does The Institutional Ownership Tell Us About Cromwell European Real Estate Investment Trust?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

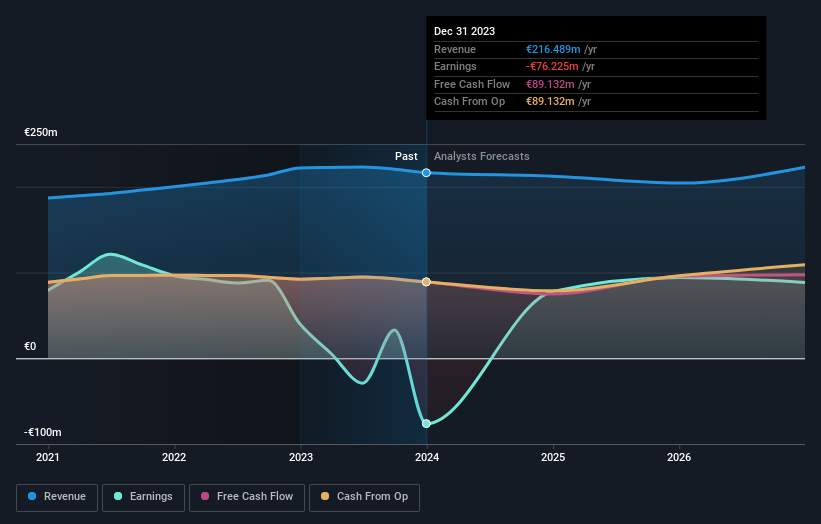

Cromwell European Real Estate Investment Trust already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can’t rely on that fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there’s always a risk that they are in a ‘crowded trade’. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Cromwell European Real Estate Investment Trust’s historic earnings and revenue below, but keep in mind there’s always more to the story.

Hedge funds don’t have many shares in Cromwell European Real Estate Investment Trust. Cromwell Property Securities Limited is currently the company’s largest shareholder with 27% of shares outstanding. For context, the second largest shareholder holds about 7.3% of the shares outstanding, followed by an ownership of 5.0% by the third-largest shareholder.

We did some more digging and found that 8 of the top shareholders account for roughly 50% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Cromwell European Real Estate Investment Trust

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders maintain a significant holding in Cromwell European Real Estate Investment Trust. Insiders own €105m worth of shares in the €838m company. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public– including retail investors — own 45% stake in the company, and hence can’t easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We’ve identified 2 warning signs with Cromwell European Real Estate Investment Trust (at least 1 which doesn’t sit too well with us) , and understanding them should be part of your investment process.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Not for distribution to United States newswire services or for dissemination in the United States.

CALGARY, Alberta, May 02, 2024 (GLOBE NEWSWIRE) — Volt Lithium Corp. (TSXV: VLT | OTCQB: VLTLF) (“Volt” or the “Company”) is pleased to announce that it has closed its previously announced non-brokered private placement of 6,818,182 units of Volt (“Units”) issued to a strategic investor (the “Investor”) at a price of US$0.22 per Unit for aggregate consideration of US$1,500,000 (the “Strategic Investment”) effective May 1, 2024. Each Unit consisted of one common share in the capital of the Company (each, a “Common Share”) and one-half of one Common Share purchase warrant (each whole warrant, a “Warrant”), with each Warrant exercisable into one Common Share (a “Warrant Share”) at a price of US$0.35 per Warrant Share until May 1, 2026. The securities issued under the Strategic Investment are subject to a hold period equal to four months and a day from the date of closing of the Strategic Investment, which expires on September 2, 2026.

The proceeds of the Strategic Investment will be used by Volt for the deployment of a field unit in the Delaware Basin in West Texas, USA and for other general corporate purposes. This field unit will produce lithium hydroxide monohydrate using Volt’s proprietary direct lithium extraction technology, building on the work done to date by Volt at the Company’s permanent demonstration plant in Calgary, Alberta (the “Demonstration Plant”).

The securities referred to herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any U.S. state securities laws and may not be offered or sold in the United States absent registration or an available exemption from the registration requirement of the U.S. Securities Act and applicable U.S. state securities laws. This news release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About the Delaware Basin

The Delaware Basin is one of the largest conventional oil and gas producing basins in North America, with approximately 10.9 million barrels of water produced every day in association with the oil and gas production.

About Volt

Volt is a lithium development and technology company aiming to be North America’s first commercial producer of lithium hydroxide and lithium carbonates from oilfield brine.

For further information, visit Volt’s website at: https://voltlithium.com/.

Contact Information

For Investor Relations inquiries or further information, please contact:

Alex Wylie, President & CEO

awylie@voltlithium.com

M: +1.403.830.5811

Forward-Looking Statements

This news release includes certain “forward-looking statements” and “forward-looking information” within the meaning of applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “will”, “would”, “could”, “schedule” and similar words or expressions, identify forward-looking statements or forward-looking information. Statements, other than statements of historical fact, may constitute forward-looking information and include, without limitation, information with respect to the use of proceeds from the Strategic Investment, the deployment of a field unit in the Delaware Basin, the production of lithium hydroxide monohydrate by the field unit, and the commercial production of lithium hydroxide and lithium carbonates from oilfield brine. With respect to the forward-looking information contained in this news release, the Company has made numerous assumptions. While the Company considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies and may prove to be incorrect. Additionally, there are known and unknown risk factors which could cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein including those known risk factors outlined in the Company’s annual information form dated February 29, 2024 and (final) short form base shelf prospectus dated July 20, 2023. All forward-looking information herein is qualified in its entirety by this cautionary statement and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Vancouver, British Columbia–(Newsfile Corp. – May 1, 2024) – Trenchant Capital Corp. (CSE: TCC) (the “Company“) is pleased to announce that pursuant to an option agreement between the Company and GNQ Insilico Inc. (“GNQ“) dated November 30, 2023, as amended from time to time ( the “Option Agreement“), it has acquired 20% of the total issued and outstanding common shares in the capital of GNQ (the “Initial Investment“).

Concurrently with closing the Initial Investment, the Company entered into an amendment agreement to the Option Agreement pursuant to which the parties agreed to complete the Initial Investment with the payment by the Company to GNQ of $650,000, the issuance of 7,500,000 common shares in the capital of the Company (each, a “Share“), and the issuance of 2,600,000 units (each, a “Unit“) at a deemed issue price of $0.25 per Unit, on or prior to April 29, 2024. Each Unit is comprised of one Share and one warrant (each, a “Warrant“) to purchase one Share (each, a “Warrant Share“) at an exercise price of $0.50 per Warrant Share until April 29, 2026. The Shares issued to GNQ, and any Warrant Shares issued upon the due exercise of the Warrants, are subject to a voluntary lock-up whereby 50% of the Shares and any Warrant Shares are restricted from transfer until April 29, 2025, and the remaining 50% are restricted from transfer until April 29, 2026.

Pursuant to the Option Agreement, the Company may acquire an aggregate of 40% of the total issued and outstanding GNQ Shares by investing an additional $5,000,000 in GNQ at any time prior to November 30, 2026 (the “Option Period“). Subject to the acquisition of 40% of the total issued and outstanding GNQ Shares, the Company may exercise the Option to acquire 50% of the total issued and outstanding GNQ Shares by investing an additional $10,000,000 in GNQ at any time prior to the expiry of the Option Period.

Upon closing of the Initial Investment, GNQ acquired, as consideration from the Company, 7,500,000 Shares and 2,600,000 Units together with additional cash consideration. In aggregate, GNQ now beneficially owns a total of 10,100,000 Shares and 2,600,000 Warrants, with such Warrants exercisable for an additional 2,600,000 Shares, representing 17.0% of the total issued and outstanding Shares on an undiluted basis (or 19.9% on a partially diluted basis assuming the Warrants are exercised up to the maximum percentage permitted by the terms of the Warrants). Prior to the Initial Investment, GNQ did not own any securities of the Company. The aggregate value of the 7,500,000 Shares issued is $150,000 and the aggregate value of the Units is $650,000, resulting in a total aggregate value of $800,000, plus $1,850,000 in additional cash consideration paid in the previous tranches of the Initial Investment. The Shares and Units were acquired for investment purposes and in the future, additional securities of the Company may be acquired or disposed of by GNQ as circumstances or market conditions may warrant.

GNQ

GNQ (https://gnqin.com/) was formed in August 2023 by My Next Health Inc. (“MNH“), a Delaware incorporated healthcare company with a vision to improve the global healthcare sector by deploying a genomics-based AI and quantum platform for clinical trials and point of care solutions. MNH’s platform uses proprietary insights on how systems of genes interact with each other as well as with epigenetic factors to drive key metabolic pathways. These insights are based on more than 15,000 case studies conducted over a decade and are now being scaled and commercialized through a platform that will leverage key exponential technologies to revolutionize personalized healthcare. MNH has exclusive and perpetual global rights to the use of certain technology that relates to functional genomics as well as the supporting clinical data, programs, methods, and interpretation know-how and analytics for use in a number of commercial applications. On November 6th, 2023, GNQ signed a Memorandum of Understanding with a Fortune 100 company towards the development of the in silico clinical trials platform and on March 6, 2024, GNQ announced that it has commenced the development of the platform with the Fortune 100 company. The full corporate update can be accessed here: https://www.einpresswire.com/article/693207326/gnq-insilico-announces-collaboration-with fortune-100-company-to-develop-next-generation-clinical-trial-platform.

Further to its News Release of April 18, 2024, the Company has closed a first tranche of the non-brokered private placement financing (the “Offering“) pursuant to which it has issued an aggregate of 450 convertible debenture units (each, a “Debenture Unit”) at a price of $1,000 per Debenture Unit for gross proceeds of $450,000. Each Debenture Unit is comprised of: (i) $1,000 principal amount unsecured convertible debenture (each, a “Debenture“); and (ii) 1,000 common share purchase warrants (each, a “Debenture Warrant“). Each Debenture Warrant will entitle the holder thereof to acquire one Share (each, a “Debenture Warrant Share“) at a price of $0.26 per Debenture Warrant Share for a period of two years following closing. The principal amount of the Debenture will have a maturity date one year following the issuance of the Debentures and will accrue interest at a rate of 10% per annum.

At the sole option of the subscriber, the principal amount and accrued interest thereon may be converted into Shares of the Company at a conversion price (the “Conversion Price“) determined by the closing market price (the “Market Price“) of the Shares on the Canadian Securities Exchange (the “CSE“) on the trading day prior to the date the Company receives a Notice of Conversion from the subscriber, provided that the Conversion Price will not be less than $0.26 per Share, and subject to the policies of the CSE. On the maturity date, at the sole option of the Company, the principal amount and any accrued interest thereon may be converted into Shares at the Conversion Price, subject to the policies of the CSE. Proceeds of the Offering were used for the Company’s initial investment in GNQ. The securities issued in connection with the Offering, and the Shares that may be issuable on exercise of the Debenture Warrants and conversion of the Debentures and interest, are subject to a statutory hold period expiring four months and one day after closing of the Offering.

The Offering is considered a related party transaction under Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions, as a director of the Company participated in the Offering. The Company did not file a material change report more than 21 days before the closing date of the Offering as the details of the Offering and the participation therein by each related party of the Company were not settled until shortly prior to the closing of the Offering and the Company wished to close the Offering on an expediated basis for business reasons.

A finder’s fee of 1,750,000 Units was paid in connection with the Option Agreement to an arm’s length third-party.

ON BEHALF OF THE BOARD

TRENCHANT CAPITAL CORP.

Per: “Eric Boehnke”

Eric Boehnke, CEO

For further information, please contact:

Trenchant Capital Corp.

Eric Boehnke, CEO

Phone: (604) 307-4274

TRENCHANT CAPITAL CORP.

Certain statements in this press release are forward-looking statements, which reflect the expectations of management regarding the Company’s exercise of the Option and related transactions. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future, including but not limited to, statements regarding MNH’s and GNQ’s business and potential in the industries in which they operate, the Company completing the transactions as described herein or at all, including the exercise of the remaining Option, the obligations to be satisfied under the Option Agreement, the Offering and its terms, including the intended use of proceeds of the Offering and additional tranches of the Offering may not close on the terms announced or at all. Such statements are subject to risks and uncertainties that may cause actual results, performance, or developments to differ materially from those contained in the statements, including risks related to factors beyond the control of the Company. The risks include that the business of MNH and GNQ may not be feasible or continue as planned, that exercising the Option may not be an optimal business strategy due to market conditions during the Option Period, as well as other risks that are customary to transactions of this nature. Further, inflationary pressures, rising interest rates, the global financial climate and the ongoing conflicts in Ukraine and the Middle East and surrounding regions are some additional factors that are affecting current economic conditions and increasing economic uncertainty, which may impact the operating performance, financial position, and future prospects of the Company, MNH, GNQ, and the transaction as a whole. Collectively, the potential impacts of this economic environment pose risks that are currently indescribable and immeasurable. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/207671

Kuala Lumpur, Malaysia, May 22, 2023 (GLOBE NEWSWIRE) — Starbox Group Holdings Ltd. (Nasdaq: STBX) (the “Company” or “Starbox Group”), announces that its Malaysian subsidiary, Starbox Rebates Sdn. Bhd., has entered into a software licensing agreement (the “Agreement”) with 1 Pavilion Property Consultancy Sdn. Bhd. (“1Pavilion”), a Kuala Lumpur-based company specializing in the sales and marketing of premium luxury properties.

Pursuant to the Agreement, the Company has agreed to provide technology support with its unique, internally developed IT system to help 1Pavilion use the Company’s data management system to better target customers and improve operational efficiency. The salient terms of the Agreement are as follows:

i) The contract period shall be for three years, commencing May 18, 2023,and ending May 17, 2026 (the “Contract Period”);

ii) The total contract sum during the Contract Period is RM12,400,000.00 (equivalent to US$2,757,087.92, based on the exchange rate of US$1.00: RM4.50 as of May 17, 2023); and

iii) The Company will grant 1Pavilion access to its data management system and will help train the staff of 1Pavilion with respect to its use.

Mr. Lee Choon Wooi, Chief Executive Officer and Chairman of the Board of Directors of Starbox Group, commented, “We are delighted to have signed the Agreement with 1Pavilion, demonstrating our market recognition and providing us with technology driven income stream for the next three years. Being a tech-driven company, Starbox Group will continue to dedicate itself to research and development and technological innovation. We believe our newly developed technologies, such as data management and the A.I. Calculation Engine, will help 1Pavilion to scale its business and improve operational efficiency. Looking forward, we will keep upgrading our technology system to meet the demand of our clients across various industries, which is expected to boost our business and revenue growth in the long term.”

About 1 Pavilion Property Consultancy Sdn. Bhd.

1 Pavilion Property Consultancy Sdn. Bhd. is a Kuala Lumpur-based company, specializing in the sales and marketing of premium luxury properties brand. All information about 1 Pavilion Property Consultancy Sdn. Bhd. contained herein has been reviewed and approved by 1 Pavilion Property Consultancy Sdn. Bhd.

About Starbox Group Holdings Ltd.

Headquartered in Malaysia, Starbox Group Holdings Ltd. is a technology-driven, rapidly growing company with innovation as its focus. Starbox is building a cash rebate, digital advertising, and payment solution business ecosystem targeting micro, small, and medium enterprises that lack the bandwidth to develop an in-house data management system for effective marketing. The Company connects retail merchants with retail shoppers to facilitate transactions through cash rebates offered by retail merchants on its GETBATS website and mobile app. The Company provides digital advertising services to advertisers through its SEEBATS website and mobile app, GETBATS website and mobile app and social media. The Company also provides payment solution services to merchants. For more information, please visit the Company’s website: https://ir.starboxholdings.com.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “approximates,” “assesses,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the U.S. Securities and Exchange Commission.

For more information, please contact:

Starbox Group Holdings Ltd.

Investor Relations Department

Email: ir@starboxholdings.com

Ascent Investors Relations LLC

Tina Xiao

Phone: +1 917-609-0333

Email: tina.xiao@ascent-ir.com