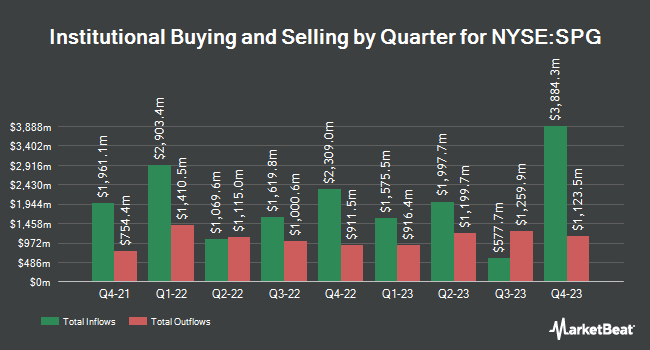

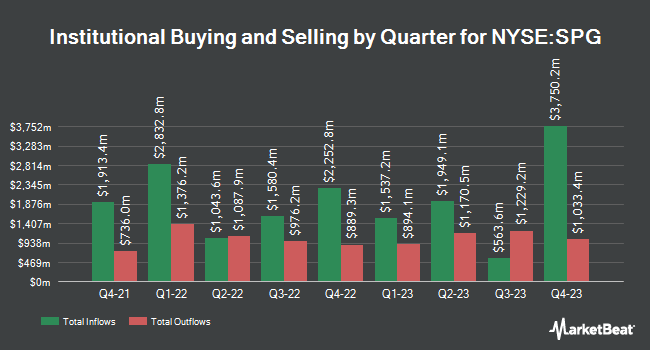

Nordea Investment Management AB raised its stake in shares of Simon Property Group, Inc. (NYSE:SPG – Free Report) by 4.6% in the fourth quarter, according to its most recent 13F filing with the SEC. The fund owned 152,740 shares of the real estate investment trust’s stock after purchasing an additional 6,703 shares during the period. Nordea Investment Management AB’s holdings in Simon Property Group were worth $21,923,000 as of its most recent SEC filing.

Nordea Investment Management AB raised its stake in shares of Simon Property Group, Inc. (NYSE:SPG – Free Report) by 4.6% in the fourth quarter, according to its most recent 13F filing with the SEC. The fund owned 152,740 shares of the real estate investment trust’s stock after purchasing an additional 6,703 shares during the period. Nordea Investment Management AB’s holdings in Simon Property Group were worth $21,923,000 as of its most recent SEC filing.

A number of other hedge funds have also added to or reduced their stakes in the stock. AMI Investment Management Inc. raised its stake in shares of Simon Property Group by 1.2% during the 1st quarter. AMI Investment Management Inc. now owns 17,576 shares of the real estate investment trust’s stock worth $2,312,000 after purchasing an additional 204 shares during the period. Raymond James Trust N.A. lifted its stake in shares of Simon Property Group by 9.8% during the 1st quarter. Raymond James Trust N.A. now owns 4,138 shares of the real estate investment trust’s stock valued at $544,000 after buying an additional 371 shares in the last quarter. Blair William & Co. IL raised its stake in shares of Simon Property Group by 56.8% during the 1st quarter. Blair William & Co. IL now owns 55,270 shares of the real estate investment trust’s stock valued at $7,271,000 after purchasing an additional 20,022 shares during the period. Prudential PLC bought a new stake in shares of Simon Property Group during the 1st quarter valued at $642,000. Finally, Dakota Wealth Management bought a new stake in shares of Simon Property Group during the 1st quarter valued at $390,000. Institutional investors and hedge funds own 84.73% of the company’s stock.

Simon Property Group Stock Down 0.3 %

NYSE SPG traded down $0.41 during mid-day trading on Thursday, reaching $154.99. The stock had a trading volume of 515,483 shares, compared to its average volume of 1,577,880. Simon Property Group, Inc. has a 1 year low of $100.17 and a 1 year high of $157.82. The stock has a market cap of $50.51 billion, a PE ratio of 22.28, a price-to-earnings-growth ratio of 8.10 and a beta of 1.65. The company has a fifty day moving average price of $146.36 and a 200 day moving average price of $129.95. The company has a debt-to-equity ratio of 7.54, a current ratio of 1.77 and a quick ratio of 1.77.

Simon Property Group (NYSE:SPG – Get Free Report) last released its quarterly earnings data on Monday, February 5th. The real estate investment trust reported $2.29 EPS for the quarter, missing the consensus estimate of $3.34 by ($1.05). Simon Property Group had a return on equity of 70.97% and a net margin of 42.30%. The business had revenue of $1.53 billion during the quarter, compared to the consensus estimate of $1.38 billion. During the same quarter in the previous year, the business posted $3.15 earnings per share. Simon Property Group’s quarterly revenue was up 9.1% compared to the same quarter last year. On average, research analysts expect that Simon Property Group, Inc. will post 12.04 earnings per share for the current year.

Simon Property Group Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, March 29th. Shareholders of record on Friday, March 8th will be issued a dividend of $1.95 per share. This is a boost from Simon Property Group’s previous quarterly dividend of $1.90. This represents a $7.80 dividend on an annualized basis and a yield of 5.03%. The ex-dividend date is Thursday, March 7th. Simon Property Group’s dividend payout ratio is currently 111.75%.

Simon Property Group declared that its Board of Directors has authorized a stock repurchase plan on Thursday, February 8th that permits the company to buyback $2.00 billion in outstanding shares. This buyback authorization permits the real estate investment trust to reacquire up to 4.2% of its shares through open market purchases. Shares buyback plans are typically a sign that the company’s board of directors believes its shares are undervalued.

Analyst Ratings Changes

SPG has been the subject of several recent analyst reports. Truist Financial boosted their price objective on shares of Simon Property Group from $128.00 to $139.00 and gave the company a “hold” rating in a research note on Tuesday, January 16th. Morgan Stanley lifted their price objective on Simon Property Group from $143.00 to $145.00 and gave the company an “equal weight” rating in a research note on Monday, February 26th. Piper Sandler lifted their price objective on Simon Property Group from $148.00 to $172.00 and gave the company an “overweight” rating in a research note on Wednesday, December 20th. The Goldman Sachs Group raised their target price on shares of Simon Property Group from $144.00 to $161.00 and gave the company a “buy” rating in a research note on Thursday, December 21st. Finally, StockNews.com raised shares of Simon Property Group from a “hold” rating to a “buy” rating in a research note on Friday, January 19th. Four research analysts have rated the stock with a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat.com, Simon Property Group currently has a consensus rating of “Moderate Buy” and an average price target of $139.33.

Check Out Our Latest Stock Analysis on Simon Property Group

Simon Property Group Profile

Simon is a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company (Simon Property Group, NYSE: SPG). Our properties across North America, Europe and Asia provide community gathering places for millions of people every day and generate billions in annual sales.

Featured Articles

Before you consider Simon Property Group, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Simon Property Group wasn’t on the list.

While Simon Property Group currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat’s analysts have just released their top five short plays for March 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

O Shaughnessy Asset Management LLC trimmed its holdings in Simon Property Group, Inc. (NYSE:SPG – Free Report) by 15.7% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 200,926 shares of the real estate investment trust’s stock after selling 37,364 shares during the period. O Shaughnessy Asset Management LLC owned approximately 0.06% of Simon Property Group worth $21,706,000 as of its most recent filing with the Securities and Exchange Commission.

O Shaughnessy Asset Management LLC trimmed its holdings in Simon Property Group, Inc. (NYSE:SPG – Free Report) by 15.7% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 200,926 shares of the real estate investment trust’s stock after selling 37,364 shares during the period. O Shaughnessy Asset Management LLC owned approximately 0.06% of Simon Property Group worth $21,706,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds have also bought and sold shares of SPG. AMI Investment Management Inc. grew its stake in Simon Property Group by 1.2% in the 1st quarter. AMI Investment Management Inc. now owns 17,576 shares of the real estate investment trust’s stock valued at $2,312,000 after buying an additional 204 shares in the last quarter. Raymond James Trust N.A. grew its stake in Simon Property Group by 9.8% in the 1st quarter. Raymond James Trust N.A. now owns 4,138 shares of the real estate investment trust’s stock valued at $544,000 after buying an additional 371 shares in the last quarter. Blair William & Co. IL grew its stake in Simon Property Group by 56.8% in the 1st quarter. Blair William & Co. IL now owns 55,270 shares of the real estate investment trust’s stock valued at $7,271,000 after buying an additional 20,022 shares in the last quarter. Prudential PLC purchased a new position in Simon Property Group in the 1st quarter valued at approximately $642,000. Finally, Dakota Wealth Management purchased a new position in Simon Property Group in the 1st quarter valued at approximately $390,000. 84.73% of the stock is currently owned by hedge funds and other institutional investors.

Simon Property Group Stock Performance

NYSE SPG opened at $150.35 on Friday. Simon Property Group, Inc. has a 52-week low of $100.17 and a 52-week high of $153.11. The company has a debt-to-equity ratio of 7.54, a quick ratio of 0.94 and a current ratio of 1.77. The company has a market capitalization of $49.05 billion, a P/E ratio of 21.54, a P/E/G ratio of 7.22 and a beta of 1.65. The company has a fifty day moving average of $143.64 and a 200-day moving average of $125.56.

Simon Property Group (NYSE:SPG – Get Free Report) last posted its quarterly earnings data on Monday, February 5th. The real estate investment trust reported $2.29 earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of $3.34 by ($1.05). The company had revenue of $1.53 billion for the quarter, compared to the consensus estimate of $1.38 billion. Simon Property Group had a return on equity of 70.97% and a net margin of 42.30%. The business’s revenue was up 9.1% on a year-over-year basis. During the same period in the prior year, the firm posted $3.15 earnings per share. As a group, equities research analysts predict that Simon Property Group, Inc. will post 12.04 EPS for the current fiscal year.

Simon Property Group Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, March 29th. Shareholders of record on Friday, March 8th will be paid a $1.95 dividend. The ex-dividend date of this dividend is Thursday, March 7th. This is an increase from Simon Property Group’s previous quarterly dividend of $1.90. This represents a $7.80 annualized dividend and a yield of 5.19%. Simon Property Group’s payout ratio is currently 108.88%.

Simon Property Group announced that its board has authorized a stock repurchase program on Thursday, February 8th that allows the company to repurchase $2.00 billion in shares. This repurchase authorization allows the real estate investment trust to repurchase up to 4.2% of its shares through open market purchases. Shares repurchase programs are usually a sign that the company’s leadership believes its stock is undervalued.

Analysts Set New Price Targets

A number of research analysts have recently commented on the stock. Piper Sandler boosted their price target on shares of Simon Property Group from $148.00 to $172.00 and gave the company an “overweight” rating in a research report on Wednesday, December 20th. Morgan Stanley lowered shares of Simon Property Group from an “overweight” rating to an “equal weight” rating and boosted their price target for the company from $132.00 to $143.00 in a research report on Thursday, December 21st. StockNews.com upgraded shares of Simon Property Group from a “hold” rating to a “buy” rating in a research report on Friday, January 19th. The Goldman Sachs Group boosted their price target on shares of Simon Property Group from $144.00 to $161.00 and gave the company a “buy” rating in a research report on Thursday, December 21st. Finally, Truist Financial boosted their price target on shares of Simon Property Group from $128.00 to $139.00 and gave the company a “hold” rating in a research report on Tuesday, January 16th. Three equities research analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat, Simon Property Group has a consensus rating of “Moderate Buy” and a consensus price target of $137.75.

Read Our Latest Stock Analysis on SPG

Simon Property Group Profile

Simon is a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company (Simon Property Group, NYSE: SPG). Our properties across North America, Europe and Asia provide community gathering places for millions of people every day and generate billions in annual sales.

See Also

Want to see what other hedge funds are holding SPG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Simon Property Group, Inc. (NYSE:SPG – Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Simon Property Group, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Simon Property Group wasn’t on the list.

While Simon Property Group currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

If a company’s CEO, COO, and CFO were all selling shares of their stock, would you want to know?

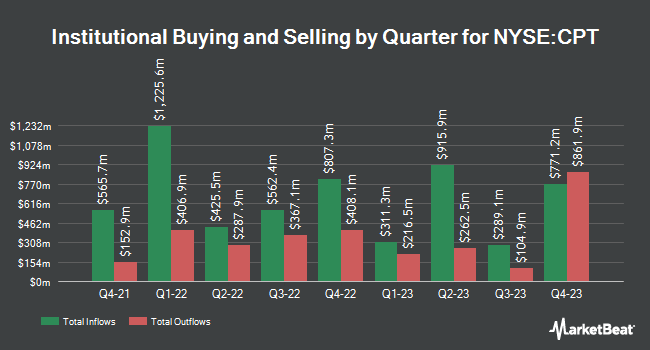

Nordea Investment Management AB lifted its holdings in shares of Camden Property Trust (NYSE:CPT – Free Report) by 141.6% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 56,172 shares of the real estate investment trust’s stock after buying an additional 32,919 shares during the period. Nordea Investment Management AB owned 0.05% of Camden Property Trust worth $5,387,000 at the end of the most recent reporting period.

Nordea Investment Management AB lifted its holdings in shares of Camden Property Trust (NYSE:CPT – Free Report) by 141.6% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 56,172 shares of the real estate investment trust’s stock after buying an additional 32,919 shares during the period. Nordea Investment Management AB owned 0.05% of Camden Property Trust worth $5,387,000 at the end of the most recent reporting period.

Other institutional investors have also modified their holdings of the company. Apollon Wealth Management LLC bought a new stake in shares of Camden Property Trust during the 2nd quarter valued at about $384,000. DekaBank Deutsche Girozentrale grew its position in shares of Camden Property Trust by 0.3% during the 3rd quarter. DekaBank Deutsche Girozentrale now owns 97,859 shares of the real estate investment trust’s stock valued at $9,272,000 after buying an additional 317 shares during the last quarter. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. grew its position in shares of Camden Property Trust by 11.3% during the 2nd quarter. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. now owns 156,338 shares of the real estate investment trust’s stock valued at $17,021,000 after buying an additional 15,851 shares during the last quarter. California Public Employees Retirement System grew its position in shares of Camden Property Trust by 7.2% during the 2nd quarter. California Public Employees Retirement System now owns 306,937 shares of the real estate investment trust’s stock valued at $33,416,000 after buying an additional 20,622 shares during the last quarter. Finally, Robeco Institutional Asset Management B.V. grew its position in shares of Camden Property Trust by 3,054.4% during the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 28,232 shares of the real estate investment trust’s stock valued at $2,670,000 after buying an additional 27,337 shares during the last quarter. Institutional investors own 95.04% of the company’s stock.

Insider Buying and Selling

In related news, CEO Richard J. Campo sold 38,336 shares of the company’s stock in a transaction that occurred on Thursday, January 4th. The shares were sold at an average price of $98.22, for a total value of $3,765,361.92. Following the completion of the sale, the chief executive officer now owns 267,132 shares in the company, valued at approximately $26,237,705.04. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. In other Camden Property Trust news, CEO Richard J. Campo sold 38,336 shares of the stock in a transaction that occurred on Thursday, January 4th. The shares were sold at an average price of $98.22, for a total value of $3,765,361.92. Following the completion of the sale, the chief executive officer now owns 267,132 shares in the company, valued at approximately $26,237,705.04. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, EVP William W. Sengelmann sold 6,493 shares of the stock in a transaction that occurred on Thursday, January 4th. The stock was sold at an average price of $98.21, for a total transaction of $637,677.53. Following the completion of the sale, the executive vice president now owns 75,082 shares of the company’s stock, valued at approximately $7,373,803.22. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 55,957 shares of company stock worth $5,495,920. Corporate insiders own 2.00% of the company’s stock.

Camden Property Trust Trading Up 1.0 %

Camden Property Trust stock opened at $95.39 on Thursday. The stock has a market capitalization of $10.18 billion, a PE ratio of 25.78, a price-to-earnings-growth ratio of 3.55 and a beta of 0.84. Camden Property Trust has a 12-month low of $82.81 and a 12-month high of $119.33. The company has a debt-to-equity ratio of 0.74, a current ratio of 0.88 and a quick ratio of 0.10. The firm has a 50 day simple moving average of $97.21 and a 200-day simple moving average of $96.89.

Camden Property Trust (NYSE:CPT – Get Free Report) last issued its earnings results on Friday, February 2nd. The real estate investment trust reported $2.03 earnings per share for the quarter, topping analysts’ consensus estimates of $1.72 by $0.31. The firm had revenue of $387.59 million during the quarter, compared to analysts’ expectations of $387.33 million. Camden Property Trust had a net margin of 26.15% and a return on equity of 8.07%. The firm’s revenue for the quarter was up 3.1% compared to the same quarter last year. During the same period last year, the firm posted $1.74 earnings per share. As a group, equities research analysts expect that Camden Property Trust will post 6.78 EPS for the current fiscal year.

Camden Property Trust Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, April 17th. Investors of record on Friday, March 29th will be issued a dividend of $1.03 per share. This represents a $4.12 dividend on an annualized basis and a yield of 4.32%. This is a boost from Camden Property Trust’s previous quarterly dividend of $1.00. The ex-dividend date of this dividend is Wednesday, March 27th. Camden Property Trust’s dividend payout ratio (DPR) is presently 108.11%.

Wall Street Analysts Forecast Growth

A number of brokerages recently weighed in on CPT. BMO Capital Markets reaffirmed a “market perform” rating and set a $100.00 price objective on shares of Camden Property Trust in a research report on Friday, December 15th. Royal Bank of Canada restated an “outperform” rating and issued a $103.00 target price on shares of Camden Property Trust in a research report on Monday, February 5th. Bank of America cut shares of Camden Property Trust from a “neutral” rating to an “underperform” rating and decreased their target price for the stock from $101.00 to $84.00 in a research report on Tuesday, October 31st. Truist Financial decreased their target price on shares of Camden Property Trust from $122.00 to $121.00 and set a “buy” rating for the company in a research report on Tuesday, January 16th. Finally, Deutsche Bank Aktiengesellschaft initiated coverage on shares of Camden Property Trust in a research report on Tuesday, January 30th. They issued a “hold” rating and a $90.00 target price for the company. Three equities research analysts have rated the stock with a sell rating, ten have issued a hold rating and five have issued a buy rating to the company’s stock. According to data from MarketBeat, the stock currently has a consensus rating of “Hold” and an average price target of $104.65.

Camden Property Trust Profile

Camden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,634 apartment homes across the United States.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Camden Property Trust, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Camden Property Trust wasn’t on the list.

While Camden Property Trust currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat’s analysts have just released their top five short plays for March 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

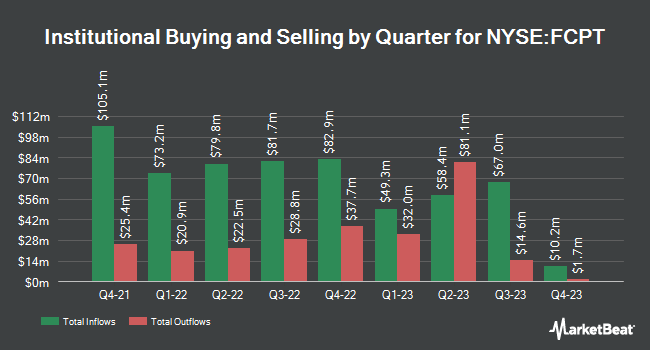

Illinois Municipal Retirement Fund purchased a new position in Four Corners Property Trust, Inc. (NYSE:FCPT – Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund purchased 50,253 shares of the financial services provider’s stock, valued at approximately $1,115,000. Illinois Municipal Retirement Fund owned approximately 0.06% of Four Corners Property Trust at the end of the most recent reporting period.

Illinois Municipal Retirement Fund purchased a new position in Four Corners Property Trust, Inc. (NYSE:FCPT – Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund purchased 50,253 shares of the financial services provider’s stock, valued at approximately $1,115,000. Illinois Municipal Retirement Fund owned approximately 0.06% of Four Corners Property Trust at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also bought and sold shares of the stock. Versor Investments LP grew its stake in Four Corners Property Trust by 32.5% in the 3rd quarter. Versor Investments LP now owns 22,825 shares of the financial services provider’s stock worth $506,000 after buying an additional 5,600 shares in the last quarter. Nomura Asset Management Co. Ltd. boosted its stake in shares of Four Corners Property Trust by 7.2% in the 3rd quarter. Nomura Asset Management Co. Ltd. now owns 101,090 shares of the financial services provider’s stock valued at $2,243,000 after purchasing an additional 6,830 shares in the last quarter. Nisa Investment Advisors LLC boosted its stake in shares of Four Corners Property Trust by 5.6% in the 3rd quarter. Nisa Investment Advisors LLC now owns 38,253 shares of the financial services provider’s stock valued at $849,000 after purchasing an additional 2,013 shares in the last quarter. Daiwa Securities Group Inc. boosted its stake in shares of Four Corners Property Trust by 8.1% in the 3rd quarter. Daiwa Securities Group Inc. now owns 28,883 shares of the financial services provider’s stock valued at $641,000 after purchasing an additional 2,165 shares in the last quarter. Finally, Teacher Retirement System of Texas boosted its stake in shares of Four Corners Property Trust by 91.9% in the 3rd quarter. Teacher Retirement System of Texas now owns 83,614 shares of the financial services provider’s stock valued at $1,855,000 after purchasing an additional 40,052 shares in the last quarter. Hedge funds and other institutional investors own 93.46% of the company’s stock.

Four Corners Property Trust Trading Down 1.2 %

NYSE:FCPT opened at $23.41 on Thursday. The company has a fifty day moving average of $24.52 and a 200 day moving average of $24.02. Four Corners Property Trust, Inc. has a 52 week low of $20.51 and a 52 week high of $29.30. The company has a quick ratio of 0.10, a current ratio of 0.10 and a debt-to-equity ratio of 0.36. The firm has a market capitalization of $2.12 billion, a P/E ratio of 21.68 and a beta of 1.01.

Four Corners Property Trust Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, January 12th. Investors of record on Friday, December 29th were issued a dividend of $0.345 per share. This is a positive change from Four Corners Property Trust’s previous quarterly dividend of $0.34. This represents a $1.38 dividend on an annualized basis and a yield of 5.89%. The ex-dividend date of this dividend was Thursday, December 28th. Four Corners Property Trust’s dividend payout ratio is currently 127.78%.

Wall Street Analysts Forecast Growth

FCPT has been the subject of a number of research reports. Robert W. Baird cut their price objective on shares of Four Corners Property Trust from $29.00 to $26.00 in a research note on Friday, October 6th. TheStreet cut shares of Four Corners Property Trust from a “b-” rating to a “c+” rating in a research note on Wednesday, October 18th. StockNews.com began coverage on shares of Four Corners Property Trust in a report on Thursday, October 5th. They set a “hold” rating for the company. Finally, Raymond James lowered their price target on shares of Four Corners Property Trust from $29.00 to $28.00 and set an “outperform” rating for the company in a report on Monday, January 8th.

View Our Latest Research Report on Four Corners Property Trust

Insiders Place Their Bets

In related news, CEO William H. Lenehan acquired 9,000 shares of the firm’s stock in a transaction on Monday, November 6th. The stock was acquired at an average cost of $22.05 per share, for a total transaction of $198,450.00. Following the acquisition, the chief executive officer now owns 568,443 shares of the company’s stock, valued at $12,534,168.15. The purchase was disclosed in a document filed with the SEC, which is available at this hyperlink. In related news, CEO William H. Lenehan acquired 9,000 shares of the firm’s stock in a transaction on Monday, November 6th. The stock was acquired at an average cost of $22.05 per share, for a total transaction of $198,450.00. Following the acquisition, the chief executive officer now owns 568,443 shares of the company’s stock, valued at $12,534,168.15. The purchase was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Douglas B. Hansen acquired 4,950 shares of the firm’s stock in a transaction on Tuesday, November 7th. The stock was bought at an average price of $21.74 per share, with a total value of $107,613.00. Following the completion of the acquisition, the director now directly owns 2,650 shares in the company, valued at approximately $57,611. The disclosure for this purchase can be found here. Company insiders own 1.10% of the company’s stock.

Four Corners Property Trust Company Profile

FCPT, headquartered in Mill Valley, CA, is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties. The Company seeks to grow its portfolio by acquiring additional real estate to lease, on a net basis, for use in the restaurant and retail industries.

Recommended Stories

Want to see what other hedge funds are holding FCPT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Four Corners Property Trust, Inc. (NYSE:FCPT – Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Four Corners Property Trust, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Four Corners Property Trust wasn’t on the list.

While Four Corners Property Trust currently has a “Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.