Friday, 26 April 2024, 12:14

After a slight drop in the third quarter of last year, the price of housing has risen once again in Malaga province, the latest data shows.

In the first three months of this year, the average price per square metre of a property for sale in the province including the Costa del Sol climbed to 2,412 euros, according to valuation firm Gesvalt. It is 1.2% more than the figure recorded at the end of 2023 and about the same figure as a year ago, when the valuer’s studies showed an average price of 2,419 euros per square metre. The data shows that the 4% drop in the prices of property for sale in Malaga province in the third quarter of last year was a one-off event.

Additionally, rental prices continue to soar in both Malaga city and throughout the province. According to Gesvalt data, the average rental price at provincial level is 14.32 euros per square metre, which is 13.5% more than a year ago and 3.2% more than three months ago.

However, the increase in rent is most noticeable in Malaga city, where the average cost has risen to 14.41 euros per square metre, 16% more than a year ago, according to the data.

In the city, the average price of housing for sale stands at 2,374 euros per square metre, which is 8% more than in the first quarter of 2023 and 2.5% more than in last year’s year-end report.

Upward trend to continue

According to Gregorio Abril, Gesvalt’s regional director for Andalucía and Extremadura, house prices in Malaga are set to continue “the upward trend of recent months, but at a more moderate pace than in recent years, tending towards stabilisation, after the slight slump in demand caused by successive interest rate increases and a general economic slowdown”.

“Once this phase has been overcome, and with the prospect of upcoming interest rate cuts, demand has once again been reactivated in a market that remains under pressure, pushing prices up again,” Abril said.

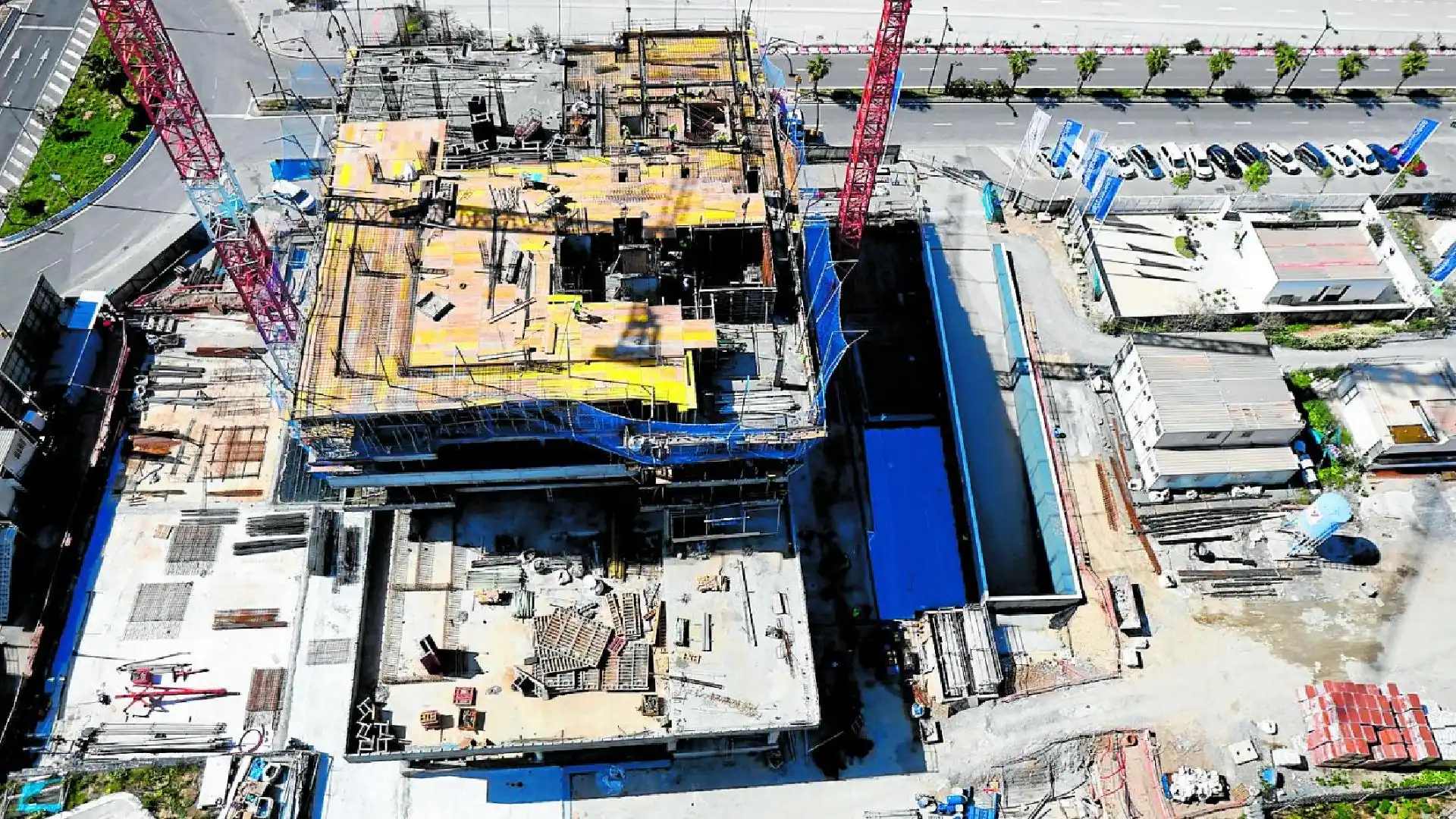

Malaga is one of the most active real estate markets in Spain, “the demand, both national and international is very active, compared to a supply that, despite the efforts of the city council and the great developer activity, is still insufficient to meet it”, the real estate expert added.

“All these factors lead us to believe that there will not be a change in trend in the coming months and it is not possible to foresee when price rises will slow,” he said.

As for the unstoppable rise in rent, Abril pointed out that this is a “more common issue than that of buying and selling”.

“While supply is more limited than for sales, there is a transfer of demand from the sales to the rental market, due to the number of house-hunters who are unable to afford to buy a home at current prices and decide to opt for renting. Our forecast is that the current trend will continue over the next few years,” he added.

Costa rentals

On the Costa del Sol, Marbella continues to lead in rental prices with an average of 18.8 euros per square metre, 12% more than a year ago. Also noteworthy is the rise in rent in towns such as Torremolinos and Benalmádena, possibly due to the increase of prices in Malaga city leading to a rise in demand for rentals in these neighbouring towns.

In the case of Torremolinos, rent has risen to 14.6 euros per square metre and is now at the same level as Estepona, with a year-on-year increase of 12%, the data shows.

At the other end of the scale Vélez-Málaga offers rents at half of the average registered on the Costa del Sol, with prices around 7.5 euros per square metre.

After a slight drop in the third quarter of last year, the price of housing has risen once again in Malaga province, according to the latest data.

In the first three months of this year, the average price per square metre of a property for sale in the province has climbed to 2,412 euros, according to estate appraisal firm Gesvalt. It is 1.2% more than the figure recorded at the end of 2023 and about the same figure as a year ago, when the valuer’s studies showed an average price of 2,419 euros per square metre. The data shows the 4% drop in the prices of property for sale in Malaga in the third quarter of last year was a one-off event.

Additionally, rental prices continue to soar in both Malaga city and throughout the province. According to Gesvalt data, the average rental price at provincial level is 14.32 euros per square metre, which is 13.5% more than a year ago and 3.2% more than three months ago.

However, the increase in rent is most noticeable in Malaga city, where the average cost has risen to 14.41 euros per square metre, 16% more than a year ago, according to the data.

In Malaga city, the average price of housing for sale stands at 2,374 euros per square metre, which is 8% more than in the first quarter of 2023 and 2.5% more than in last year’s year-end report.

According to Gregorio Abril, Gesvalt’s regional director for Andalucía and Extremadura, house prices in Malaga are set to continue “the upward trend of recent months, but at a more moderate pace than in recent years, tending towards stabilisation, after the slight slowdown in demand caused by successive interest rate increases and a general economic slowdown”. “Once this phase has been overcome, and with the prospect of the next interest rate cuts, demand has once again been reactivated in a market that remains under pressure, pushing prices up again,” Abril said.

One of most active real estate markets in Spain

Malaga is one of the most active real estate markets in Spain, “with demand, both national and international, very active, compared to a supply that, despite the efforts of the city council and the great developer activity, is still insufficient to satisfy it”, the real estate expert added. “All these factors lead us to believe that there will not be a change in trend in the coming months and it is not possible to foresee when price rises will be limited.”

As for the unstoppable rise in rent, Abril pointed out that this is a “more paradigmatic issue than that of buying and selling”. “While supply is more limited than for sales, there is a transfer of demand from the buying and selling to the rental market, due to the number of buyers who are unable to afford the purchase of a home at current prices and decide to opt for renting as a way of life. Our forecast is that the current trend will continue over the next few years,” he added.

Throughout the province, Marbella continues to lead in rental prices with an average of 18.8 euros per square metre, 12% more than a year ago. Also noteworthy is the rise in rent in towns such as Torremolinos and Benalmádena, possibly due to the increase of prices in Malaga city leading to an increase in demand for rentals in these municipalities. In the case of Torremolinos, rent has risen to 14.6 euros per square metre and is now at the same level as Estepona, with a year-on-year increase of 12%, the data shows. At the other extreme, Velez-Malaga offers rents at half of those registered on the Costa del Sol, with prices around 7.5 euros per square metre.

In terms of homes for sale in Malaga municipalities with more than 50,000 inhabitants, Marbella continues to lead the way with an average cost of 3,202 euros per square metre, followed by Benalmádena, with 2,423 euros per square metre. In contrast, in the eastern part of Malaga province, the price drops to 1,391 euros, according to the data.

Nashville restaurant group Strategic Hospitality recently announced that after over a decade at the 1711 Division Street location, both the Catbird Seat and the Patterson House will relocate to the Gulch. This coming summer, the award-winning Nashville restaurant and bar will take residence on the rooftop of the recently revitalized historic Bill Voorhees building in Paseo South Gulch.

Along with the move, the Catbird Seat will install two new executive chefs in its fifth iteration of the restaurant: Andy Doubrava and Tiffani Ortiz. The two are best known for their nomadic restaurant series Slow Burn, which is dedicated to the preservation of wild and sustainable ingredients.

Chef Brian Baxter, who has served as Catbird’s executive chef for the past four years, will remain with the restaurant until the summer move. However, both Doubrava and Ortiz will host a series of pop-ups offering a preview of what’s to come, including collaborative dinners with Chef Brian Baxter at The Catbird Seat. Reservations for the Catbird Seat are available here with walk-in availability at the Patterson House.

Union Teller Diner and Bar re-opens at the Fairlane Hotel

Union Teller, the Fairlane Hotel’s former lobby-level delicatessen, is back as both a diner and a bar serving all-day breakfast and lunch along with a new evening menu. Led by Executive Chef Angeline Chiang, Union Teller’s new menu highlights include a Big Boy Sando stuffed with four different deli meats, a salmon classic sandwich on a biscuit, stuffed French toast, sausage hash, and a bagel of the day with pimento cheese fondue. Union Teller Diner and Bar is open daily starting at 7 a.m.

A Lainey Wilson pop-up bar at Good Times

Country singer Lainey Wilson is behind a new three-day pop-up bar in downtown with Barmen 1873. Taking over Good Times (1529 4th Ave S.), the space will be decked out in Western flair and playing Wilson’s music. The bourbon-forward drinks include the Wildflowers Old Fashioned, the Wild Horses Manhattan, and the Buckle. The pop-up will be open April 5 to 6 from 6:30 to 11:00 p.m. and April 7, 2024, from 4:30 to 9:00 p.m. Tickets are $10 and available here — 100% of proceeds from the pop-up experience will go to Lainey Wilson’s charitable fund, Heart Like A Truck.

Blue Sushi Sake Grill opens a new location in Franklin

After two years at Fifth and Broadway, Blue Sushi Sake Grill has opened another location at the McEwen Northside complex in Franklin. The restaurant, which was designed in collaboration with Design Collective Nashville, features splashy elements like a backlit collage of a massive Godzilla in the lounge area and large geisha murals on the building’s exterior created by local muralist Eric “Mobe” Bass. As with its other locations, the menu features an assortment of rolls, sashimi, and Japenese-inspired dishes like the Cherry Bomb featuring bigeye tuna on top of rice tempura, topped with serrano, sriracha, togarashi, and ponzu sauce; a beef tenderloin served on sizzling rocks with jalapeno ponzu and yuzu kosho; and crispy Brussels sprouts tossed in a creamy lemon miso sauce and toasted cashews. Blue Sushi Sake Grill is open Monday through Thursday from 11 a.m. to 10 p.m., Friday and Saturday from 11 a.m. to 11 p.m., and Sunday from noon to 9 p.m.

Quick hitters:

- All-you-can-eat crawfish boil at Bringle’s Smoking Oasis: On Sunday, April 7 at 11 a.m., Bringle’s is partnering with Billy Link from Louisiana for a classic crawfish boil with drink specials throughout the day. Tickets are $45 and can be purchased here.

- Dine to Shine: Lighting the Night for Nashville Children’s Alliance: Nashville Children’s Alliance will host a fundraiser on Friday, April 5 at 6 p.m. featuring a multi-course dinner from local favorites like Noko, Sean Brock, Black Box Ice Cream, East Side Banh Mi, Butcher & Bee, and the Indigo Road Hospitality Group (Oak Steakhouse, O-Ku). Tickets are still available for $150 per person and can be purchased here.

By Kylie Stevens For Daily Mail Australia

23:39 24 Mar 2024, updated 01:25 25 Mar 2024

Australia needs 90,000 more tradies in the next 90 days in order to meet the Albanese government’s ‘impossible’ new goal to build 1.2million new homes in five years, the building industry has warned.

Major building industry groups have called out the Federal government’s plan – which would see the country construct 60,000 new homes each quarter from July 1 – as unrealistic.

One solution would be for Australia to boost immigration and fast-track skilled tradespeople, Master Builders Australia chief executive Denita Wawn suggested.

Ms Wawn said she was concerned ‘there is no way … we can get 90,000 (workers) in three months, unless we had a radical change in the way which we are looking at our migration system’.

Recognising tradies’ qualifications from other countries should be easier and cheaper, Ms Wawn said.

‘We know that there are a large number of tradies in this country that can’t get their licences recognised as it’s too expensive and too cumbersome for them,’ she said in an interview with Sunrise.

‘We have to focus on those who are currently in the country by their skills aren’t recognised.’

Ms Wawn also said there needs to be a massive push to skill up Australians and encourage them to work in the trades industry.

‘We really are focusing on school levers particularly but also those who want a career change to look at trade,’ Ms Wawn said.

‘Thirdly, as an industry, we need to retain the current tradies and call back the ones that have decided enough is enough.’

But she acknowledged finding 90,000 tradies in the next 90 days is unrealistic.

‘I think this figure reflects the difficulty that we’re going to have if we don’t resolve the tradie shortage in meeting the agreed target of 1.2 million homes over five years,’ she said.

‘The clock starts ticking on July 1 and we’ve got a huge, huge issue to resolve.’

Ms Wawn remained hopeful the government’s target of 1.2m new homes by 2029 can be achieved, despite only 170,215 new homes being built in the 12 months to September last year for 548,800 newly-arrived migrants.

‘We need to focus on how we can actually get there,’ she said. ‘The issue really is: how do we actually encourage more people into our sector?’

BuildSkills Australia executive director of research and planning Robert Sobyra said finding skilled labour will be the biggest supply-side barrier to addressing the housing supply crisis.

‘Returning the housing market to a healthy state will require a significant uplift in the national dwelling completion rate,’ he said.

‘While there are plenty of hurdles to overcome in achieving this goal, labour will be the single biggest supply-side barrier.’

Housing Minister Julie Collins said that while the government’s housing target was ambitious, it was getting on with the job.

‘We know we’ve got a lot of work to do,’ she told Sky News.

‘We’re working right across government – I know the skills ministers had a meeting just over two weeks ago, where they talked about the skills required to meet the housing demand in Australia and the challenges we currently have.’

A rise in modular housing or pre-fabricated homes common in Japan and Germany could see the housing supply fast-tracked.

Australian housing giant Mirvac is among the developers trialling modular housing construction in response to the crisis.

‘We’ve been able to reduce the construction of those homes to be watertight within 12 weeks,’ Mirvac chief executive of development Stuart Penklis told Nine News.

He added that modular housing doesn’t come with some of the challenges of a traditional build, such as supply chain shortages and severe weather disruptions.

Industry and Science Minister Ed Husic added that governments were working together ‘to take a serious look’ at modular housing.

‘Other countries have got their act together on modular housing and are seeing great jobs and great new homes – we want to be able to do that right here on shore,’ Mr Husic said.

Are home prices about to fall?

That’s the question many of us are asking after the National Association of Realtors, the trade group representing the industry, agreed to cough up $418 million as part of an antitrust lawsuit alleging that the group had artificially inflated realtor commissions that home sellers pay — which, in turn, helped inflate home prices.

Until now, home sellers paid about 6 percent of the sale price toward a fee that would be split between their own agent and the buyer’s agent. Experts are divided on exactly how much impact this will have on home buyers, who will now likely have to start paying their agents themselves. The median sale price of homes as of late 2023 was about $417,700 — 6 percent of that amounts to a little over $25,000.

As Business Insider’s James Rodriguez noted, lower fees don’t automatically mean homes will be cheaper. In certain cases, it’s possible that sellers might list their home for the same price they would have before the settlement, and pocket more of the sale. But lower commission fees can also encourage more homeowners to list their property on the market, which could lower house prices overall.

The fact is, this real estate settlement is still too new for anyone to know for sure what the ripple effects will be. But one potential winner is tech companies in the real estate space, such as Zillow and Redfin, which have made it more feasible for people to start the home-buying process on their own instead of with a real estate agent. Vox spoke to Sonia Gilbukh, a real estate professor at City University of New York, Baruch College, to explore some of the possible outcomes.

The following conversation has been edited for length and clarity.

What was the problem with the old way realtor commissions worked? And how does this settlement change that?

It used to be that when a seller hired their agent to list a property for sale, they were paying the full commission for the transaction, which was approximately 6 percent — sometimes 5 and a half. The selling agent would then offer about half of that commission to the buyer’s side. Then the buyer’s agent will bring their clients to show all the properties, and if they end up buying the house, [the buyer’s agent] would be entitled to that commission that the seller agent was advertising for the property.

There were several rules that were part of the NAR settlement. Can you explain the new rule that sellers can’t advertise buyer agents’ commissions on the multiple listing service, or MLS, the portal that many realtors subscribe to in order to share and receive information about for-sale homes?

Yes, so the settlement is that they can no longer say, “I’m going to offer the buyer agent 3 percent,” for example, or 2.5 percent. So now, what happens is that the buyer’s agent basically would have no way to know whether they’re going to be paid for the work that they do. So something will have to change. Most likely, the buyer agents will have to directly negotiate with the buyer on the commission that they’re going to receive on a transaction.

Is it still possible that the seller’s agent would pay the buyer agent’s fee?

I think if they really wanted to, they could still post it on their website — there are ways to communicate that. But I think it would be harder to sell that as an industry standard, to the seller. Because the way it worked before is that the selling agent would say, “If you want to sell your house, we have to offer the buyer agent 3 percent, the industry standard. If we don’t, then the buyer agents are not going to show your house to their clients and you’re not going to be able to sell.” Now I feel like it would be harder to make that argument.

I’m guessing that new ways of compensating buyer agents will emerge — maybe some flat fee services, or they’ll negotiate to get paid a percentage of the deal but out of the buyer’s pocket. I don’t think they’re going to be able to keep the status quo.

I’ve been seeing in various reports that the old system, of the seller paying both agents, incentivized a practice called “steering.” Can you explain what that is, and is it really common?

Steering is a practice where the buying agent will not show, or discourage their buyers from properties that offer lower commissions.

Maisy Wong, Panle Jia Barwick, and Parag Pathak have a paper called Conflicts of Interest and Steering in Residential Brokerage, and they show that when buyer agents are offered less than the industry standard, the homes have more trouble selling. That’s basically their conclusion, that the buyer agents are steering their clients away from homes that offer lower commissions to them. I think there’s some potentially alternative explanations — if you offer less commission than the standard, maybe you’re particularly hard to deal with, difficult to negotiate with. But we certainly do see that in the data, that if you’re offering less than the standard, you were potentially jeopardizing your sale outcomes.

The plaintiffs for this lawsuit were home sellers. Beyond lower fees, what does this mean for sellers? Are there other benefits for them?

Well, we don’t know what’s going to happen, but let’s say that they’re no longer responsible for the buyer commission, then the sellers are going to be paying a 3 percent transaction cost. Now, of course, most people who sell their house also then buy a different house — so they’re still going to be paying the buyer commission on the new house that they buy.

I think what’s going to come out of this decoupling of the commission — that the buyer is going to pay for their agent, the seller’s going to pay for their agent — is that the commissions are going to become more negotiable.

And what will happen for buyers? Will some of them forgo hiring a realtor at all? Will the process of searching for a home look different?

I was talking to my mother-in-law, who is a real estate agent, and she actually owned a brokerage before. She was telling me that she views buyers to be in one of two categories: Either you’re a first-time buyer, or you’re somebody who’s selling their house and also buying something else. Those who are selling and then buying, they probably have a relationship with their agents, they probably want their agents to help them buy. So it could be a similar scenario of the status quo for them, with the possibility of maybe shaving a little bit more off the commission.

For new buyers, I think the option of paying a flat fee is going to be more attractive, because it’s going to be cheaper for them to pay a flat fee of, say, $2,000 for you to help me navigate the paperwork or something like that.

Will this mean that home prices fall?

I think eventually, if the transaction costs are going to fall, because the commissions are going to become cheaper and more negotiable. That will put a downward pressure on houses — I also think that will bring more people to sell their homes, because the transaction fee falls, people are going to be more likely to move.

I see. But you said “eventually,” so it’s not necessarily something we might see right away.

Yeah, I think it’s hard to know what’s going to happen — how buyer agents are going to be compensated, and [if] we still have buyer agents at all. We’re in this period of murky transition. For now, it’s pretty easy to sell because there’s just not a lot of inventory. But there’s not a lot of transactions actually happening.

I’m curious why we used this structure in the first place. Why have sellers typically paid both selling and buying agents?

It became the industry standard [in a period when] we had no information out there. We didn’t have Zillow. So buyer agents had a monopoly on information; if I’m not compensated as a buyer agent, or if my compensation is uncertain, then I’m going to only show [clients] the listings where I’m also the seller agent. When the commission structure changed, it improved the cooperation between agents, so they ended up showing their clients listings from other agencies. So that was actually really good.

But of course, now we have Zillow. And the potential for [buyer agents] to steer their clients only to their listings is very limited right now. There’s sort of no need for this system anymore.

Since commissions have historically been paid as a percentage of the sale, did that incentivize agents to show more expensive listings?

For the selling side, they have the incentive to sell at the highest price, essentially. But when you talk to agents, their main objective is to have the transaction happen in the first place. If they put the price too high, they risk the transaction not happening at all, then it’s not really a good trade-off. There’s also this thinking that the big houses sort of subsidize the salaries of the agents, who then also work with cheaper homes.

Some experts seem to think that this settlement will mean some real estate agents exit the industry. Do you think that’s likely? And if there are fewer realtors, is that good or bad for home buyers?

I think that’s very likely. I think most new people who come into the profession start out as buying agents, so if their compensation is going to fall, it’s not going to be worth it for them to enter anymore.

I do think it’s a good thing overall. I actually have a paper, with my co-author Paul Goldsmith-Pinkham, about the experience of real estate agents, and we find that over a quarter of all agents in the market have no experience at all. I think those are the people most likely to exit. As a result, we’re going to have more experienced real estate intermediaries, and more competitive pricing. So I do think it’s overall a good thing for consumers.

What’s the housing market like right now? Is it a seller’s market or a buyer’s market?

I think it’s still a seller’s market, but it’s sort of artificial, because we still have pretty low inventory. So yes, houses are selling quickly, but mostly because there aren’t a lot of homes for sale. Once we’re past this lock-in period — right now, most of the homes have been sold on really low mortgage rates, so it’s hard for sellers to sell and buy something new, because mortgage rates are so much higher. But eventually people will start moving, and eventually they’ll be paying off their loans. So maybe eventually the [mortgage] rates will also drop.

What else is possible in terms of reform and change in the real estate industry?

They could just straight-up outlaw sellers paying buyer commissions — but the current settlement essentially all but does that.

Are there reasons other than the long-term possibility of lower home prices for sellers and buyers to get excited about this settlement? Just how important is it?

I think it’s important. I think there’s going to be more experienced agents out there to represent buyers and sellers. I think the prices are going to drop — a little or a lot, we don’t know yet — but I think they’ll have to adjust. I think there’s going to be more people willing to move homes because the transaction cost of doing that is going to be lower.

The point you make about more homes just being on the market — that seems huge, because as you said before, one of the biggest roadblocks we’re facing is low inventory.

Yes, yeah.

I do want to say that, even though I’ve done extensive research on inexperienced agents, I do think that experienced professionals are really valuable. People should seek help, because [buying a property] is the most important transaction in their lives, probably.

- It made its way to its spiritual home in Perthshire for the first time in 700 years

- It will be the centrepiece of the new £27 million museum which opens this month

It left the capital city to much pomp and pageantry befitting a sacred ancient relic.

However, the Stone of Destiny has now been driven to its new home at the Perth Museum in the most unceremonious of fashions.

The fanfare and high security operation put in place to transport the stone from Edinburgh Castle to Westminster Abbey for the King’s Coronation last May was certainly not adopted last week.

Instead, the relic was bundled into the back of a Transit van.

The historic sandstone slab has played a role in Royal coronations on both sides of the Border for hundreds of years, and will be the centrepiece of the new £27 million museum when it opens on March 30.

A small-scale farewell ceremony was held at Edinburgh Castle on Thursday to mark the departure of the stone as it made its way to its spiritual home in Perthshire for the first time in 700 years.

First Minister Humza Yousaf attended the ceremony in his capacity as a Commissioner for the Safeguarding of the Regalia.

But its arrival was somewhat anticlimactic, as the artefact was delivered to the museum in the back of a white van.

One onlooker called it ’embarrassing’, while another said they expected ‘such an iconic piece of history’ to have been delivered with some solemnity and with its return home being heralded by museum chiefs.

Perth businessman Iain Fenwick said: ‘You would have thought having spent £26.73 million there would have been more pomp and ceremony.

;However, I have been assured this is a deliberate tactic, and those with experience at Culture Perth and Kinross and Perth and Kinross Council know what they are doing.

‘Leaving everything to the last second, apparently, gathers the biggest crowds for free-to-attend events.

‘I’m looking forward to finding out what all of these events are.

‘All top secret right now, with two weeks to go.’

A council spokesperson said: ‘Arrangements remain on track for display of the Stone of Destiny in the new Perth Museum which opens to the public on March 30.’

The building now housing the Stone of Destiny has so far attracted just 500 followers on social media platform X, formerly Twitter, even though its grand opening will take place in less than two weeks’ time.

Despite the massive investment in the new home for the Stone of Destiny, it has so far failed to spark the imagination of the public.

The attraction, which is managed by quango Culture Perth and Kinross, will be hoping online follower numbers will spike once the venue officially opens. Free tickets for the opening weekend will be available to book from Friday at 10am.

The museum describes itself as a ‘world-class cultural and heritage attraction’ which will boast ‘objects and stories to put Perth and Kinross at the centre of Scotland’s story’.

The museum website says: ‘At its heart will sit the Stone of Destiny, also known as the Stone of Scone, one of Scotland and the UK’s most significant historical objects.

‘Returning to Perthshire for the first time in over 700 years, the Stone will be the centrepiece of the new museum.

‘Alongside the Stone, the Museum will display Perth & Kinross’s Recognised Collections of National Significance as well as iconic loans and exhibitions from the UK and abroad.’

OPINION

Q: We are a couple in our mid-50s. Our combined income only recently increased to $210,000. We each have around $70,000 in KiwiSaver. Minimal savings. In 2021 we purchased a two-year-old investment property in

- There are some 670,000 homes in Britain with a price tag of at least £1million

- Savills data found number of property millionaires fell by 8.3 per cent in a year

Some of Britain’s newly-minted property millionaires have lost their £1million home-owning status, according to a leading estate agent.

The number of £1million-plus homes in Britain peaked during the pandemic property boom, but has now slipped back after the race for space fizzled out and higher mortgage rates hit the market.

Savills said that at the end of 2023 there were an estimated 670,000 homes across Britain with a price tag of at least £1million, down 60,260 – or 8.3 per cent – on the year before.

However, this is still up 28 per cent – at an increase of 146,490 – compared to 2019, with most of the movement concentrated beyond the capital.

Britain’s £1million home market now stands at £1.32trillion, down from £1.43trillion in 2022, the estate agent said.

Lucian Cook, of Savills, explained: ‘The race for space and dash to the countryside from mid-2020 drove a sharp increase in the number of £1million homes outside of London and other urban settings.

‘However, increased mortgage costs and a rebalancing of demand back to city living have meant about 30 per cent of the those whose homes crossed the £1million threshold, have, for the time being at least, become aspiring million pound homeowners once again.’

London saw the smallest decrease in property millionaires last year – with a drop of 4 per cent, followed by Scotland, which was down 5 per cent.

Areas outside of London saw the most significant drop in property millionaires. But the number of £1million homes outside of London still remains 52 per cent higher than 2019.

Wales has seen an increase of 113 per cent, while the North East – where numbers are up 79 per cent -and the East Midlands – up 79 per cent – have seen the most significant uplift in housing stock valued at £1million or more over that period.

It follows separate analysis of £1million-plus sales by TwentyCI last year, which revealed that London locations continue to dominate the £1million map.

The boroughs of Kensington & Chelsea, Westminster, Camden, Hammersmith & Fulham and Richmond-Upon-Thames had the highest percentage of sales that were above £1million in 2023.

Indeed, London locations made up eight of the top 10 local authorities, joined by Elmbridge and Mole Valley outside of London.

Mr Cook added: ‘New one million-pound hotspots popped up across the breadth of Britain in the wake of the pandemic, as affluent home buyers changed priorities in the search for more space.

‘However in 2023, prime property prices held up stronger in the capital than across the rest of the country – down 1.1 per cent verses down 4.8 per cent – meaning London boroughs have been more easily been able to hold on to their share of £1million property sales.’

A square in the heart of Londonwas recently named as Britain’s most expensive place to live.

Mayfair’s Grosvenor Square led the Halifax annual survey of the most expensive streets in Britain, with an average price tag of £20.35million.

Heading west to the borough of Kensington and Chelsea in fashionable Notting Hill, Clarendon Road took second spot with an average price tag just shy of the £20million mark, at £19.96million.

Making up the top three – and home to world-famous luxury shopping destination Harrods – was London’s Knightsbridge, where properties cost an average £19.95million.

If a home on one of London’ priciest streets is top of the Christmas list this year, deep pockets will be needed, with the average price tag now £14.5million.

There’s nowhere quite like Grantley Hall. Not in its native Yorkshire, not in the north of England, not anywhere in the whole of the UK for that matter.

This is an ongoing project of such lavishness that apparently house prices in the area have risen by 20 per cent.

And it’s all due to Valeria Sykes who, following her divorce from the billionaire and Brexit-backer Paul Sykes, has spent an unconfirmed £100 million on saving this 17th-century mansion and turning it into a glitzy and glamorous resort hotel a few miles from Ripon.

Arriving after dark is a thrill, the driveway lit up, with the River Skell flowing beside it.

Handsome young men in tweed waistcoats greet us outside the front door — one takes the luggage (and it’s important to turn up with lots of luggage here), while another parks our car.

Then it’s a seat in the drawing room and a glass of champagne during check-in before being escorted to one of only 47 rooms (with more than 400 staff).

There are five restaurants, including Shaun Rankin’s Michelin-star outlet; a nightclub; casino; the swankiest of gyms (44 running machines, including one that’s underwater); cryotherapy chamber, Formula 1 car simulator; lifestyle consultant; indoor/outdoor pool in the Three Graces spa; a ‘snow room’; gift shop; Japanese garden and so on.

At times, it feels like Dubai. At others, it’s Claridge’s or The Dorchester — with prices to match.

Footballers and their wives come here to splash the cash, but most of the guests we meet are, like Ms Sykes, Yorkshire born and bred — and proud to have such a statement hotel in the county.

We eat in the Pan-Asian restaurant, EightyEight, in the basement of a separate building where there’s also a wedding reception area. This seems to be the brash part of the resort. Service is slow but apologies come thick and fast.

Generally, there’s quality at every turn — which makes me wonder why on earth so many paintings are fake copies of Old Masters in tinny frames. And there’s piped music almost everywhere.

Even in low season, you won’t get a room for less than £500 a night but, frankly, anyone who quibbles at the cost probably shouldn’t be here in the first place.

By A. James For Daily Mail Australia

23:24 05 Jan 2024, updated 23:28 05 Jan 2024

It was supposed to be one of the hottest property’s on The Block.

But Leah and Ash’s sprawling pad remains unsold after it was passed in during the show’s season finale in November for $2.9million.

Now after dropping the asking price from $3.2million to $3.125million, Realestate.com reports that listings for the lavish pad no longer mention The Block or the couple’s name.

Despite reports of multiple offers for the five-bedroom, four-bathroom Modern Art Deco home ahead of Christmas, the house has remained on the market.

In a strategic shift, Noel Susay, the agent from Buxton Hampton East handling the sale, confirmed to Domain a more ‘traditional campaign’.

This move comes after the post-auction period failed to secure a buyer, leading to a series of open inspections over the past weeks.

The agent also noted the challenges posed by the timing of the sale, with the year-end festive period typically seeing a slowdown in real estate transactions.

However, he remains optimistic about the shift to a traditional private sale campaign, hoping it will attract serious buyers.

Leah and Ash’s House 2 stirred up much excitement among potential bidders ahead of The Block’s auction in November.

The Block buyer’s agents predicted big things for the couple after the luxury home was listed with a price guide of $2.7million – $2.9million.

Designed as an updated version of the classic Art Deco-style, the spectacular dwelling features a spacious open plan, and expansive living areas.

Features also include a dramatic split-level dining/living room, an ultra-modern kitchen and al fresco entertainment area.

It comes after Yahoo Lifestyle reported in December that interest in the lavish retro home has ‘hit an all time low.’

A source told the publication that the longer the house sits on the market, ‘the further away an ending is in sight.’

The insider even speculated that it’s possible that the houses for the upcoming season of The Block will go under the hammer before Leah and Ash can get a buyer.