Essex Property Trust (NYSE:ESS – Get Free Report) was downgraded by investment analysts at StockNews.com from a “hold” rating to a “sell” rating in a research report issued to clients and investors on Saturday.

Essex Property Trust (NYSE:ESS – Get Free Report) was downgraded by investment analysts at StockNews.com from a “hold” rating to a “sell” rating in a research report issued to clients and investors on Saturday.

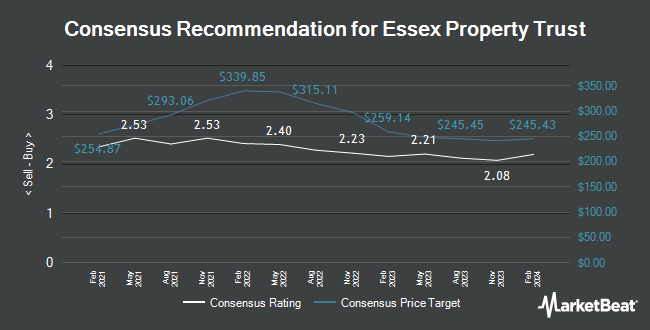

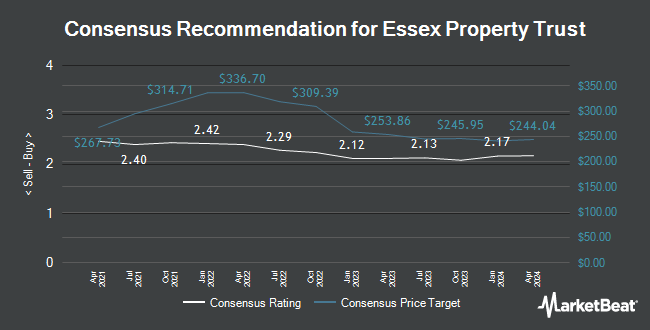

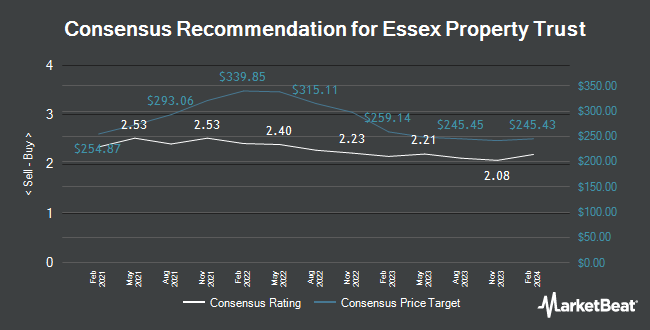

ESS has been the topic of several other research reports. Morgan Stanley boosted their price target on shares of Essex Property Trust from $227.00 to $230.00 and gave the company an “equal weight” rating in a research report on Monday, February 26th. Mizuho raised Essex Property Trust from a “neutral” rating to a “buy” rating and decreased their target price for the stock from $255.00 to $250.00 in a research report on Wednesday, February 28th. Jefferies Financial Group upgraded Essex Property Trust from a “hold” rating to a “buy” rating and lifted their price target for the company from $215.00 to $281.00 in a research report on Tuesday, January 2nd. Deutsche Bank Aktiengesellschaft initiated coverage on Essex Property Trust in a report on Tuesday, January 30th. They issued a “hold” rating and a $240.00 price objective for the company. Finally, Royal Bank of Canada raised their price objective on Essex Property Trust from $237.00 to $239.00 and gave the company an “outperform” rating in a research report on Thursday, February 8th. Four analysts have rated the stock with a sell rating, nine have assigned a hold rating and six have issued a buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of “Hold” and a consensus target price of $245.37.

Check Out Our Latest Research Report on Essex Property Trust

Essex Property Trust Stock Performance

NYSE:ESS opened at $239.29 on Friday. The company has a quick ratio of 3.26, a current ratio of 3.26 and a debt-to-equity ratio of 1.11. The firm’s fifty day simple moving average is $237.02 and its 200 day simple moving average is $229.90. The stock has a market cap of $15.36 billion, a P/E ratio of 37.92, a price-to-earnings-growth ratio of 3.60 and a beta of 0.80. Essex Property Trust has a twelve month low of $203.85 and a twelve month high of $252.85.

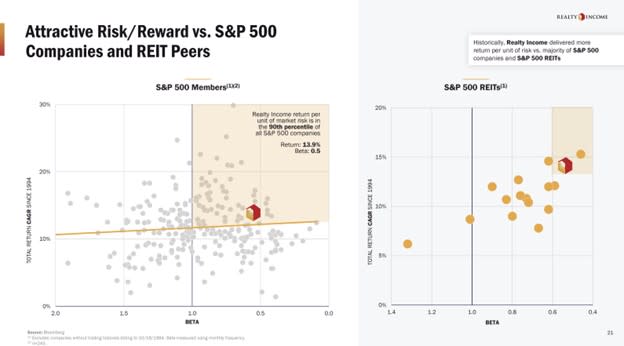

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently modified their holdings of ESS. Steward Partners Investment Advisory LLC boosted its holdings in Essex Property Trust by 100.0% in the fourth quarter. Steward Partners Investment Advisory LLC now owns 120 shares of the real estate investment trust’s stock worth $25,000 after purchasing an additional 60 shares during the last quarter. Clear Street Markets LLC purchased a new position in shares of Essex Property Trust in the 4th quarter worth $25,000. Lindbrook Capital LLC grew its holdings in shares of Essex Property Trust by 111.5% in the fourth quarter. Lindbrook Capital LLC now owns 110 shares of the real estate investment trust’s stock worth $27,000 after acquiring an additional 58 shares during the period. Pacific Center for Financial Services bought a new stake in shares of Essex Property Trust in the first quarter worth $30,000. Finally, Advisory Services Network LLC purchased a new stake in Essex Property Trust during the first quarter valued at $32,000. 96.51% of the stock is owned by institutional investors.

Essex Property Trust Company Profile

Essex Property Trust, Inc, an S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets. Essex currently has ownership interests in 252 apartment communities comprising approximately 62,000 apartment homes with an additional property in active development.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Essex Property Trust, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Essex Property Trust wasn’t on the list.

While Essex Property Trust currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Real estate investment trusts (REITs) can be fantastic investments. They supply investors with passive income. Further, REITs have historically outperformed the S&P 500 over the longer term.

On top of all that, our research has found that many REITs deliver those higher returns with less volatility compared to the broader market. Three REITs have stood out for their ability to produce high returns with lower volatility: Realty Income (NYSE: O), Essex Property Trust (NYSE: ESS), and Public Storage (NYSE: PSA). Here’s a look at these reliable REITs.

A reliable grower

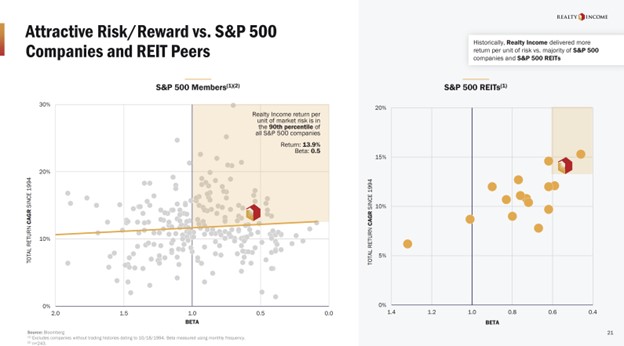

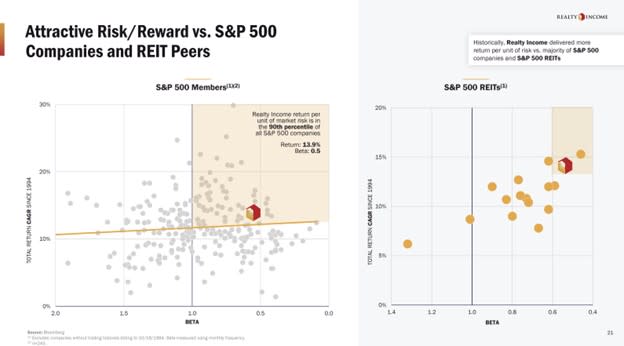

Realty Income stands out among REITs. The diversified REIT has delivered a 13.9% compound annual total return since its public market listing in 1994. While that’s not the highest return over that period, it has delivered one of the best returns per unit of risk as measured by beta:

As that slide shows, Realty Income is in the 90th percentile among S&P 500 members for the return it delivers per unit of risk. A big driver is its low beta, the second lowest among REITs in the S&P 500.

Several factors drive Realty Income’s low volatility. A big one is the overall stability of its cash flow. The company owns commercial properties secured by long-term net leases with high-quality tenants in industries relatively immune to economic downturns and the disruption of e-commerce (e.g., grocery stores, home improvement centers, and warehouses). The net lease structure requires the tenant to cover maintenance, building insurance, and real estate taxes. This business model enables it to generate very stable cash flow, three-quarters of which it pays investors via its monthly dividend.

Realty Income also has one of the highest credit ratings in the REIT sector. The company’s combination of a durable portfolio and strong financial profile allows it to steadily grow its portfolio, cash flow, and dividend (106 consecutive quarterly increases). That drives reliable returns for its investors.

A West Coast focus has driven peer-leading returns

Essex Property Trust has also delivered strong returns for less risk. The apartment REIT has delivered a 13.7% compound annual growth rate in its total return since its initial public offering in 1994. That’s the highest return among multifamily focused REITs. The company has delivered those returns with less volatility than the broader market (0.8 average beta over the last five years).

A few factors have helped drive its reliable returns. A big one is its focus on housing-constrained markets along the West Coast. That has helped drive above-average net operating income growth compared to other REITs due to high occupancy levels and higher average rent growth. The company also has done an excellent job of investing capital to expand its portfolio via high-return acquisitions and development projects. These catalysts have helped drive above-average cash flow per share growth, enabling Essex Property Trust to deliver peer-leading dividend growth (487% over the last three decades).

Essex Property Trust backs its strong portfolio with a rock-solid balance sheet. Its strong credit rating gives it the financial flexibility to make value-enhancing investments.

The low-volatility leader

Public Storage has the lowest volatility among REITs in the S&P 500 (around 0.5 times over the past five years). The self-storage REIT has also delivered an impressive 12.4% average annual return since going public several decades ago.

Its focus on self-storage properties is a big factor driving its reliable, low-volatility returns. They have a low break-even point (40% to 45% occupancy compared to 60% or more for multifamily properties), enabling the company to consistently generate strong earnings. Meanwhile, demand for self-storage properties tends to be relatively recession-resistant. On top of that, demand for space in those facilities has been steadily rising as more people use them to store their stuff. These catalysts have helped drive strong occupancy and rental growth rates for self-storage operators over the years. Since 2004, its same-store net operating income has grown at a 5.1% compound annual rate, much faster than the core real estate sector average of 2.9%.

Another factor driving Public Storage’s low volatility is its fortress-like balance sheet. It has one of the highest credit ratings in the REIT sector. That gives it the flexibility to invest in high-return development projects and make accretive acquisitions.

Reliable returning REITs

Realty Income, Essex Property Trust, and Public Storage have been fantastic long-term investments. The REITs have delivered strong returns with a lot less volatility than the broader market. Given the durability of their business models and their strong financial profiles, these top REITs should be able to continue delivering reliable returns for their investors in the decades ahead.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Matt DiLallo has positions in Public Storage and Realty Income. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

Looking for a Reliable Investment? These 3 REITs Are Less Volatile Than the S&P 500. was originally published by The Motley Fool

Bruce G. Allen Investments LLC bought a new stake in Essex Property Trust, Inc. (NYSE:ESS – Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 164 shares of the real estate investment trust’s stock, valued at approximately $41,000.

Bruce G. Allen Investments LLC bought a new stake in Essex Property Trust, Inc. (NYSE:ESS – Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 164 shares of the real estate investment trust’s stock, valued at approximately $41,000.

Other institutional investors and hedge funds also recently made changes to their positions in the company. Steward Partners Investment Advisory LLC increased its holdings in Essex Property Trust by 100.0% during the fourth quarter. Steward Partners Investment Advisory LLC now owns 120 shares of the real estate investment trust’s stock worth $25,000 after buying an additional 60 shares during the last quarter. Clear Street Markets LLC increased its holdings in Essex Property Trust by 89.4% during the first quarter. Clear Street Markets LLC now owns 125 shares of the real estate investment trust’s stock worth $26,000 after buying an additional 59 shares during the last quarter. Pacific Center for Financial Services purchased a new stake in Essex Property Trust during the first quarter worth about $30,000. Advisory Services Network LLC purchased a new stake in Essex Property Trust during the first quarter worth about $32,000. Finally, Lazard Asset Management LLC increased its holdings in Essex Property Trust by 25.3% during the first quarter. Lazard Asset Management LLC now owns 243 shares of the real estate investment trust’s stock worth $83,000 after buying an additional 49 shares during the last quarter. Hedge funds and other institutional investors own 92.93% of the company’s stock.

Essex Property Trust Stock Up 1.9 %

Shares of NYSE ESS opened at $240.59 on Thursday. The company has a quick ratio of 3.26, a current ratio of 3.26 and a debt-to-equity ratio of 1.11. Essex Property Trust, Inc. has a 52 week low of $195.03 and a 52 week high of $252.85. The firm’s fifty day moving average is $236.61 and its 200 day moving average is $228.08. The company has a market cap of $15.45 billion, a price-to-earnings ratio of 38.13, a PEG ratio of 3.09 and a beta of 0.79.

Essex Property Trust Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, April 12th. Investors of record on Friday, March 29th will be paid a $2.45 dividend. This represents a $9.80 annualized dividend and a dividend yield of 4.07%. This is an increase from Essex Property Trust’s previous quarterly dividend of $2.31. The ex-dividend date is Wednesday, March 27th. Essex Property Trust’s payout ratio is presently 146.43%.

Analysts Set New Price Targets

A number of analysts recently issued reports on the stock. Truist Financial raised their price objective on shares of Essex Property Trust from $260.00 to $276.00 and gave the stock a “hold” rating in a report on Tuesday, January 16th. Morgan Stanley increased their target price on shares of Essex Property Trust from $227.00 to $230.00 and gave the stock an “equal weight” rating in a research report on Monday, February 26th. StockNews.com lowered shares of Essex Property Trust from a “hold” rating to a “sell” rating in a research report on Tuesday, February 27th. Deutsche Bank Aktiengesellschaft initiated coverage on shares of Essex Property Trust in a research report on Tuesday, January 30th. They set a “hold” rating and a $240.00 target price for the company. Finally, The Goldman Sachs Group reiterated a “sell” rating and set a $227.00 target price on shares of Essex Property Trust in a research report on Thursday, February 22nd. Four research analysts have rated the stock with a sell rating, nine have issued a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of “Hold” and a consensus target price of $243.58.

Get Our Latest Stock Analysis on ESS

Essex Property Trust Company Profile

Essex Property Trust, Inc, an S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets. Essex currently has ownership interests in 252 apartment communities comprising approximately 62,000 apartment homes with an additional property in active development.

Read More

Receive News & Ratings for Essex Property Trust Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Essex Property Trust and related companies with MarketBeat.com’s FREE daily email newsletter.

Essex Property Trust Inc (NYSE:ESS) experienced an insider sell on February 28, 2024, according to a recent SEC filing. Director LYONS IRVING F III sold 2,083 shares of the company. This transaction has been documented in the SEC filing accessible through the following link: SEC Filing.Essex Property Trust Inc is a real estate investment trust (REIT) that primarily invests in, develops, redevelops, and manages multifamily residential properties on the West Coast of the United States.Over the past year, the insider LYONS IRVING F III has engaged in the sale of 2,083 shares in total and has not made any purchase of shares in the company.The insider transaction history for Essex Property Trust Inc shows a pattern of behavior over the past year, with 0 insider buys and 1 insider sell.

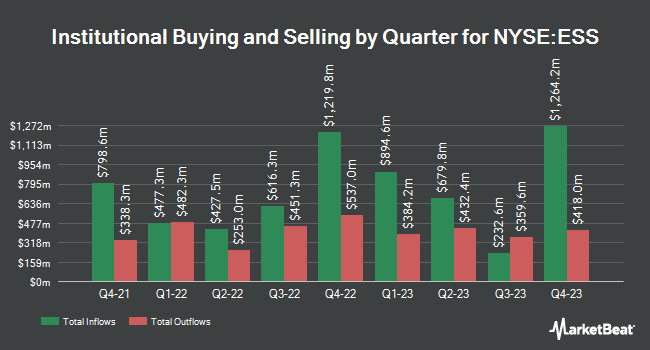

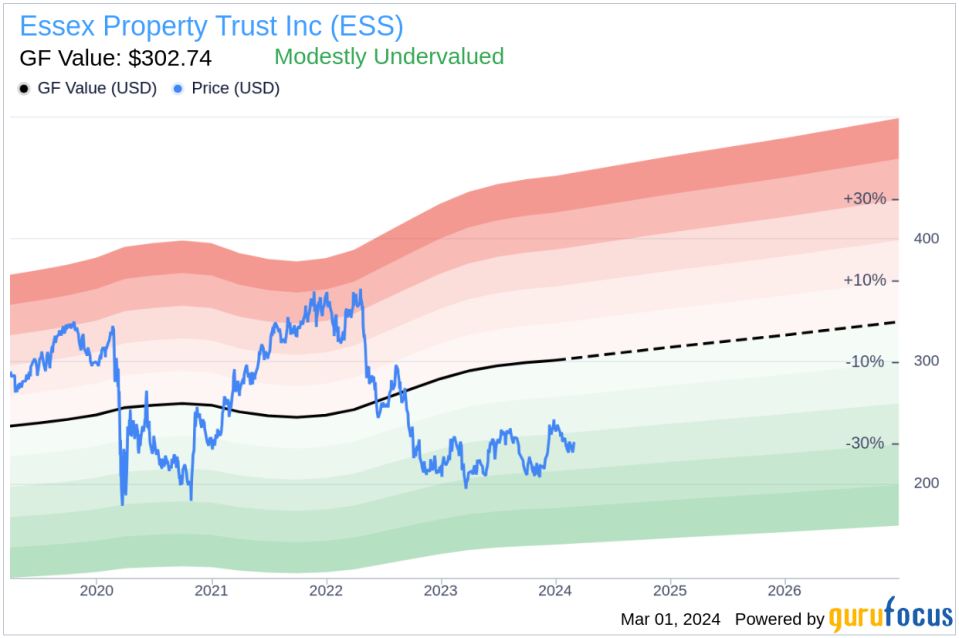

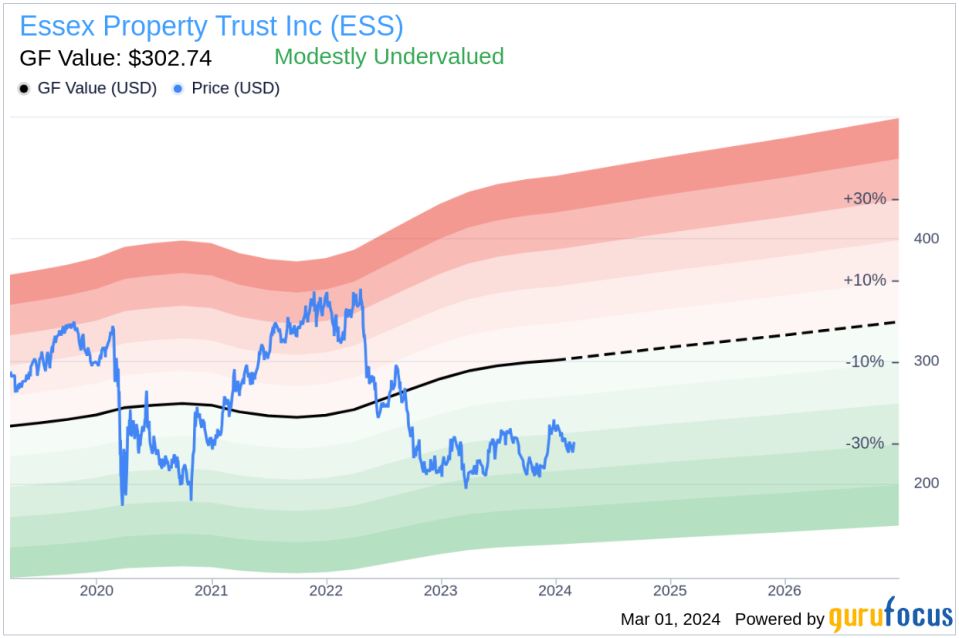

On the valuation front, shares of Essex Property Trust Inc were trading at $230.9 on the day of the insider’s recent transaction. The company has a market capitalization of $15.047 billion.The price-earnings ratio of Essex Property Trust Inc stands at 37.14, which is above the industry median of 16.765 but below the company’s historical median price-earnings ratio.According to the GF Value, with a price of $230.9 and a GuruFocus Value of $302.74, Essex Property Trust Inc has a price-to-GF-Value ratio of 0.76, indicating that the stock is Modestly Undervalued.

The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor related to the company’s past performance, and future business performance estimates provided by Morningstar analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

SAN MATEO, Calif., March 01, 2024–(BUSINESS WIRE)–Essex Property Trust, Inc. (NYSE:ESS) announced today that Angela L. Kleiman, President and CEO, will be participating in a roundtable presentation at the 2024 Citigroup Global Property CEO Conference held in Hollywood, FL on Tuesday, March 5, 2024, at 11:40 a.m. Eastern Time.

To listen to the panel, please visit the webcast link on the Investors section of the Company’s website at www.essex.com. An archive of the webcast will be available for thirty days following the event. A copy of any materials provided by the Company at the conference can be obtained through the Investors section of the Company’s website.

About Essex Property Trust, Inc.

Essex Property Trust, Inc., an S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets. Essex currently has ownership interests in 252 apartment communities comprising approximately 62,000 apartment homes with an additional property in active development. Additional information about the Company can be found on the Company’s website at www.essex.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240301394479/en/

Contacts

Loren Rainey

Director, Investor Relations

(650) 655-7800

lrainey@essex.com

StockNews.com lowered shares of Essex Property Trust (NYSE:ESS – Free Report) from a hold rating to a sell rating in a research note published on Tuesday morning.

StockNews.com lowered shares of Essex Property Trust (NYSE:ESS – Free Report) from a hold rating to a sell rating in a research note published on Tuesday morning.

ESS has been the subject of a number of other reports. Barclays raised their target price on shares of Essex Property Trust from $224.00 to $225.00 and gave the stock an underweight rating in a report on Tuesday, February 20th. Mizuho raised their target price on shares of Essex Property Trust from $232.00 to $256.00 and gave the stock a neutral rating in a report on Wednesday, January 10th. Royal Bank of Canada raised their target price on shares of Essex Property Trust from $237.00 to $239.00 and gave the stock an outperform rating in a report on Thursday, February 8th. Jefferies Financial Group upgraded shares of Essex Property Trust from a hold rating to a buy rating and raised their target price for the stock from $215.00 to $281.00 in a report on Tuesday, January 2nd. Finally, Morgan Stanley raised their price objective on shares of Essex Property Trust from $227.00 to $230.00 and gave the stock an equal weight rating in a research note on Monday. Four investment analysts have rated the stock with a sell rating, ten have assigned a hold rating and four have issued a buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of Hold and a consensus price target of $242.72.

Get Our Latest Stock Report on Essex Property Trust

Essex Property Trust Trading Up 0.9 %

Shares of NYSE:ESS opened at $227.73 on Tuesday. The stock has a market capitalization of $14.62 billion, a price-to-earnings ratio of 36.09, a PEG ratio of 2.91 and a beta of 0.80. Essex Property Trust has a 1-year low of $195.03 and a 1-year high of $252.85. The company has a debt-to-equity ratio of 1.11, a quick ratio of 2.63 and a current ratio of 2.63. The company has a 50 day moving average price of $238.84 and a 200 day moving average price of $227.80.

Essex Property Trust Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, April 12th. Investors of record on Friday, March 29th will be issued a $2.45 dividend. This represents a $9.80 annualized dividend and a yield of 4.30%. The ex-dividend date is Wednesday, March 27th. This is an increase from Essex Property Trust’s previous quarterly dividend of $2.31. Essex Property Trust’s dividend payout ratio (DPR) is 146.43%.

Institutional Trading of Essex Property Trust

Several hedge funds and other institutional investors have recently bought and sold shares of ESS. Steward Partners Investment Advisory LLC grew its position in Essex Property Trust by 100.0% in the 4th quarter. Steward Partners Investment Advisory LLC now owns 120 shares of the real estate investment trust’s stock worth $25,000 after purchasing an additional 60 shares during the last quarter. Clear Street Markets LLC acquired a new stake in shares of Essex Property Trust during the 4th quarter valued at about $25,000. Lindbrook Capital LLC boosted its position in shares of Essex Property Trust by 111.5% during the 4th quarter. Lindbrook Capital LLC now owns 110 shares of the real estate investment trust’s stock valued at $27,000 after acquiring an additional 58 shares in the last quarter. Pacific Center for Financial Services acquired a new stake in shares of Essex Property Trust during the 1st quarter valued at about $30,000. Finally, Advisory Services Network LLC acquired a new stake in shares of Essex Property Trust during the 1st quarter valued at about $32,000. 92.93% of the stock is currently owned by institutional investors and hedge funds.

Essex Property Trust Company Profile

Essex Property Trust, Inc, an S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets. Essex currently has ownership interests in 252 apartment communities comprising approximately 62,000 apartment homes with an additional property in active development.

Further Reading

Receive News & Ratings for Essex Property Trust Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Essex Property Trust and related companies with MarketBeat.com’s FREE daily email newsletter.