Friday, 26 April 2024, 12:14

After a slight drop in the third quarter of last year, the price of housing has risen once again in Malaga province, the latest data shows.

In the first three months of this year, the average price per square metre of a property for sale in the province including the Costa del Sol climbed to 2,412 euros, according to valuation firm Gesvalt. It is 1.2% more than the figure recorded at the end of 2023 and about the same figure as a year ago, when the valuer’s studies showed an average price of 2,419 euros per square metre. The data shows that the 4% drop in the prices of property for sale in Malaga province in the third quarter of last year was a one-off event.

Additionally, rental prices continue to soar in both Malaga city and throughout the province. According to Gesvalt data, the average rental price at provincial level is 14.32 euros per square metre, which is 13.5% more than a year ago and 3.2% more than three months ago.

However, the increase in rent is most noticeable in Malaga city, where the average cost has risen to 14.41 euros per square metre, 16% more than a year ago, according to the data.

In the city, the average price of housing for sale stands at 2,374 euros per square metre, which is 8% more than in the first quarter of 2023 and 2.5% more than in last year’s year-end report.

Upward trend to continue

According to Gregorio Abril, Gesvalt’s regional director for Andalucía and Extremadura, house prices in Malaga are set to continue “the upward trend of recent months, but at a more moderate pace than in recent years, tending towards stabilisation, after the slight slump in demand caused by successive interest rate increases and a general economic slowdown”.

“Once this phase has been overcome, and with the prospect of upcoming interest rate cuts, demand has once again been reactivated in a market that remains under pressure, pushing prices up again,” Abril said.

Malaga is one of the most active real estate markets in Spain, “the demand, both national and international is very active, compared to a supply that, despite the efforts of the city council and the great developer activity, is still insufficient to meet it”, the real estate expert added.

“All these factors lead us to believe that there will not be a change in trend in the coming months and it is not possible to foresee when price rises will slow,” he said.

As for the unstoppable rise in rent, Abril pointed out that this is a “more common issue than that of buying and selling”.

“While supply is more limited than for sales, there is a transfer of demand from the sales to the rental market, due to the number of house-hunters who are unable to afford to buy a home at current prices and decide to opt for renting. Our forecast is that the current trend will continue over the next few years,” he added.

Costa rentals

On the Costa del Sol, Marbella continues to lead in rental prices with an average of 18.8 euros per square metre, 12% more than a year ago. Also noteworthy is the rise in rent in towns such as Torremolinos and Benalmádena, possibly due to the increase of prices in Malaga city leading to a rise in demand for rentals in these neighbouring towns.

In the case of Torremolinos, rent has risen to 14.6 euros per square metre and is now at the same level as Estepona, with a year-on-year increase of 12%, the data shows.

At the other end of the scale Vélez-Málaga offers rents at half of the average registered on the Costa del Sol, with prices around 7.5 euros per square metre.

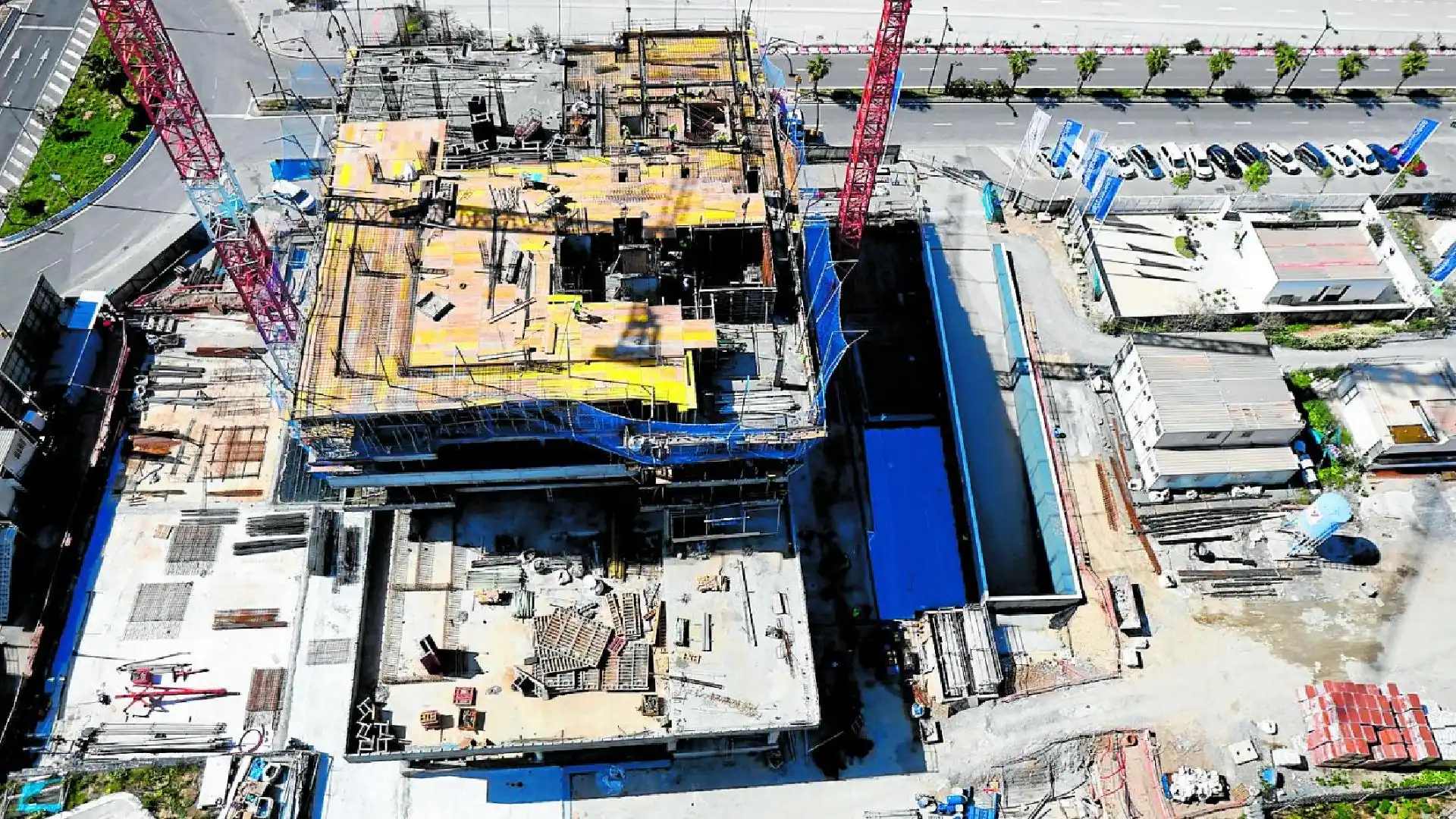

Pictured here is a real estate project under construction in Huai ‘an city, Jiangsu province, China, on April 8, 2024.

Future Publishing | Future Publishing | Getty Images

BEIJING — China needs to convince people that home prices are on their way up in order for economic activity to pick up, Richard Koo, chief economist at Nomura Research Institute, told CNBC’s Steve Sedgwick last week.

Business and consumer appetite for new loans have had a tepid start to the year, while home prices dropped at a steeper pace in January than in February, according to Goldman Sachs’ analysis.

In other words, as Koo warned last year, China may be entering a “balance sheet recession,” similar to what Japan experienced during its economic slump.

“For them to come back and borrow money, we need a narrative that says, okay, this is the bottom of the prices, the prices will start going up from this point onwards,” Koo said.

But it’s not clear whether prices have reached an actual bottom yet. Koo and other analysts have pointed out that in China’s policy-driven economy, house prices have not fallen as much as expected given declines in other aspects of the property market.

Chinese officials have said that real estate remains in a period of “adjustment.” The country has also been emphasizing new growth drivers such as manufacturing and new energy vehicles.

Real estate and related sectors have accounted for at least one-fifth of China’s economy, depending on analyst estimates. The property market began its latest slump after Beijing cracked down on developers’ high reliance on debt in 2020.

That coincided with the shock from the Covid-19 pandemic.

It also comes as China’s population has started to shrink, Koo pointed out — a big difference with Japan, whose population didn’t start to fall until 2009, he said.

“That makes this narrative, that the prices have fallen enough, you should go out and borrow and buy houses, even more difficult to justify because [the] population is now shrinking,” Koo said.

China’s economy officially grew by 5.2% in 2023, the first year since the end of Covid-19 controls. Beijing has set a target of around 5% growth for 2024.

However, many analysts have said such a goal is ambitious without more stimulus.

Chinese authorities have been reluctant to embark on large-scale support for the economy. Koo said an underlying reason is that Beijing views its prior stimulus program as a mistake.

About 15 years ago, in the wake of the global financial crisis, China launched a 4 trillion yuan ($563.38 billion) stimulus package that was initially met with skepticism — and a 70% drop in Chinese stock prices, Koo said.

“It was heading toward balance sheet recession, almost,” he said. “One year later, China had 12% growth.”

But Beijing kept up its stimulus package even after the country had achieved rapid growth, which led to an overheating of growth and speculation, on top of corruption, Koo said. “That’s one of the reasons why this government, Mr. Xi Jinping, is still reluctant to put [out] a large package because so many people think the previous one was a failure.”

Looking ahead, Koo said China should stimulate its economy to avoid a balance sheet recession, and that it should cut that support once growth reaches 12%. “Once the borrow[ing] is coming back, then you can cut, but not before.”

Athens, 4th, April 2024

AMENDEMENT OF FINANCIAL CALENDAR FOR THE YEAR 2024

BriQ Properties REIC in the context of the correct, valid and in time information to the investment community announces the following change to the financial calendar 2024:

The Annual Ordinary General Meeting of Shareholders will take place on Tuesday 30.04.2024 instead of 24.04.2024.

Therefore, the Company’s Financial Calendar for the year 2024, in accordance with articles 4.1.2. and 4.1.3.15.1. of the Athens Exchange Regulation, has been amended as follows:

Thursday 28.03.2024: Announcement (Press Release) of the financial results for the year 2023- Friday 29.03.2024: Publication of the Annual Financial Report for the fiscal year 2023

- Tuesday 02.04.2024: Annual briefing to analysts, investors and public on the financial data for the year 2023 (Conference Call).

- Tuesday 30.04.2024: Annual Ordinary General Shareholders Meeting

- Wednesday 08.05.2024: Cut-off date for the payment of the dividend for the fiscal year 2023*

- Thursday 09.05.2024: Determination of dividend beneficiaries (Record Date)*

|

• Tuesday 14.05.2024: |

Dividend payment* |

- Wednesday 25.09.2024: Publication of the Interim Financial Report of the period from January 1st to June 30th, 2024

*The above-mentioned dates for the dividend distribution, are subject to the approval of the Ordinary General Shareholders Meeting.

The Company clarifies that the Financial Results will be announced on the Company’s website (www.briqproperties.gr) and on the Athens Exchange Group website (www.helex.gr).

The Company has the right to amend the above-mentioned dates, provided that the investors will be informed on time with a new announcement.

BriQ Properties R.E.I.C.

Investor Relations Department

Contact: 3 Mitropoleos Str., 3rd floor, 10557, Athens, tel. +30 211 999 4833, Ε: info@briqproperties.gr, www.briqproperties.gr

Reg. Add.: 25,Al. Pantou Str.,17671,Kallithea, VAT n: GR0997521479,Tax off.: FAE Peiraia, GCR n.:140330201000, Reg. act: 3/757/31.05.2016

Attachments

Original Link

Original Document

Permalink

Disclaimer

BriQ Properties REIC published this content on

04 April 2024 and is solely responsible for the information contained therein. Distributed by

Public, unedited and unaltered, on

04 April 2024 11:10:06 UTC.

Athens, 4th, April 2024

AMENDEMENT OF FINANCIAL CALENDAR FOR THE YEAR 2024

BriQ Properties REIC in the context of the correct, valid and in time information to the investment community announces the following change to the financial calendar 2024:

The Annual Ordinary General Meeting of Shareholders will take place on Tuesday 30.04.2024 instead of 24.04.2024.

Therefore, the Company’s Financial Calendar for the year 2024, in accordance with articles 4.1.2. and 4.1.3.15.1. of the Athens Exchange Regulation, has been amended as follows:

Thursday 28.03.2024: Announcement (Press Release) of the financial results for the year 2023- Friday 29.03.2024: Publication of the Annual Financial Report for the fiscal year 2023

- Tuesday 02.04.2024: Annual briefing to analysts, investors and public on the financial data for the year 2023 (Conference Call).

- Tuesday 30.04.2024: Annual Ordinary General Shareholders Meeting

- Wednesday 08.05.2024: Cut-off date for the payment of the dividend for the fiscal year 2023*

- Thursday 09.05.2024: Determination of dividend beneficiaries (Record Date)*

|

• Tuesday 14.05.2024: |

Dividend payment* |

- Wednesday 25.09.2024: Publication of the Interim Financial Report of the period from January 1st to June 30th, 2024

*The above-mentioned dates for the dividend distribution, are subject to the approval of the Ordinary General Shareholders Meeting.

The Company clarifies that the Financial Results will be announced on the Company’s website (www.briqproperties.gr) and on the Athens Exchange Group website (www.helex.gr).

The Company has the right to amend the above-mentioned dates, provided that the investors will be informed on time with a new announcement.

BriQ Properties R.E.I.C.

Investor Relations Department

Contact: 3 Mitropoleos Str., 3rd floor, 10557, Athens, tel. +30 211 999 4833, Ε: info@briqproperties.gr, www.briqproperties.gr

Reg. Add.: 25,Al. Pantou Str.,17671,Kallithea, VAT n: GR0997521479,Tax off.: FAE Peiraia, GCR n.:140330201000, Reg. act: 3/757/31.05.2016

Attachments

Original Link

Original Document

Permalink

Disclaimer

BriQ Properties REIC published this content on

04 April 2024 and is solely responsible for the information contained therein. Distributed by

Public, unedited and unaltered, on

04 April 2024 11:06:02 UTC.

Linklaters has hired Accenture for client service advice as it pushes for growth.

Consultancy giant Accenture has been looking at the Magic Circle law firm’s technology, templates and processes in order to improve its interactions with its clients, Financial News has learned.

The project includes exploring the use of generative AI in client pitches, according to a person familiar with the situation.

The work with Accenture focuses on the firm’s business services teams in a drive to make them more client-centric, the people said.

READ Paul Weiss hires Simpson Thacher partner to lead Brussels expansion

“Our business teams play an integral role in the outstanding service we offer to clients. We want to ensure that we continue to be equipped to do that in the most effective ways possible,” a spokesperson for Linklaters said in a statement.

The process is being led by Linklaters’ chief growth officer Lucy Murphy, according to people familiar with the situation.

Murphy joined the firm in September last year having previously worked for Magic Circle firms Allen & Overy and Freshfields Bruckhaus Deringer in senior business services roles.

Murphy was given a brief of driving forward the firm’s client strategy when she joined last year.

“Lucy will play a pivotal role in ensuring that we are even more client centric and that everything we do as a firm is to the benefit of our clients,” Linklaters’ managing partner Paul Lewis said in September.

Linklaters has been scrambling to harness generative AI amid a rush in the professional services sector to adopt the new technology.

READ Why law firms are betting big on Saudi Arabia

The firm launched an AI chatbot for its lawyers in March last year which was built using Microsoft’s Azure OpenAI service.

Last month the firm said it was promoting the co-head of its AI steering group Shilpa Bhandarkar to partner, in a sign of its commitment to the new technology.

Linklaters is not the only Magic Circle law firm turning to consultancy firms for advice. Its rival Allen & Overy has tapped KPMG and McKinsey to advise on its merger with US firm Shearman & Sterling which is scheduled to go live in May, Law.com reported.

To contact the author of this story with feedback or news, email Edin Imsirovic

Ever since the Federal Reserve began hiking interest rates to fight inflation in March 2022, the real estate industry has been stuck in a deep freeze. High mortgage rates and even higher home prices have made buying a new home nearly impossible for many Americans; renters are facing record costs; and the commercial real estate sector is stuck in a nightmare scenario. Shifting working trends and rising borrowing costs slashed commercial real estate values by $590 billion in 2023 alone—and another $480 billion is expected to evaporate this year, according to Capital Economics.

While the pain has been severe for many in the real estate industry over the past few years, some veteran operators see opportunity. After all, the old saying in investing is “buy low, sell high,” and that means not everyone is running scared from this real estate market.

Hines, a global real estate investment, development, and property manager with $93.2 billion in assets under management, is even launching a platform that will enable wealthy clients to access new opportunities in real estate called Hines Private Wealth Solutions. With an increasing number of investors looking to allocate up to 30% of their portfolios to alternatives as the shift away from the classic 60-40 portfolio of stocks and bonds continues, Hines hopes to provide an easy way to gain diversified, global real estate exposure and capitalize on the $85 trillion of expected growth in the private wealth space over the next decade.

The company has hired Paul Ferraro, formerly the head of Carlyle Private Wealth, to lead the global private wealth strategy, and raised $10.7 billion for the venture as of Dec. 31.

Hines’ platform will offer a wide variety of real estate investment solutions for clients, including non-traded private real estate investment trusts, private placements, private debt, tax-deferred exchanges, development projects, and more. The company will also provide advisory solutions for clients that need direction when managing their personal real estate holdings.

As Hines’ global chief investment officer, David Steinbach, told Fortune, the goal of the new platform is to help investors take advantage of the beginning of a new real estate cycle, meet specific risk/return objectives, and reduce portfolio volatility.

“This is a great vintage, it’s a great moment,” he said. “This real estate correction began really over two years ago, right when the Fed started raising interest rates. So we’re two years into a cycle, which means we’re near the end.”

A multi-year real estate recovery comes into view

In a soon-to-be released white paper seen exclusively by Fortune, Hines’ team of researchers detailed their belief that the real estate industry tends to run in what they call “long cycles” that span 15 to 17 years. After one of these long cycles, there is typically a downturn that lasts, on average, 26 months. Hines’ researchers argued we’re in such a downturn now, and it’s coming to an end, which should provide a long-term opportunity for real estate investors.

“Real estate investing in the next 6-8 months may allow participation in the multi-year recovery, with investors enjoying the benefits of possibly rising income from distributions, stability in value, downside protection, and capital appreciation supported by cash flow growth as rents respond to the higher inflation expected,” they wrote.

Steinbach told Fortune that, like many experts on Wall Street, he also believes we’re in the midst of an economic “regime change” that will benefit owners of real assets like real estate, rather than financial assets like stocks. After years of near-zero interest rates and low inflation prior to the pandemic, he says we’ve entered an era of higher inflation, and thus, higher interest rates that is set to last. “And so in that world, you want to own real things,” he explained. “And I think that that’ll end up shifting some of the split that investors have allocated money to historically. It’s been kind of a 60-40 [stocks-bonds] split, and I think we’re moving to a 40-30-30 world of equities, fixed income, and private [alternatives].”

To his point, Goldman Sachs noted in a 2022 analysis, that real estate has historically provided a “strong” hedge during periods of inflation, because rents tend to re-price higher, boosting real estate investors’ income, and existing holdings also appreciate in value due to rising construction costs.

However, rising interest rates can become costly for real estate investors that borrow heavily, too. That’s why, according to Steinbach, the key to benefitting from the ongoing “regime change” is to hold high quality real estate that is spread around the world; reduce the use of leverage as much as possible; and to look for new opportunities in places like data centers which are being driven by AI.

And, he says, that’s what Hines Private Wealth Solutions will provide.

Nevertheless, Steinbach acknowledged that the easy days of near-zero interest rates are now clearly over for the real estate industry, arguing it’s like “going from downhill skiing to cross country skiing.” That means investors will need to be more selective in order to find the right opportunity. “It’s about hard work right now. And I think it will be for the next decade. If you’re willing to do it, I think there’s a great reward, but it’s gonna be hard work,” he said.

Higher returns, lower volatility

Beyond the opportunities within the coming “regime change,” Hines hopes to draw in wealthy investors to their new private wealth platform by emphasizing that, at least historically, adding real estate to portfolios has improved returns and reduced volatility. In fact, Hines found that adding 15% global real estate exposure to the classic 60-40 portfolio of stocks and bonds has increased the average annual total return of that portfolio from 6.12% to 6.4%, and reduced its volatility from 11.3% to 9.9%, since 2000.

Hines will offer a number of strategies with various risk tolerance levels for clients to take advantage of the volatility reducing and return juicing abilities of real estate. From a return-seeking “opportunistic” approach that will take more risk to its core strategy of stable income with moderate price appreciation, the company hopes to cater to individual investor needs with its platform.

Steinbach said he is also leveraging the experience of Hines’ local offices around the world to “create diamonds from the rough” that the real estate industry is currently facing. But he noted that after such a dramatic downturn in many real estate sectors, there are also a number of well-priced assets worth buying that don’t need a facelift. And with the U.S. still facing a housing shortage, Hines’ development of new properties is likely to be a winning strategy as well, Steinbach argued.

The real estate veteran concluded by emphasizing that he hopes investors take advantage of what he sees as a golden opportunity in the industry that doesn’t come around too often.

“It’s a moment that I don’t want to let pass by because these windows do close eventually,” he said. “I’ve seen a couple in my career, and I won’t see too many more. I mean, you don’t get many windows like this. So I think we’re at a unique moment that people need to be alive to.”

A spin-off is one of the options that is under consideration

Petah Tikvah, Israel, March 21, 2024 (GLOBE NEWSWIRE) — SaverOne 2014 Ltd. (Nasdaq: SVRE, TASE: SVRE), a technology company that develops and sells transportation safety solutions, today announced that it has signed an agreement, partnering with a top-tier global consultancy firm, to support the development of a business model around SaverOne’s Vulnerable Road User (VRU) solution.

The initiative focuses on assessing the potential of the VRU solution and building a full understanding of the solution’s value proposition and market potential within the automotive industry. Deliverables include a comprehensive business plan including an analysis of the competitive landscape as well as a detailed approach for developing the VRU business either within SaverOne or via a spin-off. One of the goals of this strategic initiative is to enhance shareholder’ value.

SaverOne’s VRU solution has the potential to significantly enhance the performance of Advanced Driver Assistance System (ADAS) sensors (camera, lidar and radar) through its superior ability to deal with NLoS (non-line of sight) situations as well as adverse weather conditions and low-visibility. The solution detects VRUs such as pedestrians or cyclists in the vicinity of the vehicle, to avoid and prevent a collision. SaverOne’s technology identifies the exact location and direction of movement of the VRU via their RF footprint from their cellphone signal.

Ori Gilboa, CEO of SaverOne, stated, “Leveraging our technology, our VRU sensor brings new and unique safety capabilities to the large and significant ADAS market. We believe this important initiative will enable us to further develop the business around our VRU sensor, enabling us to take well- considered strategic steps. We are committed to developing a robust business for our VRU protection solution and would like to cooperate with strategic partners and investors to implement it.”

About SaverOne

SaverOne is a technology company engaged in the design, development and commercialization of OEM and aftermarket solutions and technologies, to lower the risk of, and prevent, vehicle accidents.

SaverOne’s initial line of products is a suite of solutions that saves lives by preventing car accidents resulting from distraction from the use of mobile phones while driving. SaverOne is also developing a sensor system for early location and direction detection under all visibility conditions of vulnerable road users (VRU) through their cellphone footprint.

Learn more at https://saver.one/

Forward Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act and other securities laws that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release include, but are not limited to, statements regarding SaverOne’s strategic and business plans, technology, relationships, objectives and expectations for its business, the impact of trends on and interest in its business, intellectual property or product and its future results, operations and financial performance and condition, and may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on SaverOne’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Many factors could cause SaverOne’s actual activities or results to differ materially from the activities and results anticipated in such forward-looking statements. Factors that could cause our actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to: the ability of our technology to substantially improve the safety of drivers; our planned level of revenues and capital expenditures and our ability to continue as a going concern; the ability of our technology to substantially improve the safety of drivers; our ability to market and sell our products; our plans to continue to invest in research and development to develop technology for both existing and new products; our intention to advance our technologies and commercialization efforts; our intention to use local distributors in each country or region that we will conduct business to distribute our products or technology; our plan to seek patent, trademark and other intellectual property rights for our products and technologies in the United States and internationally, as well as our ability to maintain and protect the validity of our currently held intellectual property rights; our expectations regarding future changes in our cost of revenues and our operating expenses; our expectations regarding our tax classifications; interpretations of current laws and the passage of future laws; acceptance of our business model by investors; the ability to correctly identify and enter new markets; the impact of competition and new technologies; general market, political and economic conditions in the countries in which we operate; projected capital expenditures and liquidity; our intention to retain key employees, and our belief that we maintain good relations with all of our employees; any resurgence of the COVID-19 pandemic and its impact on our business and industry; and other risks and uncertainties, including, but not limited to, the risks detailed in the Company’s Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 27, 2023 and in subsequent filings with the SEC. Forward-looking statements contained in this announcement are made as of this date, and SaverOne undertakes no duty to update such information except as required under applicable law.

International Investor Relations Contact:

Ehud Helft

+1 212 378 8040

saverone@ekgir.com

Israeli Investors Contact:

Jonathan Eilat

John@theinvestor.co.il

Athens, 14th March 2024

FINANCIAL CALENDAR FOR THE YEAR 2024

BriQ Properties REIC announces the Financial Calendar for the year 2024 in accordance with articles 4.1.2. and 4.1.3.15.1. of the Athens Stock Exchange regulation:

Thursday 28.03.2024: Announcement (Press Release) of the financial results for the year 2023- Thursday 28.03.2024: Publication of the Annual Financial Report for the fiscal year 2023

- Friday 29.03.2024: Annual briefing to analysts, investors and public on the financial data for the year 2023 (Conference Call).

- Friday 19.04.2024: Annual Ordinary General Shareholders Meeting

- Wednesday 08.05.2024: Cut-off date for the payment of the dividend for the fiscal year 2023*

- Thursday 09.05.2024: Determination of dividend beneficiaries (Record Date)*

|

• Tuesday 14.05.2024: |

Dividend payment* |

- Wednesday 25.09.2024: Publication of the Interim Financial Report of the period from January 1st to June 30th, 2024

*The above-mentioned dates for the dividend distribution, are subject to the approval of the Ordinary General Shareholders Meeting.

The Company clarifies that the Financial Results will be announced on the Company’s website (www.briqproperties.gr) and on the Athens Exchange Group website (www.helex.gr).

The Company has the right to amend the above-mentioned dates, provided that the investors will be informed on time with a new announcement.

BriQ Properties R.E.I.C.

Investor Relations Department

Contact: 3 Mitropoleos Str., 3rd floor, 10557, Athens, tel. +30 211 999 4833, Ε: info@briqproperties.gr, www.briqproperties.gr

Reg. Add.: 25,Al. Pantou Str.,17671,Kallithea, VAT n: GR0997521479,Tax off.: FAE Peiraia, GCR n.:140330201000, Reg. act: 3/757/31.05.2016

Attachments

Original Link

Original Document

Permalink

Disclaimer

BriQ Properties REIC published this content on

14 March 2024 and is solely responsible for the information contained therein. Distributed by

Public, unedited and unaltered, on

14 March 2024 14:46:09 UTC.

(Oslo ,14 March 2024 )Ayfie Group AS (Ayfie, OSE: AYFIE) today announces the award of status as recommend solution for generative AI applications by a leading global consultancy firm. The consultancy firm is one ofNorway's leading companies for digital transformation, and assists customers on the deployment of generative AI. Following a thorough review process, Ayfie has been awarded to be part of the recommended solutions portfolio for the full Ayfie product suite, including the new Ayfie integration platform for enterprise generative AI applications. The customer demonstrations will commence medioMarch 2024 . "We are proud to be selected to the recommended product portfolio suite for one of the leading consultancy firms within digital transformation and AI. The award serves as testament for the performance of Ayfie applications, where we boost the effectiveness of generative AI applications, provide access control management for vital data and more. We look forward to the upcoming customer dialogues to showcase our full capabilities," saysHerman Sjøberg , CEO of Ayfie. For further information, please contact:Herman Sjøberg , CEO, tel: +47 926 62 233, email: herman.sjoberg@ayfie.comLasse Ruud , CFO, tel: +47 930 90 008, email: lasse.ruud@ayfie.com About Ayfie | ayfie.com Ayfie is a leading software provider specializing in data search and generative AI. With over 15 years of experience, we have honed our expertise in transforming unstructured data into valuable insights that benefit both large enterprises, medium-sized businesses, and individuals.

Click here for more information

© Oslo Bors ASA, source

Australia is establishing a A$2 billion ($1.3 billion) investment financing facility to boost investment in Southeast Asia (SEA) as part of several economic initiatives announced at this week’s Asean-Australia Special Summit to commemorate 50 years of dialogue in Melbourne.

The initiatives include recommendations from Invested: Australia’s Southeast Asia Economic Strategy to 2040, launched last year by Australian prime minister Anthony Albanese to deepen Australia’s economic engagement with SEA, according to a media release from the Australian government.

Addressing 100 Australian and SEA CEOs at a summit on March 5, Albanese unveiled the initiatives, which included a A$2 billion fund called the Southeast Asia Investment Financing Facility (SEAIFF) to be managed by Export Finance Australia. The SEAIFF will provide loans, guarantees, equity and insurance for projects that are designed to boost Australian trade and investment in SEA, particularly in support of the region’s clean energy transition and infrastructure development, the statement said.

A$140 million has been allocated over four years to extend the Partnerships for Infrastructure Program. The Program is designed to support efforts to improve regional infrastructure development and attract more diverse and quality infrastructure finance. The program has been running since 2021 and has assisted partners to accelerate transport connectivity, the clean energy transition and telecommunications reforms.

Australia has also appointed 10 ‘business champions’ to facilitate greater commercial links between Australia and the economies of Asean. The champions are senior Australian business leaders. According to The Australian, Macquarie’s group CEO Shemera Wikramanayake is one of the champions and has been tasked with opening up opportunities with the Philippines, while ANZ’s chief executive Shayne Elliott has been given responsibility for Singapore.

Landing Pads

Another initiative is the launch of regional technology ‘Landing Pads’ in Jakarta (Indonesia) and in Ho Chi Minh City (Vietnam). The new Landing Pads will provide on-the-ground support for Australian businesses to boost technology services exports to SEA markets, following the establishment of the initial ‘Landing Pad’ in Singapore in 2017.

Business visitor visas to those from SEA will be extended from three to five years. The 10-year Frequent Traveller stream will be extended to eligible Asean member states and Timor-Leste.

Albanese said: “Australia’s economic future lies in our region. I’m proud to lead a government that is strengthening our trade and investment ties with SEA, directly contributing to our shared economic prosperity. These initiatives represent further investments in our future and ensure we are working with SEA as it continues to grow in economic size and reach.”

He added: “When our region prospers, Australia prospers. Our work internationally is delivering for Australians – for jobs, for our economy and for our people.”

Australia’s two-way investment with Asean was worth A$307 billion in 2022. Two-way trade with Asean accounted for A$178 billion in 2022, accounting for 15% of Australia’s trade, which is greater than its trade with Japan or the US.

¬ Haymarket Media Limited. All rights reserved.