A financial analyst nicknamed the ‘Oracle of Wall Street’ has said a ‘growing crisis of the young American male’ will cause house prices to fall as much as 30 percent.

Meredith Whitney, who earned the title after predicting the financial crisis of 2007 – 2008, suggested young men increasingly living with their parents and disinterested in starting families will drastically reduce housing demand.

The trend of men refusing to settle in turn means more women are remaining single into later life, leaving them without the income or need for big family homes.

But it comes as baby boomers start to downsize, meaning there will be a surplus of available family homes. Much of the last decade’s gains in property values have been driven by high demand and low supply – a phenomenon, Whitney says, is reversing.

To explain the rise in men living at home, she pointed to the increasing prevalence of video games, starting in the mid-2000s.

Meredith Whitney, also known as the ‘Oracle of Wall Street,’ has predicted house prices are set to fall because men are increasingly disinterested in starting families

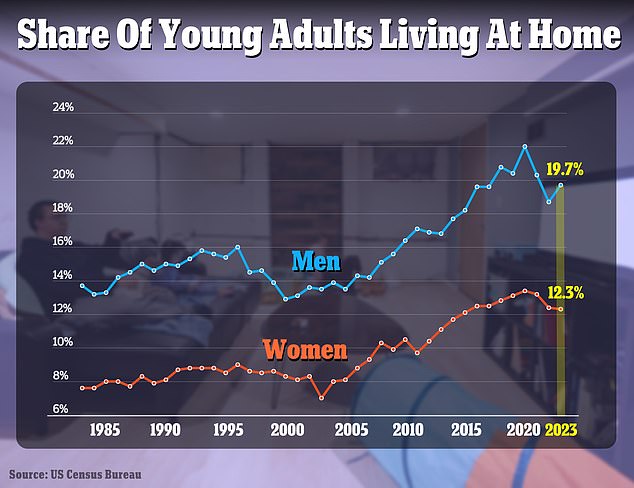

Over the last decades, the number of young men living in their family home has been on the rise. (Young adults are defined as those aged between 25 and 34)

‘You feel like you’re with other people but you’re actually at home alone, and that created a big chasm in young male sociability,’ she told DailyMail.com.

Whitney cited US Census Bureau data showing that before the financial crisis around 13 percent of men aged between 25 and 34 lived at home.

That rose to as high as 22 percent during the pandemic but even after falling back down was still almost 20 percent in 2023. It was only in the last decade that rate had risen above 16 percent.

The data also shows that young women have consistently been around twice as likely to leave their parents’ homes. Last year, just 12.3 percent were still at home.

The figures coincide with a decline in romantic relationships among young men. A 2023 Pew Research study found 63 percent of males under 30 describe themselves as single.

Experts have attributed the figures to a confluence of factors such as increased porn consumption, the rise in hook-up apps and the legacy of lockdown during the pandemic.

‘The pace at which young men live at home versus young women live at home is around 2x, I correlated all of this with in the early, mid-2000s launch of the Xbox, Wii and PlayStation,’ she said.

‘The biggest driver of home prices has historically been household formation,’ Whitney told DailyMail.com. ‘Household formation today is the lowest it’s been in 160 years.’

And household formation, she said, is driven by the ‘five Ds’ – ‘diamonds, diapers, divorce, debt, and death.’

‘Without at least the first two Ds, there’s no reason to buy a home,’ she said.

Whitney previously told Fortune the drop could be as much as 30 percent.

Whitney attributed the increasing rate of men living at home to the rise of video gaming, starting in the mid-2000s

Single women have increasingly been purchasing homes of their own. Female buyers alone make up 19 percent of American homebuyers – almost double that of single men – according to recent data from the National Association of Realtors.

That is a stark contrast from 40 years ago when the portion of single women and men buying homes was roughly the same – 11 percent and 10 percent respectively.

As of 2023, the proportion of single men purchasing property has stayed steady at 10 percent. According to the NAR, the share of recent buyers who are married couples has also dropped to 59 percent.

In 1981, when the organization began analyzing the profiles of buyers and sellers, married couples made up 73 percent of homeowners.

However, according to Whitney, single women alone will be unable to absorb the entire supply of large, family homes.

‘I don’t see single women buying a four bedroom, three bath home,’ she said.

And spurring the downsizing of the elderly into smaller homes are rising costs, Whitney said.

Despite the inconvenience of moving in old age, burdensome costs like household expenses, property taxes, insurance, utilities, homeowners association fees and mortgages may leave them with little choice.

Single women are purchasing an increasing share of homes but Whitney doubts they will be able to absorb all the demand, so prices will fall. Pictured is a ‘for sale’ sign outside a home in Phoenix, Arizona

Whether or not aging baby boomers will vacate their homes and flood the market in the coming years is uncertain

While the youth aspiring to buy homes may be eagerly waiting for baby boomers and older homeowners to start vacating theirs, whether or not that will happen is up for debate.

A Redfin survey in February found that out of more than 800 Americans aged 60 and older, some 71 percent said they would stay in place in their current homes.

A separate study by government-backed lender Freddie Mac downplayed the significance of the ‘silver tsunami’ – a metaphor sometimes used to describe population aging.

‘Some have warned of a ‘silver tsunami’ as aging boomers look to sell their homes, flooding the market with inventory,’ it read.

‘But as this analysis demonstrates, the tsunami is more like a tide, bringing a gradual exit that will mostly be offset by new entrants.’

The National Assn. of Realtors on Friday said it will make changes to its commission rules to settle national allegations the requirements stifled competition, a move that may reduce costs for at least some consumers.

The settlement, which still must receive court approval, could mark a major change in the housing market.

Today, sellers typically pay a 5% to 6% commission when they sell their homes, with half of that going to the listing agent’s brokerage and half to the buyer agent’s brokerage, and critics of that model say the settlement could upend that practice.

“This settlement over time will benefit home sellers and buyers greatly, eventually lowering agent commissions by tens of billions of dollars a year and helping align agent compensation and services rendered,” Stephen Brobeck, a senior fellow with the Consumer Federation of America, said in a statement.

Under an existing Realtor rule, listing agents must make an offer of compensation to the buyer’s broker in order to list homes on NAR-affiliated multiple listing services, or the MLS.

Though NAR says this offer can be zero dollars, the requirement to post an offer — known in the industry as “cooperative compensation” — has reduced competition and kept commission rates artificially high, according to lawsuits filed against the Realtors. The rule has also caused buyers’ agents to “steer” their clients to homes that offer higher commission rates, the lawsuits allege.

In a news release, the national trade group said it continues to deny any wrongdoing as it relates to its current commission rule, but to settle the allegations, it will pay $418 million and prohibit offers of compensation to buyers’ brokers on affiliated multiple listing services, which also populate listings on sites such as Zillow and Redfin.

“NAR has worked hard for years to resolve this litigation in a manner that benefits our members and American consumers,” Nykia Wright, interim chief executive of NAR, said in a statement. “It has always been our goal to preserve consumer choice and protect our members to the greatest extent possible. This settlement achieves both of those goals.”

Home sellers could still offer to pay buyers’ broker commissions under the settlement if they communicated it outside the MLS, according to the National Assn. of Realtors.

But not setting the rules of the game at the outset will inject more competition into the process and open up new ways of payment that should lower costs, according to Robert A. Braun, a partner with Cohen Milstein Sellers & Toll, which is representing home sellers in two of the settling cases.

Braun said sellers may still choose to pay buyers’ agents something, or buyers may pay their agents directly after negotiating a fee. They may also choose to go without an agent altogether.

Another option? A buyer agrees to pay a certain price — say $800,000 — only on the condition that the seller then pays the buyer’s agent $24,000, or 3%. “You got a free market,” Braun said.

Commission rates are a small proportion of a sales price, but they add up. For a home sold at the average Southern California price of $842,997, 6% is $50,580.

If such changes drive down commissions overall, it could have a big effect on real estate agents who are paid a proportion of the commission sent to their brokerage.

Higher mortgage rates sent home sales tumbling, reducing pay for agents who are compensated based on the number and price of the deals they transact.

In California alone, NAR lost 9,723 members from December 2023 to January 2024 — a 4.75% decline.

Not all agents are worried.

Michael Khorshidi works mostly with buyers, but sees the new requirements as an opportunity to show the value he brings to clients. Agents who aren’t able to demonstrate their worth will be the ones who lose work, he said.

“We’re always transitioning,” Khorshidi said. “This is just the latest transition.”

If the settlement ends up creating a system in which buyers pay their agents directly, it could saddle them with new costs.

However, Braun argued that buyers would ultimately see reduced costs as well because under the current system, buyer agent commissions get passed along to buyers in the form of higher home prices.

That doesn’t mean sellers make a conscious decision to set their home prices higher because they need to pay a buyer’s agent. Rather, Braun said it means fewer homes make financial sense to sell because some homeowners don’t have enough equity to pay two commissions.

If buyers paid their own agent, more homeowners could afford to sell, increasing supply and helping put downward pressure on price, Braun said.

“Going forward, there is a significant likelihood home prices will be lower than they otherwise would be,” he said.

Michael Copeland, a real estate agent in Palm Springs, doesn’t think the agreement will alter the market too dramatically.

To bring in buyers, sellers may still be incentivized to cover both commissions — just as they do today.

Mortgage rates are high and housing inventory is tight, but some experts see the market’s deep freeze starting to thaw this spring.

Homebuying started to pick up during and after the holidays. Existing home sales increased 3.1% from December to January, according to the National Association of Realtors. Meanwhile, the inventory of unsold existing homes rose 2% from December to January, totaling around 1 million at the end of last month, slightly expanding buyers’ options.

“While home sales remain sizably lower than a couple of years ago, January’s monthly gain is the start of more supply and demand,” NAR chief economist Lawrence Yun said in a news release Thursday.

“This might be the market’s first steps toward a ‘new normal’– a world where inventory remains rather scarce by pre-pandemic standards, but buyers are not exactly swarming the doorway of every open house like in 2021 and early 2022,” Zillow senior economist Jeff Tucker wrote in a blog post last week.

“More revived supply should help meet the returning demand, and head off the risk of renewed overheating,” he said.

For the last few years, limited housing inventory and low rates have put the housing market on ice. Many homeowners who’d otherwise be eager to sell have hesitated to shake off the so-called golden handcuffs of mortgage rates as low as 2% or 3%.

That’s finally starting to change, experts say — even though rates are now much higher, climbing again past 7% in recent weeks.

“Markets are just kind of recalibrating for the reality that the Fed is not going to cut interest rates right away,” said Greg McBride, Bankrate’s chief financial analyst. For many buyers and sellers alike, it’s beginning to sink in that “we’re not going back to three and four percent mortgage rates” anytime soon, he said.

In many cases, lifestyle factors — like empty-nesters looking to downsize or growing families hunting for more space — are pushing people to move, rather than wait around for sweeter deals.

“It’s a new cycle for real estate,” said Bess Freedman, CEO of Brown Harris Stevens, a real estate agency that operates throughout the East Coast. Already, she said, that shift in mindset has started to put some more “good opportunities out there. The people who are serious about it are getting into the market and taking advantage of it.”

Experts expect buyers to have a bit more leverage this year compared to last. Data from Zillow shows that 1 in 5 home listings saw a price cut in January, and the typical home was on the market for 29 days — longer than during last year’s buying frenzy, but 19 days shorter than the average before the pandemic.

You don’t need to feel pressed into making an offer on the spot.

“We’ll probably see several years of pretty tepid home price appreciation,” McBride said.

Tucker gave a similar forecast. “Home prices will neither be skyrocketing nor plunging, but hopefully moving on a slow, boring trajectory like they historically have, and a little higher in spring than in winter,” he wrote.

That could benefit those who are still browsing and saving up for a first home, McBride said. “If you get that promotion, you pay off your student loan debt, you really build up your savings, you’re going to be in a position where home prices may not be much different two years from now than they are today. But your financial position is a lot better,” he said.

Buyers should take the time now to improve their credit and get pre-approved for a loan. Freedman also cautions against waiting for lower rates if you can afford to buy. If you happen to find something you love, she said, “you can probably negotiate well and get your financing in place, and you won’t regret it.”

With supply increasing, buyers stand to benefit from a little more time in the process than in years past, when countless buyers were waiving inspections and bidding well over asking prices just to be in the running.

Right now, “you have the ability to do appropriate due diligence. You don’t need to feel pressed into making an offer on the spot, and if you do, that’s a pretty good indicator that maybe you should walk away,” McBride said. “Making the biggest financial decision of your life under duress rarely leads to success.”

Sellers may increasingly find they need to work with an agent who’s tapped into local trends to avoid having their homes sit on the market for a long time, Freedman said.

“If you’re priced right, it’s definitely a seller’s market. If you’re priced too high, you’re just going to sit there,” she said.

If a home you’re trying to sell is languishing but you can’t reduce the asking price, McBride recommends dangling other concessions. “Offering a temporary mortgage rate buy-down for the seller could be the type of incentive that gets a deal,” he said.

WASHINGTON — WASHINGTON (AP) — Higher energy and housing prices boosted overall U.S. inflation in December, a sign that the Federal Reserve’s drive to slow inflation to its 2% target will likely remain a bumpy one.

Thursday’s report from the Labor Department showed that overall prices rose 0.3% from November and 3.4% from 12 months earlier. Excluding food and fuel, the rate was even higher. The big reason was housing, with the price people pay for shelter accounting for half of the overall increase.

“This news is a setback for expectations that the Fed will soon cut interest rates,” said economist Dr. Mike Walden. Walden is a William Neal Reynolds Distinguished Professor Emeritus at North Carolina

State University.

Excluding volatile food and energy costs, though, so-called core prices rose just 0.3% month over month, unchanged from November’s increase. Core prices were up 3.9% from a year earlier — the mildest such pace since May 2021 and down from November’s 4% year-over year gain. Economists pay particular attention to core prices because, by excluding costs that typically jump around from month to month, they are seen as a better guide to the likely path of inflation.

Overall inflation has cooled more or less steadily since hitting a four-decade high of 9.1% in mid-2022. Still, the persistence of still-elevated inflation helps explain why, despite steady economic growth, low unemployment and healthy hiring, polls show many Americans are dissatisfied with the economy

That disconnect, which will likely be an issue in the 2024 elections, has puzzled economists and political analysts. A key factor is the public’s exasperation with higher prices. Though the inflation rate has been falling more or less steadily for a year and a half, the lingering financial and psychological effects of the worst bout of inflation in four decades have soured many Americans on the economy. Prices are still 17% higher than they were before the inflation surge began and are still rising.

Pollsters and economists say there has never been as wide a gap between the underlying health of the economy and public perception. Wage gains have outpaced inflation in recent months, meaning that Americans’ average after-inflation take-home pay is up. Yet a poll conducted in November by The Associated Press-NORC Center for Public Affairs Research, about three-quarters of respondents described the economy as poor. Two-thirds said their expenses had risen.

The Federal Reserve, which began aggressively raising interest rates in March 2022 to try to slow the pace of price increases, wants to reduce year-over-year inflation to its 2% target level. And there are solid reasons for optimism that inflationary pressure will continue to recede in the coming months.

The Federal Reserve Bank of New York reported this week, for example, that consumers now expect inflation to come in at just 3% over the next year, the lowest one-year forecast since January 2021. That’s important because consumer expectations are themselves considered a telltale sign of future inflation: When Americans fear that prices will keep accelerating, they will typically rush to buy things sooner rather than later. That surge of spending tends to fuel more inflation.

But that nasty cycle does not appear to be happening.

And when Fed officials discussed the inflation outlook at their most recent meeting last month, they noted some hopeful signs: In particular, they noted an end to the supply chain backlogs that had caused parts shortages and inflation pressures.

The Fed policy committee meets in two weeks. This report will be a key topic in their deliberations.

“Inflationary pressures, while generally inching lower, remain stubbornly higher than expectations as the so-called ‘last mile’ requires more time to reach the final goal,″ said Quincy Krosby, chief global strategist for LPL Financial.

The December U.S. jobs report that was issued last week contained some cautionary news for the Fed: Average hourly wages rose 4.1% from a year earlier, up slightly from 4% in November. And 676,000 people left the workforce, reducing the proportion of adults who either have a job or are looking for one to 62.5%, the lowest level since February.

That is potentially concerning because when fewer people look for work, employers usually find it harder to fill jobs. As a result, they may feel compelled to sharply raise pay to attract job-seekers — and then pass on their higher labor costs to their customers through higher prices. That’s a cycle that can perpetuate inflation.