Friday, 26 April 2024, 12:14

After a slight drop in the third quarter of last year, the price of housing has risen once again in Malaga province, the latest data shows.

In the first three months of this year, the average price per square metre of a property for sale in the province including the Costa del Sol climbed to 2,412 euros, according to valuation firm Gesvalt. It is 1.2% more than the figure recorded at the end of 2023 and about the same figure as a year ago, when the valuer’s studies showed an average price of 2,419 euros per square metre. The data shows that the 4% drop in the prices of property for sale in Malaga province in the third quarter of last year was a one-off event.

Additionally, rental prices continue to soar in both Malaga city and throughout the province. According to Gesvalt data, the average rental price at provincial level is 14.32 euros per square metre, which is 13.5% more than a year ago and 3.2% more than three months ago.

However, the increase in rent is most noticeable in Malaga city, where the average cost has risen to 14.41 euros per square metre, 16% more than a year ago, according to the data.

In the city, the average price of housing for sale stands at 2,374 euros per square metre, which is 8% more than in the first quarter of 2023 and 2.5% more than in last year’s year-end report.

Upward trend to continue

According to Gregorio Abril, Gesvalt’s regional director for Andalucía and Extremadura, house prices in Malaga are set to continue “the upward trend of recent months, but at a more moderate pace than in recent years, tending towards stabilisation, after the slight slump in demand caused by successive interest rate increases and a general economic slowdown”.

“Once this phase has been overcome, and with the prospect of upcoming interest rate cuts, demand has once again been reactivated in a market that remains under pressure, pushing prices up again,” Abril said.

Malaga is one of the most active real estate markets in Spain, “the demand, both national and international is very active, compared to a supply that, despite the efforts of the city council and the great developer activity, is still insufficient to meet it”, the real estate expert added.

“All these factors lead us to believe that there will not be a change in trend in the coming months and it is not possible to foresee when price rises will slow,” he said.

As for the unstoppable rise in rent, Abril pointed out that this is a “more common issue than that of buying and selling”.

“While supply is more limited than for sales, there is a transfer of demand from the sales to the rental market, due to the number of house-hunters who are unable to afford to buy a home at current prices and decide to opt for renting. Our forecast is that the current trend will continue over the next few years,” he added.

Costa rentals

On the Costa del Sol, Marbella continues to lead in rental prices with an average of 18.8 euros per square metre, 12% more than a year ago. Also noteworthy is the rise in rent in towns such as Torremolinos and Benalmádena, possibly due to the increase of prices in Malaga city leading to a rise in demand for rentals in these neighbouring towns.

In the case of Torremolinos, rent has risen to 14.6 euros per square metre and is now at the same level as Estepona, with a year-on-year increase of 12%, the data shows.

At the other end of the scale Vélez-Málaga offers rents at half of the average registered on the Costa del Sol, with prices around 7.5 euros per square metre.

Shutterstock Images.

Shutterstock Images.Like most Boomers, I’ve both bought and sold a house. But still couldn’t pretend to comprehend all the economic forces at work that make the housing market function. So when I downsized last year:

If the conversations between myself, my devoted Irish Rose and either the realtor or the mortgage broker got too complicated for this state college grad, I would politely ask them to dumb it down and don’t be afraid to talk to me like I’m four years old. Then remind them that everything I understand about real estate I learned from Margot Robbie in a bathtub:

Fortunately, we do have people who understand the complexities of all the forces exerting pressure on the market. The myriad of factors affecting this most essential part of The American Dream.

And this one particular expert, who has displayed a genius for predicting disasters in the past has declared another one is coming. And it doesn’t take Robbie covered in bubble bath to know the root cause is dudes not getting laid enough:

Source – A financial analyst nicknamed the ‘Oracle of Wall Street’ has said a ‘growing crisis of the young American male’ will cause house prices to fall as much as 30 percent.

Meredith Whitney, who earned the title after predicting the financial crisis of 2007 – 2008, suggested young men increasingly living with their parents and disinterested in starting families will drastically reduce housing demand.

The trend of men refusing to settle in turn means more women are remaining single into later life, leaving them without the income or need for big family homes.

But it comes as baby boomers start to downsize, meaning there will be a surplus of available properties. Much of the last decade’s gains in home values have been driven by high demand and low supply – a phenomenon, Whitney says, is reversing.

To explain the rise in men living at home, she pointed to the increasing prevalence of video games, starting in the mid-2000s. …

Whitney cited US Census Bureau data showing that before the financial crisis around 13 percent of men aged between 25 and 34 lived at home. …

The data also shows that young women have consistently been around twice as likely to leave their parents’ homes. Last year, just 12.3 percent were still at home. …

‘The biggest driver of home prices has historically been household formation,’ Whitney told DailyMail.com. ‘Household formation today is the lowest it’s been in 160 years.’

And household formation, she said, is driven by the ‘five Ds’ – ‘diamonds, diapers, divorce, debt, and death.’

‘Without at least the first two Ds, there’s no reason to buy a home,’ she said.

Before we get into this, a definition is in order:

Oracle or-e-kel – A person (such as a priestess of ancient Greece) through whom a deity is believed to speak. A person giving wise or authoritative decisions or opinions

In the world of Ancient Greece, no great decisions could be made without first consulting the Oracle of Delphi. And it’s clear that Meredith Whitney earned the nickname by predicting the housing crash that everyone but her and the Christian Bale character completely whiffed on.

So what the actual? She’s seeing another one coming because Gen Z has decided to … what, exactly? Stop trying to meet women? Reverse the entire process that has driven all living things since we were just single-celled microorganisms floating around in the primordial soup? The drive to have sex and pass on your genes? They’ve traded in the most powerful instinct in nature – the desire to procreate the species – for 8 hours a day of chasing zombies through a wasteland in Fallout?

Listen, I’m the last guy to use the played out Boomer trope of the guy “living in his mom’s basement.” That’s a tired, lazy stereotype best left for sports radio hosts who have contempt for their audience. But here it is coming directly from one of our most brilliant economists. Her depiction, not mine. And apparently it’s statically proven to be about to tank our entire way of life.

Look, I’m a Live and Let Live kinda guy. If you’d rather slap hookers or whatever you do in GTA than leave the house and try to find actual flesh and blood women who are sexually attracted to you, that’s not my concern. Go live your life. I might not think it’s a life worth living and will judge you quietly to myself, but you do you. (And if that’s you, you’re literally doing yourself.) You have the right to squander your existence and never take a desirable female to the summit of Bone Mountain all you want.

That is, until it starts to affect me. And I say this for all Boomers. I didn’t come this far and invest my entire net worth into my home just to lose it all to a bunch of people I’ve never met who’d rather sit at home on their Playstations, getting fed by their moms and the Doordash guy, instead of going out, being fruitful and multiplying.

Yours has got to be the first generation in human history to get criticized for NOT being obsessed with sex enough. And it’s time you get off the bench and into the game. The great coach called America is sending you in. You owe it us to put down the controllers, climb out the gaming chairs, get out to the bars and clubs and start doing what comes naturally. The financial health of your country – and me in particular – depends upon you to quit being such pusses and start making the babies, already.

It’s not a big ask, afterall. It’s not like your great grandfathers being handed rifles and told to storm Omaha Beach or Iwo Jima. Now get out there and do your patriotic duty. We’re counting on you.

Southern California home prices hit a record in March amid sky-high mortgage interest rates, a combination that’s creating the most unaffordable housing market in a generation.

The average for the six-county region reached $869,082 in March, according to Zillow. That’s up 9% from a year earlier and 1% higher than the previous all-time high in June 2022.

With rates hovering in the upper 6% range, the mortgage payment on the average home now tops $5,500 — if you can put 20% down.

“It’s bananas,” Tommy Kotero, a 43-year-old refinery worker, said last weekend after touring a dated, $899,000 house in north Torrance with visible cracks in the ceiling and walls. “The asking prices for what we are getting is crazy.”

How home prices hit a record despite the high cost of borrowing is a tale of too few homes for sale, combined with a wealth gap that has equipped some buyers with reams of cash that negate the effect of high rates.

When interest rates first soared in 2022, buyers backed away en masse, inventory swelled and home prices dropped.

Then potential sellers all but went on strike, with many deciding they didn’t want to move and trade their sub-3% mortgages for a loan at more than double that rate.

Inventory plunged and enough buyers returned to send home prices back up. Many of these buyers are well-heeled first-timers who aren’t ditching a low-cost mortgage.

Others are holding on to their old home and buying another. Still more are selling their old home and turning their considerable equity into hefty down payments well over 20%.

“People who have cash are not paying too much attention to interest rates,” said Alin Glogovicean, a real estate agent with Redfin who specializes in northeast L.A.

He estimates that in about one-third of his deals a buyer is paying all cash. Another third put down at least 50%, with a mortgage on the rest.

At least two-thirds of the buyers with down payments of at least 30% aren’t investors but people who want to live in the home, he said. They are professionals such as architects and Hollywood types who have saved, liquidated stock portfolios, built up equity or received help from family.

Some are willing to dip into retirement savings — a strategy many financial experts advise against.

Nationally, similar trends are afoot, according to a Zillow survey, with the share of home buyers putting at least 20% rising, as well as those who received help from family and friends.

In all, 23% of L.A. County homes sold in February were bought with all cash, up from 16% in 2021, according to Redfin.

For those without access to a spare half-a-mill, times are tougher.

According to the California Assn. of Realtors, only 11% of households in Los Angeles and Orange counties could reasonably afford the median-priced house during the fourth quarter, the smallest number since the housing bubble of the mid-aughts.

At that time, risky lending practices allowed people to buy homes they couldn’t really pay for. Today, lending standards are far tighter, which economists say should prevent a similar collapse in prices if there’s another recession.

Across the region, home prices have now set records in Orange, San Bernardino, San Diego and Ventura counties. In Los Angeles and Riverside counties, prices are less than 1% from their all-time highs.

Agent Alicia Fombona of United Real Estate Pacific States works across the Southland — from the coast to the Inland Empire. Amid high rates and high prices, she said, one strategy that’s growing more popular is co-borrowing: family and friends coming together to buy a house or duplex to keep payments somewhat affordable.

“Everybody needs a place to live and there is not enough housing for everybody,” Fombona said.

More homes are starting to come onto the market, but inventory is still tight and expected to remain so, according to forecasters. Rates may drop somewhat but are expected to remain elevated.

That combination could create a scenario in which prices don’t soar but also don’t drop much — if at all, especially because incomes for many households are growing.

“We are going to continue to see robust price growth, but nothing near where we were in the pandemic,” said Orphe Divounguy, a senior economist with Zillow.

If rates fell considerably, it would immediately make homes more affordable, but a new crop of buyers probably would flood the market and could put even more upward pressure on prices.

To help housing truly become more affordable, Divounguy said, there must be continued income growth and more housing construction.

“The way out of this is not going to come from mortgage rates,” he said.

In California, construction headed in the wrong direction in 2023, with building permits falling from the previous year, though lately there are signs of a rebound in single-family construction, which is mostly for-sale homes.

Some Californians, however, are on a timeline.

Kotero, the buyer looking in Torrance, currently rents a house in the city with his wife, Rikah, and their four children. But he said they need to find a new place by summer because the landlord is moving back in.

They’d like to buy and stay in Torrance for the schools but so far have struck out — even though Kotero makes $160,000 as a manager at a local oil refinery.

He said he and his wife were recently outbid, despite stretching their budget to offer $1 million for a house listed for $900,000.

Unlike others, the Koteros don’t have hundreds of thousands in cash to meaningfully offset high rates. Instead, Rikah, who currently stays home with the children, is thinking of looking for a job.

“If we are realistically looking to buy a home in Torrance, there’s no way around it,” Kotero said.

- ‘Disgusting’ landfill near estates in Stanway, Colchester, Essex making locals ‘ill’

Families living in an upmarket town with new £500,000 homes have been left fuming at the stench coming from a nearby landfill site.

Residents in Stanway, Colchester, Essex, claim to have become ill through the smell and say it is forcing them to want to leave the area and sell-up.

Hundreds are complaining about the issue, with many reporting the Bellhouse landfill site to the Environment Agency.

They claim the problems have gotten much more in recent weeks and have even dubbed the area ‘Stinkway’ as a result.

Others claim they have become unwell and compared it to life in ‘Victorian Britain’.

Some locals have already left, many want to or have paid thousands of pounds on air conditioning to get rid of the problem.

It impacts several estates in the area, including Hampton Park, built by Persimmon Homes.

Photos taken by Mail Online show the extent of the amount of rubbish at the site, which will continue to be used as landfill until 2026.

Charity volunteer Peter Dutch says a bad cough he has suffered in the last few weeks is as a result of the site.

The 53-year-old said: ‘It’s utterly horrific. I live only a few minutes away and it’s very constant.

‘The nickname we now have is Stinkway. It brings the area down. It’s a nightmare.

‘I’m worried about what it will do to the area, house prices and the general impression that people have.

‘It is just terrible. It has got a lot worse in the last few months and I am dreading the summer months. I can see it getting a lot worse and the heat bringing it out even more.

‘I am often now coughing very badly. It’s terrible. I often feel ill. I put it down to the tip.

‘Some women have also reported health problems and so have their children.’

Kurtley Lee, 33, bought a new property eight years ago with his partner Kailey, and says it has become a nightmare.

Now worth around £400,000, he is unsure if the couple will ever be able to sell it.

The quantitative surveyor told Mail Online: ‘It’s like a disgusting and constant sewage smell. It’s vile.

‘It dominates the area. Everyone is talking about it. It’s the only thing associated with the area.

‘It makes me feel sick a lot. The smell certainly never used to be this bad. It’s got worse over the last few months.’

Mr Lee said it seemed particularly bad in the evening.

He added: ‘I have no idea what can be done about it. It’s appalling.

‘I am very worried about what it will do to our house prices.’

Another local, whose home is valued at £450,000, says life was a ‘daily battle’.

The man, who has lived on one of the estates for four years, said: ‘I hate it. It’s soul destroying.

‘It’s like living in a zoo. The smell is awful and with summer approaching it will get much worse.

‘It’s Essex in 2024 and yet it feels like Victoria Britain.’

Margaret Simpson has lived in her £500,000 home for just eight months and says life has become a ‘living nightmare’.

The 45-year-old said: ‘We were assured it would not be a problem. People reading this will say well you moved next to a tip.

‘But the smell was not this bad when I first moved in. Now it is sheer hell. It is a living nightmare.

‘Sometimes I cannot sleep. It gives me very bad headaches. I often feel sick and I put it down to the tip and the smell.’

The finance executive says she knows of locals who have spent thousands on air conditioning units.

She added: ‘People have been taking drastic action. I am not sure where we’d stand if we tried to move, I think we would have to declare it.

‘Although anyone coming to view these properties would be able to smell it.

‘It’s disgusting. It’s like living right in the middle of the smelliest farm you can imagine.’

Mum Jolie Pearce, 38, claims her children have become unwell as a result.

She said: ‘One of my children has breathing difficulties and this has made it worse I believe. It’s horrible.

‘I am not sure why in the last few months it has suddenly become so much worse.

‘If I could move, I would. But I feel trapped. It’s a massive daily battle to not feel sick.’

The Environment Agency were approached for comment.

Enovert, which runs the site, was also approached for comment.

The cost of homes within the eurozone fell by 1.1% during the last three month of 2023. However, within the EU overall, prices were slightly higher.

One of the countries hardest hit by a fall in property prices was Luxembourg where house prices slumped 14.4%, following a 13.9% fall in the preceding three months.

Within the eurozone, average house prices were down by 1.1% in the last three months of 2023 compared with the year before, according to the House Price Index, an indicator by Eurostat.

House prices for the European Union as a whole showed a slight climb of 0.2% increase for the year.

The results show that average prices are not dropping as much as before – the same index was down 2.2% and 1.1% in the eurozone and the EU respectively for the third quarter of last year.

The biggest drop in prices was detected in Luxembourg

Luxembourg property prices fell to their lowest level since the end of 2020. The drop was put down to a combination of high interest rates and rental investors losing their appetite. There was a significant decline in housing market transactions. These, by the end of 2023, were effectively half the number of deals done in 2022.

Eight countries in Europe reported falling house prices for the final three months of 2023, although less dramatic than Luxembourg’s. Prices in Germany dropped by 7.1% while Finland saw a fall of 4.4%.

The highest property price rises were recorded in Poland, where prices jumped 13%. Bulgaria and Croatia were next in line, with property prices showing a climb of 10.1% and 9.5% respectively.

Compared with the previous three months ending in September, prices were down in 11 countries in total. France saw a drop of 2.7%, while Latvia’s prices slid 2.5%. News from Italy was more cheerful as prices remained steady.

The highest increases during that period were recorded in Poland, up 4.8%, Croatia, up 3.4% and Ireland, which saw a 3% rise.

In the fourth quarter of 2023, house prices, as measured by the House Price Index, fell by 1.1% in the euro area and rose by 0.2% in the EU compared with the same quarter of the previous year. In the third quarter of 2023, house prices fell by 2.2% and 1.1% in the euro area and EU, respectively. These figures come from Eurostat, the statistical office of the European Union.

Compared with the third quarter of 2023, house prices fell by 0.7% in the euro area and by 0.3% in the EU in the fourth quarter of 2023.

Among the Member States for which data are available, eight showed an annual decrease in house prices in the fourth quarter of 2023, and eighteen showed an annual increase. The largest falls were registered in Luxembourg (-14.4%), Germany (-7.1%) and Finland (-4.4%), while the highest increases were recorded in Poland (+13.0%), Bulgaria (+10.1%) and Croatia (+9.5%).

Compared with the previous quarter, prices decreased in eleven Member States, were stable in one (Italy) and increased in fourteen Member States. The largest falls were registered in France (-2.7%), Latvia (-2.5%) as well as Denmark and Sweden (both -2.3%), while the highest increases were recorded in Poland (+4.8%), Croatia (+3.4%) and Ireland (+3.0%).

Notes for users

Country notes

Belgium: The HPI have been revised for between Q1 2005 and Q3 2023 due to changes in the weights for new and existing dwellings, aggregation procedure and hedonic method (see also country methodological note).

Netherlands: The HPI and weights have been revised between Q1 2015 and Q3 2023 due to the implementation of several changes aimed at aligning calculation of weights for new and existing dwellings with implementing regulation 2023/1470 and improving index compilation methodology (see also country methodological note).

Austria: The HPI and weights have been revised between Q1 2010 and Q3 2023 due to several improvements, which include, among other, data processing improvements, exclusion of prefabricated houses and inclusion of transaction prices as the basis for the calculation of the price index for newly built dwellings, refinements in the hedonic repricing method, and alignment of calculation of weights for new and existing dwellings with the implementing regulation 2023/1470 (see also country methodological note).

Revisions and timetable

Compared with €-indicators release of 10 January 2024, revisions for the euro area and the EU are highlighted in bold in the table below:

|

Revisions |

||||||

|---|---|---|---|---|---|---|

|

Q1 2023 |

Q2 2023 |

Q3 2023 |

||||

|

Quarterly changes |

Previous |

Current |

Previous |

Current |

Previous |

Current |

|

-0.8 |

-0.9 |

0.2 |

0.2 |

0.3 |

0.2 |

|

|

-0.7 |

-0.7 |

0.4 |

0.5 |

0.8 |

0.7 |

|

|

Annual changes |

||||||

|---|---|---|---|---|---|---|

|

0.4 |

0.4 |

-1.5 |

-1.6 |

-2.1 |

-2.2 |

|

|

0.8 |

0.8 |

-0.9 |

-1.0 |

-1.0 |

-1.1 |

|

The next release with data (first quarter of 2024) is scheduled for 5 July 2024.

Methods and definitions

The House Price Index (HPI) measures the price changes of all residential properties purchased by households (flats, detached houses, terraced houses, etc.), both newly built and existing, independently of their final use and independently of their previous owners. The Member States’ HPIs are compiled by the National Statistical Institutes. The euro area and the EU aggregate HPIs are compiled by Eurostat. HPIs are computed as annually chained indices with weights being updated each year. The European HPI aggregates are currently calculated as weighted averages of the national HPIs using as weights the GDP at market prices (expressed in millions Purchasing Power Standards – PPS) of the countries concerned.

The figures are not seasonally adjusted.

Missing country data is estimated by Eurostat using data from non-harmonised sources. These estimates are not published but are used to calculate euro area and EU aggregates.

Geographical information

Euro area (EA20): Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland.

European Union (EU27): Belgium, Bulgaria, Czechia, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland and Sweden.

In the fourth quarter of 2023, house prices decreased by 0.3% while rents increased by 0.6% in the EU compared with the third quarter of 2023.

Compared with the fourth quarter of 2022, house prices in the EU increased by 0.2%, while rents increased by 3.0%.

This information comes from data on house prices and rents published by Eurostat today. This article presents findings from the more detailed Statistics Explained article on housing price statistics.

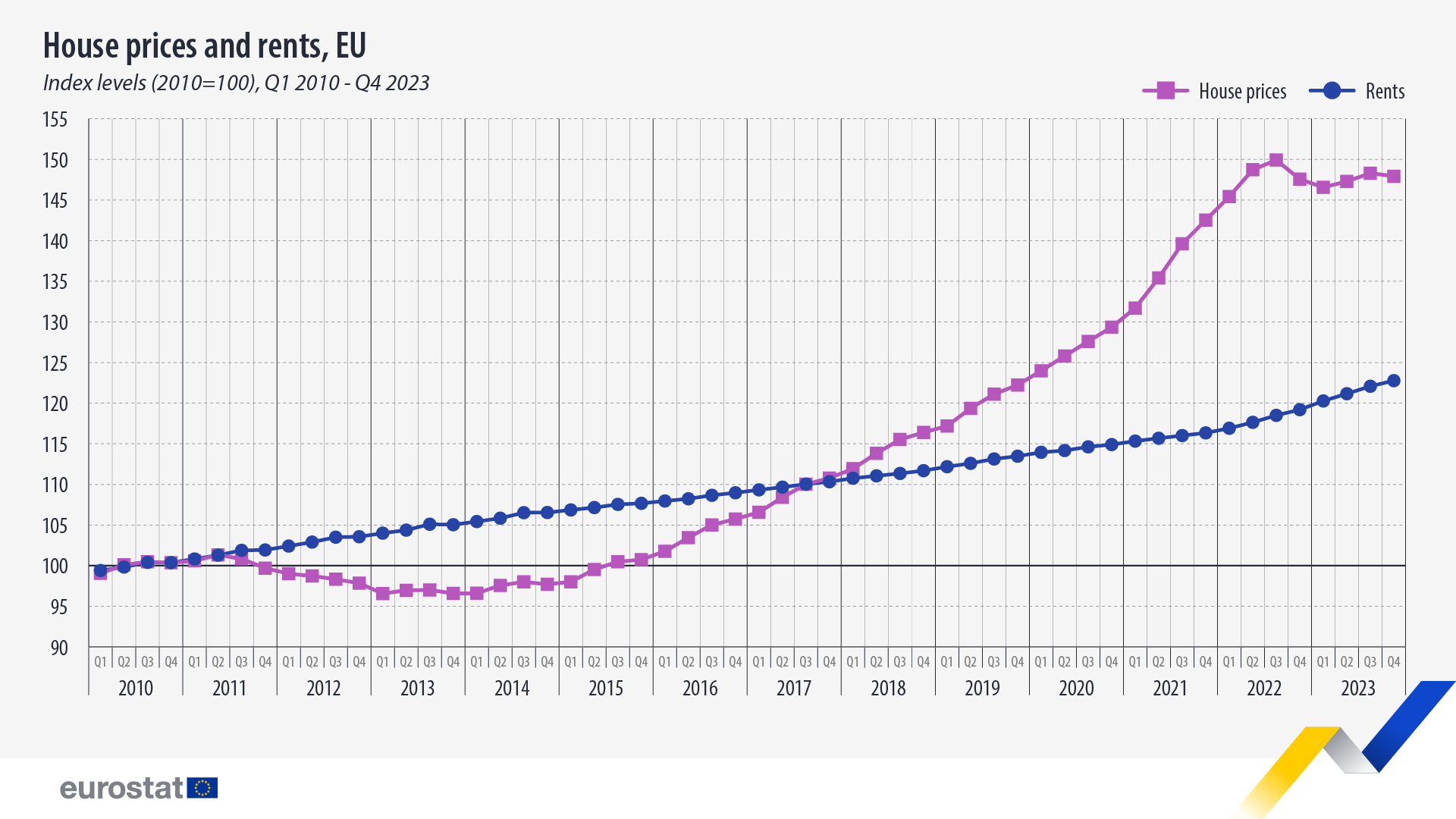

House prices and rents in the EU followed a similar pattern between 2010 and the second quarter of 2011, but are now evolving differently. While rents increased steadily since then up to the second quarter of 2023, house prices followed a different pattern, including decreases and more rapid increases.

Source datasets: prc_hpi_q and prc_hicp_midx

After a sharp decline between the second quarter of 2011 and the first quarter of 2013, house prices remained more or less stable between 2013 and 2014. A rapid rise followed in early 2015, and house prices increased faster than rents until the third quarter of 2022. Since the fourth quarter of 2022, house prices fell for two quarters in a row before rising again in the second and third quarters of 2023 and declining slightly in the fourth quarter of 2023.

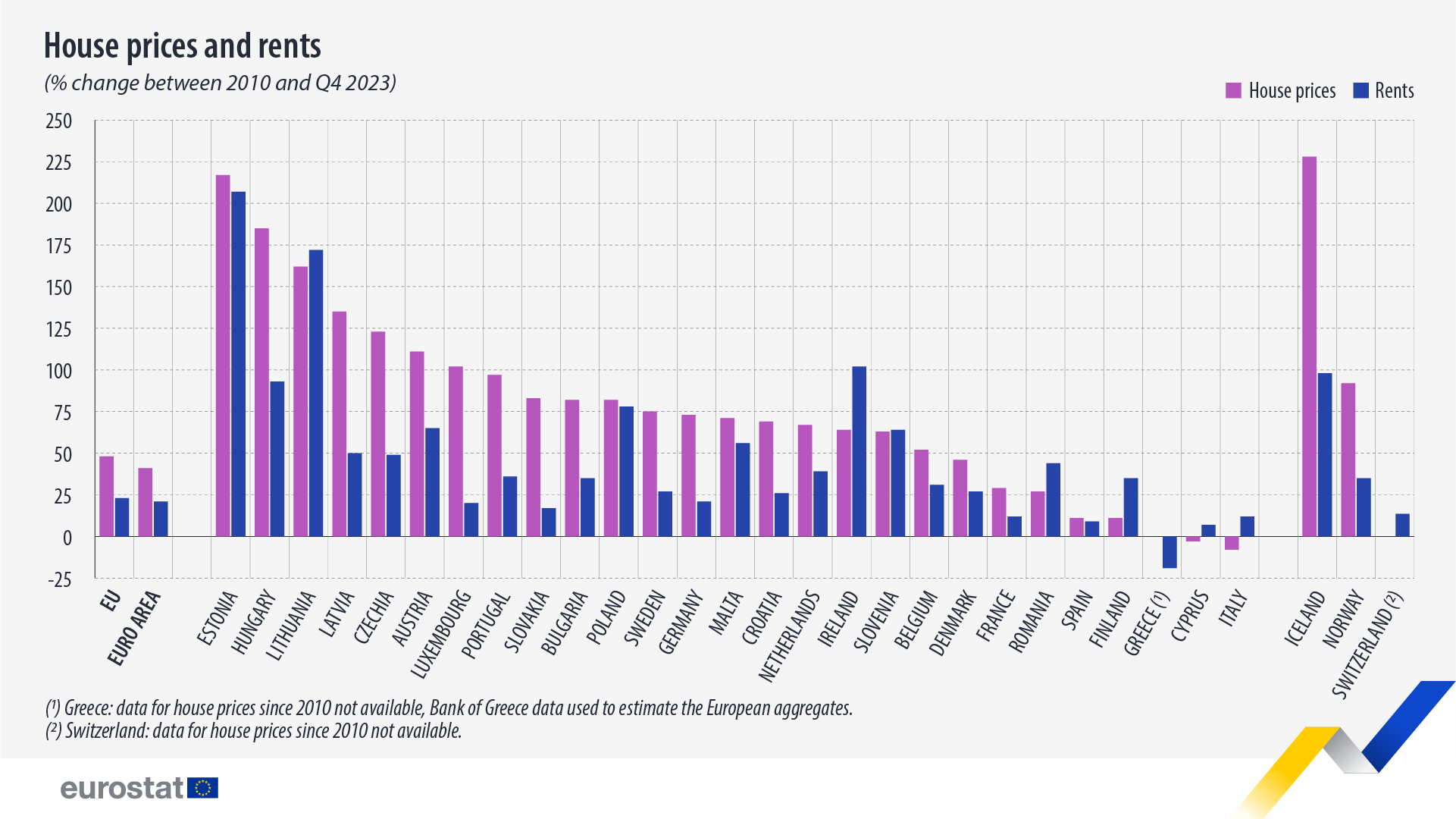

House prices more than doubled in Estonia, Hungary, Lithuania, Latvia, Czechia, Austria and Luxembourg since 2010

Between 2010 and the fourth quarter of 2023, house prices increased by 48% and rents by 23% in the EU.

Source datasets: prc_hpi_a, prc_hpi_q, prc_hicp_aind, prc_hicp_midx

When comparing the fourth quarter of 2023 with 2010, among the Member States for which data are available, house prices increased more than rents in 19 of the EU countries. House prices more than doubled in Estonia (+217%), Hungary (+185%), Lithuania (+162%), Latvia (+135%), Czechia (+123%), Austria (+111%), and Luxembourg (+102%). Decreases were observed in Italy (-8%) and Cyprus (-3%).

Rents increased in 26 EU countries with the highest rises in Estonia (+207%), Lithuania (+172%) and Ireland (+102%). The only decrease in rent prices was recorded in Greece (-19%).

HOUSE PRICES in Finland fell by more than five per cent year-on-year in February.

Statistics Finland on Thursday reported that the prices of old dwellings in housing companies fell especially in large cities – by 10.4 per cent in Vantaa, 7.1 per cent in Helsinki and 6.8 per cent in Oulu.

While the six largest cities in the country recorded a drop of 6.1 per cent and the capital region a drop of 6.7 per cent from the previous year, areas outside the largest cities registered one of 4.4 per cent.

Also the volume of sales decreased, with real estate agents brokering 15 per cent fewer sales in February 2024 than in February 2023.

The preliminary data offer some grounds for optimism, too. The prices of old dwellings in housing companies crept up by 1.4 per cent from the previous month, with increases recorded also in all large cities.

“In February, the development of home prices was better than expected both in and outside the capital region. The development witnessed at the start of the year is a reflection of the tax code change that took effect at the turn of the year, which encouraged first-time home buyers to take action late last year and decreased sales early this year,” Joona Widgrén, a senior economist at OP Financial Group, analysed according to Helsingin Sanomat.

“[The change] explains the lacklustre sales in January—February.”

Although house prices developed slightly better than the financial services provider expected, a more meaningful recovery will hinge on market activity, according to Widgrén.

“People will still have to wait for a recovery in the house market because sales volumes recover will have to recover before prices start increasing on a more permanent basis,” he stated.

Also Juhana Brotherus, the chief economist at the Federation of Finnish Enterprises, estimated that the market will continue to decline for some time. An upswing, he predicted, will not occur until later this year once falling interest rates and strengthening purchasing power make the financial equation more favourable for potential buyers.

“The house market is being depressed by hard and soft headwinds,” he wrote. “Buyers are losing interest because interest costs and maintenance fees can exceptionally be even higher than rents. Also loan repayments add to the monthly costs. At the same time, households are extremely cautious and sensitive to crises because their general sense of security has been shaken by the coronavirus, energy, war and, most recently, strike crises.”

“The uncertainties are reducing especially large acquisitions, of which home is the most important.”

Veera Holappa, a senior economist at Pellervo Economic Research (PTT), is slightly more optimistic, estimating that the return of first-time buyers could provide a boon to the housing market as soon as this spring.

“As household sentiment improves and first-time house buyers are starting to return to the market, chains of sales will start going through. It could rejuvenate the market as soon as at the dawn of summer,” she said.

Aleksi Teivainen – HT

Homeowners are leaving the high prices of the capital in favour of Britain’s Industrial Revolution cities, MailOnline can reveal.

Thousands of people are ditching London and instead looking to buy homes in cities such as Leicester, Glasgow, Sheffield and Bradford.

There were more than 75,000 searches for ‘homes for sale’ in Glasgow in the last 90 days – nearly double the interest in London, data from Purplebricks showed.

Second on the list was Sheffield with 61,000 searches, followed by 58,000 searches for properties in Bradford, once a hotbed of Britain’s textile trade.

Some 52,000 searches were made for the industrial giant of Leicester, and 43,000 for the Welsh port city of Swansea, less than 10 miles from towering steelworks in Port Talbot.

Manchester, Liverpool, London, Stoke on Trent and Birmingham all feature at the top of the table, receiving more than 30,000 searches since mid-December.

Housing expert David Hall told MailOnline: ‘Anywhere that has a developed infrastructure for transport is a model for somebody to look for cheaper prices.

‘In London [there are] eye-watering prices for properties.

‘You will see loads more of [people leaving London] in major towns and cities in the UK coming soon.

‘Don’t forget the interest rate rises for mortgages. Anyone who was looking to get a mortgage who thought for one minute they were going to get one for primetime in London has realised that’s not going to happen.

‘When you’re at 4.5 per cent, you have to move outside the city to be looking at something that’s affordable.’

Leaseholds expert Linz Darlington added: ‘There is a real appetite to move out of the capital.

‘While people love the hubbub of the city, London is incredibly expensive, particularly to buy a property in.

‘During the pandemic, people realised that London wasn’t the be-all and end-all.’

Here, MailOnline takes a look at some of the most popular places outside of London where house hunters are looking to buy properties…

Glasgow

The Industrial Revolution poured wealth and prosperity into Glasgow, turning a relatively small town into a giant of the British Empire.

Now over £5billion of new investment is set to transform the Clyde waterfront over the next 25 years.

This four-bed semi-detached home on Leithland Road in Pollok is available to buy for £185,000.

Homeowners in Glasgow have enjoyed a 4.3 per cent rise in property values, according to the latest House Price index – one per cent more than the 3.3 per cent increase seen across Scotland in the 12 months up to December.

Some see Glasgow properties as a great investment with average homes priced at £183,494, some £6,500 lower than the Scottish average and more than £150,000 cheaper than the average home in Edinburgh.

Sheffield

This three-bed home located in a desired cul-de-sac in Sheffield is on the market for £220,000.

While steel was once the main industry in Sheffield, South Yorkshire, the city is now seen as a superb employer in the tech and creative sectors.

Sheffield house prices bucked the national trend by increasing 4.9 per cent in the last 12 months, making the average property worth around £220,000.

It means they are around £82,000 cheaper than the average in England.

Sheffield’s central location in the UK means it is ideally located for travel and accessibility and has national and international connections.

Bradford

Nestled in a quaint neighbourhood, this charming two-bed terrace £180,000 house presents an enticing opportunity for families seeking a place to call home.

Bradford was once known as the wool capital of the world.

Worth £11.6billion, Bradford’s economy is now powered by advanced engineering, chemicals, automotive components and food manufacture alongside financial services and digital technologies.

The West Yorkshire city also bucked the national downward trend, with homeowners enjoying a 0.7 per cent annual increase, with the average property costing £173,337 – nearly half the national average.

Leicester

This £230,000 two-bedroom semi-detached house in Leicester, boasts three reception rooms.

Leicester’s industrial success took place in the 20th century, led by the success of its hosiery and footwear industries.

While manufacturing has been in decline across the UK in recent decades there are many modern industries thriving in and around Leicester, beyond its traditional textile trade.

The city boasts industries ranging from professional and financial services, advanced manufacturing and engineering to life sciences, space and digital technology.

Leicester has been ranked as the top city in the East Midlands to live and work as part of an influential nationwide industry report.

The average house price for the area is still below the national average at £232,324, but more expensive than nearby Birmingham at £228,877 and Nottingham at £192,298.

Swansea

This modern semi-detached two-bedroom house, located in the sought-after area of Sketty, is on the market for £190,000.

Swansea has a proud industrial heritage centred on coal, manufacturing and heavy industry.

Today, a large proportion of the economic growth is provided by public administration, education and health.

With the average price of a house at £196,000, Swansea is an affordable option for those looking to get on the property ladder, and nearly £20,000 cheaper than the Welsh average of £214,000.

Homeowners in the city saw a 0.8 per cent rise in the value of their properties in the last 12 months, despite a downturn of 2.5 per cent across Wales.

However, the port city is braced for a huge financial and social fallout after Tata confirmed plans to close two blast furnaces at nearby Port Talbot in January this year. The move is expected to cost of 2,800 jobs.