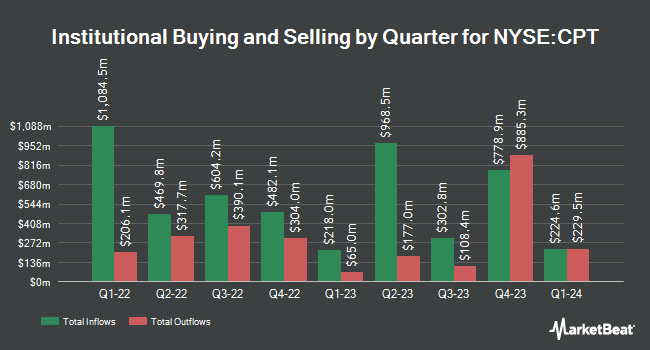

Security National Bank lessened its holdings in shares of Camden Property Trust (NYSE:CPT – Free Report) by 56.0% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 7,911 shares of the real estate investment trust’s stock after selling 10,072 shares during the period. Security National Bank’s holdings in Camden Property Trust were worth $785,000 at the end of the most recent reporting period.

Other large investors also recently bought and sold shares of the company. JPMorgan Chase & Co. grew its stake in shares of Camden Property Trust by 41.6% in the 3rd quarter. JPMorgan Chase & Co. now owns 4,044,988 shares of the real estate investment trust’s stock valued at $382,575,000 after buying an additional 1,187,974 shares during the period. Norges Bank purchased a new stake in shares of Camden Property Trust in the 4th quarter valued at approximately $376,933,000. Victory Capital Management Inc. grew its stake in shares of Camden Property Trust by 2.4% in the 4th quarter. Victory Capital Management Inc. now owns 3,686,395 shares of the real estate investment trust’s stock valued at $366,022,000 after buying an additional 87,337 shares during the period. Dimensional Fund Advisors LP grew its stake in shares of Camden Property Trust by 1.1% in the 4th quarter. Dimensional Fund Advisors LP now owns 1,547,287 shares of the real estate investment trust’s stock valued at $153,633,000 after buying an additional 16,389 shares during the period. Finally, Charles Schwab Investment Management Inc. grew its stake in shares of Camden Property Trust by 2.7% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 1,411,193 shares of the real estate investment trust’s stock valued at $140,117,000 after buying an additional 37,162 shares during the period. Hedge funds and other institutional investors own 97.22% of the company’s stock.

Camden Property Trust Stock Down 0.3 %

Shares of NYSE CPT traded down $0.29 during mid-day trading on Friday, reaching $106.69. The company had a trading volume of 407,178 shares, compared to its average volume of 801,468. The company has a current ratio of 0.43, a quick ratio of 0.43 and a debt-to-equity ratio of 0.71. The firm has a 50 day simple moving average of $101.78 and a two-hundred day simple moving average of $98.17. The stock has a market cap of $11.37 billion, a P/E ratio of 26.15, a PEG ratio of 4.18 and a beta of 0.86. Camden Property Trust has a 52-week low of $82.81 and a 52-week high of $114.04.

Wall Street Analysts Forecast Growth

Several analysts have recently weighed in on CPT shares. Wells Fargo & Company increased their price target on shares of Camden Property Trust from $92.00 to $104.00 and gave the company an “underweight” rating in a research note on Friday, May 31st. Mizuho lowered their price objective on shares of Camden Property Trust from $111.00 to $108.00 and set a “buy” rating for the company in a research report on Thursday, May 30th. UBS Group increased their price objective on shares of Camden Property Trust from $105.00 to $109.00 and gave the stock a “neutral” rating in a research report on Tuesday, May 14th. Scotiabank increased their price objective on shares of Camden Property Trust from $104.00 to $108.00 and gave the stock a “sector perform” rating in a research report on Tuesday, May 14th. Finally, StockNews.com raised shares of Camden Property Trust from a “sell” rating to a “hold” rating in a research report on Tuesday, April 30th. Two equities research analysts have rated the stock with a sell rating, ten have assigned a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat.com, Camden Property Trust currently has an average rating of “Hold” and a consensus price target of $108.03.

Get Our Latest Stock Analysis on CPT

About Camden Property Trust

Camden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,634 apartment homes across the United States.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Camden Property Trust, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Camden Property Trust wasn’t on the list.

While Camden Property Trust currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

Growth stocks offer a lot of bang for your buck, and we’ve got the next upcoming superstars to strongly consider for your portfolio.

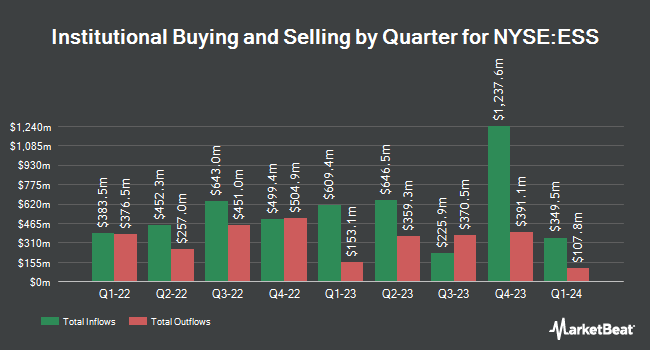

Cbre Investment Management Listed Real Assets LLC trimmed its stake in shares of Essex Property Trust, Inc. (NYSE:ESS – Free Report) by 10.3% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 476,305 shares of the real estate investment trust’s stock after selling 54,782 shares during the period. Essex Property Trust makes up about 2.1% of Cbre Investment Management Listed Real Assets LLC’s investment portfolio, making the stock its 15th biggest position. Cbre Investment Management Listed Real Assets LLC owned approximately 0.74% of Essex Property Trust worth $118,095,000 as of its most recent filing with the Securities and Exchange Commission.

Cbre Investment Management Listed Real Assets LLC trimmed its stake in shares of Essex Property Trust, Inc. (NYSE:ESS – Free Report) by 10.3% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 476,305 shares of the real estate investment trust’s stock after selling 54,782 shares during the period. Essex Property Trust makes up about 2.1% of Cbre Investment Management Listed Real Assets LLC’s investment portfolio, making the stock its 15th biggest position. Cbre Investment Management Listed Real Assets LLC owned approximately 0.74% of Essex Property Trust worth $118,095,000 as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds and other institutional investors have also modified their holdings of the company. SG Americas Securities LLC grew its position in shares of Essex Property Trust by 632.8% in the 4th quarter. SG Americas Securities LLC now owns 15,001 shares of the real estate investment trust’s stock valued at $3,719,000 after purchasing an additional 12,954 shares during the period. Daiwa Securities Group Inc. raised its holdings in shares of Essex Property Trust by 201.1% during the fourth quarter. Daiwa Securities Group Inc. now owns 534,964 shares of the real estate investment trust’s stock worth $132,639,000 after acquiring an additional 357,268 shares during the period. Victory Capital Management Inc. lifted its position in Essex Property Trust by 11.1% in the 4th quarter. Victory Capital Management Inc. now owns 49,277 shares of the real estate investment trust’s stock valued at $12,218,000 after acquiring an additional 4,943 shares in the last quarter. Kingswood Wealth Advisors LLC acquired a new position in Essex Property Trust in the 4th quarter worth $3,304,000. Finally, JLP Asset Management LLC bought a new position in Essex Property Trust during the 4th quarter worth about $2,802,000. Institutional investors and hedge funds own 96.51% of the company’s stock.

Analyst Ratings Changes

ESS has been the subject of a number of recent research reports. UBS Group increased their price objective on shares of Essex Property Trust from $250.00 to $261.00 and gave the stock a “neutral” rating in a research note on Tuesday, May 14th. Morgan Stanley upped their price objective on Essex Property Trust from $230.00 to $250.00 and gave the stock an “equal weight” rating in a research note on Tuesday, May 14th. Raymond James raised shares of Essex Property Trust from a “market perform” rating to an “outperform” rating and set a $265.00 target price on the stock in a report on Monday, March 18th. Wedbush upped their price objective on Essex Property Trust from $240.00 to $264.00 and gave the company a “neutral” rating in a research note on Monday, May 6th. Finally, Piper Sandler upped their price target on shares of Essex Property Trust from $291.00 to $315.00 and gave the company an “overweight” rating in a research note on Monday, May 6th. Two analysts have rated the stock with a sell rating, eleven have assigned a hold rating and seven have assigned a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of “Hold” and a consensus price target of $257.33.

View Our Latest Stock Analysis on ESS

Essex Property Trust Stock Performance

Shares of ESS stock traded up $4.19 during mid-day trading on Friday, reaching $259.79. 489,351 shares of the company’s stock traded hands, compared to its average volume of 269,254. The company has a debt-to-equity ratio of 1.14, a quick ratio of 3.19 and a current ratio of 3.19. The firm has a 50 day moving average price of $249.00 and a two-hundred day moving average price of $239.71. The firm has a market capitalization of $16.68 billion, a PE ratio of 31.76, a price-to-earnings-growth ratio of 3.59 and a beta of 0.79. Essex Property Trust, Inc. has a 12 month low of $203.85 and a 12 month high of $269.23.

Essex Property Trust Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, July 24th. Investors of record on Friday, June 28th will be paid a dividend of $2.45 per share. The ex-dividend date is Friday, June 28th. This represents a $9.80 dividend on an annualized basis and a dividend yield of 3.77%. Essex Property Trust’s dividend payout ratio is presently 119.80%.

Essex Property Trust Company Profile

Essex Property Trust, Inc, an S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets. Essex currently has ownership interests in 252 apartment communities comprising approximately 62,000 apartment homes with an additional property in active development.

Featured Stories

Before you consider Essex Property Trust, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Essex Property Trust wasn’t on the list.

While Essex Property Trust currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.