Alyssa Luc and her partner Xuan Tri Mai are among many Australians who wish they hadn’t rushed into building a home.

It was the end of 2020 when the couple purchased a block of land in Catherine Field, a growth area suburb south-west of Sydney.

Their block cost about $500,000, and they spent another $700,000 to enter a contract with what they thought was a reputable volume builder.

The couple moved into their new home in July 2023 and, just days in, Ms Luc says they started finding alleged defects, starting with a blockage in their toilet.

“If anyone would like to go build a new house, please think carefully,” Ms Luc warns.

“Think about the economy … think about the builders at the moment.

“I mean, they [people] can see that so many builders [have] collapsed in the past few years. They should know now that the industry is vulnerable.”

It was supposed to be the end of what building industry pundits have labelled as a “property cyclone”.

But even if the eye of that cyclone has passed, savage storms continue to wreak havoc on Australia’s $270 billion construction sector.

Each month across Australia, on average more than 200 building and construction companies go under.

The building industry is still reeling from one of its most tumultuous periods in history — a loss-making boom that eventuated soon after the pandemic.

Consumers — lured with tens of thousands of dollars of grants under the controversial HomeBuilder scheme — were sold on fixed-price contracts that builders then struggled to honour as the cost of building materials and labour soared.

The effects of that are still playing out.

Call to better protect subcontractors and consumers

Statistics from corporate watchdog ASIC show that for the current financial year so far, to March 17, there have been 1,987 insolvencies in the building industry. This is up from 1,495 a year earlier and just 782 in 2022.

More horror stories are emerging of subcontractors and suppliers waiting to get paid but at risk of never seeing a cent, and consumers left with half-built homes or major defects.

“With the [Home Builder grant] stimulation, we went from a very low point to boom time, and we weren’t ready for that big upswing,” says industry veteran and the founder and director of Satterley Property Group, Nigel Satterley.

The Perth developer has worked in the industry for more than 50 years, including advising governments on housing policies, and sees better times ahead.

“We have moved out of the cyclone — I really believe the worst is over.”

But while consumers are back making enquiries about building a home, Australia’s volume builders warn many remain nervous about signing on the dotted line.

They say consumers are holding back both because of high-interest rates and cost-of-living increases, as well as fears they might end up with a dodgy product or a builder that’s at imminent risk of collapse.

Mr Satterley is calling for a fundamental rethink of laws regulating the industry so that subcontractors and consumers are better protected.

“We need a lot more corporate regulation around directors that trade — the building companies — that know they can’t pay the bills, or they’re insolvent,” Mr Satterley says.

“For example, you could start ‘John Smith Homes’ with working capital of $200,000, and be building 500 homes a year, because these are what we call capital-light businesses that run on cashflow. And when the cash flow stops, they go bust.”

Some builders are asking customers up-front for deposits of 5 per cent or more.

Mr Satterley suggests these be placed into a regulated trust account, which already happens in the case of developers, but usually not with builders.

“If you [the builder] takes money from the trust account, you go to jail,” he says.

“I think these types of regulations need to be [implemented] across the home building industry.”

Another issue politicians constantly raise with him is how to better protect subcontractors in the industry.

“I think there should be serious regulation [if a contractor] is not paid,” Mr Satterley suggests.

“Our industry pays on the 15th and the 30th, generally of the month, so give a couple of days, if they’re not paid, they should be able to lodge an immediate complaint for protection.”

He also believes governments should do more to help build the pipeline of skilled workers needed to meet greater housing demand over the next few years.

‘It’s been very stressful’

Ms Luc agrees there are not enough consumer protections and, to try to get a resolution, they’ve had to use the legal system.

Her main concern, especially while she’s been pregnant, has been finding traces of silica dust throughout her home.

Silica dust can be toxic. It’s commonly used to make products across the home, especially for stone benchtops in kitchens and bathrooms.

Safe Work Australia says that when workers cut, drill or grind products that contain silica, dust particles are generated that are small enough to lodge deep in the lungs and cause serious illness or disease.

It’s been such a big issue impacting workers in the industry that, at the end of last year, Australia became the first country in the world to ban the use of engineered stone following a surge in workers developing lung disease silicosis.

Ms Luc says they had an expert do a report for them that suggests that traces of the dust they have been finding throughout their home may be dangerous to their health.

“We did ask them [the building company] to come out immediately because of health concerns — and so far, we’ve only had people come out to do cleaning,” she says.

Ms Luc says there are also other alleged defects around the home, and she’s lodged a complaint against the building company that will be heard by a tribunal.

“[It’s been] very stressful — it took a lot out of me. It takes a lot out of both of us. Mentally I try to be strong for myself, for the family and my baby.”

Fears of a ‘catastrophic failure’

Even for those who don’t build, but buy off the plan or opt for homes that have been recently built, significant problems have emerged.

Toplace was once one of Australia’s largest privately owned development and construction companies, which claimed to have built 30,000 properties across Sydney.

But the developer went into administration in July 2023, owing hundreds of millions to creditors, and its founder Jean Nassif went overseas despite being wanted on fraud-related charges.

The owner and founding director of the Toplace Group building licence was suspended for 10 years in 2023 by NSW Fair Trading and Toplace’s licence was permanently revoked.

IT worker Patrick Quintal says his life has been destroyed by buying into one of Toplace’s troubled developments – Vicinity Apartments in Canterbury, in Sydney’s inner south-west.

When asked if people should buy off-the-plan or newly-built apartments, he says: “Don’t. Just don’t do it, you are playing Russian roulette with your life basically.

“In fact, I think you might actually have better odds playing Russian roulette than this.

“It is crazy how poorly the government is ensuring people can actually safely buy property. You’re expected to be a lawyer, the building engineer, all of that on top of your nine-to-five job. It’s draining.”

Mr Quintal purchased a unit with his wife in May 2021 for $685,000 but now may be up for hundreds of thousands of dollars more to fix serious defects.

Within months of moving in Mr Quintal had an engineer do an expert report, which he says described the entire building as a “death trap”.

A report from the NSW Building Commissioner identified major issues with the slab and beams in the basement of Vicinity Apartments.

Mr Quintal says the entire building is now being held up by temporary steel structures and worries with increased building activity around the area — including a metro station – the whole structure could one day collapse.

“It’s not really safe,” Mr Quintal says.

“The building as it stands, could not support any kind of movement that was similar to a seismic activity. [It could mean] catastrophic failure … resulting in the building basically collapsing.”

Mr Quintal is still fighting for the council or government to pay the cost of fixing the defects, but in the meantime says he’s financially and emotionally devastated.

The Department of Fair Trading has estimated the total cost of the repairs to be about $50 million.

With 276 units, that means owners like Mr Quintal are looking at a cost of at least $180,000 each, but possibly more as construction costs remain elevated and time drags on.

At the same time, he says quarterly strata levies have jumped from $900 a month to about $4,000.

“For me, the financials are quite, quite dire,” Mr Quintal says.

“We were planning on having a family shortly after we got the place. And I feel like I’ve just been in such a mental rut that I don’t think I could afford to have kids, or whether I’m even mentally ready to have kids simply because I have to deal with the stress of this building, day-in day-out.”

Mr Quintal says the onus shouldn’t be on the owners to fix defects that weren’t of their doing. He also wants the law changed to better protect consumers.

“My hope is that the government will come in and take responsibility for basically the issues that they’ve created,” he says.

“It’s not just this building. It’s many apartments that we’ve seen over the last couple of years … They’ve all got similar problems.”

New home builds in decline as the cost of building rises

The quality of building is one issue that’s kept consumers wary of taking the leap into building.

The soaring cost of building is another. Metricon chief executive Brad Duggan says the builder is still working through a pipeline of post-pandemic boom loss-making jobs, but when it comes to getting people to commit to new home builds, now things are much tougher.

In 2022, Metricon was in financial crisis talks but was thrown a lifeline from its financier the Commonwealth Bank, which kept it from facing the same fate as many other builders.

Mr Duggan says there’s been a 40 per cent increase in enquiries from would-be buyers this year but that a “lack of confidence” is holding people back from signing a contract.

“There’s such pent-up demand [but] people don’t want to take that step [of signing the contract],” Mr Duggan says.

“It [the fear to sign a contract] comes from two places, one lack of confidence about the affordability, and also a lack of confidence in building.”

Mr Duggan hopes the RBA will soon signal when they will be cutting interest rates so that more would-be buyers will take the leap into building.

However, he also warns that building costs could go even higher now that changes to the National Construction Code, designed to make more homes energy-efficient and accessible, have taken force.

New requirements under the code include increasing minimum energy-efficiency standards for new houses and apartments from six to seven-star ratings, and more stringent accessibility standards, including step-free entry to dwellings, a toilet on the entry level, accessible doorways, and reinforced bathroom walls.

The Housing Industry Association says these changes could increase the cost of building by about $20,000 to $25,000, depending on the type of build.

While Metricon generally supports the new NCC requirements, Mr Duggan questions “whether it’s the right time to be looking at it now”, while there’s a housing affordability crisis.

“It won’t be an insignificant [price] increase.

“I think there’ll be a number of builders that may not be able to go to market because they don’t have NCC compliant homes, which may mean that there is a lack of supply for the market, which could have some impact (on supply).”

Not enough workers to build 1.2 million homes

Australian Bureau of Statistics (ABS) data shows Australia’s record level of immigration is easily outpacing new construction.

The ABS latest building approvals data released on Thursday, found that total dwellings approved in February fell by 1.9 per cent, to 12,520.

Attached dwellings drove the decline, down 24.9 per cent to 3,771. This was the weakest monthly result since 2012.

Total dwelling approvals are running at 163,099 annualised, a level well below Australia’s underlying dwelling requirement.

As demand for housing increases, the industry warns there are just not enough workers to build the 1.2 million homes (about 240,000 dwellings a year) the Albanese government wants to see built over the next five years.

There are industry estimates this target requires an increase in the building trades workforce of 90,000 people, but Mr Satterley believes it might be even more.

“Australia can only complete, annually, around 130,000 dwellings per annum, maybe just a few more,” says Mr Satterley.

“What the prime minister is saying he wants is 200,000 completions a year, that is impossible to do.

“We would need somewhere in the order of 400,000 qualified tradesmen this calendar year, and next year.”

But as baby boomers leave the industry, there are fewer young people coming in to learn trades.

Data from Master Builders suggests that over the year to September 2023, a total of 42,333 new apprentices started in the building and construction industry — this represents a 25 per cent reduction on the previous 12-month period.

“This country is being held back through not enough people to do the work,” Mr Satterley argues.

“And what we’re seeing is the tradespeople are making more money and working less. So production is slower because the tradies are working less hours for more money.”

Will more builders go under and job losses rise?

Insolvencies in the building and construction industry are predicted to continue to spike over the coming months and overtake pre-COVID highs and possibly even top post-global financial crisis highs.

That will mean more job losses.

HIA’s managing director Jocelyn Martin says she feels for those consumers who are left with those half-built projects when builders collapse, but it’s been hard for builders to manage cash flow.

“There are no winners out of the insolvency situation,” Ms Martin says.

“One of the biggest challenges we have in the industry is working with fixed price contracts — where the builders have had to lock in price for their customers, well in advance of supply of supplies, and then supply prices have increased.”

She hopes there will be fewer horror stories going forward, noting that there are already “changes happening” in the way the building industry is regulated.

“I think there is an improved regulatory system,” she says.

“There are certainly more detailed inspections around properties. There is much education for builders, in terms of repercussions for builders that have gone broke or into administration.”

The building and construction industry remains one of Australia’s largest employers, employing roughly 1.3 million Australians.

And, despite the calls for more workers in the sector, there have already been job losses off the back of failed building companies.

Others have had to take pre-emptive action and announce redundancies.

It was almost one year ago when Simonds Homes boss Rhett Simonds had to make the tough decision to cut 10 per cent of the company’s workforce.

“You’re going through and you’re adjusting to economic environments, those hard calls have to be made,” Mr Simonds tells ABC News.

The family-run builder’s decision to cut costs has paid off.

Simonds Homes, which is now listed on the ASX, earlier this year delivered a $100,000 quarterly profit, its first step into the black in two years.

“Let’s not deny it has it’s been a tough period for the industry for the last probably two to three years,” Mr Simonds says.

“We are coming through the other side of what has been … a shaky couple of years in the industry.

“As we start to see the stabilisation of interest rates and ultimately, hopefully, down the track, some small decreases in interest rates, that’s definitely going to play a major factor in consumer confidence.”

Mr Simonds hopes the industry will be given support, including enough skilled tradesmen, to build the homes needed.

“We do have a housing shortage and that is something that will continue to be a challenge for our economy and our country,” Mr Simonds says.

First Garden Cities Homes is working with award-winning housebuilder The Hill Group, on the construction of 57 much-needed affordable homes off Icknield Way, Letchworth Garden City.

The development will see Letchworth Garden City Heritage Foundation’s former offices at Foundation House revitalised into an exciting new development of one and two-bedroom apartments, designed in keeping with Letchworth’s garden city architectural heritage.

The 100% affordable development benefits from funding from Homes England and North Herts Council, with 31 apartments available for shared ownership and 26 allocated for social rent. The development will feature five apartment buildings, up to four storeys in height, complete with an attractive green space for residents, to relax and enjoy.

John Welch, Chief Executive at First Garden Cities Homes, comments: “First Garden Cities Homes and The Hill Group have a shared commitment to providing good-quality affordable housing for local communities. We are delighted to see work begin on site in what is an important new housing development for Letchworth Garden City and local residents.”

Enjoying this article? Sign up for our FREE newsletter!

Rob Jack, Regional Director at The Hill Group, comments: “Starting on site at this development marks the beginning of a major new project to bring vital, high-quality, affordable housing to Letchworth Garden City. The Hill Group is proud to continue its ongoing partnership with First Garden Cities Homes on housing delivery, and I’m confident this latest project will result in a high quality and affordable development that not only addresses local housing needs but contributes to the ongoing design legacy of Letchworth Garden City.”

Letchworth Garden City, located in North Hertfordshire, is famous as the world’s first garden city, developed in the early 1900s on the premise of generous green open spaces and high architectural standards. This exciting new development fully adheres to the design principles of the town, incorporating traditional garden city design elements such as classic brickwork, along with all the benefits of a modern home.

Situated just a 15-minute walk from the station and town centre, the development offers convenient access to shops, cafés, and the beautiful art deco Broadway cinema as well as onward transport links. The partners anticipate completion of the project in early 2026.

Let’s say you’re the typical household in Canada and want to buy a home.

You earn the median household income of roughly $85,000 a year before tax and you’re looking to purchase an $800,000 home – a standard national price of late. After years of hard work and financial prudence, you manage to save enough cash for a 20 per cent down payment.

Mission accomplished, right? Not even close.

The ownership costs – monthly mortgage payments, property taxes and utilities – would eat up 63 per cent of your gross pay, according to calculations from Royal Bank of Canada.

Not only are these costs the highest that RBC has ever observed, but they are far in excess of what policy-makers deem affordable.

The math becomes even more stretched if you want a detached home or to buy in certain markets.

Ownership costs amount to 84 per cent of median household income in the Toronto area and 103 per cent in the Vancouver region. In other words, the typical household in Vancouver doesn’t earn enough to make payments on a representative home, even before taxes are deducted and other necessities – say, food – are paid for.

These are illustrative ways to describe the affordability crisis that Canada finds itself in. Practically speaking, the country’s chartered banks would never lend to someone so swamped by mortgage payments.

Still, the RBC numbers underscore a troubling trend: A typical household has little chance of getting into the housing market today. No wonder so many young buyers are tapping their parents for financial help.

In previous decades, the suburbs and smaller cities offered an affordable option for priced-out urban dwellers. But increasingly, those markets are getting swept up in the housing crisis.

Since the start of 2020, the benchmark home price has risen 89 per cent in Moncton. In Halifax, prices are up 68 per cent. And in the Ontario town of Tillsonburg (population: 16,815), prices have jumped 72 per cent. Throw in higher mortgage rates and it becomes near impossible for someone with a regular income to buy a home. The rental market doesn’t offer relief either. Tenants are facing the steepest rent hikes in decades amid high demand for a paltry number of units.

There aren’t simple explanations for how Canada ended up in this situation. Instead, a series of decisions and trends – some decades in the making, others quickly popping up – have coalesced to make homes way too expensive.

Not so high on supply

Like an upside down version of the famous Field of Dreams quote, Canada’s pace of home construction in the face of surging population is a case of they came, but we didn’t build it.

Housing undersupply is a chronic problem in Canada. But it’s become more acute since 2016, when population growth picked up in response to increased immigration targets, without a commensurate rise in housing starts. This dynamic was magnified over the past year, as the country’s population jumped by more than a million, while housing starts slowed from a 2021 peak.

As a result, affordability has gotten much worse over the past year. As Toni Gravelle, Deputy Governor of the Bank of Canada, put it in a recent speech, the widening gap “could explain why rent inflation continues to climb in Canada. It also helps explain, in part, why housing prices have not fallen as much as we had expected.”

It’s not that homes aren’t being built. Indeed, housing starts have been notably strong over the past three years, running around 20 per cent higher than the average in the years before the COVID-19 pandemic. A record number of homes, more than 350,000, are under construction. But the brisk pace of building is not enough to keep up with the country’s population growth, and there’s little evidence that the gap will close any time soon.

No vacancy

With demand for rental units outstripping supply, the rental vacancy rate has plummeted to a record low 1.5 per cent, from an average of around 3 per cent in the decade before the pandemic. That’s pushing rental costs up at a historic clip. Average rents across the country rose 8 per cent year-over-year in 2023, with much larger increases for units with tenant turnover.

The sharp decline in the vacancy rate corresponds to the surge in population over the past two years. Newcomers – immigrants, foreign students and temporary workers – tend to be renters. Meanwhile, inflated home prices and restrictive mortgage rates are forcing many would-be homebuyers to stay put, adding pressure on the rental market.

The lack of units designed for long-term tenancy and families is particularly glaring. Since the 1990s, developers have focused on condos instead of purpose-built rental buildings, which tend to have larger units and more security of tenancy. In the Greater Toronto Area, for example, almost 90 per cent of purpose-built apartments are more than 40 years old.

There’s been a pickup in purpose-built rental construction in recent years, spurred on by government incentives. But demand continues to outstrip supply. And it takes a long time to bring these buildings to market – an average of around eight years, according to Toronto’s Building Industry and Land Development Association.

Red tape headache

It can take years to get the necessary approvals for residential developments, an issue that is particularly problematic in Southern Ontario. Approval times aren’t much different whether a project has a few dozen units or a few hundred, according to a 2022 report from the Canadian Home Builders’ Association.

Moreover, project delays can lead to substantial increases in construction costs. The same report found that for every month of delay, construction costs rose by $2,600 to $3,300 a unit, another headwind for affordability.

Warped construction times

Even once the hurdles of getting approval for a new residential project are complete, that’s just one part of a lengthy process for getting new homes built. Construction timelines have grown considerably longer over the years, and have gotten worse since the start of the pandemic.

Construction of apartments takes the longest in Ontario cities, averaging 32.6 months in February, according to the Canada Mortgage and Housing Corp., up from 29.5 months for the same period five years ago. And even though construction times have risen for single and semi-detached homes nationwide, the gap between them and apartments has also grown more cavernous.

CMHC has examined lengthening construction times in its housing supply reports. Apartments are taking longer in part because they’re getting taller. In major cities, they’re also increasingly being built on smaller sites than before that involve more complex construction requirements. Meanwhile, timelines for detached and semi-detached homes have risen in part because of supply chain disruptions and labour issues.

These stretched timelines matter because they result in the delayed delivery of new housing supply at a time when it is sorely needed, while adding risk for builders, since construction loans need to be carried for longer and builders are exposed to construction cost inflation for longer, according to a February report released by Building Industry and Land Development Association, an organization that represents Toronto home builders.

Output obstacles

The construction industry has a productivity problem. Output in the sector is back to where it was in the late 1990s, and the gap with the overall economy is growing.

There are particular issues facing the industry, CMHC deputy chief economist Kevin Hughes noted in a recent blog post. The building process is complex and varies by building type, and many aspects of production fall outside of the developer’s control, which can lead to delays. Moreover, the residential construction industry is quite fragmented and includes small players who focus on bespoke projects, but also lack the capital to make investments that would boost their productivity.

It’s not an easy problem to fix, although governments could offer incentives to builders who use more prefabricated inputs. The use of off-site construction could speed up completion times.

2×4 inflation

From wood and concrete to steel and glass, residential construction materials have soared in price compared to before the pandemic, ending years of steady and predictable cost increases. On a national basis, construction costs have jumped nearly 60 per cent since the end of 2019, and are up 80 per cent since 2017, far outpacing overall inflation.

The cost surge has directly fed into rising home prices, but has a knock-on effect because municipal governments also tie the fees they charge developers to Statistics Canada’s construction price tracker. In Toronto, for instance, development charges for a one-bedroom rental apartment jumped 22 per cent last year from 2022, and 42 per cent for a non-rental one-bedroom apartment. Add in rising wages for construction workers, which have outpaced the overall job market, and it helps explain why housing starts have slowed sharply even as politicians promise a rush of new housing to meet demand.

Bank of Canada rains on the parade

Canadians are used to seeing eye-popping house prices, especially in Toronto and Vancouver. What’s new is the rapid run-up in mortgage rates over the past two years, as the Bank of Canada tightened monetary policy to fight inflation. This combination – pricey homes and restrictive mortgage rates – has transformed a long-simmering housing affordability issue into a thoroughly middle-class problem.

Existing homeowners are seeing monthly mortgage payments jump by thousands of dollars when they renew. Would-be buyers are shut out of the market, unable to qualify for a mortgage at higher rates.

Around half of all homeowners with mortgages have renewed since the central bank began raising rates in 2022. Most of the rest will do so in the next two years. Homebuyers who overstretched in 2020 and 2021, when interest rates were at historic lows, are in for a particular big shock.

There’s hope the Bank of Canada will start lowering interest rates this year, with analysts betting on a first cut in June or July. But central bank officials remain cagey, and Governor Tiff Macklem has warned that rates are unlikely to fall as fast as they rose.

Priced-out millennials

Young Canadians are managing to buy homes, although not to the same extent as before. And because homes are so expensive, young buyers often rely on their parents’ wealth to get into the market.

In November, a Statistics Canada report found that adult children of homeowners were more likely to own a home than those whose parents were non-homeowners, and this likelihood increased with the number of properties owned by their parents. The children of multiple-property owners have lots of social capital, access to quality education and wind up in higher-paying jobs, on average.

“However, the analysis establishes a robust positive relationship between parents’ property ownership and the likelihood of home ownership for their adult children, even when controlling for income, age and province of residence,” the report read. “Inequality of home ownership appears to be reproduced across generations as parents’ property ownership conveys significant financial advantages to their children.”

Seniors staying put

Over the past decade of rising house prices, anticipation has built around the idea that a wave of aging baby boomers will sell their homes and flood the market with new supply. That isn’t happening. Instead, more seniors are aging in their houses longer, a November report by CMHC found. The sell rate of homeowners aged 75 or older who sold their homes has fallen steadily since the early 1990s, dropping to new lows in the 2016 to 2021 time period.

If there is a seniors’ sell-off coming, it won’t be any time soon. The report found the sell rate among those aged 75 to 79, the leading edge of the first wave of baby boomers, was 21.5 per cent. Sell rates didn’t rise significantly until people were in their late 80s and into their 90s, when rates rose to 55.3 per cent to 72.4 per cent.

Of course, even if seniors did start selling en masse, it might not help much. Last month Statistics Canada reported that millennials now outnumber baby boomers in Canada, thanks to the influx of permanent and temporary immigrants.

Note: RBC’s affordability calculations use a five-year fixed-rate mortgage amortized over 25 years. The mortgage rate is the weighted average of those offered by chartered banks for insured and uninsured mortgages. RBC uses benchmark home prices from RPS Real Property Solutions, and it adjusts Statscan income data for timeliness. The bank assumes the buyer makes a 20 per cent down payment.

Housing has become one of Canada’s most vexing and all-consuming quandaries. This article is part of a Globe and Mail series that examines the country’s affordability crisis, its myriad causes and prospective solutions.

I’m struggling with the idea of selling a rental property that has both a high monthly maintenance fee and a high mortgage rate. The costs to keep this house are currently higher than the monthly income it generates.

I recently refinanced in order to pull out $100,000, so now I owe $420,000 on the property, which is worth approximately $750,000.

My recent refinancing increased my mortgage rate from 5.14% to 7.9%, essentially eating up all my cash flow.

I’m on the fence. Should I sell, or should I refinance for a better rate to free up cash flow?

Losing Money Fast

‘The Big Move’ is a MarketWatch column looking at the ins and outs of real estate, from navigating the search for a new home to applying for a mortgage.

Do you have a question about buying or selling a home? Do you want to know where your next move should be? Email Aarthi Swaminathan at TheBigMove@marketwatch.com.

Dear Losing,

The fact that you’re bleeding money from this rental is not good. You need to either bring down your interest rate or raise rents so you can turn a profit in order to make it a worthwhile investment. But keep in mind that many people are sitting on the sidelines waiting for interest rates to fall, so you might not get your desired price if you decide to sell.

Your mortgage rate is likely the biggest reason your monthly costs have jumped so much. Rates are expected to fall to around 6% or lower by the end of the year. You could refinance then, but do the math to see if it’s worth it.

You’ve already been through the wringer with refinancing, and you likely paid various application, appraisal, attorney and origination fees — in addition to closing costs — to extract that $100,000. All of that is expensive, and now you’re thinking of going through it again.

Even if you refinance again at a lower rate, would that be enough to make a profit? Were you able to turn a profit on that property when rates were at 5%? If not, would you be able to raise rents for your current tenants or perhaps find new tenants who would be able to pay more? And is the house in need of repairs or upgrades?

Unless you can make a profit on the property in the next couple of years, there’s little reason for you to hold onto it, unless you believe that it’s in an area that will experience a significant appreciation in value — you’d want to see appreciation of 20% or more, given the fees you would have to pay upon selling.

Part of your retirement plan

At the same time, a second property is nearly always a good investment. Do you think there will be considerable demand for the rental in the medium to long term? Is it in an area where you might be able to find tenants who would pay enough to cover your costs in the near term so you can at least break even? If so, it’s a good idea to try to hold onto the property, especially if it’s part of your retirement plan.

Provided that you have enough savings to help you get through this current era of 7% rates, and you have the money to refinance down the road to get your monthly costs down to a level where you can have a healthier cash flow, it may be worth keeping the home.

Selling isn’t an easy or simple decision. Because this is not your primary home, you’ll need to factor in the capital-gains taxes you would have to pay, along with 6% in real-estate commissions.

If you do decide to sell at some point in the future, you could roll that money into another like-kind property in order to qualify for a 1031 exemption, in addition to a lower rate.

The bottom line: You need to think like a real-estate investor and leave emotion out of this decision. If the property is not making money or it’s not going to at least break even at some point, you have your answer. But keep in mind that the real-estate market can surprise on the upside and that once you sell the home, you will not be able to take back that decision.

By emailing your questions, you agree to having them published anonymously on MarketWatch. By submitting your story to Dow Jones & Company, the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

The numbers: Home prices in the 20 biggest U.S. metros rose for the 11th month in a row and hit a record high amid a persistent shortage of resale homes for sale.

The S&P CoreLogic Case-Shiller 20-city house price index rose 0.2% in December compared to the previous month.

Home prices in the 20 major U.S. metro markets were up 6.1% in the last 12 months ending in December.

A broader measure of home prices, the national index, rose 0.2% in December and was also up 5.5% over the past year. All numbers are seasonally adjusted.

The 20-city and the national index are at an all-time high.

Key details: San Diego posted the biggest year-over-year home-price gains in December. Prices were up 8.8%.

All 20 major markets reported yearly gains for the first time in 2023, S&P said.

Home prices rose the slowest in Portland, increasing by 0.3%.

| Cities | Change from last year |

| Atlanta | 6.3% |

| Boston | 7.2% |

| Charlotte | 8% |

| Chicago | 8.1% |

| Cleveland | 7.4% |

| Dallas | 2.1% |

| Denver | 2.3% |

| Detroit | 8.3% |

| Las Vegas | 4.2% |

| Los Angeles | 8.3% |

| Miami | 7.8% |

| Minneapolis | 2.9% |

| New York | 7.6% |

| Phoenix | 3.8% |

| Portland | 0.3% |

| San Diego | 8.8% |

| San Francisco | 3.2% |

| Seattle | 3% |

| Tampa | 4.1% |

| Washington | 5.1% |

| Composite-20 | 6.1% |

A separate report from the Federal Housing Finance Agency also showed home prices rose 0.1% in December from the last month, and were up 6.6% in the past year.

The FHA also noted that the housing market has experienced annual home price growth every quarter since the start of 2012.

The median price of a resale home was $382,600 in December 2023, and a newly built home was $413,200.

Big picture: Even though rates went to 8% in 2023 and dried up demand, that did not push down home prices significantly, per the Case-Shiller index. However early analysis of the data indicates that some markets are seeing home price declines.

But with the 30-year dropping below 7% in December, home prices may see a boost as demand picks up. And with a persistent and severe shortage of homes for sale, home prices could be pressured upwards again.

What S&P said: “Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years,” Brian D. Luke, head of commodities, real & digital assets at S&P Dow Jones Indices, said in a statement.

“While we are not experiencing the double-digit gains seen in the previous two years, above-trend growth should be well received considering the rising costs of financing home mortgages,” he added.

And the company said it was able to see the early impact of higher rates on home prices. “Increased financing costs appeared to precipitate home price declines in the fourth quarter, as 15 markets saw lower values compared to September,” Luke noted.

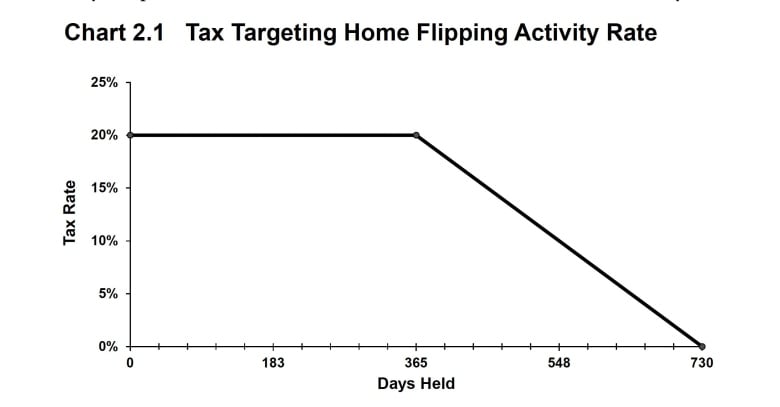

The B.C. government has announced plans to introduce a tax of up to 20 per cent on profits made when properties are sold within two years of their purchase.

The 20 per cent rate will be in place for a year after purchase and will slide to zero between 366 and 730 days after the acquisition.

B.C. Finance Minister Katrine Conroy announced the tax as one of the province’s latest tools to try to curb speculation over housing in a province where many struggle to afford appropriate shelter.

“Prices went up as governments stepped back and speculators moved in,” said Conroy during her speech presenting her latest budget in the legislature.

“That’s why we’re bringing in a home-flipping tax as our latest measure to crack down on bad actors.”

The tax is one of 20 pieces of legislation the government plans to introduce this session, meaning it will need to be passed at some point over the next three months before becoming law.

The plan is to implement it for properties sold on or after Jan. 1, 2025. It will also apply to properties purchased before then.

Conroy’s 2024-25 budget forecasts that the tax, once in place, would result in an additional $44 million in revenue in the 2025-26 fiscal year.

That revenue will go directly to building affordable housing throughout the province, she said.

Sellers would be taxed around 10 per cent after owning a home for a year and a half, with the tax lifted after ownership for two years.

The tax will apply to income from the sale of properties with a housing unit and properties zoned for residential use. It also applies to income made from condo assignments.

It does not apply to land or portions of land used for non-residential purposes, according to the government’s budget documents.

Other exemptions under the tax include life circumstances such as separation, divorce, death, disability or illness, relocation for work, involuntary job loss, change in household membership, personal safety or insolvency.

“The purpose of this tax is to support housing supply, not impede it,” reads the government’s budget documents.

“Exemptions will be provided for those who add to the housing supply or engage in construction and real estate development.”

The tax is to be paid in addition to any federal or other provincial income taxes incurred from the sale of property.

Alex Hemingway, a senior economist with the Canadian Centre for Policy Alternatives, said although the tax is another tool to try and address speculation, he’s not sure how successful it will be.

“I think a flipping tax can take a little bit of air out of the tires in terms of speculation, but it’s not really getting at the root of the housing crisis, which is a shortage of housing overall and a shortage of non-market housing in particular.”

He also said the tax could inadvertently drive down home sales and transactions, siphoning tax revenue away from property transfers.

First-time homebuyer credit

The budget also introduced expanded property transfer tax exemptions, increasing the First Time Homebuyers Program threshold up to $500,000 on the purchase of a home worth up to $835,000.

The province said the move would result in savings of up to $8,000 per purchase and would double the number of buyers that will benefit to approximately 14,500.

The province will also waive the property transfer tax for eligible purpose-built rental buildings that have four or more units until 2030.

There are 500 reasons to fall in love with a new home, at a range of Dandara’s developments across Bedfordshire, Buckinghamshire and Leicestershire.

The independent housebuilder is offering a £500 Virgin Experience voucher for a hotel and spa stay with dinner for those who reserve a Dandara home at Saxon Park, Biddenham, Abbots Place, Wavendon and The Meadows, Wymeswold, until the 18th of February.

Rachel Lindop, Head of Sales at Dandara Northern Home Counties, said: “While you enjoy the romantic whirlwind of falling in love with your new home, we want to make sure you also cherish your loved ones this Valentine’s Day.

Moving home can be a busy time, so we are treating our customers who purchase this February to a visit to one of the gorgeous Virgin Experience spas and hotels to celebrate Valentine’s Day, and of course, celebrate moving into their new Dandara home.”

The offer is available throughout all developments across Dandara’s Northern Home Counties region. Buyers can also benefit from other incentives, such as tailor-made packages, and deposit and Stamp Duty contribution.

Enjoying this article? Sign up for our FREE newsletter!

In Wymeswold, The Meadows is home to The Goodwood, a four-bedroom detached home with a single garage and driveway parking starting at £510,000. With spacious living and dining spaces downstairs and plenty of storage space throughout, buyers can also receive a £15,000 tailor-made package upon purchase.

Further south, Buckinghamshire buyers will fall head over heels at Abbots Place, located in Wavendon, just outside of Milton Keynes. Here, buyers can enjoy further offers, such as reserving The Cranbourne, Home 31 before February 29th to save over £40,000.

Customers will receive a 5% deposit contribution, a quartz kitchen and utility worktop plus a shower package in their purchase. The three-storey Cranbourne offers flexibility and practicality across its five double bedrooms, four W.Cs/bathrooms and plenty of storage, including a single garage and is available for £679,950.

Finally, those looking to settle down in beautiful Bedfordshire can avail themselves of the convenience of Biddenham’s Saxon Park. The Frogmore is a homely three-bedroom detached home which starts at £434,995. The stylish open-plan kitchen dining room is the perfect place to entertain loved ones or cosy up for a romantic dinner for two.

Buyers who reserve The Frogmore, Home 237 before February 29th can benefit from a £10,000 Tailor-Made Package, available on a range of incentives including Stamp Duty contribution, deposit contribution, flooring to the rear garden, kitchen upgrades and more.

For more information about any of the homes and offers currently available at Dandara, please visit https://www.dandara.com/new-home-counties/

House prices in Northern Ireland increased by 2.9 per cent to reach an average of £207,010 (€242,534) in the final quarter of last year, according to research from Ulster University.

The findings from the latest Northern Ireland Quarterly House Price Index show prices remained stable and continued to edge higher throughout 2023. This trend continued in the last three months of 2023 as the average house price increased by 0.4 per cent.

The research also shows signs of slowing market activity with transactions at their lowest level over the year, decreasing 26 per cent on the previous quarter.

“While the seasonal effects of Christmas and New Year traditionally see a slowing of market activity, a slight dip in buyer confidence remained in the last quarter of 2023 as the uncertainty of interest rates acted as a key factor for mortgage holders and prospective buyers alike,” the report noted.

“Encouragingly, the recent decision to keep the interest rate stable at 5.25 per cent is seemingly paving the way for more attractive mortgage deals.”

The data also shows minor declines in the cost of fixed, variable, and tracker rate mortgages during the final quarter of the year, indicating this trend could continue softening rates throughout 2024.

Vision Capital vs IRES REIT: trouble brewing at Ireland’s largest private landlord

“Lenders are motivated to build their loan books and attract customers, meaning that new borrowers or those remortgaging during 2024 may benefit from appealing deals and rates available,” the report said.

Separately, Northern Ireland has been named as the fastest-growing region in the UK for newly registered companies in 2023 in a new index from Ulster Bank and Beauhurst.

The boom in the number of start-ups was noted in the New Startup Index which found that Northern Ireland gained 14,000 new companies in 2023, which was a 59 per cent increase on 2022.

Belfast was hailed as the fastest-growing council area in the UK by number of newly registered companies, with a 123 per cent increase in the number of new businesses.

Causeway Coast and Glens, and Lisburn and Castlereagh also made the top 10 by growth in the number of companies incorporated, with the number of new businesses growing by 61 per cent and 54 per cent respectively since 2022.

The retail sector was responsible for the largest rise in the number of new businesses in Northern Ireland with 3,605 new companies set up.

Mark Crimmins, head of Ulster Bank, said: “These new ventures are predominantly small businesses, owned and run by local people, which will play an important role in supporting the growth of Northern Ireland’s economy.”

The rise in new businesses in Northern Ireland is a trend that is replicated across the UK. Some 900,000 new companies were incorporated in the UK in 2023, making it a record year for new businesses.

At a UK-level, the growth in female-founded businesses also continues to increase year on year, with a record 164,000 companies incorporated by women in 2023, up 4 per cent on 2022 and taking growth in the five years between 2019 and 2023 to 26 per cent overall.

New York Community Bancorp Inc. has been looking to shed problem commercial real estate from its books after last week reporting a surprising $185 million loss relating to a pair of loans as part of its fourth-quarter earnings results.

The lender has offered investors a chance to bid on a $22.4 million mortgage backed by three five-story walk-up apartment buildings in Washington Heights, a neighborhood in northern Manhattan, according to details of the offering viewed by MarketWatch.

The debt backs mostly rent-regulated apartments and affiliated mixed-use space. The mortgage matured in early January, with the full amount of the debt now due, plus interest at a 20% default rate, according to the offering.

Other landlords in the neighborhood who are subject to New York City’s rent-regulation laws, which were strengthened in 2019, have seen property values tumble by an estimated 50%, according to Bloomberg News.

New York Community Bancorp

NYCB

didn’t respond to requests for comment for this article.

Efforts by the bank to tackle its exposure to problem real-estate loans come as its stock has dropped by more than 60% so far this year.

The lender has a large exposure to rent-regulated multifamily properties in New York City, about a $1.8 billion office-building exposure in the city and about $250 million to $300 million in maturities in the next few years, according to Deutsche Bank researchers.

Pressures facing the bank are reigniting fears about regional banks and their commercial real-estate exposure. Treasury Secretary Janet Yellen told lawmakers on Tuesday that she was concerned about U.S. commercial real estate, saying that some institutions could be “quite stressed,” while also saying the challenge looks manageable.

Landlords have been reeling from slumping property prices and higher borrowing costs since the Federal Reserve in 2022 began dramatically raising interest rates to quell high inflation.

Many regional banks have responded by trying to quietly shed exposure to problem commercial real estate. That activity has picked up since the collapse of Silicon Valley Bank and Signature Bank last March and JPMorgan Chase & Co.’s

JPM

takeover of First Republic Bank, which deeply unsettled markets.

Late Tuesday, Moody’s Investors Service downgraded New York Community Bancorp’s credit by two notches into speculative-grade or “junk” status.

“We took decisive actions to fortify our balance sheet and strengthen our risk management processes during the fourth quarter,” Thomas Cangemi, New York Community Bancorp’s president and chief executive officer, said in a statement following the downgrade.

Cangemi also said that the bank has ample liquidity and has been growing its deposits and that the downgrade wasn’t expected to have a material impact on the lender’s contractual arrangements.

Sales of assets, even at a discount, can sometimes help banks get ahead of greater problems facing the industry, loan buyers said. But they also expect commercial-real-estate lenders to endure a challenging few years, especially as a wall of old debt comes due at a time of higher interest rates.

See: ‘No one is throwing good money after bad.’ Why 2024 looks like trouble for commercial real estate.