A wholesome Midwestern city has become the country’s hottest real-estate market because of its premium location, job market and booming culture.

Rockford in Illinois lies just 90 miles from Chicago and Milwaukee and is expecting a direct train line to the Windy City in just a few years.

Last year property prices there surged by an astonishing 51.7 percent in 12 months, according to new Realtor.com data. The median house price in Rockland sits at $233,000 and it’s still possible to buy a desirable property there that will likely appreciate considerably in value.

This is the largest gain of any metro area in the ranking’s top 20.

Rockford has attracted home buyers in recent years because of the affordable houses, growing healthcare, aerospace and logistics industries – as well as the lively community.

Entrepreneurs and aspiring business-owners have flocked to the city to take advantage of the convenient location and cheaper property prices – which helped Rockford emerge from the 2008/2009 financial crisis.

Back then, it was better known for being America’s number one ‘underwater’ mortgage hotspot – where a third of homes were worth less than the mortgages taken out on them.

It isn’t all good news though – Rockford has a higher than average crime rate for both property and violent crimes, with the statistics sitting well above the national average.

Rockford in Illinois has been named the United States’ hottest property market, with prices rising 51.7% in a year. The city’s beautiful East Rockford Historic District is pictured

Another snap of East Rockford. The historic buildings are now home to a glut of mom-and-pop stores, with the Illinois city also home to multiple prestige companies that offer highly-skilled jobs

A wholesome Midwestern city that was once the mortgage capital of America has become the country’s top real-estate market because of its premium location, job market and booming culture

Rockford, Illinois, has attracted home buyers in recent years because of the affordable houses, growing healthcare, aerospace and logistics industries – as well as the lively community

The median listing price of a home in the Rockford metro area jumped up to $235,000 in March – a staggering 51.7 percent increase compared with just one year ago. This is the largest gain of any metro area in the ranking’s top 20. The Rockford home pictured was listed for $199k

‘We are also seeing a huge boom in entrepreneurs who are from here and opening things such as retail stores, small manufacturing companies, gift shops, restaurants and bars,’ Thomas McNamara, the city’s mayor, told The WSJ. ‘Which is what we need. It’s what our community was like in its heyday.’

That influx of mom-and-pop shops and restaurants has added further to Rockford’s desirability and created a ‘virtuous cycle’ whereby newcomers help improve local services, thus enticing even more people to come and join them.

Rockford is one of the 11 Midwestern metro areas that dominated the top 20 rankings.

Americans are attracted with the Midwest because of its relatively affordable properties, especially as house prices elsewhere in the U.S. soar.

The Midwest is also less vulnerable to natural disasters with surveys showing that wildfires, tornadoes, floods and hurricanes are all growing concerns for home-buyers.

‘Areas in the Midwest tend to be less impacted by these risks, giving buyers some peace of mind when taking on a home purchase,’ said Hannah Jones, a senior economic analyst for Realtor.com.

The Coronado Theatre was reopened in 2001 – after an 18-month-long multi-million dollar renovation and expansion

In an effort to reverse the urban downfall of downtown Rockford which kicked off during the 1960s, during the 2000s the city threw millions of dollars at local cultural sites to kickstart the economy and make the city lively again

Of the top four cities in the rankings, all of which in the Midwest, three of them had median home price listings of below $250,000.

This is far cheaper than the national median listing house price of $424,900.

Rockford is a city that has a lot to offer. There is nature, history, art, markets and lively restaurants and bars.

It was previously known as ‘Screw City’ because it manufactured billions of screws, bolts and fasteners in its factories which were supplied globally.

While the city has maintained its manufacturing industry and still offers factory jobs – new industries have merged on the scene, with the healthcare sector accounting for thousands of jobs.

From 2014 to 2018 – the unemployment rate in Rockford fell from 12.9 percent to 4.4 percent. It is currently at 6.8 percent, but is trending downwards.

Major industries include aerospace, automotive logistics healthcare and advanced manufacturing.

Rockford is a city that has a lot to offer. There is nature, history, art, markets and lively restaurants and bars

Rockford is home to the stunningly beautiful Anderson Japanese Gardens – a 12-acre stretch of nature. It also has 7,000 acres of parkland and numerous public gardens

The culturally-dense city has also been nicknamed ‘River City’ because of its location just to the east of the Mississippi River. It also lies just west of Lake Michigan.

Rockford is home to the stunningly beautiful Anderson Japanese Gardens – a 12-acre stretch of nature. It also has 7,000 acres of parkland and numerous public gardens.

The Rockford City Market is a continuously growing hotspot for visitors and locals. The popular outdoor market that takes place every Friday from May to October showcases small businesses and local food vendors. Along with food trucks and beer tents, there is live music and activities for all ages.

In an effort to reverse the urban downfall of downtown Rockford which kicked off during the 1960s, during the 2000s the city threw millions of dollars at local cultural sites to kickstart the economy and make the city lively again.

The Coronado Theatre was reopened in 2001 – after an 18-month-long multi-million dollar renovation and expansion. It now hosts big-name stars, with locals flocking to appreciate the talent that stops by.

In 2008, the MetroCentre downtown arena completed a $20 million renovation was was renamed the BMO Harris Bank Center in 2011.

The population has barely changed since 2020 – when there were approximately 337,000 residents.

A shortage of available listings are driving the housing market.

Mackenzie McNally and her partner, Kyle Speck, both 30 years old, began searching for a home in Rockford a year ago. Over the course of a year, the pair made 14 offers and all of them were rejected. In April, they closed the deal on a roughly 1,000-square-foot home for $187,000 in Rockford’s Machesney Park neighborhood

Mackenzie McNally and her partner, Kyle Speck, both 30 years old, began searching for a home in Rockford a year ago. Over the course of a year, the pair made 14 offers and all of them were rejected.

In April, they closed the deal on a roughly 1,000-square-foot home for $187,000 in Rockford’s Machesney Park neighborhood.

‘Every house we had bid on we were either losing to all-cash offers or being overbid by $5,000 to $15,000,’ McNally said. ‘The house we got didn’t even go to market.’

Many Rockford homeowners are unwilling to list their houses and re-enter the buyer’s market a time of rising interest rates, local real-estate agent Ryan Petry revealed.

While a normal market in the Rockford metro area has about 1,000 homes for sale – in March there were only 230 active listings, according to local real-estate agent Dianne Parvin.

A Gen-Z property investor who owns three properties has shut down claims landlords are at fault for Australia’s current rental crisis.

Harley Giddings, 24, has worked hard since adolescence and in every job ‘under the sun’ to own a house and is now the proud owner of multiple investment properties.

The young investor posted a TikTok to his thousands of followers saying he often gets comments ‘all the time’ that blame investors for the housing shortage.

The savvy landlord said he can understand Aussies’ frustrations but thinks this is ‘misguided’, firmly believing the sky-rocketing rents and housing shortage lie with high immigration and low building approvals.

‘In 2022 and 2023 the government let in over a million migrants into the country,’ he said.

Harley Giddings, 24, has a property portfolio consisting of three investment properties. He understands people are ‘hurting’ but believes Aussies are ‘misguided’ when blaming landlords for the rental crisis

‘Basic supply and demand’ is the reason for the Australian housing crisis, according to the 24-year-old

‘According the Australian Bureau of Statistics, this is the most amount of migrants Australia has ever let into the country since they started recording.

‘These one million migrants were let in at a time when Australia already had a housing crisis.’

Mr Giddings said that when people arrive in Australia they are looking at renting and not buying, which is why so many people are at inspections for rental opens.

‘Basic supply and demand,’ he said.

The second reason the young property investor gave for the housing shortage in Australia was the low amount of homes being built.

‘We are simply not building enough properties,’ he said.

‘In Victoria, my home state, we currently have the lowest amount of building approvals that we’ve had in the last decade.

‘This issue is Australia-wide.’

The 24-year-old quoted research from the Institute of Public Affairs that by 2028 Australia’s housing supply will be short by 252,800 homes.

Many Australians agreed with the young investor, also blaming the government.

‘Absolute master stroke by the government,’ one wrote.

‘Not to mention all of Victoria’s new tax laws on investments, landlords are getting rid of them,’ one said.

‘If you can’t keep up with supply reduce the demand,’ another wrote.

Mr Giddings said the the low number of houses being built in Australia is a major reason for rents increasing so high (pictured people at an auction)

However, other Aussies were quick to throw blame back at the investor.

‘You are also the problem. You cannot just blame building and immigration. You know why people can’t afford to build? Because they can’t afford the increased prices driven up by decades of investors,’ one wrote.

‘Investors and immigration: two problems [that] need to be stopped,’ another said.

Mr Giddings told Yahoo he understands it would be very hard at the moment to be a renter and there’s a lot of ‘hurt’ due to prices increasing not just in rent, but everything else as well.

‘I just think there’s a couple of factors that is like worsening the housing crisis that isn’t caused by renters or landlords,’ he said.

The investor, who became interested in property after reading multiple books and listening to podcasts about investing, made it clear to Yahoo that he did not blame the people moving to Australia, but government policy.

Mr Giddings dropped out of university half-way through his business degree because he didn’t think it would offer him much.

The 24-year-old instead worked two jobs, seven days a week, saving more than $100,000 by age 22.

Mr Giddings, who describes his family as middle class, went halves with his dad for his first property, as told by Yahoo.

The young investor believes high rents and a competitive market has been created by the government allowing one million migrants into the country in the middle of a housing crisis

‘My parents aren’t really the kind of investment-savvy people. Like, dad’s a firefighter, mum’s a hairdresser. So he had the borrowing power because he was working full time and I had the savings,’ he said.

The hard-worker, who has always been interested in investing, purchased away from his state of Victoria and instead invested in Western Australia.

‘There’s 15,000 suburbs in Australia, it’s highly unlikely that the area you live in is going to be one of the best performing,’ he said.

The first property cost the father and son $450,000 and then the 24-year-old used more savings to buy a second property.

Mr Giddings used the equity built up in the second property to purchase his third investment.

This impressive property portfolio was achieved by the time he was just 23.

According to the Australia Tax Office, most landlords are ‘mum and dad’ investors, with a massive 71 per cent of landlords in Australia owning just one investment property.

Only 19 per cent own two properties.

According to the Australian Bureau of Statistics work begun in 2023 on just 163,836 new houses, which is the lowest amount since 2012.

Compounding the issue is a 90,000 tradie shortage, who are needed in the next three months so the government’s housing plan can stay on deadline.

The spring real estate market is in full swing and homes are going up for sale – but they’re staying there for longer in a handful of US cities.

In a smattering of metro cold spots – dotted throughout Texas, Florida, Louisiana, New York and West Virginia – homes are staying on the market for an average of more than 60 days, according to new data from Realtor.com.

Across the board, homes spent a median of 50 days on the market in March.

‘Some of these markets are perennially slow-moving,’ said Danielle Hale, chief economist at Realtor.com. ‘They tend to be smaller markets that are not on the radar of most buyers.’

In all of the areas where homes were spending longer on the market, there was also a notable increase in inventory year-on-year, according to data for March.

Huntington in West Virginia had among the coolest property markets in March, with homes remaining up for sale for an average of 66 days

Housing inventory surged by 130 percent in Punta Gorda, Florida. And in Cape Coral and Naples, both also in Florida, inventory was up 101 and 82 percent, respectively.

The areas with stagnating markets also often offer more affordable options, with nine out of the twelve metros boasting median list prices below the national average of $424,900.

For example, the most budget-friendly among them, Huntington, West Virginia, has a median list price of just $179,950.

Interestingly, eight of the twelve metro areas are located along the Gulf of Mexico, making them prone to storm-related risks. Some are still dealing with the aftermath of hurricanes and soaring interest costs as a result.

‘In some cases, homes in these areas are at risk of flooding and other hazards, leading to rising insurance costs,’ said Hale.

According to real estate agent Karen Brown of Michael Saunders & Company on the Florida Gulf Coast, Punta Gorda is suffering in the wake of Hurricane Ian in 2022.

‘Cleanup efforts are ongoing, and residents are still navigating insurance claims,’ Brown told Realtor.com.

1. Lafayette, Louisiana

Median days on the market in March: 69 (tie)

Median home list price in March: $259,250

In Lafayette, Louisiana, homes were on the market for a median of 69 days

2. Punta Gorda, Florida

Median days on the market: 69 (tie)

Median home list price: $419,000

3. Brownsville, Texas

Median days on the market: 68 (tie)

Median home list price: $308,000

In Brownsville, at the southernmost tip of Texas, on the northern bank of the Rio Grande, homes were on the market for a median of 68 days

4. Utica, New York

Median days on the market: 68 (tie)

Median home list price: $239,900

5. New Orleans, Louisiana

Median days on the market: 67

Median home list price: $329,000

6. Crestview, Florida

Median days on the market: 66 (tie)

Median home list price: $644,000

7. Huntington, West Virginia

Median days on the market: 66 (tie)

Median home list price: $179,950

In Huntington, West Virginia, homes were on the market for a median of 66 days

8. Waco, Texas

Median days on the market: 66 (tie)

Median home list price: $345,000

9. Longview, Texas

Median days on the market: 64 (tie)

Median home list price: $305,500

10. Naples, Florida

Median days on the market: 64 (tie)

Median home list price: $849,000

In Naples, Florida, homes were on the market for a median of 64 days. The median house price was significantly higher than elsewhere on the list

11. Cape Coral, Florida

Median days on the market: 64 (tie)

Median home list price: $474,100

12. Baton Rouge, Louisiana

Median days on the market: 64 (tie)

Median home list price: $305,000

In Baton Rouge, Louisiana, homes were on the market for a median of 64 days

A financial analyst nicknamed the ‘Oracle of Wall Street’ has said a ‘growing crisis of the young American male’ will cause house prices to fall as much as 30 percent.

Meredith Whitney, who earned the title after predicting the financial crisis of 2007 – 2008, suggested young men increasingly living with their parents and disinterested in starting families will drastically reduce housing demand.

The trend of men refusing to settle in turn means more women are remaining single into later life, leaving them without the income or need for big family homes.

But it comes as baby boomers start to downsize, meaning there will be a surplus of available family homes. Much of the last decade’s gains in property values have been driven by high demand and low supply – a phenomenon, Whitney says, is reversing.

To explain the rise in men living at home, she pointed to the increasing prevalence of video games, starting in the mid-2000s.

Meredith Whitney, also known as the ‘Oracle of Wall Street,’ has predicted house prices are set to fall because men are increasingly disinterested in starting families

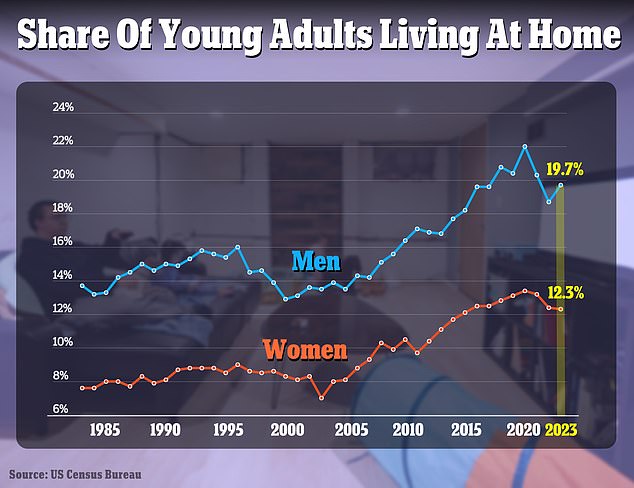

Over the last decades, the number of young men living in their family home has been on the rise. (Young adults are defined as those aged between 25 and 34)

‘You feel like you’re with other people but you’re actually at home alone, and that created a big chasm in young male sociability,’ she told DailyMail.com.

Whitney cited US Census Bureau data showing that before the financial crisis around 13 percent of men aged between 25 and 34 lived at home.

That rose to as high as 22 percent during the pandemic but even after falling back down was still almost 20 percent in 2023. It was only in the last decade that rate had risen above 16 percent.

The data also shows that young women have consistently been around twice as likely to leave their parents’ homes. Last year, just 12.3 percent were still at home.

The figures coincide with a decline in romantic relationships among young men. A 2023 Pew Research study found 63 percent of males under 30 describe themselves as single.

Experts have attributed the figures to a confluence of factors such as increased porn consumption, the rise in hook-up apps and the legacy of lockdown during the pandemic.

‘The pace at which young men live at home versus young women live at home is around 2x, I correlated all of this with in the early, mid-2000s launch of the Xbox, Wii and PlayStation,’ she said.

‘The biggest driver of home prices has historically been household formation,’ Whitney told DailyMail.com. ‘Household formation today is the lowest it’s been in 160 years.’

And household formation, she said, is driven by the ‘five Ds’ – ‘diamonds, diapers, divorce, debt, and death.’

‘Without at least the first two Ds, there’s no reason to buy a home,’ she said.

Whitney previously told Fortune the drop could be as much as 30 percent.

Whitney attributed the increasing rate of men living at home to the rise of video gaming, starting in the mid-2000s

Single women have increasingly been purchasing homes of their own. Female buyers alone make up 19 percent of American homebuyers – almost double that of single men – according to recent data from the National Association of Realtors.

That is a stark contrast from 40 years ago when the portion of single women and men buying homes was roughly the same – 11 percent and 10 percent respectively.

As of 2023, the proportion of single men purchasing property has stayed steady at 10 percent. According to the NAR, the share of recent buyers who are married couples has also dropped to 59 percent.

In 1981, when the organization began analyzing the profiles of buyers and sellers, married couples made up 73 percent of homeowners.

However, according to Whitney, single women alone will be unable to absorb the entire supply of large, family homes.

‘I don’t see single women buying a four bedroom, three bath home,’ she said.

And spurring the downsizing of the elderly into smaller homes are rising costs, Whitney said.

Despite the inconvenience of moving in old age, burdensome costs like household expenses, property taxes, insurance, utilities, homeowners association fees and mortgages may leave them with little choice.

Single women are purchasing an increasing share of homes but Whitney doubts they will be able to absorb all the demand, so prices will fall. Pictured is a ‘for sale’ sign outside a home in Phoenix, Arizona

Whether or not aging baby boomers will vacate their homes and flood the market in the coming years is uncertain

While the youth aspiring to buy homes may be eagerly waiting for baby boomers and older homeowners to start vacating theirs, whether or not that will happen is up for debate.

A Redfin survey in February found that out of more than 800 Americans aged 60 and older, some 71 percent said they would stay in place in their current homes.

A separate study by government-backed lender Freddie Mac downplayed the significance of the ‘silver tsunami’ – a metaphor sometimes used to describe population aging.

‘Some have warned of a ‘silver tsunami’ as aging boomers look to sell their homes, flooding the market with inventory,’ it read.

‘But as this analysis demonstrates, the tsunami is more like a tide, bringing a gradual exit that will mostly be offset by new entrants.’

A homeowner who slammed British houses for being ‘too narrow’ found herself in a pricey predicament after she took drastic measures to fit a sofa into her living room.

Deby Oscar, originally from Nigeria but lives in the UK, documented her dilemma on TikTok after ordering a brand new corner sofa to her home in November 2023.

In a shocking video – which has since amassed over 500,000 likes – uploaded to her TikTok account, @debyoscar, the content creator captioned the footage with: ‘Why are british homes so narrow?’

Oscar and her husband critiqued Victorian homes in Britain for their narrow dimensions as the sofa arrived in separate parts at their front door.

The pair, alongside a mover provided by the company they placed their order with, struggled to maneuver parts of the sofa through the slender hallway and window into the living room.

Deby Oscar and her husband critiqued Victorian homes in Britain for their narrow dimensions as the sofa arrived in separate parts at their front door

The pair, alongside a mover provided by the company they placed their order with, struggled to maneuver parts of the sofa through the slender hallway and window into the living room

Oscar said in the footage: ‘So my sofa arrived and as you can see, the middle part fits, but the remainder of my sofa did not fit through my narrow hallway.

‘Like, who invented this narrow hallway? I tried so many sofas. This is the seventh sofa.’

Despite their best efforts, the sofa stubbornly refused to cooperate, leaving the couple at their wit’s end.

It was at this point the frustrated homeowner revealed that, in a moment of sheer desperation, she made a bold decision: out with the window, in with the sofa.

She said: ‘At this point, I was like, I don’t care. Take the windows out, because I need a sofa. We tried so many different ways. We removed the window, so I made the executive decision to pull the whole frame out.’

Oscar complained of the added expense of having the window frames removed by professionals, as the footage captures the moment a builder unscrews the panels and the mover returns to slide parts of the sofa through the opening.

She said: ‘They pulled the whole window, the whole thing off, which cost me so much money.

‘When they did that, the sofa, of course, finally fit. Once that was in, they closed the windows – they had to rebuild it anyway.’

It was at this point the frustrated homeowner revealed that, in a moment of sheer desperation, she made a bold decision: out with the window, in with the sofa

Before and after: Oscar complained of the added expense of having the window frames removed by professionals, as a builder unscrews the panels and the mover returns to slide parts of the sofa through the opening

However, the couple’s efforts hit a snag when the light grey colour of the sofa clashed with their living room décor, leaving them disheartened and in disbelief.

Oscar added: ‘My dilemma is that I do not like the colour of my sofa. I’m looking at it and I’m thinking, “I wanted a beige,” and it’s just not what I ordered.’

She asked: ‘What do I do? Do I take the window out and pull it out, do I just live with it, or do I just cover it with a blanket?

‘I’m changing the blinds to like a white and the lampshade to something else so I feel like it won’t go with the final design I had in mind.’

Over 6,700 comments poured in from viewers who shared their thoughts, with many suggesting the homeowner use sofa covers to mask the colour clash, while others criticised the couple for ordering a sofa that is ‘too big’ for the living space.

The couple’s efforts hit a snag when the light grey colour of the sofa clashed with their living room decor, leaving them disheartened and in disbelief

Over 6700 comments poured in from viewers who shared their thoughts, with some criticising the couple for ordering a sofa that is ‘too big’ for the living space

One person, who sympathised with the couple’s issue with their narrow hallway, said: ‘Old homes weren’t built for today’s furniture, not just in the UK.’

Meanwhile, one critic said, ‘The bigger issue you have is that sofa is far too big for the room,’ while another wrote regarding the sofa’s colour, ‘You didn’t see the colour while they were handling it?’

A fourth critic wrote: ‘You should measure the dimensions of the hallway and doors etc before buying,’ to which Oscar responded, ‘Trust me I moved in August and just now got a sofa. I tried the narrowest sofa from most companies. None fit.’

It comes as experts have warned against a trend that sees people on social media attempt to revamp their sofas with paint.

The trend is popular on TikTok and Instagram reels, gaining more than 29.7 million views, as creative fans try to save money through their DIY projects.

Home prices have doubled in less than ten years in 68 of the 100 largest cities in the US, a sobering new study shows.

And in some major American cities, the cost of the average property has doubled in as little as five years.

In Detroit, home prices were half of what they are now as recently as 2019, data from real estate marketplace Point2 reveals.

Home prices in Miami and Tampa, Florida, have doubled since 2018, as they have in Baltimore, Maryland, and Spokane, Washington.

Buyers in Irvine, California – the most expensive housing market in the study – have seen average home prices double from an already steep $750,000 to $1.5 million in just seven years.

A storm of high inflation and interest rates, tight supply and surging demand has meant that the national median home price has yo-yoed toward around twice what it was a decade ago.

The cost of the average home in the US has gone up from around $200,000 to around $400,000.

According to Point2, a common home appreciation theory is that residential properties tend to double in value in about 10 years.

In the so-called ‘Motor City’ Detroit, one of the reasons that house prices have risen twofold in half this amount of time is because they have been historically low compared to the national average.

House prices in the city have been among the fastest-growing in the US in recent years, as the city bounces back from the mortgage crisis which left some homes virtually worthless.

Less than two decades ago, one in five houses stood empty in the city with foreclosures mounting and properties on deserted streets being sold for $1.

The crisis and the demise of the big carmakers – which had previously made Detroit an industrial powerhouse – drove millions from their homes.

But as the car industry – this time with a focus on electric vehicles – begins to pick up speed again, house prices have risen rapidly.

House prices in Detroit have been among the fastest-growing in the US in recent years, as the city bounces back from the mortgage crisis which left some homes virtually worthless

At the start of 2019 you could buy a home in Detroit for $40,000, according to Point2.

Now, according to listings website Realtor.com, the median home listing price in the city is $89,900.

Despite the short-term price surge, Detroit still remains among the more affordable of the major cities in the US.

Detroit was lagging behind other cities in terms of house price growth, according to CoreLogic chief economist Selma Hepp, so some of this growth is catch-up.

Similarly, data shows that prices also doubled quickly in Spokane, where not that long ago, in March 2018, a home cost just $184,500 – compared to $371,000 today.

Spokane has seen house prices surge as Americans have moved to the city amid investor interest and urban revitalization efforts.

And some people who fled to so-called pandemic ‘boomtowns’ such as Boise, Portland and Austin, later moved to Spokane in search of cheaper housing – which has driven up prices further.

Prices also doubled quickly in Spokane, where not that long ago, in March 2018, a home cost just $184,500 as compared to $371,000 today

According to Point2, home prices have accelerated just as dramatically in Miami, as well as in Tampa, amid a surge of new residents.

The past six years were enough for homes to double in cost to about half a million dollars in both cities.

Prices in all five of the largest markets in Florida – including Jacksonville, Orlando, and St. Petersburg – have doubled in just six to eight years.

Arizona is in a similar position – with seven large cities doubling in price between six and seven years.

Prices increased twofold in booming Scottsdale, where the average home costs a huge $837,500 compared to $416,000 at the end of 2017.

Phoenix has also seen a surge in home prices – which local incomes can barely keep up with.

Home prices have surged dramatically in Miami amid a surge of new residents

House prices in Tampa, Florida, have doubled in the last six years according to Point2

It comes as separate data shows the US housing market gained a huge $2 trillion in value in the last year alone, amid a historic shortage of homes for sale.

Soaring mortgage rates mean many Americans locked into lower deals have stayed put, leading to a significant inventory shortage.

This, in turn, has meant home values have continued to rise, pricing many Americans out of the market entirely.

While mortgage rates had been slowly declining in the first months of this year, the average 30-year fixed rate deal is beginning to creep up again.

Following data released earlier this week which showed inflation remains stubborn, the average 30-year mortgage deal rose to 6.88 percent, according government-backed lender Freddie Mac.

Angry residents of a suburban street are embroiled in a three year row with their neighbour after he demolished most of his house to build an extension – without getting permission from the council to do so.

Harminder Singh Reehal, from Oldbury in the West Midlands, applied to Sandwell Council seeking permission to build a series of extensions at his home back in 2021.

But he then sought permission to build a bigger two-storey extension – and has ploughed on with partially demolishing the house to build it despite council planners not giving him the green light.

A meeting of the council’s planning committee was scrapped last month after it emerged only one of the home’s original walls was still in place – with the rest reduced to rubble to the fury of neighbours who say it’s ruining their lives.

Images show wooden hoardings surrounding the house, which itself is without a roof and hollow. It is also covered in scaffolding.

The house in Oldbury has been all-but demolished despite the project not having permission to proceed

Residents have branded the unauthorised project an ‘eyesore’ after all but one of the original walls was torn down

At least one resident has been trying to sell her house for the last year – and says she hasn’t been able to shift the property because potential buyers always mention the half-built project across the street.

The woman, named Samantha, lives across the road and said she has been having trouble selling her house, which has been on the market for over a year.

Samantha, who didn’t want her last name revealed, said: ‘It’s been horrible… Just look at it. I’ve lost count now but it has been in that state for a long time.

‘I’ve actually been trying to sell my own house and when we have house viewings, the potential buyers always mention it. It’s made it hard to sell our houses. It’s definitely had a negative effect on us all.’

Residents also expressed concern over the state of the building works, with a next neighbour saying she is concerned about subsidence in her own home.

The neighbour, who didn’t want to be named, said: ‘I’ve only lived here for about a year, we actually bought this house to be closer to my partner’s family.

‘It’s not great. It’s actually damaged my wall on the side and we are concerned about the possibility of subsidence because it looks like they have done work to the floor.’

Another, David Summerhill, said: ‘Just look at it, it’s been that way for a good while now. What more can you say? It’s ridiculous.

‘Something needs to be done about it. It’s unsightly. It’s been going on for three years now.’

Another local resident, who wished to remain anonymous, added: ‘It’s an absolute eyesore and bringing down the whole area which had been reduced to a building site’.

Google Street View images suggest the fencing has been up since at least June 2022.

The latest proposals had included a first-floor side extension, single-storey side extension and two-storey rear extensions.

Mr Raheel had apologised to neighbours following the planning meeting on March 27, saying the work had taken longer than expected.

In the meeting, he said: ‘We just want to improve the area and get on. It’s a family house, my mum and dad are supposed to come in and that’s why we want to extend the house. I just want to look after my mum and dad.’

The applicant, Harminder Singh Reehal, said he wanted to build the extension so his mother and father could live with him

The house in 2019 (left) and in June 2022, when the fencing was put up and the demolition works appeared to be underway

But when Mr Reehal told the committee he had demolished all but one of the walls on the old building, the council’s solicitor recommended an immediate deferral.

The solicitor said: ‘From what the applicant has just said, he has pretty much demolished his original building in which case it puts into doubt the 2021 permission and also puts into doubt everything you are reading tonight.’

Councillor Ellen Fenton said she was ‘very uncomfortable’ deciding on an extension when it appeared to be a ‘complete new build with one external wall from an old building’.

Ahead of the meeting, Sandwell Council’s planning officers had recommended the application should be approved.

A planning officers report said: ‘The development would have no significant impact on the amenity of surrounding residents and the design and scale would assimilate into the surrounding area; being compliant with development plan policy.

‘Whilst the unauthorised extensions and removal of the former verge is regrettable, the proposal builds on the principles set in the previous approval and seeks to rectify wrongs with a reasonable scheme to address the visual amenity issues.’

Australian big city house prices are tipped to surge by more than a third during the next three years with Sydney‘s median price set to hit the $2million mark.

The increases forecast between now and June 2027 would be even more significant than the price rises since the onset of Covid four years ago, which covered interest rates aggressively rising from record-low levels as immigration soared.

Oxford Economics Australia is forecasting that Sydney’s median house price will hit $1.934million by June 2027, with Perth reaching $1million.

The median price in Melbourne and Brisbane was also expected to reach seven figures during the same period as prices rise between a third and 43 per cent.

Even before the rate cuts, Australian investor lending has increased 13.3 per cent during the past year in a sign buyers fear missing out on more price rises, new official lending figures released on Monday revealed.

This means average-income earners on a $98,218 salary, and with plenty of savings for a 20 per cent mortgage deposit, are being urged to shop around now for a suburban house or inner-city unit under $640,000 to avoid missing out on the boom.

Until the Reserve Bank cuts interest rates, possibly from late 2024, banks are only able to lend a borrower 5.2 times their pay before tax.

But once the rate cuts start, banks will be able to lend more, leading to even higher prices, with values tipped to particularly soar at the more affordable end of the market.

‘The November 2023 cash rate hike to 4.35 per cent is expected to be the last this cycle, with the next movement downward,’ Oxford Economics Australia said.

‘Anticipated interest rate cuts from late 2024, overlaid by a sustained housing shortage, are set to accelerate price growth in 2025.’

Sydney’s median house price was tipped to hit a new record-high of $1.933million in just three years – up 36.7 per cent or $519,271 from last month’s $1.414million level, based on CoreLogic data (pictured is the Sydney Harbour Bridge as seen from Observatory Hill)

Australia’s net overseas migration level hit a record high of 548,800 in the year to September but Oxford Economics Australia is expecting that to slow to 410,000 in 2023-24 and 250,000 by the 2026-27 financial year.

‘Net overseas migration is driving the current surge in Australia’s population growth,’ Oxford Economics Australia said.

‘While three-quarters of new overseas arrivals enter the rental market, which relies on investor supply, there remains a channel that is adding to the competition for established properties.’

The more affordable end of the property market is tipped to soar as baby boomers downsize and those aged 30 to 45 look to escape rising rents.

‘Strong growth in rents is likely having a spillover effect, encouraging some households to enter owner-occupation,’ the report said.

Price rises are tipped to grow by at weaker pace in cities like Adelaide and Hobart, that boomed during the pandemic but no longer receive a huge influx of interstate migration.

Canberra, now Australia’s second most expensive capital city market after Sydney, was tipped to slip into fourth place behind Melbourne and Brisbane by mid-2027 – even with a typical house price in the seven figures.

Sydney

Sydney’s median house price was tipped to hit a new record-high of $1.934million in just three years – up 36.7 per cent or $519,271 from last month’s $1.414million level, based on CoreLogic data.

This would be an even steeper increase than the 25.4 per cent rise in Sydney property prices since early 2020, including the peak two years ago.

The city is so dear the median apartment price was tipped to be in the seven figures within three years, climbing by 29.2 per cent or $245,656 to $1.085million.

Inner-city unit values in particular were tipped to soar, as rental vacancy rates remained near historically-low levels.

‘Support factors include affordability pressures, migration patterns, and weak apartment completion volumes intensifying competition, especially for available inner-city apartments,’ Oxford Economics Australia said.

Australia’s most expensive city is only affordable for couples buying a home, with a single investor having to travel 115km north to San Remo on the Central Coast where $676,824 is the mid-point house price.

But Auburn, 22km west of the city, has a mid-point apartment price of $535,025.

Sydney receives the biggest influx of overseas migrants but also the biggest exodus to other states because it is too expensive for young people.

Brisbane

Brisbane, one of Australia’s strongest performing capital city markets since the pandemic, would see its mid-point house price climb by another $297,712, translating into a 32.7 per cent increase as the median house price rose to $1.208million, up from an existing record high of $909,988.

Oxford Economics Australia senior economist Maree Kilroy said strong interstate migration into south-east Queensland would boost Brisbane values.

‘Demand fundamentals are expected to remain strong, with Queensland positioned at the front of the pack in terms of population growth,’ she said.

‘The soft near-term supply outlook means pressure on the housing stock is set to endure, creating a strong platform for further growth once the current monetary policy tightening cycle reverses.’

Brisbane, one of Australia’s strongest performing capital city markets since the pandemic, would see its mid-point house price climb by another $297,712, translating into a 32.7 per cent increase as the median house price rose to $1.208million, up from $909,988

The Queensland capital however still has pockets of value, with flood-prone Rocklea just 12km from the city having a median house price of $639,980, compared with the Logan suburb of Beenleigh’s $609,503 and Caboolture’s $660,993, in the Moreton Bay area.

Melbourne

Melbourne, a slower-growing market since the pandemic, would see its median house price rise by 36.7 per cent or $343,451 to $1.278million, up from $935,049.

Investors hoping to buy on their own still have choices at Frankston North, 54km from the city, where the median house price is still $597,429 and Jacana, 25km north of the city where the mid-point is $550,716.

Perth

Perth, Australia’s best performer during the past year, was expected to be Australia’s best performing market during the next three years, with the median house price tipped to climb by 42.7 per cent or $314,124 to $1.049million, up from an existing record high of $735,276.

‘The Perth boom looks firmly entrenched,’ Ms Kilroy said.

‘Risk is firmly to the upside with it noted that the Perth property market has shown a propensity for significant upswings in price cycles that dwarf other markets.’

Bentley, just 10km south of the city, still has a relatively affordable median price of $656,141.

Adelaide

Adelaide’s median house price was tipped to rise by 21.4 per cent to $954,300, up $168,329 from a record high now of $785,971.

But beachside Taperoo has a more affordable mid-point of $672,901.

South Australia’s interstate migration is a lot weaker than the internal inflow into Queensland and Western Australia.

Melbourne, a slower-growing market since the pandemic, would see its median house price rise by 36.7 per cent or $343,451 to $1.278million, up from $935,049

Hobart

Hobart’s median house price was tipped to grow by 23.4 per cent or $162,749 to $855,700, up from $692,951.

Darwin

Darwin’s equivalent mid-point house price was tipped to rise by 21.2 per cent or $122,102 to $695,600, up from $573,498.

Canberra

Canberra, now Australia’s second most expensive capital city market after Sydney and ahead of Melbourne, was expected to slip into fourth place, behind Brisbane.

Oxford Economics is only expecting 21.2 per cent growth during the next three years as the median house price rose by $206,564 to $1.170million, up from $964,136.

But with public servants having higher pay, Canberra is in fact considered a more affordable property market compared with incomes.

Interest rates

While Reserve Bank interest rates are now at a 12-year high of 4.35 per cent, the futures market and the big banks are expecting a series of rate cuts in 2024 and 2025.

The Commonwealth Bank is expecting six rate cuts by June 2025, which would see the cash rate fall back to 2.85 per cent.

Perth, Australia’s best performer during the past year, was expecting to be Australia’s best performing market during the next three years, with the median house price tipped to climb by 42.7 per cent or $314,124 to $1.049million, up from $735,276

A borrower with an average, $598,624 mortgage would see their monthly repayments fall by $570 from $3,780 now to $3,210 as their variable rate fell to 4.99 per cent, down from 6.49 per cent.

The prospect of rate cuts is buoying lending with the value of owner-occupier loans soaring by 9.1 per cent in the year to February while investor mortgages went up by 21.5 per cent, new Australian Bureau of Statistics lending data released on Monday showed.

CommSec economists Craig James and Ryan Felsman said the 13.3 per cent annual surge in overall home lending showed buyers had a fear of missing out.

‘There is a general perception that interest rates have peaked, and this may be seeing greater urgency by home buyers to secure their purchase, fearful of a more significant influx of buyers when interest rates actually start their descent,’ they said.

America has a record number of ‘million-dollar cities’ – where the average house price now exceeds six figures, new data shows.

In total 550 US cities have an average property price of $1 million or above, up by 59 from this time last year.

The data from property portal Zillow lays bare how red-hot America’s real estate landscape remains after years of consistent growth.

California alone counts 210 ‘million-dollar cities’ – the highest of any US state and an increase of 12 from last year.

It was followed by New York, New Jersey and Florida which count 66, 49 and 32 respectively.

California alone counts 210 ‘million-dollar cities’ – the highest of any US state and an increase of 12 from last year. Pictured: a San Francisco home on the market for $1.49 million

In total 550 US cities have an average property price of $1 million or above. Pictured: a San Francisco home on the market for $1.49 million

The growth of luxury real estate has largely outstripped the general housing market, Zillow’s research shows.

While typical US home values have grown 4.2 percent compared to last year, those in ‘million-dollar cities’ had seen an average year-on-year increase of 4.6 percent.

New Jersey has experienced the biggest increase in cities where home values are over $1 million. It added 14 to its state in the last year.

Meanwhile New York, San Francisco, Los Angeles and Boston were the four metro areas with the highest amount of ‘million-dollar cities.’

It comes as America’s so-called ‘frozen’ property market shows signs of thawing as the number of new listings advertised on Zillow increased 20 percent between January and February.

Soaring mortgages have created a ‘lock-in effect’ as homeowners are reluctant to trade in the cheap 30-year fixed deals they secured before rates started rising.

Data from Government-backed lender Freddie Mac shows the average rate on a 30-year fixed mortgage is now 6.79 percent.

This is more than double where they were three years ago when they were hovering at 3.17 percent.

New York, San Francisco, Los Angeles and Boston were the four metro areas with the highest amount of ‘million-dollar cities.’ Pictured: a $1 million home currently for sale on Zillow in Boston, MA

An LA home for sale for $1.49 million on Zillow

The New York metro area had the largest amount of ‘million-dollar cities.’ Pictured: a $1.5 million apartment for sale in Manhattan’s Lenox Hill

It means a buyer purchasing a $400,000 property today faces monthly payments of $2,474. This analysis assumes a 5 percent downpayment.

However, had they bought in March 2021, this figure would be just $1,637 – a difference of $800 per month.

Yet a recent report by Zillow suggested housing activity was starting to uptick again.

Homes that sold in February spent an average of 17 days on the market – slower than during the homebuying frenzy of 2021 and 2022 but still much faster than pre-pandemic.

Experts are divided over where the housing market is now headed after they have remained surprisingly resilient.

Last week Shark Tank star Barbara Corcoran predicted even the smallest drop in mortgage rates would cause property values to shoot up.

She told Fox Business: ”If rates go down, just another percentage point, prices are going to go through the roof.

‘Everyone will come out and buy. There are probably 10 buyers on the sidelines [for each home on the market] waiting for interest rates to come down,’ she continued. ‘So everybody’s going to charge the market.’

Contrastingly, analyst Meredith Whitney recently told DailyMail.com that prices would soon fall as more and more Baby Boomers start to downsize -and free up inventory.

Whitney – who earned the nickname the ‘Oracle of Wall Street’ after accurately predicting the 2008 financial crash – said: ‘Around 90 percent of housing stock is owned by over 40s while 74 percent is by those over 50.

‘It makes logical sense that lots of these owners will start to downsize in the next decade. That’s almost 35 million homes – it’s a huge number to go through the system.

‘My advice to homeowners is: if you want to sell, you’re better off doing it sooner than later.’

A young woman who runs a successful property investing business has revealed how she had to choose between proper meals and cracking into the tough real estate investing market.

Maggie Zhang from Melbourne works as a healthcare management consultant and also runs her real estate venture, which now includes six properties, with a business partner.

Her purchases include her own Melbourne home, a unit in Heathmont that she is renovating with a friend, and rental properties in Broadmeadows and Frankston.

‘I was happy to eat brown rice, baby broccolis and chilli sauce for dinner for a year when things were tight rather than miss out on a property opportunity,’ Ms Zhang told real estate.com.au this week.

‘It wasn’t easy, but I’m very glad I did it.’

Maggie Zhang said she ate only brown rice and broccoli for about a year for dinner while she used her money to invest in property but that she is glad she did

Ms Zhang said the string of interest rate rises that were implemented between November 2020 November 2023 – which brought the cash rate up from a record low of 0.10 per cent to its current level of 4.35 – were particularly tough.

But she added that with inflation now appearing to ease, most economic analysts believe that interest rate cuts will happen this year, and that should make for better conditions for borrowers.

‘I think now is a really good time to get into the market, investors are really aware rate cuts are imminent although no-one knows when,’ Ms Zhang said.

All four big banks are forecasting the rate cuts, with CBA suggesting there could even be three 25-basis point reductions by the end of the year.

The bank’s head of Australian economics Gareth Aird said the rate cuts will be likely this year with inflation nearing the central bank’s target band of 2-3 per cent.

‘The six-month annualised pace of price increases on track to be 3.2 per cent for the current quarter … just outside the target band,’ he said.

He added the rate cuts would be required as the RBA’s focus shifted this year to concerns about the unemployment rate and consumer spending rather than inflation.

The high interest rates over the last few years have forced some landlords to sell up, which in turn has forced renters to look elsewhere for a roof over their head, making the rental market even tougher.

Research by Suburbtrends found that in January and February this year hundreds of ex-rental properties went on the market in Melbourne alone.

Mount Waverley had the most with 270, followed by South Yarra with 160, Point Cook with 122, Richmond with 108, St Kilda with 102, and Hawthorn with 93.

But despite the cost-of-living crunch and rate hikes, Australian homes added about $12,000 in value in the first three months of the year, fresh data has revealed.

CoreLogic’s latest data, released on Tuesday, shows that housing values so far this year were rising faster than the pace of growth that was occurring at the end of 2023.

However, that 1.6 per cent jump in the three months to March was half the 3.3 per cent quarter-on-quarter price rises that were occurring in the middle of 2023.

‘Rate hikes, cost of living pressures and worsening housing affordability are all factors that have contributed to softer housing conditions since mid-last year,’ CoreLogic’s research director Tim Lawless said.

‘However, an undersupply of housing relative to demand continues to keep upwards pressure on home values despite these headwinds.’

Every capital city apart from Darwin experienced an increase in house values in March which fell 0.2 per cent.

Ms Zhang advised interest rate cuts are on the way which will make for easier conditions for real estate investors (pictured is a Melbourne auction)

CoreLogic’s home value index has increased $71,832 or 10.2 per cent since January, 2023.

Regional housing markets are also booming, although Victoria stood out with a 0.3 per cent drop in home values.

Home sales across the country in the past three months were estimated to be 9.5 per cent higher in comparison to last year’s first quarter.

On rents, unit prices continue to rise faster than leasing a house, but the analysis shows a gradual narrowing of the gap between house and unit rental growth trends.

‘A rise in rental yields alongside an expectation that housing values could rise and rental markets remain tight for an extended period of time is likely to be seen as an attractive opportunity for property investors,’ Mr Lawless said.

However, he warned that with mortgage rates averaging six per cent, investors new to the market could expect to make a loss on their rental unless they ‘stump up a sizeable deposit’.