Friday, 26 April 2024, 12:14

After a slight drop in the third quarter of last year, the price of housing has risen once again in Malaga province, the latest data shows.

In the first three months of this year, the average price per square metre of a property for sale in the province including the Costa del Sol climbed to 2,412 euros, according to valuation firm Gesvalt. It is 1.2% more than the figure recorded at the end of 2023 and about the same figure as a year ago, when the valuer’s studies showed an average price of 2,419 euros per square metre. The data shows that the 4% drop in the prices of property for sale in Malaga province in the third quarter of last year was a one-off event.

Additionally, rental prices continue to soar in both Malaga city and throughout the province. According to Gesvalt data, the average rental price at provincial level is 14.32 euros per square metre, which is 13.5% more than a year ago and 3.2% more than three months ago.

However, the increase in rent is most noticeable in Malaga city, where the average cost has risen to 14.41 euros per square metre, 16% more than a year ago, according to the data.

In the city, the average price of housing for sale stands at 2,374 euros per square metre, which is 8% more than in the first quarter of 2023 and 2.5% more than in last year’s year-end report.

Upward trend to continue

According to Gregorio Abril, Gesvalt’s regional director for Andalucía and Extremadura, house prices in Malaga are set to continue “the upward trend of recent months, but at a more moderate pace than in recent years, tending towards stabilisation, after the slight slump in demand caused by successive interest rate increases and a general economic slowdown”.

“Once this phase has been overcome, and with the prospect of upcoming interest rate cuts, demand has once again been reactivated in a market that remains under pressure, pushing prices up again,” Abril said.

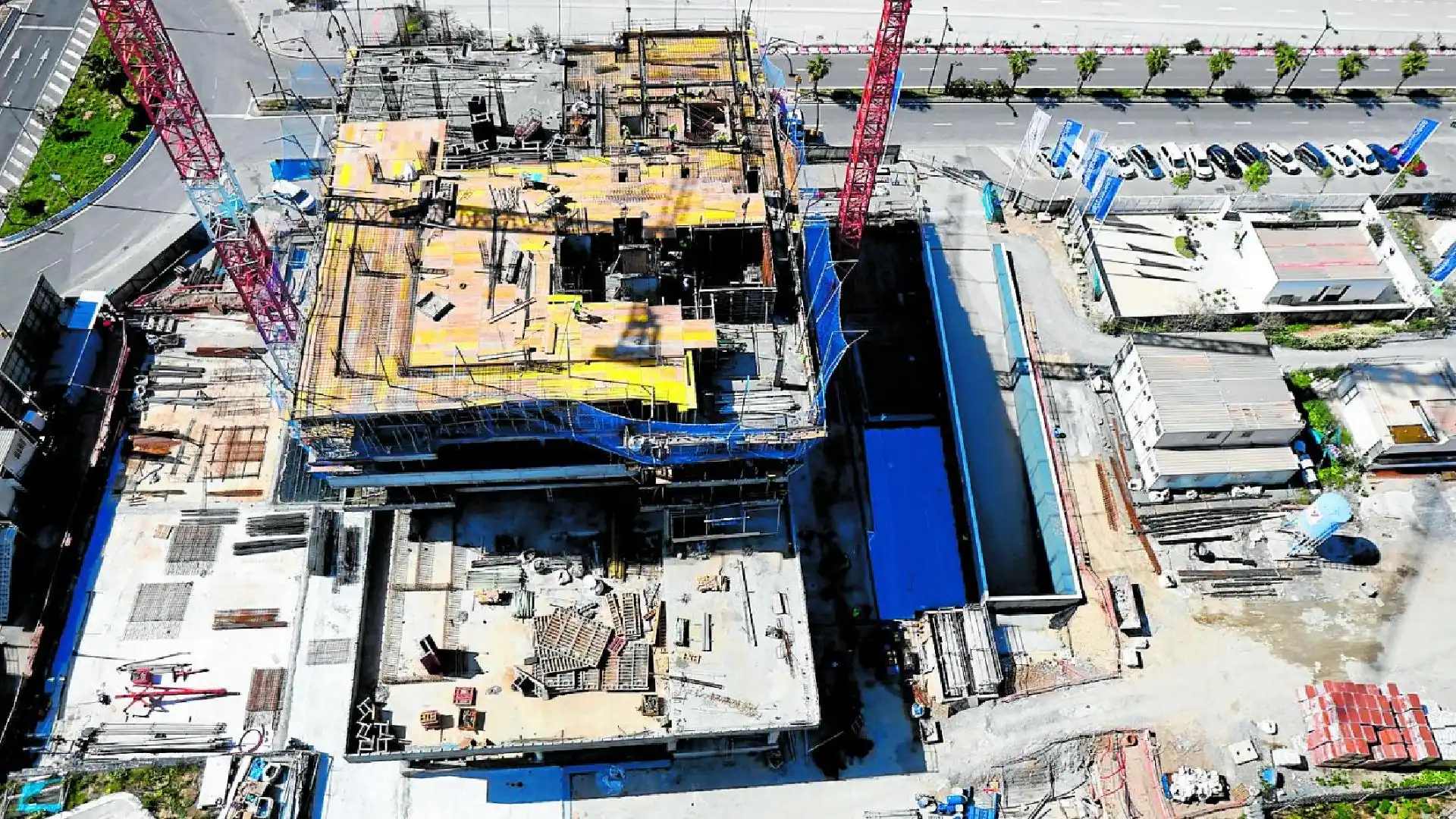

Malaga is one of the most active real estate markets in Spain, “the demand, both national and international is very active, compared to a supply that, despite the efforts of the city council and the great developer activity, is still insufficient to meet it”, the real estate expert added.

“All these factors lead us to believe that there will not be a change in trend in the coming months and it is not possible to foresee when price rises will slow,” he said.

As for the unstoppable rise in rent, Abril pointed out that this is a “more common issue than that of buying and selling”.

“While supply is more limited than for sales, there is a transfer of demand from the sales to the rental market, due to the number of house-hunters who are unable to afford to buy a home at current prices and decide to opt for renting. Our forecast is that the current trend will continue over the next few years,” he added.

Costa rentals

On the Costa del Sol, Marbella continues to lead in rental prices with an average of 18.8 euros per square metre, 12% more than a year ago. Also noteworthy is the rise in rent in towns such as Torremolinos and Benalmádena, possibly due to the increase of prices in Malaga city leading to a rise in demand for rentals in these neighbouring towns.

In the case of Torremolinos, rent has risen to 14.6 euros per square metre and is now at the same level as Estepona, with a year-on-year increase of 12%, the data shows.

At the other end of the scale Vélez-Málaga offers rents at half of the average registered on the Costa del Sol, with prices around 7.5 euros per square metre.

49.2% of Latvian residents expect real estate prices to go up in the next 12 months. This is slightly less when compared to results of a survey conducted last autumn, as reported by SEB Bank representatives with reference to SEB Housing Price Indicator.

13.4% expect housing prices to go down.

25.8% of Latvian residents do no expect real estate prices to change in the near future. This is slightly less when compared to last autumn.

11.5% of respondents had no opinion about the possible changes of real estate prices in the near future.

The highest share of people who expect real estate prices to go up still remains in Zemgale – 73%, which is not only the highest percentage compared to other regions, but also an increase of 10 percentage points since the autumn survey.

Latgale is next with 58% of residents who expect real estate prices to go up, Kurzeme – 46.5%, and Vidzeme – 44.7%.

Only 43.1% of respondents in Riga expect prices to go up.

The majority of the people who expect real estate prices to go down are in Vidzeme and Riga region – approximately 16.5%.

The value of SEB’s House Price Indicator – the difference between the number of predictors of house price rises and price falls – is slightly lower this spring than last autumn and accounts for 38.2 points.

Analysis of respondents’ responses in different socio-economic groups shows that the highest expectations of real estate price rises are among population aged 25–34 years – about 55%, as well as aged 18–24–54%. Similarly, students (65.5%), housewives (57.5%) and entrepreneurs (56.2%) are similarly inclined.

The least among those who expect real estate to become more expensive is among higher- and middle-level managers (36.8%).

Income-wise, the majority of the people who expect prices to up are among low and medium-size wage recipients – 59% and 53%. Among high and medium-high income earners, there are also those who expect the value of real estate to drop by 28% and 31%, respectively.

The fact that the expectations for the real estate market have slightly settled down is understandable, says SEB Bank economist Dainis Gašpuitis. The passed period was rather challenging for many households and the first signs of economic recovery were rather unconvincing at the beginning of the year. There was low activity on the market.

On the other hand, economists admit that while avoiding major shocks, the overall expectation of further price increases has remained quite high, including compared to changes in neighbouring countries. Nevertheless, Gašpuitis says the high level of expectations of prices going up indicates the return of rapid activity to the market. The optimism of the index is raised by groups whose involvement in the market is unlikely, they rather reflect the perception of the rapid increase in total cost.

“That is, respondents who are more optimistic than the average are with primary education, low income and live in the countryside. On the other hand, residents of Riga, middle or higher-level managers with high incomes have a much lower rating. It follows that the real estate market will continue to move positively, but not rapidly, and price recovery will be slow,” explains Gašpuitis.

The survey was conducted in March 2024 in cooperation with the SKDS research centre. 1 004 permanent residents of Latvia aged 18-75 were interviewed by the stratified random sampling method throughout Latvia, conducting face-to-face interviews at the respondents’ places of residence.

Also read: France hopes to use Greece’s air defence system at the Olympics

Inflation is not only cramping Americans’ food and energy budgets, but it’s taking a bite out of the housing market. The combination of high interest rates and high prices continues to stifle the residential real estate market. The latest data shows mortgage applications have dropped for three straight weeks, while the average rate on a 30-year fixed mortgage has risen to 6.82%, up more than a half-percent from a year ago. At the same time, the average home price in the U.S. is at a record high. “Taking into account mortgage rates, incomes, and house prices, affordability right now is strained at the worst levels in about four decades,” says Lance Lambert, CEO of the real estate analytics firm ResiClub, in a recent interview with Fox Business.

With limited supply keeping prices elevated and the Federal Reserve keeping interest rates high to counter inflation, the market is caught in the perfect storm for buyers and sellers. “A lot of home buyers can’t get in, and a lot of home sellers can’t sell and buy something else because they can’t afford those new monthly payments,” says Lambert.

Faced with this latest economic challenge in an election year, the Biden administration is doing what it does best: blaming someone else. The same administration that tried to blame high gas prices on greedy gas station owners, and high food prices on ‘price-gouging’ corporations, is now blaming high home prices on…you guessed it…greedy real estate agents. “They’re scapegoating,” says Lambert. “They act like lowering commissions would improve housing affordability…you know, going after soccer moms making $60,000 a year, because that’s the only job that works around their kids’ schedule.”

Rather than attacking realtors, the administration should be implementing policies to increase housing supply and reduce inflation, according to Lambert. “Putting in tax policy that works for new construction and not against new construction, lower fees on homebuilding, all the boring stuff that would increase supply in the long-term…that is what would improve housing affordability,” he says.

- ‘Disgusting’ landfill near estates in Stanway, Colchester, Essex making locals ‘ill’

Families living in an upmarket town with new £500,000 homes have been left fuming at the stench coming from a nearby landfill site.

Residents in Stanway, Colchester, Essex, claim to have become ill through the smell and say it is forcing them to want to leave the area and sell-up.

Hundreds are complaining about the issue, with many reporting the Bellhouse landfill site to the Environment Agency.

They claim the problems have gotten much more in recent weeks and have even dubbed the area ‘Stinkway’ as a result.

Others claim they have become unwell and compared it to life in ‘Victorian Britain’.

Some locals have already left, many want to or have paid thousands of pounds on air conditioning to get rid of the problem.

It impacts several estates in the area, including Hampton Park, built by Persimmon Homes.

Photos taken by Mail Online show the extent of the amount of rubbish at the site, which will continue to be used as landfill until 2026.

Charity volunteer Peter Dutch says a bad cough he has suffered in the last few weeks is as a result of the site.

The 53-year-old said: ‘It’s utterly horrific. I live only a few minutes away and it’s very constant.

‘The nickname we now have is Stinkway. It brings the area down. It’s a nightmare.

‘I’m worried about what it will do to the area, house prices and the general impression that people have.

‘It is just terrible. It has got a lot worse in the last few months and I am dreading the summer months. I can see it getting a lot worse and the heat bringing it out even more.

‘I am often now coughing very badly. It’s terrible. I often feel ill. I put it down to the tip.

‘Some women have also reported health problems and so have their children.’

Kurtley Lee, 33, bought a new property eight years ago with his partner Kailey, and says it has become a nightmare.

Now worth around £400,000, he is unsure if the couple will ever be able to sell it.

The quantitative surveyor told Mail Online: ‘It’s like a disgusting and constant sewage smell. It’s vile.

‘It dominates the area. Everyone is talking about it. It’s the only thing associated with the area.

‘It makes me feel sick a lot. The smell certainly never used to be this bad. It’s got worse over the last few months.’

Mr Lee said it seemed particularly bad in the evening.

He added: ‘I have no idea what can be done about it. It’s appalling.

‘I am very worried about what it will do to our house prices.’

Another local, whose home is valued at £450,000, says life was a ‘daily battle’.

The man, who has lived on one of the estates for four years, said: ‘I hate it. It’s soul destroying.

‘It’s like living in a zoo. The smell is awful and with summer approaching it will get much worse.

‘It’s Essex in 2024 and yet it feels like Victoria Britain.’

Margaret Simpson has lived in her £500,000 home for just eight months and says life has become a ‘living nightmare’.

The 45-year-old said: ‘We were assured it would not be a problem. People reading this will say well you moved next to a tip.

‘But the smell was not this bad when I first moved in. Now it is sheer hell. It is a living nightmare.

‘Sometimes I cannot sleep. It gives me very bad headaches. I often feel sick and I put it down to the tip and the smell.’

The finance executive says she knows of locals who have spent thousands on air conditioning units.

She added: ‘People have been taking drastic action. I am not sure where we’d stand if we tried to move, I think we would have to declare it.

‘Although anyone coming to view these properties would be able to smell it.

‘It’s disgusting. It’s like living right in the middle of the smelliest farm you can imagine.’

Mum Jolie Pearce, 38, claims her children have become unwell as a result.

She said: ‘One of my children has breathing difficulties and this has made it worse I believe. It’s horrible.

‘I am not sure why in the last few months it has suddenly become so much worse.

‘If I could move, I would. But I feel trapped. It’s a massive daily battle to not feel sick.’

The Environment Agency were approached for comment.

Enovert, which runs the site, was also approached for comment.

House prices fell for the first time in six months in March amid rising mortgage rates, according to Britain’s biggest mortgage lender.

A typical home now costs £288,430, around £2,900 less than last month, said Halifax.

The typical property value fell by 1% month-on-month, following a rise of 0.3% in February. Property prices increased by 0.3% annually in March, slowing from an increase of 1.6% in February.

Halifax mortgages director Kim Kinnaird said: “Affordability constraints continue to be a challenge for prospective buyers, while existing homeowners on cheaper fixed-term deals are yet to feel the full effect of higher interest rates.

“This means the housing market is still to fully adjust, with sellers likely to be pricing their properties accordingly.”

Read more: Easter brought new seller surge as property market rebounds

Markets are pricing in a potential first cut in interest rates by June, and a total of three quarter-point reductions by December.

Kinnaird predicted that the housing market will remain subdued this year: “Taking a slightly longer-term view, prices haven’t changed much over the past couple of years, moving in a narrow range since the spring of 2022, and are still almost £50,000 above pre-pandemic levels.

“Looking ahead, that trend is likely to continue.”

Analysts said the latest fall in house prices show that mortgage affordability has become “absolutely pivotal” to buyers.

Read more: When will interest rates fall and what should you do?

Imogen Pattison, assistant economist at Capital Economics, said: “The first decline in the Halifax house price index in six months confirmed that the slight rise in mortgage rates since the start of the year has caused house prices to stall.

“Looking ahead, we expect mortgage rates to remain higher than in January and February and hover at just under 5% over the coming months, which will subdue demand and prevent further gains in house prices. But given public house price expectations are positive, we doubt prices will fall much either.”

The average rate on a two-year fixed deal this week stood at 5.74%, while for a five-year deal, rates came in at 5.24%, according to figures from Uswitch.

Tom Bill, head of UK residential research at estate agent Knight Frank, said: “Since November, 10 weeks of recovery in the UK housing market have been followed by 10 weeks of drift.

“Mixed signals around inflation, rising supply and a wave of people rolling off sub-2% fixed-rate mortgages agreed in early 2022 mean the direction of travel for the property market is currently sideways. Once a rate cut appears firmly on the horizon and more mortgage rates start with a three, we expect stronger demand to push UK prices 3% higher this year.

“And if we are right to think that Bank Rate will be cut further than most forecasters anticipate, mortgage rates will fall to below 4% by this time next year, giving house prices a fresh boost.”

The Bank of England’s (BoE) decided to leave UK interest rates on hold at their current 16-year high of 5.25% for a fifth consecutive time.

Read more: Best UK mortgage deals of the week

Looking at the survey from a regional perspective, Northern Ireland remains the strongest performing nation in the UK, with house prices up by 4.3% on an annual basis, according to Halifax.

Properties in Northern Ireland now cost an average of £194,743, which is £7,972 more than a year ago.

In Wales annual property price growth slowed to 1.9% in March, from 3.9% in February, with the average home now costing £219,213.

Meanwhile house prices in Scotland rose 2.1% year-on-year to stand at £204,835.

In England, there is a clear north/south divide in when it comes to house prices.

The North West saw the strongest growth, up by 3.7% on an annual basis to £232,315.

Properties in Eastern England recorded the biggest decline of 0.9%, with homes selling for an average of £330,627, a drop of £2,878 over the last year.

London continues to have the highest average house price in the UK, at £539,917. Prices in the capital have increased by 0.4% over the last year.

Watch: Homeowners ‘should start feeling positive’ about selling their property, UK’s largest building society says

Download the Yahoo Finance app, available for Apple and Android.

The cost of homes within the eurozone fell by 1.1% during the last three month of 2023. However, within the EU overall, prices were slightly higher.

One of the countries hardest hit by a fall in property prices was Luxembourg where house prices slumped 14.4%, following a 13.9% fall in the preceding three months.

Within the eurozone, average house prices were down by 1.1% in the last three months of 2023 compared with the year before, according to the House Price Index, an indicator by Eurostat.

House prices for the European Union as a whole showed a slight climb of 0.2% increase for the year.

The results show that average prices are not dropping as much as before – the same index was down 2.2% and 1.1% in the eurozone and the EU respectively for the third quarter of last year.

The biggest drop in prices was detected in Luxembourg

Luxembourg property prices fell to their lowest level since the end of 2020. The drop was put down to a combination of high interest rates and rental investors losing their appetite. There was a significant decline in housing market transactions. These, by the end of 2023, were effectively half the number of deals done in 2022.

Eight countries in Europe reported falling house prices for the final three months of 2023, although less dramatic than Luxembourg’s. Prices in Germany dropped by 7.1% while Finland saw a fall of 4.4%.

The highest property price rises were recorded in Poland, where prices jumped 13%. Bulgaria and Croatia were next in line, with property prices showing a climb of 10.1% and 9.5% respectively.

Compared with the previous three months ending in September, prices were down in 11 countries in total. France saw a drop of 2.7%, while Latvia’s prices slid 2.5%. News from Italy was more cheerful as prices remained steady.

The highest increases during that period were recorded in Poland, up 4.8%, Croatia, up 3.4% and Ireland, which saw a 3% rise.

Housing prices in Latvia went up more rapidly in Q4 2023 when compared to the same period of the year prior. Prices grew by 1%, which is more rapid than the average housing price growth in the EU, according to data published by Eurostat for 26 member states.

The fastest year-on-year increase in housing prices was recorded in Poland (13%), Bulgaria (10.1%), Croatia (9.5%) and Lithuania (8.3%). In Estonia, house prices went up by 5.8%.

In general, housing prices in Q4 2023 went up in 18 EU member states for which data is available. The most rapid drop, however, was in Luxembourg (-14.4%), Germany (-7.1%) and Finland (-4.4%).

In EU member states, the average annual housing prices increased by 0.2% in October, while in Eurozone they decreased by 1.1%. On a quarterly basis, housing prices in the EU fell by 0.3% on average in the fourth quarter and by 0.7% in Eurozone.

In quarter-on-quarter terms, housing prices went down in 11 member states of the bloc, with the sharpest drop observed in France (2.7%), Latvia (2.5%), as well as Denmark and Sweden (2.3% in both), with the largest increases recorded in Poland (4.8%), Croatia (3.4%) and Ireland (3%), while in Italy they remained unchanged. In Lithuania, housing prices increased by 1.5% and in Estonia by 2.1%.

No data is available for Greece.

“The American dream of owning a house may be vanishing,” the U.S. Government Accountability Office said in a research report, “because of higher housing prices and a decline in housing affordability.”

“Many young, middle-income, and first-time home buyers can no longer afford to buy an existing house.”

The GAO released this dire news on May 11, 1978. The median selling price of a house “hit an all-time high of $44,300” in 1976, the GAO glumly reported.

Fast forward four and a half decades and the median price of a home in the fourth quarter of 2023 was over $417,000.

Get out of here, disco-era GAO. Your median-priced home would be slightly better than the median amount for a down payment these days.

Why are house prices so high?

Read more: How much house can I afford?

Historical housing prices

This graphic shows the steady rise of median home prices over the years, then the dramatic jump in prices beginning in 2020. Prices peaked in the fourth quarter of 2022 and then fell sharply.

This is about the best news a prospective home buyer today could look for. Prices seem to be moderating to a steady climb again rather than the previous hockey stick of growth.

Investors, seniors staying put, and fees contribute

The ongoing rise in home prices can be pegged to specific catalysts.

Real estate investors are snagging fixer-uppers and blocking family buyers. The U.S. housing supply is aging and in need of repair. The median U.S. home is over 40 years old, the Brookings Institution said in a recent analysis.

Investors, flush with cash to spend, often snatch up this inventory, renovate it, and put the houses on the rental market. Families looking to buy a home often lack the financial flexibility to compete.

Seniors are remaining in their larger homes rather than downsizing. Young families with children often look for homes with three or more bedrooms. That represents over 94 million American homes.

However, according to an Urban Institute analysis of the 2022 American Community Survey, more than half (56%) of those houses have only one or two occupants — most of whom are age 62 or older.

Another contributor to the high price of homeownership: fees. The Consumer Financial Protection Bureau is coming after lenders charging high “junk fees.” Home buyers face a mountain of charges when closing on a house. These can include origination fees, credit report fees, discount points, and many more.

“From 2021 to 2022, median total loan costs rose sharply, increasing by 21.8% on home purchase loans,” the CFPB said in a release. “In 2022, the median amount paid by borrowers was nearly $6,000 in these costs and fees.”

A 2021 study by Fannie Mae found that for more than 14% of lower-income homebuyers, their closing costs met or exceeded the amount of their down payment.

Learn more: Should I pay for mortgage discount points?

And you can blame the pandemic

Economists at the Chicago Federal Reserve suspect the pandemic also played a role in the latest inflation of house prices in three ways:

-

The pandemic led to many people spending much more time at home.

-

Historically low interest rates reduced the cost of mortgages.

-

Consumers spent less money and received federal stimulus payments that increased household savings available for down payments.

In the meantime, “supply chain problems and rapidly rising wages for construction workers led to higher homebuilding costs,” the Chicago Fed added.

Learn more: Buying a new construction home — pros, cons, and how to finance it

A tale of two house-price booms

Not all house-price run-ups are the same.

“There have been two U.S. house-price booms in the 21st century,” Lara Loewenstein, a research economist at the Federal Reserve Bank of Cleveland, wrote in a February 2024 analysis.

“The first, which occurred from about 2000 to 2006, preceded the Great Recession and was followed by a substantial fall in house prices and a spike in foreclosure rates. The second started during the COVID-19 pandemic, with annual house-price growth exceeding that of the 2000s boom.”

The difference between the two house price escalations is pinned to two factors, Loewenstein believes:

-

Single-family home construction has lagged in the 2020s

-

Meanwhile, the number of new households has exploded

“The number of households grew by 3% every three years until 2004, after which it slowed during the peak years of the 2000s boom and then declined further to 1% during the Great Recession. By contrast, the 2020–2022 period saw the highest rate of household formation in recent history,” Loewenstein noted.

Perhaps most importantly, the mortgage rate lock-in effect

“The most noteworthy feature of the housing market right now is the rate lock phenomenon — the fact that all these homeowners have low-interest-rate mortgages,” Dr. Paul Willen, senior economist and policy adviser with the Federal Reserve Bank in Boston Research Department, tells Yahoo Finance.

In January 2024, nearly half (47.9%) of homeowners with a mortgage backed by Fannie Mae or Freddie Mac had an interest rate of 3.5% or lower, according to research by the Urban Institute. At the same time, the average interest rate for a new 30-year fixed-rate mortgage was 6.6%.

To get an existing homeowner with a low interest rate to sell, “you would need to pay them a lot more. So that’s locked up the market for all but the people who are kind of forced to move,” Dr. Willen says.

Research published in March 2024 by the Federal Housing Finance Agency shows that for every percentage point that market interest rates exceed a homeowners’ existing mortgage rate, the probability of a sale decreases by more than 18%.

The mortgage rate lock-in led to a 57% reduction in home sales with fixed-rate mortgages in the fourth quarter of 2023 — and increased home prices by 5.7%, the FHFA study said.

Dig deeper: 5 strategies to get the lowest mortgage rate

What it will take to slow the rise in home prices

Dr. Willen says there will be older, empty-nester homeowners looking to downsize who ultimately realize there is more to the cost of homeownership than a low mortgage interest rate.

“I think right now, there’s a certain amount of shock associated with the fact that rates are so high. But remember, mortgage interest is just one component of the cost of owning a house. There’s taxes, insurance, utilities, all that stuff.”

“I think what will unlock this, in a sense, at the very least, is time,” Dr. Willen says.

Buying a house when prices are high

The graphic up top attests to the long-term price appreciation of houses in America. When you own a home, that’s a very good thing. You’re slowly building equity in your house. You don’t want that to end.

If you were shopping for a house from mid-2020 through the end of 2022, you may have been embroiled in an overheated market. If you sold your house during that time, you’re probably smiling.

Is this a good time to buy a house? It’s important to remember that regional differences in home prices remain an important factor to consider. But the reversion to the mean since 2023 should make potential home buyers feel better about their prospects of getting a fairer price than they might have a couple of years ago.

- House prices in Cornwall fell by 1.3% in December, more than regional average

The property market boom in Cornwall has come to an end after the market which soared during the pandemic has now cooled, with prices falling by nearly 1.5 per cent.

Houses and flats in Cornwall are now selling for less compared to last year, and can take over two months to sell, as estate agents struggle to find buyers – and one six-bed family home had to drop its asking price from £750,000 to £695,000.

Since 2019, the average property price in Cornwall increased by 35 per cent to £313,420, according to estate agents Hamptons.

But prices fell rapidly last year by 1.3 per cent in December, more than the fall in the South West of 0.5 per cent.

Properties took 77 days – around two-and-a-half months – to sell on average last year, which is the longest sell time in since 2015, Hamptons say.

According to analysis by PropCast, which studies the proportion of properties for sale that are under offer, Cornwall is now a buyer’s market for the first time since Covid.

Around 31 per cent of properties for sale are under offer at present, which is a fall of eight percentage points since the same month last year, The Telegraph reports.

Properties wait around longer up for sale and are more likely to have the price slashed.

Sellers have had to bring prices down to cope with the changing market. A six-bed detached house on the Lizard Peninsula saw its price fall from £750,000 to £695,000 – by £55,000 – from August to December last year.

A four-bed detached house with its own pool in St Mawgan had its asking price dropped from £1.5million to 1.25million from July to February. And a two-bedroom cottage in the same part of Cornwall has had its asking price slashed twice since December from £525,000 to £499,000.

In Cornwall, 3.2 per cent of properties up for sale had a price reduction of five per cent or more in the four weeks to March 17, which is less than than a year prior, according to property website Zoopla.

But house buyers have noticed, and the total sales agreed in the first eight weeks of this year is 23 per cent higher than last year, according to Savills who have used TwentyCi data.

Buyers and sellers are reportedly now adjusting to the ‘new normal’ of five per cent interest rates and some are fed up of waiting around, Robin Thomas of Recoco Property Search told The Telegraph. He told the paper that he has had his first two clients – cash buyers with budgets more than £1.5million – in Cornwall in three months.

He said that last year there was a ‘huge divergence’ between what sellers expected to sell for and what clued-up buyers were willing to pay which caused blockages in the market.

Mr Thomas said there has now been a price adjustment and that many properties worth over £1million are going on sale ‘off-market’.

But the coast of Cornwall is the most popular places for clients of First In The Door founder Claire Whisker, which matches house buyers with agents.

She told The Telegraph that more people are moving to Cornwall rather than buying holiday homes. She said there was an increase in housing stock and buyers are getting reductions in the asking price, which did not happen in 2022.

And Savills has found that the high-end properties have dropped off in price even moreso, with the price of the most expensive homes falling by 8.7 per cent in the year to September 2023 – higher than the 6.5 per cent average for coastal locations in the UK.

Jonathan Start, of Start & Co, told The Telegraph that for properties below £500,000, the market is more active as buyers think that prices are unlikely to fall further, after a 10 to 15 per cent fall since 2022.

The reduction in the higher rate of capital gains tax on residential property sales from 28 per cent to 24 per cent, and the removal of tax reliefs for some holiday lets could lead to a decline in people entering the holiday home business, Josephine Ashby, from agents John Bray & Partners told The Telegraph.

Homeowners are leaving the high prices of the capital in favour of Britain’s Industrial Revolution cities, MailOnline can reveal.

Thousands of people are ditching London and instead looking to buy homes in cities such as Leicester, Glasgow, Sheffield and Bradford.

There were more than 75,000 searches for ‘homes for sale’ in Glasgow in the last 90 days – nearly double the interest in London, data from Purplebricks showed.

Second on the list was Sheffield with 61,000 searches, followed by 58,000 searches for properties in Bradford, once a hotbed of Britain’s textile trade.

Some 52,000 searches were made for the industrial giant of Leicester, and 43,000 for the Welsh port city of Swansea, less than 10 miles from towering steelworks in Port Talbot.

Manchester, Liverpool, London, Stoke on Trent and Birmingham all feature at the top of the table, receiving more than 30,000 searches since mid-December.

Housing expert David Hall told MailOnline: ‘Anywhere that has a developed infrastructure for transport is a model for somebody to look for cheaper prices.

‘In London [there are] eye-watering prices for properties.

‘You will see loads more of [people leaving London] in major towns and cities in the UK coming soon.

‘Don’t forget the interest rate rises for mortgages. Anyone who was looking to get a mortgage who thought for one minute they were going to get one for primetime in London has realised that’s not going to happen.

‘When you’re at 4.5 per cent, you have to move outside the city to be looking at something that’s affordable.’

Leaseholds expert Linz Darlington added: ‘There is a real appetite to move out of the capital.

‘While people love the hubbub of the city, London is incredibly expensive, particularly to buy a property in.

‘During the pandemic, people realised that London wasn’t the be-all and end-all.’

Here, MailOnline takes a look at some of the most popular places outside of London where house hunters are looking to buy properties…

Glasgow

The Industrial Revolution poured wealth and prosperity into Glasgow, turning a relatively small town into a giant of the British Empire.

Now over £5billion of new investment is set to transform the Clyde waterfront over the next 25 years.

This four-bed semi-detached home on Leithland Road in Pollok is available to buy for £185,000.

Homeowners in Glasgow have enjoyed a 4.3 per cent rise in property values, according to the latest House Price index – one per cent more than the 3.3 per cent increase seen across Scotland in the 12 months up to December.

Some see Glasgow properties as a great investment with average homes priced at £183,494, some £6,500 lower than the Scottish average and more than £150,000 cheaper than the average home in Edinburgh.

Sheffield

This three-bed home located in a desired cul-de-sac in Sheffield is on the market for £220,000.

While steel was once the main industry in Sheffield, South Yorkshire, the city is now seen as a superb employer in the tech and creative sectors.

Sheffield house prices bucked the national trend by increasing 4.9 per cent in the last 12 months, making the average property worth around £220,000.

It means they are around £82,000 cheaper than the average in England.

Sheffield’s central location in the UK means it is ideally located for travel and accessibility and has national and international connections.

Bradford

Nestled in a quaint neighbourhood, this charming two-bed terrace £180,000 house presents an enticing opportunity for families seeking a place to call home.

Bradford was once known as the wool capital of the world.

Worth £11.6billion, Bradford’s economy is now powered by advanced engineering, chemicals, automotive components and food manufacture alongside financial services and digital technologies.

The West Yorkshire city also bucked the national downward trend, with homeowners enjoying a 0.7 per cent annual increase, with the average property costing £173,337 – nearly half the national average.

Leicester

This £230,000 two-bedroom semi-detached house in Leicester, boasts three reception rooms.

Leicester’s industrial success took place in the 20th century, led by the success of its hosiery and footwear industries.

While manufacturing has been in decline across the UK in recent decades there are many modern industries thriving in and around Leicester, beyond its traditional textile trade.

The city boasts industries ranging from professional and financial services, advanced manufacturing and engineering to life sciences, space and digital technology.

Leicester has been ranked as the top city in the East Midlands to live and work as part of an influential nationwide industry report.

The average house price for the area is still below the national average at £232,324, but more expensive than nearby Birmingham at £228,877 and Nottingham at £192,298.

Swansea

This modern semi-detached two-bedroom house, located in the sought-after area of Sketty, is on the market for £190,000.

Swansea has a proud industrial heritage centred on coal, manufacturing and heavy industry.

Today, a large proportion of the economic growth is provided by public administration, education and health.

With the average price of a house at £196,000, Swansea is an affordable option for those looking to get on the property ladder, and nearly £20,000 cheaper than the Welsh average of £214,000.

Homeowners in the city saw a 0.8 per cent rise in the value of their properties in the last 12 months, despite a downturn of 2.5 per cent across Wales.

However, the port city is braced for a huge financial and social fallout after Tata confirmed plans to close two blast furnaces at nearby Port Talbot in January this year. The move is expected to cost of 2,800 jobs.