by Calculated Risk on 4/27/2024 08:11:00 AM

The key report scheduled for this week is the April employment report.

Other key reports include February Case-Shiller house prices, April vehicle sales, and the March trade balance.

The FOMC meets this week and no change to policy is expected.

For manufacturing, the April Dallas Fed manufacturing survey, and the ISM index will be released.

—– Monday, April 29th —–

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April.

—– Tuesday, April 30th —–

This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.7% year-over-year increase in the Comp 20 index for February.

9:00 AM: FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for a reading of 45.0, up from 41.4 in March.

10:00 AM: the Q1 2024 Housing Vacancies and Homeownership from the Census Bureau.

—– Wednesday, May 1st —–

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in April, down from 184,000 added in March.

10:00 AM ET: ISM Manufacturing Index for April. The consensus is for the ISM to be at 50.1, down from 50.3 in March.

10:00 AM: Construction Spending for March. The consensus is for a 0.3% increase in construction spending.

10:00 AM ET: Job Openings and Labor Turnover Survey for March from the BLS.

This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings were little changed in February at 8.76 million from 8.75 million in January.

The number of job openings (black) were down 11% year-over-year in February.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

All day: Light vehicle sales for April. The expectation is for light vehicle sales to be 15.7 million SAAR in April, up from 15.5 million in March (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for the previous month.

—– Thursday, May 2nd —–

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 207 thousand last week.

8:30 AM: Trade Balance report for March from the Census Bureau.

This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $68.8 billion. The U.S. trade deficit was at $68.9 billion in February.

—– Friday, May 3rd —–

There were 303,000 jobs added in March, and the unemployment rate was at 3.8%.

This graph shows the jobs added per month since January 2021.

10:00 AM: the ISM Services Index for April. The consensus is for a reading of 52.0, up from 51.4.

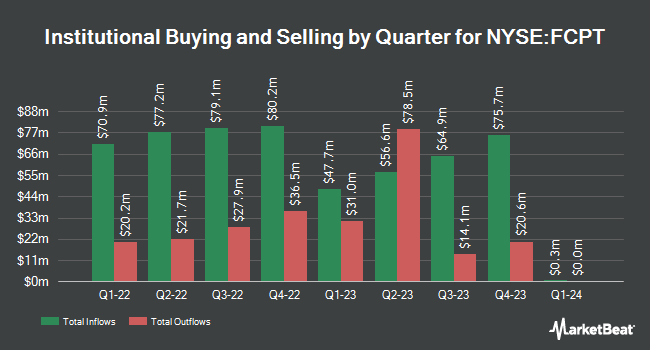

Nisa Investment Advisors LLC decreased its position in Four Corners Property Trust, Inc. (NYSE:FCPT – Free Report) by 5.1% during the 4th quarter, according to its most recent filing with the SEC. The institutional investor owned 36,288 shares of the financial services provider’s stock after selling 1,965 shares during the period. Nisa Investment Advisors LLC’s holdings in Four Corners Property Trust were worth $918,000 as of its most recent filing with the SEC.

Nisa Investment Advisors LLC decreased its position in Four Corners Property Trust, Inc. (NYSE:FCPT – Free Report) by 5.1% during the 4th quarter, according to its most recent filing with the SEC. The institutional investor owned 36,288 shares of the financial services provider’s stock after selling 1,965 shares during the period. Nisa Investment Advisors LLC’s holdings in Four Corners Property Trust were worth $918,000 as of its most recent filing with the SEC.

Several other institutional investors have also recently bought and sold shares of the company. Belpointe Asset Management LLC raised its holdings in shares of Four Corners Property Trust by 1,120.0% in the first quarter. Belpointe Asset Management LLC now owns 915 shares of the financial services provider’s stock valued at $25,000 after purchasing an additional 840 shares during the last quarter. Fortis Capital Advisors LLC grew its position in Four Corners Property Trust by 18,200.0% in the first quarter. Fortis Capital Advisors LLC now owns 915 shares of the financial services provider’s stock valued at $25,000 after purchasing an additional 910 shares in the last quarter. Eagle Bay Advisors LLC acquired a new stake in Four Corners Property Trust in the 2nd quarter valued at $33,000. Lazard Asset Management LLC bought a new stake in Four Corners Property Trust during the 3rd quarter worth about $52,000. Finally, Quantbot Technologies LP lifted its position in Four Corners Property Trust by 72.4% during the 1st quarter. Quantbot Technologies LP now owns 2,559 shares of the financial services provider’s stock worth $69,000 after buying an additional 1,075 shares in the last quarter. Institutional investors own 98.66% of the company’s stock.

Four Corners Property Trust Stock Performance

Shares of FCPT opened at $23.24 on Tuesday. The company has a market cap of $2.14 billion, a PE ratio of 21.52 and a beta of 1.00. The firm has a 50-day moving average of $23.85 and a 200-day moving average of $23.54. Four Corners Property Trust, Inc. has a one year low of $20.51 and a one year high of $27.60. The company has a debt-to-equity ratio of 0.35, a current ratio of 0.12 and a quick ratio of 0.12.

Four Corners Property Trust (NYSE:FCPT – Get Free Report) last posted its quarterly earnings results on Thursday, February 15th. The financial services provider reported $0.27 EPS for the quarter, missing analysts’ consensus estimates of $0.40 by ($0.13). The business had revenue of $65.14 million for the quarter, compared to the consensus estimate of $65.23 million. Four Corners Property Trust had a return on equity of 7.78% and a net margin of 38.04%. The company’s revenue for the quarter was up 13.6% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.41 EPS. As a group, equities analysts forecast that Four Corners Property Trust, Inc. will post 1.64 earnings per share for the current year.

Four Corners Property Trust Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, April 15th. Investors of record on Thursday, March 28th were issued a dividend of $0.345 per share. This represents a $1.38 dividend on an annualized basis and a dividend yield of 5.94%. The ex-dividend date was Wednesday, March 27th. Four Corners Property Trust’s payout ratio is presently 127.78%.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on the company. Wells Fargo & Company lifted their target price on Four Corners Property Trust from $24.00 to $25.00 and gave the company an “overweight” rating in a research report on Tuesday, February 20th. Raymond James lowered their price target on Four Corners Property Trust from $29.00 to $28.00 and set an “outperform” rating on the stock in a research report on Monday, January 8th.

Get Our Latest Research Report on FCPT

Four Corners Property Trust Profile

FCPT, headquartered in Mill Valley, CA, is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties. The Company seeks to grow its portfolio by acquiring additional real estate to lease, on a net basis, for use in the restaurant and retail industries.

See Also

Want to see what other hedge funds are holding FCPT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Four Corners Property Trust, Inc. (NYSE:FCPT – Free Report).

Receive News & Ratings for Four Corners Property Trust Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Four Corners Property Trust and related companies with MarketBeat.com’s FREE daily email newsletter.

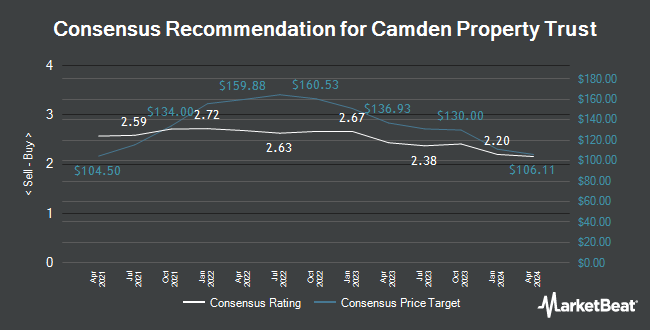

StockNews.com downgraded shares of Camden Property Trust (NYSE:CPT – Free Report) from a hold rating to a sell rating in a research report released on Thursday morning.

StockNews.com downgraded shares of Camden Property Trust (NYSE:CPT – Free Report) from a hold rating to a sell rating in a research report released on Thursday morning.

A number of other analysts have also weighed in on the stock. Barclays lowered shares of Camden Property Trust from an overweight rating to an equal weight rating and reduced their price objective for the company from $138.00 to $100.00 in a research note on Tuesday, February 20th. Royal Bank of Canada restated an outperform rating and issued a $103.00 price objective on shares of Camden Property Trust in a report on Monday, February 5th. Truist Financial reiterated a buy rating and set a $113.00 target price (down from $121.00) on shares of Camden Property Trust in a research note on Wednesday, March 13th. Piper Sandler restated an underweight rating and issued a $90.00 price target on shares of Camden Property Trust in a research note on Tuesday, March 26th. Finally, BMO Capital Markets reiterated a market perform rating and issued a $100.00 price objective on shares of Camden Property Trust in a report on Friday, December 15th. Four investment analysts have rated the stock with a sell rating, eight have assigned a hold rating and six have assigned a buy rating to the company. According to MarketBeat, the stock presently has an average rating of Hold and an average price target of $104.24.

View Our Latest Research Report on CPT

Camden Property Trust Price Performance

CPT stock opened at $95.87 on Thursday. The company has a debt-to-equity ratio of 0.74, a quick ratio of 0.88 and a current ratio of 0.88. The firm has a 50 day moving average price of $96.22 and a 200-day moving average price of $95.01. Camden Property Trust has a 52-week low of $82.81 and a 52-week high of $114.04. The firm has a market capitalization of $10.26 billion, a price-to-earnings ratio of 25.91, a PEG ratio of 3.58 and a beta of 0.83.

Camden Property Trust (NYSE:CPT – Get Free Report) last announced its quarterly earnings data on Friday, February 2nd. The real estate investment trust reported $2.03 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $1.72 by $0.31. Camden Property Trust had a return on equity of 8.07% and a net margin of 26.15%. The business had revenue of $387.59 million during the quarter, compared to analysts’ expectations of $387.33 million. During the same quarter in the previous year, the business earned $1.74 earnings per share. The firm’s quarterly revenue was up 3.1% compared to the same quarter last year. Equities research analysts forecast that Camden Property Trust will post 6.75 EPS for the current fiscal year.

Camden Property Trust Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, April 17th. Investors of record on Friday, March 29th will be given a dividend of $1.03 per share. The ex-dividend date is Wednesday, March 27th. This is an increase from Camden Property Trust’s previous quarterly dividend of $1.00. This represents a $4.12 annualized dividend and a yield of 4.30%. Camden Property Trust’s payout ratio is 111.35%.

Institutional Trading of Camden Property Trust

A number of hedge funds and other institutional investors have recently bought and sold shares of CPT. Norges Bank bought a new position in shares of Camden Property Trust during the 4th quarter valued at approximately $376,933,000. Centersquare Investment Management LLC boosted its position in shares of Camden Property Trust by 2,517.6% in the fourth quarter. Centersquare Investment Management LLC now owns 1,398,343 shares of the real estate investment trust’s stock worth $138,841,000 after purchasing an additional 1,344,923 shares during the period. JPMorgan Chase & Co. raised its position in shares of Camden Property Trust by 41.6% during the 3rd quarter. JPMorgan Chase & Co. now owns 4,044,988 shares of the real estate investment trust’s stock valued at $382,575,000 after purchasing an additional 1,187,974 shares during the period. Long Pond Capital LP lifted its stake in shares of Camden Property Trust by 149.0% during the 4th quarter. Long Pond Capital LP now owns 948,280 shares of the real estate investment trust’s stock valued at $106,094,000 after buying an additional 567,487 shares in the last quarter. Finally, State Street Corp boosted its holdings in Camden Property Trust by 9.8% in the 1st quarter. State Street Corp now owns 6,066,515 shares of the real estate investment trust’s stock worth $1,013,817,000 after buying an additional 540,683 shares during the period. Hedge funds and other institutional investors own 97.22% of the company’s stock.

Camden Property Trust Company Profile

Camden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,634 apartment homes across the United States.

Featured Articles

Receive News & Ratings for Camden Property Trust Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Camden Property Trust and related companies with MarketBeat.com’s FREE daily email newsletter.

Jaipur-based Holani Consultants Pvt Ltd, a SEBI registered merchant banker and stockbroker, has launched an angel fund, Holani Venture Capital Fund, with a target corpus of Rs 400 crore (around $50 million).

The fund also has a green shoe option of another Rs 100 crore.

The fund received an in-principle approval for its category I AIF in April. It will raise capital from institutional investors and high-net-worth individuals who seek higher returns and portfolio diversification. Its investment team will be headed by Ashok Holani, director of Holani Consultants.

“This (fund launch) milestone further enhances our ability to serve our clients and partners by providing them with access to a diverse range of investment opportunities tailored to their specific needs,” said Holani.

The fund’s investment strategy involves a combination of thorough due diligence, sectoral expertise, and a keen eye for emerging trends.

Holani Consultants offers services related to the financial markets such as IPO management, business valuation consultancy, financial management and advisory, bank financing, stock broking and other advisory or consultancy services related to the securities market.

The firm received its SEBI merchant banking licence as a “Category-I Merchant Bankers” in 2018 and its SEBI stock broking licence as an “Alpha Category Stock Brokers” in 2021.

The company claims that in the past, it has assisted in the valuations of more than 100 private placement transactions and has handled various SME IPOs on the BSE SME/ NSE Emerge platform. It has also handled main board IPOs and rights issues.

Data is delayed by 20 minutes

Data is delayed by 20 minutes

To see more commodities please register for our portal

Centerspace (NYSE:CSR – Get Free Report) and InterRent Real Estate Investment Trust (OTCMKTS:IIPZF – Get Free Report) are both small-cap finance companies, but which is the better stock? We will contrast the two businesses based on the strength of their analyst recommendations, dividends, risk, valuation, earnings, profitability and institutional ownership.

Analyst Recommendations

This is a breakdown of current ratings for Centerspace and InterRent Real Estate Investment Trust, as provided by MarketBeat.

| Sell Ratings | Hold Ratings | Buy Ratings | Strong Buy Ratings | Rating Score | |

| Centerspace | 0 | 3 | 4 | 0 | 2.57 |

| InterRent Real Estate Investment Trust | 0 | 0 | 0 | 0 | N/A |

Centerspace presently has a consensus target price of $65.57, indicating a potential upside of 14.76%. InterRent Real Estate Investment Trust has a consensus target price of $17.44, indicating a potential upside of 74.20%. Given InterRent Real Estate Investment Trust’s higher possible upside, analysts plainly believe InterRent Real Estate Investment Trust is more favorable than Centerspace.

Dividends

Centerspace pays an annual dividend of $2.92 per share and has a dividend yield of 5.1%. InterRent Real Estate Investment Trust pays an annual dividend of $0.18 per share and has a dividend yield of 1.8%. Centerspace pays out 125.3% of its earnings in the form of a dividend, suggesting it may not have sufficient earnings to cover its dividend payment in the future. InterRent Real Estate Investment Trust pays out 38.3% of its earnings in the form of a dividend. Centerspace has raised its dividend for 1 consecutive years. Centerspace is clearly the better dividend stock, given its higher yield and longer track record of dividend growth.

Volatility and Risk

Centerspace has a beta of 0.93, indicating that its stock price is 7% less volatile than the S&P 500. Comparatively, InterRent Real Estate Investment Trust has a beta of 0.72, indicating that its stock price is 28% less volatile than the S&P 500.

Insider and Institutional Ownership

79.0% of Centerspace shares are held by institutional investors. 0.9% of Centerspace shares are held by insiders. Comparatively, 6.8% of InterRent Real Estate Investment Trust shares are held by insiders. Strong institutional ownership is an indication that large money managers, endowments and hedge funds believe a company is poised for long-term growth.

Profitability

This table compares Centerspace and InterRent Real Estate Investment Trust’s net margins, return on equity and return on assets.

| Net Margins | Return on Equity | Return on Assets | |

| Centerspace | 15.81% | 4.76% | 2.15% |

| InterRent Real Estate Investment Trust | 38.61% | 3.54% | 2.07% |

Valuation and Earnings

This table compares Centerspace and InterRent Real Estate Investment Trust’s gross revenue, earnings per share (EPS) and valuation.

| Gross Revenue | Price/Sales Ratio | Net Income | Earnings Per Share | Price/Earnings Ratio | |

| Centerspace | $261.31 million | 3.29 | $41.97 million | $2.33 | 24.52 |

| InterRent Real Estate Investment Trust | $175.65 million | 8.25 | $68.32 million | $0.47 | 21.30 |

InterRent Real Estate Investment Trust has lower revenue, but higher earnings than Centerspace. InterRent Real Estate Investment Trust is trading at a lower price-to-earnings ratio than Centerspace, indicating that it is currently the more affordable of the two stocks.

Summary

Centerspace beats InterRent Real Estate Investment Trust on 10 of the 16 factors compared between the two stocks.

About Centerspace

Centerspace is an owner and operator of apartment communities committed to providing great homes by focusing on integrity and serving others. Founded in 1970, as of September 30, 2023, Centerspace owned interests in 71 apartment communities consisting of 12,785 apartment homes located in Colorado, Minnesota, Montana, Nebraska, North Dakota, and South Dakota. Centerspace was named a Top Workplace for the fourth consecutive year in 2023 by the Minneapolis Star Tribune.

Centerspace is an owner and operator of apartment communities committed to providing great homes by focusing on integrity and serving others. Founded in 1970, as of September 30, 2023, Centerspace owned interests in 71 apartment communities consisting of 12,785 apartment homes located in Colorado, Minnesota, Montana, Nebraska, North Dakota, and South Dakota. Centerspace was named a Top Workplace for the fourth consecutive year in 2023 by the Minneapolis Star Tribune.

About InterRent Real Estate Investment Trust

InterRent?REIT is a growth-oriented real estate investment trust engaged in increasing Unitholder value and creating a growing and sustainable distribution?through the acquisition and ownership of multi-residential properties. InterRent’s strategy is to expand its portfolio primarily within?markets that have exhibited stable market vacancies,?sufficient suites available to attain the critical mass necessary to implement?an efficient portfolio management structure, and?offer opportunities for accretive acquisitions. InterRent’s primary objectives are to use the proven industry experience of the Trustees,?Management and Operational Team to: (i)?to grow both funds from operations per Unit and net asset value per Unit through investments in a diversified portfolio of multi-residential properties; (ii)?to provide Unitholders with sustainable and growing cash distributions, payable monthly; and (iii)?to maintain a conservative payout ratio and balance sheet.

InterRent?REIT is a growth-oriented real estate investment trust engaged in increasing Unitholder value and creating a growing and sustainable distribution?through the acquisition and ownership of multi-residential properties. InterRent’s strategy is to expand its portfolio primarily within?markets that have exhibited stable market vacancies,?sufficient suites available to attain the critical mass necessary to implement?an efficient portfolio management structure, and?offer opportunities for accretive acquisitions. InterRent’s primary objectives are to use the proven industry experience of the Trustees,?Management and Operational Team to: (i)?to grow both funds from operations per Unit and net asset value per Unit through investments in a diversified portfolio of multi-residential properties; (ii)?to provide Unitholders with sustainable and growing cash distributions, payable monthly; and (iii)?to maintain a conservative payout ratio and balance sheet.

Receive News & Ratings for Centerspace Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Centerspace and related companies with MarketBeat.com’s FREE daily email newsletter.

by Calculated Risk on 3/27/2024 09:41:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 2.4% Below Peak

Excerpt:

It has been over 17 years since the bubble peak. In the January Case-Shiller house price index released yesterday, the seasonally adjusted National Index (SA), was reported as being 71% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 10% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 1% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $427,000 today adjusted for inflation (42% increase). That is why the second graph below is important – this shows “real” prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index

…The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 2.4% below the recent peak, and the Composite 20 index is 3.3% below the recent peak in 2022. Both indexes were mostly flat in January in real terms.

In real terms, national house prices are 10.2% above the bubble peak levels. There is an upward slope to real house prices, and it has been over 17 years since the previous peak, but real prices are historically high.

Ride On St. Louis has found a permanent home after flooding forced the equine-assisted service program from its home at the Anheuser Estate in Kimmswick five years ago.

The nonprofit organization, which offers equine therapy to children and adults with disabilities, will move its operation to a 27-acre property at 9000 Grab Lane off Sandy Valley Acres Drive northeast of Hillsboro it purchased for about $745,000, said Stephanie Stark, Ride On’s campaign committee adviser.

On March 15, the organization, which was formed in 1998, held a ribbon-cutting and blessing ceremony at its “forever home” with about 35 supporters in attendance.

However, it will be months before staff members and the horses can move there, Stark said.

Marita Wassman, Ride On’s CEO and co-founder, said more fundraising and renovations are needed before the organization may transition to its new home.

She hopes that will happen later this year but until then, services will remain at the group’s leased interim site at 8499 Byrnesville Road in Cedar Hill.

According to the group’s website, approximately $800,000 of the $1.3 million needed for the relocation project has been secured so far.

In addition to acquiring and renovating the property for the organization’s new home, the $1.3 million would provide funds to add staff and expand services, as well as for an endowment.

Stark said the renovations are needed to make it safe for children and adults with disabilities to ride horses at the new property.

She said the property will be ADA (Americans with Disabilities) compliant and PATH (Professional Association of Therapeutic Horsemanship) compliant.

The fields need to be sectioned off and enclosed with about 5,915 feet of fencing. An old barn will be demolished and another will be renovated for six stalls and work areas. Plans also call for a classroom, restroom facilities and parking, Wassman said.

“Additionally, immediate plans include replacing many of the existing wood beams and foundation posts in the barn,” according to the group’s website. “To date, a small structure has already been demolished and removed from the property, and the future barn/stable existing structure has been gutted and prepared for utility updates and grading.”

After the group lost the property in Kimmswick in 2019, the COVID-19 pandemic struck, so most of the therapy staff was furloughed, Stark said.

“So what’s included in that $1.3 million is restaffing the entire organization to be able to provide services, not only for existing participants but also for the (116 people) who are currently on the waiting list for services,” she said.

“We anticipate transitioning our herd in (the third or fourth quarter) of 2024, with program offerings continuing in a limited capacity based upon our herd’s acclimation,” Wassman said. “We will have additional buildout phases and capital improvement projects beyond 2024.”

Wassman said the organization has volunteer opportunities for skilled laborers, and anyone interested in helping with the cause may visit rideonstl.org or call 636-464-3408.

The next fundraiser will be Denim & Diamonds, a private dinner on April 25 at the Fox Run Golf Course Carriage House in the Jefferson County portion of Eureka. For information, email info@rideonstl.org or call 636-464-3408.

Flooding and COVID

Ride On previously was located on the Anheuser Estate along the Mississippi River in Kimmswick, and the property was first affected by flooding in 2013 and then again in 2015, 2016, 2017 and 2018, said BriAnn Session, Wassman’s daughter, who serves as the group’s grant manager.

“It cost Ride on St. Louis approximately $200,000 after every flood to rebuild all their infrastructure,” Stark said.

Session said after each flood, the organization had to close for about eight months while it rebuilt and sanitized affected areas.

When it first moved from Kimmswick in 2019, a friend with a breeding farm in Illinois allowed Wassman to run the organization’s Barn Buddies program from his property for that year.

In 2020, Ride On St. Louis leased the stable in Cedar Hill.

“Before moving there, we had a lot of work to do,” Session said. “We had to clean the pastures out; they were very overgrown. It was vacant for years. We had to build out stalls and temporary fencing that we can bring with us.”

When COVID shut everything down in March 2020, Session said the group was one of the first to offer a virtual equine services program.

Then, after COVID, the organization provided what services it could in Cedar Hill, but the temporary property was not appropriate for anyone in a wheelchair, which makes up a large percentage of the population the organization serves, Stark said.

Session said the organization put a lot of planning into exactly how the new property needs to flow.

At its peak and before the group moved out of Kimmswick, it was serving 50 clients a week from counties in Missouri and Illinois. Since 1998, it has provided equine-assisted services to more than 2,600 people, and it helped about 270 people last year.

According to its website, Ride On St. Louis relies on private donations, fundraising, volunteer efforts, in-kind gifts and grants.